From accelerating in the fast lane to a pump the brakes approach, Colorado’s housing markets deliver a touch of everything in July

ENGLEWOOD, CO – Aug. 11, 2021 – From the fast-paced acceleration of the express lanes to the pump-your-brakes gridlock of metro-area highways and weekend mountain traffic, Colorado’s housing markets are demonstrating a similar range of activity, as well as buyer and seller behavior, according to the latest data and expert analysis from the Colorado Association of REALTORS® (CAR).

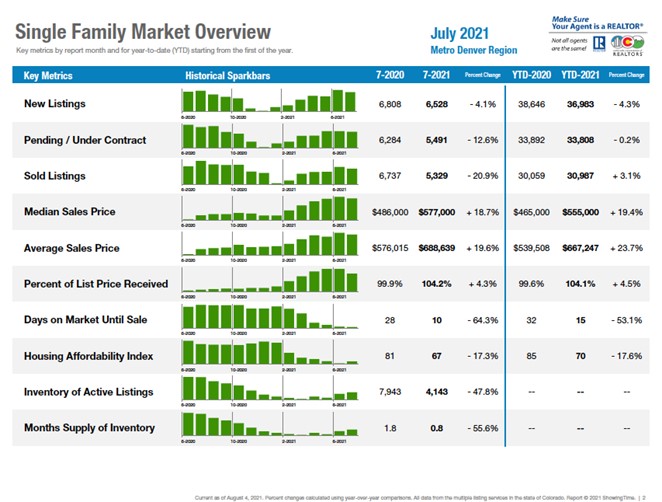

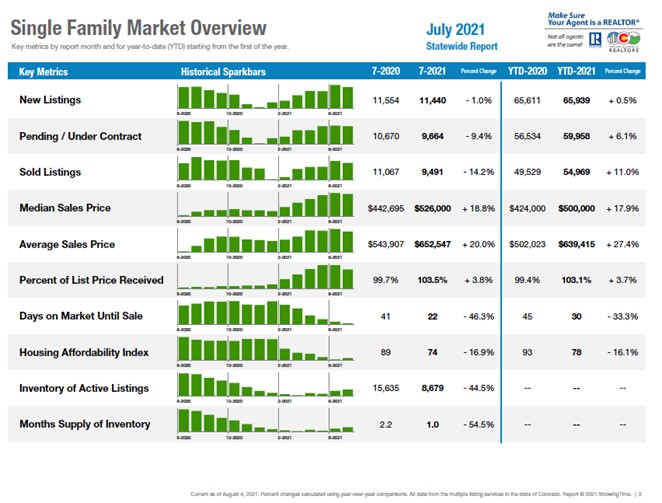

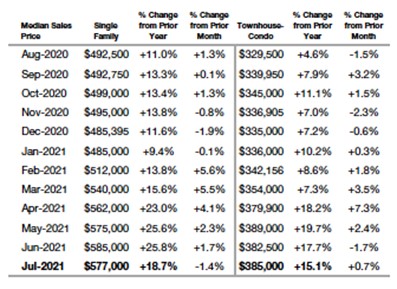

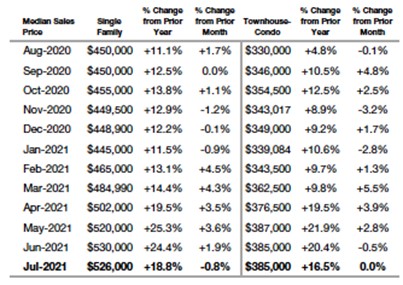

July data, seasonal expectations, and forward-looking signs point in multiple directions, according to REALTORS® working in markets across Colorado. Despite dips in new listings and homes under contract both in the metro area and statewide, inventory of active listings and months supply of inventory rose nicely month- over-month but remain down significantly from a year prior. The combination of factors helped hold median pricing for single-family homes at or slightly below June levels however, they remain up more than 18% from a year prior in the seven-county Denver metro area and statewide as well.

“There seems to be no ceiling to the escalation of home prices here in Estes Park,” said area REALTOR® Abbey Pontius. “Similar to many smaller Colorado communities, there is a deficit of properties on the market, and the ones that are available continue to go fast and for top dollar.”

Pent up demand, a longtime factor in rising home prices statewide, has taken on new meaning according to Fort Collins-area REALTOR® Chris Hardy.

