July Teases the Start of a New Real Estate Game for Second Half Of 2022

ENGLEWOOD, CO – With active listings and inventory rising across the seven-county metro area and state, slowing sales and fewer new listings have kept the full swing of the real estate pendulum in check, according to the July 2022 Market Trends Housing Report from the Colorado Association of REALTORS®. The combination of factors, including rising interest rates, is giving potential buyers a few more options and opportunities but it remains a seller’s market as median pricing holds strong.

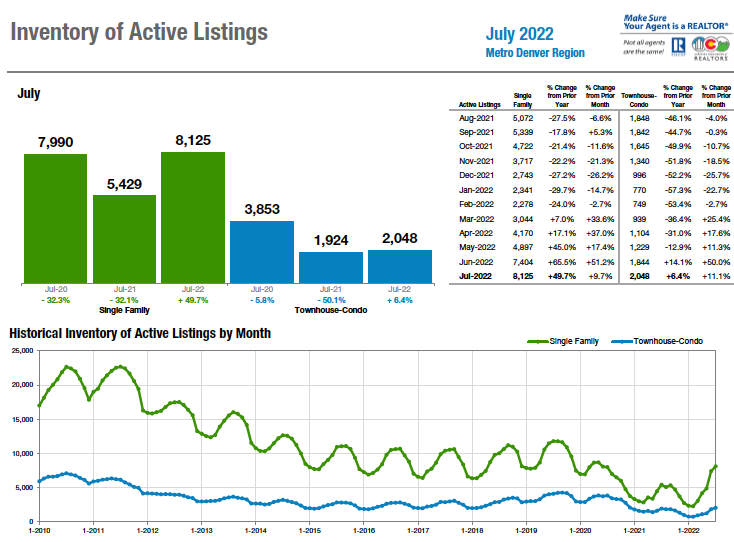

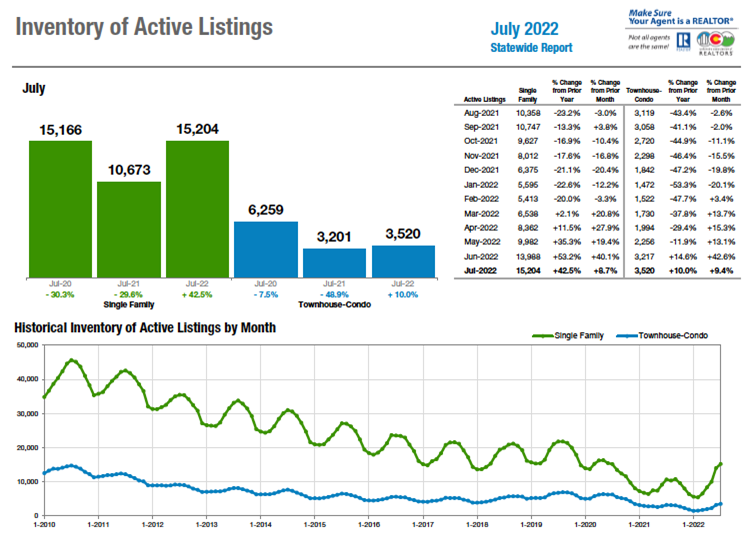

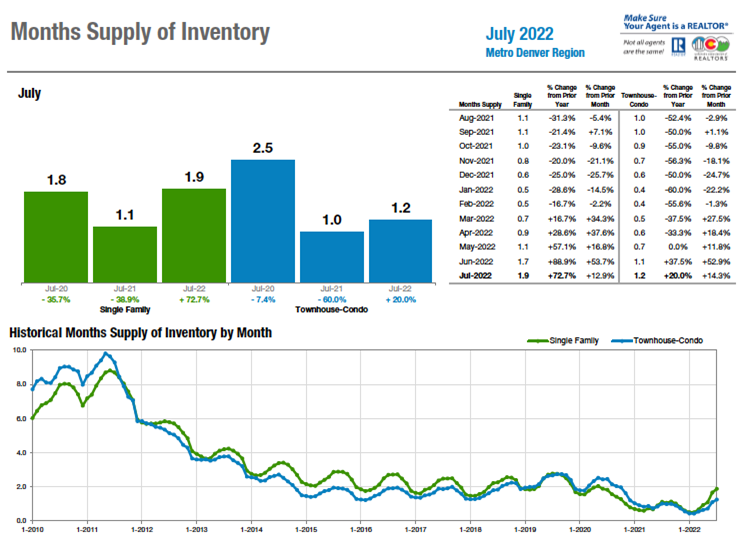

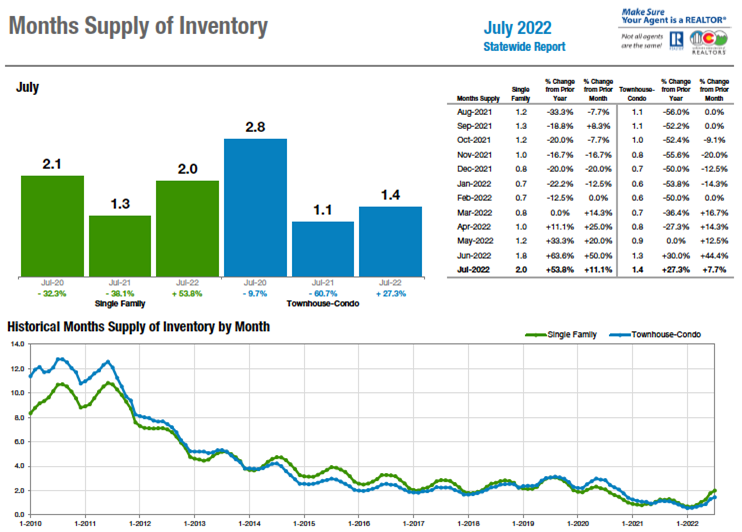

