Looking to rebalance, housing markets taking much needed breather

ENGLEWOOD, CO – With potential sellers sitting tight on their low interest rates and buyers skeptical of rising interest rates and reduced buying power, housing markets across the Denver metro area and state continued to take a much-needed breather in the month of February, according to the latest Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR).

“We are rebalancing the ship and the water is a bit choppy,” said Boulder/Broomfield-area REALTOR® Kelly Moye. “After 24 months of craziness, our housing markets need to breathe. When markets slow, it causes pent-up demand which then pushes it forward again. We are in the breathing space now and the question is, when will the surge come? From the current data, it seems the second half of the year will be more robust than the first, assuming interest rates decline.”

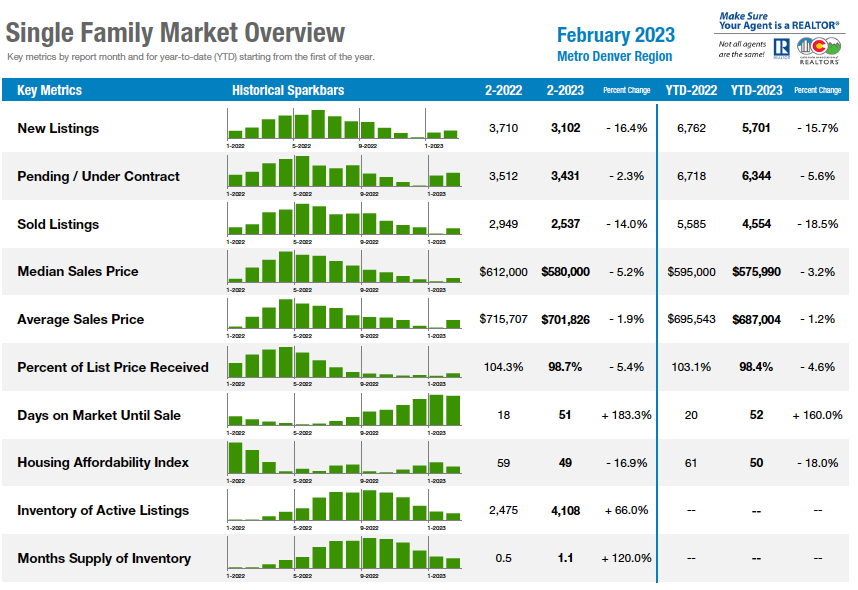

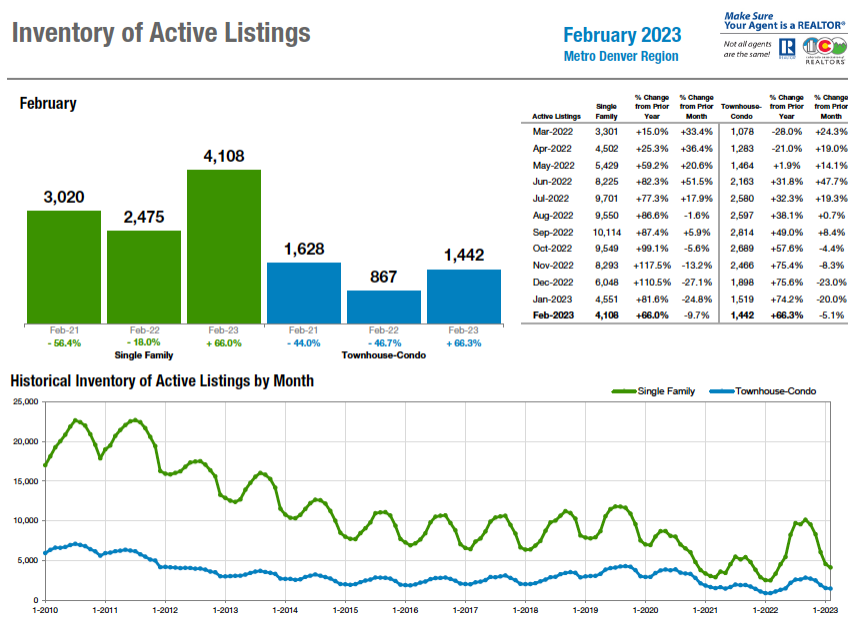

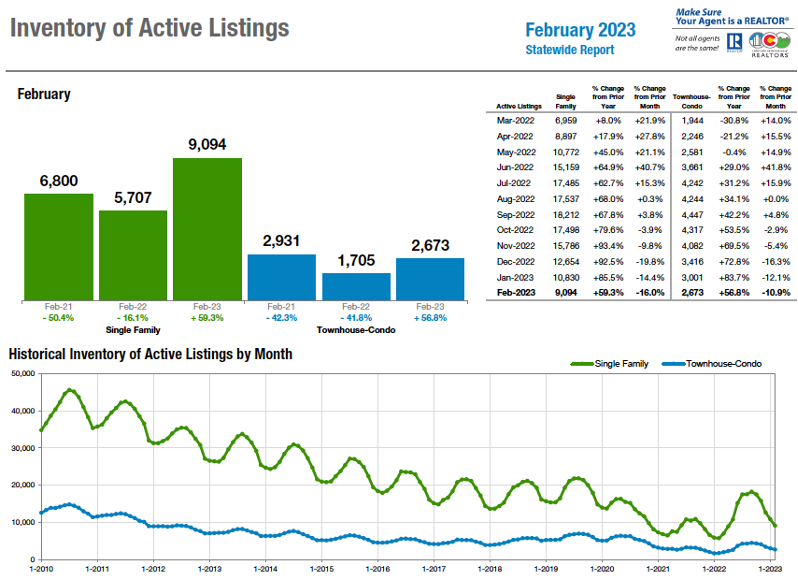

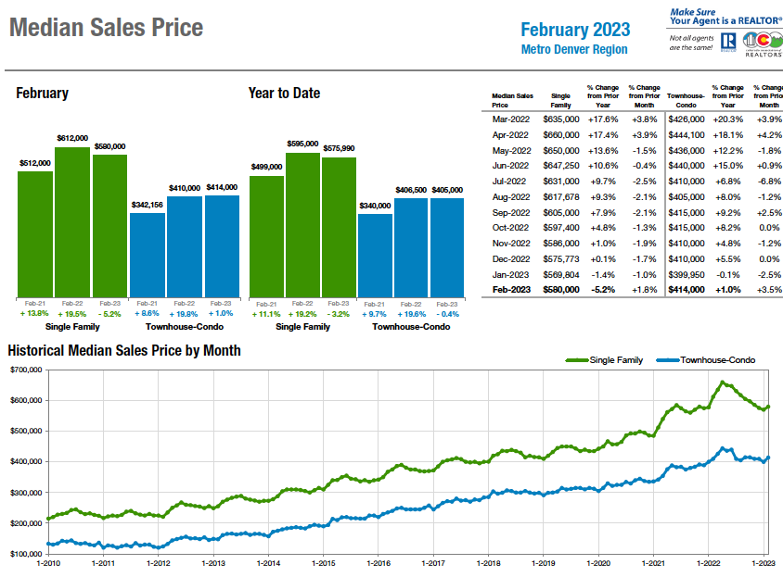

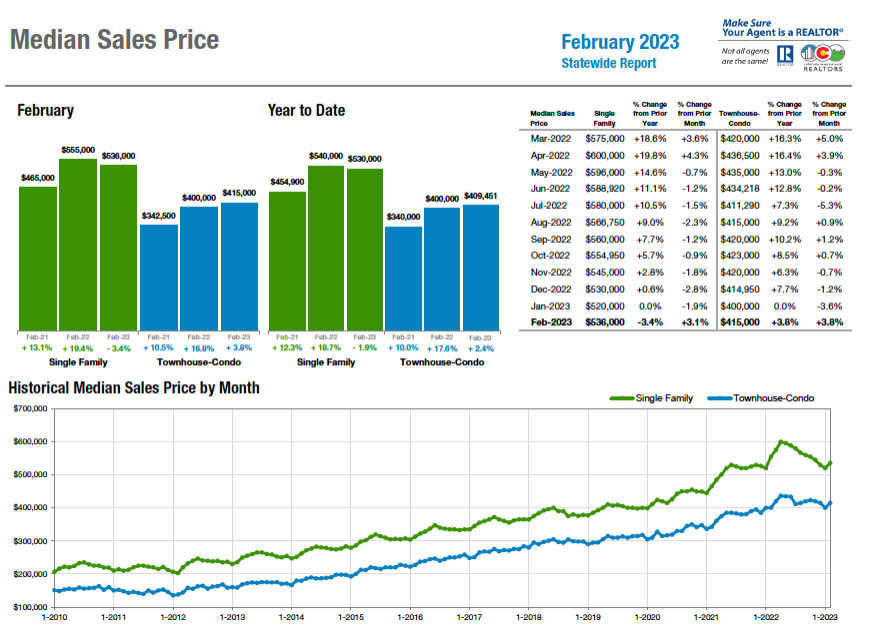

In the Denver metro area and statewide, active inventory is up approximately 60% over the same time last year for both single-family homes and condo/townhomes. However, the overall months supply of inventory remains well below what would be considered a balanced market. And, despite higher mortgage interest rates, a steady demand from potential buyers is helping keep housing prices up across the seven-county Denver-metro area and state. In fact, after nine consecutive months of month-over-month decline in median sales price for single-family homes, both in the seven-county metro-Denver area and statewide, prices rose from January to February. Single-family homes in the metro-Denver area rose 1.8% to a median price of $580,000, while statewide, single-family home pricing rose 3.1% to $536,000.

“Home sellers are reluctant to sell, choosing instead to ‘shelter in place’ and enjoy their 3% existing mortgage rates and maybe do some remodeling and redecorating to make do with what they have,” said Fort Collins-area REALTOR® Chris Hardy. “The reality of all of this is we are seeing a ‘normalization’ of the market. Buyer demand for housing hasn’t decreased. The need for additional housing is at an all-time high. Buyer ability to buy is squelched by high interest rates relative to current list prices. This is a time of recalibration.”

