Sellers Entrenched in Driver’s Seat as Scarce Housing Inventory Pushes Offers, Concessions and Median Prices to All-Time Highs Statewide

Buyers required to have patience, persistence, grit…and cash

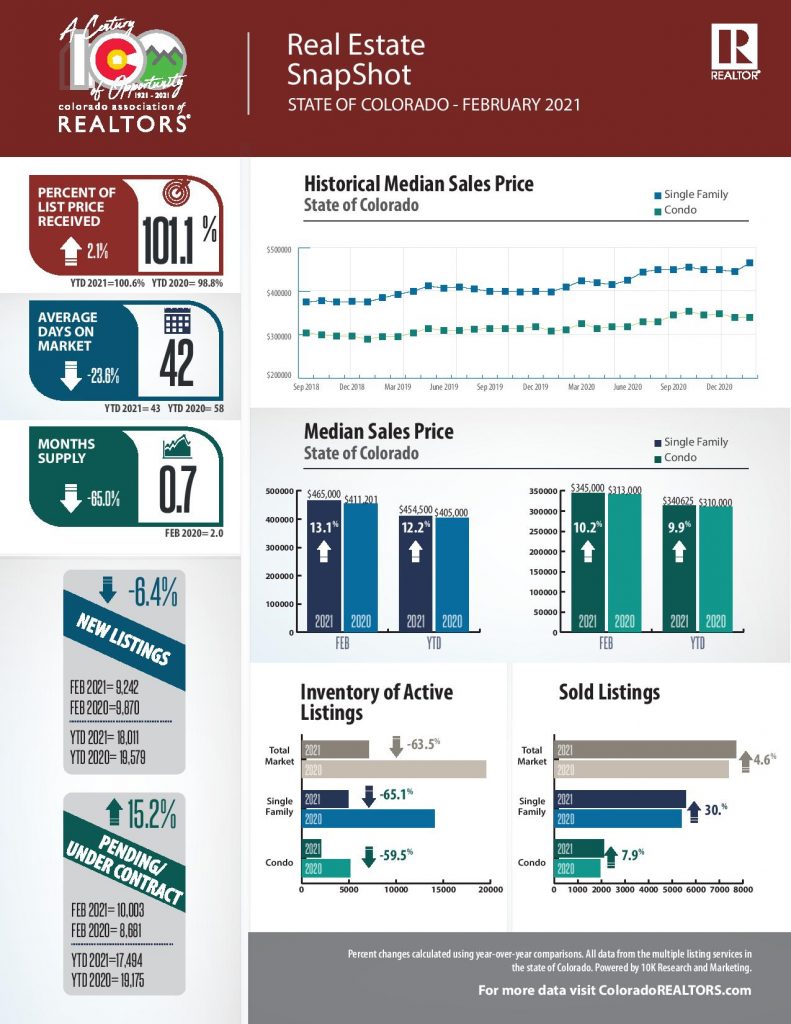

ENGLEWOOD, CO – March 10, 2021 – Colorado home sellers remain firmly entrenched in the driver’s seat as the inventory of homes available for purchase dropped to all-time lows across the Denver metro area and state, according to the February 2021 housing data from the Colorado Association of REALTORS® (CAR). At the same time, low interest rates and frenzied competition from a high volume of buyers continued to push pricing, concessions and above-asking-price offers to levels not seen by even the most veteran REALTOR® professionals.

Buyers are “providing relief and certainty to a seller in the form of inspection provisions, appraisal provisions, payment of seller’s fees, tightening contingency deadlines and more to make an offer stand out from the crowd,” said Fort Collins-area REALTOR® Chris Hardy.

