Housing prices seemingly unfazed by growing inventory as buyers and sellers face different challenges

ENGLEWOOD, CO – Housing market challenges for both buyers and sellers continued through the month of June and closing out the first half of the year with inventory reaching levels not seen in more than a decade, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons working in markets across the state.

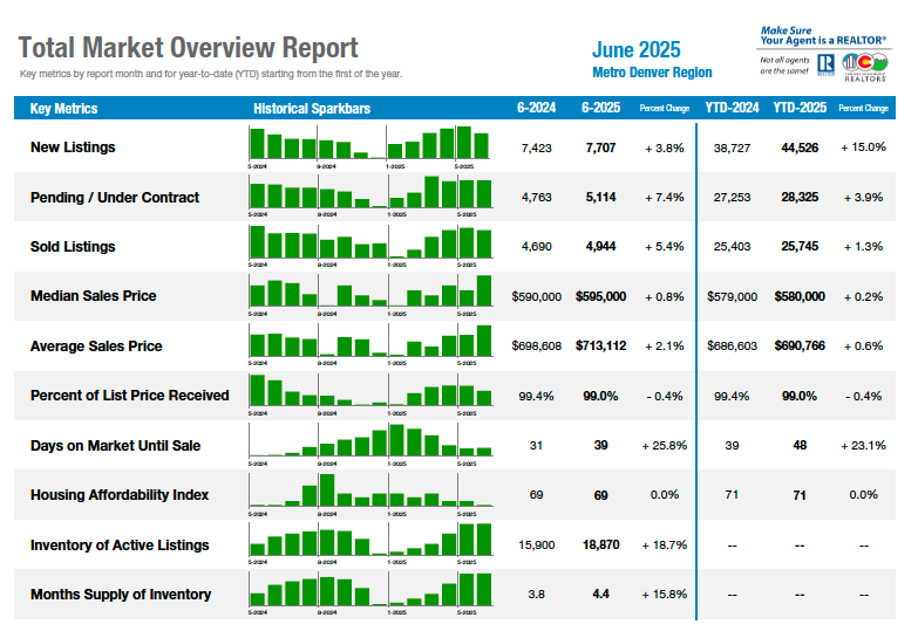

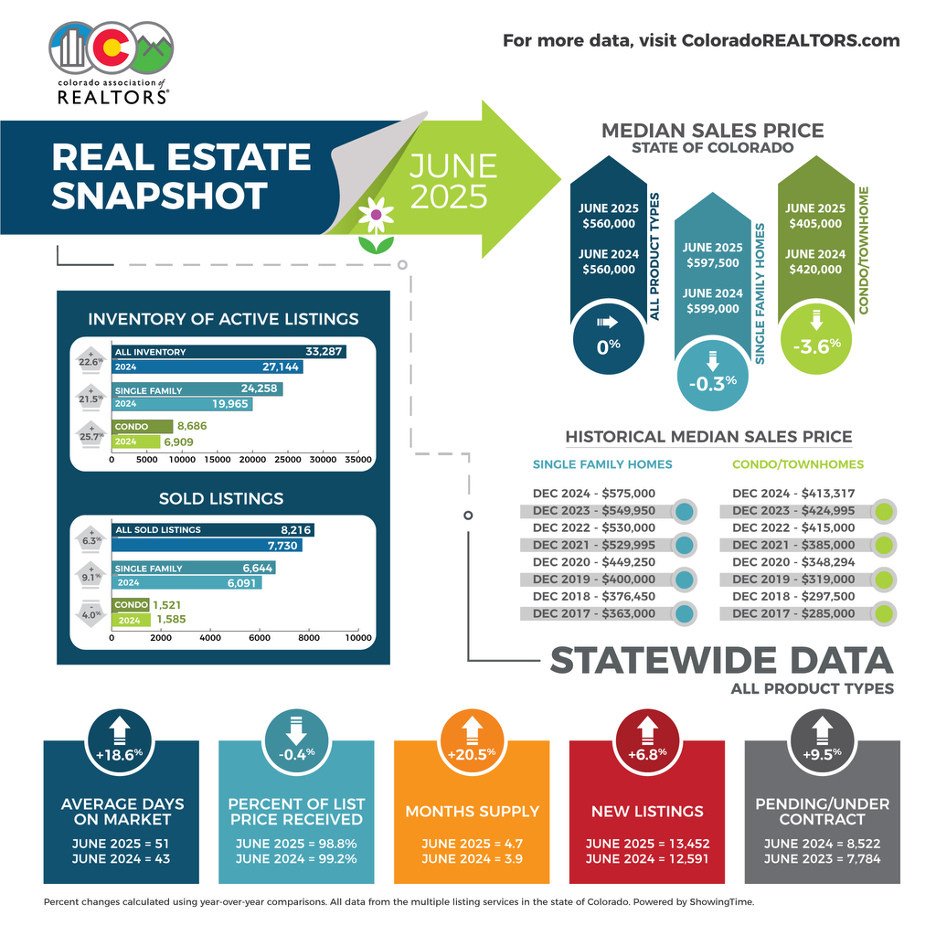

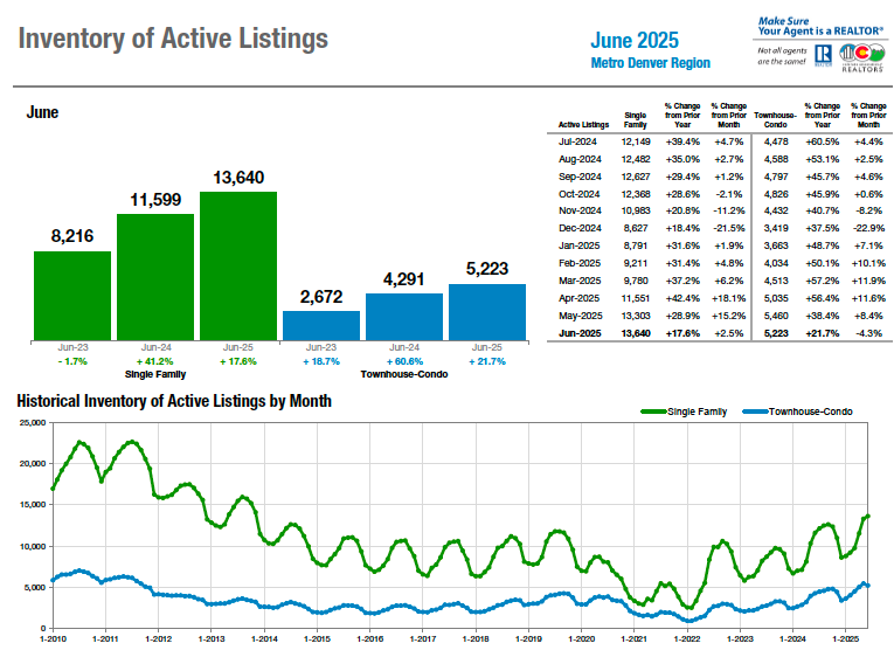

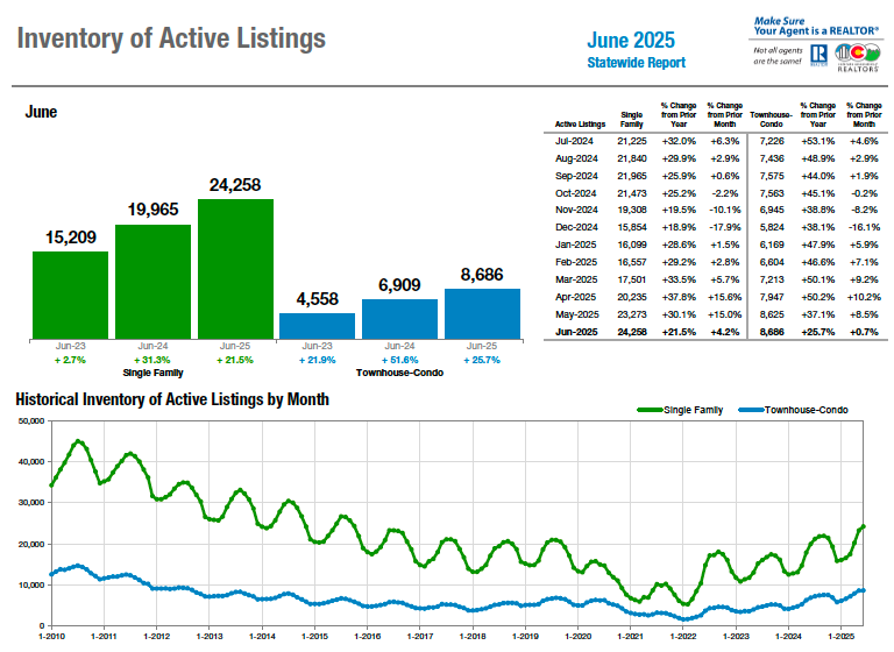

Sellers pumped the brakes a bit in June with new listings for single-family homes falling 13.8% and condos down more than 20% in the seven-county Denver metro area from May. Statewide, single-family new listings fell 11.2% while condo new listings were off 14.2% from the prior month. Despite the easing in new listings, inventory of active listings jumped to 18,870 in the seven-county Denver area, an 18.7% increase from a year ago while statewide, active listings reached 33,287 in June, up 22.6% from June 2024 thanks to a slowdown in closings across the metro area and state and reflecting continued caution from buyers still facing higher interest rates and overall affordability challenges.

