“Unprecedented” and “shocking,” REALTORS® running out of ways to describe state’s record low housing inventory

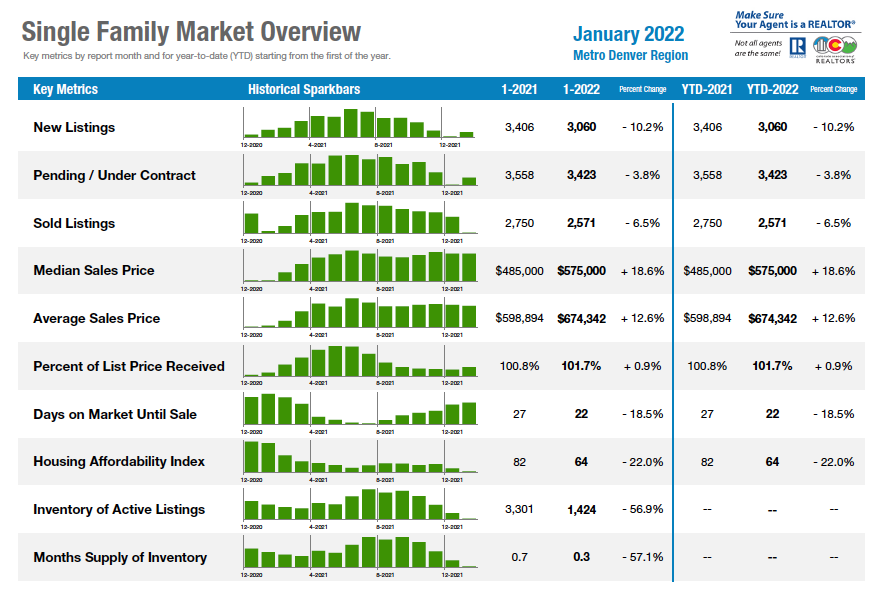

ENGLEWOOD, CO – Despite a nice, but expected seasonal uptick in the number of new listings that came to the Colorado housing market in January, a strong month of pending/under contract activity quickly gobbled up available inventory, once again keeping active buyers pushing the limits of their budgets and patience, according to the January data from the Colorado Association of REALTORS®.

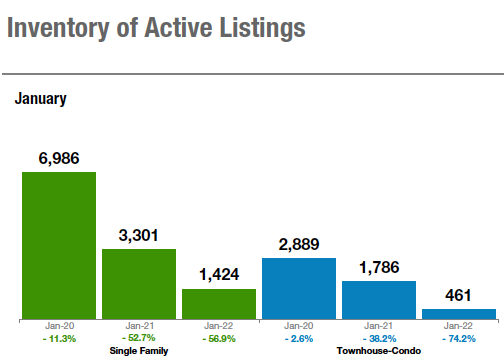

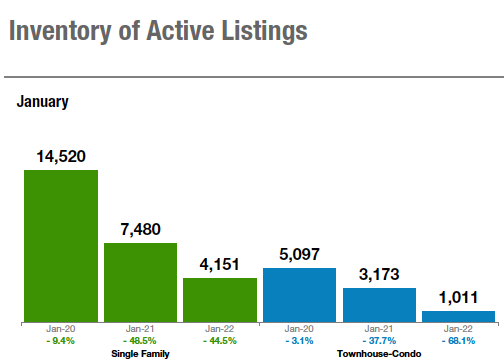

While the volume of closings fell in January, per traditional calendar activity, the overall inventory picture remains “unprecedented and shocking” to even the most experienced REALTORS® working in markets across the state. January’s inventory of active listings fell to yet another round of all-time lows. In the seven-county Denver-metro area, there were just over 1,400 single-family homes available, off 57% from a year ago, and 461 condo/townhome properties, off 74% from January 2021. Statewide, a total of 4,151 single-family properties reflects a 44.5% dip from a year prior, while the 1,011 active condo/townhome listings represent a fall of more than 68% from a year ago. All of these conditions have pushed the months supply of inventory to 0.5 months or less both Denver metro and statewide – once again, record lows. A balanced market, according to the National Association of REALTORS®, would have approximately six months inventory supply to create opportunities for both buyers and sellers.

