Home Sales Decline Second Consecutive Month

Single-family home prices down 3 percent for summer months.

Fewer homes were sold in Colorado during August, the second consecutive month this year to see declining sales, according to market statistics released today by the Colorado Association of REALTORS® (CAR). The 10,657 properties sold last month represent an 8 percent decrease over July. From June through August of this year total home sales declined statewide 11 percent. Even so, sales year-to-date are up 7 percent for single-family homes and 14 percent for condominiums/townhouses compared to the first eight months of 2014.

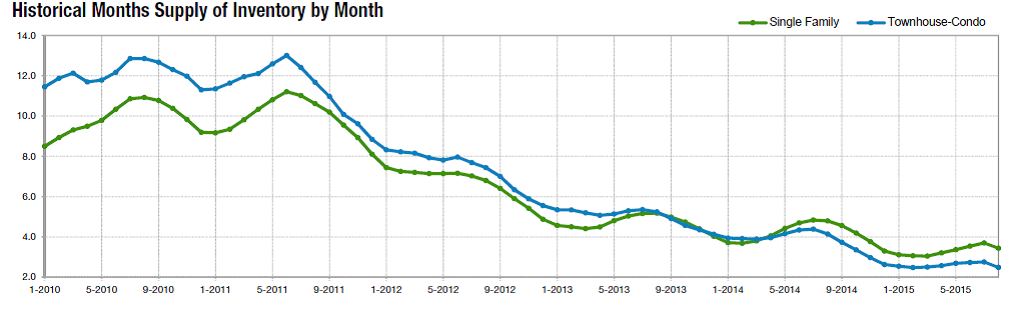

REALTORS® report that low inventory is currently the single most challenging factor in Colorado’s housing market. At the end of August there were 29,116 properties available for purchase in the state, down 24 percent from August 2014 and -7 percent from July of this year. Statewide that inventory should last just three and a half months for single-family homes and two and a half months for condominiums/townhouses, well below the 5-7 months that experts say are needed for a balanced market.

The statewide median price of a single-family home decreased to $307,200 during August, a drop of 1 percent compared to July and down 3 percent from the year’s high of $316,000 set in June. Meanwhile, the median price of a condominium/townhouse statewide rose 2 percent in August to $220,000, matching the year’s highest level set in May. For the full reports on each region, please visit: www.coloradorealtors.com/real-estate-statistics/

In the Metro Denver Region (Denver, Jefferson, Adams, Arapahoe, Broomfield and Douglas counties) sales of single-family homes declined 11 percent compared to July and are down 15 percent from June through August. Condominium/townhouse sales are down 12 percent compared to July and 9 percent for the three summer months of June, July and August. Compared to August 2014, sales of single-family homes are about the same and condominium/townhouse sales are up 8 percent.

The median price for a single-family home fell very slightly from $347,000 in July to $345,000 in August. Condominium/townhouse prices are holding steady at around $215,000.

At the end of August there were 7,735 single-family homes for sale in the region and 1,824 condominiums/townhouses, representing a two-month and one-month supply of homes, respectively.

Anthony Real, CAR spokesperson in the Metro Region reports “Housing in the Denver Metro Region is following seasonal trends where the late push of new listings at the tail-end of summer helps keep sales activity strong while pushing prices flat or even slightly downward from June when the market peaked in just about every category. Buyer demand remains very high as the Federal Reserve elected to leave interest rates unchanged for now, so perhaps consumers will be anxious to take advantage of seasonal slowdown opportunities in the coming months.”

In the Mountain Region (Garfield, Grand, Gunnison, Jackson, Pitkin, Routt, San Miguel and Summit Counties) summer sales followed a different pattern than most of the rest of the state, reflecting the region’s attractiveness for home buying in the summer. Both single-family and condominium/townhouse sales increased significantly from May through August, both Month-over-Month and when comparing 2015 to 2014. Year-to-date sales are up 17 percent over 2014 for single-family homes and 14 percent for condominiums/townhouses.

The median price for a single-family home increased to $526,225, up 7 percent compared to August of 2014 and rose to $372,500 for condominiums, up 6 percent compared to 2014. Helping boost the median sales price is a steady decline in the number of lender-mediated properties as part of the sales mix. These distressed property sales represented only 2 percent of all sales in August in this region, down from a high of 30 percent in February 2012.

The number of days that properties are on the market before selling decreased in this area by 11 percent compared to August 2014. Today those figures are down to 144 days for single-family homes and 136 days for condominiums/townhouses. At the end of August there were 5,434 properties on the market in this region, representing about a 10-month supply.

In the Northeast Region of Colorado (Boulder, Larimer, Logan, Morgan and Weld counties) sales of single-family homes decreased 7 percent to 1,412 compared to July and are down 10 percent June through August. Condominium/townhouse sales dropped 8 percent to 333 compared to July and are down 12 percent for June through August. Compared to the first eight months of 2014, sales are significantly improved – single-family year-to-date up 6 percent and condominiums/townhouses up 9 percent.

The median price for a single-family home in the Northeast Region has held steady at around $315,000 through the months of June, July and August. Compared to August 2014 that price is a 15 percent increase. Similarly, condominium prices hovered around $220,000 through the summer months and are up 19 percent compared to last summer New listings decreased to their lowest levels in five months adding to the already challenging inventory issues in this region.

At the end of August there were 2,681 single-family homes available for purchase, down 22 percent from a year ago and down 15 percent from July. For condominiums/townhouses (362 available), the decline in August was 31 percent compared to last year and 8 percent from July.

