August Market Trends: Signs of a Shifting Market? Homes in Colorado Are More Affordable But Taking Longer to Sell

Regional and Statewide Statistics

Contact: Marty Schechter for CAR

303-882-4585 cell

marty@schechterpr.com

ENGLEWOOD, CO. – Sept. 12, 2019 – Still far from what would be defined as balanced, Colorado’s residential housing data continues to show signs that markets are shifting, according to the latest monthly market data from the Colorado Association of REALTORS®.

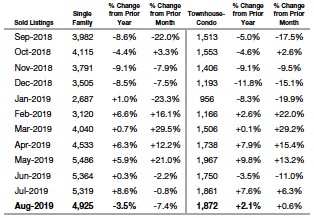

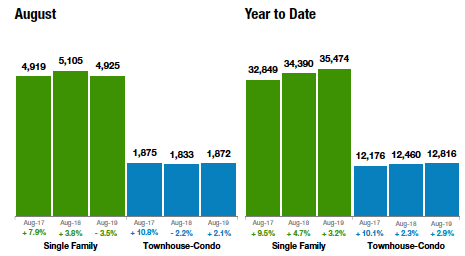

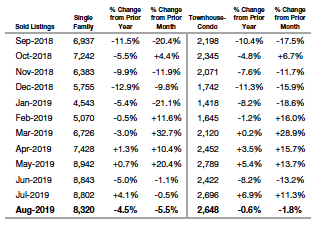

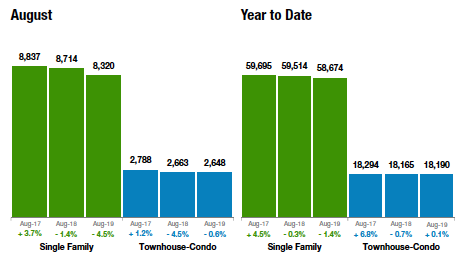

Despite three-year lows on interest rates and median pricing that dipped 1 percent in August, single-family home sales fell 7.4 percent from July to August in the seven-county Denver metro area and were down 5.5 percent statewide. Townhome/condo sales remained relatively flat from July to August in the metro area and statewide as well.

The median price of a single-family home in the metro-Denver region fell $5,000 to $445,000 over the past month but remain up 3.5 percent over the same time last year. Statewide, the median price of a single-family home also fell from $409,000 in July to $405,000 in August, but also remains up 3.8 percent over August 2018.

The median price of a condo/townhome ticked up slightly to $312,500 for both the Denver-metro area and statewide and were up 4.2 percent and 5.5 percent, respectively over last year.

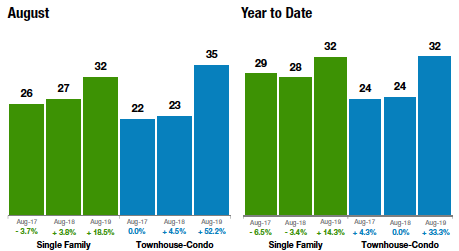

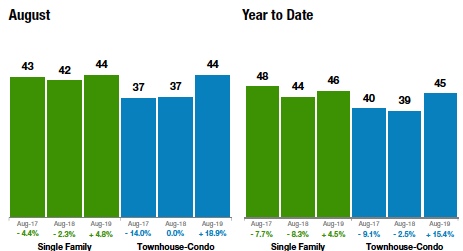

The most notable percentage change was reflected in the August 2019 average days-on-market as buyers demonstrate a little more patience amid economic uncertainty while taking advantage of a little growth in inventory. Single-family homes in the Denver-metro area were on the market an average of 32 days in August, up nearly 21 percent from July and 18.5 percent over last year. Condo/townhomes rose from 31 to 35 average days-on-market from July to August but were up more than 52 percent over August 2018.

Statewide, single-family homes and condo/townhomes were on the market an average of 44 days, up 7.3 percent from July to August 2019. However, condo/townhomes were up just shy of 19 percent year-over-year.

