Colorado housing markets spotlight dramatic fall change

Conditions drive inventory and opportunity for an increasingly skeptical and cautious buyer pool

ENGLEWOOD, CO – As cooling temps lead to dramatic changes in foliage across Colorado’s iconic mountain forests, rising interest rates and a growing list of economic challenges and uncertainties are creating their own dramatic changes in the state’s housing markets, according to the September 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

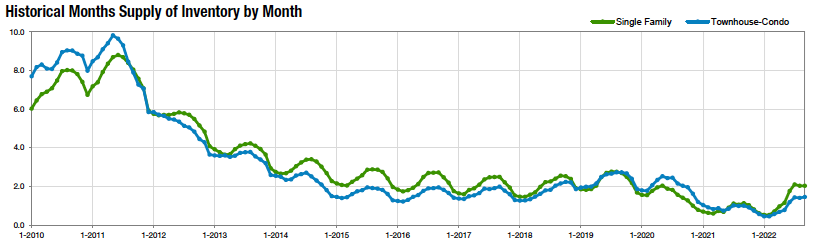

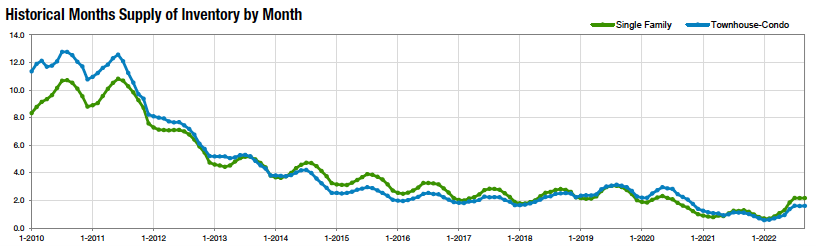

Dramatic dips in pending sales and sold listings (ranging from -20% to -33%) helped drive up inventory options for an increasingly skeptical and cautious pool of buyers. With the inventory of active listings slipping from August to September both in the seven-county Denver metro area and statewide, the volume of available properties remains well above where the markets stood in September 2021. Months supply of inventory also remained flat in September and, at roughly 2 months, remains well short of what would be defined as a balanced market (4-6 months supply).

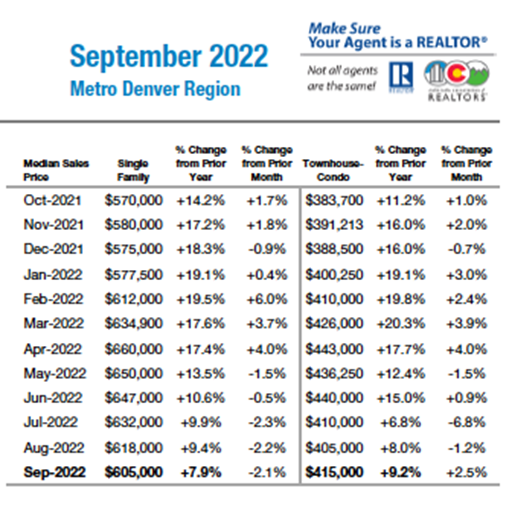

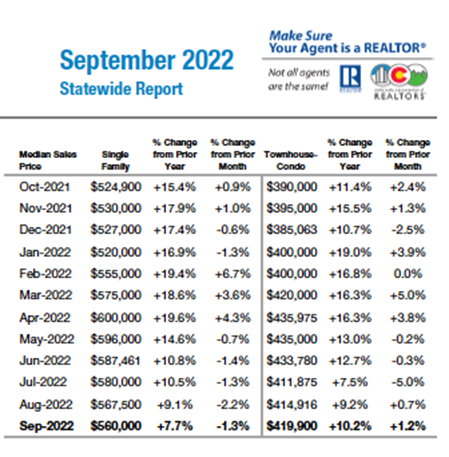

The combination of factors pushed median pricing down slightly for single-family homes in the Denver-metro market, as well as statewide. However, the more affordable townhouse/condo market saw median prices tick up 1.2% statewide to $419,900, and 2.5% in the seven-county Denver area to $415,000. That said, sellers are having to price properties carefully and are facing scenarios not seen in a few years that includes reducing prices and offering buyer concessions as the percent of list price received fell slightly again in September to ranges not seen since early 2020.