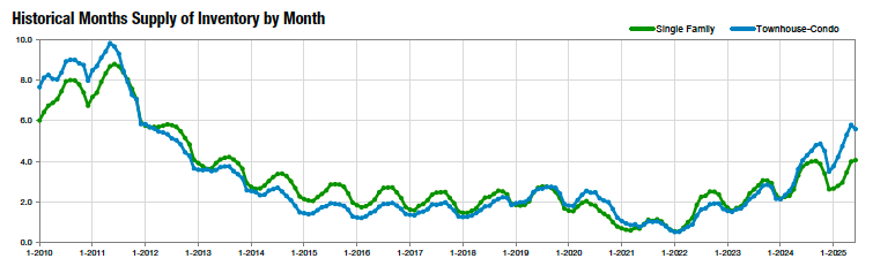

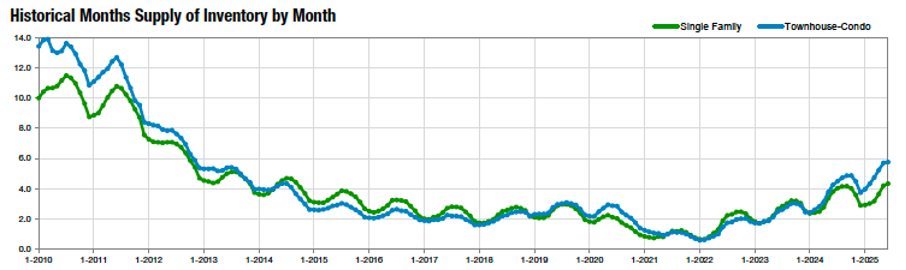

With sold listings relatively flat in the Denver area and down just shy of 2% statewide, the months supply of inventory rose to 4.4 and 4.7 months, respectively in the Denver metro area and state. Again, inventory numbers not seen since 2013.

“Many current sellers are homeowners who may want to move but don’t necessarily need to. With substantial equity, low interest rates locked in, and little financial pressure, these sellers are holding onto price expectations that may be unrealistic,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

“Buyers, on the other hand, are seeing more inventory than they’ve had in over a decade—and they’re being ultra picky. With hopes for lower interest rates and new, more appealing listings popping up each day, many are choosing to wait, creating a slow, cautious environment on both sides of the transaction.”

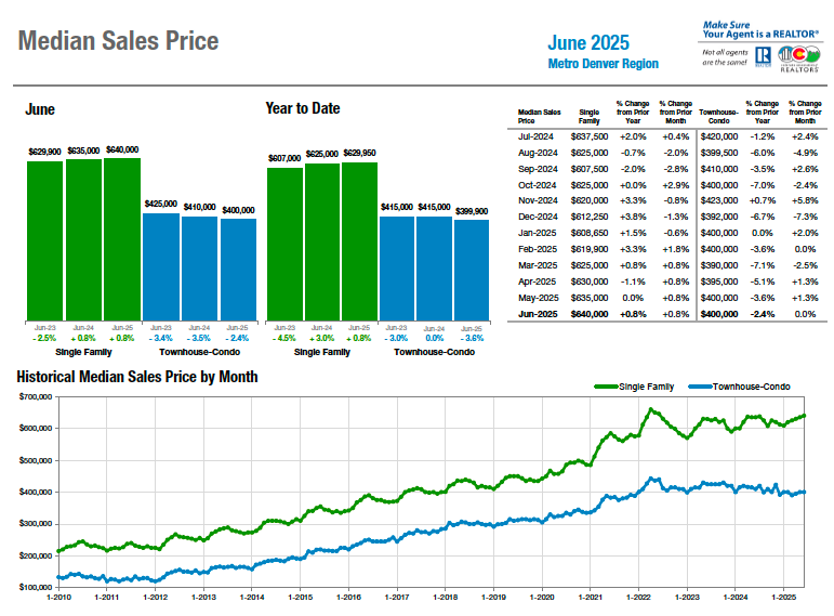

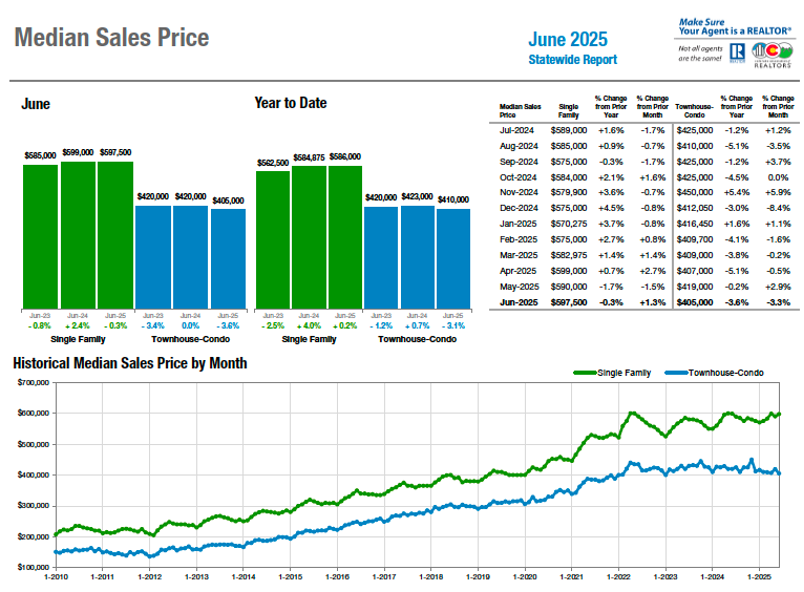

For the fourth straight month, and seemingly unfazed by the large volume of active inventory, median pricing for single-family homes in the seven-county Denver area ticked up 0.8% in June and is up exactly the same 0.8% from a year prior at $640,000. Condo/townhome median pricing remained flat for the month comparison at $400,000 but is down 2.4% from June 2024. Statewide, the median price of a single-family home rose 1.3% in June to $597,500, down just 0.3% from a year prior. Condo-townhome median pricing fell 3.3% from May to June and is down 3.6% from a year ago at $405,000.

“Even as negotiating leverage continues to lean in the favor of homebuyers, many sellers have yet to adjust their strategy to current market conditions,” said Denver County-area REALTOR® Cooper Thayer.

