Home Prices Up Across Colorado Despite Snowy, Cold February

Winter weather doesn’t slow home sales as buyers gobbled up record low inventory

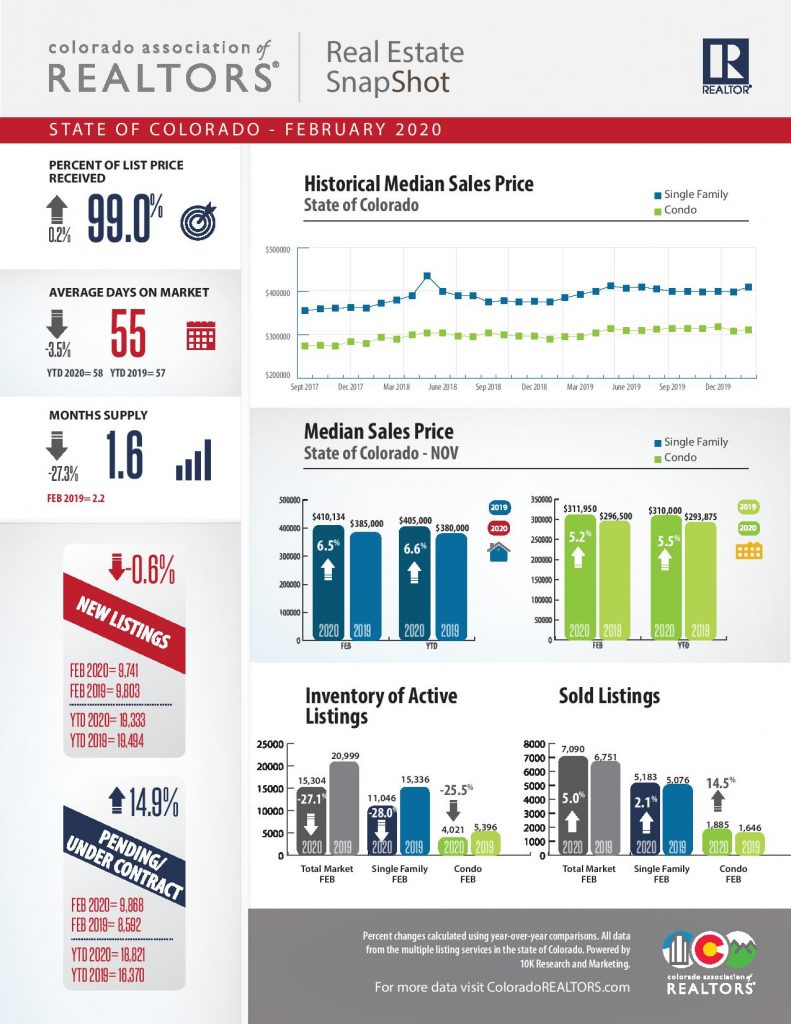

ENGLEWOOD, CO. – March 11, 2020 – A growing number of homes coming onto the market in the first few months of the year, coupled with a cold and snowy February, wasn’t enough to offset pent-up demand from buyers ready to gobble up available single-family homes and condo/townhomes and driving up prices, according the latest monthly market data from the Colorado Association of REALTORS® (CAR). Market conditions across the state continue the trend seen throughout 2019 as the state closed out the decade with 10-year record or near record lows in several key inventory related categories.

