Colorado Housing Market Finds Its Footing as 2025 Winds Down

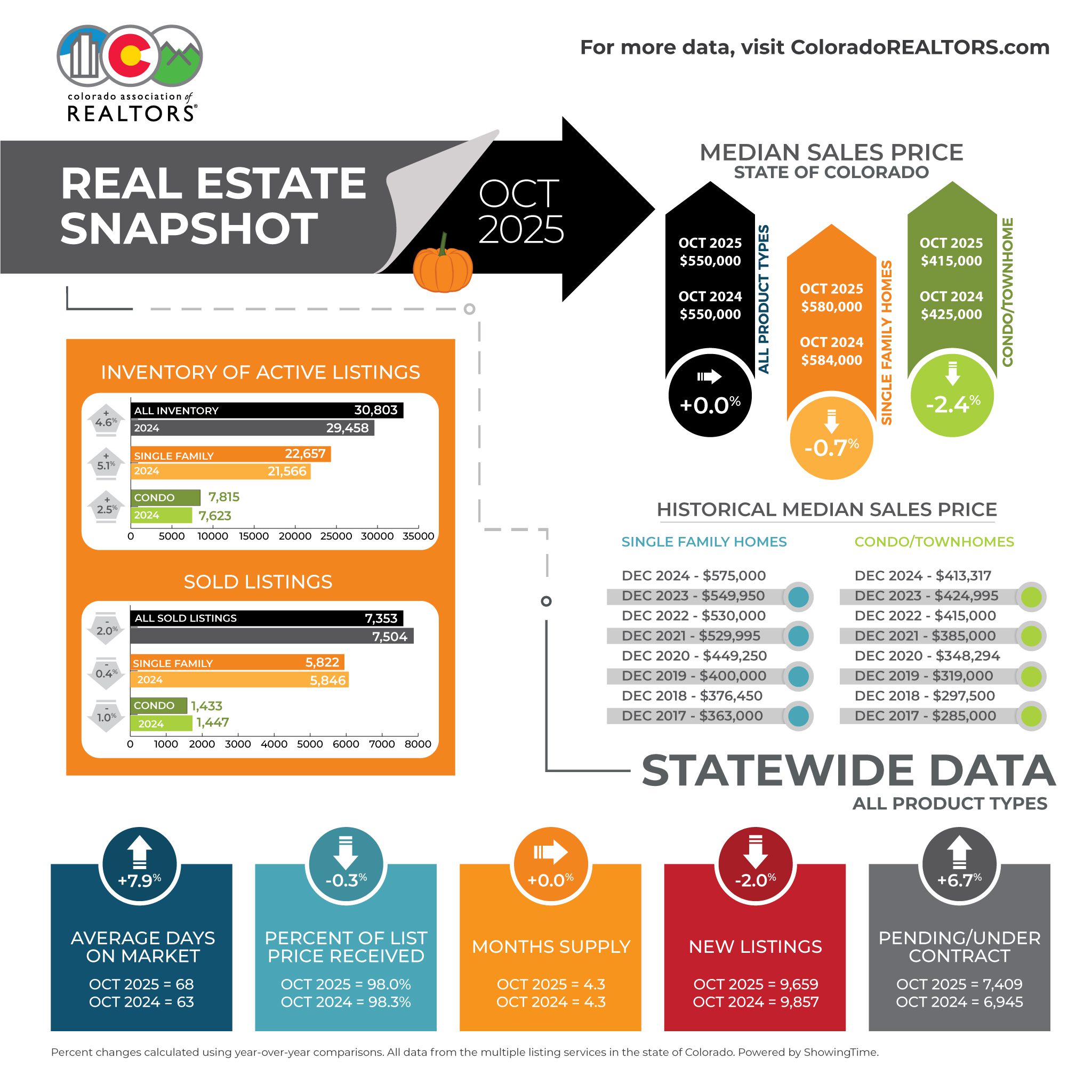

ENGLEWOOD, CO – Colorado’s housing market is settling into a new rhythm as the year draws to a close, with steady prices and signs of a broader market recalibration, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons working in markets across the state.

