Concert tickets or homes – the search is demanding, inventory limited, and prices are ticking up

For buyers and sellers, the trick is being ‘just right’

ENGLEWOOD, CO – If you thought finding tickets to Taylor Swift’s upcoming Denver concerts was a challenge, the search for homes in Colorado hasn’t gotten much easier either, according to the latest Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR).

Despite a double-digit percentage bump in new listings coming to the market in May, limited inventory continues to create challenges for potential buyers while many others are being kept at bay by an average 7% interest rate on a 30-year mortgage. Although the metro area and statewide median price remains down from last spring and summer’s record highs, the combination of factors over the past several months has helped push prices for single-family homes across Colorado up slightly for the fourth straight month, and three out of the last four months for condo/townhomes.

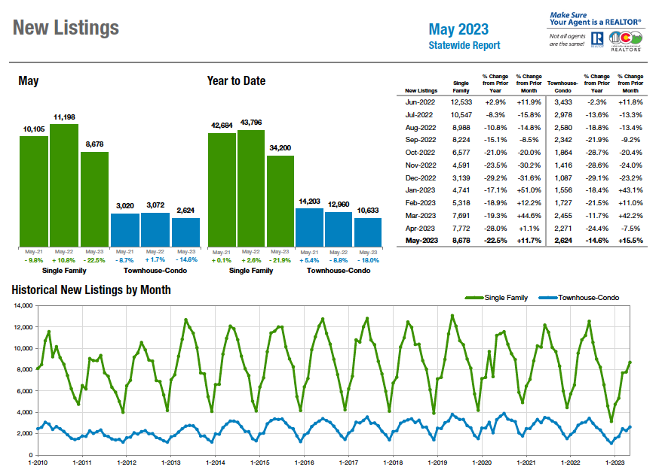

Statewide, 8,678 single-family new listings hit the market in May, up nearly 12% from a month prior but down more than 22% from May 2022. Another 2,600-plus condo/townhome new listings arrived across Colorado as well, up 15.5% from April but down 14.6% from a year prior.

In the case of Taylor Swift, the overall lack of ticket inventory in all price points has left fans, like many homebuyers, standing on the sidelines.

With local markets presenting their own unique variables and opportunities for buyers and sellers, the investment of time and energy to find your seat or home is real, and the biggest trick is to try to be ‘just right’ in price, quality, timing and more.

“If you think scoring Taylor Swift tickets is tough, finding a suitable home in Durango seems just as demanding,” said Durango-area REALTOR® Jarrod Nixon. “Single-family homes experienced decreases in new and sold listings while prices continued to rise. Townhomes and condos also saw a decline in new listings, but prices skyrocketed. Overall, the market is challenging for buyers as they face limited inventory and rising prices.”

“Buyers have more opportunity and a bit less pressure but shouldn’t get complacent, as that well priced, good condition property in that ‘just right’ location is experiencing multiple offers in just a few days on the market,” said Denver Metro-area REALTOR® Karen Levine. “Sellers, if you’re looking for top dollar, then your home better be priced ‘right on’ and your condition needs to be superior to your competition. Being ‘right’ is what’s most important in this fickle market.”

“Now more than ever, the variables present in the marketplace are creating challenges for sellers and buyers alike. Searches are taking longer. Buyers are willing to wait for the Goldilocks Home (the one that is ‘just right’),” said Fort Collins-area REALTOR® Chris Hardy.

“Potential sellers aren’t selling because they like their sub-3% mortgages and don’t see value in making a move-up purchase right now. Yet, demand for housing remains at an all-time high, and homes are selling at a faster rate than they were in December, January, or February. This isn’t just one housing market, it’s half a dozen or more housing markets – all with a specific socio-economic demographic that is searching for balance. You might say the market for buyers and sellers is all over the road until both find the lane that’s moving in a mutually profitable direction.”

