Interest rates defined 2023 housing market and will likely drive the story again in 2024

ENGLEWOOD, CO – Defining the 2023 Colorado housing market came down to one major factor: interest rates. No other single component of the housing equation had as far-reaching effects on the market as the Federal Reserve’s raising of the Federal Funds Rate, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

Beginning in March 2022 and carrying through 2023, the rate rose from just .25% to 5.5% in a span of 20 months. The result pushed would-be buyers and sellers to the sidelines as buying power diminished and potential sellers decided to sit tight on their locked-in low rates. The combination of factors helped keep inventory near historic lows, particularly in the lower price ranges, and pushed median prices up, albeit nowhere near the double-digit appreciation seen in markets statewide throughout the pandemic.

“The fundamental economic principle of supply and demand emerged as the dominant force preventing a price downturn,” said Steamboat Springs-area REALTOR® and CAR spokesperson Marci Valicenti. “In 2023, the number of new property listings in our market reached the lowest point in the last 18 years, underscoring the scarcity of available housing.”

The combination of these elements effectively stalled what was, prior to these events, a red-hot and some might even say, unsustainable housing market where a 30-year mortgage hovered in the low 3% range compared to the high of 8% in early fall 2023.

“Not only have high mortgage rates been a death-knell for first time homebuyers or homebuyers without a minimum down payment, it has also stopped the move-up market where a huge percentage of current home owners have mortgages under 3.5% and don’t want to trade that in. This has further exacerbated low inventory challenges for those buyers still in the market which has led to median prices remaining stubbornly high,” said Fort Collins-area REALTOR® and CAR spokesperson Chris Hardy. “The U.S. economy, however, has chugged along, beating expectations with better than average job creation, relatively low unemployment, declining inflation, and consumer spending also quite robust. With those factors in place, it seems that the key to a rebounding housing market is quite simply lower mortgage interest rates as there is likely quite a bit of pent-up demand for housing across all sectors.”

But it’s the hope and forecast of a stabilizing or downward trend in the interest rates that has buyers and sellers buzzing as we head into 2024.

“Interest rates have come down and there is a fresh, new outlook on the market. Buyers are adapting to the new normal and sellers are learning that, with fewer competitors, they can still win in this market,” said Boulder/Broomfield-area REALTOR® and CAR spokesperson Kelly Moye. “The activity for 2024 is already brewing and my prediction is that if rates continue to decline, buyer activity will significantly change, prices will go up, and days on market will come down. The wait for lower rates and nostalgia of our past 2021/2022 markets is over. A more realistic outlook for 2024 will breathe some new life in what was a lackluster 2023.”