In October, the state recorded 9,659 new listings and 7,353 home sales, both down 2% from a year ago, while active listings reached 30,803, equal to about 4.3 months of supply. The median sale price held firm at $550,000, virtually unchanged year over year.

However, buyers are gaining leverage as homes spend more time on the market, an average of 68 days, up 12% from last October. This added breathing room has led to more measured negotiations, with buyers closing at roughly 5.7% below original list prices on average.

With mortgage rates hovering in the mid-6% range and cost pressures still weighing on budgets, value remains the deciding factor. Sellers who adapt quickly, pricing realistically, presenting well, and offering strategic concessions are the ones finding success in this new phase of the market’s evolution.

Across Colorado’s regions, distinct local patterns are emerging. From metro-area price stability to more pronounced inventory shifts in resort and rural markets, the October snapshot offers a deeper look at how the recalibration is unfolding across the state.

Colorado Housing Markets – October Snapshot

Based on analysis from REALTORS® working in markets across the state

(for a more in-depth analysis by market, see full content in report):

Aurora – Aurora, Adams, and Arapahoe counties remain steady year over year, with minimal shifts in listings, sales, or prices. Aurora reports 1,157 active single-family listings, down 5% from last year, and a median price of $520,000, off 2%. Greenwood Village/Centennial’s 80111 ZIP shows a sharper 29% price drop to $892,000. Homes average 50 days on market, favoring buyers as sellers adjust with concessions and strategic pricing.

Boulder and Broomfield counties – Boulder and Broomfield counties are holding steady despite rising inventory and slower buyer activity. In Boulder County, new listings are up 9.5% year-to-date while sales rose 4.4%, keeping prices stable—about 1.6% higher than early 2025. Homes average 60 days on market, with condos taking 71. In Broomfield, homes sell faster at around 40 days, though condo sales are down 30%. With inventory outpacing demand, buyers are gaining leverage and negotiating favorable deals.

Colorado Springs – October brought seasonal chills to the housing market as listings unexpectedly rose 10.5% while sales fell 12.4% and median prices slipped 1.1%. Inventory in both single-family and condo/townhome segments continued to build. REALTORS® report growing challenges in the condo market as rising insurance costs drive up HOA dues. Meanwhile, rental properties are sitting vacant at the highest levels in a decade, forcing landlords to cut rents and offer incentives.

Colorado Springs – The Colorado Springs housing market shifted toward balance in October 2025 as inventory rose to 3,918 homes—the highest October level since 2013 and a 15.4% annual increase. With 4.5 months of supply, prices softened: the average fell 2.5% to $543,590, and the median dipped to $473,500. Sales dropped 12.2% year-over-year to 876, the lowest since 2013, though year-to-date totals remain slightly higher. Homes now average 54 days on market. With more listings, easing rates, and negotiable sellers, buyers hold a clear advantage, marking one of the most balanced and affordable conditions in Colorado Springs in over a decade.