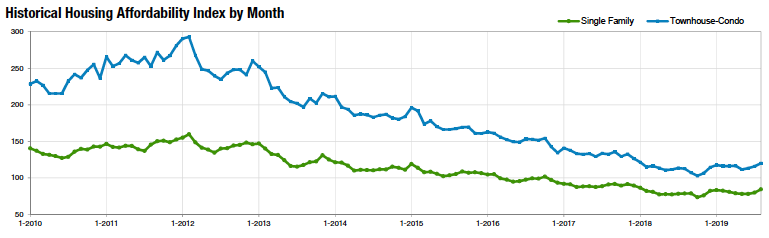

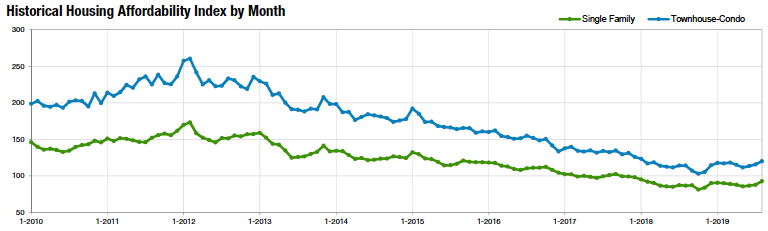

The combination of factors helped push the CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – to index numbers not seen since late 2017. The higher the number, the more affordable a region is considered to be. The index hit 84 (up 6.3 percent from a year ago) for single-family homes in the Denver-metro area in August and topped out at 93 statewide (up nearly 7 percent from 2018). The affordability index hit 120 for the townhome/condo market both in the Denver-metro area and statewide, up 6.2 percent and 5.3 percent, respectively.

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA/CENTENNIAL

“Aurora’s

housing market remained very strong through August although the listing inventory was down (699) compared to

August 2018 (843). Given the reduced number of listings, it makes sense

that home prices would be up 5 percent from last year with the median price in

Aurora at $390,000. As always, these numbers vary by zip code; the median price

in 80016 is $559,995 which is down slightly from a year ago, while 80013 is up

5.3 percent over August 2018 with a median price of $370,000. The zip code

with the most momentum is 80010 where the median price is $321,000, up 6.5

percent from August 2018. Overall, the average days on the market is 29

days.

“Looking at Centennial the numbers reflect the same story. Inventory is down, prices are up from a year ago. The $490,000 median price is up 6.5 percent from last year. The Centennial condo market is showing an even greater increase in pricing with the median price up 13 percent over last year at $361,750. Condo inventory is down and average days on the market is 43.

“Overall, with very low interest rates, this is still a very good time for buyers to jump into the market. For sellers, they continue to see home values rising,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“It’s good to be a buyer in Boulder County

with new listings hitting the market (10 percent more than this time last year)

but, they are just sitting there. The number of sold listings remains the same,

giving more inventory than we’ve had in the last five years. Prices are

flat with no change from this time last year. It appears there is a stagnant

“plateau” happening in the market and buyers rejoice, with more homes to see,

better prices, and more time to make their decisions. With days on the

market still hovering at 45, it would appear to still be a strong market but

with increasing inventory and waning consumer confidence in the general

economy, it’s hard to say how long that will last.

“There was no shortage of activity in Broomfield County where we had 20 percent more listings on the market than last year, but we’ve also sold those 20 percent as soon as they came up. Prices are holding at about the rate of inflation – up about 2 percent since last year. Nothing to celebrate, but also not in red like some of Broomfield’s neighbors. The relatively affordable median price of $506,000 is keeping Broomfield’s real estate market moving at a quick pace. The townhome market is active with median sales prices up 4.2 percent and sales are brisk with properties selling in under 27 days,” said Boulder-area REALTOR® Kelly Moye.