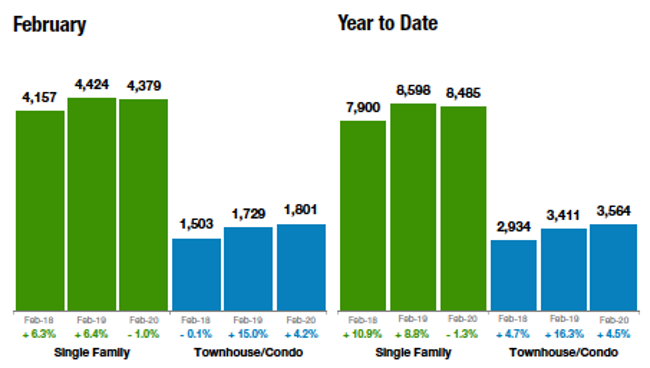

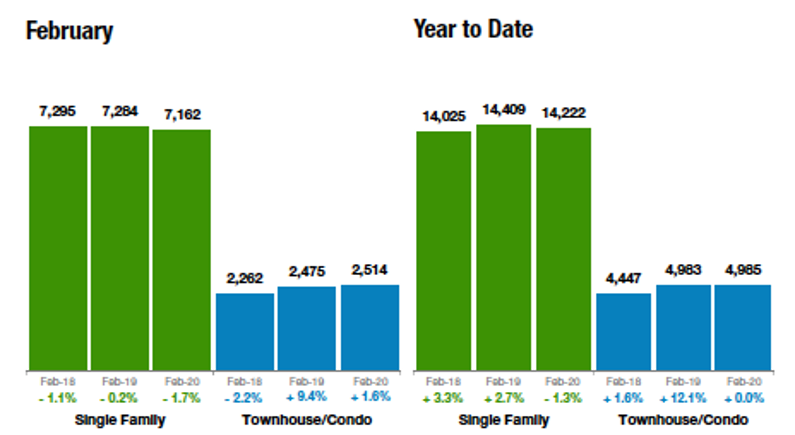

Anticipated seasonal single-digit increases in new listings, both in the seven-county Denver metro region and the state, were met with even larger percentage increases in the number of sold listings and homes pending/under contract. The circumstances drove the inventory of active listings down as much as 12 percent from January to February, pushing the months supply of inventory to the lowest levels seen since CAR began tracking the data in 2010.

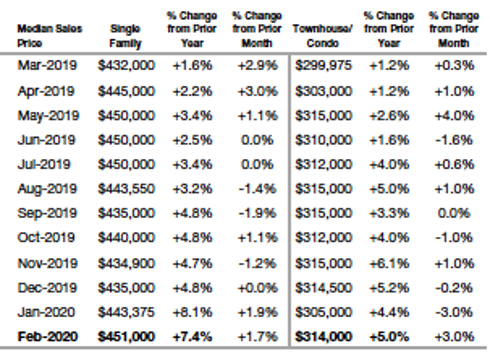

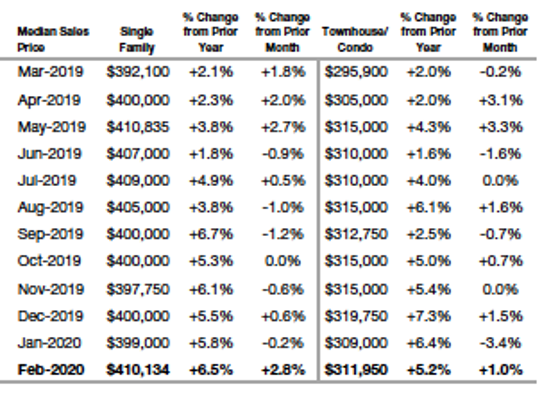

Median pricing for single-family homes in the seven-county Denver metro region ticked up 1.7 percent from January to February to $451,000 and are up 7.4 percent from a year ago. Condo/townhomes in the Denver area rose 3 percent from January to February and are up 5 percent compared to February 2019 hitting $314,000. Statewide, single-family homes rose nearly 3 percent month-over-month and are up 6.5 percent year-over-year at $410,134. Condo/townhome median pricing reached $311,950 in February 2020, up 1 percent from January and more than 5 percent from a year prior.