“When you hear real estate folks talk about pent-up demand, it’s usually about demand for housing,” said Hardy. “With the COVID pandemic still adversely affecting many aspects of the supply chain, pent-up demand can refer to so much more; building materials, new appliances, new vehicles, or even intangible activities like getting away for travel. Make no mistake, it is still a highly competitive market with over-asking offers the norm rather than the exception. However, with a more widely dispersed public, listings have ticked downward as well – contributing to the market remaining highly competitive.

And in markets like Boulder and Broomfield, there is a combination of seasonal factors and buyers and sellers taking a little slower approach, according to area REALTOR® Kelly Moye.

“The brakes are pumpin’ in the Boulder and Broomfield markets. While the numbers are still strong as they represent the activity started in June, REALTORS® in this area find themselves wondering where all of the showings went and have started price reductions to get their listings sold,” said Moye. “July and August are typically slower months in the real estate market. This year, more people than ever before decided to travel. That, coupled with buyer fatigue, has shifted the demand and while there is not more inventory yet on the market, the fall will be an important indicator of things to come. If it picks right back up, we can recognize this shift as seasonal. If it doesn’t, it may be an indicator of a big change to come.”

While seasonal change is anticipated, a new set of variables may have pushed the slowdown up a bit on the calendar.

“The combination of more new listings and less of them selling has contributed heavily to a seasonal change we hit every year, a subsiding of summer’s frenzied homebuying. Typical of late August to mid-September, it’s not surprising that the insatiable buyer appetites have burned people out just a little early this year,” said Denver-area REALTOR® Matthew Leprino. “These numbers by no means signal a massive change in the marketplace, but they do indicate that, statistically-speaking, summer may have ended a little early this year – the typical ‘cooling’ of fall may have shown up a little early this year,”

METRO DENVER REPORT

STATEWIDE REPORT

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“Although Aurora’s housing market numbers still looking amazing, the reality is slightly different as we begin to see a rise in the number of listings without the frenzy we experienced in early and late spring. Today, buyers have a better opportunity at homeownership without some of the crazy bidding wars that we have seen. We are still experiencing low inventory, down about 40% compared to July 2020, but it has increased considerably from earlier in the year. Prices are up 15-20% over this time last year and homes are selling in under a week in most cases. It is still very much a seller’s market although, if not priced right, some sellers are having to reduce prices to stay competitive. The market is in a bit of a shift and the coming months will be important to watch.

“Median price for 80015 zip code is $578,000, median price for 80016 is $699,000 and 80013 is seeing a median price just under $500,000. Looking at Arapahoe County combined, the median price is $536,000.

“Buyers can still be taking advantage of the low interest rates and the opportunity for more available inventory,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The brakes are pumpin’ in the Boulder and Broomfield markets. While the numbers are still strong as they represent the activity started in June, REALTORS® in this area find themselves wondering where all of the showings went and have started price reductions to get their listings sold.

“In Boulder County, inventory continues to drop and the homes that are on the market are still selling under 36 days. We’ve seen an appreciation rate of 29% since the beginning of the year but homes that are not priced right on the money are finding they need to reduce in order to make that sale. Bidding offers are slowing, and buyer demand is following that trend.

“Broomfield County homes are moving more quickly with days on market averaging under 14 days. Prices have gone up 20% so far this year but even this area is seeing signs of a slowdown.

“July and August are typically slower months in the real estate market. This year, more people than ever before decided to travel. That, coupled with buyer fatigue, has shifted the demand and while there is not more inventory yet on the market, the fall will be an important indicator of things to come. If it picks right back up, we can recognize this shift as seasonal. If it doesn’t, it may be an indicator of a big change to come,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS/PIKES PEAK AREA

“While prepping for Independence Day, many REALTORS® were also trying to predict what July’s real estate market would bring. Buyer fatigue was setting in, and REALTOR® rigor mortis set in about 6 months earlier. There were discussions on social media asking about slowdowns, market conditions, and listing activity. But as the fireworks went up at the beginning of the month, we found out prices pushed up as well. Another staggering 19.2% in the median price on all properties in one year.

“Now, you may ask, how? Great question. We also got to witness a 38.6% drop in active properties. Anytime we cut the inventory down and demand stays high we push prices up. That’s Econ 101, my friends. Toss in some free money (thank you FED) and just like the fireworks, BOOM. To add to the madness, days on market dropped 63.2% on single-family homes and 62.5% on townhomes/condos. Although we have heard nationwide that we have more inventory coming on the market, the front range is going to ignore that trend for now and hike this hill a little more.