In the metro-Denver market, the inventory of active listings rose nearly 10% for single-family homes and more than 11% for condo/townhomes. Statewide, those numbers were up 8.7% for single-family and 9.4% for condo/townhomes. Those numbers helped push the months supply of inventory for single-family homes in metro Denver to 1.9 months – up 72% from a year prior – reaching a volume not seen in approximately two years. Statewide, that figure did hit the two-months supply mark and is up nearly 54% from July 2021.

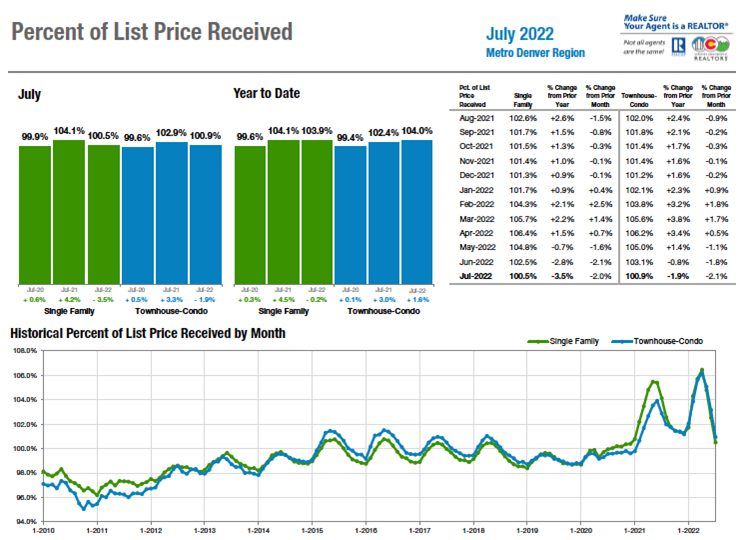

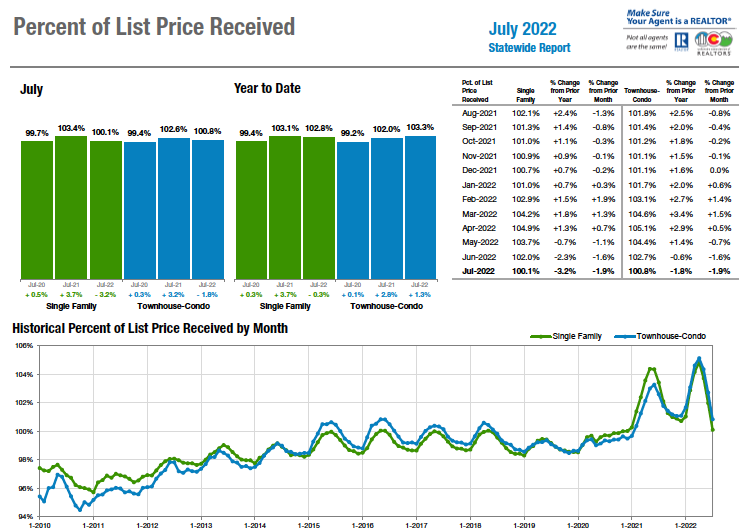

Traditional seasonal slowdowns and uncertainty among sellers also helped drive down new listings approximately 15% between June and July across all product types statewide. In addition, the percentage of list price received also dipped approximately 2% across the board and ranges from 100.1% for single-family homes statewide to 100.9% for condo/townhomes in the Denver metro market.