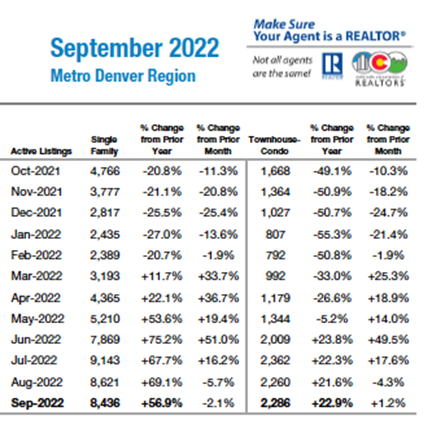

Denver Metro Single-Family Snapshot:

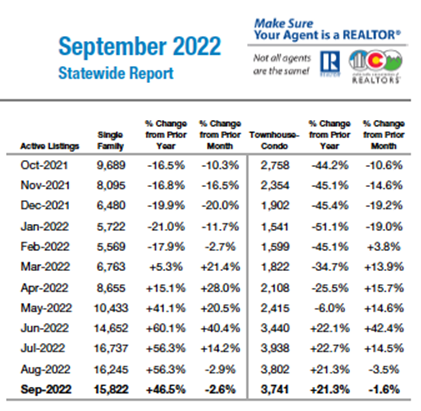

Statewide Single-Family Snapshot:

Capturing the changes, REALTORS® across the state are focusing their lens on local housing markets that are changing like the leaves – some are turning a variety of colors, some are hanging on to their pristine color palette, while others are beginning to see the fall.

REALTORS® across the metro area and state shared these highlights (expanded summaries of each market are included in the following pages):

- Aurora – We’re experiencing a very common theme among the Aurora and Centennial zip codes as prices continue to go up, days on market have nearly tripled, inventory is rising, and the number of closed sales is down.

- Boulder/Broomfield counties – In Boulder and Broomfield counties, we are in a ‘Tornado’ market, a phrase coined by my REALTOR® colleague Frederick Warburg. It’s a market where, ‘one home trades hands briskly while other, similar properties languish.’

- Colorado Springs – With active properties up 91.9 %, we are beginning to feel the pain, a pain brought on by higher interest rates, up 55% from a year prior. The tables have turned from sellers demanding high prices, appraisal gaps and the first born, to sellers beginning to get aggressive on pricing and still hoping to see an offer come in. The good news is, we are still selling homes, but you better be serious about price and condition to bring that buyer in.

- Denver County – Are we headed for a 2008-era crash or is there simply going to be a course correction that, although major in comparison to the last two years, is really nothing more than a slight pivot? The latter is looking true of the Denver market since the course correction began several months ago. This last month was, in fact, the first time that price appreciation was back to single digits counted year-over-year in over four years. It’s important to consider this metric as it represents that there has not been a ‘crash’ but rather a simple, ordinary correction. Remarkable in its transition speed but rather unremarkable on a multi-year graph.

- Denver Metro – In the metro-Denver region there are over 50% more single-family homes on the market than there were just a year ago, providing more choice and opportunities to buyers. Affordability continues to be a challenge as interest rates move up again, with the average for a 30-year mortgage around 6.7% and the median price of a single-family home in metro Denver sitting at $630,000, an increase of 13.7% year to date. With more time and more choices to make a decision about buying, many buyers are choosing to sit on the sidelines and watch.

- Douglas County – Inventory in Douglas County jumped more than 54% year-over-year in September, continuing the shift towards a buyer’s market. Naturally, as the supply of housing increases and demand is constrained by rising interest rates, single-family home prices were forced lower, decreasing 2.8% month-over-month in September. The townhouse/condo market, however, continued its upswing with median sales prices increasing 5.6% last month.

- Durango/La Plata County – The ‘cream puff’ properties are still getting snatched up in a matter of days at asking price or above. Properties that are in less desirable locations or conditions are staying on the market for extended amounts of time, and these properties are seeing multiple price reductions. There is still strong buyer demand, but buyers are becoming more discerning and unwilling to settle. Sellers are getting creative, offering incentives to help with down payments or buying down points on buyers’ loans.