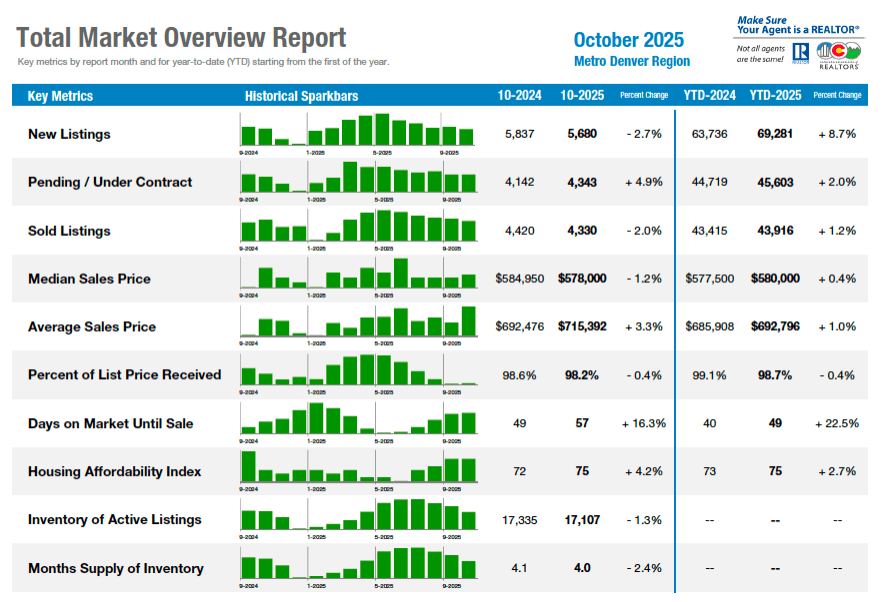

Denver Metro – As 2025 winds down, Denver’s housing market continues to recalibrate. October saw 5,680 new listings (-2.7% YoY) and 4,330 sales (-2% YoY), ending with 17,107 active homes—about four months of supply. The median price rose slightly to $580,000 (+0.4% YoY), though sellers are conceding more in negotiations. Homes averaged 49 days on market (+22.5%), giving buyers leverage to secure deals roughly 5.7% below list. With rates near 6.3%, well-prepared sellers and value-focused buyers define this balanced, strategy-driven market heading into 2026.

Durango/LaPlata County – October saw renewed activity in La Plata County’s housing market, shifting from a buyer’s market toward balance. Median prices rose 47.8% year-over-year, driven by luxury sales, though many rural areas remain flat. Inventory tightened slightly as listings withdrew for winter; days on market climbed to 110, while supply held at 5.3 months. Condo and townhome sales fell sharply, and prices dipped 4.5% to $535,000. In-town Durango led price gains, while rural areas lagged. Overall, October was busier than midsummer, fueled by pre-holiday moves and high-end demand, reflecting an oscillating market moving gradually toward equilibrium.

Evergreen – The Mountain Metro foothills market remained steady in October as new single-family listings rose 4% year over year to 684, while closed sales dipped 2% to 607. Median prices edged up 2% to $697,000, and average days on market climbed from 40 to just over 50. Sellers are achieving about 98% of list price but must price realistically to attract buyers. Evergreen and Conifer saw sales up 20%, driven by higher-end activity. Overall, the foothills mirror statewide trends—more inventory, slower pace, and a shift toward balanced, negotiation-driven conditions heading into winter.

Fort Collins – October brought no Halloween shocks to the Fort Collins housing market, which continued its seasonal slowdown. Sold listings, days on market, and inventory levels held steady year over year, though new listings fell 11.5%. Overall inventory remains elevated, averaging 16% higher than last year. Mortgage rates hover near 6.3%, sidelining many buyers amid ongoing economic uncertainty. Sellers are cutting prices and offering concessions to attract interest, as many homes sit on the market for two months or more in a cautious, rate-sensitive environment.

Grand County – Grand County’s housing market showed signs of balance in October. The typical home value sits around $764,000, down 0.9% year over year, with a median price near $838,000. Homes are averaging 87 days on market and selling at about 97% of list price. Buyers now have more negotiating power, while sellers must price strategically in a slower market. With prices at their lowest since 2019, Grand County and Winter Park remain high-value, lifestyle-driven markets offering opportunities for buyers, sellers, and investors alike.

Pagosa Springs – Compared to October 2024’s seller-driven gains, October 2025 reflects a clear buyer’s market in Pagosa Springs. Median and average sales prices fell sharply—median at $485,000 (down 22.4%) and average at $619,966 (down 26.1%). Year-to-date, the median is $570,000 (down 4.1%) and the average $706,723 (down 8.2%). Buyers are focusing on value-priced homes under $1 million, pushing prices lower while high-end listings flood the market. Inventory rose 20.4%, dominated by luxury homes, driving Days on Market up 149 days and supply to 8.7 months.