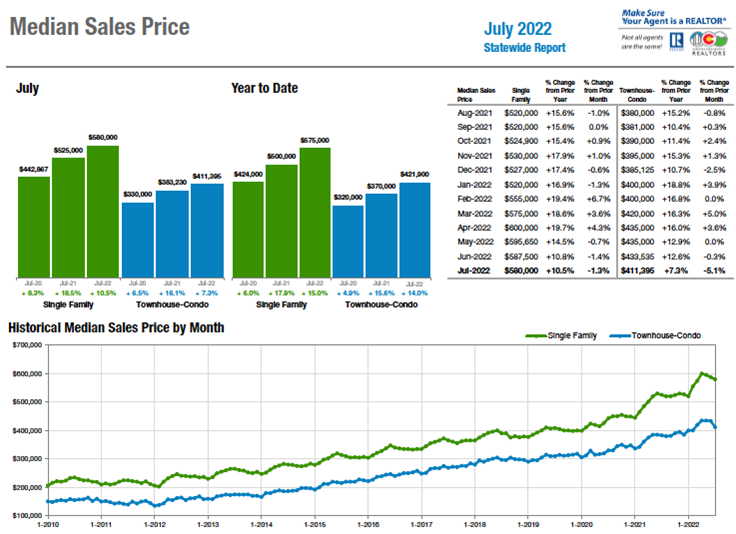

Despite rapid changes in several market measurements, median pricing held its own. In the Denver metro area, single-family homes dipped 1.7% from June to July to $635,000 but remain up more than 10% from a year prior. Condo/townhomes fell nearly 7% from month-to-month, however they remain up 6.8% compared to a year ago. Statewide, median pricing for single-family homes fell 1.3% to $580,000, up 10.5% over July 2021. Condo/townhome median pricing slipped 5.1% to $411,395 which is up 7.3% over a year prior.

With diverse and local factors playing out across the state, REALTORS® across the metro area and state shared these highlights:

- Aurora – The best description for the Aurora/Centennial market is fickle. The good news for buyers is that the inventory is up about 30% over last July, giving buyers more choices and the opportunity to avoid bidding wars and some of the craziness that we saw earlier in the year. Average days on the market is also up over last year. For sellers, the good news is that prices are still up over last year. In Aurora, prices are up 12% to a median price of $555,000, and in Centennial prices are up 8% to a median of $680,000.

- Boulder/Broomfield counties – News of price reductions pepper our emails each morning and bidding wars seems to have gone away however, the market shift hasn’t impacted Boulder and Broomfield counties significantly. Buyers who qualify at higher rates enjoy a few more days to look at homes and less competition. This market correction is just what we needed to slow down a bit, but not enough to come anywhere close to a buyer’s market. Not yet.

- Colorado Springs – One weekend we’re watching buyers toss everything they can at a house. Four weeks later, sellers are shell shocked they may have missed the top of the market. July puts into perspective how much of a change we are seeing. We start with a 23% drop in sold properties, year over year. That number by itself would make one sit back in their chair and ponder. But the follow up to that is a 91% increase in active listings and the final blow is a 19% drop in pending listings. We are playing a totally different real estate game.

- Denver County – The rate at which prices are increasing, is decreasing – just 11.5% year over year vs. July 2021’s 21.5%. With 1.3 months inventory supply, we tie that of pre-COVID-madness levels. The median price for a freestanding home, though still record-setting, $723,750, is actually lower than last month’s $750,000. However, it’s important to note that before you read that last number and wonder if that means prices are decreasing, the answer is a resounding ‘no.’

- Douglas County – Slow can seem scary, especially accompanied by headlines about recessions and bubbles, but I reiterate my remarks from last month: this is a step toward normalcy and it is NOT unhealthy. The shift we are seeing in the markets right now are likely driven by real estate’s natural seasonality, and actually represent a more healthy market. A year ago: inventory was more than 34% lower, homes spent almost half the time on the market, and were going for about 3.7% more over list price. It was extremely difficult to buy a home.

- Durango/La Plata County – The pendulum appears to be swinging slightly in the direction of a normal summer month. Given the craziness the real estate market has seen in the last two years due to COVID, 2019 is the most recent ‘normal’ year to use for comparison. Comparing July 2022 to July 2019, the number of single-family listings sold was just seven units short of 2019. Inventory, or the lack of, continues to buoy prices.

- Estes Park/Larimer County – We’re showing some relief from the feverish market experienced the past year, specifically in terms of more time that listings are on the market and the percent-of-list price received. New listings aren’t popping up to meet the demand and the ones currently on the market are selling. Seeing some price reductions as well indicates that listing prices were inflated and coming back to reality, or closer to it.

- Fort Collins/Northern Larimer County – The housing market of the 2020s has been defined by high demand, low inventory, and until recently, cheap money conditioning buyers to be constantly vigilant for the “Goldilocks Home, ”the home that’s ‘just right’. The crest of this phenomenon hit in April 2022 as list-price to sale-price ratios climbed to nearly 6% over-asking. Then buyers were slapped with big jumps in fixed rates for 30-year mortgages in May, June, and July that made buying houses at the current median price of over $600,000 exceedingly impractical. While these market results show some softening – this is not a bubble bursting by any stretch.