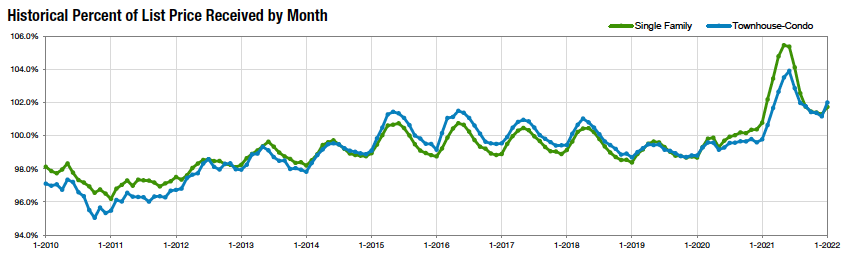

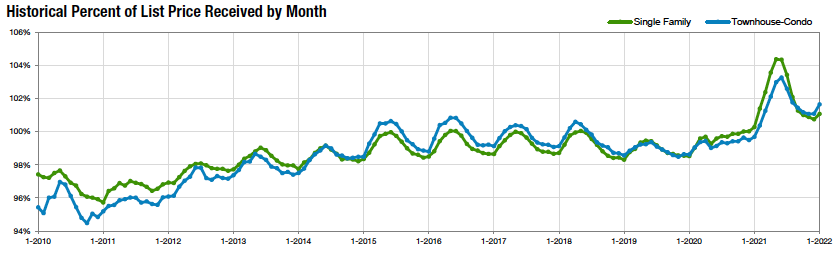

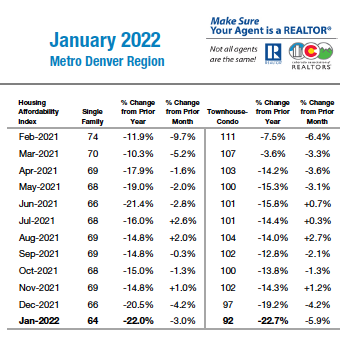

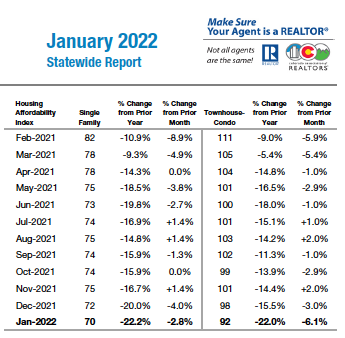

As a result, median pricing held steady from December to January but remains up 17 – 19% in both the seven-county Denver metro area and statewide, with the condo/townhome properties on the higher end of that range. The percent of list price received also ticked back up between 101 – 102% in January after dipping slightly over the previous 4-5 months.

Accessibility and affordability remain a significant theme across all markets as the CAR Housing Affordability Index – a measure of how affordable a region’s housing is to consumers based on interest rates, median sales price and median income by county, – is down 22% from a year prior in both Denver-metro and statewide.

With diverse and local factors playing in across the state, here is a snapshot look at some local market numbers and summaries:

- Aurora – There were only 164 total active listings (single-family, condo/townhome) at the end of January for the entire city of Aurora – the 3rd largest city in the state.

- Broomfield – There were eight new listings for the entire month of January in Broomfield. Eight listings. That is a number that many REALTORS® carry on their own for the month, not the entire real estate community, combined.

- Crested Butte/Gunnison –There are currently 30 single family homes on the market which doesn’t sound like a low number until you consider that none of them are under $1 million and only 7 are under $2 million.

- Denver County – Had seen supplies hovering from around two months of inventory in peak 2016 months to just 0.2 months today – which means – in just 6.2 days (0.2 months) of a normal 31-day month, every home that has or will become available that month is sold.

The median price for a townhome or condo in Denver County fell 1.2% from January 2021 to ‘22. During the same period last year, the increase was 8.2%. From 2019 to ‘20, a 17.6% increase. Price increases are slowing and, in this instance, pretty close to zero.

- Durango/La Plata County – There are no active single-family listings in the three largest subdivisions in the Durango market. There are only 13 active properties within the Durango city limits. Twelve of these properties are single-family homes (and four of those homes haven’t even been built yet). The remaining active property is a condo/townhome. La Plata County has roughly 50 single-family properties currently active with 55 pending.

- Estes Park/Larimer County – Active listings are down 71.2% with single-family home new listings down 38.3% and condos/townhomes off a similar -32.7%. Historically, Larimer County has been in a constant flux of rises and falls considering new listings. Looking back, a similar mountain-shape pattern has taken place since the year 2010 where the valley of the graph reaches its lowest low in the winter months and steadily shoots back up to its highest peak in the summer months.

