Buyers and sellers shelter in place as home sales slow across the state

ENGLEWOOD, CO – Although increases in inventory are helping to restock what were nearly empty cupboards across the Denver metro and statewide housing markets over the past few years, the typical year-end housing slowdown is being fueled by some interest rate uncertainty, as well as speculation and hope for what spring 2023 may offer to patient buyers, according to the November 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

While there is still a sound and growing number of opportunities for buyers, the activity and pace of eager buyers and sellers have taken a much-needed break as parties on both sides seem content to let the holidays play out and see what the new year may bring.

“The lack of inventory and the hike in interest rates are causing some sellers and buyers to shelter in place. Sellers may not want to sell because they might not want to give up their low interest rate or worry about where they would go if they did sell; buyers may have discovered they can no longer afford to ‘move up’ or purchase at all with the higher interest rate and mortgage payment,” said Steamboat Springs-area REALTOR® Marci Valicenti.

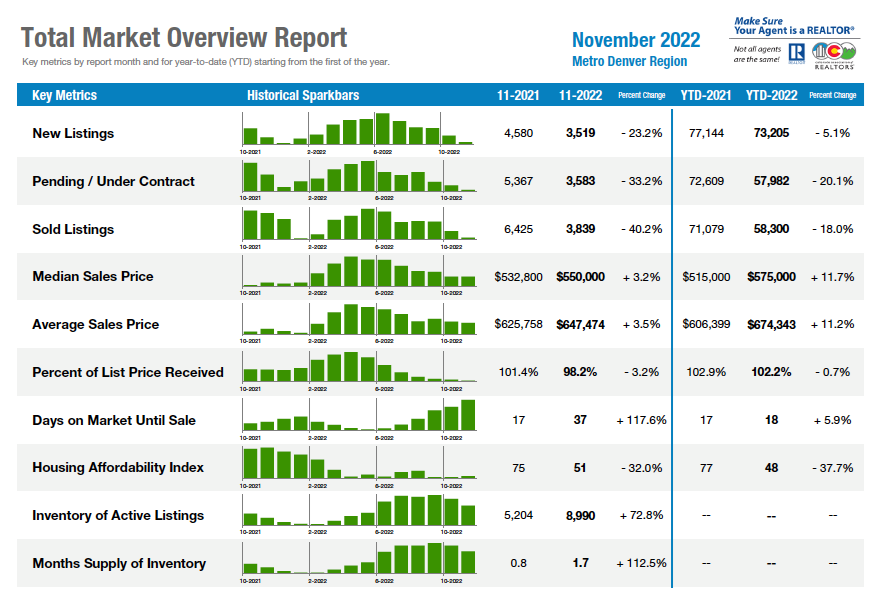

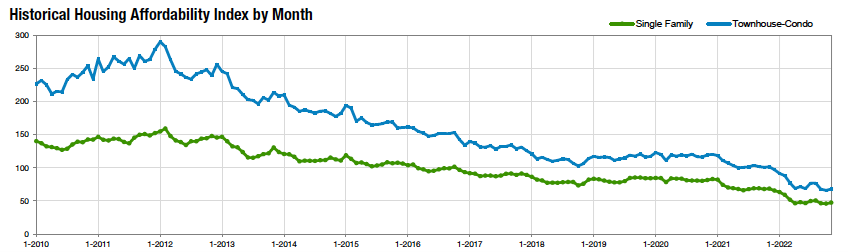