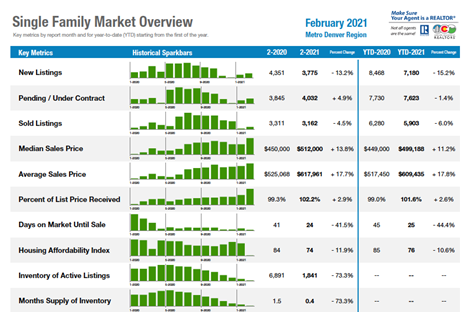

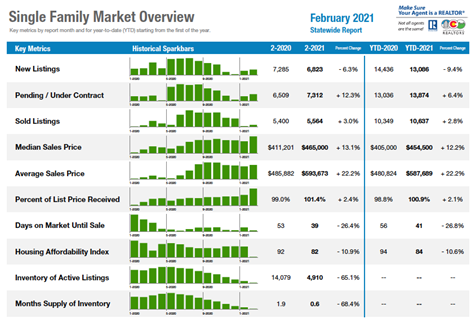

With comparisons to Hunger Games, snowboard cross competition and numerous other physically and mentally challenging scenarios, the current environment has, in many cases, pushed potential buyers to submit offers tens of thousands of dollars above asking price and driven median pricing for single-family homes to record highs — $512,000 in the Denver-metro area, up 13.8% over a year prior, and $465,000 statewide, a 13% increase over February 2020.

Patience, persistence, grit and cash are requirements for any buyer in this market, according to Summit County REALTOR® Dana Cottrell.

“Over three days, with showings every 15 minutes, it is not uncommon for buyers to be one of 50 or 60 people looking at a home for sale. Their offer will likely be one of 15 to 25 received by the seller and, if they want to be considered in the running for the home, they will need $25,000 to $50,000 over the asking price and a significant amount of cash to make up any appraisal gap,” said Aurora-area REALTOR® Sunny Banka.

In addition to fierce competition between buyers across the state, in some cases, sheer lack of available options is leaving potential buyers out of the game completely. “What do Sasquatch, unicorns, and active listings in La Plata County have in common? They don’t exist. Well, maybe Sasquatch does,” said Durango-Area REALTOR® Jarrod Nixon. According to Telluride REALTOR® George Harvey, there are so few listings in the Telluride area, the conversation with potential buyers starts with “what don’t you want?” rather than focusing on what they do.

The inventory of active single-family listings dipped to an all-time record low of 1,841 properties in the seven-county Denver-metro area for February, down more than 73% from a year ago. Statewide, active listings fell 65% from a year prior to just 4,910 single-family properties. With strong sales and continued demand testing each and every market across Colorado, the months supply of inventory for single-family homes fell another 25% from January to February 2021 and now sits at just 0.4 months in the Denver metro area and 0.6 months statewide. If the supply of homes for sale stopped today, the market would be out of inventory in about two weeks. A balanced market, one that is good for both buyers and sellers, is considered to have four to seven months of inventory.

With rising prices and limited inventory, affordability issues continue to take center stage in the state’s housing market debate. The Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price and median income by county, fell more than 11% from a year prior and sits at near record lows. “In 2017, the highest median price change to occur in a year-over-year calculation was +15.6%. In 2018 it was +16.4% and in 2019 it was just +10.1%. However, the last two years have shown the most staggering increases at +21.3% and +21.9% during the months of February,” noted Denver-Area REALTOR® Matthew Leprino.

METRO DENVER REPORT

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“Patience is the word of the day. Over three days, with showings every 15 minutes, it is not uncommon for buyers to be one of 50 or 60 people looking at a home for sale. Their offer will likely be one of 15 to 25 received by the seller and, if they want to be considered in the running for the home, they will need $25,000 to $50,000 over the asking price and a significant amount of cash to make up any appraisal gap. My heart goes out to these buyers. With record low interest rates, it is still well worth buyers continuing their efforts to find their home yet, in most all Aurora and Centennial neighborhoods, inventory is down 70 – 82% over last year. Home prices continue to climb with a $584,000 median in Centennial and Aurora now at $438,000,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Being a buyer right now in

Boulder and Broomfield counties feels a bit like you’ve been thrown into the

Hunger Games. Buyers wait patiently for the listing to come out, the cages

open, and the fight begins. The one lucky buyer who gets the house

retreats while the others lick their wounds on Monday and prepare to go back to

battle and do it again.

