Record-shattering housing market showed no seasonal differentiation in 2021 Astounding highs and lows likely to continue well into 2022

ENGLEWOOD, CO – Record-low inventory combined with insatiable buyer demand drove housing prices to record highs in markets across Colorado in 2021, according to the December data and year-end analysis from the Colorado Association of REALTORS®. The resulting activity, prevalent from January through the end of the year in markets across the state, made it nearly impossible to define any type of seasonal highs and lows seen in a typical, one-year real estate cycle.

“We left 2020 at what felt like a solid 10,000 feet in elevation only to find we were on the side of Mount Everest with 19,000 feet left to go,” said CAR spokesperson and Colorado Springs-area REALTOR®, Patrick Muldoon. “Already out of breath from two straight years of hiking and camping, the real estate industry was already winded, to say the least. But 2021 was going to push the industry to all new highs, and lows. It just depended on if you were a buyer or a seller.”

Inventory:

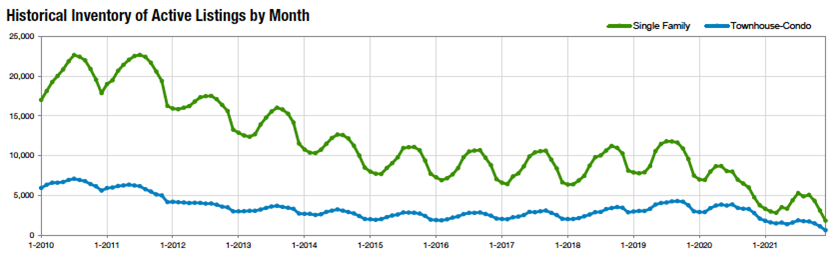

Although new listing volume tried to hold its own in 2021, it simply couldn’t compete with the unending demands of a highly-competitive buyer market responsible for over-asking-price contracts in a matter of days and closing in record setting fashion. The 1,801 active single-family homes for sale at the end of December in the seven-county Denver metro area, and 614 active condo/townhomes were down 52% and 70% from a year prior, respectively. The months supply of inventory hit record lows at year end sitting at 0.4 months for single-family homes (down 50% from Dec. 2021) and 0.3 months for condo/townhomes (down 75% from Dec. 2021).

“December has recorded the lowest yearly inventory numbers over the last three years and still in the top three over the previous three years from there, so this isn’t exactly unprecedented, but the fact that we’ve set a new record for lows shows just how dire the shopping experience can be for buyers. In each of these previous years, January shows nearly identical numbers to January, the improvement only beginning to show its head in February and even more so in March. If we keep the ‘typical’ lifecycle with ‘a-typical’ numbers in 2022, spring is going to be a whole lot better, but we won’t see full inventory again until somewhere between May and September,” said Denver-area REALTOR® Matthew Leprino.

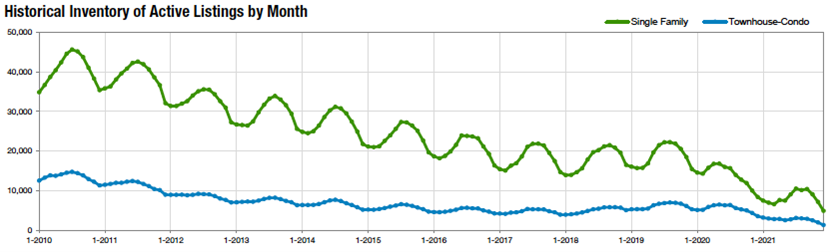

Statewide, there were just shy of 4,900 single-family active listings and another 1,292 condo/townhomes, down 41.6% and 63.2% from a year ago, respectively. The months supply of inventory also dipped to a statewide record low at 0.6 months for single-family homes (-40% from a year prior) and 0.5 months for condo/townhomes (-64.3% from a year prior).

“In 2019, we were starting to see a plateau in the real estate market with appreciation under 5% in most areas and homes were starting to stay on the market longer and longer throughout the year. COVID happened in 2020 and the expected waning of the real estate market made an abrupt change. It appeared that many people wanted to live in Colorado but were tied to their jobs elsewhere. When working remotely became a reality, the migration to Colorado became significant. Meanwhile, as families had to navigate everyone at home, all of the time, the need for more space became evident and many locals chose to move to larger homes to accommodate their new work and school environment. And thus, the unbelievable low inventory and high demand shot prices up in 2020 and 2021 and the market went to a level we haven’t experienced before,” said CAR Spokesperson and REALTOR® Kelly Moye.

Median Price:

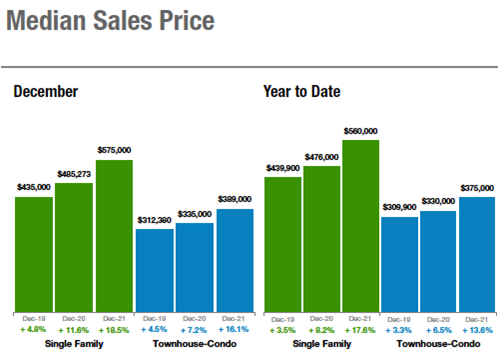

While the final month of the year delivered flat to very slight decreases in median pricing, those figures remained very close to all-time highs for single-family and condo/townhomes in the seven-county Denver metro area and statewide. The median price of a single-family home sold in metro Denver rose 18.5% in 2021 to $575,000. Condo/townhomes were up just more than 16% from December 2020 to December 2021 to $389,000.

