Low Inventory /Prices Challenges Buyers and REALTORS®

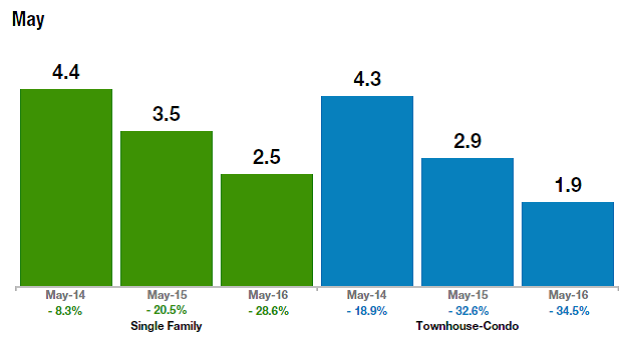

The supply of homes for sale in Colorado in May reached historic lows throughout much of the state according to statistics released today by the Colorado Association of REALTORS®. There were 17,724 single-family homes available statewide for purchase, down 24 percent from a year ago and representing just a 2.5-month supply. Similarly, the 4,237 condominiums and townhouses for sale in May were 30 percent fewer than last year and were projected to last just under 2 months without replacement. Inventory in May was just slightly below April for single-family homes and 5 percent lower for condominiums/townhouses.

Historical Number of Months Supply of Inventory

While the Metro Denver and Mountain Regions of the state saw some improvement in the number of new listings coming onto the market in May (compared to a year ago), overall there were 1 percent fewer single-family new listings and 7 percent fewer condominium/townhouse new listings statewide. From April to May of this year, new listings rose 5 percent for single-family and 7 percent for condominiums/townhouses, continuing a 5-month trend upwards that is common at this time of year. Sales followed similar patterns, flat or down from a year ago but up around 10 percent from April to May.

Statewide the median price of a single-family home rose 8 percent to $335,000 from May 2015 to May 2016. Condominium/townhouse prices increased 12 percent to $245,500. Those medians are $10,000 and $5,000 above April 2016 for each respective type of home and 60 percent higher than in January 2010. All areas of the state except the Southwest Region saw prices increase from last May to this year.

The number of days that homes stayed on the market in May before selling dropped an additional 13 percent to 48 days. The combination of low inventory and rising prices continues to drive affordability down (-9 percent), leading to buyer (and REALTOR®) frustration throughout the state.

Lender-mediated properties (Foreclosure, REO, Short Sale or other distressed sales types) represent just 1-3 percent of sales in most of the state except the Northwest Region where this category is close to 10 percent of sales.

For the full reports on each region, please visit: www.coloradorealtors.com/real-estate-statistics/

![]()

In the Metro Denver Region (Denver, Jefferson, Adams, Arapahoe, Broomfield and Douglas counties) the number of single-family homes available for purchase in May dropped 23 percent to 5,352 compared to a year ago and -4 percent from April of this year. The condominium/townhouse market saw supply drop 29 percent to 1,330 homes compared to 2015 and -9 percent from April. Experts estimate that this supply would last about 1.3 months if not replenished.

New listings were down 1 percent for single-family and -11 percent for condominiums compared to May 2015. Sales were also down, -4 percent for each category compared to a year ago but up about 9 percent compared to April of this year.

Median pricing for homes in the Metro Denver Region continued to rise, up 10 percent to $390,000 for single-family homes and +14 percent to $245,000 for condominiums/townhouses when compared to May 2015. From April to May of this year single-family prices jumped $15,000 and condominiums/townhouses $5,050.

The number of days that properties were on the market in May before selling rose 8 percent for single-family and +13 percent for condominiums/townhouses. Even so, homes last about 24 days on average in the Metro Denver Region.

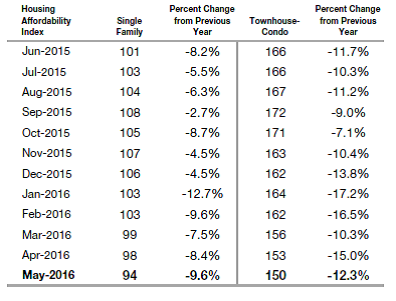

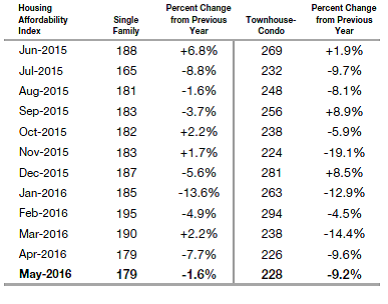

Affordability, measured based on interest rates, median prices and local income averages, declined about 10 percent from May 2015 to this year for single-family homes and -12 percent for condominiums/townhouses.