“Inventory is still declining with 20% fewer homes and condos on the market than this time last year. The median price for single-family homes rose 10% since this time last year and for condos in Broomfield, a whopping 30%. Average days on market in Broomfield hovers around 22 days, and in Boulder around 51 days. However, REALTORS® who are selling in this market now will explain that many homes sell in a weekend.

“The question is, ‘why are there so few homes on the market?’ It’s best explained by the migration of people moving here from other states. With the increased number of buyers adding to the competition, the supply and demand remain unbalanced. Homeowners here who would like to upgrade to another home are finding the prices too high to make the move. So, they stay, remodel and repurpose the home they are in, thus removing the inventory from the market, and the cycle continues.

For those buyers who are hoping to get into our frenzied market, solid financing, working with an experienced professional REALTOR®, and some luck may tilt the odds in your favor,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

BRIGHTON/I-76 CORRIDOR

“Brighton and the I-76 corridor remain in line with the rest of the Denver area with an approximately 80% decrease in inventory from a year ago. With record low inventory, listings are receiving multiple offers, pushing the purchase price up well above asking price. Buyers are becoming quite creative, trying to make their offers stand out. Others are choosing to go the new build rout. Yes, there are builders building homes in the area as fast as they can. New homes are being built on all four sides of Brighton, in Commerce City, Fort Lupton, Hudson, Keenesburg, and areas further out I-76. The farther east you go, the more affordable the homes are. In February, the average sales price of a home in Adams County was $469,092, Weld County $440,733, and Morgan County $305,777. With many people working remote, purchasing a home farther from the Denver area for less makes home ownership a reality,” said Brighton-area REALTOR® Jody Malone.

COLORADO SPRINGS/PIKES PEAK AREA

“Springtime is coming to the Rockies and housing remains in a full-blown shortage. With the median price range up on all properties 17.5% from last year, there is no relief coming into summer. Active listings took a beating, dropping over 50% and has led to fewer homes, more offers, higher prices, and buyers simply not having any inventory to pick from. At this time, strong financed offers are beat out by stronger financed offers, and stronger financed offers get destroyed by cash offers. Imagine being a buyer playing rock, paper, scissors, and every time you play, no matter what you pick, you get beat. It’s just not very fun and eventually you take your losses and go home. The problem is, there is no home go to. Rental pricing is pushing up, home prices are pushing up, and unless you get lucky as a buyer, you are competing against double-digit offers on every home.

“Meanwhile, sellers cannot add to the inventory for fear they won’t find a home either. This problem is occurring across the country. Every housing market is blazing hot. It is making it hard for people to make a choice on what to do with such limited options and it’s making our housing shortage even worse.

“Looking at the bigger picture, the U.S. economy is not just wounded, it is bleeding out. Every indicator from GDP to first-time unemployment claims, to the coming eviction crisis leads anyone watching this to realize the party has to stop at some time. Today, we found out in our local paper that across Colorado the lifting of the eviction moratorium may put one out of four adults out of their homes. And that appears to be from rentals alone. We have no idea what delinquent loans look like since the Federal Government placed a moratorium on those. The data we need to try and make an educated guess about the direction of our housing future simply isn’t available. So, the direction we take for the foreseeable future is going to be much of the same, until it isn’t,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS/PIKES PEAK AREA

“It’s the same old story in Colorado Springs, with an unprecedented, acute shortage of active listings that is pushing the price to a number subjectively established by the buyer based upon the level of desperation, need and pocketbook, irrespective of the normal valuation process of comparative market value. I believe, these situations present an ethical dilemma for the sellers.