- Estes Park – The most notable stat to share in this regard is the average days on market, a direct reflection of the slowing and general change to the market. Single-family homes have gained four days on the market longer than September of last year, a 10.5% increase. Year-to-date this is a 15.9% jump in time on the market to close.

- Fort Collins/Northern Larimer County – Our housing market is a little like that vintage game show, The Price is Right, where contestants are tasked with ‘guessing’ the closest retail price of goods without going over in order to win a host of fabulous prizes. Right now, sellers and listing brokers are the contestants trying to guess the right price to list a house.

- Grand Junction – September of 2022 is a very different story versus September 2021. New listings are down 18.7%, pending sales are down 19%, and solds are down 26.8%. However, prices are up, with the median up 19.2% to $404,000, and the average up 17.5% to $445,853. We are not yet seeing prices go down. We are seeing incentives from sellers, such as buying down the buyers’ interest rate, and some small price reductions. The troublesome statistic in Mesa County is that our affordability index is down 38.4% to 53.

- Jefferson County/Golden – Homes are now sitting on the market an average of 25 days compared to 13 a year ago, a significant expanded timeframe for sellers. It is still a seller’s market now that new inventory has also declined 20% however, sellers are not receiving the multiple offers as in the past several weeks and most are having to reduce the list price to sell the home.

- Pagosa Springs — This year continues to deliver an abundance of changes – prices, interest rates, inventory, home affordability. Even expectations for buyers and sellers have changed. Like the change of season, today’s market is significantly different from three weeks ago, and just as it has been since the first of five interest rate hikes this year.

- Pueblo – “The Pueblo market continued to slow in September with new listings down 22% compared to September 2021. Pending sales were also down 22% from September 2021 and -3.4% year to date. Solds were down 29.4% from September to September and down 0.3% year to date. The theme here is down.

- Steamboat Springs/Routt County – For Routt County, a shortage of housing persists. Single-family had almost 56% less new listings on the market in September than it had last year, resulting in almost 20% less active listings; multi-family had almost 39% less new listings with active listings a mere six more than the prior year. Average sales prices for houses declined 13.8% from September last year yet remains up 5.8% YTD at $1,627,394.

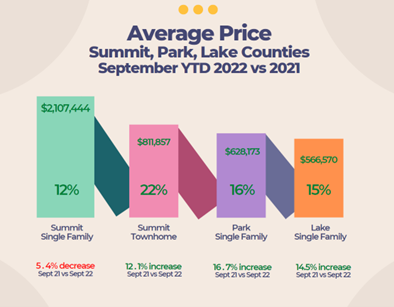

- Summit, Park, and Lake counties – Compared to last September, Summit single-family home inventory is up 73%, condo inventory is up 37%. Inventory in Park is up 12%, and Lake is up 40%. Homes are getting about 96% of list. With all these listings you would think sales would be going up, but sales have decreased 32%. In the last week, 23 properties dropped their prices. While prices have not fallen to even 2021 levels, sale prices are down 30% on average from the peak of the market this past January.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“We’re experiencing a very common theme among the Aurora and Centennial zip codes as prices continue to go up, days on market have nearly tripled, inventory is rising, and the number of closed sales is down. Obviously, the situation varies among neighborhoods and zip codes including in 80016 where the southeast part of Aurora is showing a median price of $763,000, up 4.5% over last year. However, total sales are down 25%. In 80015, another southeast Aurora zip code, we see double the inventory from last year and a median price of $598,700, up 15.8% over 2021. Once again, actual closed properties are down 32% from last year. In 80011, a north Aurora zip code, we also see an inventory double however, that is only a total of 57 properties on the market and a median price of $451,000 and closed properties are down 46%.

“Centennial is also seeing inventory rise almost 70% over this time last year with a median price of $675,000. Closed sales are down 31%. For buyers, the takeaway is that there is more opportunity through more inventory and homes that are staying available longer. For sellers, the takeaways are that pricing is key, and there is more competition for those buyers. The best news is that we are seeing the market start to balance in all price ranges,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“In Boulder and Broomfield counties, we are in a ‘Tornado’ market, a phrase coined by my REALTOR® colleague Frederick Warburg. It’s a market where ‘one home trades hands briskly while other, similar properties, languish.’ The statistics show a continued brisk market despite recent interest rate fluctuations, with 10% appreciation since the beginning of the year and a healthy 31 average days on market. But a view from the ground tells a different story. Many homes are listed, price reduced many times, with a final sale much lower than the seller expected. Others are experiencing multiple offers and enjoying over list price premiums. Officially, our sales price/ list price ratio remains at 103% but many sellers are not having that experience.