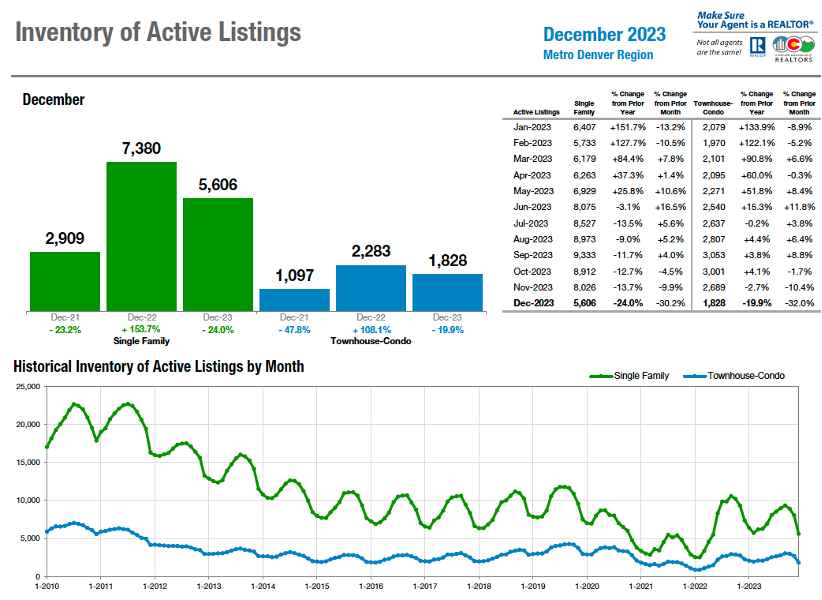

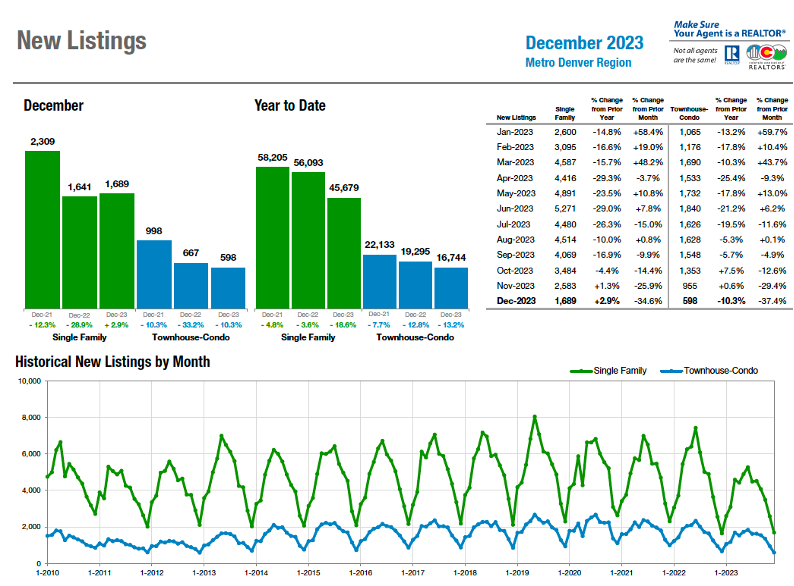

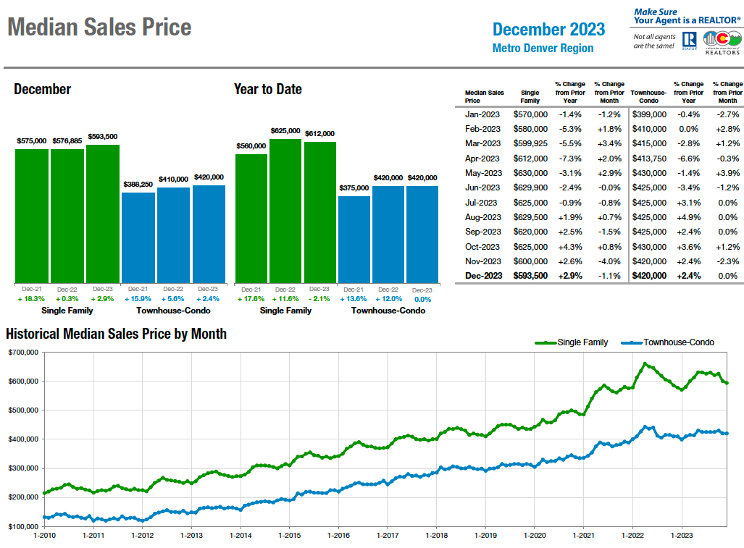

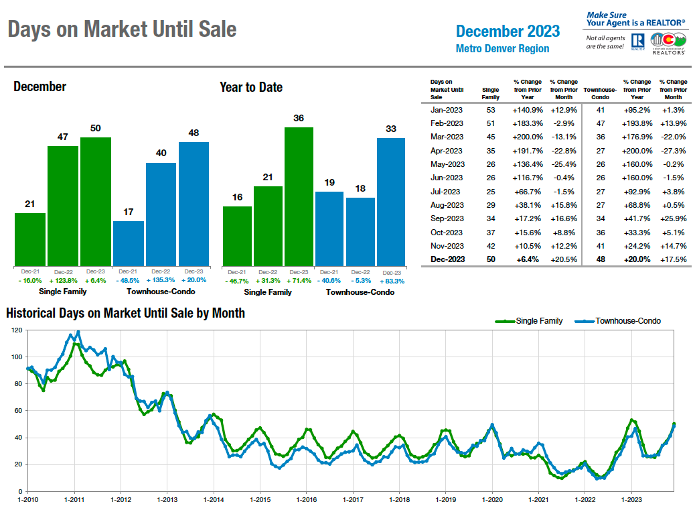

Seven County Denver area Market Overview:

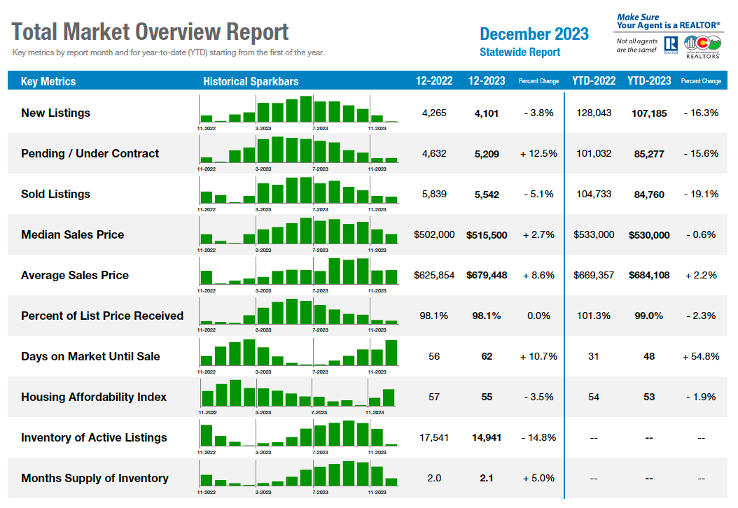

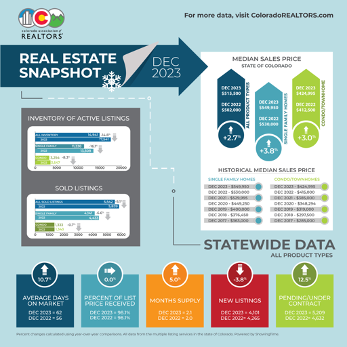

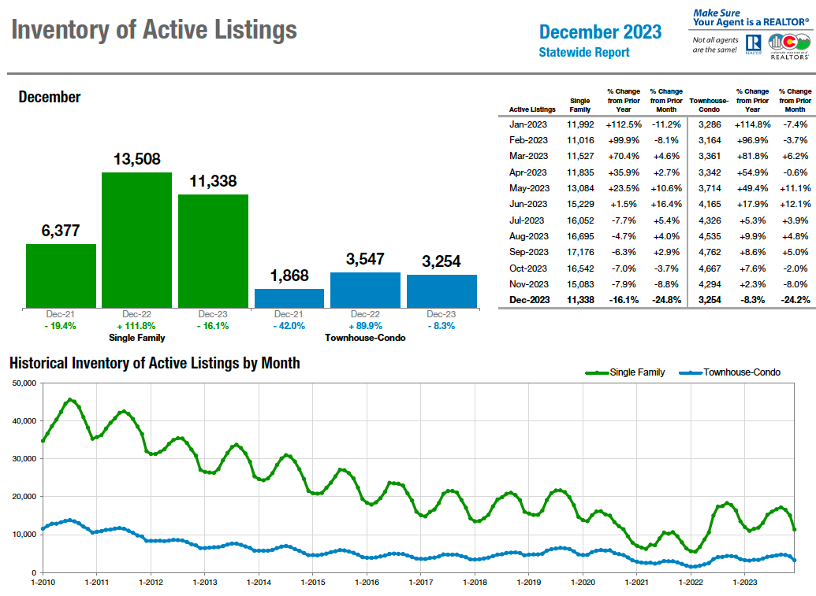

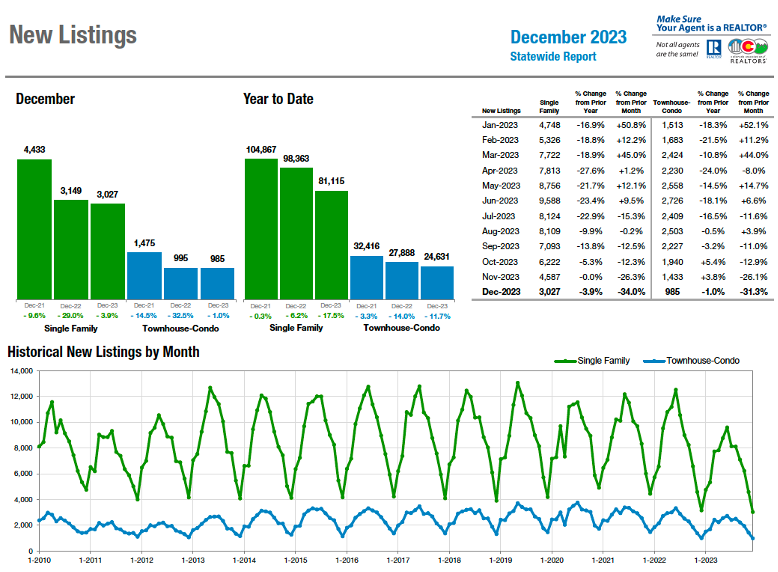

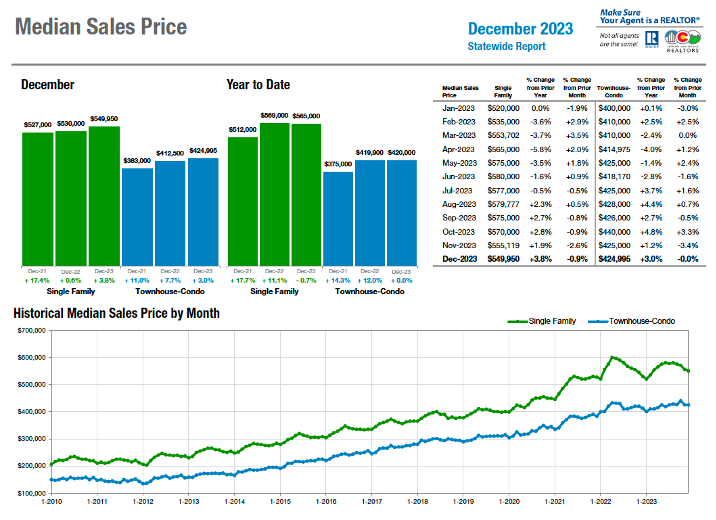

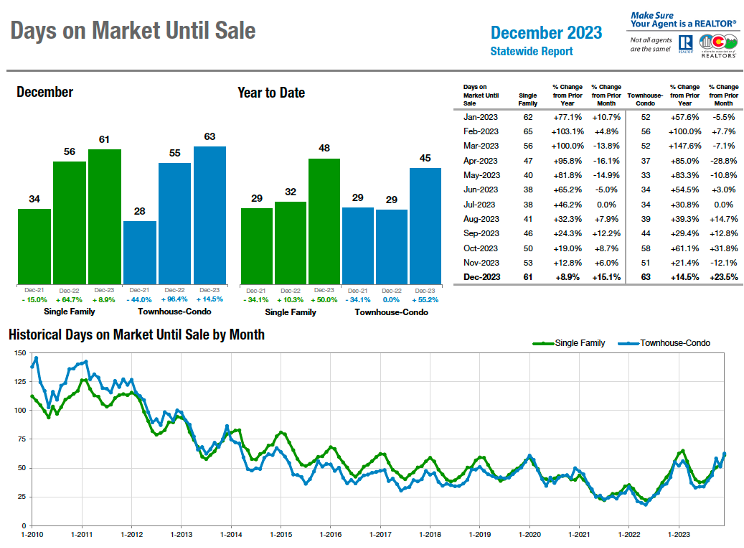

Statewide Market Overview

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“While some areas of the Denver metro market experienced price reductions and longer times on the market thanks to rising interest rates, the numbers show that the Aurora, Centennial, Adams, and Arapahoe County areas did not see the same price decreases. Most zip codes experienced a 2%-5% increase in sales price over December 2022. Inventory in the same Adams and Arapahoe County areas was down approximately 30% in each zip code. The low inventory helps explain why solds were down and high demand explains why prices were up. Average days on market was also lower than a year ago.

“Looking for some of the best values in our market will take you to the 80011-zip code with a median price of $445,000, a 6% increase over December 2022. In the central Aurora zip code 80013, we saw a 2.6% increase over 2022 and a median price of $490,000. Newer and more pricey homes in 80016 delivered a median price of $790,000, up 5% from December 2022. The 80111 zip in Englewood/Greenwood Village gained 12.7% in pricing to a median of more than $1.14 million.

“The higher interest rates have certainly kept the year-over-year price increases more modest however, the low inventory, down 30% for most areas, has allowed sellers to enjoy continued appreciation.

Given the current demand and low inventory, it stands to reason that if interest rates come down, there will be more demand for housing. It is very possible that buyers could see bidding wars and showing frenzies once again. The crystal ball is cloudy and will depend on the interest rate decisions of the Federal Reserve in the year ahead,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“In spite of a robust economy, strong job market, and continued strong demand to live along the front range, the Boulder and Broomfield housing markets fizzled out in the last quarter leaving many sellers wondering what happened and closing out the year with a big sigh. There are always numerous factors that lead to a significant change in the way the market flows, and this time is no exception. However, the quick and steep rise in interest rates certainly took most of the blame with sellers unwilling to lose the typically low rates they currently have and buyers unwilling to take the one that’s available. Even with massive seller concessions offering the promise of lowering buyer’s interest rates, their efforts were ignored as the year came to a quiet end.

“With such little inventory, it’s no surprise that sales were down 13.5% in Boulder County and -18% in Broomfield. Prices tried to hang on and at the end of the year, landing just about where they started at the beginning of the year for Broomfield and about 3% lower for Boulder County. The average days on market increased to 52 in Boulder and sits at just 30 in Broomfield, highlighting that houses sold in a relatively quick timeframe, but the diminished buyer pool failed to push those prices up.