Steamboat Springs/Routt County – Steamboat Springs saw rising inventory in October, with 247 single-family listings year-to-date, up 9.3%, while sales held steady at 19 and prices hovered within 2% of last year. The median home price was $2.05 million (down 8.8%) and the average $3.09 million (up 6.3%). Multi-family listings surged 33%, with sales up 22% and a median price of $875,000. Across Routt County, months’ supply now ranges from 6 to 8, signaling a more balanced market where buyers have leverage and sellers must price strategically to compete.

Summit and Park Counties – As ski season kicks off, Summit and Park counties’ housing markets are gaining momentum. Summit County saw single-family sales surge 73% year over year, with 64 closings and a median price of $1.85 million (down 7.5%), while condo sales held steady at a $755,000 median. Park County cooled, with sales down 46% but prices steady near $610,000. Combined inventory rose 21%, offering buyers more choice. Homes average 79 days on market, with sellers still earning 96% of list price—signaling a balanced, stable market heading into winter.

Vail – October marked a calm transition between Steamboat’s summer and ski seasons, though sales activity climbed. Single-family/duplex and townhouse/condo sales each rose 36% year over year. Pending sales were mixed, up 11% for single-family but down 24% for condos. Inventory grew, with single-family listings up 25% and condos up 17%, resulting in a 6.4-month overall supply. While new listings declined 5%, the market shows a healthy balance heading into ski season, supported by cash buyers and improving affordability for locals as mortgage rates ease.

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Aurora, Adams County, and Arapahoe County continue to track closely with last year’s numbers, showing little change in listings, sales, or prices compared to both October 2024 and the previous month. Most ZIP codes reflect a modest decline in listings, though a few have seen slight upticks in sales, possibly influenced by the recent, if minor, dip in interest rates.

“Aurora currently has 1,157 active single-family listings, down 5% from this time last year, with a median price of $520,000, which is about 2% lower year over year. Conditions are similar across neighboring ZIP codes, though Greenwood Village/Centennial’s 80111 stands out with a median price of $892,000, a notable 29% drop from last October.

“Homes across the Aurora/Centennial corridor are spending roughly 50 days on the market, giving buyers more leverage. Many motivated sellers are responding with price flexibility and concessions. Looking ahead, more inventory and renewed buyer activity are expected by spring, but for now, market conditions remain especially favorable for buyers, while sellers focused on presentation, repairs, and realistic pricing continue to see success,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“The Boulder and Broomfield County real estate markets continue to hold on, even as inventory levels climb and buyer activity is slow. While new listings have increased and homes are taking longer to sell, overall home prices in Boulder remain steady, holding approximately 1.6% higher than at the start of the year.

“In Boulder County, new listings are up 9.5% year-to-date, reflecting a continued desire to capitalize on the area’s strong long-term demand. However, sales have risen just 4.4%, signaling that the pace of buyer activity has not fully kept up with the influx of homes entering the market. Despite the shift, prices remain solid thanks to the region’s enduring desirability and limited land availability. The average days on market has increased to 60 days, and that is assuming the property is priced right and shows well.

“Condominiums and townhomes largely mirror the single-family home market, though they are taking slightly longer to sell with an average of 71 days on market. Higher HOA fees, driven in part by rising insurance premiums, have made these properties somewhat less appealing to first-time homebuyers, who remain sensitive to rising payments.

“In Broomfield County, the numbers closely reflect Boulder’s market, though homes are selling faster, averaging around 40 days on market. This quicker pace is likely tied to the area’s more affordable housing options, which continue to attract a broader pool of buyers. However, condos and townhomes are facing headwinds, with fewer new listings and sales down roughly 30% compared to this month last year. The decline may be influenced by higher HOA fees, as well as first-time homebuyers choosing to wait for improved mortgage rates before entering the market.