“Nationwide, we have seen first-time unemployment claims still averaging 400,000 per week. We have net losses on jobs if we subtract the jobs added from the first-time unemployment claims. The moratorium was supposed to end in July, but the CDC decided the tyrannical approach to government was the way to go, and against the Supreme Court’s ruling has now extended that day to September 30. What will August bring us to report? Oh, man, I am giddy to see,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“When referring to a ‘cooling,’ it’s important to remember that the term is relative. Although we have seen a slightly earlier than seasonal change, the year-over-year numbers remain staggering. A key example would be Denver’s median price dipping 2.2% over last month while it increased 4.1% in the same time last year – a positive change though still 21.5% higher overall than last July.

“There were also more new listings last month than last year and fewer sold, down from 918 to 718 in the freestanding home. The combination of more new listings and less of them selling has contributed heavily to a seasonal change we hit every year, a subsiding of summer’s frenzied homebuying. Typical of late August to mid-September, it’s not surprising that the insatiable buyer appetites have burned people out just a little early this year.

“For comparison’s sake, the condo and townhome market has taken a larger change this year over last. The median price, now $449,950 is up just 5.9% over last year while 2019 to 2020 saw a 13% increase.

“These numbers by no means signal a massive change in the marketplace, but they do indicate that, statistically-speaking, summer may have ended a little early this year – the typical ‘cooling’ of fall may have shown up a little early this year,” said Denver-area REALTOR® Matthew Leprino.

ESTES PARK

“I am speechless…there seems to be no ceiling to the escalation of home prices here in this picturesque town of Estes Park. Similar to many smaller Colorado communities, there is a deficit of properties on the market, the ones that are available go fast and for top dollar. If desirable and priced right, minutes not hours after listing there are offers and many times multiple offers presented.

“The fierce competition and low inventory are directly affecting the average sales prices, days on market and unfortunately, a shift in affordability that is effecting the working class. These homes are flying on and off the market as fast as the listing can be put together. Days on market for single-family homes has plunged to only 43 in July this year, compared to 84 in 2020. Townhouse/condos have cut their time even more from 89 days on market in 2020 to a barely recordable 33 – down 63%.

“The lack of choices has become severe with just 27 total new listings for single-family homes in July. Townhouse/condos were even more scarce at a whopping 11 new listings. The year-to-date figures for new single-family home listings doesn’t look so bad. Year-to-date, there is actually a 0.6% increase. That doesn’t seem to matter in the overall picture. Townhouse/condos, which tend to be more affordable, have dipped in new listings year-to-date by 19.4% and compared to July 2020 are off 42%. The average sales price has shot up as inventory and affordability have plunged. The average sales price of a single- family home in Estes Park is $846,759, a 25% increase from July 2020 when we sat at $677,202. Some larger home sales can skew these numbers with such low inventory but there are undoubtedly steep increases happening. Year-to-date, the average sales price of a single-family home has increased 31.6%. Townhouse/condos experienced a 28.2% increase over July last year to $515,182 from $401,964. Percent-of-list-price has exceeded asking in both single-family homes and townhouse/condos. Single-family homes have reached 101.4% of asking price and townhouse/condos have increased 7.7% over July 2020 to 104.9% of list price,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“This month’s real estate sales figures point in multiple directions at once. Listings are down, median price is up, months supply of available inventory is down, and year-to-date homes sold is up.

“Looking closely at the data however, it is clear that pent-up demand is playing a role in the seasonal nature of our real estate markets. When you hear real estate folks talk about pent-up demand, it’s usually about demand for housing. With the COVID pandemic still adversely affecting many aspects of the supply chain, pent-up demand can refer to so much more; building materials, new appliances, new vehicles, or even intangible activities like getting away for travel.

“In year’s past, July has been the month of vacations and time spent with family and friends, often away from our homes. Spring and early summer demonstrated that housing was a primary consumer concern. For July, a more seasonal dip in listings and closings seems to be underway as families couped up for 16 months begin to take advantage of recreational opportunities across the country and even beyond U.S. borders that were pre-empted due to the pandemic. Logic would dictate that a more widely dispersed public has removed some of the attention from the focused housing purchase frenzy of earlier in the year.

