CAR Receives Strong Performance Ratings Across Programs in 2021 Member Survey

CAR members had the opportunity to complete a survey in October of 2021 that included collecting data on member sentiment on CAR programs and services as well as the industry overall and the issues that impact their business most. Below are preliminary findings.

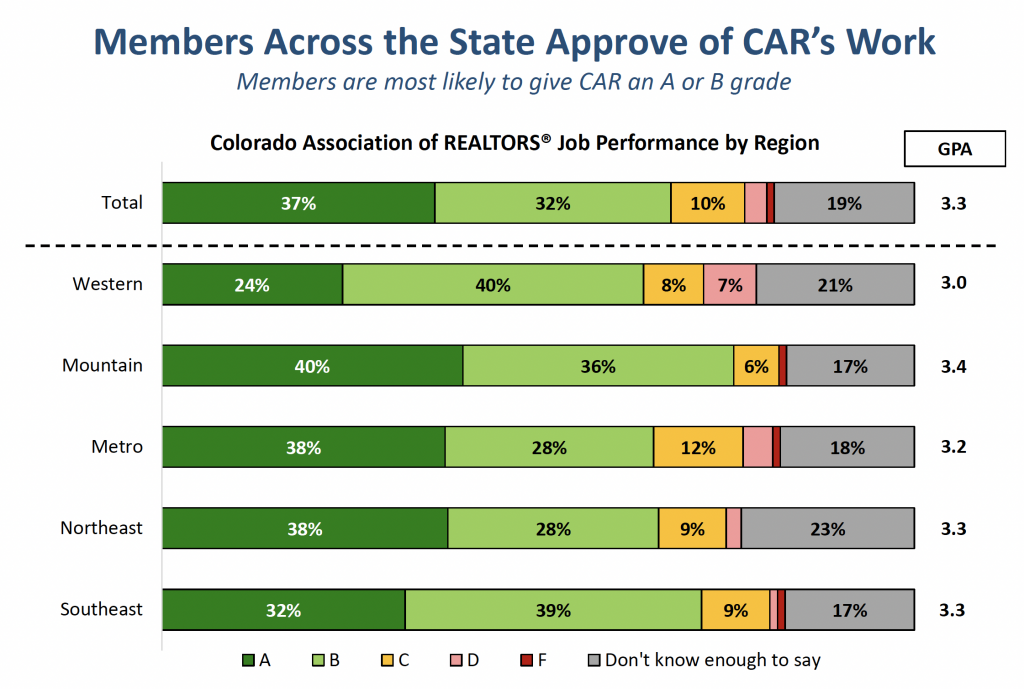

Members give CAR consistently strong job approval ratings. Overall, 68 percent of members give CAR an A (37 percent) or a B (32 percent) with an overall GPA of 3.3. These grades are consistent with May of 2019, when 66 percent gave CAR an A (32 percent) or B grade (34 percent) with an overall GPA of 3.1. When asked about the future trajectory of CAR, 58 percent are positive about how things are headed (rated as a 1 or 2 on a 5-points scale); only 6 percent say things are headed off track. Additionally, members are pretty confident in the CAR Board of Directors (54 percent rated as a 1 or 2 on a 5-point scale). These numbers are also consistent with May of 2019.

CAR receives strong performance ratings across programs. GPAs for individual programs range from 2.9 to 3.3. The association receives the most A and B grades for providing information and updates on industry trends (75 percent A/B, 62 percent very valuable), continuing education classes (73 percent A/B, 68 percent very valuable), and advocating for REALTORS® at the federal, state, and local government levels (71 percent A/B, 64 percent very valuable), as these are the programs that members are most familiar with and find most valuable to their real estate business. Other highly rated programs include legal tools and resources and enforcing the code of ethics (67 percent A/B, 64 percent very valuable).

Most say it is very important for CAR be involved in land use and regulatory issues in Colorado. Ninety-four percent say CAR’s involvement in land use and regulatory issues in Colorado are very (58 percent) or somewhat important (36 percent). Three-fourths (75 percent) say that CAR is a very (45 percent) or somewhat credible (30 percent) advocacy organization. CAR’s credibility has improved according to members (now seen as very credible by 45 percent of members, up from 35 percent in May 2019).

Protecting private property rights (mean 8.0 on 0 to 10 scale), holding the line on residential property taxes (mean 7.5), housing inventory (mean 7.4), housing affordability (mean 7.3), and business regulations impacting independent contractors (mean 7.3) are among members’ top policy priorities. Supporting zoning changes that allow for greater housing density is a much lower priority than inventory and housing affordability (mean 6.1 on a 0 to 10 scale).

Members oppose taxing short-term rentals at the commercial property rate (75 percent opposed). A 57 percent majority also opposes increasing the property tax rate on short-term rentals from the current residential rate of 7.1 percent to 10 to 15 percent. Members are most open to a compromise that would tax short-term rentals at the residential property tax rate for individual or joint owners and at the commercial property tax rate for institutional or corporate owners (50 percent favor, 50 percent oppose). Previous polling shows that a broad majority of members favors allowing property owners to rent out their properties for short-term stays through companies like Air BnB, VRBO, and Homeaway (82 percent favor in October 2019).

One-third of members own or manage rental properties. The average number of rental units that members own is 5.1. While most members who manage rental properties only manage one to nine units (95 percent), there is a small percentage who manage hundreds of units (2 percent), which brings the average up to 101 units for each member who manages rental properties. Eighteen percent of members who own or manage rental properties have tenants who are a month or more behind on rent (6 percent of all members). Half of these, or 3 percent of all members, have started the process to evict a tenant for non-payment of rent.

Members say that current economic conditions are good (63 percent) to excellent (20 percent). They describe their local housing market as competitive, busy, challenging, chaotic, or hot and point to low inventory and high costs. Members almost universally say that housing inventory is a very serious problem (28 percent) or serious problem (61 percent), and they say that inventory has a huge (52 percent) or big (42 percent) impact on housing costs.

COVID has had a big impact on inventory and housing costs but is not the whole story. Half of members say that COVID has had a huge or big impact on housing inventory in Colorado (48 percent). Just over half say that COVID has had a huge or big impact on housing prices (57 percent).

Full survey results and association report card will be shared over the next month.