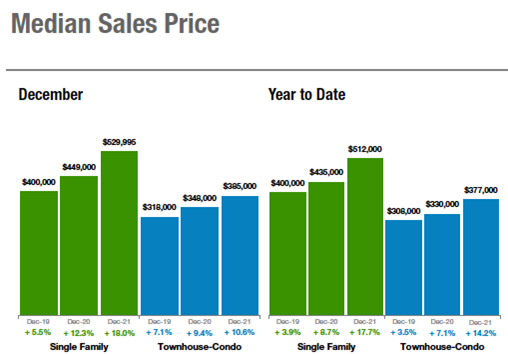

Statewide, median pricing for a single-family home also rose 18% to just shy of $530,000, while the median price for a condo/townhome rose 10.6% to $385,000.

Housing Affordability:

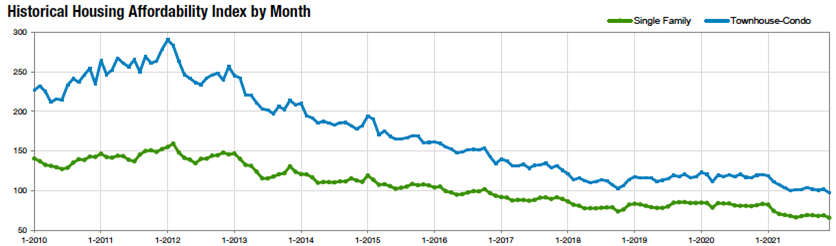

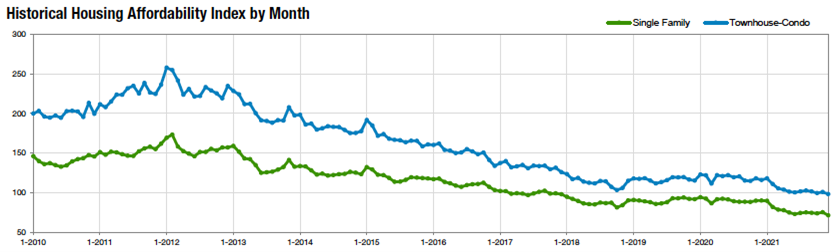

A common story and concern in both the Denver metro and statewide analysis, market conditions continue to negatively impact housing affordability. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to consumers based on interest rates, median sales price and median income by county, fell once again in December to new record lows and are down approximately 20% from December 2020 for single-family homes in the Denver metro area and statewide.

“Based on the brisk market even during the holidays, it appears that 2022 will continue with a seller’s market, high demand, low inventory and rising prices,” added Moye. “However, the interest rates will likely go up and purchasing power will diminish. In an already expensive market, that could push buyers away from Colorado and into more affordable areas. That may just be the beginning of balancing our market again but it will take a few years for the market to react to that adjustment. I expect we will see another strong market and the challenge for buyers here will remain. However, I think it will be tempered with the rising interest rates and lack of affordability in our area. We’ll see appreciation in 2022 but not as much as we saw in 2021.”

“Numerous discussions transpired over 12 months about housing shortages and affordability; yet, at the end of the year, the Marshall Fire gave ‘housing crisis’ a whole new significance for Coloradans,” said Steamboat Springs-area REALTOR® Marci Valicenti.

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“While we welcome 2022 and the housing market changes it may bring, based on the low current inventory, it’s very likely that we are going to see more of the same in the year ahead. Overall, listings were down 60% over 2020, and pricing was up 20.5%. Ironically, the sold numbers are only down 1.3%. This is a clear indication that listings are selling as quickly as they come to market. The numbers do vary between zip codes. Centennial inventory was down 78% and pricing up 27% at year end, with a median price of $667,000. Aurora’s inventory was down 65% at year end, showing only 117 active listings. The median price was up 21.3% to $515,500.

“Adams County Aurora is a rapidly growing area with new construction booming at High Point, Aurora Highlands, and Painted Prairie subdivisions. However, if one of these communities are on your list, plan on a waiting list for these new homes. Adams County inventory is down 52% with a median price of $505,000. By comparison, Arapahoe County inventory is down 68% with a 19% increase in the median price at $550,000.

“The bottom line is, extremely low inventory is resulting in pricing pressure throughout the metro area. Demand continues to significantly outpace available inventory. There is some expectation that interest rates rise which may provide for some slowing in the pricing. Currently, we are experiencing our spring frenzy during mid-winter given the pressure for homebuyers to lock in the currently low interest rates,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The numbers are astounding. Boulder

County experienced 22% price appreciation in 2021 and Broomfield County was

close behind at 17%. The bidding wars continued, even over the holidays,

indicating we are not planning on a slow-down anytime soon. Then, the fire happened.

“What was already a tight market for rental and sales just became a lot tighter with more than 1,000 families displaced and in need of housing immediately and close by. Days on the market looks like around a month for these areas but in reality, homes are listed for only a few days before going under contract for well over list price. We don’t normally see this kind of activity until the spring. This particular area will be one to watch in terms of the market as we’ve lost several entire neighborhoods to the fire and the effort to rebuild will take years.

“In 2019, we were starting to see a plateau in the real estate market with appreciation under 5% in most areas and homes were starting to stay on the market longer and longer throughout the year. COVID happened in 2020 and the expected waning of the real estate market made an abrupt change. It appeared that many people wanted to live in Colorado but were tied to their jobs elsewhere. When working remotely became a reality, the migration to Colorado became significant. Meanwhile, as families had to navigate everyone at home all of the time, the need for more space became evident and many locals chose to move to larger homes to accommodate their new work and school environment. And thus, the unbelievable low inventory and high demand shot prices up in 2020 and 2021 and the market went to a level we haven’t experienced before.