- Fort Collins/Northern Larimer County – In 2002, the active inventory of single-family homes for sale at the end of January was a staggering 1,117 homes with 173 homes selling that month for a total sales volume of just over $40 million at a median price just over $200,000.

Fast forward 20 years to January of 2022: Active inventory at the end of the month was just 95 homes. 122 homes were sold for a total sales volume of nearly $73 million. Median price topped out at $541,000 selling on average for more than 2% over the list price.

- Glenwood Springs/Garfield County – In 2010, when the market was starting a slow recovery, there were approximately 700 homes active in Garfield County, with the inventory rising to nearly 950 single-family homes mid-year. From mid-2010 to today, it is a clear, steady decline ending with a total of just 80 single-family homes and 21 townhomes active in January 2022. The months supply of inventory hovered between 40-50 months for homes and 28-32 months for townhomes in 2010. Today, both sectors are less than one month.

- Grand Junction/Mesa County – Inventory of active listings sits at 0.7 months supply, with a total of just 265 active listings which is down 27.8% from January 2021

- Jefferson County – There were only 125 single-family homes on the market in January 2022 and just 50 condo/townhomes. The median sales price for single-family homes reached $646,000 compared to this time last year, the median price was $546,200. For condo/townhomes the median sales price was $393,250 at the end of January, compared to last year’s $299,000, almost the same amount of equity growth as the single-family homes.

- Pueblo – In January, the Pueblo West Metro Board initiated a moratorium on permits and water taps scheduled to last until the middle of March. Although it may not be a significant problem, Pueblo West did account for 59% of last year’s approved permits. That could add up to about 77 homes not getting built this year, when we need all we can get.

- Steamboat Springs/Routt County – January 2022 delivered 24 active single-family listings and 26 homes that went under contract – fortunately, 14 new listings came on and, to date, there are 32 active listings. Multi-family saw a similar predicament with 19 active listings and 26 units that went under contract with 24 respective new listings that came on and 18 currently available.

- Summit, Park & Lake counties – We ended the year with over $3 billion in sales volume, 31% above 2020. Single-family home prices in Summit went up a whopping 87.3% to an average of $2.84 million compared to last January. The highest price home sold was $12.2 million and the lowest was $815,000.

- Superior – There were two listings for sale in all of Superior and 23 under contract in just the month of January as those who lost their homes try desperately to stay in the same community while they try to rebuild.

- Telluride – January dollar amount of sales was $88.27 million, an all-time record for January. However, the number of sales were down 34% making it five months in a row for a decrease in this category. We’ve been expecting this reduced number of sales for over a year as we are finally running out of sellers willing to leave the Telluride region for a big profit.

- Vail – The market continues to amaze as transactions were down 14.1%, yet dollars generated were positive 8.8%. The increase continues to be driven by the $3 million-plus pricing niches as the under $3 million niches lost 3 points of market share – which was immediately picked up by the upper end niche. This trend has continued since the middle of 2021 and will continue until more property is available in the lower price points.

Taking a more in-depth look at some of the state’s local market data and conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“Despite my 42 years of working in the Denver-Aurora area as a REALTOR®, the January numbers were nothing short of shocking. To say that there is no inventory is a drastic understatement. The number of active listings in the entire city of Aurora sits at a miniscule 164. That may be a more appropriate number for a singular zip code but not the total of all active single family, condos and townhomes for the entire City of Aurora, the 3rd largest city in the state of Colorado.

“The lowest priced option in that very small pool is a one-bedroom condo at $155,000. The lowest priced single-family home is listed at $267,000 in Meadowood but you’ll need to hurry, because there is only one single-family residential home available under $300,000. The next available option in the city is listed at $379,000. Again, only one home is available at $379,000. In fact, under $445,000, across all Aurora zip codes, you will find only seven active listings.

“It makes perfect sense that prices have increased 19.8% over the past year, with some zip codes, 80015 for example, increasing over 23%. Plan to pay a median price over $500,000 in zip code 80013, and up to $740,000 median in southeast Aurora’s 80016.

“With inventory this low and buyers calling daily, we do not expect a decrease in pricing in the near future. Interest rates are increasing, but they are still historically low. With labor shortages, supply chain issues, cost increases on fees, permits, labor and material, builders cannot build homes fast enough. Patience and persistence are key,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Can we possibly use the word ‘unprecedented’ yet one more time? The story of low inventory coupled with high demand and rising prices is nothing new. We’ve been talking about it for two years now. In the Boulder and Broomfield county markets, we are seeing trends and experiencing a market like we truly have never seen before. It is actually, unprecedented.