- Grand Junction/Mesa County – Median and average sales prices are off from last month, but only slightly. Compared to July 2021, median is up 16.2% at $395,000, and average sold is up 16.4% to $435,907. The market factors are giving buyers a little more selection, but it remains a seller’s market. Interest rates leveled out a little last week, and it will bear watching what effect it has on activity.

- Jefferson County/Golden – The housing market story remains the same for the month of July in Jefferson County. Although it is still a seller’s market, prices are getting reduced if the home is not priced right when it hits the market. For single-family homes, the median sales price increased 8.6% to $695,000. New listings were up 13% with overall inventory up 41.7% and average days on market up 50%.

- Pagosa Springs/South Fork – We’re seeing shifts in inventory and mindset. July appears to be the awakening month in Pagosa Springs and South Fork, Colo. Both day temperatures and home sale price points rose to the heat of summer. Although like summer nights that cool down, so are exaggerated home prices that are now showing price adjustments daily.

- Pueblo – Similar to our June analysis, the July market numbers trended downward with the exception being median sales price that rose 4.7% to $321,000 and is up 14.5% year to date. Compared to July 2021, new listings were off 0.8% and overall sales fell 18.2%. The percent of list price received also dipped 1.7% to 99.7% compared to last July. All of these factors helped push the months supply of inventory up nearly half a month to 1.9 months and is providing a little bit of relief and help to potential buyers.

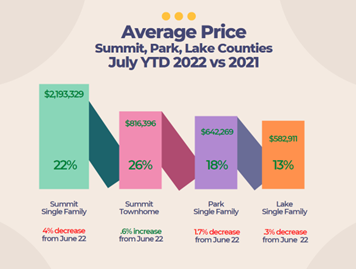

- Summit, Park & Lake counties – The market is leveling, and chances are better than ever to get a property in Summit, Park or Lake counties. You might even get to brush off your negotiating muscles. While economic factors and interest rate hikes might make some back off, it makes a great opportunity for others. There is now about 4 months of inventory. A balanced market is about 6 months, so these changes feel like we are heading to equilibrium.

- Telluride – With sellers adjusting their prices somewhat and buyers still feeling good about the safety of their real estate investments, I believe 2022 will continue to have very good sales. The higher-end markets do price out some buyers, but now they might be letting some of those buyers back in as August sales are off to a very good start.

- Vail – July brought the market trend to a new position. The transactional volume has been declining for a number of months and year-to-date has dived to down to -27.3%. A few months ago, we saw a negative dollar volume versus the same month in 2021. In July, the year-to-date dollars were -6.2%. The July performance versus 2021 was -27.3%, transactions were negative 25.5% in dollars. Based upon this performance, it appears the volatility of the past two years may have reached a level where the market trend is more normal, as well as the the trend moving forward.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The best description for the Aurora/Centennial market is fickle. The good news for buyers is that the inventory is up about 30% over last July, giving buyers more choices and the opportunity to avoid bidding wars and some of the craziness that we saw earlier in the year. Average days on the market is also up over last year.

“For sellers, the good news is that prices are still up over last year. In Aurora, prices are up 12% to a median price of $555,000, and in Centennial prices are up 8% to a median of $680,000. As always, local factors play a significant role. We are seeing a large number of contracts fall out, putting those properties back on the market and creating additional opportunities for buyers who are keeping a close eye. We are also seeing numerous emails each day announcing price reductions. The nice, clean, updated properties in high demand locations are still seeing multiple offers, and in some cases, offers over list price,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“News of price reductions pepper our emails each morning and bidding wars seems to have gone away, however the market shift hasn’t impacted Boulder and Broomfield counties significantly. As evidenced by the July statistics, this part of our front range market remains very much on the seller’s side with prices up to 11% in Boulder since the beginning of the year and days on the market are still under about a month. Sales are down, however, they are a direct effect of the interest rate hikes over the last few months. Our months supply of inventory has increased from about one month to two months – still low but moving in a direction that gives buyers a few more options. Boulder County condos/townhomes are bringing home the big numbers with 17% appreciation since January and over-list price expected on most sales.

“Broomfield homes are still flying off the market in under 11 days and prices are up 9.5% since January. Sales are down here, too, thanks to the interest rate hikes, but most homes are selling for more than list price. With only 1.8 months of supply, we are still in a seller’s market.