Housing Affordability

![]()

In the Mountain Region (Garfield, Grand, Gunnison, Jackson, Pitkin, Routt, San Miguel and Summit Counties) the number of single-family homes available for purchase in May dropped 20 percent to 2,422 compared to a year ago and rose 3 percent from April of this year. The condominium/townhouse market saw supply drop 27 percent to 1,889 homes compared to 2015 and -5 percent from April. Experts estimate that this supply would last about 8 months if not replenished.

New listings were down 2 percent for single-family and -5 percent for condominiums compared to May 2015. Sales were up 5 percent for single-family homes and down 6 percent for condominiums/townhouses compared to a year ago. Sales were also up from April to May. Median pricing for single-family homes in the Mountain Region continued to rise, up 2 percent to $458,000. Prices for condominiums/townhouses actually dropped 3 percent to $376,000 when compared to May 2015. From April to May of this year single-family prices dropped $102,000 and condominiums/townhouses – $7000.

The number of days properties were on the market before selling in May dropped 15 percent for single-family and -5 percent for condominiums/townhouses. Even so, homes last about 133 days on average in the Mountain Region.

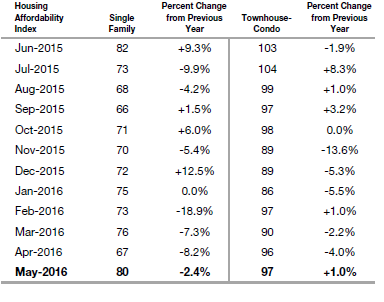

Affordability, measured based on interest rates, median prices and local income averages, declined about 3 percent from May 2015 to this year for single-family homes and improved 1 percent for condominiums/townhouses.

Housing Affordability

![]()

In the Northeast Region of Colorado (Boulder, Larimer, Logan, Morgan and Weld counties) the number of single-family homes available for purchase in May dropped 18 percent to 2,020 compared to a year ago and remained at the same levels as April of this year. The condominium/townhouse market saw supply drop 30 percent to 266 homes compared to 2015 and -9 percent from April. Experts estimate that this supply would last about 1.6 months if not replenished.

New listings were down 7 percent for single-family and -5 percent for condominiums/townhouses over May 2015. Sales were up 1 percent for single-family and down 16 percent for condominiums/townhouses over last year, and up 13 and 8 percent respectively over April.

Median pricing for homes in the Northeast Region continued to rise, up 7 percent to $330,000 for single-family homes and +15 percent to $265,000 for condominiums/townhouses when compared to May 2015. From April to May of this year single-family prices stayed the same and condominiums/townhouses increased $7,100.

The number of days properties were on the market in May before selling fell 2 percent for single-family and -10 percent for condominiums/townhouses. Even so, homes last about 65 days on average in the Northeast Region.

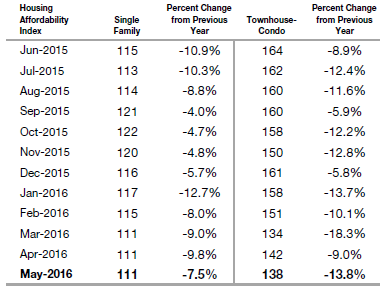

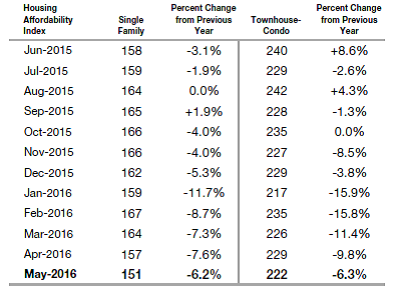

Affordability, measured based on interest rates, median prices and local income averages, declined about 8 percent from May 2015 to this year for single-family homes and -14 percent for condominiums/townhouses.