Kelly Moye, CAR spokesperson for the Northeast Region sees her market this way. “Once again, our inventory remains low, with a 2% increase in listings since this time last year. Our prices have increased about 15% and days on the market continue to get shorter in response to the lack of inventory. While multiple offers still exist, we aren’t seeing the number of offers we did in the spring. An affordable home in good condition might get 2-3 offers instead of 17-20. A general “buyer exhaustion” seems to be permeating through the market as they tire of the multiple offers and low inventory.”

The Northwest Region of Colorado (Delta, Hinsdale, Mesa, Moffat, Montrose, Pitkin and Rio Blanco counties) experienced a significant drop in sales (month over month) in August. Compared to July, single-family homes decreased 16 percent and condominium/townhouse sales dropped 20 percent. Taking the three summer months of June, July and August together, sales dropped 18 percent for single-family and 34 percent for condominiums.

The median price of a single-family home decreased to $198,900 compared to July’s $217,500 which was the highest median the region had seen in five years. Condominium/townhouse median prices also dropped to $145,000 from a 10-month high of $155,000 reached in July. Compared to August 2014, single-family prices are up 7 percent and condominium prices are up 14 percent.

The region has seen dramatic change in the percent of sales that represent lender-mediated, or distressed properties (e.g., short sales, REO properties). In January of 2011 lender-mediated sales comprised nearly half of all sales. Today that figure is down to 10 percent.

At the end of August there were 2,164 single-family homes (a six-month supply) and 163 condominiums/townhouses (a five-month supply) available for purchase in this region. This makes the Northwest region the only part of Colorado enjoying the ideal balanced market (5-7 months’ supply) which creates an even playing field for sellers and buyers.

From Sandy Borman, CAR spokesperson in the Northwest Region we hear “the Grand Junction market and surrounding areas continued to show signs of improvement in August 2015 when compared with 2014. With the median sales price up almost 10% over August last year and days on market down almost 10% we are improving at a healthy pace. The biggest change year over year was the month’s supply of inventory which was down 32% to less than five months. Pending sales were up almost 32% over 2014 and year to date sold listings are up 16%. The key issues we are watching in our market now are the decrease in new listings, down a little over 6% in August compared to last year, sold listings down 5%, and the number of active listings versus August last year down 21.9% which is spurring the upward trend in sales prices.

The Southeast Region of the state (Baca, Chaffee, Crowley, Custer, El Paso, Fremont, Huerfano, Las Animas. Otero, Pueblo and Teller countries) has experienced a very slight decline in single-family home sales (down less than 1 percent) from June through August. During that same period, condominium/townhouse sales decreased by 17 percent. Compared to 2014, however, single-family home sales in this region are up 18 percent and condominium/townhouse sales are up 39 percent.

Dave Anderson, a CAR spokesperson in the Southeast Region reports that “the Pueblo market is still positive. August sales were up 15% over 2014 and dollar volume was up 21%. New home construction is slowly improving.” The median price for a single-family home in the Southeast region dropped slightly to $220,000 (compared to $224.950 in July) but is up 5 percent compared to August 2014. Similarly, the August median of $149,900 for condominiums/townhouses is a drop from $156,000 in July but represents a 1 percent increase over August 2014. Both categories have seen steady price drops over the last four months.

The number of days single-family properties stay on the market before selling (DOM) has remained fairly level over the last 12-14 months – hovering around 80 days. Condominiums/townhouses show more fluctuation and have not experienced the significant decreases that some other regions (e.g., Metro Denver and the Northeast region) have seen.

At the end of August there were 5,303 single family homes and 411 condominiums/townhouses on the market in the Southeast. These represent a 4-month and 3-month supply, respectively.

The Southwest Region of Colorado (Alamosa, Archuleta, Conejos, Costilla, Dolores, Hinsdale, La Plata, Mineral, Montezuma, Saguache and San Juan counties) has experienced some increasing sales of homes during the summer months. Single-family home sales increased 4 percent from July to August and are up 128% since the first of the year. Condominium/townhome sales dropped 27 percent between July and August.

Lender-mediated sales (e.g., REO’s, short sales and other distressed properties) as a percentage of all sales in August declined to a little over 3 percent, down from January 2012 when those sales were 50 percent of the activity. From January through May of this year new listings of both single-family and condominium/townhouse properties steadily increased. During the summer months (June, July and August) the opposite occurred leading to an increased inventory of available properties.

While the trend has been generally upward since January 2013, the median price for a single family dropped to $288,000 in August, down $9000 from July’s pricing. Condominium prices increased to $240,000 up significantly from July’s figure of $220,000.

At the end of August there were 1,421 single-family homes and 255 condominiums/townhouses available for purchase representing an 11-month and an 8-month supply, respectively.

According to Don Ricedorff, CAR spokesperson for the Southwest Region, “The real estate market in the Southwest corner of the state is continuing to trend up with increasing sales and median price up 6.6%. The Durango In Town market continues to lead the way with the highest median price in the region, currently at $440,000. The demand for “walkable and rideable” neighborhoods drives the In-Town market, and the availability of those homes is more limited, and consequently, homes are selling at 98% of list price in Durango.”

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by 10K Research and Marketing, a Minneapolis-based real estate technology company, and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The August 2015 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.

The complete reports cited in this press release are available online at: www.coloradorealtors.com/real-estate-statistics/