“Townhomes and condos continue to enjoy more appreciation than single-family homes – around 17% since the beginning of the year, likely related to their affordability compared to houses. Homes that are priced right from the start, staged, and are updated are the ones being touched by the tornado while the others are often overlooked by increasingly skeptical and cautious buyers. According to the statistics, the average days on market has remained the same from the previous month but, in order to sell in a short time, sellers must price properly, make their homes shine, and even offer a buyer concession to help pay down the volatile interest rates. What a storm,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Housing affordability coming to a city near you, but when? It seemed like just yesterday when the REALTOR® population at large stated that Colorado would not and could not see declines in housing prices. We were told that we just did not have any inventory and because of that reason alone home prices were safe and rental prices were too. But that season has changed and as we work through the beautiful fall weather here in Colorado, housing is heading for winter, and fast.

“We dropped 26.8 % on sold listings year over year – a number that simply amazes me. Just think how many people that drop affects. From the mortgage world to new home builders, REALTORS® and more. That number is massive. And with active properties up 91.9 %, we are really beginning to feel the pain, a pain brought on by higher interest rates, up 55% from a year prior. But even before that we were in bubble territory, this just exaggerated that bubble. Because of that, the tables have turned from sellers demanding high prices, appraisal gaps and the first born, to sellers beginning to get aggressive on pricing and still hoping to see an offer come in. The good news is, we are still selling homes, but you better be serious about price and condition to bring that buyer in. And then you can expect lower offers, concessions, and tossing in a fridge or two.

“The industry is trying to wrap its mind around what happened. So many couldn’t see this day coming and now that it has, panic is beginning to set in. Maybe one of the reasons is that the Fed is going to continue quantitative tightening until they break something. So, these first few months are just the beginning of the downturn. With talk of recession, home prices dropping in many areas across the nation, international and national news of possible large, international bank failures, devaluing currencies, untamed and high inflation, and gas prices heading north again, we have very little good news to work with. If I was a betting man, I bet house prices are headed south from here and until affordability along with economic stability is reached, many may be shocked on what is coming and how bad this may get. Not to mention that 2008 isn’t that far away and many have a bad taste left over from how fast that hit and what it cost us all. The headlines today are reminiscent of those days.

“Currently, sellers are going to have to price their homes aggressively to sell them, and even then, we are witnessing buyers sitting on the sidelines knowing there is blood in the water and waiting is probably going to snag them an even better deal. As the large IDX sites continue to show price drops, I cannot say I blame buyers for their patience. As for the industry as a whole, it reminds me of the parable, ‘The Ant and The Grasshopper.’ I hope there are more ants than grasshoppers because these could be trying times,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“Whenever a market shifts, it’s only natural to wonder how deep and wide that correction is going to be. As real estate has proven through the years, more often than not, simple changes in our trade tend to be a good barometer of the overall economy’s health, or lack thereof. Are we headed for a 2008-era crash or is there simply going to be a course correction that, although major in comparison to the last two years, is really nothing more than a slight pivot? The latter is looking true of the Denver market since the course correction began several months ago. Prices have continued to increase but much, much slower than 2020 and 2021. The year-over-year median increases were in the double digits over the last three years but in September 2022, they are back under 8%, similar to the trajectory of 2017 and even slightly higher than 2018. This last month was, in fact, the first time that price appreciation was back to single digits counted year-over-year in over four years. It’s important to consider this metric as it represents that there has not been a ‘crash’ but rather a simple, ordinary correction. Remarkable in its transition speed but rather unremarkable on a multi-year graph.

“Further evidence of this crashless pivot has been the time a home sits on the market before sale. At 23 days last month, that number is certainly higher than last year’s 12 and is marginally larger than 2020’s 19 days. However, 23 days is still higher than 2016, 2017 and 2018 which all tied at 22 days on market – a statistically even number with pre-COVID September performance.