“First, there are eight new listings for the entire month of January in Broomfield. Eight listings. That is a number that many REALTORS® carry on their own for the month, not the entire real estate community, combined. With only eight new listings and a few new construction homes still on the market from December, the mad rush to buy in this area has pushed the prices up by a whopping 36% since last January. Second, the data shows a 101.8% sales price/list price ratio, but once January sales close in February, they will likely reflect closer to 10%-15% over list price. Buyers have heard the news about the rising interest rates and they want in.

“To add to the challenge in these counties, the Marshall fire destroyed 1,100 homes, leaving the same number of displaced families trying to find housing. There are two listings for sale in all of Superior and 23 under contract in just the month of January as those who lost their homes try desperately to stay in the same community while they try to rebuild.

“Boulder County started with higher prices and has likely outpriced the majority of the new homebuyers, which seem to make up the majority of the homebuying population at the time. Inventory is still low, but prices rose a modest 8.7%. Attached units rose 4.5%, nothing to brag about to our neighbors in other counties. The lack of affordability may finally be slowing down the more expensive areas. It may just be the lead into a more balanced market one day,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

CRESTED BUTTE/GUNNISON

“Historically, January and February are the slowest months for closings in the Crested Butte/Gunnison area. The first quarter of 2021 was very busy with a lot of land selling that had been on the market for a long time (multiple years in some cases). The first month of this year is starting to show the effects of the lack of inventory with the number of transactions down 1/3 from last year and less than half the dollar volume. It is still a seller’s market with well-priced properties of all types going under contract with multiple offers in a matter of days.

“Since June 2020, prices in the area have skyrocketed and there is no sign that they will be going down anytime soon. Combining the price increase and the low number of homes for sale paints a very different picture for buyers. There are currently 30 single family homes on the market which doesn’t sound like a low number until you consider that none are under $1 million and only seven are under $2 million. It wasn’t long ago that $3 million was the most expensive house in the area and now there are 13 listed for that or more. There are eight homes under contract that are listed for $2 million or less so that tells you that homes in this price range are still appealing to buyers if the quality and location are appropriate for the price.

“Inventory numbers are lower than we have seen since before 2008 for all property types – single family, condos/townhomes and vacant land. In many areas, the number of properties for sale is less than half of what they were last year at this time. Listings continue to be king and buyers need to be prepared to act quickly when the right property comes along,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER COUNTY

“Where there’s a will, there’s a way and when it comes to prices, buyers have found a way. Long ago, we used to report numbers that weren’t ‘low inventory, high prices’ but as any reader knows, that is the carbon copied headline from around 2014 on. Today, fresh on the heels of the you-know-what-pandemic, the emergence of spring and borderline insane demand for housing, we see that the will of weary homebuyers in the Denver Metro area has found a remedy – albeit likely a temporary one. From 2016 through 2019, there was a cyclical supply and demand that fluctuated with the temperature. When the months got warmer, buyers would emerge like a grizzly bear in deep hibernation only to find that many, many other grizzlies were also starved. Seller grizzlies would get their home ready to market, list and close. Buyer grizzlies would emerge famished for food, ahem, housing and absorb anything and everything in sight. As the daylight would fade, so-to would the market and supply along with it. From early 2020 on, however, there has been close to zero seasonality for our bear friends as there hasn’t been enough to feed their appetite in the peak months. Denver County, for example, had seen supplies hovering from around 2 months’ worth of inventory in peak months in 2016 to just 0.2 months today. Put differently, in just 6.2 days (0.2 months) of a normal 31-day month, every home that has or will become available that month is sold. That’s the bad news.

“The good news is that buyers are changing their habits and adapting to the buying climate. During this same 2016 to 2022 timeline, there used to be a hefty difference in the demand between a freestanding home and anything else attached (condo, townhome, multi-family, etc.). When there were 1.5 months worth of inventory in the freestanding category in November 2016, for instance, there were 2.3 months worth for attached homes. Now, in January 2022, according to new data from the Colorado Association of REALTORS® for Denver County, that difference is just 0.1 month – the delta between the two products coming within a rounding error of one another.