“New listings, however, haven’t been the primary driver behind the spike in inventory. Rather, it’s the slower pace of those listings finding buyers that has caused the ‘pile-up’ effect in the market.”

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

INVENTORY OF ACTIVE LISTINGS – DENVER METRO AREA

INVENTORY OF ACTIVE LISTINGS – STATEWIDE

MEDIAN PRICE – DENVER METRO AREA

MEDIAN PRICE – STATEWIDE

MONTHS SUPPLY OF INVENTORY – DENVER METRO AREA

MONTHS SUPPLY OF INVENTORY – STATEWIDE

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“To say that the housing market is hyper-local is an understatement. Pricing and overall activity depends heavily on the location within our city and county. Aurora’s 80015 and 80016 have seen increases across all categories including pricing, inventory and solds compared to 2024. The median price in zip code 80016 is $800,000 up 5% from June 2024. Zip code 80015 pricing is also up from 2024 at $565,000. The rest of the Aurora zip codes are reflecting higher inventory and lower pricing from a year ago. Looking at zip code 80013, inventory is up 14.6% with a median price of $499,000, down from June 2024. This scenario is fairly consistent across other Aurora zip codes as well. Increased inventory with decreased pricing is great news for entry level buyers.

“Englewood, Greenwood Village and the 80111-zip code has active listings up 98% from 2024 and a median price of $1.4 million, a 60% increase from 2024. The higher priced markets seem to be doing much better than the more entry-level housing with stronger demand for housing in these areas.

“Currently Aurora new listings reached 8,904 year-to-date, a number we have not seen in more than a decade. With that, Aurora’s 5,739 year-to-date solds, down slightly from 2024. Buyers certainly have the upper edge in most areas. The southeast area of Aurora delivers more challenges as far as buyer negotiations. Opportunities are still out there for both buyers and sellers,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“The Boulder and Broomfield housing markets are experiencing a good old-fashioned buyer/seller standoff. Inventory is up 15% since January, but the market is far from fluid. Many current sellers are homeowners who may want to move but don’t necessarily need to. With substantial equity, low interest rates locked in, and little financial pressure, these sellers are holding onto price expectations that may be unrealistic.

“Buyers, on the other hand, are seeing more inventory than they’ve had in over a decade—and they’re being ultra picky. With hopes for lower interest rates and new, more appealing listings popping up each day, many are choosing to wait, creating a slow, cautious environment on both sides of the transaction.

“In Boulder, appreciation has leveled off, with prices flat year-to-date. Homes are still selling relatively close to asking, with the average list-to-sales price ratio holding steady at around 98%. However, homes are sitting longer—average days on market have extended to 60 days, a sign of buyer hesitation and pricing resistance. Notably, about 60% of homes in Boulder and Broomfield have undergone at least one price reduction before going under contract, so the days on market may actually be much longer than the statistics suggest.

“Broomfield presents a split picture. The single-family home segment is a bright spot, with appreciation reaching 7.5% so far this year and an average of just 39 days on market—again, measured from the most recent list price. These homes are attracting motivated buyers and are moving more quickly than in nearby Boulder. However, Broomfield’s condo and townhome market is seeing a very different trend. Values have dropped 10% since the beginning of the year, and all metrics across the board are down, reflecting the unwillingness of buyers to pay higher HOA fees due to increased insurance premiums.

As the second half of the year unfolds, all eyes will be on interest rates and inventory trends to see which side blinks first,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Summer fun may be here but, real estate in the Pikes Peak region is far from fun for most. June was lackluster for much of the broader housing market. We saw a negligible increase in median prices of 0.3%. More listings came to the market year after year with a 25.7% increase, and we did have an uptick in overall sales of 6.5%. The market continues to feel stagnant in many price points. Days on market increased 26.7% for single-family homes and townhomes/condos was up just shy of 43%.

“The U.S. economy added 147,000 jobs and unemployment dropped. But once you get into the details, a large portion of those jobs were government employees. Manufacturing saw job loss. We continue to see delinquency rates rise over in the commercial mortgage-backed world, now at a record 11.1%. This is above the 2008 high of 10.7%. Nationwide, homebuyer demand is very low. Consumers continue to feel the pressure economically and this is being felt in housing.

“The Federal Reserve meets in July and there was talk about a .25% drop in the Fed Rate. However, the latest jobs report, along with inflation fears, may keep them from doing that. Many markets are starting to see affordability enter the housing market. Austin Texas and Texas in general, as well as many areas around Florida continue to see increased inventory, lower demand and prices are pulling back. Often it is noted that Florida is the canary in the mine for what the nation’s housing market is doing. If that is the case, buyers may have some relief coming. Currently, it is a stagnant, not much happening, slow market here in the Pikes Peak area. Buyers are getting better deals, concessions and things are looking better than a few years ago,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“An analysis of the single-family and patio homes’ statistics for Colorado Springs in June 2025 raises a proverbial question: “Is the glass half empty or half full?” Since 2015, low inventory has posed the most significant challenge in our real estate market. In June 2015, the supply was a meager 2.3 months. This downward trend continued, reaching an alarmingly low 0.4-month supply in June 2021. However, an improving trend began at a snail’s pace. Last month, with 4,055 active listings and 1,197 sales, the supply rose to 3.4 months, moving closer to a more desirable range of 4 to 6 months.