“In Denver County specifically, fewer new listings and fewer overall sales occurred last month than at any over the past 6 years. It makes sense that there’d be less sales with less new listings but it’s important to consider the factors resulting in lower listings. It could simply be that in 30 months of experiencing a post-pandemic world, people are simply staying put. During the early months of 2020, there seemed to be a mass swapping of living situations as we all adjusted to our new surroundings. Since then, we have sharpened our expectations and are collectively appreciating a little less chaos. Add in a dash of higher interest rates, prices looking like they’re poised to grow at a more healthy rate and you might just have yourself a real estate market that is becoming healthier, more sustainable, and less volatile than it’s been in recent memory,” said Denver-area REALTOR® Matthew Leprino.

DENVER METRO

“Fall is in the air and as the leaves are changing their colors, so is the real estate market. Many might consider the current real estate market not as pretty as the fall colors, but with change there is always opportunity. In the metro-Denver region there are over 50% more single-family homes on the market than there were just a year ago, providing more choice and opportunities to buyers.Also, there are nearly 23% more townhouses and condos on the market compared to a year ago. Properties are staying on the market longer, 29 days for single-family properties compared to 14 days, and 24 days for townhouse-condos compared to 15 days a year ago. All of this provides buyers a bit more time to make their home buying decision.

“Affordability continues to be a challenge as interest rates move up again, with the average for a 30-year mortgage around 6.7% and the median price of a single-family home in metro Denver sitting at $630,000, an increase of 13.7% year to date. With more time and more choices to make a decision about buying, many buyers are choosing to sit on the sidelines and watch. The data continues to support downward pressure on home prices, but that pressure is staying in check as we see well priced, well positioned properties successfully going under contract,” said Denver-area REALTOR® Karen Levine.

DOUGLAS COUNTY

“Inventory in Douglas County jumped more than 54% year-over-year in September, continuing the shift towards a buyer’s market. Naturally, as the supply of housing increases and demand is constrained by rising interest rates, single-family home prices were forced lower, decreasing 2.8% month-over-month in September. The townhouse/condo market, however, continued its upswing with median sales prices increasing 5.6% last month. While the Douglas County market is relatively flushed with multi-family inventory (+122% since last year), there is still an imbalance of housing stock in the category, with multi-family sales making up just over one in every 10 closings in the county. As the population surges throughout the county, fueled by massive retail growth in places like Parker and Castle Rock, there remains a lack of entry-level housing to accommodate the large number of middle-class households joining the workforce.

“Slowdowns in the housing market can be a compounding issue due to their nature as a feedback loop. As homes stay on the market longer, consumers fear economic uncertainty, dissuading them from purchasing a home or decreasing their budget, causing the market to slow further. Consumer confidence has decreased beyond peak-pandemic levels in May 2020, accelerating the seasonal housing market slowdown into the winter months. While Douglas County’s housing market is quite strong and more stable than in the spring of this year, consumer doubt about economic conditions will likely continue to push prices down and inventory up in the months to come. Sellers can expect a noticeably longer time to sell their home this fall and may consider more upgrades/repairs to their home to make it more attractive compared to the larger inventory. Buyers, while constrained by affordability, will have many more options while searching and increased negotiating power while under contract,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“To say the Durango market is in flux would be an understatement. Compared to the previous month, the average sales price in September trended upward, hovering at just over $1 million. Current inventory levels continue to rise, with just over a three-month supply of single-family homes for sale. Days on market increased to 87 from 65 in August. The number of new listings decreased, as did the percentage of the list price received. What does all of this mean? Buyers have more time to make buying decisions with additional options and a better negotiating position. Sellers, on the other hand, must be much more strategic when positioning their properties for sale in this market.

“The ‘cream puff’ properties are still getting snatched up in a matter of days for the asking price or above. Properties that are in less desirable locations or conditions are staying on the market for extended amounts of time, and these properties are seeing multiple price reductions. There is still strong buyer demand, but buyers are becoming more discerning and unwilling to settle. Sellers are getting creative, offering incentives to help with down payments or buying down points on buyers’ loans.