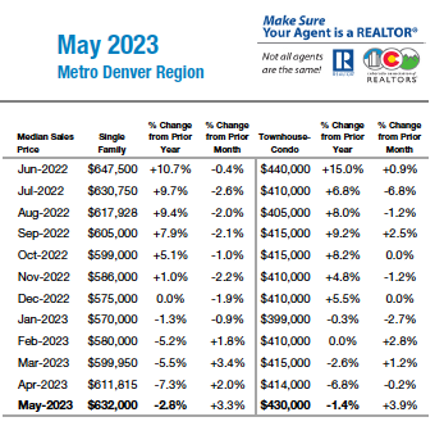

MEDIAN SALES PRICE:

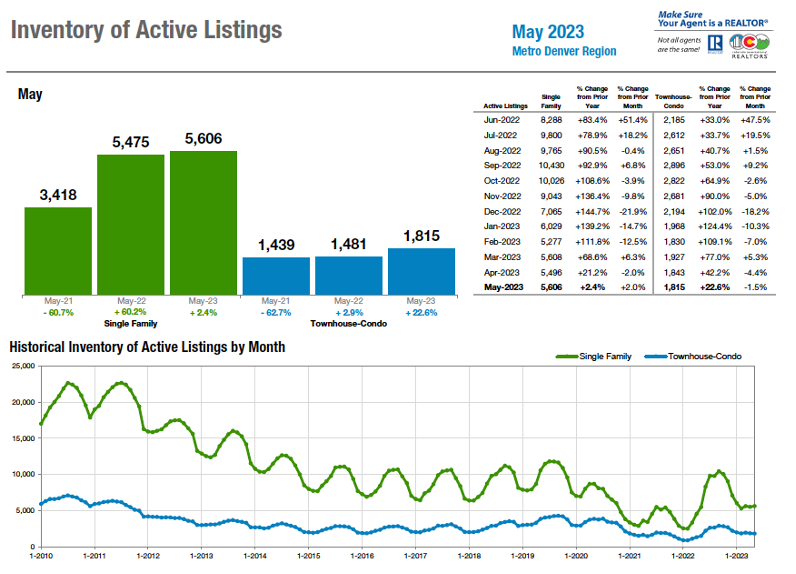

Other key highlights from the May Market Trends report and year-over-year comparisons include:

May 2023 compared to May 2022

- Sold listings increased nicely from April to May but are down roughly 25% from a year prior and remain well off the typical spring volume of recent years.

- Percent of List Price Received remains flat as sellers are receiving just over list price across property types in the Denver metro area, and just under list price statewide.

- Homes were moving faster again in May 2023 but nowhere near the pace from a year prior. Average days on market dipped to 26 days for all property types in the Denver metro area – more than double where things were a year ago. Statewide the number slipped from 47 days in April to 40 days in May for single-family homes – also nearly double where things were in May 2022.

Seven-county Denver metro area:

Statewide:

CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county, finished the month of May down more than 5% compared to the same time last year for the Denver metro area and statewide.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The Aurora market can be described as down, down, down, and up. Inventory remains very low compared to this time last year and is down in every Aurora zip code while inventory in Centennial remains the same as last year. Prices are also down in most Aurora zip codes including 80010 with a median price of $435,000, down 7%; 80013 has a median price of $505,000, down 7%; 80015 with a median price of $594,000, down 9% over this time last year; and 80016, currently has a median price of 907,000, down just 2%. The number of properties in each zip code that are under contract is also down. It stands to reason that if inventory is down, under contract will also be down. There just isn’t enough inventory out there for buyers. That said, with higher interest rates, I do believe that there are fewer buyers in the market right now. If they are waiting for interest rates to come down, they may be waiting for a long time.

“The ‘up’ in our assessment is days on market. It appears that, on some properties, buyers may have the option to sleep on the decision. However, that comes with a warning. The nice homes, priced well, and well maintained are selling fast with multiple offers. If buyers find a good one, sleeping on the decision may cost them the home of their dreams.