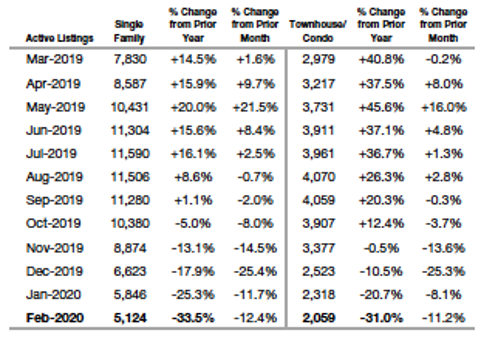

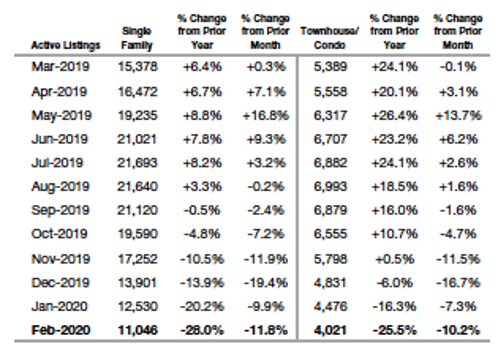

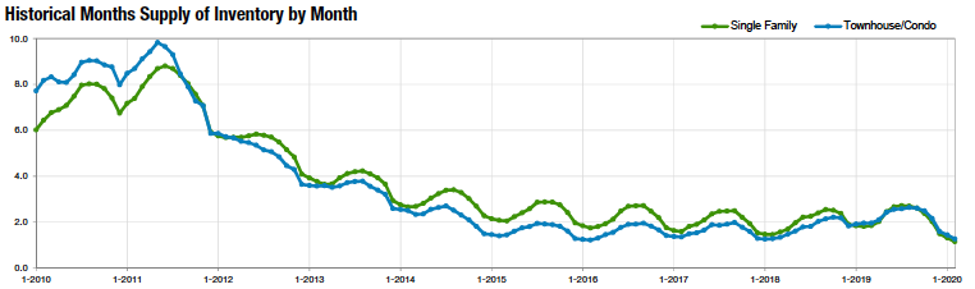

Active inventory for single-family homes in the seven-county Denver metro area was down more than 33 percent from a year ago, while condo/townhome inventory was down 31 percent year over year. That scenario pushed the months supply of inventory down 39 percent from a year ago to 1.5 months for single-family homes and down 35 percent for condo/townhomes to 1.7 months. A balanced market would have a supply of 4-6 months, numbers not seen since the early part of the past decade.

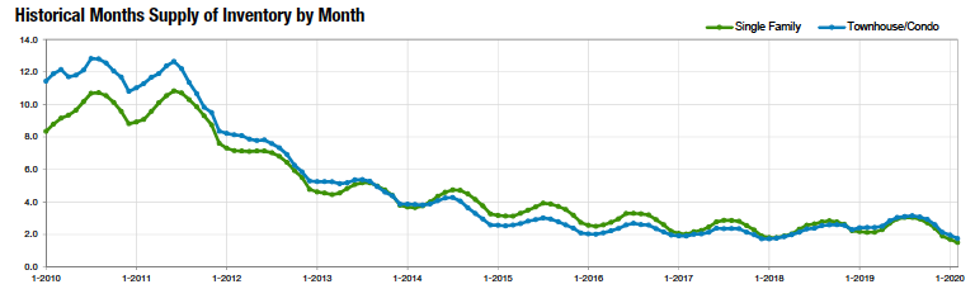

Statewide, single-family home active inventory was off 28 percent in February 2020 compared to 2019, and down more than 25 percent for condo/townhomes pushing months supply of inventory down 29 percent statewide to a record low 1.5 months for single-family homes and 1.7 months for condo/townhomes.

The CAR Housing Affordability Index (HAI) – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – fell slightly from January to February 2020 but remains slightly improved over the same period last year. A higher HAI reflects greater affordability.

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“Low inventory is definitely reflected in Aurora with areas like 80013 down 66.7 percent from February 2019 and median price up 4 percent to $379,500. Moving southeast from there, 80015 was down 21 percent in active inventory, still a significant reduction in for sale properties in what is typically one of the most active sales areas in the Denver-metro area and a median price of $438,000 for February 2020. Ironically, just a little further southeast in 80016, active inventory was down 50 percent from 2019 and pricing rose just a tick. Moving north to the 80018 zip code, inventory was up more than 60 percent and prices still rose 6.5 percent. There is significant new construction in the 80018 and 80019 zip codes where median pricing hit $425,000.

“As we move from a very snowy February into spring, we are seeing pent-up demand for housing, multiple offers and, of course, a need for more housing. The good news is that there are several new construction areas in the north, south and east areas of Aurora with record low interest rates enticing buyers to explore,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“In Boulder county, buyers are smelling the

spring flowers, maybe a little earlier than expected! They are out and

about, taking advantage of the low interest rates and fairly affordable prices

coming off of a sluggish winter. Inventory is down due sellers possibly

waiting for the magic of the April market, but sales are up 27 percent. The

word to sellers is to list as soon as possible as the buyers are active and

demand is high. Such brisk market activity has pushed sale prices up 4.3

percent already this year, more than we saw all of last year. With an average

of 64 days on the market, the sellers still rule, but buyers are enjoying

taking a little more time and a few percent off the list price at the

end.