“Last month, the inventory of single-family/patio homes in the Colorado Springs market shrank to a trifling 462 properties compared to 1,085 in February 2020, 1,518 in February 2019, and always above 3,000 in any February until 2013. While the inventory sank to a new record low, sales were still strong at 981 homes.

“In February 2021, we recorded the highest level of year-to-date sales, monthly and year-to-date sales volumes, as well as record-high average and median sales prices, compared to any month of February on record.The year-over-year single-family home sales activity saw a 17% increase in monthly sales volume, a 20% increase in the year-to-date sales volume, an 18% increase in the average and median sale prices ascending to $454,899 and $403,000 respectively, with a devastating over 57% decline in the active listings.

“When looking back 5 years and comparing single-family/patio home sales in February 2016 with February 2021, monthly sales are up 13%, year-to-date sales rose 14%, monthly sales volume climbed 90%, year-to-date sales volume increased 89%, average and median sales prices climbing 68% to $454,899 and $403,000, respectively. All of this escalation took place while active listings were shockingly down 74%.

Last month, 72.7% of the single-family homes sold were priced under $500,000, while 22.2% were between $500,000 and $800,000, and 5.1% were priced over $800,000. Year-over-year, there was a 53% drop in the sale of single-family homes priced under $300,000, primarily due to the inventory shortage, while we had a 59% increase in homes priced between $400,000 and $600,000, an 81% increase in homes priced between $600,000 and $1 million, and a 93% increase in homes priced over $1 million.

“Buyers generally purchase properties offering competitive values, even in a strong real estate market. Unsurprisingly, 10% of El Paso County and 8% of Teller County active listings in the Pikes Peak MLS had price reductions. Unequivocally, pathetically low inventory and affordability challenges due to ever-soaring prices continue to be the most problematic aspect of the Colorado Springs area housing market,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON VALLEY

“Like much of Colorado, finding a home or condo to buy in the Crested Butte & Gunnison area is significantly challenging right now. Properties priced correctly are receiving multiple offers and going under contract quickly for above the asking price.

“The Crested Butte/Gunnison area has quite a bit of vacant land and many buyers are moving towards taking on the task of building their own home rather than dealing with the current buying frenzy for existing homes. Typically, people do not buy land in the winter because it is under feet of snow, but the lag in land sales means that properties have been on the market for months or even years, so there are at least summer photos to see what might be hiding under the white stuff. The building trades are already as busy as they can be so it remains to be seen how or if they will handle the coming influx of people who are ready to have their place in paradise as soon as possible.

“We continue to see new properties listed for sale and most are at prices just above recent sales. I expect this to continue as the ski season draws to a close and we prepare for our busy summer season. If you don’t have someone paying attention for you and/or you aren’t ready to act, you could miss out on several properties and watch the prices continue to grow. It is tough to imagine a scenario where the market hits a downturn in the near future so the ‘wait and see’ approach could just end up being a long wait,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER COUNTY

“When a median price changes, it’s something worth noting because the number is less susceptible to quick, listing-specific changes and can instead indicate a trend. The average, in contrast can be easily skewed by a $10 million listing which shows up one month and is gone the next.

In 2017, the highest median price change to occur in a year-over-year calculation was +15.6%. In 2018 it was +16.4% and in 2019 it was just +10.1%. These are all changes in the single-family sector of Denver and, on their own, also detail a trend as the last 5 years in our City have become the most expensive we’ve ever recorded.

“However, the last two years have shown the most staggering increases at +21.3% and +21.9% during the months of February. Last month’s $585,000 median price for a single-family Denver home is quite different than 2017’s $406,500 and shows a realistic picture of what is selling vs. our current average price of $729,340,” said Denver-area REALTOR® Matthew Leprino.