“Higher interest rates are having the intended impact. Sellers do not want to sell and lose their low interest rate. As a result, we have reduced inventory and buyers are left to digest the higher interest rates and higher payments,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Our markets in Boulder and Broomfield counties are settling in to a new normal. Interest rates have had their 15 minutes of fame and now buyers and sellers are focusing more on the state of the market and how to make a move. People don’t move because of the interest rates. They move because of life changes and necessity.

“Inventory is down 20% in Broomfield and 11% in Boulder as sellers hold on tightly to their low rates. The lack of inventory and continued buyer demand should presumably push up prices but instead, buyers are requiring concessions to get assistance with the interest rate and median prices have declined 6% since the beginning of the year. A much-needed correction, most REALTORS® would say, and a welcome break for buyers.

“As expected, average days on market has increased from about 30 days to 60 days and sales price/list price has gone from 108% to 99%. So, sellers are still getting a great price for their home, but they need to expect a bit of negotiation and have more patience. Buyers are thrilled to no longer have to outbid their competitors and are enjoying taking a bit more time to make a decision. Our market will likely hold into a steady, even summer while consumers adapt to this change in our market,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“What should have been a busy May just wasn’t. So now, what’s in store for the remainder of the year? Our total units sold remained significantly off last year’s numbers, down 25%. We also saw the median price drop 3.7% year over year. A lot of people are talking about how values are not crumbling therefore, we don’t have a housing issue. I would argue that if last year I sold 100 widgets for $10 and this year I sold 75 widgets for $9.70, we have an issue. We sold 25% fewer widgets at a lower price. And, if a home is a widget, then we have a lot of industry who feel that.

“The Pikes Peak region is not the only area seeing this change. Nationally, housing pulled back. With interest rates approaching 7% again you can feel buyers pause. Why buy a home when you can rent one for less? That is one hurdle we have locally. The other is the fact that sellers don’t want to jump out of a 3.5% rate into a 7% rate. We have a housing gridlock going on.

“Inflation numbers continue to be pesky. The Federal Reserve does not seem to be ruling out another rate hike whether in June or later in the year. Manufacturing continued to lag, a true indicator of the economy as we move forward. Layoffs are also continuing in certain industries. Add to that shrinking job openings and, many employers began to cut hours. All of these indicators don’t bode well in the long term for the U.S. economy. To top off the news, Germany has now admitted they are in recession. Posting two quarters of negative growth which is sure to be felt across Europe. The grand opening of China sputtered out quickly and they do not seem to have their housing/development situation under control. Across the world, nations are beginning to show signs of further declines economically. Then toss in the commercial industry in the U.S. which is beginning to crumble. Investors are turning the keys to large skyscrapers, hotels, and office buildings back to the banks as vacancies stay high and values plummet.

“Like in the 2008 timeframe, Angelo Mazilo, then CEO of Countrywide Home Loans said, ‘This is now becoming a liquidity crisis.’ With the follow up statement, ‘it’s going to get uglier.’ And like then, we are beginning to understand that a liquidity crisis is approaching, and that history shows us that it can get ugly from here. Has the Fed painted itself into a corner and does that ultimately affect housing? Time will tell,” said Colorado Springs-area REALTOR® Patrick Muldoon.