“In Broomfield county, it seems that everyone who lives in a townhome or condo is moving up to a house. Inventory is up in the townhome market by 21 percent and houses are down by just that same amount. Since 2019, houses in Broomfield have appreciated about 11 percent and are continuing on that climb this spring. Townhomes and condos have more inventory and are not seeing such positive numbers. In general, however, the market remains strong in Broomfield with an average days on market at about 40 and solid appreciation year over year.

“The question on everyone’s minds is will the Coronavirus actually find its way into the housing market and will we see effects from this global issue? With the presidential election on the horizon, that may also influence our local markets,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS/PIKES PEAK AREA

“In February 2020, the Colorado Springs-area housing market for single-family/patio homes recorded the highest level of monthly and year-to-date sales and sales volumes, as well as the highest level of average and median sales prices compared to any month of February on record.The year-over-year home sales activity saw a more than 7 percent increase in monthly sales and an 18 percent increase in the months’ sales volume, over 4 percent increase in the year-to-date sales and more than 14 percent increase in the year-to-date sales volume, over 10 percent increase in the average sale price, ascending to $386,749, and over 8 percent increase in the median sale price rising to $341,000. All of this while, shockingly, active listings declined by more than 28 percent.

“Looking back 5 years and comparing single-family/patio homes sales in February 2015 with February 2020, monthly and year-to-date sales are up 37 and 40 percent respectively, monthly sales volume spiraled 114 percent, year-to-date sales volume soared 111 percent, median sales price rose 56 percent, and average sales price was up 52 percent. All of this escalation took place while active listings are down 55 percent.

“Pathetically low inventory and affordability challenges, due to ever-soaring prices, continue to be the most challenging aspect of the Colorado Springs area housing market, especially for first-time homebuyers. Though the current level of escalated prices presents a daunting challenge for our local buyers, for buyers from the Denver area, our housing prices are still very attractive. As a result, we are seeing a steadily increasing interest of Denver buyers in our Colorado Springs listings,” said Colorado Springs-area REALTOR® Jay Gupta.

“With active listings down more than 33 percent in February, we’ve started off the year with no homes for sale. This led to an all-out buyer war for what was on the market. Which then led to a medium sales price increase of 7.9 percent in the single-family home market and a decrease of 22.7 percent for days on market. February conditions resulted in multiple offers in almost all price points and we were back to appraisal waivers, cash offers and all-out frustration when we didn’t get the deal. Many agents and buyers were at a breaking point and simply throwing in the towel.

“February also brought our first exposure to Coronavirus. What began as a problem overseas quickly began to ripple into numerous other countries. An uncertain and turbulent U.S. stock market wiped out 1000s of points in weeks. Supply chain disruptions began in February and we began to get word that China, Germany and the United States were possibly looking at a recession. The FED jumped into action pumping hundreds of billions into the debt market trying to stabilize the yield curve. The world economy is starting to feel the effects of too much debt, a global slowdown from many angles and yet, housing in Colorado is chugging along just fine. It’s going to be an interesting March will be a very interesting month,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER

“After last spring’s apparent correction, the Denver market looks to be gaining steam again, reminiscent of the second half of the twenty-teens. This time last year, the median price dropped $7,153 where the previous year saw a $49,000 appreciation. This year, the median price for a single-family residence increased $31,653, seeming to run consistent with the supply decreases we are seeing. With less than a month’s worth of supply, 0.8, we are below one month for the first time in two years,” said Denver-area REALTOR® Matthew Leprino.