“Make no mistake, it is still a highly competitive market with over-asking offers the norm rather than the exception. At nearly 4%, the average over-asking purchase price of a home in the Fort Collins area is a substantial figure. To put this in perspective, here’s the math: A home that closed at the median price of $540,000 had a likely list price of $520,000 or less. Homes sold within this price point are up 70% year-over-year (mostly due to aggressive price appreciation). However, with a more widely dispersed public, listings have ticked downward as well – contributing to the market remaining highly competitive.

“In the next 60 days, seller’s will likely see a bit of downward pressure on what had previously been sky-high valuations as people finish up summer vacations, prepare for kids to go back to school, and uncertainty around the increase in COVID infections continues. Keep an eye on interest rates as those remain the arbiter of a potential home purchaser’s buying power,” said Fort Collins-area REALTOR® Chris Hardy.

GOLDEN/ARVADA – JEFFERSON COUNTY

“In Jefferson County, the buyers hit the brakes on purchasing homes. The market did slow down. It may be seasonal, and we will see what happens after school begins. As for the stats, there was an increase in new listings and the medium sales price increased again by 20% to $640,000. However, the days on market declined by 66% to 8 days on the market and the inventory fell by 31% for single family homes from this time last year. Homeowners are adjusting their purchase price if the home doesn’t sell in the first week or so and sellers are not receiving several multiple offers as in the past months.

For condo/townhomes, new listings fell by 15%, days on the market down by 65%, and inventory decreased by 48% year-over-year. However, the medium sales price increased by 19% to $365,250. Buyers will now have more time to view a home and be more selective with what they purchase. Appraisals are to be watched: some may not be coming in at the price value the seller needs to keep the deal a float because buyers are not as willing to add an appraisal clause for gap coverage in the contract. If the Feds increase the interest rate as predicted by the end of the year, we will be moving towards a more balanced market,” said Golden/Jefferson County-area REALTOR® Barb Ecker.

GLENWOOD SPRINGS/GARFIELD COUNTY

“The market in Garfield County remained hot as a firecracker in July with new listings in the single-family sector down 12.9% and pending sales decreasing by 25%. With the lack of inventory, sellers named their price and buyers found a way to pay it. The median sale price for a single-family home in Garfield County was up 28.4% over 2020 to settle in at $655,000. The multiple offer situations have continued but the agents on the street can feel a slight shift in the heat as the weather and the market start to cool slightly.

“The Townhome-Condo market showed even more declines with new listings down over 22% and pending sales decreasing by more than 28%. The median sales price in the townhome-condo sector rose by 18.8% coming in at $410,000.

“Days on market for both sectors also dropped significantly with single family homes closing in an average of 22 days and townhome-condos in 24. This is of course a result of cash offers and buyer agents working hard to get their clients offers chosen over those with financing or other contingencies to overcome.

“Garfield County is a large, diverse county with much of the western part of the county being rural. As the years have passed since 2010 and housing prices have skyrocketed, more and more people have relocated to the western ends of the county to find affordable housing. The community of New Castle has seen a 51% increase in median sales price in the last year and the trend is becoming more apparent as you go further west to Silt, Rifle and Battlement Mesa,” said Glenwood Springs/Garfield County-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County continues to surprise with the prices and sales being generated. Our new listings were down 3.7% in July to 437 however, solds backed off a little in July to 369, but pending sales were strong. Prices continue to be on an upward trend with an average price sold of $382,643, the median $345,000, both new benchmarks for Mesa County. The downside of that is that the affordability index is down 16.7% to 85. We have seen pullback from the under $300,000 buyers because of that. Our busiest price ranges are $300,000-$500,000, reflective of continuing low interest rates. Days on market have also shrunk to 59 days, and we have a 1.2-month supply. For the month of July, the activity has stayed fairly strong, even though this is a very traditional low activity month due to vacations, back-to-school preparation, and more,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“The Pueblo housing market is seeing more changes in July. The new listings are still increasing to 394 up 13.9% over July of 2020 and up 27.79% to 1,844 compared to the first 7 months of 2020. Pending sales were up to 326 plus 0.6% compared to July of 2020, but solds are down 21.7% to 246 compared to last July. The year-to-date solds are up 4.19% to 1,661. The median price is still climbing to $302,500 up 23.5% compared to July 2020 and up 22.2% to 275,000 year-to-date.