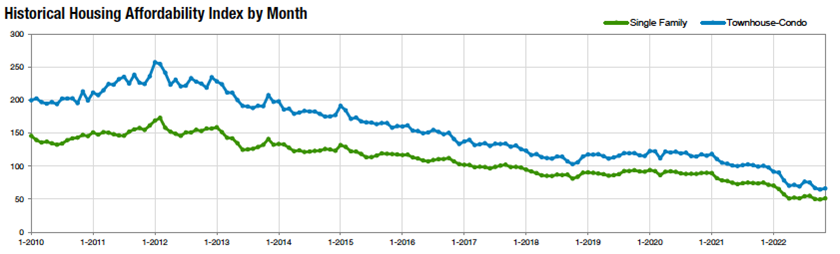

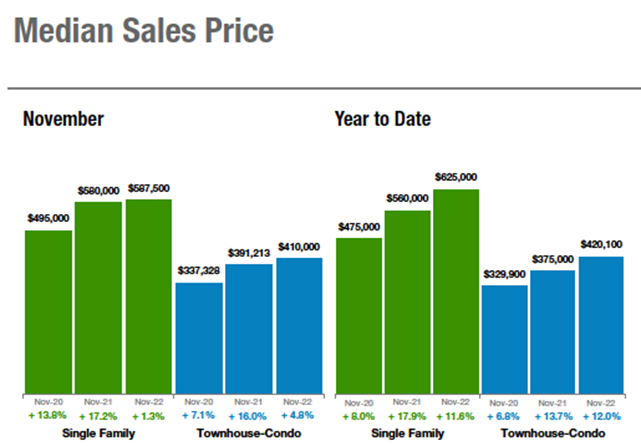

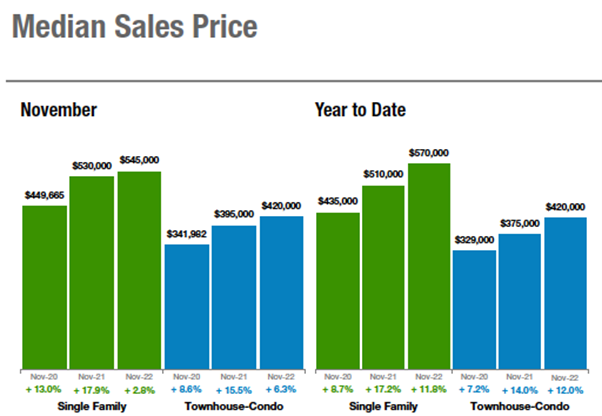

The slowdown can be seen across multitude of categories with numbers that are a far cry from the market frenzy a year prior when it comes to pending/under contracts; sold listings; average days on market, active listings, and the overall months supply of inventory. Despite the swings, median sales pricing continues to rise across all property types, keeping the CAR Housing Affordability Index at or near its record lows.

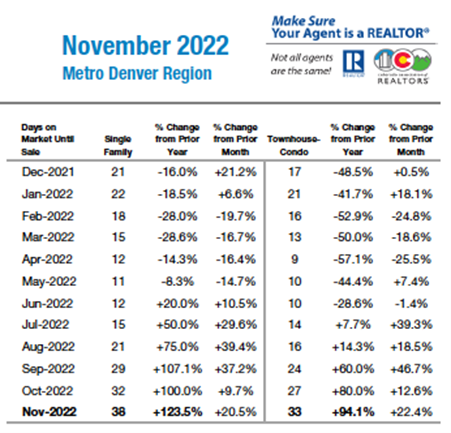

Looking at the seven-county Denver metro area across all property types (single-family and condo/townhome):

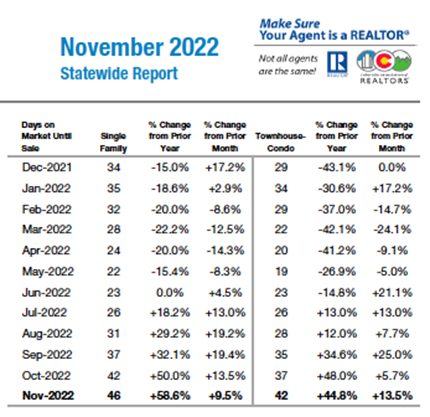

Statewide market across all property types (single-family and condo/townhome):

REALTORS® across the metro area and state shared these highlights (expanded summaries of each market are included in the following pages):

- Aurora – The condo market seems to be much hotter than a year ago or even from just a couple months ago. Given the high prices of housing and rents, condo sales are up, and pricing is up on condos in most zip codes. Perhaps consumers are finding an affordable alternative to single-family houses.