“The good news in this scenario is that while the freestanding home remains the most popular and still, the most highly desired by most, buyers have accepted that inventory is what it is, and we now have something much closer to a harmony between the categories. Add to that another startling statistic and there is a glimmer of hope that there could either be a top of the mountain with regard to price or, more negatively, a fatigue that will slow demand. The median price for a townhome or condo in Denver County fell (1.2%) from January 2021 to ‘22. That might not seem like much but during the same period last year, the increase was 8.2%. From 2019 to ‘20, a 17.6% increase. Price increases are slowing and, in this instance, pretty close to zero.

“Nobody knows what the next month or, heck, the next week will look like, but we do have a noteworthy trend to observe here. Contemplating that the freestanding home now has slightly less pressure on it because of buyers’ adaptation to the attached home market, it’s not wild to consider that pricing for one will most certainly follow the other, ravenous bear-sized appetite or not,” said Denver-area REALTOR® Matthew Leprino.

METRO DENVER

“The Metro Denver housing market continues to experience robust activity despite the scarce inventory. The January statistics for the townhome-condo market are staggering. New listings were down 23.6% compared to January 2021. Pendings/under contracts were down 16.4 % and sold properties were down 13.6%. Although we continue to have fewer properties to sell, the American dream of homeownership is still an important dream to achieve for many, but it is significantly more challenging in this extremely competitive marketplace.

“Add the fact that we haven’t been adding many new condominium units and not enough new townhome units to the marketplace due to the Construction Defect Legislation put into place over a decade ago, available housing units will continue to be a challenge. Condominiums and townhomes have been a place where first time homebuyers could start their homeownership path and move down homebuyers could leave their large family homes and enjoy a more maintenance free lifestyle. As the 2022 Colorado Legislature went into session in January, there has been some talk about looking at revising this legislation in hopes of increasing the building of this housing product. Due to the severe lack of inventory of this type of housing, we have seen the effect on pricing with the median townhome-condo price up 19% at $400,000, which has caused the housing affordability index to drop to 92. Working with some first-time homebuyers these past few weeks, they have found properties that fit their needs and their budget, but the fierce competition of 15 to 20 offers on a property alone can be discouraging, not to mention that, to be competitive, you need to offer 10 to 20% above the list price, limit your inspection and not make the offer conditional on an appraisal, just makes the process that much more challenging for the majority. As affordability and availability continue to be challenges in today’s housing environment, real estate still offers not only shelter, security and stability, but a great investment vehicle as the 19.6% appreciation would attest to,” said Denver-area REALTOR® Karen Levine.

DURANGO/LA PLATA COUNTY

“The law of supply and demand is a theory that explains the interaction between the sellers of a resource and the buyers for that resource. The theory defines the relationship between the price of a given good or product and the willingness of people to either buy or sell it. Generally, as price increases, people are willing to supply more and demand less and vice-versa when the price falls. What the theory doesn’t take into consideration is in real estate, a lack of inventory can almost cause a spiral feeding on itself. When there is no inventory, many potential sellers decide not to sell since there is nowhere to go: there are no homes available that suit them. This causes even less inventory to come on the market, and demand then grows even more.

“The Durango market is seeing prices continue to rise by leaps and bounds. Inventory levels are continuing to plummet to near non-existent levels, and buyer demand remains very strong. At the time of this report, there are no active single-family listings in the three largest subdivisions in the Durango market. There are only 13 active properties within the Durango city limits. Twelve of these properties are single-family homes (and four of those homes haven’t even been built yet). The remaining active property is a condo/townhome. La Plata County has roughly 50 single-family properties currently active with 55 pending.

“NAR’s definition of a healthy market is a six-month supply of inventory. La Plata County currently has less than one month’s supply. Median home prices climbed by more than 18% for single-family homes and 53% for townhouses and condos compared to January 2021. Inventory levels decreased by almost 40% for single-family and 31% for condos/townhomes since January 2021.

“There has never been a better time to sell a home than right now. Buyers are clamoring to secure contracts before the anticipated interest rate hike later this spring. As frustrating as it is for buyers, the peak of the market has yet to be reached. Homeownership is still considered to be one of the safest and best ways to build wealth,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK/LARIMER COUNTY

“Not only has the weather come in at a slow stroll this year, listings across Larimer County are following suite with active listings down -71.2%. Single-family home new listings fell 38.3% and condos/townhomes were down a similar -32.7%. These numbers are not as surprising as one may gather off first glance. Historically, Larimer County has been in a constant flux of rises and falls considering new listings. Looking back, a similar mountain-shape pattern has taken place since the year 2010 where the valley of the graph reaches its lowest low in the winter months and steadily shoots back up to its highest peak in the summer months. This pattern is likely to continue as time goes on until new inventory can make its way to the market.