Looking at the CAR Housing Affordability Index, a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county, the reports show that after three straight months of slight improvements, affordability fell once again in February and continues to be a major issue for many potential buyers across the state.

A few key highlights:

Statewide

- Total Market (all property types) – the Housing Affordability Index has dropped from 70 to 55 in one year.

Denver Metro

- Total Market – year-over-year median price dropped 2.5%, $560,000 to $546,260.

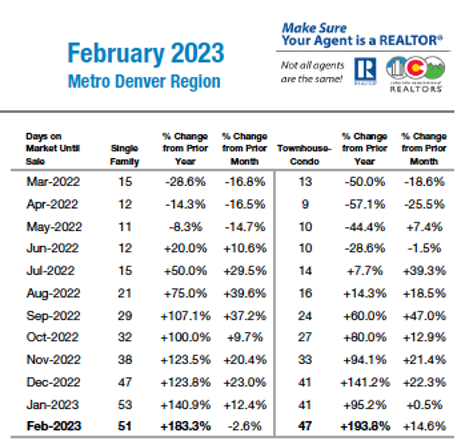

- Days on Market, year-over-year is up from 17 to 50.

- Months Supply of Inventory more than quadrupled going from 0.3 months to 1.1 month.

- There were 17% fewer new listings YoY and 15% fewer sold.

Denver County

- Single Family Median Price went down 6.5%, condos were down 3.5%.

- Months Supply of Inventory went from 0.2 to 0.8 months for single family, and from 0.2 – 1.1 for condo/townhomes.

- Single Family Median Price is now $615,000, down from its $750,000 peak in April 2022.

Seven-county Denver metro area Single-Family Overview:

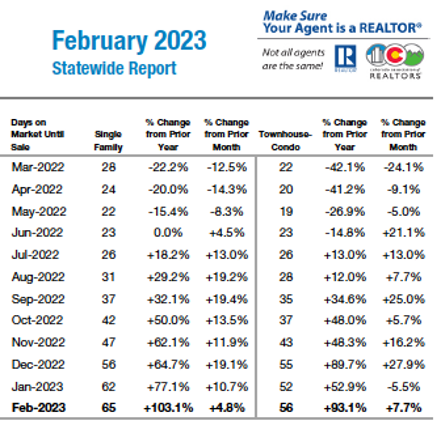

Statewide Single-Family Overview:

REALTORS® across the metro area and state shared these highlights (expanded summaries of each market are included in the following pages):

- Aurora – In general, inventory is up from last year and pricing is down slightly in most cases. Demand remains for housing in the metro suburbs and, the nicer the house, the higher the potential for multiple offers. Just as many other issues in life, the good ones go quickly. The others may sit on the market a little longer.

- Boulder/Broomfield counties – We are rebalancing the market after 24 months of craziness and the water is a bit choppy while it all pans out. Sellers are loving their low rates and are deciding not to make a move, causing our inventory to continue to decline. Boulder saw 6% fewer listings last month and Broomfield struggled with 8% fewer just as buyers were enjoying a break in interest rates. Now with news that another rate is imminent, buyer’s motivation is again postponed, and the market slows.

- Colorado Springs – Despite the myth that we had such a small amount of inventory and that a pullback on pricing and demand was not likely, we found out there are even fewer buyers than homes on the market. Despite low inventory, we dropped 27.1% in sales year over year. Top that off with a 96% increase in properties on the market and the local housing market is feeling some softening.

- Unequivocally, inconceivable affordability challenges due to a staggering combination of high interest rates and record high home prices are the most daunting barriers for the Colorado Springs area home buyers,”

- Crested Butte – Prices remain steady, even though the median price of single-family home is up about 40% over last February and condos and townhomes are down 36% from a year prior. Inventory is up significantly – 74% more single-family homes and 155% more condos and townhomes for sale than this time last year. The number of new listings that came on the market in February was down, which makes sense given that the average days on market has more than doubled for condos and townhomes.

- Denver County –Denver’s real estate market is ‘over the hill.’ No, it’s not celebrating the big 4-0, buying a Porsche and getting an earring but rather demonstrating that it’s past the really big ‘party years’ and now must get realistic with the aches and pains of how it punished its body over the last decade.

- Douglas County – February statistics indicate a strong spring market ahead for Douglas County. Median sales price rose slightly to $687,000, and days on market fell from 57 to 54. Months supply of inventory is holding steady at just about one month, which is constrained enough to combat the effects of lower affordability. We believe inventory is likely to pick up over the next few months, but it is unlikely to be enough to make up for the large shortage, which will continue to hold prices up throughout the year.

- Estes Park – Comparing single-family homes and townhouse/condos, they are performing quite differently. New listings are down 11.4% for single-family homes compared to a nearly 22% increase for townhouse/condos compared to February 2022. Median sales price, compared to 2022, rose 8% for townhouse/condos to $421,208. For single-family homes, median sales price actually declined 2.6% compared to February 22.