“The buyers who can still qualify at the higher rates are enjoying a few more days to look at homes and fewer competitive situations. All in all, this market correction is just what we needed to slow down a bit, but not enough to come anywhere close to a buyer’s market. Not yet,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“I have to admit, even I am a little shocked at how fast the market decided to change. It is like we had a really hot summer day and a few days later, a blizzard. One weekend we were watching buyers toss everything they could at a house just to have a chance. Four weeks later, sellers were still shell shocked they missed the top of the market. That was May, and then June hit and the trend continued. But July really puts into perspective how much of a change we are seeing. We start with a 23% drop in sold properties, year over year. That number by itself would make one sit back in their chair and ponder. But the follow up to that is a 91% increase in active listings and the final blow is a 19%drop in pending listings. We are playing a totally different real estate game.

“Inflation continues to be a pesky little fella. At 9.1%, many people are feeling that pressure. Throw in higher gas and food prices, and we watched consumer debt rise trying to cover it all. To try and slow inflation, the Fed jumped in to save the day and chased up short-term rates over a couple months putting even more pressure on anyone who had any credit card debt while they were still trying to catch up from all their other costs going up. The story of transitory inflation soon turned to short-term inflation, and then that story turned into longer-term inflation. This is all beginning to put some pressure on what had been a very resilient housing market. Although homes continue to sell quickly, the change is here, and I suspect we will continue to see days on market extend and price drops pick up speed.

“On the national scene, we can see that manufacturing is beginning to slow. A leading indicator to a slowing economy. We found out that last two quarters of Gross Domestic Product were negative, showing we are in a recession, regardless of how politics tries to explain it away. Top that off with whispers of layoffs here and there, and I suspect that the tight labor market will begin to see more layoffs and those in turn will start to show even more weakness in the economy. Unemployment hitting 6-7% would be a game changer. The Fed has admitted stocks will fall, unemployment will rise and housing has to cool. I would say that takes a lot of guess work out of what is in the future for the economy and housing,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“You’re on your flight. Your phone is in ‘airplane’ mode, and you switch into vacation mode. The takeoff was bumpy, you’re headed over the mountains after all. About 10 minutes in and you feel the plane start to level out. The engines sound like they’re working a little less strenuously and you pop your ears one last time. The feeling is calm because the climb, especially this one, was quite choppy, and despite having a nice window seat to know everything was okay, you saw plenty of storm clouds on the horizon.

This is the 2010-2021 real estate market. We taxied around for a while in 2008-2009 with prices not really doing anything, inventory was high, really high, but few could qualify and so the supply of homes, despite hitting record lows, lingered.

“In 2010, things started to change, and people’s financial outlooks appeared to recover, ever-so slightly. The plane left the safety of the jet bridge and started out towards the runway. By the time we reached our takeoff position, call it 2011, supply began to descend, prices began inching up and by 2013, the landing gear was retracted – we were airborne.

“From 2014 until the first quarter of 2021, it seemed like the jet was going to completely leave earth’s atmosphere. Higher and higher, bumpier and bumpier and the hope for reality, like any semblance of normalcy in our marketplace, grew further and further away. With 2022 Q3 well underway, we have finally reached cruising altitude. In Denver particularly, the rate at which prices are increasing, is decreasing – just 11.5% year over year versus July 2021’s 21.5% increase. Our months supply of inventory, 1.3, ties that of pre-Covid-madness levels. The median price for a freestanding home, though still record-setting, now $723,750, which is actually lower than last month’s high of $750,000.

However, it’s important to note that before you read that last number and wonder if that means prices are decreasing, the answer is a resounding ‘no.’ In the last five years, prices have dropped nominally and are similar to this year, that in three of those cases, it further explains that June usually peaks at seasonal price highs throughout the calendar year.

“The concept that ‘what goes up, must come down’ is certainly not lost on me in this scenario. As is the case with most June to July and December to January periods, things fluctuate. Although 2013 to 2022 was one heck of a long ascent, one can hope that we will now have a period of low turbulence, a smooth flight, and we’ll at least get in several bad movies before the captain alerts us to any initial descent,’” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“Compared to the highly volatile real estate market earlier this year, July concluded in a rather mundane fashion. The market statistics for July look fairly similar to those of June, with the slowdown continuing slightly as sellers realize their significant drop in negotiating power since the spring peak. Median sales price for single-family homes in July dropped just $600 from last month to $730,000, but percent of list- to-close price dropped dramatically from 101.5% to 100.2%, implying lower list prices. From these figures, it’s pretty clear that sellers have begun to take the advice of many agents to list their home more modestly. Our buyer clients are much more confident to submit below asking price offers and negotiate inspection items more than any other time this year.

“Slow can seem scary, especially accompanied by headlines about recessions and bubbles, but I reiterate my remarks from last month: this is a step toward normalcy and it is NOT unhealthy. The shift we are seeing in the markets right now are likely driven by real estate’s natural seasonality, and actually represent a more healthy market in my opinion. As the rapid pace of appreciation has come to a halt and mortgage rates have contracted to a more manageable level, there are more opportunities for first-time homebuyers (and those without $200k for a down payment) to confidently search for homes. To illustrate just how much healthier this market is, look back to a year ago: inventory was more than 34% lower, homes spent almost half the time on the market, and were going for about 3.7% more over list price. It was extremely difficult to buy a home.