“As Lawrence Yun (Chief Economist for National Association of REALTORS®) recently noted, ‘When inventory rises faster than demand, buyers gain bargaining power. That’s when the market shifts from speed to strategy.’ Buyers in this market who recognize the ability to buy down their interest rate using seller concessions are getting some great deals at a time when seller motivation is high before the holidays,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“October ushered in ghosts and ghouls, and our weather began to change. It was interesting to see that listings increased 10.5% across all properties in a time that we usually see homes pulled from the market. Sold listings dropped 12.4% and median prices pulled back 1.1%. We edged up on months supply of inventory in both townhome/condos and single-family homes.

“Area REALTORS® acknowledge that the townhome/condo market is having problems due to higher insurance costs causing higher HOA dues putting pressure in that area of the market. Property managers are sitting on the most vacant homes they have had in a decade and are now offering out incentives to get them rented. During past slowdowns if a seller could not sell, they rented and usually got their payment covered, or close to it. Today, a seller who cannot sell tries to rent only to find out they are still upside down $500-$1000. Rents are dropping as apartments offer out incentives and property owners must adjust to compete.

“The Federal Reserve did get a rate drop in and in response mortgage rates increased. Debt at all levels is at historic highs and loan delinquencies continue to rise across automobiles, credit cards, and student loans. December will likely see another quarter point drop, but that doesn’t seem to be relieving higher rates in the mortgage world. The 10-year continues to be sticky. Layoffs continue to show up in headlines. Amazon being one of many big names. Fannie Mae announced a recent poll suggesting 70% of consumers feel it’s a terrible time to buy. That is an issue for housing. As the economy continues to struggle, housing is also feeling that pain. Hopefully, we get some relief soon,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The Colorado Springs housing market saw a significant rise in inventory in October 2025, marking a turning point from recent years. Active listings for single-family and patio homes reached 3,918—the highest October level since 2013—representing a 15.4% annual increase and a 344.7% surge since October 2020. Overall supply climbed to 4.5 months across all price ranges, aligning with what’s considered a balanced market (four to six months of inventory).

“As supply grows, prices typically soften. After more than a decade of steady October price gains, the average home price declined 2.5% year-over-year to $543,590, ending a streak of increases dating back to 2011. Despite this dip, the average price remains 25.7% higher than in 2020 and more than double that of 2015. The median price also slipped slightly to $473,500, continuing the modest downward trend from $475,000 last year.

“Sales activity mirrored this cooling pattern. Just 876 homes sold in October—the lowest level for the month since 2013—down 12.2% from last year and nearly half of October 2020’s volume. Year-to-date, however, sales are up 3.2%. Monthly sales volume dropped 14.5% year-over-year but remains 63% higher than in 2015.

“Buyers now hold an advantage. With ample inventory and softening prices, motivated sellers are increasingly open to negotiation. Combined with easing interest rates, conditions are favorable for buyers seeking opportunities before winter. “In today’s high-inventory market, well-priced and move-in-ready homes sell quickly, while overpriced or outdated properties linger,” said REALTOR® Jay Gupta.

Market Breakdown by Price Range

Homes under $400,000 account for 31.1% of all sales, with a 3.8% increase year-over-year. The $400,000–$600,000 segment, representing 42.1% of sales, saw a 19.4% decline. Sales between $600,000 and $1 million dropped 12.2%, while homes above $1 million fell sharply by 28.6%. Supply remains healthy across all tiers: 3.4 months for homes under $400,000, 4.3 months for $400,000–$600,000, 5.4 months for $600,000–$1 million, and a generous 9.3 months for homes over $1 million.

Days on Market

Homes took an average of 54 days to sell in October, up from 44 last year, reflecting a slower pace as buyers take more time to evaluate options.

Outlook

The Colorado Springs market is entering a more balanced phase after years of tight supply and soaring prices. While activity has cooled, the combination of high inventory, softening prices, and improving affordability presents one of the most buyer-friendly environments in over a decade.