“Based on the brisk market even during the holidays, it appears that 2022 will continue with a seller’s market, high demand, low inventory and rising prices. However, the interest rates will likely go up and purchasing power will diminish. In an already expensive market, that could push buyers away from Colorado and into more affordable areas. That may just be the beginning of balancing our market again but it will take a few years for the market to react to that adjustment. I expect we will see another strong market and the challenge for buyers here will remain. However, I think it will be tempered with the rising interest rates and lack of affordability in our area. I think we’ll see appreciation in 2022 but not as much as we saw in 2021,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS/PIKES PEAK AREA

“There is a quote that hangs on my wall that reads, ‘Life is not a journey to the grave with the intention of arriving safely in a pretty and well-preserved body, but rather to skin in broadside, thoroughly used up, and totally worn out loudly proclaiming, wow, what a ride.’ Let’s apply that quote to 2021 real estate.

“The journey began with a fast ascent up an ever-increasing mountain. We left 2020 at what felt like a solid 10,000 feet in elevation only to find we were on the side of Mount Everest with 19,000 feet left to go. Already out of breath from two straight years of hiking and camping, the real estate industry was already winded, to say the least. But 2021 was going to push the industry to all new highs, and lows. It just depended on if you were a buyer or a seller.

“We got to the end of December and realized we had pushed the prices of real estate up 18.6% from one year earlier. All year was a decline in listing inventory and a vertical arrow of price increases. We got to see iBuyers buying up homes for rentals blowing owner occupants out of the market. The industry saw the goliath Zillow have to take a knee on its ibuyer program and admit defeat and that their own valuation algorithms did not work. We witnessed hedge funds buying up complete neighborhoods, sub-divisions, and residential homes nationwide. The FED printed more money this year than at any other time in history. The year ended with record inflation, first time unemployment claims rocketing up as 4.5 million Americans left workforce, all the while employers are trying to hire 10 million.

“If I were a drinking man, I would be typing this with a stiff drink in front of me and a cigarette in my mouth. Imagine the 1950’s TV shows, where I have a trash bin full of writings that did not pan out, a cocktail on my desk, my hat on crooked and a burned-out cigarette in the ashtray. This is how the real estate industry feels as a whole. We need a serious detox.

“I don’t have a crystal ball in front of me, but the future may not be as bright this year. The U.S. has stacked up record debt. The middle class is getting clobbered. And the FED has painted itself into a corner and not admitted it. Raise interest rates, crash the economy – leave them where they are, super inflation becomes a very real issue. All of this affects real estate,” said Colorado Springs-area REALTOR® Patrick Muldoon.

CRESTED BUTTE/GUNNISON

“The real estate market in the Gunnison Valley and Crested Butte went up or improved in all metrics except inventory. We started 2021 with a relatively low inventory so it seemed hard to imagine that we could exceed the sales from 2020, but that is just what happened. Transactions were up almost 37% year-over-year, and, with increased prices, the dollar volume is up almost 60%. Our total sales volume exceeded $900 million for the first time ever. The average sale price for a single-family home is up 25% and condos/townhomes are up 16% from 2020 to 2021. Sellers are getting closer to their asking prices and the number of days on market is down significantly. Even with record low inventory, properties are still being listed for sale and selling quickly.

“What will 2022 bring? Currently there are only 90 single-family homes in the entire Gunnison Valley and 42 in the Crested Butte area. Only one in the Crested Butte area is listed for less than $1 million. Inventory of condos and townhomes tells the same story. The Gunnison Valley has quite a bit of vacant land compared to many other ski towns, but those who own it are hanging on for the time being with less than half the vacant parcels available now vs. this time last year. I believe we will continue to have owners who decide now is the time to sell and buyers who want to buy. Pricing will be important as we are starting to see some price reductions and properties sit on the market for a longer period of time if they are overpriced. Rising interest rates will have an effect, but many of our buyers pay cash so it shouldn’t stop sales. Prices shouldn’t continue their meteoric rise, but they are unlikely to go down anytime soon.

“Having an expert to keep an eye out for new listings is very important for buyers to be able to purchase a great property when it comes along. Sellers need to evaluate the market carefully to make sure they are able to sell for the most money in the shortest amount of time,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER COUNTY

“December 2021 was, dare we say it, a fairly ‘typical’ performer in the world of statistical reporting. The median price for both freestanding and condo/townhomes in Denver County dipped ever-so slightly from November, as they traditionally and seasonally do, compared to June of the same reporting year. Inventory availability came in at about one third of peak summer marketing, and average days on market came in at third and fourth highest, respectively, for the year – again, mirroring what we traditionally see for a yearly cycle of our real estate market.

“What is different this year, however, is the records we’ve set – and they’re not small ones. For both the freestanding and condominium markets, December recorded the lowest ever supply of inventory. At only 0.2 months for freestanding and 0.4 for condos, the overall demand as determined by absorption means that in only 6 days of a 30-day month, everything that has or will come on the market has been consumed.

“December has recorded the lowest yearly inventory numbers over the last three years and still in the top three over the previous three years from there so this isn’t exactly unprecedented, but the fact that we’ve set a new record for lows shows just how dire the shopping experience can be for buyers. In each of these previous years, January shows nearly identical numbers to January, the improvement only beginning to show its head in February and even more so in March. If we keep the ‘typical’ lifecycle with ‘a-typical’ numbers in 2022, spring is going to be a whole lot better, but we won’t see full inventory again until somewhere between May and September,” said Denver-area REALTOR® Matthew Leprino.