“As the year continues, the market will almost certainly slow down even more; not because of recessionary fears or crazy interest rates, but because that is the seasonal nature of real estate. If you’re looking to buy a home, now is a great time to get started or get serious about your search as inventory picks up and sellers become more motivated. And to sellers: don’t be dissuaded. The Douglas County market remains incredibly desirable and is certainly still a seller’s market, though it may take a little more effort to sell your home,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The pendulum appears to be swinging slightly in the direction of a normal summer month. Given the craziness the real estate market has seen in the last two years due to COVID, 2019 is the most recent ‘normal’ year to use for comparison. Comparing July 2022 to July 2019, the number of single-family listings sold was just seven units short of 2019. Inventory, or the lack of, continues to buoy prices. There were 553 active listings on the market in July of 2019 (almost a nine-month supply), compared to just 215 in July 2022 (a three-month supply). The year-to-date median price for single-family homes has continued to drop but is still up more than 18% compared to 2021. The percent of list price received dropped below 100% for the first time since January 2022.

“For buyers, there are more options, less competition, and fewer bidding wars as they begin to get some of their negotiating power back. Cash buyers have a big advantage with rising interest rates pushing some buyers to the sideline.

“Sellers still hold the majority of the cards. Homes located in the most desirable locations in the best condition are still in high demand and are commanding over-asking offers. Homes needing updating or with deferred maintenance are staying on the market longer and requiring sellers to either make concessions for repairs or adjust their list price to entice more buyers. This is finally leveling the playing field for some buyers.

“The bottom line is that there is no better way to hedge against inflation than by owning real estate. With rents mirroring the cost of owning a home and interest rates still at a relative low rate, owning versus renting is a no-brainer for most buyers,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK/LARIMER COUNTY

“Larimer County has been showing some relief from the feverish market experienced the last year, specifically in terms of more time that listings are on the market and the percent of list price received. New listings aren’t popping up to meet the demand and the ones currently on the market are selling. Seeing that there are some price reductions as well indicates that listing prices were inflated and coming back to reality, or closer to it.

“New listings for single-family homes have continued to decline. Compared to July 2021, new listings have plummeted 33.33%, and year-to-date they are at -17.9%. Days on market for single-family homes have stayed fairly steady compared to last July with an average of 35 days, compared to 38. The average sales price continues to build momentum. With a 10.8% increase at this time last year, we now see a notable increase of 18.5% year-over-year. The percent of-list-price received is dropping a bit. In July 2021, sales were at 103.4% of list price, and this July it dipped 2.5% to fetch just over list price at 100.8%. It seems single-family homes are the hot item in the housing market in Larimer County.

“The townhouse/condo market is a completely different beast today. The stats are all over the place with low inventory and increasing prices, yet there is a delay in days to close. New listings are down 16.9% from July last year, and year over year are down 22.6%. The average sales price has stayed at a consistent increase, along with single-family homes, with a 13.8% bump compared to July last year. The percent-of-list-price has reduced as well, to 1.9% year over year and 0.9% compared to July 2021. The craziest stat is average-days-on-market, where we’ve gone from 59 days in July 2021 to a whopping 113 this past month, a 91.5% increase. Are condos becoming less desirable as the affordability wanes?” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“Our housing market is far more complicated than simply supply and demand. Back in the olden days (pre-COVID, pre-great recession), the housing market moved at a comparatively snail’s pace. Shifts in 30-year mortgage-rate adjustments were quite small, incremental events that occurred quarterly or perhaps monthly, as opposed to the seemingly daily volatility we see now. Shifts in inventory, that is, houses available for sale, remained consistently robust, and a seller’s expectation for selling a home was calculated in months, not days. It was a more predictable and methodical pace. That was then. This is now.

“The housing market of the 2020s has been defined by high demand and low inventory, and until recently, cheap money. Sellers have sold their homes in days or hours and buyers spent less time in a home they’re about to buy than they do test driving a new car they’re about to buy. Even home loans – the dogged ‘hurry-up and wait’ portion of the home transaction process – has accelerated processing to the point where application, credit checks, and underwriting can technically get done in hours and days instead of weeks. The accelerated pace of the housing sector drove prices higher by the minute and swallowed-up inventory faster than ever before. This has conditioned buyers to be constantly vigilant for the next house that comes available and to factor in how many other buyers are likely competing for this Goldilocks Home, you know, the home that’s ‘just right’. The crest of this phenomenon was in April of this year when list price to sale price ratios climbed to nearly 6% over-asking.