CRESTED BUTTE/GUNNISON

“The 2025 real estate market in the Crested Butte and Gunnison area continues to be similar to 2024, but a robust September pushed us ahead of last year. Overall, the area served by the Gunnison Crested Butte Association of Realtors has had transactions that are up 6% from 2024 and the dollar volume is up 7%. The Gunnison area continues to lead the market with 20% more sales in 2025 than the previous year and dollar volume up 15%. Average and median prices are about the same in the GCAR area and in Gunnison with slight variations. Crested Butte area sales are slightly up over last year, but the dollar volume is up 16% which reflects the market shifting towards luxury and higher prices overall.

October brought the highest-priced sale of a single-family home in the area. The record-breaking sale was a home with a one-of-a-kind location, and it sold for $11,915,000. This surpassed the sale of a home in the ski-in, ski-out subdivision of Prospect in Mt. Crested Butte that sold for $10,000,000 in 2023. There are currently three homes in the Crested Butte area for sale for $10 million or more. One of these is a single-family home listed for $25,000,000, which is the most expensive single-family home listed in the area ever. Located between Crested Butte and Mt. Crested Butte on 125 acres, this 6,500 square foot home is indicative of a shadow inventory of luxury homes that have been built in the area, but have never been for sale. As the owners of more of these homes decide to move on for one reason or another in the coming years, luxury buyers will find that Crested Butte is a place they should consider,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER METRO (Seven County)

“As we enter the final months of 2025 and look ahead to next year, it’s clear the Denver-metro area market is in recalibration mode. October inventory metrics looked familiar, with 5,680 new listings (-2.7% YoY) and 4,330 closed sales (-2% YoY), wrapping up the month with 17,107 homes on the market, representing about four months’ supply of inventory. Prices remained fairly steady, portraying a balanced-to-slightly buyer-favorable negotiating environment. Year-to-date, the median sale price has climbed marginally to $580k (+0.4% YoY), but sellers aren’t quite receiving everything they are asking for.

“Market velocity, not volume, has proven to be the backbone of changing leverage. While the number of new listings and sold listings each month has remained consistent with historical norms, average time on market this year has climbed 22.5% to 49 days, which allows weekly inventory to accumulate even when the inflow of new and sold listings stays consistent. The result of elevated relative inventory allows buyers to be not only methodical but also more aggressive in their approach. So far this year, buyers have negotiated an average net close price (net of concessions) approximately 5.7% below the average original list price.

“This market environment rewards preparation and execution over speculation. With mortgage rates hovering near 6.3% and non-mortgage costs elevated, demand is limited but still expresses itself when value is obvious. Sellers who calibrate to today’s pace will price to the market on day one, present cleanly, and use targeted concessions where they move the needle. The mechanics are simple: more time on market creates a pile-up of inventory, the pile-up shifts leverage, and realistic pricing resets the conversation back to value.

“Looking ahead to 2026, inflation patterns, and thus, the path of mortgage rates, will set the cadence. If mortgage rates climb toward or above 7%, expect days on market to remain elevated, months’ supply to drift higher, and prices to run flat to slightly negative as sellers are forced to compensate to remain affordable. If rates hold near current levels, anticipate a similar year to 2025: steady new and sold counts, slower turns, and prices oscillating around flat with small gains in well-positioned segments. If rates fall into the low to mid-5% range, absorption improves, time on market shortens, list-to-sale ratios tighten toward 99%, and modest appreciation becomes plausible as sidelined buyers re-enter the market with newfound motivation,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“October brought renewed activity to La Plata County’s real estate market, signaling a shift from summer’s buyer-leaning conditions toward a more balanced environment. Median prices surged 47.8% year-over-year, reversing recent months of decline. This jump was largely driven by a spike in luxury sales—30 homes over $2.5 million sold year-to-date compared to 11 last year—making prices appear stronger overall, though many rural areas remain flat or down.

“Inventory tightened slightly as rural listings began their typical pre-winter retreat. Days on Market rose 23.6% to 110 days, but months’ supply of inventory held steady at 5.3 months, offering brief stability after months of growth.

“Condo and townhome activity remains subdued: sales fell 40.6% in October and 8.5% year-to-date. The median price in this segment dropped 4.5% to $535,000, while supply rose 36% to 6.4 months.