“The average and median sales prices reached historic highs in June of $570,516 and $500,000, respectively. The average number of days properties spent on the market in June 2025 was 40. Notably, 51.7% of active listings in El Paso County and 39.4% in Teller County experienced price reductions. Despite these reductions, the sale price to list price ratio stood at 99.5%.

“With the current higher level of active listings, sellers must price competitively from the start to avoid price reductions and ensure their properties are attractively staged to draw buyers. The abundance of available homes presents a fabulous opportunity for buyers to find properties that suit their preferences. It also allows them to negotiate more favorable offers with motivated sellers,” said Colorado Springs-area REALTOR® Jay Gupta.

June Key Highlights from the Colorado Springs Market:

- Active Listings – Supply: In June 2025, there were 4,055 single-family and patio homes for sale in Colorado Springs, according to the Pikes Peak MLS. It marked an impressive year-over-year increase of 36.3% and a hefty 10.5% increase compared to the previous month. The inventory level was the highest for June since 2015.

The overall months’ supply of active listings was 3.4 months. For homes priced under $400,000, the supply was 3.1 months. Homes in the price range of $400,000 to $600,000 also had a modest supply at 2.8 months. The supply for homes priced between $600,000 and $1 million was more plentiful at 4.2 months. However, for homes priced over $1 million, the supply was robust at 5.8 months.

- Sales – Demand: In the Colorado Springs area, 1,197 single-family and patio homes were sold last month, marking a healthy year-over-year increase of 7.4% and a 2.7% increase compared to the previous month.

The monthly sales volume experienced an increase of 5.0% compared to the previous month and a nice 8.5% rise year-over-year. Year-to-date sales volume showed a significant increase of 25.6% compared to previous month and 9.6% compared to June of last year. In comparison to June 2015, both the monthly and year-to-date sales volumes have escalated remarkably, with increases of 74.6% and 99.0%, respectively.

- Days on the Market: The average number of days on the market in June 2025 was 40, which is lower from 41 days last month but higher from 32 days in June of last year.

- Sales by Price Range: Last month, 21.2% of homes sold were priced below $400,000, while 48.0% were sold for between $400,000 and $600,000. Homes priced between $600,000 and $1 million accounted for 24.4% of the sales, and those priced over $1 million represented 6.4% of the total sales.

In June 2025, there was a modest 5.9% increase in the sale of single-family homes priced under $400,000 compared to the previous year. Homes priced between $400,000 and $600,000 also saw a decent 7.1% rise in sales. There was a minor 0.7% increase in the sale of homes priced between $600,000 and $1 million. In contrast, homes sold for over $1 million experienced an incredible 20.3% increase in sales.

- Average & Median Sales Prices: Last month, the average sales price of single-family and patio homes reached a historic high for June at $570,516. It marks a slight increase of 1.1% compared to last year and an impressive escalation of 41.9% compared with June 2020, just five years ago. Additionally, there has been a remarkable 104.3% increase compared to June 2015.

Similarly, the median sales price saw a marginal increase of 0.2% year-over-year. Nevertheless, it had a huge 38.9% increase compared to June 2020 and an astounding 100.0% escalation compared to Juney 2015.

- Price Reductions: Last month, 51.7% of active listings in El Paso County and 39.4% in Teller County saw price reductions. With the current high volume of active listings, sellers must price competitively from the start to avoid price reductions and stage their homes attractively to draw buyers.

CRESTED BUTTE/GUNNISON

“Summer is in full swing in the Gunnison Crested Butte area. The wildflowers are beautiful and the streets and trails are busy. Although our visitor numbers start to pick up in June, real estate typically doesn’t pick up until after July 4.

“Real estate sales continue to be mostly in line with 2024. The entire Gunnison-Crested Butte Association of Realtors® area has had 15% more sales this year (253 vs. 220), but the dollar volume is down 2.8% ($204 million vs. $209 million in 2024). While it is tempting to assume that prices are going down, the increased sales volume and slight decrease is dollar volume is actually because of shifts in the prices and types of properties that are selling.

“Diving a little deeper, the Crested Butte area has almost exactly the same number of sales (112 vs. 111 in 2024) and dollar volume is slightly up ($132 million vs. $130 million). As mentioned in previous months, the Gunnison area had seen a large increase in inventory and that has translated into more sales. The number of sales is up 37% (97 vs. 71) and the dollar volume is up 25% ($59 million vs. $47 million).

“There is more for sale than we have had in a couple of years, but still far less than we had pre-Covid. Total listings are up 8.5% for the Gunnison-Crested Butte area and the number of single-family homes for sale are up 19%. At this time, the number of properties under contract is down 11.5%. The Town of Crested Butte is seeing a surge in single family home listings and sales. The number of listings are up 29% from this time last year and there are five under contract vs. none at this time last year.

“Even in our relatively small geographic space, the market varies widely throughout the valley. It is helpful to look at the overall statistics to get an idea of the market, but if you are ready to buy or sell, it is important to have a good guide,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER METRO (11-County)

“Even as negotiating leverage continues to lean in the favor of homebuyers, many sellers have yet to adjust their strategy to current market conditions. More than 7,700 new listings hit the market in the Denver-metro area in June, bringing total active inventory to a new 13-year record high for the third consecutive month, at more than 18,800 active listings. New listings, however, haven’t been the primary driver behind the spike in inventory. In fact, the number of new listings entering the market this year has remained very consistent with trends dating back to 2013. Rather, it’s the slower pace of those listings finding buyers that has caused the ‘pile-up’ effect in the market.

