Colorado Association of REALTORS Statewide Market Report for March 2017

FOR IMMEDIATE RELEASE

March brings seasonal spike in new listings across Colorado’s housing market;

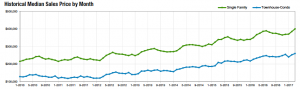

Median sales price hits record $400,000 for Denver metro single-family home

https://coloradorealtors.com/market-trends/

Key findings from the March 2017 research report include:

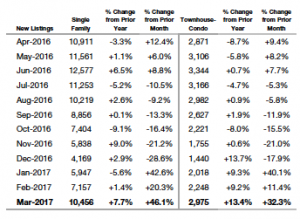

- 46 percent increase in new single-family listings and 32 percent increase in townhouse/condo listings across the state from February to March

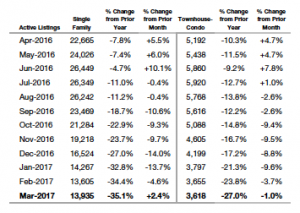

- Despite increase in listings, strong sales keep inventory at record lows – down 35 percent from one year ago

- Median sales price for single-family home in the Denver metro area hits record high $400,000

- Denver metro townhome/condos hit median sales price of $260,000

- Denver Metro area has 50 percent fewer active listings than one year ago

- Statewide median sales prices up more than 10 percent from year prior

- Median sales price for single-family and condominium/townhomes across the state rose 3.2 percent and 4.8 percent, respectively

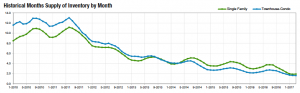

- Statewide there is a 1.9 month supply of inventory, while in the Denver Metro area there is just 1.3-month inventory supply

ENGLEWOOD, Colo. – April 11, 2017 – New listings for single-family homes and townhouse/condominiums bloomed across the state in March. However, strong sales kept inventory hovering around record lows and bumped median sales prices to record highs in the Denver metro area, according to the latest statewide housing report from the Colorado Association of REALTORS® (CAR).

The addition of 10,456 single-family listings and 2,975 townhome/condominium listings across the state, of which more than half were in the Denver-metro region, was once again matched by consistent sales resulting in a relatively flat inventory of active listings from February to March 2017.

The combination of factors continued to drive median sales prices up across the state. Single-family homes across the state were up 3.2 percent in March to a median sales price of $353,000, while the median sales price of townhouses/condominiums rose 4.8 percent from a month prior to $263,000, according to CAR market trends research.

In the Denver metro market, median sales prices for a single-family home hit $400,000 for the first time in the history of the CAR research. The median sales price for a Denver metro townhome/condominium reached $260,000, also a CAR market trends report record high.

Denver Metro Median Sales Price

Statewide New Listings

Statewide Active Listings

With just over 17,700 active listings across the state, the monthly supply of housing inventory remains below 2 months and is nearly 35 percent lower than one year ago. Balanced markets range from 4-7 months supply.

Operating in a limited inventory environment and growing seasonal demand from would-be home owners, the average days a for sale home stayed on the market continued to drop as well. With a 54 day average for single family and townhome/condo units across the state, the Denver metro market saw that average dip to just 31 days from a house going on the market through closing.

Here are a few quotes about the most recent housing market conditions from Colorado Association of REALTOR® research spokespersons representing regional markets:

Boulder

“Bidding wars in the more affordable sectors are still the name of the game in the northern areas. We are finally seeing more listings come on the market and our inventory improve, but not enough to satisfy the demand,” said Boulder-area REALTOR® Kelly Moye.

Denver

“Creativity prevails in the Denver Metro Market this Spring. The once unheard-of inspection-waiver or appraisal reserve no longer distinguish buyers as they once did. Extended rent-free leasebacks and even sight-unseen offers have changed the offer game as we cross the new median sales price threshold of $400,000,” said Denver-area REALTOR® Matthew Leprino.

“In the Denver Metro area new listings are going under contract as fast as they are hitting the market, not allowing for any recovery in our already low inventory numbers. In general, these properties are receiving full price or better. Housing affordability continues to be a challenge as the average and median home prices continue to escalate and no new entry-level home product is being built to help with the lack of affordable housing supply,” said Denver-area REALTOR® Karen Levine.

Colorado Springs

“The El Paso County inventory of single-family patio homes dropped 32 percent in March compared with March 2016. The months supply of inventory are also at drastically low levels – 1.2 months for single-family patio homes and 0.7 months for townhouse/condos,” said Colorado Springs REALTOR® Jay Gupta.

Telluride

“The Telluride market experienced the biggest first quarter increase in four years. The dollar amount of sales was up 46% over the first quarter in 2016 and the number of sales were up 13%. This means that the more expensive properties in our region have really started to move. The number of properties under contract today is 80 with the dollar amount under contract at $126,000,000. The entire first quarter of dollar amount of sales was $136,000,000. This seems to show a really big year in the making. My general thoughts are that the affluent are feeling really good about their investment portfolios and their comfort in buying their dream properties in a resort market.,” said REALTOR® George Harvey from Telluride, Colorado.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry, and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The March 2017 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

KEY METRICS GLOSSARY

New Listings –This is a measure of how much new supply is coming onto the market from sellers. For example, Q3 New Listings are those listings with a system list date from July 1 through September 30.

Pending/Under Contract – This is the most real-time measure possible for homebuyer activity, as it measures signed contracts on sales rather than the actual closed sale. As such, it is called a “leading indicator” of buyer demand.

Sold Listings – This measures how many home sales were actually closed to completion during the report period.

Median Sales Price – This is a basic measurement of home values in a market area and basically states that 50 percent of the homes sold were either higher or lower than the Median Sales Price.

Average Sales Price – This is another basic measurement of home values in a market.

Percent of List Price Received – The mathematical calculation of the percent difference from the list price and the sold price for those listings sold in the reported period.

Days on Market – A way to measure how long it is taking homes to sell.

Affordability – Uses median sales price, prevailing interest rates and average income to measure local housing affordability. A higher number is usually interpreted as greater housing affordability.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 24,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.