Regional Highlights

- In-Town Durango:Higher-end single-family transactions boosted both average and median prices by over 30% versus October 2024, though the year-to-date median remains 10% lower. Inventory is unchanged at 2.8 months.

- Rural Durango:Inventory and sales volume are both down compared to 2024, but median prices are up 9.5% YTD, supported by upper-tier purchases.

- Rural Bayfield:Inventory has eased, holding the median price steady near $542,000. However, these homes take significantly longer to sell—averaging 125 days, nearly two months slower than last October.

- Purgatory Resort Area:Active listings climbed sharply in 2025, up 67% for single-family homes and 25% for condos/townhomes, thanks to new subdivisions. Sales have yet to rise, but momentum is expected heading into the winter season.

“October was unexpectedly brisk, with title companies busier than midsummer. Buyers favored in-town Durango or properties offering clear value and amenities outside urban areas. Rural sellers, meanwhile, faced longer wait times and fewer showings, highlighting a split market defined by location and perceived value.

“No single factor explains the uptick. Some buyers likely moved to purchase before the holidays, while luxury demand may reflect investors seeking diversification or unique legacy properties hitting the market.

“The local shift from a seller’s to buyer’s market isn’t straightforward. Instead, it oscillates—periods of strong activity alternating with slow spells—creating a market that feels unpredictable even as it trends toward balance,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“October brought a quieter, more deliberate pace to the Colorado foothills housing market. After several months of elevated inventory and active summer selling, the market is settling into a more balanced posture: more choices than in recent years, but longer days on market and slightly softer momentum on the sales side,” said Evergreen-area REALTOR® Julia Purrington Paluck.

Supply up modestly, sales easing

Across the Mountain metro foothills, new single-family listings in October rose about 4% year over year, with 684 new listings compared with 656 last October. At the same time, closed single-family sales slipped just under 2%, from 619 to 607.

The result is a market where buyers have a healthier selection than they did during the 2020–2022 rush, but where sellers are still finding buyers, particularly when homes are well-prepared and priced in line with recent comparable sales. Pricing is key and sellers should assume a downward trend when considering list price. If it is priced too high to start, it will sit and continue to lower.

Prices holding, time on market stretching

Pricing in the foothills remained resilient in October. The median single-family sales price for the region edged up roughly 2% year over year to about $697,000, and the average price ticked up just over 1%. This is below the inflation rate so suggests sluggish home sale market.

The bigger shift is in time on market. Single-family days on market increased from about 40 to just over 50 days, a jump of roughly 25–30% compared with last October. Sellers are still achieving strong results, with the percent of list price received hovering near 98%, but the days of weekend-long listing periods and automatic multiple offers are firmly behind us.

Local foothills trends

Conditions varied by submarket, but in the Evergreen / Conifer market, this year’s closed sales are up around 20%, reflecting steady buyer demand for this core foothills corridor. Pricing is more nuanced: the year-to-date median sales price is slightly below last year, while the average price is up close to 10%, highlighting continued strength at the upper end even as more moderately priced homes soften.

How the foothills compare statewide

Statewide, single-family new listings in October were slightly lower than last year, and the statewide median price dipped fractionally, even as pending contracts increased and average prices inched higher. By contrast, the foothills posted a small gain in median price while still seeing slower absorption and longer days on market.

In other words, the foothills are largely tracking the statewide pattern of normalizing demand and increased negotiation, but with somewhat stronger price stability at the single-family level.

Takeaways for the months ahead

The October data continue a theme we’ve seen throughout 2025: Inventory is materially higher, prices are adjusting by segment and location rather than collapsing across the board, and days on market and concessions are doing part of the work that price cuts used to do alone. As we head into the winter season, the foothills market appears stable but slower, with an emphasis on realistic pricing, full property preparation, and careful negotiation on both sides of the transaction.