“It makes sense with interest rates on the rise that people are making tough choices regarding their money and investments. There are plenty of thought-provoking choices to make in life more so when you take a glance at predictions and numbers that can relate back to yours or your client’s livelihood. When average sale prices of single-family homes in your area fall around $583,367 followed by townhomes and condos at their average of $393,000, this amount of money will have major pull on life’s choices. Do we stay, invest more in our property, and ride the slopes of the economy? Or do we sell and make the most of a new beginning? The choice can go both ways when you look at the numbers however, it isn’t always the option that sales prices are up +15.4% and property owners are seeing gains of up to +1.3% on listing prices for a total of 101.5% over asking price,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“What a difference 20 years makes. The number of homes available for sale in greater Fort Collins and northern Larimer county is at an all-time low. In 2002, the active inventory of single-family homes for sale at the end of January was a staggering 1,117 homes with 173 homes selling that month for a total sales volume of just over $40 million. Median price was just over $200,000.

“Fast forward 20 years to January of 2022: Active inventory at the end of the month was just 95 homes. 122 homes were sold for a total sales volume of nearly $73 million. Median price topped out at $541,000 selling on average for more than 2% over the list price.

| Year | 2002 | 2022 |

| Homes Sold | 195 | 122 |

| Sales Volume | $44,137,360 | $72,682,605 |

| Active Inventory | 1,117 | 95 |

| Median Price | $203,000 | $541,000 |

| SP/LP % | 98.2% | 102.2% |

SOURCE: IRES Multiple Listing Service

“What’s striking is that 2002 was considered a ‘hot market’ and 2022 is shaping up to also be a ‘hot market’ but in a completely different way. Right now, home buyers are desperately on the hunt for a house to buy before interest rates go up any further which could price them out of eligibility for purchasing a home altogether. The problem, as the chart above illustrates, is that there just aren’t enough homes available to buy, causing multiple offers that drive the final purchase price to as much as $30,000 or more over the original list price. On a modest home that came on the market last week, there were as many as 30 offers submitted within just a few days of being on the market.

“Interest rates have crept up just over 4% for a 30-year fixed rate and the forecast is for that number to climb to over 4.5% by mid-year. This will likely cast buyers to the sidelines and slow the pace of offers in the spring. Sellers may be in for a surprise if they don’t adjust their earnings expectations as buyers may simply step out of the home buying market altogether.

“As current pandemic woes continue to ease and the global supply chain gets back on track, the American economy is poised to chug ahead with plenty of momentum heading into spring. Wage increases should weather inflation which is anticipated to return to a more manageable benchmark later this year. Just about any home that is put on the market will likely sell quickly and buyers will just as likely continue to compete fiercely for the few homes available to buy,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/ROARING FORK VALLEY/GARFIELD COUNTY

“Housing and snow have a lot in common in the Roaring Fork and Colorado River Valleys. Along with the lack of snow, new single-family home listings were down 31% in January with pending sales showing a decrease of 44.2% compared to 2021. The market showed a slight increase in the townhome/condo sector with new listings being up 6.3% but pending sales decreasing 32%. The lack of inventory this January is at an all-time low. With more and more people wanting to relocate to western Colorado, the strain on affordable housing, water and infrastructure has local municipalities on edge. Sellers who have found a place to go have never had it this good and buyers moving from other pricey states are willing to pay.

“Looking back to 2010, when the market was starting a slow recovery, there were approximately 700 homes active in Garfield County, with the inventory rising to close to 950 single-family homes mid-year. If you examine the graph from mid-2010 to today, it is a clear, steady decline ending with a total of 80 single-family homes and 21 townhomes active this January. In 2010, the months’ supply of inventory hovered between 40-50 months for homes and 28-32 months for townhomes, today, both sectors throughout Garfield County are less than one month.