“Fortunately for sellers, drastic measures haven’t been necessary just yet — but patience and adaptability have proven key to finding success in Denver’s first buyer’s market in years. Home values have maintained a remarkable resiliency to lower demand, with average sale prices in the Denver Metro Area climbing about 0.6% so far this year compared to last year. New strategies have emerged to attract the limited pool of potential buyers, most prominently the use of seller concessions to make financing more attainable amid elevated interest rates. Last month, more than 60% of closings reported a seller concession, at an average of more than $10,500.

“Yes, the current market feels slow and intimidating, but potential buyers and sellers shouldn’t fear. If buying or selling a home makes sense for you personally in 2025, there are still absolutely plentiful opportunities available. With 4.4 months’ supply of inventory on the market, buyers have the gift of options and the ability to negotiate a deal that works best for them. For sellers, there will always be a great demand for homes in the Denver-metro area, and the perfect buyer for your home is out there,” said Denver County-area REALTOR® Cooper Thayer.

EVERGREEN/MOUNTAIN METRO

“As inventory continues to rise in the foothills market, we are witnessing the anticipated transition from a seller’s market to a buyer’s market. While buyers remain challenged by elevated interest rates and ongoing insurance hurdles, sellers are beginning to feel the pressure of a cooling market. The peak of the summer selling season has arrived, yet many listings are seeing fewer showings and falling short of full price offers. This shift is prompting growing anxiety among sellers, leading to a noticeable growth in price reductions.

“Although there has been a modest uptick in closings, the market is still seeing three times as many new listings—and listings returning to market due to failed contracts—as there are successful closings each week. This imbalance has pushed inventory levels to a striking six months’ supply. Many sellers, expecting to close within 90 days of listing, are now facing prolonged timelines, resulting in a higher-than-usual number of withdrawn and expired listings for this time of year.

“Despite these dynamics, pricing has remained relatively stable. The average and median sales prices for single-family homes are holding within 1–2% of last year’s figures. After the sharp appreciation from 2020 through early 2023, both median price and price-per-square-foot have remained largely flat over the past 24–30 months. However, with the current trend of price reductions, we anticipate a gradual downward shift in pricing during the second half of the year.

“A closer look reveals that suburban areas are faring better than their rural counterparts. The Evergreen and Conifer markets have seen year-to-date increases in average and median prices of 1.4% and 2.4%, respectively. In contrast, more rural areas in Clear Creek and Park Counties have experienced declines of up to 10% in average sales prices. These areas already have lower price points, which led me to analyze the market by price bracket: homes under $1 million are seeing more significant impacts than those priced above $1 million.

“This lower-priced segment is also where we see a higher concentration of low down-payment loans, which puts more homeowners at risk as equity shrinks. While we haven’t yet seen a surge in short sales or foreclosures, the inability of some homeowners to sell when needed may lead to a gradual reappearance of these distressed sales in the coming months.

“So, while the heat of summer sets in, expect prices to be cooling in our foothills housing market,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“Let’s talk condos. The attached home market (condos and townhomes) had a months’ supply of inventory (MSI) at a remarkable 4.7 months in June. This number has been steadily climbing all year. The MSI number is essentially a calculation of how long it would take, at the current historic sales pace, to sell all the condos and townhomes currently on the market if no other new listings came on the market. At nearly 5 months – that’s a jump of more than 50% year-over-year and places the inventory number (nearly) squarely in the historical “balanced market” status – meaning that, at this juncture, the supply of homes available is nearly equal to the demand.

“By comparison, single-family detached homes’ MSI has climbed to 3.5 months, indicating more demand for stand-alone housing than condos and townhomes. Currently, from an economic perspective, condos and townhomes remain the most accessible entry-point for homeownership with the affordability index pegged year-to-date at 102 which shows median household income is at 102% of what it takes to qualify for a townhome or condo at current interest rates and median price (the higher the index number, the greater the affordability). This is a significant difference compared to detached housing which has an affordability index of 68.

What’s driving these numbers? Sales of condos/townhomes have remained fairly stable, increasing nearly 2% year over year, but inventory has consistently outpaced sales. One possibility is that in the current market, owners of townhomes are making a move toward detached housing. With the market a bit more favorable to buyers at the moment, condo-townhome owners could be ‘trading up’ and leveraging equity built over the last 5 years to escape the shared-wall experience of condo living for the next level in home ownership: owning the whole enchilada from foundation to roof. This trade-up however, comes at a cost as interest rates remain much higher than 5 years ago. With sellers willing to negotiate more than in years’ past, buyers can secure concessions not heard of 24 months ago to help reduce the prevailing interest rates. This is especially true in the case of new construction where builders are providing substantial buyer incentives to move inventory and keep their construction crews building houses.

“Buyers looking for a more affordable way to purchase real estate or current detached homeowners looking for a way to ‘right-size’ into a real estate investment may want to reconsider looking at the condo/townhome segment of the housing supply,” said Fort Collins-area REALTOR® Chris Hardy.