CRESTED BUTTE

“In the Gunnison Valley, the flowers are starting to bloom at the lower elevations even as the low temperatures help the snow stick around on the high peaks. The weather has been cool and rainy this spring, but sellers seem to think this summer will be a hot time to sell. Overall, the number of properties for sale is up a bit from this time last year, but there are some segments where the inventory growth is significant. For example, right now there are more than twice as many condos for sale in Mt. Crested Butte than were offered last year. Properties are staying on the market longer with days on market increasing by at least 45% to more than doubling in some areas giving buyers some time to make a decision and figure out their financing. However, average, and median prices of sold properties continue to increase so waiting for prices to go down could mean a long wait. We continue to see a tale of two markets – if properties are in great shape and priced correctly, they are selling quickly with multiple offers and if they need work and are pushing the limits of pricing, they are sitting on the market awaiting an offer. With the increasing inventory and continued buyer interest, the real estate market should be busy this summer and a good time to explore opportunities,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Have you noticed a few less ‘sold’ signs in your neighborhood? If you live in Denver County, you’re not wrong with roughly one-third fewer sales taking place across freestanding homes and condos alike this May. Within a small margin of difference for condos, Denver’s freestanding category saw 29.3% fewer sales, 542 to be exact last month, compared to 767 in May 2022.

“With supply being where the conversation usually heads in these instances, there is a discrepancy between the data as 19-20% fewer homes came on the market. That easily accounts for two thirds the sold data, but what about the rest? Well, that can be explained by a far slower demand than last year which is translated as ‘days on market.’ While the average home was on the market for 7 days last May, that number jumped 143% to 17 this year – a staggering increase which forces the seller to be a little more patient and provides the buyer a little more breathing room.

“By comparison, the ‘days on market’ figure was fairly average in May prior to 2020 however, sales were not. In May 2016, we saw 759 freestanding homes sold, 716 in 2017, 782 in 2018, 786 in 2019, 417 in the weirdest of weird years, 2020, 730 in 2021 and 766 just a year ago,” said Denver-area REALTOR® Matthew Leprino.

DENVER METRO

May is the month that we celebrate the coming of spring and new beginnings, new growth, and new life. In the metro-area real estate market I don’t know that ‘new’ would describe what we saw this May. We had fewer new listings, fewer homes under contract and fewer homes made it to the closing table compared to May 2022.

“What we did experience was more time for buyers to make decisions as homes stayed on the market for an average of 26 days compared to just 11 days a year ago. There were more, not a lot more, but more single-family active listings, an increase of 2.4% on the market, meaning buyers had 5606 homes to choose from compared to just 5475 homes last May. The attached condo/townhouse market also saw fewer new listings, fewer under contracts and fewer homes closed. Sold townhouse/condos totaled 1460 units in May, compared to 1836 units a year ago. Days on market did increase as we also saw with single-family homes. Townhouse/condos were on the market an average of 26 days compared to just 10 days in May of 2022. Inventory has increased in both single-family and townhouse/condos, with single family sitting at a 1.8-month supply and townhouse/condo with a 1.4-month supply.

“What does this mean to buyers and sellers? Buyers have more opportunity and a bit less pressure but shouldn’t get complacent, as that well priced, good condition property in that ‘just right’ location is experiencing multiple offers in just a few days on the market. If you’re a buyer willing to put in some sweat equity and accept a home in poorer condition, your opportunities have increased. You may have more negotiating power regarding price and or seller concessions.

Sellers, this warning goes out to you as well. If you are looking for top dollar, then your home better be priced ‘right on’ and your condition needs to be superior to your competition. If you’re not willing to do those two things, your property will most likely sit on the market longer and receive under list price offers. Typical buyers have not been willing to compromise, but they are willing to pay for the ‘right home.’ In conclusion, I’d say that being ‘right’ is what’s most important in this fickle market,” said Denver Metro-area REALTOR® Karen Levine.

DOUGLAS COUNTY

“The May market in Douglas County is best described by ‘all or nothing’ conditions. Increased inventory of ‘normal’ listings compensated for 7%-plus mortgage rates on the buy-side, causing an increase in market velocity. However, a lack of ‘exceptional’ listings drove prices up and days on market down from April. The state of the top-tier market segment (that is, homes priced well, in excellent condition, or both) was reminiscent of the spring 2022 frenzy. Cash offers, appraisal gaps, escalation clauses, and bidding wars were not uncommon in May, however, you’d only find such demand in that top decile of listings. For the average listing, a few showings in the opening weekend was the best-case scenario, as monthly housing costs continued to discourage entry- to mid-level buyers.