“Some industry experts expect interest rates to hit double digits in the coming year, sidelining more buyers. In addition, fewer sellers are willing to give up the low-interest loans they secured in the past few years. Buyers waiting for prices to drop need to be aware of the effect rising interest rates have on their buying power. As interest rates continue to increase, locking in a lower rate today could save buyers hundreds of dollars on their monthly payments. If rates go down in the future, they can always refinance. Sellers must be prepared to be patient and flexible in order to get their homes sold in this ever-changing market. Even with all of the uncertainty in the current market, appreciation is still near 25% year-to-date,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“As the temperatures fall and the leaves turn, the air in the real estate market is similar in Larimer County. The most notable stat to share in this regard is the average days on market, a direct reflection of the slowing and general change to the market. Single-family homes have gained four days on the market longer than September of last year, a 10.5% increase. Year to date this is a 15.9% jump in time on the market to close. Townhouse/condos are feeling the drag to the finish line as well. Compared to September 2021’s average of 42 days on market, this September lengthened to 100, a 138.1% increase. Year to date it’s not as bad with a 44.3% increase to 88 DOM versus 61.

“New listings are still down from historical points for both single-family and townhouse/condos. Single family are down 8.2% year-to-date, townhouse/condos are -22% year-to-date. The shortage of homes in the affordable range, coupled with the hefty interest rates, is really slowing the market for your entry level buyer, or the average family who lives paycheck to paycheck. What could have been affordable this time last year, between interest rates and price increases, has gotten even further out of range. Average sales prices have climbed again. Single-family homes are closing for 10.9% more than September 2021, a year-to-date increase of 15.5%. Townhome/condos are seeing the same with a 17.7% increase over September 2021. Percent of list price received however, is down to 100.4%, a small dip of 0.9%.

“Townhouse/condos have gained 1.4% momentum over list, to a 103.1% average year-to-date. Single-family homes are starting to come down to earth a bit too. Percent of list price received dropped 2.2% in September 2022 compared to last year to 99.2% of list price. Year to date the figures are still over listing at 102.2%, but that’s a 0.3% year-to-date drop. So, September is showing some slowing and buyer negotiating power across the board. It will be interesting to see if the real estate market leaves fall from the trees this season,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“Planning to buy or sell a home between now and the New Year? Come on down, you’re the next contestant on The Price is Right.

“Interest rates are at a 20-year high; inventory of homes available for sale is on the rise; and 20% or more of the traditional buyer pool is sidelined due to lack of funds (primarily first-time home buyers).

“The run-up in home prices throughout the first third of the year has come to a halt – note the drop in median price from its high of $634,240 in June to $585,000 in September. That’s a cascade of over 8% in the span of less than 90 days. The absorption rate – also known as months’ supply of inventory is four and a half times higher now than it was in February of this year. Rapidly rising mortgage interest rates remain at the top of the list for dragging the housing market from an all-out sprint to a leisurely stroll.

“But how is this housing market like a vintage game show where contestants are tasked with ‘guessing’ the closest retail price of goods without going over in order to win a host of fabulous prizes? Right now, sellers and listing brokers are the contestants trying to guess the right price to list a house. Price volatility is not generally used to describe real estate pricing. Since 2012 home prices have only moved in one direction. Facing a stall in price appreciation in the span of just a few months after years of escalation requires stoic acceptance of what is so – not what is wishful thinking.

“The rapid departure of buyers willing to pay top dollar for high-priced homes thanks to cheap money from lenders and dramatic post-covid stock gains was swift as interest rates exceeded the 7% mark briefly at the end of September. This has made pricing a home supremely challenging as there is still plenty of demand for housing – just not ‘at any cost.’

“Home prices in the median range are seeing multiple price corrections after initial listing if the house isn’t under contract within the first 10-14 days on the market. Savvy sellers (or sellers with savvy listing brokers) understand the value of pricing aggressively to drive interest and create a scenario for multiple offers or in some cases, any offer.

“With discretionary cash being eaten up by higher interest rates, buyers are looking for turn-key properties that won’t require cash to fix-up. Buyers have a little more latitude to pick and choose the houses with the best floor plans, the best staging, the best landscaping, and the best price. Sellers must recalibrate for the season at hand if they must sell now. Sellers with the luxury of time on their side may take a ’wait-and-see’ posture hoping that inflation diminishes after the mid-terms and New Year with interest rates trailing lower behind that drop,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION

“September of 2022 is a very different story versus September 2021. New listings are down 18.7%, pending sales are down 19% and solds are down 26.8%. However, prices are up, with the median up 19.2% to $404,000, and the average up 17.5% to $445,853. We are not yet seeing prices go down. We are seeing incentives from sellers, such as buying down the buyers’ interest rate, and some small price reductions. The troublesome statistic in Mesa County is that our affordability index is down 38.4% to 53.