“The lack of inventory, coupled with interest rates on the rise and inflation at a new high, means buyers in this market will need to be patient and lock in their rates as soon as they have successfully secured a contract,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“The new year in Mesa County has presented a familiar but significant challenge for home buyers. Inventory of active listings sits at 0.7 months supply, with a total of just 265 active listings which is down 27.8% from January 2021. In fact, all statistical categories are down with the exception of price. January 2022 median price was $370,000, up 25.4% and the average was $401,853, up 18.3%. The housing affordability index dropped to 75. We are down 50% on the $200,000 – $300,000 price range in active inventory, and 30% on the $300,000 – $400,000 range. Those are our highest demand price ranges, so many buyers get disappointed. As the interest rates start to increase, it will become increasingly hard for those buyers to find a property. If you go back only 3 years to 2019, active listings in January were 837. We now have less than a third of that available and are definitely setting historical markers for the local real estate market,” said Grand Junction-area REALTOR® Ann Hayes.

GOLDEN/ARVADA/JEFFERSON COUNTY

“Cash is the name of the game. If buyers have cash, either for the complete purchase of a home or to cover the appraisal deficiency from what the home appraises for and the purchase price offered, you win.

“In Jefferson County, there were only 125 single-family homes on the market in January 2022 and just 50 condo/townhomes. To say this is the least amount of inventory on the market in decades is an understatement. This market is brutal with buyers offering thousands if not tens of thousands over the asking price. The median sales price for single-family homes reached $646,000 compared to this time last year where the median price was $546,200. For condo/townhomes, the median sales price was $393,250 at the end of January, compared to last year’s $299,000, almost the same amount of equity growth as the single-family homes. Days on the market is currently around 20 days so homes are still selling quickly. Buyers need to be swift to tour a home as soon as it hits the market and have a game plan of how they will be able to win the bidding war amongst several other buyers,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“The year has started strong with new listings up 8.1% to a total of 293. Our pending sales jumped 25.3% compared to January 2021 and even our sold listings came in up 13% over January 2021. Our problem, like everyone else, remains lack of inventory. Despite the new builders in town, the inventory is still historically low. Getting building supplies is still a big problem and new homes are taking 6-8 months to complete with prices continuing to go up. The percent of list price received fell to 99.2% compared to last year’s over 100% ratio at this same time.

“The median price sits at $295,000 at the end of January. Although prices are still going up, buyers are still putting in offers as they understand that it is cheaper to buy now instead of waiting for the market to slow down. We’re even seeing buyers from other markets starting to look a little closer at Pueblo and learn more about our market. That’s just not something I’ve seen much of over the past 25 years.

“Last month, the Pueblo West Metro Board initiated a moratorium on permits and water taps scheduled to last until the middle of March, as they look to get water issues worked out. Although it may not be a significant problem, Pueblo West did account for 59% of last year’s approved permits. That could add up to about 77 homes not getting built this year, when we need all we can get,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“You’ve heard it – do the math. Now more than ever, math skills are being honed because math has gotten trickier for real estate due to historically low inventory. Buyers are having to weigh the pros and cons of living in city limits versus outside the city. Figuring out distance, time, and cost for travel, rationalization of higher or lower price per square foot of one property over another, and calculating the cost to renovate versus the cost to build are some of the quandaries that purchasers must weigh.

“Buyers in 2022 will need to budget for the probability of progressive interest rate increases over the year and its effects on down-payment and buying power. Most buyers are hoping to purchase sooner than later; however, justifiably not feeling in control due to inventory. The anxiousness to purchase is often because of paying record rental rates that can continue to increase. Many have done the math and know that they could own for the same or lower monthly payment, earn tax deductions and begin the opportunity to gain equity.

“The first month of 2022 in Routt County revealed 24 active single-family listings and 26 homes that went under contract – fortunately, 14 new listings came on and, to date, there are 32 active listings. Multi-family saw a similar predicament with 19 active listings and 26 units that went under contract with 24 respective new listings that came on and 18 currently available.

“When the months supply is calculated, it equates to less than one month supply of houses and less than two weeks supply of townhomes/condos. January is historically a slower period for our valley – both for sales and listings. Statistics reveal that the percent of list price received for single-family was 97.4% and 101.9% for townhomes/condos. Median sales prices are up 12% for both single- and multi-family over January 2021, while average sales prices are up almost 26% for single-family and just under 6% for multi.

“The market is still seeing at least 50% of transactions closing in cash – sellers are selecting cash over finance offers most of the time as it comes down to math – cash deals close faster, less carrying costs and fewer contingencies. Buyers could end up competing against one or more cash offers and different provisions may need to be factored to compete – all the more advisable to work with a broker that has geographical expertise, since not all markets are the same and within markets there can be micro-markets that call for different pricing or strategy.