DURANGO/LA PLATA COUNTY

“What do Sasquatch, unicorns, and active listings in La Plata County have in common? They don’t exist. Well, maybe Sasquatch does. Lack of inventory and high demand continue to push prices up and supply down to record lows. February 2021 saw 12% fewer new single-family home listings than February 2020. This leaves us with just over a months supply of inventory. The overall inventory of available single-family properties was down 73% from February 2020. Townhouse and condo sales were up 38% with new listings down 11%, leaving just under a months supply of inventory. There were just 25 active townhouse and condo listings in February compared to 170 this time last year, an 85% decrease.

“Multiple offer situations are the new normal for our market. Most homes are going under contract the same day they are listed, and most are selling significantly over the asking price with buyers offering to waive financing and appraisal contingencies. Buyers need to be ready to pull the trigger, sometimes sight-unseen, with little or no negotiation.

“March is looking remarkably similar to February, with just under 100 active listings and 123 pending sales for single-family residences for the entire county. Fifty-one of the available homes are priced at over $1 million. Townhouse and condo inventory remain depleted as well, with just 21 units available in the county. Inventory levels should increase this spring and summer due to traditional seasonality. Sellers that elected to sit on the sidelines last year due to COVID-19 will hopefully enter the market this season, helping to level the playing field a bit. Historic-low interest rates and the desire for a more rural lifestyle are continuing to drive buyer demand,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“I’ll admit, I’m old enough to remember watching The Wide World of Sports on ABC as a kid and listening to the iconic voice of Jim McKay’s intro: ‘…spanning the globe to bring you the constant variety of sport…the thrill of victory…and the agony of defeat…the human drama of athletic competition.’ The crashing ski-jumper is etched into my brain. Now, let’s rewrite that opening for the Wide World of Real Estate: Homebuyers are scanning an incredibly limited inventory of homes for sale across the front range. These homebuyers have the ‘thrill’ of finally finding a home they like well enough to purchase and make an offer $25,000 over asking. The thrill is quickly followed by the agony of defeat when notified that 14 other buyers offered a similar contract and at least one of these buyers offered more and/or better terms. Imagine doing this not once, twice, or even three times in a week. Imagine writing offer after offer, week after week, and experiencing the disappointment of loss after loss. Yet, that is what’s happening in our market across the state and across multiple price points. The human drama of the search for a place to call your own has likely never been more keen than at this point in our selling season.

“Colorado remains one of the most desirable states to live. In mid-January, it was as though a switch flipped and buyers came out in droves after the holiday doldrums, quickly snapping up the existing inventory of homes for sale – both resale and new construction. By mid-February, multiple offers on nearly every single listing were commonplace. Listing brokers, using current listing data to help sellers price their homes, found the recent analysis wasn’t keeping pace with demand. A home that would have commanded $400,000 in December could now command a competing offer scenario driving the price to $450,000 with many offers being all cash or mostly cash deals.

“Looking at the most recent sales data for February bears out the agony of what buyers are facing in this market: In the Fort Collins area, inventory levels are down more than 58% compared to last year at this time. The most striking losses occurring in the most desirable price ranges between $300,000 – $499,000 where the deficit of inventory is well over 70% compared to the year before. For sellers, the thrill of victory is seen in the 14% increase in median price from last February to a whopping $485,000.

“We saw a slight change in the terrain when interest rates bumped up following the market volatility in the 10-year treasury yield, and a brief pause showed how many buyers’ purchasing power is highly sensitive to interest rates. We may see some calming following the passage of the massive federal stimulus package – but the crystal ball is a bit blurry when it comes to the question of whether 30-year mortgage rates will ease back to sub-3%. The challenges for buyers in this market remain substantial. Just as premier athletic competition requires practice, practice, practice to be at the top of your game, buyers committed to buying a house can win as long as they and their broker remain diligent and put strategies in place to make their offers highly appealing to sellers – and not just in terms of purchase price. Providing relief and certainty to a seller in the form of inspection provisions, appraisal provisions, payment of seller’s fees, tightening contingency deadlines and more can all add-up to make a buyer’s offer stand out from the crowd,” said Fort Collins-area REALTOR® Chris Hardy.