DENVER METRO

“Despite the large snowfall totals in February, housing activity in the Denver metro region looked more like the spring selling season with pending/under contract properties up nearly 14 percent from February 2019. Despite the continued low inventory environment, there is a lot of activity in the marketplace. Overall, new listings on the market reflected the same numbers as February 2019, with just slightly more than 6,000 properties coming on the market. The biggest influx of inventory was in the townhouse/condo market, with an increase of 4.2 percent more units coming on the market this February compared to February 2019. Buyers definitely took advantage of the influx of townhouse/condos on the market, as under contracts were up 20.6 percent compared to last year. Due to the continued market pressure of slightly more than a months supply of inventory in the Denver metro region, average and median prices continue to move upward. The average price of a single-family home is now $526,803 and the median price is $451,000, a 7.0 percent and 7.4 percent increase, respectively. The townhouse/condo market didn’t experience as significant of an increase in average and median prices, with the average townhouse only increasing 4.9 percent compared to February 2019 and the median price moving up 5.0 percent compared to last February. Affordability will continue to be a challenge in the metro Denver region, but the current decline in interest rates should offer a bit of relief to increasing price, or it might just spur more activity and competition in the marketplace,” said Denver-area REALTOR® Karen Levine.

DURANGO

“With a strong February 2020, La Plata County sales are almost even with last year-to-date, up five sales overall and a sharply climbing median price. Current pending sales predict a strong showing in March as well. With a median price standing at $517,000 for a single-family home, current low rates likely have a strong influence on our robust market. With all that is in the news with COVID19, we’re all in a bit of a wait and see mode. Seventy-five percent of our buyers are local. Of the 25 percent that come from elsewhere, many choose Durango as a destination for their second home because it is within a day’s drive of their city. With the current fear of air travel, La Plata County may be able to ride the storm to come without a large downturn in our local market,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“Larimer County is showing signs of strength and growth even over the colder winter months. Although it has been chilly, there is a definitely a feeling of spring in the air. New listings have increased 5.7 percent year-to-date and 4.7 percent over February 2019 for single-family homes. These listings are selling at 98.8 percent of list price. The median sales price continues to climb steadily sitting at $414,900 for February, a 1.2 percent increase year-to-date. Townhome-condos have continued to outperform single-family homes in regard to new listings up nearly 14 percent year-to-date, a staggering 25.6 percent higher than February 2019. Average sales price has reached $353,117 a 11.5 percent rise.

“Estes Valley is showing similar trends. Overall, new listings are up 6.7 percent and sold listings are up 11.7 percent. The average sales price is gently increasing, up less than one percent to $435,645. The cooler weather hasn’t stopped the market from growing. Days-on-market for single-family homes is less than February 2019, down from 81 to 78, a 3.7 percent decrease. Townhome-condo days-on-market has lengthened from 113 to 128, a 13.3 percent increase. As spring approaches, the market in the Estes Valley and Larimer County should stay strong,” said Estes Park-area REALTOR® Abbey Pontius.

FREMONT/CUSTER COUNTIES

“Custer County has started the year off in a positive motion with January new listings up 20 percent over January 2019 and February new listings up 33 percent compared to February 2019. Sold residential listings in the area are up 76 percent over the first two months of last year. The current median price of $251,650 is up just over 11 percent year-over-year. Custer County continues to show positive increases in median home pricing throughout the area.

“Fremont County has started out a bit slower in new listings for the first two months of the year as compared to last year. New listings for January were down 7.1 percent year-over-year but remain down less than 1 percent year-over-year in February. New sales on the other hand are up for the first two months of 2020 over last year with January showing an increase of 8.1 percent and February’s year-over-year number up nearly 15 percent. The current median price of a residential home in the area is $236,500; up 11.8 percent over February 2019. Months supply of inventory has decreased in 10 of the last 12 months. Perhaps there is some relief for buyers on the way as April through August are traditionally the most active listing months of the year,” said Fremont and Custer County-area REALTOR® David Madone.

GLENWOOD SPRINGS

“The market throughout the valleys continues to experience a significant lack of inventory in both the single- family and townhome sectors. The single-family market did see an increase in both pending and sold listings, as well as the expected increase in the median and average sale prices. It seems single-family homebuyers are letting out a big sigh and settling for the best available property they can get for their money. Days on market over last February fell 42.5 percent and the months supply of inventory fell to 2.7 months, another 42 percent decrease. The end of the month settled in at 184 single-family active homes from Carbondale to Parachute which is 44 percent less inventory than we had at the end of February 2019. The townhome market saw a similar number of new listings as February of last year and sold listings rose 61.5 percent with 21 properties. Days-on-market held steady while active listings fell 24 percent and the months supply of inventory dropped slightly over the same period last year to 2.2 months inventory. We’ll see if the spring season returns us to the days of more inventory or if homebuyers will be out of luck with the lack of new housing to replace resale properties,” said Glenwood Springs-area REALTOR® Erin Bassett.