- Boulder/Broomfield counties – The lack of homes on the market and higher interest rates have kept buyers on the couch, so closed sales are down over 20% since last year. Sellers who want to move are holding on tightly to their low interest rate noting the change in payment if they move would be significant. Buyers are shellshocked by the rate hikes and are choosing to rent to ‘watch and see what happens.’ Gridlock.

- Colorado Springs – Winter is here, for housing too. Shell-shocked sellers are still trying to figure out how they missed the top, and when will the market rebound? The simple answer is, they did miss the top and the market is not likely to rebound. Overall, sales for all properties dropped 37.7% year over year. Active listings jumped 122.7%, and pending sales fell 25.3% for single-family homes and – 43.2% for townhomes/condos. It’s going to be a bumpy ride in 2023.

- Denver County –We are four months in to the unofficial 2022 course correction in Denver’s real estate market. We saw the year-over-year median prices dip in August to the single digits from their 2021 high of 29%. This is also the same period that prices dipped below their pinnacle for 2022 at $750,000. Now, at $675,000 for a freestanding home in Denver, calculated on the median, it’s plainly arguable that despite the higher rates, it remains less expensive to buy a home now than it was last year.

- Douglas County – An unexpected twist, single-family home prices actually increased 3.6% in November, the first monthly increase in prices since April. Days on market continued to trend upwards, increasing from 37 to 43 days, the highest level since February 2020. Inventory also continued to tighten, decreasing about 14% during the month. The strange combination of low inventory and relatively high days on market makes for an interesting market, and balances out negotiating power between buyers and sellers.

- Durango/La Plata County – Low inventory levels continue to push prices to all-time highs. La Plata County median home price climbed to $827,000 in the month of November, a 12.5% increase over last year. With increased mortgage rates and historically high home prices, affordability is a major concern for buyers. Many buyers are being forced to the sidelines, waiting for rates to soften and prices to stabilize.

- Estes Park – The market has definitely shifted and, while homes are still selling, it’s just not quite like before. New listings continue to dwindle, down 24.1% for single-family homes from November last year with townhouse/condos down 22.8% year to date. Single-family homes reached an average $668,734 a 14.1% increase year to date. Townhouse/condos average sales price has reached $469,389, a 22.4% increase from November last year.

- Fort Collins/Northern Larimer County – How do you respond to the current housing sales market? Try this: Relax – that’s exactly what the Fed is going to do eventually. Breathe – enjoy this pause in the frenetic pace of what the housing market has been. Be patient – if you are prepared for interest rates to drop this spring – even to just under 6% – there will likely be a resurgence of buyer appetite. Be Kind – it’s been a year fraught with challenges. Find ways to be kind to those around you. It really is contagious.

- Glenwood Springs – The market in the Roaring Fork and Colorado River valleys remains strong despite uncertainty in the stock market and the rise in interest rates. New listings continue to be scarce keeping sellers optimistic and prices stable. The single-family median sale price was up 34.1% to $755,000 while the multi-family sector saw a slight, 2.7%, bump to come in at $365,000.

- Grand Junction/Mesa County – Sold listings for single-family homes fell nearly 42% from November 2021 to 2022 and just over 58% for townhomes/condos. Interestingly, median and average prices in both categories are up, so sellers are not reducing prices significantly. Instead, they are offering buydowns and closing costs as incentives. The single-family average home price reached $443,900, a new high for Mesa County.

- Jefferson County – Interest rates increases have pushed some buyers out of the market. Solds for single-family homes fell 47.4% from a year prior however, the median sales price still ticked up 2.9% from a year ago to $640,000. Days on market is nearly double (34 days) compared to this time last year (18) another clear indication that sellers must price their home correctly if they want to sell quickly.

- Pueblo – Activity continued to slow in November with new listings down approximately 25% with 116 fewer listings than in November 2021. Pending sales were down 43.3% compared to last November nearly matching the big drop in sold listings, which were down just shy of 47%. That said, our median pricing is holding up at $311,950, a 10.6% increase for the year.