“Events in the Middle East, the upcoming elections, and the holidays also played a role in the slowdown at the end of the year. However, bright and early on January 2, those phones started to ring. Interest rates have come down and there is a fresh, new outlook on the market. Buyers are adapting to the new normal and sellers are learning that, with fewer competitors, they can still win in this market. The activity for 2024 is already brewing and my prediction is that if rates continue to decline, buyer activity will significantly change, prices will go up and days on market will come down. The wait for lower rates and nostalgia of our past 2021/2022 markets is over. A more realistic outlook for 2024 will breathe some new life in what was a lackluster 2023,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“I would begin by saying 2023 was anticlimactic. Home prices held and the stalemate between buyers and sellers remained. In general, buyers opted out in 2023 as shown by the month-over-month declines in sold listings, and sellers didn’t budge on pricing. What did sell in 2023 pushed median prices up, but overall, stagnant may be the word of 2023. December’s numbers summed this all up. Sold listings were down 11.7% year over year, the median price was up 3.9% while active listings fell 6.3%. A common occurrence throughout the past year. Despite prices holding, overall units sold plummeted in the last few years. In 2021, 6.89 million homes were sold nationwide. In 2022, the total fell to 5.67 million, and by 2023, only 4.79 million homes sold, according to statista.com. And the entire industry, both locally and nationally, felt that.

“Moving forward, we have some strong headwinds on the economy that could really hamper the housing market. Consumer credit debt cleared $1 trillion with Mastercard recently reporting that 30-day delinquents spiked. Over the past 12 months, we had 1.5 million vehicles seized, up from 1.2 million in 2022. Forty percent of student loan payments were missed and nearly 40% of small businesses failed to pay rent as of November 2023. We are also at a 50-year high on multi-family apartment builds that are coming online and that will put some more down pressure on rents, which are in fact competing with sales. A recent Fannie Mae survey showed that 84% of people thought it was a terrible time to buy, adding to the lack of buyer demand. Germany’s economy shrank adding to fears of a European recession. Japan admitted they are in recession now and remains the world’s third largest economy. China’s s housing crisis is escalating, and their form of QE is not slowing that down. Add to that one of their shadow banks, Zhongzhi Enterprise Group, just filed for bankruptcy. China has also lost a few large developers. I mention all of this because we are living in a synchronized world economy. It is very hard to believe that three out of the top four economies can be having such massive issues and America is not.

“If we look at past cycles, it is hard to ignore the fact that it takes two years from the tightening of monetary policy to the point things begin to look worse off than we thought. If 2023 brought the failure of several banks, 2024 will also show us that we have more banking issues in front of us. June of 2024 will be the 2-year mark, and although the Federal Reserve claims we have achieved the ‘soft landing’ it wanted, we can look back at 40 years of soft landings and realize, none of them were soft.

“In January 2012, then Fed Chair Ben Bernanke was quoted saying, ‘I remind you that the Fed has not been terribly successful with soft landings. We have a chance to get one. All else being equal, I think it would be good if we could achieve that.’

“Despite record debt levels at both personal and government levels, is this time different? Does the Fed finally pull off the soft landing that all fairy tales are made of? The fact that Fed Chair Powell is talking about rate cuts on December 13, 2023, just two weeks after saying we were higher for longer, tells me they see something there that they did not tell us about, and it probably isn’t good. The coming year should be very interesting, and we should all be hoping the Fed achieves the soft landing they are hoping for,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“In Colorado Springs, the single-family/patio homes sales activities in December 2023 were mediocre. The 577 new listings compared to 895 in the previous month and 1,891 active listings compared to 2,397 in November 2023. There were 777 sales compared to 851 in December 2022. The month’s supply of active listings was 2.4, and average days on market was 46 days. The average sales price was $519,961 compared to $490,910 in December 2022, representing 5.9% increase, and the median price was $455,000, a 3.2% year-over-year increase.

“Last month, 29.6% of the single-family homes sold were priced under $400,000, 30.4% were between $400,000 and $500,000, 30.5% were between $500,000 and $800,000, and 9.5% were priced over $800,000. Year-over-year, there was a 29.6% drop in the sale of single-family homes priced between $300,000 and $400,000, and 45.8% increase in homes priced over $1 million.

“In our market, the most outstanding real estate stat of 2023 shows an astounding shift in the percentage of single-family patio homes sold under and over $400,000 price points. In 2023, 27.9% homes sold were priced under $400,000 and 72.1% were priced over $400,00, compared to 2019 when 72.2% homes sold were priced under $400,000 and 27.8% were priced over $400,00. The average sales price in 2023 was $539,155 compared to $366,371 in 2019, representing a 46.8% increase. Also, in 20023, there were 23% corresponding deceases across all three crucial data points: new listings, sales, and year-to-date sales volume.

“Knowing that almost every expert’s best guess about where the economy is heading changes on an on-going basis is more evidence of just how difficult it is to predict what’s ahead. However, the fact is, people need housing and there is a huge pent-up demand. Buyers who postponed buying decisions expecting prices and interest rated to drop have learned the hard lesson. The rental cost continues to rise with no reason to expect a downturn. In the backdrop of these factors, it is reasonable to expect a modest 10% increase in sales in 2024, barring any significant negative economic changes,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

Overall, 2023 saw fewer sales for higher prices than 2022 in the Crested Butte and Gunnison areas, but the devil is in the details. The Crested Butte area had 25% fewer sales for 16% less total dollar volume while the Gunnison area had 9% more sales for 10% more total dollar volume. Overall, the market was down 18% in total sales and 6% for total dollar volume.

“The number of single-family home sales in the valley increased from 2022 to 2023. In the Gunnison Crested Butte Association of REALTORS® MLS area, there were 252 single-family sales in 2023 vs. 234 in 2022. The majority of that increase was in the area around Gunnison where there were 124 sales vs. 93. The Crested Butte area also went from 80 to 85 sales of single-family homes. These numbers are quite close to the number of sales in pre-pandemic 2019, but the average prices have changed dramatically. In 2019, the average price of a single-family home in the Crested Butte area was $1.37 million. By 2023, that increased 67% to an average price just shy of $2.3 million. However, in the more affordable Gunnison area, the 2019 average price of $397,060 increased a whopping 95% to $773,546 in 2023. Looking at a shorter time frame, prices from 2022 to 2023 stayed flat in the Crested Butte area but went up 33% in the Gunnison area.