MESA COUNTY

“Mesa County inventory has grown to 845 active listings, but sales are still lagging. Prices are almost flat, with the average sold price, year to date, up 0.1%. Interest rates seem to be biggest challenge, as many of the jobs do not produce the income required to qualify. The most active price ranges are between $300,000 to $700,000. Slowly, we are creeping to a balanced market with now 3.3 months of inventory,” said Mesa County REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Buyers and sellers are continuing to dance together at the current beat of the market song. For homes priced higher than the median and average sale prices, a market song with a faster beat is needed. June shows buyers and sellers debating on who shall lead the dance. New listings in June were down 9.2% from a year prior and contributed to homes coming onto the market earlier this year. However, year-to-date listings are up over 10% at 303 homes for sale. Sold listings in June experienced a slim gain at 33 homes compared to 32 homes in 2024. The big awakening point for both the buyers and sellers is the price drop in June median and average sale prices and shows influence toward 2025 Pagosa Springs real estate market sales numbers.

June 2025 June 2024

June Median Sales Price $515,000 $579,500 (-11.1)

Year-to-Date Median Sales Price $687,811 $720,319 (-3.1%)

June Average Sales Price $654,667 $825,847 (-20.7%)

Year-to-Date Average Sales Price $687,811 $720,319 (-4.5%)

“These drops are attributed to gained early season median and average inventory and buyers purchasing. Average days on market at 123 days is 50% higher than June 2024. Although some price points such as the current 66 homes priced $1-2 million are at a year-plus inventory level with a sluggish 17 sold in the six months of this year (66 sold 2024) and will certainly face even longer days on the market.

“Relative to buyer activity, 170 homes have sold this year compared to 154 homes at the same time last year. Months’ supply of inventory climbed (up to 8.9 months) and sales numbers show buyers are gravitating to the median to average sale prices, not by choice, but by inventory. Homes priced below those levels are limited to condos and manufactured homes. Homes priced above come with a hefty mortgage with consideration to price and interest rate. Local homeowners desiring to sell to move up are perplexed regarding pricing. Realistically, they are competing with second homeowners who may not have quick motivation to sell and hold their price. Some sellers are stuck on past high price sales and are not observing such prices were abundant due to low interest rates and low inventory.

“Strategic pricing and buyer incentives are helping sellers and buyers meet their goals. The June percentage-of-list-price received dropped to 96% (-2%), indicating homes are not selling at the list price, even with price reductions. To meet the demand to sell within (or sooner) the 123 days on the market, sellers are forced to compete for buyers. Strategic home pricing is the most important home sale factor, especially as inventory climbs in particular price points,” said Pagosa Springs-area REALTOR® Wen Saunders.

SAN LUIS VALLEY

“In Alamosa County, the market gained notable strength in June with 13 homes sold, up 116.7% from June 2024. The median sales price rose to $335,000, a 10.2% increase, while the average sales price reached $342,577, up 6.9%. Homes sold much faster this month, averaging just 53 days on the market compared to 116 last June. The number of new listings remained flat at 14, while the months’ supply of inventory increased slightly to 5.8.

“Rio Grande County also posted strong gains. New listings increased 42.1% to 27, while the median sales price rose 22.4% to $330,550. The average price surged 42.3% to $513,888. Despite a 11.1% drop in closed sales (8 vs. 9 last year), the market saw higher price appreciation. Days on market more than doubled to 193, and inventory held steady at 83 homes.

In Conejos County, sold listings were flat at two, but the median sales price dropped sharply, 74.9% to $175,000. The average sales price mirrored this decline, also falling 74.9% to $175,000. New listings dropped 36.4% to just seven. Despite fewer transactions, sellers received 112.1% of asking price on average, likely due to unique property situations or competitive bidding.

“Costilla County saw a 72.7% decline in closed sales (from 11 to 3), with the median sales price falling 9.1% to $250,000. Average prices dropped more steeply—down 29.6% to $192,667. New listings increased to 15 (up 25%), while the months’ supply of inventory fell from 14 to 11.4.

“In Mineral County, sales volume fell drastically—just one home sold compared to 10 in June 2024, a 90% decrease. The median price fell 20.7% to $345,000, and the average dropped 28.3% to match. Inventory rose 33.3% to 24 homes, and the months’ supply jumped to 8.3, up from 4.7.

“Saguache County recorded three home sales in June, down 50% year-over-year. The median sales price fell 40% to $234,000, while the average dropped 38.2% to $245,500. New listings decreased 36% to 16. Notably, homes sold much faster, with days on market dropping from 95 to just 38. Inventory remained level at 94 homes,” said San Luis Valley, REALTOR® Megan Bello.

STEAMBOAT SPRINGS/ROUTT COUNTY

“In Routt County, opportunities remain for both buyers and sellers however, the dynamics are different than the previous four years. In 2019 it was a more ‘normal’ market with more inventory, average days on market was longer and there were price and inspection negotiations. The major difference now is that prices are higher. There are still properties that go quick and buyers that know a cream puff when they see one are moving fast. Multiple offers happen, but they are fewer in number, as well as fewer over asking price. Sellers of single-family homes in Steamboat Springs are receiving 97.2% of their list price, while sellers of multi-family are receiving 97.5% of their list price, slightly less than June of last year. However, the question is, which list price? The original list or the reduced list price? So, yes, the Routt County real estate market is realizing some price improvements. In June, about one-third of the active listings incurred an average price drop of 5.7%. New listings may have a trial period for sellers wanting to see what the market appreciation will bear this year over last. Even with increased listings, there is a limited supply within price ranges. Single and multi-family sales in Steamboat had about 12 fewer transactions each year to date over last year, yet the average sales price for homes is up 20.5% to $3.45 million while condos/townhomes are down 8% to $1.03 million.