“The under $300,000 price is where we are seeing most of the negatives. Sales under $300,000 are down 33.3% for single-family homes and 40% for condo/townhomes. The dramatic rise in interest rates, coupled with rising prices, are simply pricing those in the lower incomes in Mesa County out of the market,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY/GOLDEN

“In Jefferson County, pricing a home correctly for this market is the name of the game and it’s getting harder and harder to correctly price homes as they hit the market. Homes are now sitting on the market an average of 25 days compared to 13 a year ago, a significant expanded time frame for sellers. It is still a seller’s market now that new inventory has also declined 20%. However, sellers are not receiving the multiple offers as in the past several weeks and most are having to reduce the list price to sell the home. Typically, there is a cooldown in the market in the later months of the year which explains some of the lower inventory currently. The median sales price for single-family homes increased yet again to $655,000, and for condo/townhomes, the median sales price ticked up to $391,925. It will be very interesting to see if interest rates continue to increase and what that will do to the market in late January and February,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS

“This year continues to deliver an abundance of changes – prices, interest rates, inventory, home affordability. Even expectations for buyers and sellers have changed. Like the change of season, today’s market is significantly different from three weeks ago, and just as it has been since the first of five interest rate hikes this year. With our rural average days on market at 79, correct pricing and seller concessions mindset change is imperative to meet the average days on market sale period. Buyers and sellers in today’s market are both faced with reality and affordability. Buyers are either adjusting their expectations, standing on the sidelines, or are likely priced out of the market. The same is true with sellers finding it difficult to find a replacement or move-up home, obtaining their desired home sale proceeds, offering seller concessions, and accepting home sale contingent offers. The largest gains in September 2022 compared to September 2021 were sales price and inventory (median sales price at $525,000 (+11.8%), average sales price at $659,771 (+15.7%), and Inventory of homes at 193 (+44%).

September showed us that the highest current inventory gains were homes priced $500,000-$699,900 (+90%) at 42 homes, $1M to $1.99M (+121%) at 42 homes, and $100,000-199,999 (+150%) at five homes. We currently have a 4.5-month supply of homes. True, inventory is at a year high, just not in the price range of many buyers. Several homes priced in the ‘comfort buyer price level’ are not meeting the buyer expectations as they may be a distance from town or not quite the buyer’s desired neighborhood. Additionally, most homes in comfort-level pricing need maintenance, repairs, or updates. These projects can be costly and overwhelming to a buyer in a rural area seeking a first, second, or retirement home.

“Another 2022 change is the Archuleta County short-term permit moratorium set until Spring 2023. Historically, out-of-state buyers have chosen short-term rentals to help offset home expenses and provide opportunity for more buyers to purchase a second home. Even with an abundance of price reductions, sellers and buyers in all price points are challenged with changes in the real estate market to meet their desires and needs. With new interest rates making average monthly payments about 70% higher than it was a year ago, cash buyers may have a little negotiating leverage with sellers, as fewer buyers are previewing homes and making an offer on any of the homes previewed. Many buyers are still on the sidelines hoping to jump into the game and score in this market change. Higher interest rates have created fewer buyers and lower sales unit numbers. As such, home prices will continue to decelerate for sellers desiring to sell within the average days on market, the onset of winter home showing demands, and before the new year. Price adjustments are not of abundance in the “comfort price point”, as the larger inventory exists in the higher price points. Winter season has historically offered buyers in higher price points discounted pricing- and perhaps their best time to buy!

Vacant land is also tracking the same as home sales. Higher inventory volume at higher prices. However, land sales will not come close to the over 700 units sold in 2022. Currently, only 312 land parcels have been sold, with an inventory of 300+ parcels. Higher land prices have curved land purchase numbers. Some buyers have changed their home buying option to a land purchase, as it is an instant comfortable compromise and affordable to the buyer’s budget. Most builders are now taking building orders for 2025. With continued escalated infrastructure, building, and labor prices, land buyers are purchasing with the intent not to build right away,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The Pueblo market continued to slow in September with new listings down 22% compared to September 2021. Pending sales were also down 22% from September 2021 and -3.4% year to date. Solds were down 29.4% from September to September and down 0.3% year to date. The theme here is down.