The sales price to list price is still above 100% to 101.3% up 2.2% in July and up to 101.2% up 2.69% year-to-date. New housing permits pulled in July were 68. Year-to-date total permits pulled are 455 that’s up 42.6% from 2020. A couple new builders are getting into the Pueblo market. They pulled 12 permits in July. This is a good sign for buyers, giving buyers more homes to choose from. Inventory for homes is still around 1 months supply,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“As the Games of the XXXII Olympiad concluded, we can look back over the previous two weeks and think about the stories that were shared, their spirit and dreams, the rigorous training and preparation, and the glory of victory and agony of defeat.

“Buyers and sellers in Routt County may feel like they are in a bit of an Olympiad themselves. The market is still experiencing multiple offers, with the winning participant getting the gold and those in silver and bronze positions sometimes opting for back-up offers. Prepped by buyers’ agents, the buyer entered ready to compete- knowing there was little room for error/negotiation, as their opponent – the seller, received within 1% of what they were asking for in home sales and 2.7% more than ask for condo/townhome closings. The market continues to be challenging due to the low-standing inventory; new listings for July were down 20% for single-family homes and 21.3% for multi-family. Understandably, with inventory levels, pending sales are down approximately 37% for both categories, resulting in average median prices up almost 19% for single-family and 42% for multi-family. Days on market realized almost a 50% reduction from the same period last year, as 52% of the transactions closed with cash. New listings continue to come on daily- though not likely to significantly impact the current rate of less than two-month supply for single-family and approximately 18 days for multi-family.

“Homeownership became a symbol of the American spirit and a facet of the American dream after WWI. Like an Olympian, every buyer and seller has a story. For some it may be harder, and they may have to be more persistent to obtain the dream and get their medal of a home in the Steamboat area. If buyers are feeling like they are in a real estate Olympiad, coaching them that ‘nothing worth having is easy,’ to be ready and determined and eventually their efforts will likely pay off,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“The dog days of summer were barking up our proverbial tree this July. Heat in the mid 80s and smoke to blur the peaks were common in the high country. Just like the temperatures (for our altitude) real estate remained hot.

“Summit and Park counties had fewer homes listed, pending and sold for July but, year-to-date, significantly more properties sold than before. With that low inventory continues a shortening of days on market and an increase in prices. Breckenridge’s average single-family home price is over $2 million, up more than 47% compared to last year, Frisco is up 71% and Silverthorne is up 22%. Condos are still the more affordable option and although the prices have gone up, they have not been at the fast rate of single-family residences,” said Summit-area REALTOR® Dana Cottrell.

July Average Prices (% change YTD from Previous Year)

| Single Family | Year to Date | Average Price YTD |

| Summit County | 34% | $ 1,769,513 |

| Park County | 25% | $ 498,701 |

| Lake County | 47% | $ 516,610 |

| Townhouse / Condo | Year to Date | Average Price YTD |

| Summit County | 16% | $ 703,990 |

TELLURIDE

“July sales of $88.43 million came in a close second barely second to the $90 million we saw in July 2007. However, our year-to-date sales of $772.83 million is up 134% over the first seven months of 2020. As home and condominium listings are getting fewer and fewer, vacant land sales are going through the roof. There were 170 vacant resident land sales in the first seven months of 2021 with 100 of those in our rural mesas and valleys mostly west of Telluride. In 2021, the top two markets where buyers are coming from are Dallas and Austin, Texas.

“In the last two months, we are starting to see a little price resistance. Some listings that aren’t contracting quickly are getting small price reductions. My guess is, it’s to send enough of a signal to buyers that the seller would like an offer. On the other hand, we are still seeing some ever-increasing pricing for high-end luxury properties at double the price per square foot from just two years ago. Those super high-end listings are moving very, very slowly.

“In the bottom price segment of the market, for one- and two-bedroom condos, there are only a few one- bedroom properties under $1 million and very few two bedroom units under $2 million in the Town of Telluride.

“Lastly, the demand for workforce housing is so great, that we are seeing new regulations and ballot proposals that may further drive real estate prices higher with the long shot possibility to create more local rental housing. The next year or two may see the most disruption of the resort real estate we have ever experienced. Put your seat belt on,” said Telluride-area REALTOR® George Harvey.

Median Sales Price – Seven-County Denver Metro Area

Median Sales Price – Statewide

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The July 2021 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 28,500 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.