PUEBLO

“The Pueblo housing market moves further into 2020 well short on inventory. While new listings are down just 4.6 percent from last year, active listings are down nearly 40 percent from February 2019. Pueblo West is now under 50 active listings, our lowest amount in 2 years. The result, heavy competition and multiple offers that some buyers just won’t take part in. The big surprise is pending sales up 42.4 percent to 262 with about 40 percent of those in Pueblo West. Listings sold were up just over 12 percent to 176 for the month of February as the median sales price dropped 8.4 percent to $190,000. The average sales price remained relatively flat, up less than 1 percent, to $214,276 as homes sold for 93 percent of list price.

“Looking at new construction, the story remains the same. These properties sell as soon as they are complete, and we simply don’t have enough of them. As you might guess, total showings are up as buyers, fueled by record low interest rates, are out and actively looking,” said Pueblo-area REALTOR® David Anderson.

TELLURIDE

“Telluride seems to be having a ‘boom hangover’ from 2019. The first two months of 2020 are both up in sales over 2019 with the dollar amount of sales up 58 percent and the number of sales up 20 percent. This is remarkable in that inventory is at a 10-year low. This is the fifth straight month that volume of sales per month has exceeded that of the prior 5-year average for the same period of time. Since Telluride real estate is an affluent market and mostly a discretionary real estate market, all eyes have been on the stock market. Also, Texas is the number one state for the source of our second home purchasers. Global oil prices plunged earlier this week to a level not seen since the 1991 Gulf War. In addition, more than 50 percent of Telluride tourists fly to Colorado to access our resort. Since we sell a discretionary real estate product here, the potential for a sudden drop in market sales could happen,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Vail Market has been a bit volatile for the first two months when comparing January and February to the same months in 2019. However, the year to date performance is amazingly static with transactions down for February in single family/duplex units offsetting the positive from January. However, the Condo/Townhome market offsets the negative with a solid February. The pending sales trend is similar to the closed sales performance with a basically flat number on total market with the swings in the categories of product the same.

The driver for this relatively static performance is the continuation of the trend we experienced in 2019. However, the trend of low inventory has become more significant than last year. Inventory of active listings is down 19.2 percent compared to 2019 with extremely low inventories in critical price points. The lack of inventory causes an overall increase in dollars for the market however, it is a mix of product versus rates of appreciation and thus a bit misleading in the true dynamics of the market. The months supply of product is 5.8 on single family duplex negative 20.5 percent from 2019 while condo/townhomes are at 5.1 months of supply or down 25 percent year over year.

We will watch the macro economic effects on the market along with global turmoil to see the reaction on our resort market real estate performance moving forward,” said Vail-area REALTOR® Mike Budd.

New Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

New Listings – Statewide

Inventory of Active Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Inventory of Active Listings – Statewide

Months Supply of Inventory – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Months Supply of Inventory – Statewide

Median Sales Price – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Median Sales Price– Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The February 2020 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The recently released January ShowingTime Showing Index® saw a 20.2 percent year-over-year increase in showing traffic nationwide. All regions of the country were up double digits from the year before, with the Midwest Region up 15.7 percent and the West Region up 34.1 percent. As showing activity is a leading indicator for future home sales, the 2020 housing market is off to a strong start, though it will be important to watch the spread of COVID-19 and its potential impacts to the overall economy in the coming months.

- The benefits of using MLS data (rather than Assessor Data or other sources) are:

- Accuracy and Timeliness – MLS data are managed and monitored carefully.

- Richness – MLS data can be segmented.

- Comprehensiveness – No sampling is involved; all transactions are included.

- Oversight and Governance – MLS providers are accountable for the integrity of their systems.

- Trends and changes are reliable due to the large number of records used in each report.

- Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 26,500 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.