“These changes have basically ended 2.5 years of a seller’s market. The months supply of inventory sits at 2.4 as homes are simply staying on the market longer. Our median price of $315,000 is exactly where we were just a few months ago and the percent of list price received dropped a little to 98.5% in September 2022. Another telling sign of our market conditions changing: We now are seeing multiple open houses – sometimes for 3 or 4 days a week – compared to just a few months ago when there were no open houses.

“Sellers are dropping their prices as they see far fewer buyers in the market thanks to rising interest rates and products that don’t match expectations. The result has been a growing level of concern from sellers,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Real estate seems to be ‘in a pickle’ right now – a phrase traditionally coined by baseball when a player was caught between two bases. Some buyers are caught between the bases – wanting to buy, but not economically confident if they should advance to the next base (purchase) or run back (stay in existing or rent). The rapid rise in interest rates has left some buyers standing on the base- or worse yet, not allowing them to even get up to bat with lost purchasing power. The higher interest rates have resulted in lowering of some list prices which can somewhat counteract the higher interest rate. Where we may see real estate prices drop, rental prices have not, thus creating another pickle for Buyers who are now stuck as they have been priced out of buying due to the higher interest rates. Sellers also find themselves in a pickle as they come to grips with a market that has shifted. Although still considered a seller’s market, getting to the closing table sooner than later now often requires a Seller to negotiate on purchase price, concessions, and inspections. Appropriate pricing at the onset can still produce a homerun depending on property condition and location.

For Routt County, a shortage of housing persists. Single-family had almost 56% less new listings on the market in September than it had last year, resulting in almost 20% less active listings; multi-family had almost 39% less new listings with active listings a mere six more than the prior year. Average sales prices for houses declined 13.8% from September last year yet remains up 5.8% YTD at $1,627,394. Condos/townhomes average sales prices were up 51.8% over September 2021 and +33.7% year to date at $1,101,708. With fewer properties to sell, it makes sense that 2022 would realize fewer contracts and sales yet realize appreciation. Influencers of interest rates, inflation, and consumer confidence have their effects on slowing the market a bit more to almost three months’ supply of single-family homes and almost two months for multi-family. To effectively navigate a particular segment of the market, buyers and sellers should seek a REALTOR® for the rundown,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTY

“Yes, average prices are falling like the leaves in Summit County, but we need a little perspective. Prices ran up so fast and so high last year that, even with an average $203,961 less for property, the overall price for a home is still higher than the previous year-to-date for Summit, Park, and Lake counties. Compared to last September, Summit single-family home inventory is up 73%, condo inventory is up 37%. Inventory in Park is up 12%, and Lake is up 40%. Homes are getting about 96% of list.

“With all these listings you would think sales would be going up, but sales have decreased 32%. In the last week, 23 properties dropped their prices. While prices have not fallen to even 2021 levels, sale prices are down 30% on average from the peak of the market this past January. This could indicate that lower-priced properties are selling most often, and/or overall prices are coming down. September saw about 31% of closings paid for with cash. Looking at inventory, we currently have about four months of supply and we would consider it to be a balanced market with about six months.

“An interesting change is that Keystone and Copper, which do not have any short-term rental restrictions, outperformed the rest of Summit County by 10%. There are 515 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $149,900 and a high price single-family home in Breckenridge for $18.9 million, which has been on the market for over 2 years. Out of the 177 sales in September, the lowest was a home in Park County for $194,000 and the highest was a single-family home in Breckenridge for $5.45 million. These numbers exclude deed restricted, affordable housing. In Summit County, an average priced home is below the $2 million mark at $1,933,610, down about $204,000 from last month,” said Summit-area REALTOR® Dana Cottrell.

SEVEN-COUNTY DENVER METRO AREA

Inventory of Active Listings

STATEWIDE

Inventory of Active Listings

SEVEN-COUNTY DENVER METRO AREA

Months Supply of Inventory

STATEWIDE

Months Supply of Inventory

SEVEN-COUNTY DENVER METRO AREA MEDIAN SALES PRICE

STATEWIDE MEDIAN SALES PRICES

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The Sept 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.