Higher Tax Assessments Show Improved Markets

As Colorado property owners have been receiving their 2015 tax assessments this spring, they can point to a steady increase in the price of homes sold in Colorado over the last several years as the cause for somewhat dramatic increases in their property valuations. Home values throughout the state continued to move upward in April, extending a pattern that began in early 2012 according to data reported and distributed by CAR earlier this month.

Statewide, the median price for a single-family home increased to $300,000 while prices for condominiums and townhouses rose to $215,000. At the same time, Days on Market (DOM) continued a downward trend going from 71 in March for single-family homes to 64 in April. Similarly, DOM for condominiums and townhouses went down to 49 days from an average of 57 in March.

Experts generally agree that a 5-7 month supply of housing represents a balanced market – favoring neither sellers nor buyers. At the end of April there were 23,328 active listings in our state representing less than a 3-month supply. While inventories have improved modestly in some areas of the state, the volume of properties needed to meet demand is far below where it was even just one year ago.

“There’s lots of good news in our data about sales, pricing and a slightly improving inventory,” said CAR Research Committee Chair Kelly Moye. “At the same time we are experiencing challenges with qualified buyers not able to find a property to buy or finding one and losing out to all-cash and bids over asking price. Hopefully the rest of 2015 will bring more sellers into our markets and help turn this situation around.”

Here are brief snapshots of select housing indicators in each of CAR’s six regions in Colorado. For the full reports on each region, please visit: www.coloradorealtors.com/real-estate-statistics/

Additional reports focusing on specific counties and neighborhoods can be obtained from the Association in your local area.

![]()

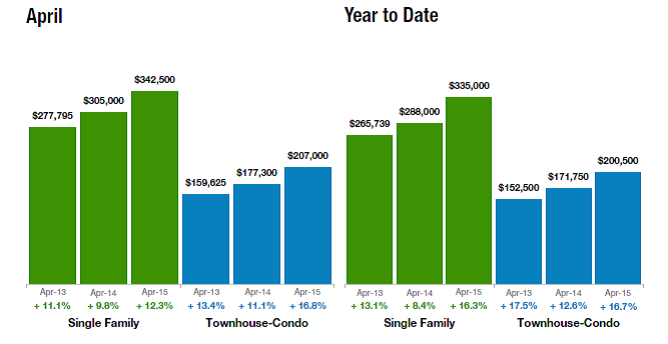

In the Denver Metro area (Denver, Jefferson, Adams, Arapahoe, Broomfield and Douglas counties) the median sales price for the 3607 single-family homes sold in April 2015 was $342,500, an increase of 12 percent compared to April 2014 and up 9 percent since the first of the year. For condominiums and townhouses taken together, the median price rose 17 percent to $207,000 compared to last year for 1365 properties sold last month.

Median Sales Price:

The average number of days that homes were on the market (DOM) last month declined significantly, reflecting the continued low inventories that have frustrated buyers now for a number of months. DOM dropped 24 percent to 28 days for single-family homes and 48 percent to 16 days for condominiums and townhouses compared to a year ago. At the end of the month there were 6594 active listings of properties for sale in the region representing about a one-and-a-half month supply.

![]()

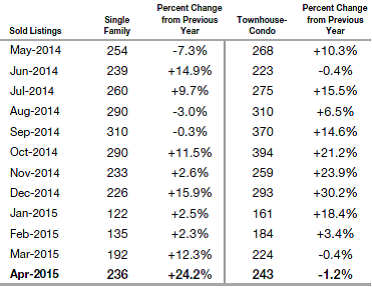

In the Mountain Region (Garfield, Grand, Gunnison, Jackson, Pitkin, Routt, San Miguel and Summit Counties) median prices for all homes sold taken together increased 3 percent to $450,000 when compared to April 2014. Condominium/townhouse prices fell a bit in April (down 4 percent) to $382,500 though they are up 1 percent Year to Date compared to the first four months of 2014.

Sales of single-family homes continued to show steady growth, increasing 24 percent on 236 sales in April 2015 compared to the same month in 2014. Condominium and townhouse sales did not show similar year to year improvement though the raw number of properties sold has been increasing each month in 2015.

Sold Listings:

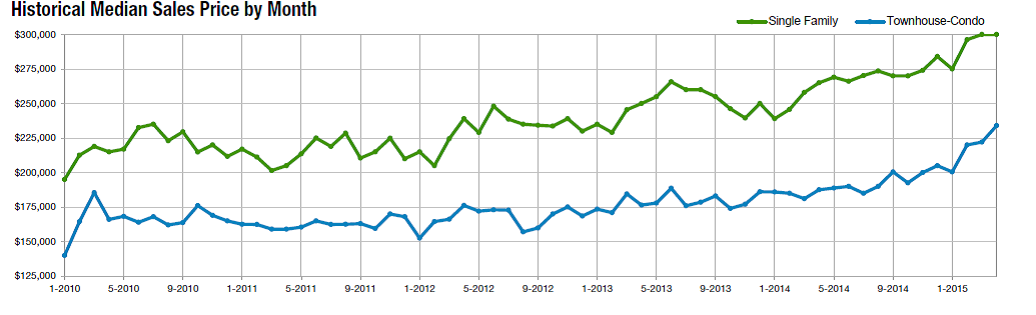

![]()

The Northeast Region (Boulder, Larimer, Logan, Morgan and Weld counties) enjoyed another month of significant increases in housing prices. The median price for a single-family home rose 13 percent to $300,000 on 1250 sales while condominium/townhouse prices increased 25 percent to $234,000 on 311 sold properties compared to April 2014. Since January 1, 2015 single-family home prices are up 6 percent and condominiums/townhouses are up 14 percent. As the graph below demonstrates, this region has enjoyed steadily rising prices for a number of years in a row.