“As the summer starts to wind down and the kids return to school, the housing market for the month of August in the Brighton and I-76 Corridor has shown a slight increase in activity over the month of July. Homes are sitting on the market longer and prices are slightly softening, with the median sales price going down from $410,900 in July 2019 to $403,913 in August 2019. While the month-to-month statistics show a decline, the year-to-date comparison for the median sales price for the month of August is up 6.7 percent from a year ago,” said Brighton/I-76 Corridor-area REALTOR® Jody Malone.

COLORADO SPRINGS/PIKES PEAK AREA

“In the Colorado Springs area housing market, the year-over-year single-family home sales activity in August 2019 saw a one percent increase in the monthly sales, a 5 percent increase in the months’ sales volume, a 4 percent increase in the year-to-date sales volume, a four percent increase in the average sale price ascending to $371,552, a five percent increase in the median sale price rising to $330,000, and a three percent increase in new listings with over nine percent decline in the active listings. During the past three years, the year-to-date sales activity has been remarkably steady with 10,785 sales in 2019, 10,824 in 2018, and 10,941 in 2017. Since August 2014, the average and median sales prices have shot up by 44 percent, year-to-date sales by 43 percent, and year-to-date sales volume by an astounding 109 percent. Last month recorded the highest level of monthly sales volume, year-to-date sales volume, average sales price, and median sales price compared to any month of August on record. However, the pace of increases on a month-to-month basis is gently leveling off.

“Last month, 85.5 percent of the single-family/patio homes sold were priced under $500,000, while 12.3 percent were between $500,000 and $800,000, and 2.1 percent were priced over $800,000. Year-over-year, there was a 19 percent drop in the sale of single-family/patio homes priced under $300,000, primarily due to the inventory shortage, while we had a 23 percent increase in homes priced between $300,000 and $400,000, and a 49 percent increase in homes priced between $600,000 and $1,000,000.

“Even in a strong real estate market, buyers generally purchase properties offering competitive values. Predictably, 41 percent of the El Paso County and 36 percent of the Teller county active listings in the Pikes Peak MLS had price reductions. Prevailing low inventory and affordability challenges due to ever-rising prices continue to be the most restraining aspect of the Colorado Springs area housing market,” said Pikes Peak-area REALTOR® Jay Gupta.

“August remained a robust month for the Pikes Peak Region as prices continued to increase for single-family homes, as well as the townhome/condo market. The low inventory environment continues with average days on market for single family decreasing 15.2 percent. On the other side, townhome/condo days on market rose 45.5 percent. Across the region we continue to hear REALTORS® ‘feel’ like there may be a shift coming, but it is not showing in the statistics.

“On the national front, we need to be cautious. The Federal Reserve is talking further interest rate drops after economic news continues to look softer than they would like. The dreaded yield curve flipped and flopped in August sending recession talk and fears across the market. Manufacturing recessed for the first time in 10 years and the DOW has been a roller coaster of ups and downs that would make most of us nauseous.

“If jobs remain steady with lower unemployment, I believe the housing market may soften but should stay steady. If we start to get word of layoffs or higher unemployment numbers start to creep into the economy, it is anyone’s guess how that plays out. The economy is based on emotion more than anything else, and if people start to get worried, than that is what worries me most,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER

“Denver homeowners still have reason to celebrate this month – though, like leaves in the fall season, the market’s luster is beginning to fade. While the median price for a single-family home still rose 3.2 percent this August over the previous year, that is in stark contrast to the 7.7 percent rise the year previous and even less like the 12.5 percent gain from August 2016 to 2017.

“While the median price appreciation is slowing, the days-on-market figure is also changing rather rapidly. In August, over the previous year, the average time on market rose 22.7 percent while the previous August (2017 to 2018) saw only a 10 percent increase.

“It’s far too soon to predict negative growth or even a ‘bad’ market – but it’s absolutely appropriate to note that balance is coming to Denver’s housing market and that buyers can soon approach housing in ways we haven’t seen in a decade,” said Denver-area REALTOR® Matthew Leprino.