“The townhome and condo market also has seen some dramatic changes but, unlike single-family home sales, the number of sales were down about 35% from 2022 to 2023. Average prices have also increased substantially since 2019 (between 35-65% depending on the area), with the largest increase in the Crested Butte area where the average price hit $791,620 in 2023 vs. $470,868 in 2019.

“Heading into 2024, we are seeing more listings come on the market and they are staying on the market for a longer time before selling. The number of residential properties for sale is up about 25% over this time last year, but most of those are condos or townhomes. The number of single-family homes for sale is down a bit.

“Given the new average prices, our typical buyer has shifted to a more affluent level then we had pre-pandemic. In 2019, there was one sale for $5 million or more. In 2023, there were 11 and there are currently 31 properties for sale. On the other end of the spectrum, the least expensive property for sale in the Crested Butte area is a 447-square-foot studio listed for $379,000 and in Gunnison, there is a two-bedroom condo with 861-square-feet listed for $235,000 that is currently under contract. The least expensive active listing in Gunnison is $385,000 for an 899-square-foot condo.

“With many unknowns in terms of the interest rates, overall economy, oil prices, the election, and the stock market, we head into 2024 hopeful that more people will be able to accomplish their dream of owning a home in the mountains – whether it is to live here full time or to enjoy as a vacation home. We anticipate more properties for sale and prices should continue to stabilize but will not likely go down as inventory grows but remains at historically low levels,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“The Denver County market, from as far back as we measure, can be summed up in one word: volatile. Explosive growth, prices, and previously considered impossible metrics have finally reached the trailing edge of a bell curve that signifies not a downturn, but rather a simmer, for now. With supply finally reaching points not seen since the end of the Great Recession and early 2010s, prices have stabilized, though statistically speaking, have not dropped. This last suggestion is an interesting development as the main tenant of supply and demand has always been an inverse reaction – not the case in Denver or again, not yet. As supply has increased, prices have stabilized which helps our prediction going into 2024’s spring and early summer market. Should prices begin to rise again, they will push supply down. On the other hand, a still-increasing supply would certainly usher in a lower price and while it would be logical to ask which of these is going to happen and in what order, external factors such as interest rates, general economic conditions, and the reality that this is a major election year all act as main ingredients to what the overall 2024 recap will be.

“If interest rates decline, that doesn’t necessarily mean that sales go up, and if the corresponding supply decreases, price increases will occur. Denver may be at or near the end of its real estate boom as crime, homelessness, congestion, and overall quality of life has changed since this explosive growth began. We just may be in a place of flat or negative growth as net migration is showing decreases throughout the state. When this happens, the main catalyst for price being demand will go down and bring prices along with it.

“Circling back on volatility, the year-over-year median price changes have almost certainly worn out those would-be homebuyers in the next handful of years who have next to no desire to enter the homebuying race again. During six months in 2021, the median price rose over 20% from the same months in 2020, eight in 2022 were north of 10% yearly gains and, in stark comparison with last year, in 2023 all but two were negative price growth months as compared to the previous year.

“The unsustainable, unpredictable, and indeed volatile time seems to be past us and also having a little bit of an overcorrection. There will always be price growth when we look at stats on a larger scale but the rubberbanding between years will ultimately become the undoing of skyrocketing prices. I’ve heard it accurately described as ‘the enemy of high prices is high prices’ and that is exactly what played out as we ushered in 2023. Between the months of February and March, Denver saw its first instance since the Colorado Association of REALTORS® has tracked the data of consecutive months experiencing price decreases. At -6.5% in February and a whopping -12.6% decline in March, if real estate eras had headstones, that is when Denver’s would have gone up.

“With an averaged month’s supply of inventory in Denver within the freestanding category being 1.58 during 2023, 2021 saw a combined average of .45 – increasing buyer choice by three times. With more choices come lower prices due to the lessened negotiation power of the buyer.

“From my chair, 2024 looks to be a cruise control year. Every graph and metric shows a flattening of all numbers except supply. Trendlines show a reverse of growth and the ever-present volatility looks something like predictability. Remembering that prices always increase in the long run and with trends coming and going with time, buyers should be paying very close attention to entering the market. Sellers will still benefit from demand for Denver though certainly substantially less than they have. Marketing will return to individual properties and hunger from the brokerage force will return. Houses will not sell as quickly as they have, and all parties are now welcoming back patience to their process. Buyers will have to wrap their heads around rates not being as low as previous years but still being very low from a historical perspective. Overall and in the long-run, prices won’t go down and so the best time to buy is always today – high prices or not. The only thing that changes is how long it will take to see a return. Being that prices will statistically be the same, more or less, this time next year, buyers will be safer than they’ve been in years, parking their money in real estate and hoping for longer term gains,” asks Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“Last year was undoubtedly one of the most interesting, unpredictable years for the real estate market in Douglas County. Despite 23-year record high mortgage rates, significant increases in property tax and insurance costs, and general macroeconomic uncertainty, over $4.9 billion of real estate changed hands within the county, down around 17% year-over-year. Prices have generally held steady over the past three years while the number of transactions slowed down, causing the reduction in overall volume.

“The year began and finished on a slower note, with the height of the selling season occurring between March and August as expected, just before interest rates reached 7% territory. The median close price during 2023 was $677,618 – a slight decline from the 2022 figure of $690,000 but far above the 2019 pre-pandemic median of $480,000. The median days on market before a sale increased by 10 days over 2022 to 17 days, its highest level since 2019. Variability in performance at different price points began to emerge, with transactions in the $500,000 – $1 million market facing more potent affordability challenges. Interestingly, for a majority of the year, homes priced above $1 million actually sold significantly faster than in the $500,000 – $1 million range.

“The desirability to live in Douglas County did not cease last year, as we continued to be one of the most in-demand suburban markets in Colorado. The sustained lack of inventory and enormous demand are likely to keep prices stable in the near future, regardless of turbulence in the U.S. economy. While the market may begin favoring buyers more as interest rates stabilize, sellers still hold plenty of leverage in their transactions since alternative options for buyers remains scarce,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“In the year’s final month, both new and sold listings took a modest dip compared to the same period in 2022. La Plata County saw 140 homes for sale, a 5% decrease from December last year. While the number of listings decreased slightly, the average sales price rose to $955,000—a 5% increase from 2022. However, the market wasn’t without its challenges. The days on market increased 12%, reaching an average of 103 days. The month’s supply of inventory held steady at three, indicating a strong seller’s market.