“There are common denominators for buyers looking to buy real estate in the mountains. Typically, they want active lifestyle, convenience to the outdoors and the activities of the area. There is also an atypical common denominator that many real estate brokers have started experiencing, which is periods of time where they have only one, or even zero active residential listings (single or multi) and the same situation occurring with pending sales. As we get nearer to summer, we usually see an uptick of house listings. The end of ski season usually brings on more multi-family properties. In the meantime, properties will trickle on and, for the vast majority, rapidly go under contract,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“I don’t know how many times my jaw can hit the floor as I review the stats for Summit, Park and Lake counties, but at this point I should have a sore jaw. Summit ended the year with over $3 billion in sales volume, 31% above 2020. That is a truly amazing, record-breaking number for the area. As we enter 2022, a new year with new expectations and thoughts of change, the change is still heading in the ‘holy cow’ direction.

“Single-family home prices in Summit went up a whopping 87.3% to an average of $2.84 million compared to last January. Of course, the market is small enough that a large sale can skew the statistics, but this represents just one less home sold in 2022. The highest price home sold was $12.2 million and the lowest was $815,000. All active residential listings range from $160,000 for a home in Leadville to about $19 million for a home in Breckenridge. The catalyst for the price increases, as we have been repeatedly commenting on, is limited inventory with new listings down over 30% and overall sales down 21%.

“Short-term rentals and affordable housing are hot topics with no perfect solutions. Per Land Title’s stats, local buyers make up 23% of the market, front range 44%, and out-of-state, 33%,” said Summit-area REALTOR® Dana Cottrell.

| Single Family | Average Price % Jan YTD 2022 vs 2021 | Average Price YTD 2022 |

| Summit County | 87.3% ↑ | $2,847,346 |

| Park County | 65% ↑ | $813,956 |

| Lake County | 34% ↑ | $588,333 |

| Townhouse / Condo | Average Price % Jan YTD 2022 vs 2021 | Average Price YTD 2022 |

| Summit County | 20% ↑ | $749,588 |

TELLURIDE

“January dollar amount of sales was $88.27 million which was an all-time record for January. However, the number of sales were down 34% making it five months in a row for a decrease in the number of sales. We’ve been expecting this reduced number of sales for over a year. My guess is that we are finally running out of sellers willing to leave the Telluride region for a big profit. Yes, there will be some more sellers willing to take the money and run, but most won’t be able to buy back in.

“At the same time, our market is losing some buyers to other Colorado resorts where the dollar just buys more square footage. It’s also hard to get a restaurant reservation between 6:30pm and 8:30pm in the pricier Telluride restaurants. We had to book our Valentine’s Day reservation a month in advance and still had to call the owner for a ‘favor’ for the time we wanted. I share this because real estate prices affect our community in positive ways and some not so positive.

“On a side note, the Telluride Resort market is one of the few in Colorado in which the number of REALTORS® here is still about the same as in 2013 at the end of the Great Recession,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Vail Valley market continues to amaze me as transactions were down 14.1%, yet dollars generated were positive 8.8%. This increase continues to be driven by the $3 million-plus pricing niches as the under $3 million niches lost 3 points of market share – which was immediately picked up by the upper end niche. This trend has continued since the middle of 2021 and will continue until more property is available in the lower price points. The volume of $158,631,400 is amazing as the inventory is 142 units versus 408 units during the same period 2021. This reduction is negative 65.2% and is at the lowest inventory we have ever started a year over the past four decades. The months supply of inventory is 1.0 and it is definitely skewed to the upper pricing niches.

“Buyer demand continues to be strong as sales are achieving 100% of asking price market wide and, in certain areas of the market sales are reaching over asking price with multiple offers. Interest rate increases will definitely impact the lower pricing niches however, a vast majority of the upper range are cash transactions. Buyers see owning real estate as a solid investment versus other alternatives in light of all the many potential negatives worldwide that are hanging out in this period of global turmoil,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA SINGLE-FAMILY SNAPSHOT

STATEWIDE SINGLE-FAMILY SNAPSHOT

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

COLORADO

HOUSING AFFORDABILITY — SEVEN-COUNTY DENVER METRO AREA

HOUSING AFFORDABILITY – STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The January 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.