- Steamboat Springs/Routt County – The lack of inventory and hike in interest rates are causing some sellers and buyers to shelter in place. Sellers may not want to sell because they might not want to give up their low interest rate or worry about where they would go if they did sell; buyers may have discovered they can no longer afford to ‘move up’ or purchase at all with the higher interest rate/mortgage payment.

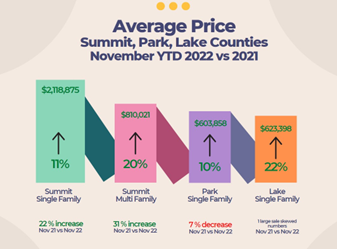

- Summit, Park and Lake counties – Last year, we were busy saying prices were going up, up, up. This year, we’re saying prices are going down – kind of. Logic says interest rates heavily impact the market. We found this logic to be true when interest rates were so low. Now, logic says interest rates going up should bring our prices down, but we continue to see YTD average prices for 2022 above 2021 for Summit, Park and Lake counties. Rates up, prices up and sales volume down – not quite what we expected.

- Telluride – October and November sales were down significantly compared to the first nine months of 2022. The 33 November sales were the lowest number of sales in that month since 2011. Dollar amount of sales was down in Telluride, the Mountain Village, and the remainder of San Miguel County, -16%, -12% and -18%, respectively. However, in all three sectors, the average sales prices were up with Telluride up 20%, Mountain Village up 37%, and the remainder of San Miguel County up 27%.

- Vail – With a 50% inventory increase compared to November 2021 and a 114% increase in months supply, market conditions certainly offer buyers more flexibility in their search. Even though the inventory is below historic levels, it is almost double where it had been and can offer buyer opportunities.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Housing numbers for November are looking just as we expected; homes are on the market longer, and prices are higher than last year, however, we did see decreases in median prices in September. Tis the season, as we generally see a slow down this time of year. And while this year is no different, there are some interesting numbers. The condo market seems to be much hotter than a year ago and even from just a couple months ago. Given the high prices of housing and rents, condo sales are up, and pricing is up on condos in most zip codes. Perhaps consumers are finding an affordable alternative to single-family houses.

“We are seeing no reason for fear. It appears that consumers are still buying houses, even at higher interest rates. They are not closing on as many single-family homes as in the past months, but this is not the best time of year to make judgement on the market. However, this is a good time to get that home in order, get your financing in order and be ready on January 1,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“We are stuck in a real estate gridlock, one where sellers are hesitant to sell at a lower price than their neighbors from last spring and leave their low interest rate behind, and buyers are afraid what the future will bring in terms of interest rates and home prices.

“In Boulder and Broomfield counties, listings are down from this time last year, which is already a traditionally slow time of year for new inventory. The lack of homes on the market and the higher interest rates have kept buyers on the couch, so closed sales are down over 20% since last year. Those sellers who want to move are holding on tightly to their low interest rate noting the change in payment if they move would be significant. Buyers are shellshocked by the rate hikes and are choosing to rent to ‘watch and see what happens.’ Gridlock.

“That being said, home values are up 9% since this time last year, although most of those gains were seen in the first six months of the year. Homes are still selling in about a month and the market, at least on paper, looks strong. The prediction for the next six months is that rates will decrease further, bringing buyers off the couch and creating more competition for the very few listings that are on the market. Depending on how pent up the demand really is, it could push us back into a market where sellers hold the cards. Buyers would be wise to get off the couch now and take advantage of some of the motivated sellers who wish to close in the next few months.

“Assuming interest rates decline a bit, our local economy stays strong, and the job market continues to be robust, I predict next year will see some appreciation on home prices, but more likely in the single digits and it may not happen until the middle-end of the year, unlike our typical real estate cycle,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Winter is here, for housing too. Shell-shocked sellers are still trying to figure out how they missed the top, and when will the market rebound? The simple answer is, they did miss the top and the market is not likely to rebound. Not if we are looking at the trends. And the trends are not fantastic. Overall, sales for all properties dropped 37.7% year over year. Each month slower than the last when looking at past sales. Active properties jumped 122.7%, once again creating a softening in the market not experienced for many years. The final blow is pending sales dropped 25.3% for single-family homes and crashed down 43.2% for townhomes and condos.