DURANGO/LA PLATA COUNTY

“Taking a little different approach to interpret the monthly statistics, I decided to compare December pre-COVID to December 2021. The comparisons were mind-blowing, to say the least. The average sales price for a single-family residence in La Plata County pre-COVID (December 2019) was just over $512,000 compared to over $785,000 in December 2021, a 44% increase. Just as shocking was the number of available units for sale. In December 2019, there were 434 homes for sale compared to just 96 in December 2021. December 2019 had just over a 6.5-month supply of inventory compared to a 1.3-month supply in December 2021. Another interesting statistic was the percent of list price received. December 2019 was 96.2% versus 100.1% in December 2021. The townhome/condo market had even larger spreads. The average sales price increased by more than 55%, from $314,000 to $511,000. Inventory levels dropped from 154 units in 2019 to just 21 in December 2021. The monthly supply of inventory dropped from 5.5 months to just over 2 weeks.

“Currently, there are only nine homes listed for sale, not under contract or pending, within Durango city limits and a mere 78 for the entire county. The condo/townhome market only has four available in-town listings and 16 for the whole county. Inventory will be the major story for 2022. Industry experts are predicting interest rates will remain under 4% this year and buyer demand will remain strong. The market should remain in favor of sellers for the foreseeable future, but with cheap money available, it is still a great time to buy. My advice to buyers is to have all of their ducks in a row and be ready when the right property presents itself,” said Durango-area REALTOR® Jarrod Nixon.

The tables below show the key metrics by year:

Single-Family

| 2019 | 2020 | 2021 | |

| Average Sales Price | $512,399 | $572,184 | $785,101 |

| # of Homes for Sale | 434 | 177 | 99 |

| % of List Price Received | 96.2% | 97.9% | 100.1% |

| Months Supply of Inventory | 6.5 | 2.0 | 1.3 |

Condo/Townhouse

| 2019 | 2020 | 2021 | |

| Average Sales Price | $314,992 | $377,687 | $511,341 |

| # of Homes for Sale | 154 | 44 | 21 |

| % of List Price Received | 97.4% | 99.4% | 100.3% |

| Months Supply of Inventory | 5.5 | 1.3 | 0.7 |

ESTES PARK/LARIMER COUNTY

“2021 was definitely a test of skill, knowledge, and simple grit to get the clients to the finish line. Looking over the new and hot listings to get them reviewed and out before they were gone. A test of patience for buyers for sure. Some heartbreak and some success stories were had. We, too, were one of those lucky folks who just happened to see the sign go up in the yard and could act immediately. Strong offer, to the point, and diligent.

“The Larimer County stats are not terribly surprising given the buzz from other parts of the state or the trends noted earlier in the year. New Listings are down 7.7% over last year. Sold Listings hang in there at -0.2 % barely losing any ground given the short inventory. Townhouse/condos has -74.9% less homes for sale than in December 2020. Single-family homes are not much better at a negative 48.1% compared to last year. Single-family homes are selling quickly at only 44 days on the market as compared to 61 year-to-date. Townhouse/condos are seeing a similar trend with now 62 days on the market versus 88. That’s a dip of 29.5%.

“Looking back on some historical median sales prices in early 2010, prices hovered somewhere between $150,000 – $200,000 for a single-family home, a townhouse/condo in the $125,000 – $150,000 range. At the end of December 2021, the median sales price in Larimer County is $535,475 for single family and $375,00 for a townhouse/condo. A steady increase over time with a big jump this year of 20.3% over December last year for single-family homes and a 14.7% increase for townhome/condos.

“I believe the prices will continue to increase as the supply is under the current demand. However, the fury we felt this year may not be the case for 2022. Interest rates were so low and driving refinancing, selling, and buying, as this aided affordability and was enticing to many. Locking in that interest rate was important and buyers had to act before the impending rate increase, or not. Who knows in 2021, or 2020, let’s be honest, what a rollercoaster.

“Supply chain and worker shortages have slowed new construction holding off new units that should have been available in 2021. Hopefully, they will be complete condo/housing/ projects as the economy recovers, interest rates will continue to bump up here and there, and homes will be filled as fast as they are built/listed,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“Median price in our market ended the year at a 12-month high of $559,950. That’s a 25% increase from December 2020. Inventory levels ended the year with the fewest homes active on the market EVER (or at least in the 21 years that particular statistic has been available). That’s a 45% decrease from December 2020. Yet, the lack of ‘leftover’ inventory at the end of the month doesn’t necessarily mean fewer sales – our year ended with a total of 3,103 home sales – just 6 sales shy of the number sold in 2020. Bottom line – nearly everything that comes on the market goes under contract in the same month and on average is closed within 53 days. That is why there is currently less than a 15-day supply of houses for sale at the start of the New Year.

“The forecast for 2022 appears to be following a similar pattern to what we saw in 2021 along with these key differences: Interest rates are likely to be higher.With longer term inflation fears creating uneasiness in the financial sector, mortgage interest rates are likely to rise this year which will reduce homebuyer purchase power which, in turn, will do at least two things: In the near term, it may slightly ease the competitive pressure for what few listings are available; in the longer term, we may see sellers recalibrating expectations for what they can realistically expect to squeeze out of the sale of their homes.