“The median sales price of single-family homes increased slightly month-over-month to $725,000 in May but remains down 5% from May 2022’s $756,000. Days on market significantly decreased (-32%) to 26 days from April, which is relatively natural for this time of year. The most significant statistic in the single-family market was the percentage of list price received, which reached 100.1% in May, driven higher by the aforementioned bidding wars on exceptional listings.

“The townhouse/condo segment tells a much different story, where the early stages of a contraction may be appearing. Days on market surprisingly increased by four days month-over-month to 40 days, a curious twist considering the lack of multifamily inventory in the county. Prices did increase slightly, but the number of sold listings remained consistent between April and May, at 105 and 106 units, respectively. With zoning density being a hot issue in local politics, it will be interesting to see the effects of changing inventory on this segment in the near future,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO

“If you think scoring Taylor Swift tickets is tough, finding a suitable home in Durango seems just as demanding. Single-family homes experienced decreases in new and sold listings while prices continued to rise. Townhomes and condos also saw a decline in new listings, but prices skyrocketed. Overall, the market is challenging for buyers as they face limited inventory and rising prices,” said Durango-area REALTOR® Jarrod Nixon.

May 2023 Durango highlights include:

Single-Family Homes

- New listings for single-family homes experienced a 12% decrease compared to May 2022.

- Sold listings took a tumble with a staggering 38.8% drop.

- Median sales price for single-family homes increased by 2.6%, reaching $785,000.

- Average sales price for single-family homes rose by 6.6% to reach $950,000.

- Inventory of homes for sale fell 8.8%.

- Months supply of inventory stood at 3.2, a slightly tighter spring selling season volume.

Townhomes/Condos:

- Listings for townhomes and condos experienced a 14% decrease compared to May 2022.

- The month’s supply of inventory stood at 2.6, indicating it’s still a very competitive market.

- The median price for townhomes and condos rose 26% to $460,000.

ESTES PARK

“What a change from this time last year. We’ve gone from multiple offers and well-over asking price sales to sitting with a wonderful home active and ready for a new owner. The market is still moving, but it seems strained and less interested than the last couple of years.

“Prices keep climbing for townhouse/condos, but single-family homes are seeing a decline and potentially a correction. Townhouse/condos have crept up in average sales price 11.7% compared to last year, where single-family homes dipped 2.9% over last year.

“Average days on market reflects this disconnect from the hasty actions of last year on single-family homes. They are holding on an average of 50 days, a bump of 61.3% over May 2022. Townhouse/condos are stealing the show with fewer average days on market, 56, a dip of 25.3% compared to May last year.

“Is it the general pricing that is driving sales toward townhouse/condos? The average price for a single- family home in Larimer County is $669,016, and townhouse/condos average sits at $464,810.

Traditionally, inventory is low, and getting even lower. Single-family homes are being listed at an average of 12.9% less than last year, and townhome/condos are being listed less too, with a dip of 4.1% compared to May last year,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“This month’s real estate market numbers remind me of that phrase, “all over the road.” The lack of homogeneity creates uncertainty for both buyers and sellers: Is a home in good shape for under $500,000 going to sell quickly? Probably. Median price has tipped downward 5% but is still at $595,000 and homes on average are selling for full price as opposed to 5% over asking like last summer. How about that home that is so-so and listed at $750,000 on a huge lot in a mature neighborhood? Hard to tell. Properties active on the market are up 46.7% from last May, yet sales are down 7%. Clearly, inventory is sitting on the market longer. Further, what about a new construction home priced aggressively but has a steep metro taxing district mill levy for the next 30 years? Again, it all depends on the buyer motivations. Buyers’ motivations and abilities to purchase are all over the road!!