“Mortgage demand nationwide continues to slow, despite softening in the rates. And without buyer demand, being a seller isn’t as fun as it once was. Builder sentiment continued its downward trend, as well. The Fed is sticking to at least one more rate hike in December before looking at recent data to see if there will be more hikes or slowing of hikes. But, as I write this, job data came in good, and PPI (Produce Price Index) numbers hit showing inflation is still holding at the wholesale level. In fact, it was up .3% in November. With both data points in, it’s going to be hard for the Fed to pause rate hikes while seeing persistent inflation. Even though these rate hikes don’t directly affect the 30-year mortgage, it does affect debt for consumers

“As we wrap up November, we are not in a great place, economically, and housing is in the crosshairs. Blackstone and Blackrock, along with other major hedge funds, saw investors trying to pull money from their once very popular REITS. This shows once again, people are losing faith in housing. That is a real issue as we move forward. With rents softening, the funds are looking at the potential of massive losses. As we tip-toe into December, I have to think the trend is set, housing is in a bear market and unless a Christmas miracle happens, look for similar data in December as well. It is likely going to be a very bumpy ride in 2023,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“We are now four months in to the unofficial 2022 course correction in Denver’s real estate market. We saw the year-over-year median prices dip in August to the single digits from their 2021 high of 29%. This is also the same period that prices dipped below their pinnacle for 2022 at $750,000. Now, at $675,000 for a freestanding home in Denver, calculated on the median, it’s plainly arguable that despite the higher rates, it remains less expensive to buy a home now than it was last year.

“What’s also noteworthy is that in six of the last seven years, the month of January is statistically the least expensive month to buy of the 11 following months. In five of the last seven years, the most expensive month was June. Statistically speaking, it’s clear that Denver’s prime time to buy is now and the prime time to sell is June,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“In an unexpected twist, single-family home prices actually increased 3.6% in November, the first monthly increase in prices since April. Days on market continued to trend upwards, increasing from 37 to 43 days, marking the highest level since February 2020. Inventory also continued to tighten, decreasing about 14% during the month. The strange combination of low inventory and relatively high days on market makes for an interesting market, and balances out negotiating power between buyers and sellers. In the townhouse/condo market segment, median sales prices decreased slightly to $497,000, and days on market spiked by nearly two weeks to 39 days. Since June, there has been a rapid decline in new townhouse and condo listings, down to 54 in November from the year’s peak of 162 in June.

“Our buyer and seller client’s experience in November seemed to be indicative of a fairly normal, balanced market. Showing activity on our listings was noticeably quieter, but fairly-priced listings still received favorable offers at or near asking price. We’ve observed the key to success with listings in this market is modest pricing, as buyers have shifted expectations and will avoid listings with perceived overpricing. Our buyers’ main challenge in November was overcoming the lack of inventory. We have also shifted our offer strategy and began to ask for significantly more price discounts and concessions, especially on listings that have been on the market for a while. Overall, the market feels very balanced and relaxed – a nice break before we enter the spring selling season,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“November is typically the beginning of Durango’s shoulder season, with sales activity slowing seasonally. This year’s key metrics are no different. The number of new and sold listings continues to decline month over month. The number of sold listings in November 2022 compared to November 2021 was down almost 50%, with just 44 units being sold. Inventory has increased from last November. There were 165 properties with an active status this November, a nearly 50% increase compared to November 2021. While that seems like a significant increase, it is still less than a third of the inventory a balanced market would have.

“The low inventory levels continue to push prices to all-time highs. The La Plata County median home price climbed to $827,000 in the month of November, a 12.5% increase over last year. With increased mortgage rates and historically high home prices, affordability is a major concern for buyers. Many buyers are being forced to the sidelines, waiting for rates to soften and prices to stabilize.