“Supply Chain, Supply Chain, Supply Chain -If the supply chain crisis corrects itself, inflation may decline, our nation’s strong economic engine will continue to steam forward, and more houses can be built to correct for the over 5 million housing unit shortage we currently face as a nation. That said, the ongoing pandemic, labor shortages, geopolitical struggles, and domestic social and political divisiveness may preclude a return to the pre-pandemic level of abundant goods, reliable services, and sustainable economic prosperity,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT & CUSTER COUNTIES

“Buyers who are waiting for that market correction to take place in Fremont and Custer counties may be waiting a long time. This market, which is very similar to other areas of the state, has seen steady price growth over the last 5 years and it doesn’t appear that it is going to level off any time soon. There are many factors influencing this price growth. Lack of inventory, increasing costs of building materials, and a lack of qualified tradespeople to build new units are just a few of the reasons. Another reason may be the fact that home prices in the northern areas of the state have rocketed up to twice the median price of homes in Fremont and Custer counties. Owners in these metro areas that are close to retirement or able to work out of their home are beginning to cash in on their investment there and head south to our market as cash buyers. The rural area is appealing, not to mention the ability to bank much of the cash that they pull out of their northern Colorado investment.

“The price appreciation here began near the end of 2017 when the median price home here was $170,500. This price had seen conservative price increases of around 3-5% in the previous years. In 2018 the median price increased by 15% to $196,000; 2019 by 13.8% to $222,900; 2020 by 12.2% to $250,000 and currently in 2021 by a whopping 23% to $307,500.

“Prices are only going to increase in the future. I am advising buyers who are sitting on that fence waiting for a market correction to buy as much home as they can as soon as they can. The adage, ‘The best time to plant a tree was 20 years ago. The second-best time is now,’ is fitting advice,” said Fremont and Custer County-area REALTOR® David Madone.

GLENWOOD SPRINGS/ROARING FORK VALLEY/GARFIELD COUNTY

“Garfield County continues to outpace all its past performances in the real estate market. After a year of brokers lamenting the lack of inventory that drove prices up and created a buying frenzy, the dust has settled, and we can look back and get a perspective on what we just experienced. Ironically, the year-over-year number of new listings that hit the market was not that different from 2020. 2021 saw 1,036 single family and 365 townhome condo units change hands, a decrease of only 2.4% for single-family homes (25) and negative 16.1% for townhome/condos (70). Sold listings were up 3.7% for homes and a whopping 26% for townhomes. Median sales prices increased 13.2 % in the home sector with the multi-family product rising 13.5%. Days on market declined in both categories, down 35% for single family homes and 4.8% for townhomes and condos. On Jan. 1, 2022, there were 82 homes and 19 townhomes in all of Garfield County for sale in our MLS. There was a significant number of new home permits issued this past year – 160 to be exact. So, what is the cause of this continual lack of inventory we have been experiencing since COVID struck in March 2020? It appears the perfect storm has made its way into our peaceful valley. With a combination of the mass exodus from large cities, more people working from home, and the increase in home-schooling, our valley has become more and more appealing. This influx of people from out of state have driven prices and devoured the normal inventory that locals historically took advantage of. In addition, the popularity of short-term rentals has encouraged part-time homeowners to purchase and be able to offset their investment by renting on the short-term, ensuring they have a place to escape to if need be. In turn, this environment has also had a huge effect on our rental market. Prices in the long-term rental market have skyrocketed, putting pressure on the local workforce and our community’s infrastructure. Traffic, water, and fire issues have been brought to the forefront, forcing local governments to take a step back and delay new multi-family housing projects to examine what long-term effects they may have on the quality of life we have come to know,” said Glenwood Springs-area REALTOR® Erin Bassett.

Looking at median home pricing throughout the valley provides a good overview of Garfield County communities:

SINGLE-FAMILY HOMES

| Town | Median Price Dec 2020 | Median Price Dec 2021 | % change | Median YTD 2021 | % change | Mo supply | % change | |||||||||||||||

| Carbondale | $995,000 | $1,537,500 | 54.50% | $1,200,000 | 54.50% | 1.7 | -39.30% | |||||||||||||||

| Glenwood Spgs | $717,000 | $930,000 | 29.70% | $767,897 | 22.90% | 0.09 | -47.10% | |||||||||||||||

| New Castle | $430,000 | $585,000 | 36% | $555,000 | 27.00% | 0.07 | -68.20% | |||||||||||||||

| Silt | $400,000 | $489,000 | 22.30% | $483,750 | 14.50% | 1.1 | -64.50% | |||||||||||||||

| Rifle | $338,750 | $399,088 | 17.80% | $397,750 | 17.00% | 1 | -60% | |||||||||||||||

| Battlement Mesa | $333,500 | $334,625 | 0.03% | $323,000 | 19.60% | 0.05 | -70.60% | |||||||||||||||

| TOWNHOME/CONDOS | ||||||||||||||||||||||

| Town | Median Price Dec 2020 | Median Price Dec 2021 | % change | Median YTD 2021 | % change | Mo supply | % change | |||||||||||||||

| Carbondale | $975,000 | $1,086,818 | 11.50% | $640,000 | 15.30% | 0.2 | -93.50% | |||||||||||||||

| Glenwood Spgs | $86,500 | $448,000 | 417.00% | $401,500 | 21.70% | 1 | -67.70% | |||||||||||||||

| New Castle | $325,000 | $361,500 | 11% | $348,000 | 20.00% | 0.8 | -61.90% | |||||||||||||||

| Silt | $299,000 | $310,000 | 3.70% | $317,000 | 12.20% | 0.5 | -66.00% | |||||||||||||||

| Rifle | $195,000 | $323,750 | 66.00% | $268,500 | 32.30% | 0.3 | -95% | |||||||||||||||

| Battlement Mesa | $180,000 | $212,000 | 17.80% | $225,000 | 25.40% | 0.7 | 75.00% | |||||||||||||||

While the last 2 years have been a boon to sellers, it remains to be seen if the growth and price increases are sustainable. Some amount of stabilization seems to be in order for our communities to continue to be diverse and appealing,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“2021 has been an unprecedented real estate year for Mesa County. All of our builders are busy, with many homes under construction. They invariably go under contract well before completion even with escalating construction and regulatory costs. The resale market also is extremely tight, with only 317 active residential listings at the end of 2021. Pending sales are off from last year, but not by much, at – 0.09%. However, on a positive note, – and we have not had too many – sold listings, while down significantly for December, finished the year up 1.1%.