- Fort Collins/Northern Larimer County – Sellers who have to sell are adjusting their expectations to the current market. Buyers who are prepared to take action will find a less competitive market than last spring – but houses in great condition will still garner multiple offers in a wide range of price points.

- Glenwood Springs – New listings of single-family homes were down 40% from February 2022 with a total of 39 homes listed in our wide-reaching MLS. The multifamily market added 18 listings, a 14.3% decrease over this time last year. Locally, buyer demand remains high, with well-priced properties still garnering multiple offers minus the craziness of contracts received last year.

- Jefferson County/Golden/Arvada – The spring market is already starting to pop with some sellers seeing multiple offers again however, these homes are most likely upgraded and look very nice inside and out. We are not seeing the volume of multiple offers we were seeing a year ago. Buyers see those higher interest rates and still decide to jump in. Rates aren’t dropping and list prices aren’t plummeting either.

- Pagosa Springs – February presented epic snowfall that challenged house and land hunting. There was still some out-of-state buyer interest in previewing during this winter wonderland season. Sellers’ interest in placing homes on the market, not so much. No doubt these factors contributed to the total of 10 homes Sold (-67.7% decrease from February 2022) and 17 new listings (-22.7% from February 2022).

- Pueblo – A combination of variables has led to a mixed bag of results for the Pueblo area real estate market in February as the median price rose 4.9% to $320,000 compared to February 2022. The downward trends were highlighted by a 17.5% dip in new listings from February 2022, -14.7% year to date. Pending sales were down 26.7% to 198 compared to 270 in February 2022.

- Steamboat Springs/Routt County – Similar to February 2022, this past month delivered fewer new and active listings with months supply of 2.1 months for single-family and 1.1 months for multi-family. Interest rates on the other hand, had quite a disparity from February 2022 where the month ended with an average 30-year fixed rate of 3.76% and this February bounced between 6.09% – 7.13%.

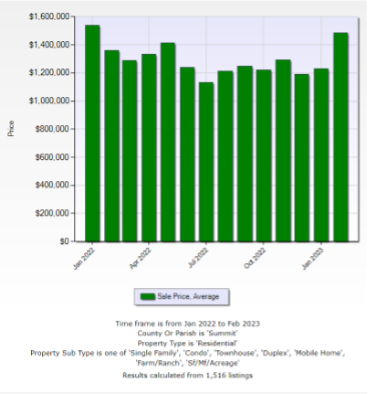

- Summit, Park, and Lake counties – Average sales price is higher than it has ever been at $1,484,891, with the exception of one month, January 2022, our highest average ever (a 3.8% spread). Average price of the top 10 most expensive properties sold in February was over $4 million. In Summit County, an average priced residential property was $1,484,891 and the average single-family home was $2,776,800, an increase of $918,474 from last month.

- Telluride – San Miguel County recorded $48.65 million in February sales, almost exactly the same amount as February 2020. The big difference is the number of sales: 20 sales this February compared to 42 sales in February 2020 before the COVID real estate market began. The 20 February sales were the lowest monthly total in our market since February 2009 when there were 16 sales.

- Vail – The market, in its unique way, seems to be stabilizing albeit, in a negative fashion. Transactions in the month of February were down 45% versus a year ago. However, for the first time in months, the dollar decline was on the same plane at minus 44%. We have been seeing dramatic swings in this comparison for months, often in double-digit variances. If the trend continues, it may well lead to a more predictable market and hopefully moving to a positive comparison.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Predicting the market right now is like predicting Colorado weather, wait a day and it will likely change. The 80010 zip code, the original Aurora area, is seeing some increased inventory and reduced pricing. Looking to a more central location east of I-225, 80013 is experiencing reduced inventory (-4%) and pricing (-8.5%) over last year. That said, the $480,000 median pricing in 80013 is up over last month.

Looking to the 80015 zip code in the southeastern part of Aurora, we see inventory up about 32% over last year and a median price of $544,000, a decrease of $4000 over last month. In 80016, which includes Southshore, Tallyn’s Reach, Blackstone and Wheatlands, inventory rose about 53% over last year and pricing is down just slightly from a year ago. Interestingly, the pricing in 80016 is up significantly from last month with a current median of $758,000. The Englewood, Greenwood Village zip of 80111 is showing inventory down from last month however, the median price has gone from $975,000 one month ago to $867,000 for the current month.

“In general, the inventory is up from last year and pricing is down slightly in most cases. Demand remains for housing in the metro suburbs and, the nicer the house, the higher the potential for multiple offers. Just as many other issues in life, the good ones go quickly. The others may sit on the market a little longer,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“We are rebalancing the ship and the water is choppy in Boulder and Broomfield counties with the median price down about 5%, new listings are down and average days on market just about doubled. At the same time, many homes are selling in a weekend with bidding wars. It’s a strange place to be for sure, and REALTORS® are doing their best to counsel their buyers and sellers on how to navigate this market. We are rebalancing the market after 24 months of craziness and the water is a bit choppy while it all pans out. Sellers are loving their low rates and are deciding not to make a move, causing our inventory to continue to decline. Boulder saw 6% fewer listings last month and Broomfield struggled with 8% fewer just as buyers were enjoying a break in interest rates. Now with news that another rate is imminent, buyer’s motivation is again postponed, and the market slows. That said, homes are still selling in 2 months or less and for about 98% of the list price. It’s the continual fluctuation that seems to be occurring at the whim of every interest rate change that makes the market so hard to predict.