“December is expected to be more of the same, with fewer properties being listed and sold. Buyers will be wishing for Santa to bring more inventory, lower interest rates, lower inflation, and world peace. We will have to wait to see if they were on Santa’s naughty or nice list,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“It’s strange how a market shift can leave a person hanging. Sellers who listed at ‘the wrong time’ had the taste of the frenzy of the summer gone by, and now it’s a whole new ballgame. Buyers who potentially had no chance competing are now able to negotiate more, but with the interest rates are not comfortable with the entry rates. Financing with the intent to refinance is the norm while paying the high interest rates.

“It’s interesting trying to explain to a potential seller that the home may sit for a day, or six months before an offer in this current climate. And you most likely won’t receive full or over-asking offers anymore. Sellers are holding onto that idea and it’s a learning curve for them that some just have to experience themselves.

“The Larimer County market has definitely shifted. Homes are still selling, just not quite like before. New listings continue to dwindle, down 24.1% for single-family homes from November last year. Townhouse/condos are similar at a 22.8% drop year to date. Prices continue to go up. Single-family homes reached an average $668,734 a 14.1% increase year to date. Townhouse/condos average sales price has reached $469,389, a 22.4% increase from November last year. Days on the market are showing the indication of market shift and lengthened time to close/offer. Single-family homes are staying on the market 27.5% longer, from 40 to 51 days compared to November 2022. Townhouse/condos are really slowing down from 65 days to 88 days a 35.4% lengthen of time. Year-to-date, townhouse/condos show more of the lengthening at a 44.3% increase from 61 days to 88 days year to date. It’s a feast or famine business, and we went from feast to famine almost overnight,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“How do you respond to the current housing sales market? Try this: Relax. Breathe. Be patient. Be kind.

“Yes, the market has shifted – but it has shifted in a fundamentally artificial way. In an effort to curb the inflationary trajectory of the single largest household expense (shelter), the Federal Reserve’s actions over the past nine months have resulted in mortgage interest rates doubling. The cascading effect of higher interest rates for borrowers effectively removed first-time home buyers from the market (historically, nearly 25% of the buyer pool) along with many others. November readings show a year-over-year drop of just over 43% in actual sales.

“Further, homeowners enjoying sub-three percent interest rates on their existing homes decided now is not a good time to sell their home for a profit only to take on a new mortgage at twice the cost. They have decided to stick it out a little longer in their existing homes. Last month’s numbers show a more than 28% drop in new listings compared to last year.

“Sellers who weren’t able to sell their homes in August or September have been relegated to either lower the price of their home, provide substantial concessions to accommodate buyers’ needs for lower interest rates (aka a rate buy-down), or take the home off the market and wait to sell when interest rates drop and buyers re-enter the market. They are hoping that demand will increase and drive the sale price of their home higher than where it is now. Statistics indicate about two months of inventory currently on the market with homes selling for 1.2% less than asking on average. The time it takes to sell a home (aka Days on Market) has increased to 54 days from the year’s low of 34 days back in May.

“So why relax, breathe, be patient, and be kind? Relax – because that’s exactly what the Fed is going to do eventually. They’ll relax the interest rates as the inflation numbers continue to show signs of having peaked. Breathe – enjoy this pause in the frenetic pace of what the housing market has been over the last 18 months. Be patient – if you are prepared for interest rates to drop this spring – even to just under 6%, there will likely be a resurgence of buyer appetite. The demographics show there will be extremely high demand for housing for the foreseeable future as millennials age into their prime homebuying years. Be Kind – it’s been a year fraught with challenges. Use this season of giving and gratitude to find ways to be kind to those around you. It really is contagious. Imagine a pandemic of kindness and the amazing year 2023 can be,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“The market in the Roaring Fork and Colorado River valleys remains strong despite uncertainty in the stock market and the rise in interest rates. New listings continue to be scarce keeping sellers optimistic and prices stable. The single-family median sale price was up 34.1% to $755,000 while the multi-family sector saw a slight adjustment of 2.7% to come in at $365,000. New listings were down a whopping 52% for single-family homes, with the townhome-condo sector coming in at an astonishing 63% reduction in listings over 2021. Pending sales numbers are also down dramatically compared to November of last year with single-family homes sales decreasing 47% and multi-family coming in at 60%. We are starting to see days on market Increase and months supply go up slightly, but this is typical of our seasonal slowing,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County is feeling the effect of increased interest rates as sold listings for single-family homes fell nearly 42% from November 2021 to 2022 and just over 58% for townhomes/condos. Interestingly, median and average prices in both categories are up, so sellers are not reducing prices significantly. Instead, they are offering buydowns and closing costs as incentives. The single-family average home price reached $443,900, a new high for Mesa County. Our current inventory of 577 available properties represents an increase of 62.1% compared to the same time last year. Looking to new construction, sales are also way down with builders reporting significant changes in the number of homes going under contract in the past few months,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – GOLDEN/ARVADA