“The townhome and condo market saw some significant changes as well. New listings for these properties surged by an impressive 72%, primarily fueled by the introduction of new construction units to the market. However, the number of condos and townhomes sold decreased 43%. The inventory of townhome condos increased 30%, totaling 60 units, but many were still in the early stages of construction. The months’ supply for townhomes and condos settled at 3.2 months.

“Zooming out to a year-to-date perspective for 2023, local homeowners stayed put, thanks to enticingly low interest rates on their current homes. New listings were down nearly 15%, and sold listings followed suit with a 16% decrease due to limited inventory. La Plata County’s current housing supply plummeted to its lowest point in 37 years. The scarcity of builders and a lack of available land were formidable barriers to meeting the escalating demand. As the curtain closed on 2023, the real estate stage was set for an impactful 2024. The new year heralded a promising beginning, with many homeowners ready to fulfill their pent-up desires to make a move. Anticipation grows as lower interest rates appear on the horizon, motivating sellers who have been observing from the sidelines for the past couple of years to enter the market finally. The prospect of increased inventory signals a potential shift in the Durango real estate market dynamics, bringing renewed hope to buyers and sellers alike,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“To rephrase a famous quote from political consultant James Carville, instead of ‘It’s the economy, stupid,’ I’d suggest more politely, ‘It’s interest rates, silly.’ No other single component has had as far-reaching effects on the housing market as the Federal Reserve’s aggressive raising of the Federal Funds Rate beginning in March 2022.

“The rate has basically gone from .25% to 5.5% in the span of 20 months. Second to that is the change in long-term U.S. Treasury Bond yields which sets the tone for how attractive mortgage-backed securities are to investors. These rates tend to be governed by less tangible things like investor confidence in the US Economy. Needless to say, the combination of these two elements has effectively stalled what was, prior to these events, a red-hot and some might even say, unsustainable housing market where a 30-year mortgage hovered in the low 3% range compared to the high of 8% we saw in early fall 2023.

“Not only have high mortgage rates been a death-knell for first time homebuyers (or homebuyers without a minimum down payment), it has also stopped the move-up market where a huge percentage of current home owners have mortgages at rates under 3.5% and don’t want to trade that in – not even for a lower total mortgage amount. This has further exacerbated low inventory challenges for those buyers still in the market which has led to median prices remaining stubbornly high.

“The U.S. economy however, has chugged along, beating expectations with better than average job creation, relatively low unemployment, declining inflation, and consumer spending also quite robust. With those factors in place, it seems that the key to a rebounding housing market is quite simply lower mortgage interest rates as there is likely quite a bit of pent-up demand for housing across all sectors.

In Fort Collins, the year-long graph of home sales for each of the primary price ranges ($300k-$500k; $500k-700k; 700k to 900k; and $1 million-plus) show a distinct downhill slide to the end of the year beginning in August 2023. The only exception to that graph is the million-plus price point which actually went up nearly triple what sold in November (4 units vs 13 units, respectively). The data for new listings reveals a similar pattern with new listings cascading downward through December except for the million-plus price point which ticked up in the last month of the year.

“Other indicators like months of inventory (up), days on market (up), median price (increasing since October), and sale price as a percent of list price (down), new listings (down) have all shown greater variability in the last quarter of the year but collectively illustrate the challenges facing buyers and sellers. The interesting piece about pricing is that the sale-price-to-list-price-ratio does not include an item on the settlement statement known as the ‘seller concession’ which is money the seller contributes to the buyer in order to help the buyer reduce their loan costs through an interest-rate reducing program called a ‘buy-down.’

“In this scenario, buyers put up additional cash (either their own or contributed via the seller to reduce the interest rate on the loan). Buy-down concessions have been a staple strategy for sellers who want to ‘prop-up’ their purchase price (hence the stubborn median sales price numbers) while still offering attractive incentives to buyers who can enjoy a lower interest rate in the hopes they can refinance to an even lower interest rate in the future.

“While hopes are high that mortgage interest rates in 2024 will stabilize and begin a downward trajectory, the U.S. economy continues to show resilience which will more than likely stay the Fed’s hand in reducing rates for the first half of the new year. In the meantime, sellers and buyers who are engaging together in the market right now have not been in a more balanced negotiating position in over a decade,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“Fremont County real estate values increased in 2023 by just a little over 3%, which is keeping up with inflation. This increase is the smallest year-over-year increase in more than five years. However, looking at the bigger picture, the median home price in Fremont County increased nearly 71% in the same five-year period.

“Our average days on the market increased more than 16% and months of inventory available increased from 2.9 months to 3.6 months. On the other hand, listing inventory trended downward 13.6% over 2022 giving consumers less inventory to choose from. The total number of homes sold decreased more than 16% as well.

“It has been a stagnant year. Many homeowners are sitting on the fence not wanting to give up their lower interest rates obtained in the last few years. With interest rates and inflation mellowing a bit we will see more activity in 2024 as the market starts to breathe a bit,” said Fremont County-area REALTOR® David Madone.

GLENWOOD SPRINGS

“The housing market in Garfield County is facing a persistent shortage of available homes, which is affecting both sales and prices. According to the December data, new listings for single-family homes dropped 35%, while new listings for townhouse-condo properties fell more than 46%. Pending sales showed mixed results, with a 6.7% decline for single-family homes but an 87.5% surge for townhouse-condo properties. December sales ended up 7.5% (43 sales) in the single-family sector but down 28.6% (5 sales) in the townhome-condo market.

“The median sales price increased just shy of 10% to $689,000 for single-family homes but decreased 3.2% to $705,000 for townhouse-condo properties. The average time on the market was slightly higher for both types of properties, with a 3.8% and 3.3% increase for single-family homes and townhouse-condo properties, respectively.