“Prices continue their upward climb, with the median finishing the year up 14.7%, at $330,000, and average sold prices year-over-year up 16% at $371,062. Because of the tight inventory, and high demand, (even through December) homes are selling at or over asking price. The ability for a buyer to move fast is critical when properties do come on market, as time on market has dropped to an average of 69 days. In the lower prices, they are much less. Buyers need to be prequalified, decide what is really important to them, and what is just a ‘wish list.’ With predictions that interest rates will potentially start increasing by mid-year, the first 6 months of 2022 could be extremely busy,” said Grand Junction-area REALTOR® Ann Hayes.

GOLDEN/ARVADA/JEFFERSON COUNTY

“In the metro-Denver area there were only 1,477 homes on the market at the end of 2021. That is the lowest inventory in decades. In Jefferson County, the inventory of just 167 active single-family homes represents a 50% drop from this time last year. The median sales price has now ticked up to $627,000. Buyers will need to be as aggressive as possible to win the bid on a home for sale.

“For condo/townhomes the inventory dropped 59% year over year with the median sales price rising to $381,000. There are so few homes for sale, the bidding wars will be in full strength with a seller’s market continuing throughout the year,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS & SOUTHFORK

“Have you tried to purchase a new car this year? The 2022 real estate market and auto markets appear similar – little to zero inventory and a lot of buyers at no fault to their industries. Buyers in both arenas are forced to the consideration of settling on purchase options. Pagosa Springs and South Fork, Colorado bring an abundance of visitors seeking escape from the heat, epic skiing, and beautiful moments capturing hope for futures.

“Historically, visitors and resort owners alike from Texas, Oklahoma, New Mexico, Arizona and the front range of Colorado have discovered Pagosa Springs and South Fork. Year 2021 has changed the visitor and resort owner demographic with buyers. More and more out-of-state homeowners spent more time here or even sold their out-of-area homes (and living in southwest Colorado full-time) than ever before. Why? Folks have fine-tuned remote working and schooling scenarios, as well as retirement options. Employers are accepting remote working as the new normal. Retirees selling out-of-state homes have taken to the road in RVs and awaiting the perfect home to appear on the market. This area now sees homebuyers from throughout the United States. Competition for homes, land, and condo properties has roared a not so pretty buyer’s experience. Frustration of numerous property contracts, multiple offers, and higher than list price for land and homes and a handful of properties available as inventory in every price point is prevalent (with the exception of properties priced $1 million and higher). With average inventory of 50 or less homes (30 in Rio Grande County-South Fork), 2022 sellers are demanding higher prices because they are in the catbird position. Many sellers are relocating to another state, using their real estate wealth from Colorado. Some buyers are seeking other state purchase options, as they have been priced out of beautiful southwest Colorado. These factors will certainly play out in 2022 sales.

“2021 continued to set heroic buying records in land, condo, and homes, even with the median (year-to-date) price up 24% to $475,000 (compared to $350,000 in 2020). Average sales price (year-to-date 2021) is up 23% at $590,268 (compared to $450,362 in 2020). Contributing to low inventory, the number of listings sold in 2021 were down slightly (-3.1%) from 2020 (619 verses 639) and the higher price point purchases were up significantly. Currently, there are only 17 homes priced under $500,000 (out of inventory of 50 homes). This inventory beast trend will set new average market prices for 2022. The new year presents a new reality. Pagosa Springs buyers must purchase a $500,000 or higher home. In 2021, homes priced under $500,000 fell short in numbers of sales – thanks to rising prices and inventory drops. “Homes priced $600,00 and higher shattered previous year’s numbers, including the most homes ever sold in Pagosa Springs over $1 million. Higher prices present challenges for buyers selling before buying a home, as sellers have been spoiled with cash buyers.

“Like many Colorado mountain communities, short-term rental property purchases boomed and contributed to historical sales records and prices. In Pagosa Springs, 2021 brought short-term rental (STR) regulations (town & county). More and more subdivisions banded STRs and several more are considering the same option. Many out-of-state owners desire to STR their homes in months when they are not there. This provides income for heating in the snowy winter, the home having use, and the affordability for a second home purchase for many out-of- state buyers. Those buyers desiring a short-term rental property will choose to buy and live elsewhere. Unfortunately, even with the STR curtailment, locals find it difficult to afford rents or the current home prices. They are also moving and leaving job positions unfilled.

“2021 was an ambitious year of real estate sales numbers in Pagosa Springs and South Fork. Most price categories were shattered from previous years with the result now being the slimmest inventory (down a crushing 75.4%). Even land mimicked home sales statistics with impressive sales numbers. Buyers would never have imagined there would be a day with seeking a home with only the selection of five homes or land in every price point. In South Fork and Pagosa Springs, there are price points with no homes available. Now that mother nature is playing catch up with abundant snowfall, March and April promise to bring on inventory and at historically higher prices,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“We finished the year with some very good numbers including a 9.1% increase in new listings compared to this time last year. The year finished with 3,841 total new listings, up 13.4% over 2020. Pending sales were up 25% over December 2020, finishing the year up 4.4%. December sold listings were the same as December 2020, but up 4.4% for the year. We had 3,113 sold properties in 2021.