During 2014 this region saw the average number of days that properties stayed on the market (DOM) before selling increase. This year there have been four consecutive months of decreasing DOM, returning to a pattern that had been consistently pointed downward for several years. The DOM for single-family homes fell 16 percent to 69 days and for condominiums and townhouses, down 7 percent to 57 days. At the end of the month there were 2400 active listings in the region representing less than a two month supply of available homes.

![]()

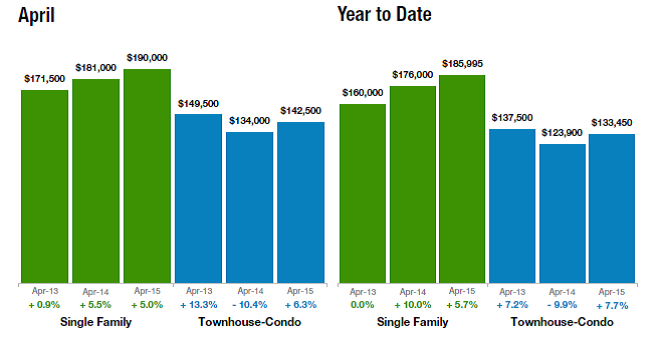

The Northwest Region (Delta, Hinsdale, Mesa, Moffat, Montrose, Pitkin and Rio Blanco counties) enjoyed increases in median sales prices in both the single-family and condominium/townhouse categories. The median price of the 371 single-family homes sold in April was $190,000, up 5 percent from April 2014. Condominium/townhouse sales (28 properties) produced a median price of $142,500, an increase of 6 percent over the previous year. Year-to-Date prices are up even higher.

Median Sales Price:

Days on the Market (DOM) continues to be a roller coaster ride in this region of the state. This year the direction has been mostly downward, returning the market to approximately where it was 12 months ago. The average DOM for single-family homes is 128 days; for condominiums/townhouses it is 108 days.

A balanced market (one that neither favors buyers or sellers) is usually defined as one in which there is a 5-7 month supply of available homes. The Northwest Region is the only area of the state that actually meets this description. At the end April there were 2287 available properties (all types combined) representing a 6.7 month supply.

![]()

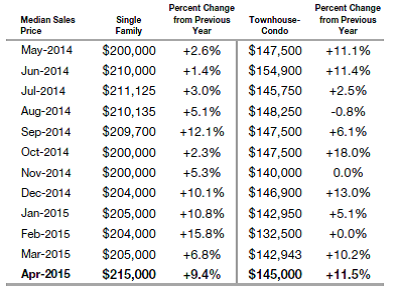

In the Southeast Region (Baca, Chaffee, Crowley, Custer, El Paso, Fremont, Huerfano, Las Animas. Otero, Pueblo and Teller countries) median sales prices enjoyed their largest increases when compared to 2014. The median price for a single-family home increased by 9 percent to $215,000 on 1441 sales compared to April 2014. For condominiums and townhouses, the comparable increases were 12 percent to $145,000 on 136 sales.

Median Sales Price:

Sales in this region also improved both Year-to-Year and Year-to-Date. Single-family home sales were up 19 percent for the first four months of 2015 compared to the same period in 2014. Condominium/townhouse sales increased 46 percent for the same two compared periods of time. At the end of April there were 5251 active listings of properties for sale in this area, representing less than a four month supply.

![]()

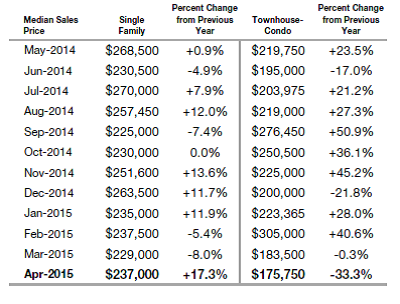

Finally, in the Southwest Region (Alamosa, Archuleta, Conejos, Costilla, Dolores, Hinsdale, La Plata, Mineral, Montezuma, Saguache and San Juan counties) the median sales price for single-family homes increased 17 percent to $237,000 on sales of 160 properties comparing April 2015 to April 2014. Condominium/townhouse prices dropped 33 percent to $175,750 comparing the same two periods.

Median Sales Price:

After a very significant drop between 2013 and 2014, the average number of days that properties remained on the market before selling (DOM) increased substantially from April 2014 to April 2015. For single-family homes the DOM rose to 185, a 34 percent increase and for condominiums the increase was 74 percent to 179 days. At the end of April 2015 there were 2065 properties available for purchase in this region of the state representing about an 11-month supply.

To see regional and statewide reports, visit www.coloradorealtors.com/real-estate-statistics/