The crescendo of this frenetic pace peaked as buyers were slapped with big jumps in fixed rates for 30-year mortgages in May, June, and July, which made buying houses at the current median price of over $600,000 exceedingly impractical. It was the final step toward a fiscal cliff of impossibility and many buyers stepped back…way, way back. As is the case with asymmetrical information scenarios, sellers of homes who got in the game a little late are finding that the disappearance of a substantial number of buyers is leading to longer days on market, fewer competitive offers, consideration of list price reductions, and demands for repairs or improvements the sellers didn’t think they’d have to address. The months’ supply of inventory jumped from less than two weeks of inventory at the beginning of the year to nearly two months in July. Average list price to sale price dropped to just 1% (which means there are a number of homes selling for less than asking).

Buyers beware. While these market results show some softening – this is not a bubble bursting by any stretch. Right-priced homes in good condition are still garnering multiple offers well-over asking. Many buyers may have stepped back from that fiscal cliff – but there is still substantial demand for homes in northern Colorado. Sellers are just a little late to making pricing adjustments in a market that can brake as quickly as it can accelerate. Overall, momentum is only mildly reduced.

Just this week, we’ve seen mortgage interest rates fall below 5% (kind of like gas prices). We’ve also seen national economic data pointing to a decline of inflation on the horizon, job creation has been positive, and while there’s certainly been economic contraction, the U.S. does not currently appear to be in a full-fledged recession at the moment. The fall selling season may be a great time for buyers to find that bridge across the cliff,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“New listings in July 2022 compared to last July are down by 6.7% with only 419 properties coming on market last month. However, both pending and solds were down 14.5% and 26.3%, respectively, compared to last July. Both prices and interest rates are contributing factors and inventory of available listings has increased 33.8% to 648. The months supply now stands at two months.

“Median and average sales prices are off from last month, but only slightly. Compared to July 2021, the median price is up 16.2% at $395,000, and the average sold price is up 16.4% to $435,907. The market factors are giving buyers a little more selection, but it remains a seller’s market. Interest rates leveled out a little last week, and it will bear watching what effect it has on activity,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY/GOLDEN

“I hate to sound like a broken record, however the housing market story remains the same for the month of July in Jefferson County. Although it is still a seller’s market, prices are getting reduced if the home is not priced right when it hits the market. For single-family homes, the median sales price increased 8.6% to $695,000. New listings were up 13% with overall inventory up 41.7% and average days on market up 50%.

“For condo/townhomes, the median sales price increased to $420,000, a 15% jump along with inventory up 21% and average days on market up 85.7%. Rising interest rates are pricing buyers out of the homes that they could once purchase. New listings to the market dipped slightly (0.6%) and sellers are now seeing that their home may not sell in the first weekend as they had been for the past few years,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS/SOUTH FORK

“We’re seeing shifts in inventory and mindset. July appears to be the awakening month in Pagosa Springs and South Fork, Colo. Both day temperatures and home sale price points rose to the heat of summer. Although like summer nights that cool down, so are exaggerated home prices that are now showing price adjustments daily. Both buyers and sellers see interest rates that doubled from the first of the year and are making their mark in inventory and purchases. No surprise that sold listings were down 31.7% from this time last year. A contributing factor is the shift to higher price-point homes, which is pushing some home buyers out of the market. Over 63% of homes sold were priced $500,000 and higher with the average sales price jumping over 24% to $698, 697, and the median sales price lowering to $545,000,a 3.1% drop from July 2021. This is still good news for sellers desiring to sell this year as home prices are up over 20% year-to-date. Buyers desiring homes under $500,000 are struggling to find inventory as these price points are selling quickly. With over 75% of the current 198 homes for sale priced $500,000 and higher, inventory will continue to grow. Whether a second-home buyer, which makes up a large portion of purchases, can or will be able to adjust to higher price points, may be more questionable.

“Another growing inventory factor is Pagosa Springs’s short-term rental (STR) market. With even more county restrictions and a six-month moratorium starting Sept. 1, 2022, the county will not issue short-term rental permits. Out-of-state STR buyers are faced with rising home costs, inflated STR fees, and rising utility expenses. This formula is not so welcoming to the current and prospective STR owners. Some have decided to sell or not participate and are adding some inventory. County and town officials believe limiting STRs is an answer to the local housing market dilemma by adding inventory for local home purchases or long-term rentals. Locals say they have difficulty qualifying for a loan with the average priced home and their rent payment (based on current wages), even with working two and three jobs. Sadly, they are also exploring other options in other places.

“July’s highest gain in inventory exists within the $600- to $1 million-plus price points. Those sellers will be adjusting prices or staying happy with the the fact that their properties are on the market longer (similar to 2019 (135 days) and 2020 (149 days). July presented 63 days on market, beating the buying frenzy of July 2021 at 75 days. July sales data showed that 38 buyers with 29 financed scenarios had locked in their lower interest rates. July 2022, relative to July 2021, showed a modest 5% increase in listings. More revealing, July 2022 shows a five-month supply of homes (two times more than 2021). Industry leaders say a six-month inventory is a more normal productive market. Currently, buyers at the average price point have more homes to preview because there are fewer buyers desiring the new normal price point. Land is still coming on the market at record pricing, yet it is affordable to the average buyer who intends to build years later.