DURANGO

“Residential sales numbers are slipping slightly in La Plata County when compared to 2018. Overall, sales are down just shy of 5 percent year-to-date, with single-family reigning in at -9.6 percent year-to-date. The median price stands strong with a 6.9 percent increase to $465,000 in single-family and 2.8 percent increase year-to-date in condos/townhomes to $298,000. The reduced sales figures are clearly not a lack of inventory problem, as new listings this year are up 2.3 percent overall. Instead, buyers have started questioning whether local markets have reached their peaks and are cautious to make decisions. Buyers are becoming ambivalent, both losing interest in purchasing aging inventory or finding newer subdivisions lack enough perceived value to pull the trigger. With six to nine months inventory of homes for sale, the market is stable. Sales are expected to continue at the slightly reduced pace through the end of 2019,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“New listings for Larimer County single-family homes were down over last year, but not dramatically at less than 1 percent. Sold listings are also on a downward plane at -3.5 percent. Even with this slowing of new properties on the market, the average sales price continued to climb, 3.2 percent in August, to an average of $470,890. Days on market was slightly shorter at 61 versus 64 last year.

“Looking at the townhouse-condo market, we saw an 11.1 percent increase in new listings over 2018 and are fetching 99.5 percent of the list price. Average sales price continues on an upward trend at $317,731 a 3.1 percent jump from 2018.

“In Estes Park we are seeing similar trends with townhouse-condos. New listings were up 16 percent year-to- date and closing with a 6.1 percent increase over 2018. Median sales price is dramatically increasing from $295,000 in 2018 to $363,000 in August 2019 – a surprising increase of more than 23 percent. Percent of list price is holding steady at 95.7 percent. Days on the market increased to an average of 80 days. This is not unexpected with the heavy increase in these properties currently on the market.

“Single-family homes in Estes Park are not keeping up pace with the townhouse-condos. The stats for single- family homes have all declined, with the exception of days on the market, which has increased from 83 days to 105 year-to-date, a 26.5 percent increase. New listings are down 18.5 percent, closed sales down 14.6 percent and even the average sales price has dropped. Year-to-date, the average sales price is $581,161 as compared to 2018 at $602,104 a dip of 3.5 percent,” said Estes Park-area REALTOR® Abbey Pontius.

GOLDEN/JEFFERSON COUNTY

“It seems as if the Jefferson County real estate market is currently in a transition phase. As the sun is setting on our current cycle, the market appears to be slowing. One of the strongest predictors of an approaching recession is slowing consumer home purchases, and for Jefferson County, single-family home sales have dropped slightly with townhome/condos dipping 1.1 percent from this time a year ago. Regardless of when the next recession begins, the real estate market is already feeling the impact with additional new listings hitting the market up 2.8 percent for single-family homes and 4.6 percent for townhome/condos. In addition, the average days on the market increased 35 percent for single-family homes and 43.8 percent for townhome/condos from this time last year. Despite more inventory to view, sales were down. The median sales price did increase for single-family homes to $477,000, while townhome/condos decreased slightly to $292,950 from a year ago. Sellers will need to price their homes correctly and possibly list their home slightly under market comparables if they want a quick sale,” said Golden-area REALTOR® Barb Ecker.

GUNNISON COUNTY/CRESTED BUTTE

“The August housing statistics for the Gunnison-Crested Butte area tell a story that is different from the one many in the area are sharing. In general, the number of properties for sale is going up while the number of properties selling is going down. This would indicate a slowing of the market which seems to be happening around the state. However, there are certain segments of the market that are very positive. High-end homes within the Crested Butte town limits are not only selling but setting new records. But, the high net worth individuals who are buying them are looking for the best locations, amazing finishes and great layouts. Anything less and those homes are sitting on the market.

“We are seeing average prices continue to rise, but the sale-to-list price percentage is going down. Sellers have been testing the market with high prices and buyers are not rising to the new levels. REALTORS® and other consultants are advising that the “Vail effect” will create greater demand in the market so prices will go up. In the year since the ski area purchase, this effect has not really shown itself. So the question is, will Vail save Crested Butte from the market shift that seems to be happening throughout the state or will we see a downturn that many buyers are hoping for,” said Gunnison County-area REALTOR® Molly Eldridge.