“The community of Hayden represents the most affordable location in Routt County with the average home sale to date at $697,947 and multi-family just under $400,000. The third quarter historically generates the bulk of the sales volume for Routt County and with interest rates currently lower than a year ago, the numerical gap of transactions may be resolved during this period,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“As the last turns of ski season melt into memory and trailheads fill with hikers, the real estate market in Summit, Park, and Lake counties is beginning its seasonal ascent. The snow has thawed, but this isn’t a mad dash up the mountain—it’s a steady climb with a few stops to catch our breath.

“Inventory has grown like summer trail traffic—up 32% compared to June of last year as more property owners step onto the path to selling. Sales, however, are only slightly ahead of last year, rising just 0.7%. The market isn’t racing toward the summit, but it’s moving forward with deliberate steps.

“The luxury segment is leading the elevation gain. Sales of single-family homes priced between $5 million and $10 million climbed 80% over the previous rolling 12-month period. Meanwhile, year-to-date sales in the $1.5 million to $2 million range rose 88%. The high-altitude market remains active, even as the base slows down.

“Still, the trek isn’t without its challenges. In Summit County, single-family homes are spending 75% more time on the market compared to last year. Prices are flattening or edging downhill with the average single-family sale price dropping 16% compared to June 2024. More sellers are throwing in concessions to keep deals on track.

June 2025 Average Sale Prices – Single-Family Homes:

• Summit County: $2,148,953 (30 sales, up 9 from June ‘24)

• Park County: $574,445 (14 sales, up 2)

• Lake County: $667,753 (16 sales, up 5)

June 2025 Average Sale Price – Multi-Family Homes:

• Summit County: $848,060 (59 sales, up 4)

“The 84 June closings ranged from a $327,500 studio condo in Silverthorne to a $5.8 million luxury home in Breckenridge. On the active market, there are currently 874 listings ranging from a $160,000 mobile home to a $21 million ski-in/ski-out estate, both in Breckenridge. Of all listings, 57% are priced above $1 million, with 60 homes asking over $5 million.

“High-end buyers are still trekking along. Half of all June sales were above the $1 million mark and cash deals remain a strong force in the market, making up 39% of all closings.

“So where are we on the trail? Somewhere between a cautious incline and an open vista. This isn’t a red-hot seller’s market or a buyer’s free-for-all, it’s a transitional season. The ground is soft, the path is shifting, and anyone stepping into the market should tread with awareness. Summer’s here, and the market’s warming up, but it’s a climb, not a sprint,” said Summit-area REALTOR® Dana Cottrell.

Note: These figures exclude timeshare, deed-restricted, land, and commercial properties.

TELLURIDE

“In June 2025, San Miguel County recorded $39.8 million in sales over 34 transactions. Six-month year-to-date sales totaled $358.51 million with 213 sales, and the number of sales was down 29% compared to the same period in 2024. However, the number of sales for that period was down only 1% compared to the first six months of 2024. The stat that got my attention was all sales in the luxury segment above $5 million were down 54% in the first six months compared to the same period in 2024. On December 31, 2024, there were 17 single-family homes for sale in the town of Telluride and 23 homes for sale in Mountain Village. Those respective numbers on June 30, 2025, were 24 homes for sale in Telluride and 36 homes for sale in Mountain Village. One other anomaly, there was not one vacant residential sale in Telluride in the first six months of 2025.

“Overall, inventory is up almost 30% in the first six months of 2025 compared to December 31, 2024. The good news is that the number of buyers hasn’t changed so far compared to last year. Maybe luxury buyers are watching Bloomberg every day and are a bit cautious with big dollar real estate purchases,” said Telluride-area REALTOR® George Harvey.

VAIL

“June is historically the kick-off for the summer selling season. The performance was positive versus 2024 with units up 1% and dollars up 7%. The month wasn’t huge but compared to the year-to-date sales, the trend was encouraging. Sales for the year are negative 18% on units and 6% on dollars. A factor in the comparison of the two years was the closing of a significant number of transactions in early 2024 from a new development in the upper range of pricing niches.

“Looking forward, new listings for the month are positive 21% which keeps the year-to-date performance at 25%. A key factor in the inventory is the percentage in the pricing niches conforming to the market sales trend in the same niches. The percentage of price for sales has maintained a level of 97% for the month and year. The inventory of active listings is plus 43% versus 2024 and at the highest level in recent years. The dramatic increase in inventory has affected days on market, up 41% and hitting a level of 85 days. The increase of product has raised the months’ supply to 8.6, the highest level in recent years.

“Obviously, macro-economic factors may affect the rest of the summer season. However, based upon current market trends, we are optimistic for the season as the buyers have greater selection options. As visitors enjoy the valley for their summer vacations, the product options can be a stimulus to acquire a vacation home,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The June 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.