“New listings in Jefferson County are down which could mean there is another brief seller’s market in the new year. With the Fed trying to balance the economy, several interest rate increases this year have pushed some buyers out of the market. Solds for single-family homes fell 47.4% from a year prior however, the median sales price still ticked up 2.9% from a year ago to $640,000. Days on market is nearly double (34 days) compared to this time last year (18) another clear indication that sellers must price their home correctly if they want to sell quickly.

“For condo/townhomes, new listings decreased 34%, in part due to the traditional seasonal slowdown. Sold homes fell 44% and days on market increased 56.3% year over year as the median price for condo/townhomes reached $400,000, a slight increase from this time last year. Market conditions over the last few months have been very difficult to measure. The new year should shed new light on where just where we stand and how we continue to move toward a more balanced market,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“Activity across Pueblo’s real estate market continued to slow in November with new listings down approximately 25% with 116 fewer listings than in November 2021. Pending sales were down 43.3% compared to last November nearly matching the big drop in sold listings, which were down just shy of 47%. That said, our median pricing is holding up at $311,950, a 10.6% increase for the year. The 97.4% of list price received is down 1.8% compared to last November with average days on market up 8.7% from a year prior. We’re seeing that similar increase in our months supply of inventory, now at 2.6 months.

“We saw a total of 16 new building permits in November 2022, equaling the number from October of this year. Looking at the first 11 months of the year, we’re down 202 permits compared to the same period in 2021.

“Overall, the housing slowdown is having a ripple effect across the industry as we see more title companies, mortgage companies, and builders reducing staff. Many in the industry are predicting a tough year ahead,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“The Steamboat Ski Resort opened November 23 with the most amount of terrain that has been available on opening day since the 2014/2015 season. A far cry from November 2021 when the resort postponed its opening date by seven days due to weather/snow conditions. Ah, the difference a year makes- not only for ski conditions but real estate.

“The 2022 interest rate hikes were the fastest in decades- nearly twice as fast as the rate hike cycle of 1988-89. Understandably, the climate for real estate would turn stormy. Historically, November and December see fewer new listings come to the market – this November realized a significantly smaller number of new listings compared to last year. Active listings for single-family are almost 34% less than the same period in 2021. However, multi-family saw a 43.2% increase (63 units vs 44). The limited inventories represent approximately a two-month supply for each category. Median and average sales prices for single-family increased slightly over 8% from 2021; multi-family median/average sales prices also realized an annual increase in value of 33% +/-.

“The lack of inventory and the hike in interest rates are causing some sellers and buyers to shelter in place. Sellers may not want to sell because they might not want to give up their low interest rate or worry about where they would go if they did sell; buyers may have discovered they can no longer afford to ‘move up’ or purchase at all with the higher interest rate and mortgage payment.