“Housing markets need to breathe. When markets slow, it causes pent-up demand which then pushes it forward again. We are in the breathing space now and the question is, when will the surge come? From the current data, it seems the second half of the year will be more robust than the first, assuming interest rates decline,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“In a stunning turn of events, February 2023 saw a 5.2% pullback, year-over-year on the median price. A year ago, we were told this could not happen. The myth was that we had such a small amount of inventory and that a pullback on pricing and demand was not likely. What we found out is that there are even fewer buyers than homes on the market. Despite low inventory, we dropped 27.1% in sales year over year. Top that off with a 96% increase in properties on the market and the local housing market is feeling some softening. The rollover from our peak values in May and June are now double-digit drops. Look for this month-over-month trend to continue as we move forward into the summer.

“Zooming out, we have seen a drop in mortgage applications nationwide. The lowest levels in 28 years. This is directly tied to much higher interest rates. To compensate for this, sellers continue to cut prices to try to offset it. But the constant news of an impending recession and company layoffs keep buyers frozen. Not to mention affordability is the worst it’s been since 2007. The average consumer is not in a healthy economic environment. Car delinquencies continue to be at 2009 levels, credit card debt remains at all-time highs, and inflation remains stuck. All this ties back to housing and whether a buyer can afford it. After all, 68% of Americans cannot cover living expenses for one month if they lose their job.

“Recessions take a longer time to play out than many people think. But we wade into recessions slowly, using past data to try to predict future outcomes. Manufacturing remains weak, shipping worldwide is dropping, oil reserves are increasing, layoffs continue, and all these factors point toward further economic pain. The Achilles heel of this will be employment. If the Federal Reserve can keep unemployment lower, we may see a softer landing. But if the economy starts shedding hundreds of thousands of jobs, and we end up pushing 7-10% unemployment, the soft-landing dream will be dashed for another economic crash for the history books,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS/PIKES PEAK

“The February 2023 inventory of single-family/patio homes in the Colorado Springs area market was 196% higher year-over-year February 2022, while the monthly sales were down by more than 23%, sales volume by over 25%, median sales price was -5.4%, and average sales price -2.8%. This is the first year-over-year drop in the monthly median and average sales prices in the month of February since 2012. The average days on market (DOM) drastically increased to 54 days from 13 days, the sale price to listing price ratio declined to 98.7% from 103%, and the number of listings under contract dropped by 23.2% compared to February 2022.

“Last month, 65.5% of the single-family homes sold were priced under $500,000, 26.5% were between $500,000 and $800,000, and 8% were priced over $800,000. Year-over-year in February 2023, there was a 14.5% drop in the sale of single-family homes priced under $300,000, a 31.8% drop in homes priced between $400,000 and $600,000, a 39.2% drop in homes priced between $600,000 and $1 million, and a 23.1% increase in homes priced over $1 million.

“When looking back five years and comparing single-family/patio homes sales in February 2023 with February 2022, active listings are up over 17%, monthly sales are down 18%, and sales volume by over 24%, average sales price ascended 51%, and the median sales price was up over 50%.

“Unequivocally, inconceivable affordability challenges due to a staggering combination of high interest rates and record high home prices are the most daunting barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE

“After a very slow end to 2022, the start of 2023 has shown a bit of improvement in the Crested Butte and Gunnison markets. More properties are being listed for sale and buyers are making offers. Prices remain steady, even though the statistics show that the median price of single-family homes up about 40% over last February and the median price of condos and townhomes down 36%. Because the number of sales is relatively small, these numbers are easily skewed by a handful of high- or low-priced sales. Inventory is up significantly – 74% more single-family homes and 155% more condos and townhomes for sale than this time last year. However, the number of new listings that came on the market in February was down, which makes sense given that the average days on market has more than doubled for condos and townhomes.

“We continue to see multiple offers and properties selling above asking price on well-priced residential properties. Even with rising interest rates, it seems that if sellers price their properties in line with recent sales instead of above them, demand will continue to be strong for properties in the Gunnison Valley,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER COUNTY

“Denver’s real estate market is ‘over the hill.’ No, it’s not celebrating the big 4-0, buying a Porsche and getting an earring but rather demonstrating that it’s past the really big ‘party years’ and now must get realistic with the aches and pains of how it punished its body over the last decade. With a median price of $615,000 in February for a freestanding home, $423,500 for the condo segment, both have fallen from their $750,000 and $515,000 2022 peaks, respectively. Given that February is always lower than the mid-year peaks, it’s also important to note that the freestanding home last month dropped 6.5% from just a year prior, 3.5% for condos. During the same timeframe in 2022, we were seeing double-digit price increases which would last until August when they dipped into the single figures and have fallen ever since.