“The toughest part about this type of market is that sellers still expect a premium list price for their homes despite interest rates still over 7%. Sellers, in the more interest-rate-sensitive price-points, have gotten the message a little quicker since first-time home buyers (who typically make up more than a third of the home buying market) are still on the sidelines waiting for those interest rates to come down. Sellers in this price range have had to lower their expectations to accommodate the vacuum of qualified buyers. But what about the higher-end home sellers in the high $700s? Demand for those homes has been strong even throughout the period of higher interest rates. The challenge here is finding exactly the right price. If a home in this price range is overpriced by $20,000, it will sit on the market for weeks until a buyer comes along and makes a lower offer, or the seller drops the price to attract a broader spectrum of buyers. Condition and location are playing much larger roles in decisions to buy than they have in years past. If the home isn’t in pristine condition – sellers should price aggressively. If the home has some location stigmas (backs to a busy street, adjacent to high tension power lines, again, the seller will need to accommodate price to offset these kinds of material defects.

“Now more than ever, the variables present in the marketplace are creating challenges for sellers and buyers alike. Searches are taking longer. Buyers are willing to wait for the Goldilocks Home (the one that is ‘just right’). Potential sellers aren’t selling because they like their sub-3% mortgages and don’t see value in making a move-up purchase right now. Yet, demand for housing remains at an all-time high. Even with two months of inventory for sale – homes are selling at a faster rate than they were in December, January, or February. This isn’t just one housing market, it’s half a dozen or more housing markets – all with a specific socio-economic demographic that is searching for balance. You might say the market for buyers and sellers is all over the road until both find the lane that’s moving in a mutually profitable direction,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION

“Some encouraging signs in Mesa County with May’s pending sales up 3.3% compared to April, and solds up as well with 300 compared to 233 in April. Median sales price in May hit $406,000, and average was $445,412. The increase in activity pushed active listings down for the first time in 12 months. The strongest activity was in the $300,000-$600,000.

“Year-to-date, comparing 2023 to 2022 does not look so bright. New listings are down 25.1%, pending sales are down 15.7% and solds down 26.6%. We are still seeing a lot of buyers out there looking, but they are taking more time to make a decision, resulting in days on market increasing to 92,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“Without sounding like a broken record, our selling season this year has been virtually nonexistent. Buyers are sitting on the fence waiting to see what happens with interest rates and hoping the housing market prices will decrease. For single-family homes the median sales price did just that and is now sitting at $700,000, a 2.1% dip. New listings are down 26.3% however, average days on market increased to 18 days, up 80% year over year.

“As for condo/townhomes, the median sales price held steady at $430,000. With new listings decreasing 25.6% and a whopping 266% increase over this time last year in average days on market at 22. Sellers will need to have the best house on the block to get it sold quickly. In the meantime, we’ll wait and see if the rates jump up again and if so, how those rates impact our pricing,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“Pueblo’s housing market continued its downhill coasting in May with new listings off nearly 21% from a year ago and down 18.3% year to date. Pending sales were down 10% compared to May 2022 and are down 22.2% year to date. The month of May also delivered its biggest drop in the sold homes category, down 27.2% from a year ago and down 31.4% year to date, closing just 220 sales.

“The median sales price in May dropped 11.8% to $300,000 and is down 1.6% year to date. The percent of list price received also dropped 1.5% in May to 98.9% and is down 1.5% year to date. Sellers are having to make concessions to get homes sold and that is contributing to an increase in average days on market, up 42.2% year to date to 91 days.

“Buyers are still on the sidelines concerned about 6-7% interest rates. New building permits hit 40 in May with 12 in Pueblo West. Through the first five months of the year, 144 permits have been pulled. That is still down 48% from the first five months of 2022. The open houses are happening, but potential buyers aren’t showing up,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Eighteen months ago, the listing price was still the starting price – just like it had been for the previous year. A year ago, the Federal Reserve flipped a switch implementing a rapid rise in interest rates in an effort to slow the economy as they started their attempts to tame inflation – thus creating apprehension that didn’t do a thing to help a housing shortage.