“The low inventory levels are driven by several factors including fluctuating interest rates, high demand, limited construction, and homeowners staying longer in their homes. As of December 31, Garfield County had a total of 187 active listings with close to 80% of those listings priced over $500,000. Garfield County is experiencing the biggest shortage of entry level housing that it has ever dealt with historically. While there are some multi-family apartment buildings being developed in the Glenwood Springs area, they will help the rental market but not provide the inventory that is desperately needed in the homeownership sector,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County is still in hibernation with new listings down 16.4% to 148. Sold listings fell 22% to 149 and inventory levels shrank 17.1% to 597 units. However, as has been the case, both median and average pricing increased about 1%.

“Year-to-date pending sales came in at 2868 compared to 4280 in 2020, and 3309 in 2022. A similar story with year-to-date solds at 2818 compared to 4233 in 2020 and 3459 in 2022. Days on market jumped to 83 days, up from 68 days in 2022.

The interest rates have improved, and hopefully, as we move further into this new year, both activity and inventory will increase,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Home prices maintained and showed modest increases as a result of buyer’s desire to live in rural Pagosa Springs. December presented 21 under contract homes. The average sales price hit a record high at $777,079 thanks to inventory in higher home prices and perhaps tracking to higher prices in 2024. Days on market are tracking toward four months, typical for a resort-like community. Low inventory and cash buyers also contributed to rising prices. The Archuleta County housing market experienced a high number of cash buyers. Some have cashed out on homes in other areas of Colorado or other parts of the country to purchase here with no intention of selling in the foreseeable future. Interest rates and pricing have no impact on their home purchases. As for the sellers not selling in 2023 who held-on to their historically low interest loan rates, some are seeing now as their window to sell and still retain their home’s real estate wealth even if they pay a higher interest rate for another purchase. Their strategy is the home sale wealth is greater than the interest rate payments, as they intend to refinance later. The 2024 real estate market will be driven by life events (aging, deaths, divorces, births). It appears, high interest rates do not discourage these buyers (and sellers) to obtain their desired lifestyle.

“Looking at other factors, the county continues to struggle with housing affordability for locals. The past year showed expansive town and county short-term rental restrictions and fees, with the hope sellers would throw themselves into the long-term rental market and fix the county’s affordable housing dilemma. Some frustrated buyers and sellers moved on to other communities or states embracing their desires. Short-term rental sellers placed homes for sale and unfortunately, locals struggled to afford them. To meet the county’s affordable housing needs, an abundance of new construction multi-housing projects (versus single family homes) should be on the building platform, however, regulations and restrictions have discouraged this platform. The 2024 inventory in each price point from $300,000 to $900,000, can be counted on two hands. Homes priced $1 million and higher are counted on nine hands. As interest rates drop slightly and allow buyers a little more buying power, some buyers may venture into the buying ring. Like 2023, there will be fewer buyers than year’s past (440 in 2023, 434 in 2022, 606 in 2021),” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The past year delivered negative results across most of the major measurable categories in the Pueblo real estate market, with the exception of one: average days on market. However, that increase of more than 32% to 86 days could easily be interpreted as a negative as sellers were forced to sit on properties a little longer and make far more concessions than at any time in the past several years. Buyers were far more cautious in their approach as well thanks to a wide range of market uncertainties and a rising interest rate that diminished buying power and kept many would-be buyers on the sidelines.

“The list of categories that were down over the past year include: solds down 22.4%; new listings down 16.3%; pending sales down 17.3%; and the median price ticked down slightly (0.09%) to $307,150. In addition, the percent of price received compared to list price was down 1% to 98.3% and our overall new home permits were down a significant 40.4%.

“Sellers, often caught up in the pricing typically seen from 2020-2022, often priced their home too high and are just now beginning to offer significant price reductions to meet market conditions. Home builders are also being very cautious with new starts due to many of the same cautionary reasons – pricing and high interest rates that are keeping buyers away.

“We remain optimistic about 2024 and the falling interest rates – now in the mid 6% range – will certainly help the market overall as we wait for the spring and buyers to get active once again,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“Similar to 2022, interest rate volatility continued throughout 2023 with rates that soared to 8.03% in October. That was the highest interest rate in 23 years and certainly slowed the housing market. We closed out 2023 at 6.58%.

“Routt County experienced 276 single-family homes sales during 2023 compared to 333 in 2022. The highest-priced sale was a home in Storm Mountain Ranch with 11,248 finished square feet on more than 70 acres located three miles from city limits. It closed in 48 days from the listing date for $15.65 million achieving 99% of its list price. The average sales price for the year was up 10.8% for the second year in a row to nearly $1.9 million while the median sales price of $1.36 million was 1.2% higher than 2022. Of the 276 sales, 107 of them sold for less than $1 million and 20 sold for more than $4 million – an amount that was comparable to the 19 which sold the year prior. Sellers received 2.2% less on their list price than they did in 2022 resulting in 95.9% of ask and achieving that in an average 64 days vs. 50 days the year before.

“Multi-family sales tallied 316 units for 2023 vs. 400 in 2022. Of the 316 sales, only 18 came from the county’s more affordable towns of Hayden and Oak Creek. The second half of the year produced a record-high sales price with a seven-bedroom, luxury ski-in/out offering for over $9 million with 15 days on the market. There were four ski-in, ski-out condominiums that sold above $7 million and the sales price per square foot for these sales ranged between $1,790-$1,942 per square foot. The median and average sales prices did not see a significant difference from 2022 at $870,000 and $1.1 million, respectively. Average sales price for Hayden was approximately $353,000 and $489,000 for Oak Creek/Stagecoach. Strong demand for multi-family persists and sellers received 99.7% of their list price which was off slightly from 101.1% in 2022.

“In June 2010, Routt County had approximately 600 homes and 825 condos/townhomes on the market. In 2017, this inventory became 225 and 335, respectively. Today, buyers have a total of 76 homes to choose from and 43 multi-family homes. Most of the new construction that has occurred over 13 years has been upper-end custom homes and has not provided relief to the housing shortage.

“Plans and negotiations for the proposed Brown Ranch affordable housing includes both multi and single-family housing with phased new construction of 2264 units that would be complete by 2040. In March, voters living within the Steamboat city limits will determine whether Brown Ranch will be annexed into the city limits or not.

