Shrinking Inventory Driving Factor in Colorado Markets

Single family and townhouse/condo listings down more than 30 percent since July peak.

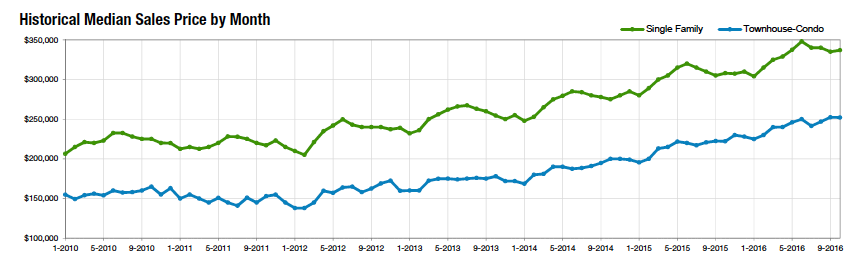

While the median sales price for single-family homes and townhouse/condominium units between September and October 2016 remained relatively flat, $337,000 and $252,000 respectively, a shrinking inventory of active listings across the state continues to play a significant role in the overall housing market, according to the latest statewide housing report from the Colorado Association of REALTORS®.

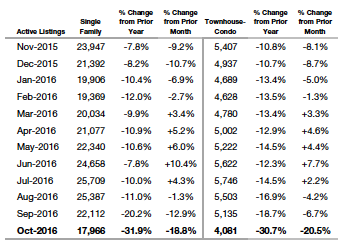

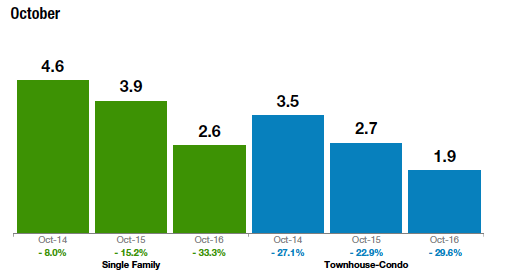

With 7,127 new single-family home listings in October and 2,200 new listings for townhouse/condos in the month, the overall active listings for each category are down more than 30 percent from their July peaks (see the chart below). Overall, there were 23,327 homes on the market in October across the state, the lowest total in the prior 12-month period, providing just a two-and-a-half-month supply of single-family homes and 2-month supply of townhouse/condominiums.

Inventory of Active Statewide Listings

Months Supply of Inventory

Despite the decreasing supply of homes, the median sales price for both single-family homes and townhouse/condominiums remained relatively flat across all regions of the state. However, compared to a year ago, single-family median prices are up approximately 10 percent while condominiums/townhouses are up just more than 13 percent.

The October median sales price of $345,000 in the metro Denver area remained even with its prior month pricing while every other area of the state experienced a slight decrease in the median sales prices. Homes in the mountain region of the state experienced a -5.2 percent decrease from $480,000 in September to $455,000 in October. The state’s northeast region experienced a -4.1 percent decrease from $315,000 to $302,000 while the northwest and southeast regions, the state’s most affordable, experienced dips of -2.3 percent and -2.1 percent, respectively. The southwest region dipped -1.4 percent in median sales price from $281,000 to $277,000.

Affordability, based on the relationship between housing prices and local income levels, also took a hit in the month of October for both single family (-5.1 percent) and townhouse/condominiums (-9.1 percent).

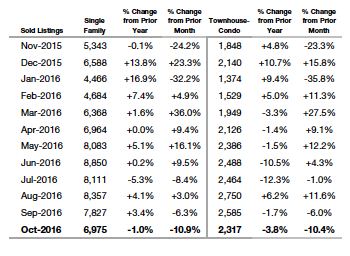

In addition, sales also declined from September to October, down nearly 11 percent to 6,975 single-family homes and -10.4 percent to 2,317 condominiums/townhouses. However, compared to October 2015, single-family sales were off just one percent while condominiums/townhouse sales were down nearly four percent.

Sold Listings

As expected, the continued short supply of homes plays a role in the average number of days that homes stay on the market (DOM) before selling. The DOM for single-family homes in October was 52 – just one day more than the September DOM. For condominiums/townhouses it was 49, up three days from the September report. Both single-family and condominium/townhouse DOM were down compared to a year ago.

The complete reports cited in this press release, as well as regional reports specific to the Denver Metro, Mountain, Northeast, Northwest, Southeast and Southwest markets are available online at: www.coloradorealtors.com/real-estate-statistics/

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry, and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2016 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.