“Unlike a mid-life crisis, we don’t know how this particular cycle will work itself out. With supply remaining low, up four times the amount from this time last year but still 75% short of anything resembling a balance of supply and demand, one would hope that more inventory and lower prices would be a positive development for the buyers who just want to get into a good home. That looks brighter and more positive than it has in some time for Denver, so long as interest rates don’t keep climbing and offset any potential market savings,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“Despite mortgage rates remaining elevated, the February statistics indicate a strong spring market ahead for Douglas County. Median sales price rose slightly to $687,000, and days on market fell from 57 to 54. Months supply of inventory is holding steady at just about one month, which is constrained enough to combat the effects of lower affordability. The townhouse/condo market has displayed more volatility in Douglas County this winter, with median sales prices jumping up nearly 4% between January and February.

“This week, we are anticipating a rapid increase in the pace of the market. We’ve received a massive increase in buyer and seller activity since March began, bringing back familiar feelings from last year – and previous years. We believe inventory is likely to pick up over the next few months, but it is unlikely to be enough to make up for the large shortage, which will continue to hold prices up throughout the year. Overall, the Douglas County market is in a comfortable position entering the spring, and February’s stats back up steady property values regardless of moderate changes in interest rates,” said Douglas County-area REALTOR® Cooper Thayer.

ESTES PARK

“It’s been a slow and cold month in Larimer County, including real estate. But there is a twinge in the air of spring on the way. That on-and-off weather we come to love and expect from living in Colorado seems to reflect how the real estate market is also flip flopping.

“Comparing single-family homes and townhouse/condos, they are performing quite differently. New listings are down 11.4% for single-family homes compared to a nearly 22% increase for townhouse/condos compared to February 2022. Median sales price, compared to 2022, rose 8% for townhouse/condos to $421,208. For single-family homes, median sales price actually declined 2.6% compared to February 22.

“Average days on market clearly reflects a flop with the lengthening from list to close. Single-family homes have increased 62.2%, cooling from an average of 45 days to 73. Townhouse/condos are seeing a deeper chill with an 86.5% increase in average days on market, 74 to 138 days, compared to February 2022. Sold listings are about as chilly with a 16.6% decline for single-family homes, and a 20% decline for townhouse/condos,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“You’re going to see the word ‘down’ quite a bit in the coming months:

- New Listings – down 11.2%

- Sold Listings – down 12.1%

- Median Sales Price – down 5.8%

- Sale Price to List Price – down 3.6%

- Affordability – down 17.2%

For single-family homes, the only numbers going up are:

- Days On Market (up 50%)

- Active Listings (up 100%)

- Months Supply of Inventory (up 160%)

“The one number that would change all of this is the average mortgage interest rate for a 30-year fixed loan. Interest rates remain well above 6% and, depending on your credit score and other criteria, the cost of obtaining a loan has gone up quite a bit as well.

“Most of these down-trending numbers are comparing February 2022 to February 2023. Last February was the start to a frenzied spate of home buying and selling, the likes of which were truly unprecedented (not unlike the inflation numbers during the same period).

“When the Federal Reserve initiated hikes in the interest rate it charges banks for short-term loans, mortgage rates shot up and put a ginormous damper on a homebuyer’s ability to qualify for a loan subject to the burgeoning price run-ups of Q2 2023. Home sellers became reluctant to sell, choosing instead to ‘shelter in place’ and enjoy their 3% existing mortgage rates and maybe do some remodeling and redecorating to make do with what they have. The reality of all of this is we are seeing a ‘normalization’ of the market. Buyer demand for housing hasn’t decreased. The need for additional housing is at an all-time high. Buyer ability to buy is squelched by high interest rates relative to current list prices. This is a time of recalibration.

“Many buyers and sellers are waiting for interest rates to come down before they take action. Some economists say a drop in mortgage interest rates could happen before the end of the year. This waiting game sets up a cat and mouse scenario that will prove to be quite interesting should interest rates become meaningfully more attractive (i.e., under 6%) by May.

“Sellers who have to sell are adjusting their expectations to the current market. Buyers who are prepared to take action will find a less competitive market than last spring – but houses in great condition will still garner multiple offers in a wide range of price points,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“Two months into 2023 we have a re-run of the last few months. New listings of single-family homes were down 40% from February 2022 with a total of 39 homes listed in our wide-reaching MLS. The multifamily market added 18 listings, a 14.3% decrease over this time last year. The continued lack of inventory is keeping home prices mostly steady albeit with a decrease of 13.7% in the single-family sector coming in at $500,000. The multifamily market showed an increase of 12.4% coming in at $409,750. The only sign that interest rates are softening our local market, is a slight increase in days on market, which rose 8.6% in the single-family sector but decreased 38% for multifamily, perhaps because the price range of multifamily is the more affordable option for the average homebuyer. Locally, buyer demand remains high, with well-priced properties still garnering multiple offers minus the craziness of contracts received last year,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

The trend in Mesa County and Grand Junction continues downward. Comparing February 2023 to February 2022, new listings are down 14.9%, pending down 15.7% and solds down 36.9%, with only 157 solds all month. Average solds pricing was also down 0.6% to $411,519 and median price was down 18% to $355,100. That is reflected by the fact that the most active price range was the $300,000-400,000, followed by the $200,000-300,000 and then the $400,000-500,000 price ranges.