Steamboat Ski Resort became the second largest ski resort in Colorado with the opening of an additional 650 acres of advanced/expert terrain known as Mahogany Ridge and Fish Creek Canyon. Their Wild Blue Gondola was completed in December and at 3.16 miles is the longest and fastest 10-person top-to-bottom gondola in North America. For 2024, appreciation for Routt County is predicted to be 4.85%. Since 2020, Routt County has seen 218 closings with an average sales price per finished square foot of $1218. As we see new development at the base area, I don’t think any one of us will be surprised to see new construction start around $1,500 per square foot which would still be considered a value when compared to other world-class ski resorts,” said Steamboat Springs-area REALTOR® Marci Valicenti.

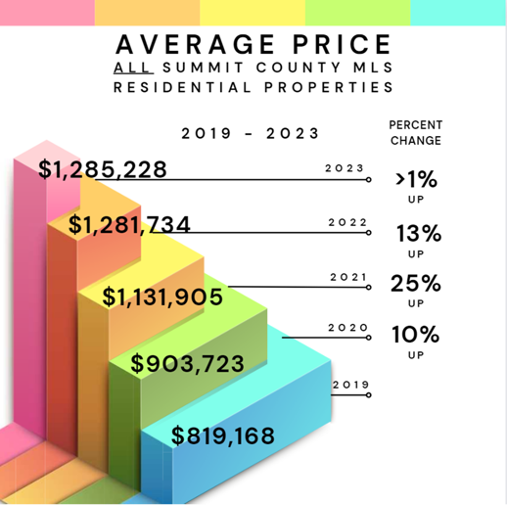

SUMMIT, PARK, AND LAKE COUNTIES

“As 2023 unfolded, expectations were high for a tempering of the previous years’ upward trend in real estate prices. Following a staggering 25% increase in 2021 and a further 13% climb in 2022, many anticipated a correction in the housing market. The past year saw the end to the meteoric rise in prices but, despite adversities, single-family homes maintained an average price consistent with 2022, while multi-family homes saw a modest uptick.

“We also had fewer 2023 home sales (down 16.5%), as interest rates went up, insurance rates went up, pretty much everything cost more, and it took more than twice as long to sell a home from the year before. Yet, on average, Summit County single-family homes were the same price as 2022, and multi-family home prices were up about 3.5%. Single-family home prices in Park and Lake counties were up over 7%.

“The fundamental economic principle of supply and demand emerged as the dominant force preventing a price downturn. In 2023, the number of new property listings reached the lowest point in the last 18 years, underscoring the scarcity of available housing.

“Are current prices the new ‘normal?’ The potential factors that could have dampened demand in the previous year did not materialize, leaving room for speculation that they may not exert the same influence in 2024, provided inventory remains low. The delicate equilibrium between supply and demand could shift if more homeowners decide to enter the market in the coming year.

“Data from Summit in December 2023 compared to the same period in 2022 reveals the average sale price for single-family homes surged to over $2.4 million, an increase of 28.6%. Townhouse-condo properties also experienced a price hike of 9%, to an average $840,903. Year-to-date figures indicate a modest 0.5% uptick for single-family homes and a more substantial 3.3% increase for townhouse-condos. Sellers, on average, received about 97% of their list price. Park County’s 2023 average single- family home price was $646,927, while Lake County’s was $673,683.

“Out of the 445 active listings, the least expensive property is a mobile home in Grand County for $64,500 and the most expensive is a single-family home in Breckenridge for $19.49 million (on the market for 1,224 days). Out of the 107 sales in December, the lowest was a mobile home in Kremmling for $67,700 and the highest was a single-family home in Breckenridge for $12 million, which was the highest priced residential sale for 2023. Across those sales, 37.5% were cash. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The Telluride regional market ended the year with $865.73 million in sales as compared to $1.1 billion in 2022, a 22% decrease. The 445 sales reflect a decrease of 24% compared to 2022’s 582 sales.

“For perspective, 2023 dollar amount of sales was only down 10% compared to the previous five years average annual dollar amount of sales. However, the number of sales in 2023 was down 34% as compared to the five-year average number of sales. My perspective is that the upper 10% of our market, the truly high-end luxury segment, still has buyers who can afford the best and their wealth lets them fly above the potential turbulence of the economy, no matter what that means. The other 90% of buyers are looking for a deal and are being cautious. We are seeing weekly price drops, mostly in the bottom 75% of the market segment and that is generating some purchases.

“For the first time I can remember, the Mountain Village generated 51% of the dollar amount of all sales in San Miguel County at $440 million. The segments of the market in San Miguel County that are sensitive to interest rates are down 14% in the dollar amount of sales.

“Lastly, there were 50 sales at $5 million or more in 2023. In 2022 there were 59 sales at $5 million or more. My prediction for 2024 is about the same as 2023 or maybe 5% more in dollar amount of sales. Also affecting future sales is low inventory that is not expected to recover for years,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Vail market followed the trends of the past few months with one anomaly that made a significant positive change in both units and dollars. A new development that closed its first phase and represented approximately one-third of unit sales and 44% of dollar volume. Without this impact, the monthly units would have been negative 15 % and -11% in dollar volume. Comparing all transactions for the year, in units we are negative 21% and -13% in dollars.

“Based upon the trend, I believe we have found a new baseline, and the future is a more conservative trend for the market. We have ongoing inventory issues as currently there are 327 units on the market. This is improved from the pandemic era but is still about 50% of the inventory levels as recently as 2019. The percentage of sales in the market niches have gravitated to the higher price points driven by appreciation and supply in the lower niches.

“As we look to the future, the prospect for construction in the lower niches is controlled by inflation in building costs and lack of privately owned land in the valley. Most of the available land for development is very limited as most of the acreage is federally or state owned. Thus, the value of existing land is more costly and, coupled with construction cost increases, requires higher pricing for development. The vagaries of mortgage rates are less significant in the higher niches as a significant percentage of sales are cash transactions. However, the lower niches are much more reactive to rates and become a factor not in the control of local markets. All of these factors would indicate some market stabilization and a positive trend forward. Albeit, at a lower baseline for total transactions in 2024 and the foreseeable future,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The December 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.