GOLDEN/ARVADA – JEFFERSON COUNTY

“The song and dance continues in Jefferson County where inventory for both single-family homes and condos/townhomes has dropped 70 percent. The situation drives median home prices up once again with single-family now sitting at $571,750 and condo/townhomes at $321,000. There was less than one month supply of homes for sale in February hopefully, that will increase in the month of March with warmer weather and more daylight to encourage more sellers to the market,” said Golden/Jefferson County-area REALTOR® Barb Ecker.

GLENWOOD SPRINGS/GARFIELD COUNTY

“It seems sellers in the single-family sector of Garfield County are starting to get the hint, now is the time to sell. New listings were up 43.3% in February where ready, willing and able buyers scooped them up days after they hit the market. Pending sales increased 51% and the median sales price rose nearly 12% to $502,500.

In the townhome/condo market, new listings were down 25%, which resulted in a 126% increase in pending sales and in turn brought a 42% increase in median sales price, coming in at $431, 000.

“Each community in Garfield County has its own personality with market diversity from community to community as you follow the rivers down valley. While asking and sold prices are still very diverse, never before have these communities looked so similar in their amount of inventory or days on market. In the seven communities examined by this Association, only Meeker and Carbondale have a two-month supply of inventory, the other 5 are much lower. Interesting, as these two communities lie at the opposite end of affordability and price. The median sales price of a single- family home in Carbondale in February was $1.5 million in stark contrast to Meeker which came in at a meek $179,000. The remaining communities in the Roaring Fork and Colorado River valleys continue to experience incredibly low inventory with New Castle and Battlement Mesa under one month and Rifle, Silt and Glenwood Springs just over one month,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“With just 294 active available listings, down 57.9%, and less than a month supply of inventory, buyers are being challenged across our market. New listings continue to be low, down 14.9% year-to-date, while pendings are up 8% and solds up 2.5%. Other challenges include the increase in median and average prices, while interest rates have ticked up a little to just over 3%. Our current median price is $295,000, and our current average price is $332,000. This is typically the time of year when more inventory starts to become available, and it will be interesting to see if that happens. Until we do see more inventory, price pressures will continue,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“It’s no surprise that the low inventory environment remains the biggest problem for potential buyers across Pueblo, not just for established homes but vacant land in Pueblo West as well. We’re operating in an environment where multiple offers on vacant land are now commonplace.

“Looking at the overall market for February, we saw new listings up 14% over February 2020 and up 2% year-to-date. Pending sales show the active buyers up 13.2% over 2020 and up 4.7% over last February. Sold listings were down 10.5% from February 2020 and down 6% year to date. Our median price is up 29% over last February and up 26.9% year to date. Our average days on market fell to 71 as we watch new home permits continue to climb,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Real estate in Ski Town USA® feels a little like a snowboard cross competition. Buyers and their agents make up a team on the starting line of new listings and are typically pitted against four to six other competitors who are navigating their way through a fast, narrow course all with the same goal: to be the best with a winning contract and ultimately pass the finish line receiving the gold and a deed in their hand.

“The course is full of speed – timeliness of showings and offers, jumps – over-ask offers and acceleration clauses, drops – decreased listings, buyers choosing not to compete, and the occasionalcollision – properties not appraising. Routt County caught big air in February up 108% in sales while active listings dropped 66%. The first 70 days of 2021 resulted in 14 closings on homes over $2 million with an average sales price of $3.34 million. Median sale prices for single-family were just over $1 million and multi-family at $592,000 representing 32% and 62.2% increases from the previous year, respectively. Total county inventory for single-family is 70 and 38 for multi-family, both at just a little over a one-months’ supply.