“It’s important to remember that the Fed raising interest rates is an endeavor to slow the economy. Recent signs of inflation cooling resulted in some interest rate drops – but who knows if this trend will continue or stabilize. Conforming loan limits (30-year) are going to be higher in 2023; most counties in Colorado will have limits of $726,200- Routt County’s limit is 16% higher at $845,250,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTIES

“Last year, we were busy saying prices were going up, up, up. This year, we’re saying prices are going down – kind of. Logic says interest rates heavily impact the market. We found this logic to be true when interest rates were so low. Borrowing money didn’t cost much, so a lot of people were buying. Rates down, prices and volume of sales up. Now logic says interest rates going up should bring our prices down, but we continue to see YTD average prices for 2022 above 2021 for Summit, Park and Lake counties. Rates up, prices up and sales volume down – not quite what we expected.

“This not a completely logical market and it takes a little looking into to explain. From December 2021 to January 2022, in just one month, the average single-family home in Summit County sky-rocketed up a crazy 65%. The average price came down steadily through July but started going up again in August. The November single-family average price is down 28% off that January high. That high number in January hikes up the 2022 year-to-date numbers. Even with that crazy January 22, the month-to-month comparison of November 2021 to November 2022 is up significantly in all areas except Park County.

Sales have decreased 43% which equates to 57 fewer properties sold in Summit and a 63% drop (26 fewer properties) in Park, There are about 46%, more listings to choose from. That sounds like a lot of properties but the reality is, that equals 40 properties in Summit and eight in Park. Keeping in mind that a balanced market is considered to be six months of inventory, there are about three to four months of inventory currently available. So statistically we are still in a seller’s market.

“There are 393 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $139,900 and a high price single-family home in Breckenridge for $19.5 million. Out of the 108 sales in November, the lowest was a home in Park County for $235,000 and the highest was a single-family home in Breckenridge for $4.1 million. These numbers exclude deed restricted, affordable housing. In Summit County an average priced home is a little over $2.1 million, up about $8,000 from last month,” said Summit County REALTOR® Dana Cottrell.

TELLURIDE

“October and November sales were down significantly as compared to the first nine months of 2022. In fact, the 33 November sales were the lowest number of sales in that month since 2011. Additionally, the dollar amount of sales was down in Telluride, the Mountain Village and the remainder of San Miguel County, -16%, -12% and -18%, respectively. However, in all three sectors, the average sales prices were up with Telluride up 20%, Mountain Village up 37%, and the remainder of San Miguel County up 27%. Finally, there have been 566 sales so far this year through November in all of San Miguel County which is very close to 2017’s 575 total through November. However, the dollar amount of sales this year through November for the whole county is $1,076,000 and in 2017 the dollar amount of sales through November was about half that at $552,460. The bottom line, it is a seller’s market most of the time with few exceptions. However, after almost three years, the inventory is really picked over and buyers are rejecting properties that they just can’t get excited about. We toured about a dozen homes and condominiums in the Town of Telluride a few days ago. Most were just too weird or seemed overpriced for what they were. That being said, we did see a couple of homes and a couple of condos that were really unique and of high quality,” said Telluride REALTOR® George Harvey.

VAIL

“The market trend for the Vail area has stabilized in units and dollars, albeit a factor of comparison with the previous year and not a historical performance stabilization. November delivered a negative 47% in transactions and negative 45% in dollars. This monthly performance, across all pricing niches, is a bit misleading as two transactions totaled $69 million of the $190.6 million total for the month. The $1-million-plus niches had been even or positive comparisons before November however, all niches were negative compared to 2021. The slowing, which appears to be driven by macro-economic factors, did allow for a significant, 50% inventory increase compared to November 2021 and a 114% increase in months supply. The improvement in inventory should offer buyers more flexibility in their search for a new home. Even though the inventory is below historic levels, it is almost double where it had been.

There is no consensus from a macro standpoint on pricing trends however, from a local market standpoint, the movement within each price niche is variable and can offer buyer opportunities.

“We have just begun our ski season and the epic snow fall is accelerating visitor reservations. Guests see the beauty and lifestyle of the market and, coupled with an improving buyer’s market, we portend the possibility of enhanced transactions in the foreseeable future,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

Days on Market Until Sale

STATEWIDE

Days on Market Until Sale

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The November 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.