“The evolving shift in inventory, pricing and mindset continues. The scale appears to be even, however August may tip the scale,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“Similar to our June analysis, the July market numbers trended downward with the exception being the median sales price, which rose 4.7% to $321,000 and is up 14.5% year to date. New listings were off 0.8% from last July and overall sales fell 18.2% compared to July 2021. The percent of list price received also dipped 1.7% to 99.7% compared to last July. All of these factors helped push the months supply of inventory up nearly half a month to 1.9 months and is providing a little bit of relief and help to potential buyers.

“The market remains very active, but we are experiencing a few price reductions as those interest rate hikes take their toll on buying power. With the fast-approaching State Fair and the return to school, we may see the market slow a bit in the short run,” said Pueblo-area REALTOR® David Anderson.

SUMMIT, PARK AND LAKE COUNTY

“Buyers, it’s time to get excited. The market is leveling, and chances are better than ever to get a property in Summit, Park or Lake counties. You might even get to brush off your negotiating muscles. While economic factors and interest rate hikes might make some back off, it makes a great opportunity for others.

“Single-family home inventory is up which means more choices and more time to decide between your choices. Inventory in Summit is up 71%, Park is up 48%, and Lake is up 31%. Prices are still higher year to date, but the average square-foot sale price in July 2022 vs July 2021 is down 7.3% and on average these homes are getting 96% of list. Lake County is still getting over list price on homes. There is now about 4 months of inventory. A balanced market is about 6 months, so these changes feel like we are heading to equilibrium.Of course, we all know that doesn’t last long.

“There are 612 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $149,900 to a high price single-family home in Breckenridge for $18,999,000. The lowest priced sale in July was a mobile home in Kremmling for $75,000 and the highest was a single-family home in Breckenridge for $3.5 million. These numbers exclude deed restricted, affordable housing. In Summit County an average priced home is now nearly $2.2 million, down about $83,000 from last month,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“Some buyers are getting cautious because they don’t feel quite as wealthy as they were on Jan. 1 of this year. Transactions are down 29% through July as compared to the same period of time in 2021. However, the dollar amount of sales is only down 8% for the same period. The dollar amount of sales through the first seven months of 2022 was $708.72 million and the number of sales was 382 for the same period of time. We have also seen regular price adjustments in asking prices for several months, generally in the 10% range. Sales remain reasonably strong for two reasons. One, there is still a low supply of real estate nationally and buyers may see real estate as a safer bet than the stock market.

“Secondly, real estate brings with it a pleasure of use. COVID pushed people to think about what is important in their lives and how and where they want to spend their time. Colorado resorts are coveted nationally for their recreation, healthy lifestyle and beauty. When buyers think of these resorts, they think about their family and spending more time with them and their friends. Telluride has been well placed with a combination of beauty and remoteness which translated to safety and quality of life. Those factors have not changed while the financial markets have become somewhat riskier. With sellers adjusting their prices somewhat and buyers still feeling good about the safety of their real estate investments, I believe 2022 will continue to have very good sales. The higher-end markets do price out some buyers, but now they might be letting some of those buyers back in as August sales are off to a very good start,” said Telluride-area REALTOR® George Harvey.

VAIL

“July brought the market trend to a new position. The transactional volume has been declining for a number of months and year-to-date has hit -27.3%. A few months ago, we saw a negative dollar volume versus the same month in 2021. In July, the year-to-date dollars were -6.2%. July sales versus 2021 were down 27.3%, transactions were down 25.5% in dollars. Based upon this performance, it appears the volatility of the past two years may have reached a level where the market trend is more normal as well as the trend moving forward. This assumption is based upon the declining percentage of -27.3% and -25.5% which removes the big swings of the recent past.

“The micro entities, such as new listings, are down 11.6% for the month and up 3% year to date. Pending sales are -25.5% for the month, -23.9% year to date. Inventory is still low historically, but is up 18% compared to July 2021. One more sign of a trend toward a more normal market is months supply, which hit 3.2 months, the highest in two years, and headed upward. The trend on price niche performance holds steady with everything below $2 million still negative, versus the historic trends of unit sales and inventory. The upper niches have been carrying the market in sales and inventory. Albeit slowly, the market is normalizing.

“The days of multiple offers and open house visitors are also showing more normal signs, which is good for the long term. New construction in the valley is inhibited by availability of homes, supply chain issues, volatility of material costs, and availability of land. These are macro market factors and basically beyond control of the local market,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The July 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.