“Days on market have increased to 102, giving buyers that are in the market more time to consider a property and active available listings are almost doubled, compared to this time last year. We now have a 2.1 months supply of inventory. This is typically the time of year that more sellers list however, sellers that have a low interest loan on their current property are reluctant to consider paying almost 7% on a new purchase, which is affecting the new listings coming on market,” said Grand Junction-area REALTOR Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“The spring market is already starting to pop with some sellers seeing multiple offers again however, these homes are most likely upgraded and look very nice inside and out. We are not seeing the volume of multiple offers we were seeing a year ago. Buyers see those higher interest rates and still decide to jump in. Rates aren’t dropping and list prices aren’t plummeting either. The median price for single-family homes dropped 8.4% and is now at $635,000 from $693,000 a year ago. New listings are down 26.7%, and solds are down 5.7%. The days on the market has increased 354% from 11 days last year to 50 days this year.

“For condo/townhomes, new listings were down 14.3%, solds were down 19.3% and the median sales price slipped 1.1% to $405,500. Average days on market increased 166.7% from 15 to 40 days year over year. Today’s market requires that you price your home correctly if you want it to sell reasonably quick. Buyers are looking to buy down points, assume loans, or possibly look to owners to carry loans, as well as other ways to ease them into a larger home payment,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS

“February presented epic snowfall in large quantities for an abundance of days and doubts of snowmelt anytime soon. House and land hunting presented challenges from clearing access paths/driveways and large snow berms created from snowplows in neighborhoods for buyers, sellers, and REALTORS® previewing homes. There was still some out-of-state buyer interest in previewing during this winter wonderland season. Sellers’ interest in placing homes on the market, not so much. No doubt these factors contributed to the total of 10 homes sold (-67.7% decrease from February 2022) and 17 new listings (-22.7% from February 2022). Where several areas report drops in median and average sales pricing, this is not the scenario in Pagosa Springs. The median price increased 12.6% compared to a year prior to $520,000 and the average price rose 20% compared to February 2022 to $664,504.

“Recent listings hitting the early spring market suggest these numbers will continue to rise. In the last nine days, four of the seven new listings were priced at $650,000 or above. However, purchase activity is still extremely sensitive to interest rate movements and still-high prices, giving both buyers and sellers reason to pause. Months supply of inventory (the measure of the balance between supply and demand, calculated by the number of months it would take for the current inventory to sell at the current sales pace) was 2.6 months in February, up from just one month a year ago – reflecting a 160% increase in inventory.

“Weather, interest rate movement, and higher home prices contributed to the February days on market climbing to 137 days compared to 100 days (year-to-date). With higher prices, high mortgage payments, more inventory, and fewer buyers, it is even more important for sellers to set realistic expectations by pricing competitively, conducting some updates, or simply having patience in the time period required for selling their home. Just as buyers have been spoiled with low interest rates, sellers have been spoiled with quick sales. Both scenarios have altered dramatically in the first quarter of 2023. Quarter two of 2023 will present a realistic outlook for our market,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“A combination of variables has led to a mixed bag of results for the Pueblo area real estate market in February as the median price rose 4.9% to $320,000 compared to February 2022. The downward trends were highlighted by a 17.5% dip in new listings from February 2022, -14.7% year to date. Pending sales were down 26.7% to 198 compared to 270 in February 2022. Sold listings took a big hit too, down 35.1% from last February and down 40.7% year to date.

“The percent of list price received fell 1.4% to 98.4%. In the first two months of the new year, we’ve dropped 1.6% to 97.9%. With fewer buyers looking, rising interest rates, and more sellers putting their home on the market, active listings jumped 69.5%. We also saw our month supply of inventory double to 2.4 months. In the next few months, buyers will have more homes to look at and less competition.

Home builders are still being cautious with new starts. Only 20 new permits were pulled in Pueblo County in February, and 12 were in Pueblo West.

“The lack of activity is very noticeable, sellers are taking note, and many have lowered asking prices to get showings scheduled,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“February 2023 has some similarities to February 2022 – specifically, that there were fewer new and active listings than the prior year. Months’ supply reflects a seller’s market with only 2.1 months for single-family and 1.1 months for multi-family – not a significant difference from the previous year. Interest rates on the other hand, had quite a disparity from February 2022 where the month ended with an average 30-year fixed rate of 3.76% and this February bounced between 6.09% – 7.13%. This fluctuation has certainly made an impact. Days on market for multi-family increased from 27 to 65 days giving some buyers hope of a softening market- not always an accurate picture as the lag sometimes attributed to not being able to get buyers into the unit because of guest occupancy. Cream puff listings still bring multiple offers above asking price. Buyers have demonstrated they are still willing to pay full price (or more) for updated, move-in ready or a new property. With low inventory, properties that need improvements may still bring multiple offers however, buyers are more circumspect and overzealous pricing by brokers or sellers on these types of properties increases days on market, results in price reduction or lower and fewer offers.