“Homeowners enjoyed some very solid increases in their equity in 2021.Median sale price was up 21.8% in December to $300,360 and up 20.9% to $285,000 for the year. In January 2021 the median price was $251,000. The percent of list price received in December was 99%, down just 1% from last December but it remains up (100.6%) for 2021, a 1.5% increase over 2020. With so few homes available and an inventory supply hovering right around a month, average days on market continues to drop. We closed the year with 731 new home construction permits, 158 more than 2020. Pueblo West lot sales dropped about 100 from last year but prices continue to rise.

“Looking ahead at 2022, we anticipate new home building will continue to be strong, existing home sales will be up 5 – 7%, and prices up 8% over 2021. We will continue to struggle with low inventory which will drive those multiple, over-asking price offers. Pueblo County will see strong activity in 2022 with more big builders and businesses coming in and four or five schools being rebuilt,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Looking at 2021, it was a year of perspectives. Feelings about COVID ran the spectrum from better, the same, or worse than 2020. Attitudes towards real estate were good, bad, or indifferent – largely decided by whether you were a seller, a buyer, or a seller and a buyer. Numerous discussions transpired over 12 months about housing shortages and affordability; yet, at the end of the year, the Marshall Fire gave ‘housing crisis’ a whole new significance for Coloradans.

“To gain perspective on housing inventory in Routt County, we can look back to the peak of the housing recession in July 2010, when there were approximately 815 single-homes on the market and 600 multi-family. No significant new construction starts occurred from 2008-2015. When construction geared up in 2015, the residential inventory was 50% less than 2010. New builds were mostly on land that had been purchased at distressed pricing, with final products delivered in Steamboat in the $1.5 million range and the bulk of affordable homes built in Hayden. Roll forward six years and active inventory for all of Routt County in December 2021 – no matter what price – is a mere 38 single-family homes and 21 multi-family. This is the second year-running where active listings are more than 60% less than the year before. Home inventory for 11 out of 12 months of 2021 averaged about a two-month supply- except December, which dipped to just over one month’s supply; multi-family hovered around a month’s supply for 10 months, and then in November/December succumbed to about a two-week supply. 2021 realized 387 sales of single-family and 596 multi-family units; the bulk of this transaction count occurred within the price range of $300,000-$599,000 for both homes and condos/townhomes, and a record number of 96 single-family and 28 multi-family sold for over $2 million. The median sales price for a home in Routt County at year-end was $1.16 million and $644,500 for condos/townhomes – up over 30% from last year. With the increase of property sales over $2 million, the average price in the Yampa Valley is now at $1.53 million for single-family and $814,000 for multi – also up almost 30%.

“So, what does 2022 look like? More of the same? Well, yes and no. We can expect that new listing activity will be similar to 2021 and as such, multiple offers will continue. While my crystal ball shattered in 2020, I would not foresee 30% increases in pricing for 2021 and suggest we might see some stabilization? Interest rates will be climbing this year; sadly, who this affects the most is the first-time home buyer who is already having a hard time competing in many markets. The interest rate increase affects their buying power as a 1% increase equates to 10% less in purchase price. Second homeowners wanting to finance will also see increased fees around the end of first quarter as the Federal Housing Finance Agency (FHFA) announced that pricing for second homes and high-balance loans will be increasing Loan Level Pricing Adjustments (LLPAs) for loans purchased by Fannie Mae and Freddie Mac on/after April 1, 2022 (HousingWire). Buyers who may be looking to purchase a second home or get a high-balance loan (loan amounts greater than $647,200 for 2022), would ideally want to close on their second home or high-balance loan by the end of February or early March to hopefully avoid this pricing hit (since it usually takes 2-4 weeks to sell a loan to a servicer after closing- so this means it could take roughly 30 days before the loan is purchased by Fannie Mae/Freddie Mac). The FHFA says it is taking this step to both strengthen the government-sponsored enterprises’ safety and soundness and ensure access to credit for first-time homebuyers and low- and moderate-income borrowers. The impending interest rate increase may add more urgency in the first half of the year for some buyers and the new FHFA fees may add increased activity for first quarter for those looking to avoid those fees as well as obtain a lower interest rate.

“While Steamboat had a slow start to winter weather, we are now at 138% snowpack compared to the 30-year average. Development at the ski resort is underway as they set out to spend an unprecedented $180 million to create an après ski plaza, new restaurants and bars, new lodging, a ski beach, and an ice rink. A large, anonymous donation bequeathed to the Yampa Valley Housing Authority was directed so that the Authority could purchase two sites that will eventually provide more housing options for full-time residents down the road,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“The song, ‘If I had a million dollars…I would buy you a house,’ came out in the early 90s and wow, have things changed. You would be hard pressed to find a single-family home in Summit County for a million dollars as the average single-family home is about $1.9 million in 2021, which is 26% higher than the year before. You can still get a single-family home for under a million in Park ($557,261) and Lake Counties ($543,506) where the average price went up 35% in Park County and 55% in Lake County in 2021.

“The lack of inventory and amazing 42.6% rise in the median sales price of all types of property for the region garnered the most staggering number of all – nearly $3 billion in sales volume for 2021 ($2,949,006,906).