“More inventory will come with the spring market. Sellers who short-term rent their multi-family properties typically wait until after the ski season to list when the rental season is quieter; single-family sellers look to show the lawn that has been hiding beneath the snow. Current conditions make the ups, downs and turns feel a little bit like a roller coaster ride. Buyers who have competed, yet left with silver or bronze positions, need to stay the course and be diligent to ultimately get their gold,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“The trend continues with rising average sales prices, low inventory and high demand for mountain properties, but there is a silver lining. There have been 24.4% more properties selling in Summit and Park Counties than the previous year. This means that properties are going under contract faster but there have been more of them available to buy.

February 2021 Single Family Averages:

Summit County: $1,929,458 34 properties sold

Park County: $415,849 16 properties sold

February 2021 Townhouse/Condo Average:

Summit County $590,712 95 properties sold

Keystone’s $2,522,500 and Frisco’s, $2,250,000 represented the highest average single-family home prices with Breckenridge averaging $1,986.026. About a third of properties are being purchased with cash.

“Patience, preparation and grit are the qualities buyers need right now. Of course, cash doesn’t hurt either,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“’What don’t you want?’ is my favorite quote from the movie Hell or High Water. It’s what a tired old waitress in rural Texas asked Texas Ranger Jeff Bridges at the T-Bone Café. You can either get green beans or corn on the cob with your T-bone, but you can’t have both.

“Same is true for the Telluride real estate market where there are just three condominiums for sale in under $2 million as of March 8, 2021. Yes, I said three, so ‘what don’t you want?’ The inventory is so low in the Town of Telluride that it’s been a couple of decades since sales were higher in the Mountain Village. Total dollar amount of February sales was up 75% over February 2020 with the number of sales up 40% for the same period of time. We are now getting some pushback by buyers on prices.

“We’ve recently listed the least expensive two-bed, two-bath condominium in the Town of Telluride at $1.2 million. The property seller was also our buyer client four years ago paying $587,000. They did remodel it extensively, but that is a heck of a gain. In our opinion, the buyers that move forward with a purchase in our market truly want to be here and somewhat reluctantly pay the prices. There is more price resistance at the bottom one third of the market than the top one third of the market. We have passed the top prices in the 2005-07 period some 15 – 25% with new listings really reaching for the sky. It’s our observation that we are seeing some buyers starting to shop around other Colorado resort markets that are more friendly to their budgets. Some of that trend has buyers looking here that started looking in Aspen, Jackson Hole or Vail first. Everything is relative in the sense of budget and resort markets. As we have often said, Colorado resorts are like buying ice cream. Nobody has to buy ice cream but most people like it. It’s just a matter of what flavor you like and how many scoops (bedrooms) you want,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Vail Valley Market continues at a strong pace in spite of COVID-19 and the economic factors locally and globally. The sales transactions were positive 5.9% for February 2021 versus February 2020. On a year-to-date basis sale are plus 18.9% versus 2020. The strength of the market continues with pending sales plus 67.1% versus February 2020. On a year-to-date comparison pending sales are plus 42.8%. On a year-to-date comparison the pending sales bode well for the coming months. The potential cloud on the horizon is the inventory or lack thereof! Active listings are off 52.4% and are low in some of the key volume niches. Hopefully, we will begin to see new inventory hitting the market over the next couple of months as the current months of supply are at 2.3 when a normal market would be 5-6 months. The imbalance of inventory in traditional high-volume niches is causing a significant dollar volume increase as the upper spectrum represents proportionately a greater number of sales in a strong demand market.

February was the best snow month of the year so far and the visitor count increased from prior months. March an April are traditionally our snowiest months which brings visitors and hopefully clients to the valley. We certainly have a much more positive outlook for the next two months the same period in 2020,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The February 2021 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

- Accuracy and Timeliness – MLS data are managed and monitored carefully.

- Richness – MLS data can be segmented

- Comprehensiveness – No sampling is involved; all transactions are included.

- Oversight and Governance – MLS providers are accountable for the integrity of their systems.

- Trends and changes are reliable due to the large number of records used in each report.

- Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 27,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.