“Roll forward 12 months and today, brokers can more accurately predict selling prices. Yes, this market is experiencing some overzealous list pricing that will eventually be met with price reductions; however, the properties that are priced to location, condition, views, etc. will likely get their asking price and potentially a multiple offer situation. This is evidenced by homes receiving 99.2% and townhomes/condos receiving 101.6% of their list price.

“There are still some record-high sales occurring in some developments. May of this year delivered over 15% fewer single-family new listings/13.8% active listings and almost 28% less multi-family new listings/12.5% active listings than the prior year. While this resulted in 38.5% fewer homes going under contract, the number of homes sold was equivalent to last year.

“For multi-family, the story was different with 29.7% fewer homes that went under contract and 37.8% fewer properties sold. Months’ supply for single-family is just under three months and multi-family is at 1.5 months – approximately two weeks more supply than the same time last year. Median and average sales prices were down for both categories from May 2022. For buyers hoping for prices to fall, they need to look at the continual decline of inventory and the offerings during the period in which the prices fell – it may not paint an accurate picture. As the Steamboat area exits ‘mud season’ and locals gear up for summer season; the onset of third quarter historically produces Routt County’s largest volume of real estate transactions for the year,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“April showers bring more May showers to Summit County and Park County. If you are looking for that mountain retreat, now there is more inventory and prices have come down in some sectors. So, depending on the neighborhood, flowers are coming up for buyers or sellers!

“Median sale prices were down 10.3% and the number of sold properties fell 19.2% compared to last year. Active listings were up 3.4%, which is lower than we had seen in the last couple of months. We have consistently seen a higher inventory percentage compared to the fewer sales percentage for months, which leads us to have between a one-month to an over six-month supply of inventory depending on the town. Will May showers bring June flowers?

“Comparing May 2023 to May 2022, the average sales price for single-family homes in Summit dropped 15.9%. The year-to-date drop is even higher at -16.8% to $1.9 million. The average sale price for all types of residential properties was $1.1 million and the condo sale price average was $822,856. Sellers received about 97% of their list price.

“Park County’s year-to-date average single-family home price hit $646,479, while Lake County’s was $500,500. There are 489 residential active listings in the Summit MLS (over 100 more than last month) that range from a low-price, mobile home in Park County for $130,000 and a high price single-family home in Breckenridge for $19.5 million (on the market for 1,023 days). Out of the 113 sales in May, the lowest was a condo in Grand County for $140,000 and the highest was a single-family home in Breckenridge for $3 million. These numbers exclude deed restricted, affordable housing,” said Summit County REALTOR® Dana Cottrell.

VAIL

“The continuing trend of striving for a more stable market after the last few years of extreme volatility is progressing. May is a month referred to as ‘Shoulder Season’ as we begin to transition from the winter to summer market dynamics. July 2022 is when we began to see the market transition from the volatility of the market surge and should become a more favorable comparable as we enter July 2023. Thus, closed sales for the month were negative 44% and in the same range of minus 39% year to date. The market activity is controlled by active inventory which is flat compared to 2022. We have yet to see the usual bump in listings that historically occur as the summer season approaches.

“The single family/duplex inventory is positive 7% and condo/townhomes is negative 6% which is a driving factor in the sales activity as we need more product in key price niches. We have several new construction projects under way and that should be a positive factor in the coming months. The other factor that should be a catalyst to increasing inventory is the stabilization of interest rates, albeit at a higher level than the recent past giving sellers more confidence in an exit strategy. If this trend continues, hopefully our months supply of inventory, which is still low at 3.3 months, should stimulate sales and continue the trend toward a more normal market.

“There is an adage ‘You come to the valley for the skiing and then stay for the summer lifestyle.’ The high peaks still have some snow however, the rivers are running high, the golf courses are open, as are most of the hiking and biking trails. These are the reasons why the summer has become a greater factor in real estate sales as the valley evolves,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE:

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The May 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing nearly 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.