FORT COLLINS

“The fall came a little early – for interest rates, that is. Interest rates dropped to historic lows at the end of this summer dropping to under 4 percent, which many industry experts never thought they’d see again. This has sparked both refinances for existing homeowners as well as provided additional enticements to first time homebuyers looking for ways to increase their buying power in a market that appears to be flattening a bit in price.

“The Fort Collins market has seen a drop in median price to $420,000 in August, down from the 2019 high of $438,500 in June. This drop is likely due to a bit of stalling in the high-end as sales over $1 million are down 3.5 percent, as well as in the sub $400,000 price range which is down nearly 20 percent year-over-year. This ‘stall’ has provided for an uptick in standing inventory which in turn has provided buyers in the middle price points a bit of breathing room as they have multiple properties to tour and competition for these desirable mid-price homes has eased a bit. This easing continues to force sellers to adjust their pricing expectations as well as consider upping the ante on improving the condition of their homes before putting them on the market,” said Fort Collins-are REALTOR® Chris Hardy.

FREEMONT/CUSTER COUNTIES

“Custer County new listings for the month of August continued in a positive direction as we head into fall with new listings up nearly 21 percent from July. Sold residential units were up 50 percent over August 2018 while the average price has remained fairly stable, coming in at $278,111. Overall inventory is down just under 2 percent. The market in this high mountain area will begin to slow slightly as the temperatures drop and the snow starts flying.

“New listings in Fremont County increased 25.4 percent from July to August, but the number of sold properties dropped off the last couple of months dipping 9.8 percent for July and another 19.6 percent for August which may be a result of summer coming to an end and the start of a new school year. Overall inventory is up 2.4 percent year-over-year. Sold properties are down slightly (-2 percent) and the $219,943 median price has risen an even 10 percent since this time last year. It appears to be a fairly stable market encountering slight fluctuations in inventory and sales while home values continue to grow at a reasonable pace,” said Freemont and Custer County-area REALTOR® David Madone.

PUEBLO

“Pueblo experienced another up and down month in the housing market. Still short of inventory but month-to-month we were up 5.1 percent, but down 3.1 percent year-to-date. Pending sales were up just over 1 percent from July to August but down 1.6 percent year-to-date. With sold listings were down 15.4 percent from July to August, we are down just 5.4 percent YTD. Our median sales price rose 16.4 month-to-month to $217,700 and is up 10.4 percent over last year. The shortage of lower priced homes continues to push median and average sales prices up

“With average days on market moving up to 70 days, we are seeing more price reductions. Sellers are getting the message that the market is slowing down and if they want the home sold now, they need to adjust the price down. Agents across the market are noting that it’s taking a lot more work to get homes sold now than it did a couple of years ago,” said Pueblo-area REALTOR® David Anderson.

TELLURIDE

“The Telluride real estate market had its best month of the year in August with the dollar amount of sales up 29 percent and the number of sales up 94 percent and the number of properties under contract in the first 10 days of September is also up. The downside of all of this is the reduction in inventory which will continue to be a challenge and likely a downward influence on sales over the next few months. The average price of a home sold in Telluride this year is $2,549,455 with the average sales price of a home in the Mountain Village being $3,618,500. Interesting in that the average price of a home in Telluride per square foot is $1221, yet it’s about half that in the Mountain Village at $650 per square foot. Condominium sales continue to be brisk in both towns with buyers wanting the convenience of central locations in easy walking distances to core restaurants and shopping. Sales are more spread out in the county with good activity 30 to 45 minutes from Telluride. Historically, August, September and October are the best sales months in our market,” said Telluride-area REALTOR® George Harvey.

Sold Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Sold Listings – Statewide

Days on Market – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Days on Market – Statewide

Housing Affordability Index – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Housing Affordability Index – Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The August 2019 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.

CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems. Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter. The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 26,500 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com