“For February, sellers received 94.7% of their list price compared to 99% last February; townhome and condominium sellers received 97.8% versus 102.5%, respectively. While Steamboat Springs/Routt County is technically still a seller’s market, some sellers are having to give concessions to make a deal. Property owners considering selling may want to consider contacting an experienced REALTOR® in advance to discuss improvements they could make to help their sale.

“In the last six months, 46 properties have sold for an average price per square foot of $1095, and 17 properties are currently pending with an average price per square foot of $1,131. Looking back at the the same period for 2021-2022, there were 35 properties that closed for an average finished price per square foot total of $1,162. Routt County has 54 single-family listings with 24 priced $2M and above; multi-family has 31 units for sale with approximately 50% of those priced under $1M.

“To help with local’s affordable housing, Steamboat has been fortunate to have a public-private partnership with The Yampa Valley Housing Authority and Overland Property Group which has completed three high-quality apartment complexes and is underway with construction on the fourth. Rents fluctuate and are determined based on various area median incomes (AMI),” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“Topsy turvy strikes again. In an unexpected market stat, Summit County average sales price is higher than it has ever been at $1,484,891, with the exception of one month, January 2022, our highest average ever (a 3.8% spread), per the Summit MLS. The average price of the top 10 most expensive properties sold in February was over $4 million.

“There were 19.3% fewer sales than a year prior, but that number is about 18% better than we did last month. The median sales price is up 20.4% over the same time last year. Another Federal Reserve rate hike could flatten our market again, but as for now, even with this upward trend, sellers are receiving about 97% of their list price and negotiations are happening.

“Inventory, although higher than last year, is low. Right now, there are 10 active listings in Dillon and 92 in Breckenridge. There are more buyers waiting and when the Feds are done raising the rates and they drop to 5.5%, I expect to see buyer activity pick up. There are 318 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $139,900 to a high price single-family home in Breckenridge at $19.5 million. Out of 92 sales in February, the lowest was a condo in Silverthorne for $340,000 and the highest was a single-family home in Breckenridge for $6 million. These numbers exclude deed restricted, affordable housing. In Summit County, an average priced residential property was $1,484,891 and the average single-family home was $2,776,800, an increase of $918,474 from last month,” said Summit County REALTOR® Dana Cottrell.

TELLURIDE

“San Miguel County recorded $48.65 million in February sales, almost exactly the same amount as February 2020. The big difference is the number of sales: 20 sales this February compared to 42 sales in February 2020 before the COVID real estate market began. The 20 February sales were the lowest monthly total in our market since February 2009 when there were 16 sales.

“Savvy investors are generally staying on the sidelines with a close eye on the overall economy and predictions from market experts in all financial sectors. However, some are riding above the whims of the global economies and are still purchasing their dream properties. Drilling down a bit, the Mountain Village comprised 65% of all real estate sales in San Miguel County in the first two months of this year. That’s where the most inventory exists for the majority of current buyer desires. For the same period of time, the town of Telluride has seen a 66% decrease in the dollar amount of sales. Still a little early in the year to know if there is any big variation from this two-month trend,” said Telluride-area REALTOR® George Harvey.

VAIL

“The market, in its unique way, seems to be stabilizing albeit, in a negative fashion. Transactions in the month of February were down 45% versus a year ago. However, for the first time in months, the dollar decline was on the same plane at minus 44%. We have been seeing dramatic swings in this comparison for months, often in double-digit variances. If the trend continues, it may well lead to a more predictable market and hopefully moving to a positive comparison. The year-to-date units are within one percentage point of February transactions, while dollars are similar with 4% less in decline. I know the level of negative performance is significant however, first half of 2022 was still an abnormal trend with significant market activity. Pending sales are following the same trend with approximately 30% negative for the month and year to date.

“Days on market are up significantly which is due to increased inventory which is positive 9% in active listings. This increase has raised our months supply 65% however, we are only up to approximately 50% of the inventory necessary to elevate months supply to what is considered a stable market. The single- family/duplex segment is showing an encouraging trend in inventory which is key to attaining the balanced market we need.

“Obviously, there are still headwinds in the macro-economic news relative to inflation and probable Federal Reserve interest rate intervention. But the local market indicators are holding their own versus the macro issues and that is encouraging as we head toward the spring selling season,” said Vail-area REALTOR® Mike Budd.

DAYS ON MARKET – SEVEN-COUNTY DENVER METRO AREA

DAYS ON MARKET – STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

MEDIAN SALES PRICE – SEVEN-COUNTY DENVER METRO AREA

MEDIAN SALES PRICE – STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The February 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.