“Summit, Park, and Lake counties have listings that range from $200,000 for a single family in Leadville to a $19 million single-family home in Breckenridge.

“Where can this meteoric rise in prices go for 2022? Until a variety of inventory becomes available, the more affordable properties will continue to be snapped up and prices will continue to rise. Expect to see a flattening or slower price growth due to announced higher interest rates and inflation when those issues become a factor. One of the best bets against inflation is owning real property, so for our investor buyers, prognosticators say that money will be pulled out of the stock market and invested in real estate. This will keep our resort property market strong through 2022.

“The part we are holding our breath and watching closely is short-term rental regulations. We are unclear what the market effect will be as new owners face changes in the way they can short term rent their properties,” said Summit-area REALTOR® Dana Cottrell.

| Single Family | Average Price % YTD 2021 | Average Price YTD 2021 |

| Summit County | 26% ↑ | $1,898,502 |

| Park County | 35% ↑ | $557,261 |

| Lake County | 55% ↑ | $543,506 |

| Townhouse / Condo | Average Price % YTD 2021 | Average Price YTD 2021 |

| Summit County | 18% ↑ | $682,535 |

TELLURIDE

“The Telluride regional market set a new record in 2021 with dollar volume of $1.42 billion. In 2020, total dollar sales were just over $1.16 billion. Until 2020, the best year was 2007 when sales totaled $760 million which lasted until 2020. The number of sales in 2021was 944 compared to 814 sales in 2020. At the beginning of 2021, I had predicted a drop in the dollar amount of sales and the number of sales. My thinking then was that the low inventory at the end of 2020 would just force sales volumes down for 2021. I never anticipated how many sellers would jump into the market to grab these record sale prices. Some 2021 sellers had only owned their properties for three or four years. I do think that some sellers were aging out of our market and wanted to have a second home closer to their grandchildren.

“December sales were strong with 80 transactions totaling $159.25 million in sales. One off-market sales of three homes sold for $22 million setting a new record for a residential transaction in the town of Telluride. Even with that sale, the number of single-family homes sold in the town of Telluride dropped 11% due to a lack of inventory,” said Telluride-area REALTOR® George Harvey.

VAIL

“Sitting in my office on a snowy day recapping the month of December 2021 and the year-end results is a great way to start the New Year. The second half of 2020 and total year of 2021 have set records for sales in the valley. Buyer demand has been historic and basic economics of supply/demand has generated appreciation in value valley wide. The trend, which started a few months ago, has continued to drive the market. December 2020, the active inventory for sale was 438 residential units which, at rate of sale, was 3 months supply. A stable market is recognized as 6-months supply. December 2021 ended with only 165 units, which is 1.2 months of supply at current absorption rates. However, the macro numbers as stated really don’t give the accurate status of the market. The month shows 52% decline in closed transactions while the total year is only negative by 3%. The dollar sales for the month were negative approximately 5%, while the yearly number reflects a 17% growth. The year had been showing great transactions and dollars until the inventory slipped to its current level.

“Following the old adage, ‘a picture is worth a thousand words,’ I will try and give more insight into the drivers of the market,” said Vail-area REALTOR® Mike Budd.

The Chart below looks at sales over the past two years by price and current inventory for sale by niche highlighted:

| 20-Dec | % of mkt | 21-Dec | % of mkt | Total yr 20 | % of mkt | Total yr 21 | % of mkt | Active Inventory | %mkt | |

| Price Niche | ||||||||||

| < $1M | 106 | 50% | 41 | 39% | 968 | 55% | 815 | 48% | 14 | 9% |

| $1-$2M | 65 | 31% | 26 | 25% | 428 | 24% | 408 | 24% | 27 | 16% |

| $2-$5M | 31 | 15% | 23 | 22% | 286 | 16% | 355 | 21% | 55 | 33% |

| $5M + | 11 | 4% | 14 | 14% | 75 | 4% | 119 | 7% | 69 | 42% |

| Total | 213 | 104 | 1757 | 1697 | 165 |

- The inventory by market pricing has altered the shares for the niches significantly. In December 2020, the under $1 million represented 50% share while in December 2021 it was down to 39%. On a yearly basis, the share dropped from 55% to 48% with transactions down 16%. The decline in share has accelerated in the second half as the inventory kept dropping and now is only 9% of homes on the market.

- The $1-$2 million niche has been more stable, albeit its share of inventory is about 33% below the current absorption rate. Unit sales are negative approximately 5%.

- The $2-$5 million niche has been very strong with sales up 24% and market share growing at 31%. This is the first niche where saleable inventory is a little above one-and-a-half months.

- The $5 million-plus area is amazing as historically, over the past 20 years, it has been very stable at 4%. However, it has increased to 7%, a 59% growth in the segment. This growth was 33% year over year and there is 7 months of inventory supply.

“This analysis gives the depth to look into the crystal ball for 2022. I must say it is murky as we continue to have strong Buyer demand and inventory is the only impediment to a strong year. This is a great opportunity for owners to take advantage of their current equity for a trade up or a lifestyle change requiring a move. As we are early in 2022, it is difficult for the crystal ball to be very clear other than on the top two price niches which have shown great strength which should continue due to inventory,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA SINGLE-FAMILY SNAPSHOT

STATEWIDE SINGLE-FAMILY SNAPSHOT

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

COLORADO

HOUSING AFFORDABILITY — SEVEN-COUNTY DENVER METRO AREA

HOUSING AFFORDABILITY – STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The December 2021 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.