Housing Affordability

![]()

In the Northwest Region of Colorado (Delta, Hinsdale, Mesa, Moffat, Montrose, Pitkin and Rio Blanco counties) the number of single-family homes available for purchase in May dropped 12 percent to 2,076 compared to 2015 and was 3 percent lower than in April of this year. The condominium/townhouse market saw supply drop 9 percent to 184 homes versus 2015 and -1 percent from April. Experts estimate that this supply would last about 6 months if not replenished.

New listings were up 8 percent for single-family and +5 percent for condominiums compared to May 2015. Sales rose 21 percent for single-family and fell 10 percent for condominiums/townhouses compared to May of last year and rose 8 percent from April to May 2016.

Median pricing for homes in the Northwest Region continued to rise, up 1 percent to $205,000 for single-family homes and +9 percent to $160,650 for condominiums/townhouses when compared to May 2015. From April to May of this year single-family prices stayed the same and condominiums/townhouses decreased about $1500.

The number of days that properties were on the market in May before selling fell 17 percent for single-family and increased 4 percent for condominiums/townhouses. Even so, homes last about 104 days on average in the Northwest Region.

Affordability, measured based on interest rates, median prices and local income averages, declined about 2 percent from May 2015 to this year for single-family homes and -9 percent for condominiums/townhouses.

Housing Affordability

![]()

In the Southeast Region of the state (Baca, Chaffee, Crowley, Custer, El Paso, Fremont, Huerfano, Las Animas. Otero, Pueblo and Teller countries) the number of single-family homes available for purchase in May dropped 37 percent to 3,838 compared to a year ago and was at the same level as in April of this year. The condominium/townhouse market saw supply drop 56 percent to 234 homes compared to 2015 and -5 percent from April. Experts estimate that this supply would last about 2.5 months if not replenished.

New listings were up 2 percent for single-family and +11 percent for condominiums compared to May 2015. Sales were up 8 percent for single-family homes and down 7 percent for condominiums/townhouses compared to May of this year and up 15 percent for both from April 2016.

Median pricing for homes in this region continued to rise, up 6 percent to $242,810 for single-family homes and +6 percent to $165,000 for condominiums/townhouses when compared to May 2015. From April to May of this year prices rose $9,500 and $5,500 respectively.

The number of days properties were on the market in May before selling fell 41 percent for single-family and -73 percent for condominiums/townhouses. Single-family homes last about 50 days on average but condominiums/townhouses just 23 days in Southeast Region.

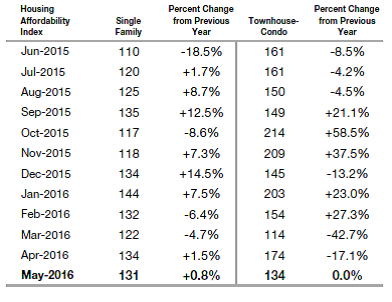

Affordability, measured based on interest rates, median prices and local income averages, declined about 6 percent from May 2015 to this year both for single-family homes and condominiums/townhouses.

Housing Affordability

![]()

In the Southwest Region of the state (Alamosa, Archuleta, Conejos, Costilla, Dolores, Hinsdale, La Plata, Mineral, Montezuma, Saguache and San Juan counties) the number of single-family homes available for purchase in May increased 4 percent to 1,480 compared to a year ago and was 9 percent better than April of this year. The condominium/townhouse market saw supply drop 13 percent to 226 homes compared to 2015 but was 7 percent up from April. Experts estimate that this supply would last about 10.5 months if not replenished.

New listings were up 3 percent for single-family and +14 percent for condominiums compared to May 2015. Sales were up 6 percent for single-family homes and +17 percent for condominiums/townhouses over 2015 and up 9 and 13 percent respectively from April of this year.

Median pricing for homes in this region fell 2 percent to $279,000 for single-family homes and -1 percent to $272,450 for condominiums/townhouses when compared to May 2015. From April to May of this year prices rose $5,600 and $62,500 respectively.

The number of days properties were on the market before selling in May fell 7 percent for single-family and -10 percent for condominiums/townhouses. Both types of homes last about 139 days on average in the Southwest Region.

Affordability, measured based on interest rates, median prices and local income averages, rose about 1 percent from May 2015 to this year for single-family homes and was unchanged for condominiums/townhouses.

Housing Affordability

For the full reports on each region, please visit: www.coloradorealtors.com/real-estate-statistics/