FORT COLLINS

“Other than trick-or-treaters, there was nothing particularly spooky, paranormal, or scream-worthy about the October Fort Collins housing sales reports. Considering seasonality, there appeared to be a traditional slowing of the market with sold listings, days on market, and months’ supply of inventory essentially unchanged from a year ago. New listings provided perhaps the most frightful change, falling 11.5% behind last year’s number but inventory of homes for sale remained well above par, posting a 12-month average increase of over 16%.

“Thirty-year mortgage interest rates dipped briefly then back up and remain at the 6.3% level – keeping many would-be buyers firmly planted on the sidelines. Roller-coaster economic news and forecasted woes for those impacted by the extended shutdown of the federal government have further alienated both buyers and sellers from entering what is perceived to be a volatile real estate marketplace providing tummy-aches without the scarfing down the leftover Halloween sweets and chocolates. Active sellers are facing price reductions to get their properties sold while also giving up cash concessions to lure the active buyers in the market to tour and make offers on their homes (many of which have been on the market for 2 months or more).

“Until the uncertainty of the ‘economic crisis du jour’ abates – the residential real estate sector will likely remain subject to boos and hisses on both sides of the transaction until some sort of relief is provided by lower interest rates and a less antagonistic marketplace where investors see mortgages as long term wins like they did in years’ past,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND COUNTY

“It was an exciting October in Grand County’s housing market and here’s a few things that are stacking up and insight on why now is a moment to pay attention, whether you’re buying, selling, or just watching from the sidelines,” said Grand County REALTOR® Monica Graves.

What the numbers are telling us:

- The typical home value in Grand County is around $764,095, having dipped slightly (-0.9%) over the past year.

- The median home price is about $838,000 over a 12-month trend.

- The market is easing — in August, the median listing price was down 8.4% year-over-year, and homes are spending more days on market, 87 days is average.

- The sale-to-list ratio is ~97% — meaning homes are selling just under list price on average.

Why it matters — market vibe and opportunities:

- Buyers: You might have more leverage than in the frenzied peaks of past years. With prices slightly softened and more days on market, there’s room to negotiate.

- Sellers: Still a high-value market — the typical home is well into the mid-six-figures — but you’ll want to price smart, stage well, and be prepared for a bit longer than lightning-fast sale times.

- A nearly $850K median signals that this is premium real-estate territory: the lifestyle, the scenery, and the resort access matter. The median price is lowest it has been since 2019.

- The market “breathing out” a bit gives both sides a chance to strategize more thoughtfully rather than rush.

- Autumn is an aesthetic season here — leaving the summer rush and heading into a quieter window, which may bring motivated sellers and interesting listings.

- If you’re looking for second-homes, vacation investments, or a mountain lifestyle relocation — this is a moment to explore Grand County Real Estate.

Winter Park is still a premium mountain/resort sub-market, but it’s shifting:

- For buyers: There may be more opportunity now than in the “boom” years of rapid multiple offers. Inventory is relatively higher and negotiation room is more likely if the property is not “perfect”.

- For sellers: Premium location still matters (near resort, views, good condition) — but you’ll need to price smart, present well, and expect perhaps more time on market than 2020-2022.

- For investors: Strong recreational draw remains (skiing, summer trails), but watch for higher cost of ownership (rates, maintenance) and longer marketing as the market normalizes.

PAGOSA SPRINGS

“Compared to October 2024, when sellers experienced significant price gains, the Pagosa Springs market in October 2025 reflects a notable shift toward buyer control. Median and average sales prices have declined both month-over-month and year-to-date, signaling a market recalibration following two years of elevated activity.

Key Market Indicators

- October 2025 Median Sales Price: $485,000 (down 22.4%)

- October 2025 Average Sales Price: $619,966 (down 26.1%)

- Year-to-Date Median Sales Price: $570,000 (down 4.1%)

- Year-to-Date Average Sales Price: $706,723 (down 8.2%)

“Buyers are increasingly focused on value and affordability, favoring homes below the median and average price ranges. This shift has tempered the high-end market, where listings over $1 million continue to grow. Of the 42 homes currently pending, only six are priced above $1 million, a continuation of the trend seen in recent months. As a result, average and median prices are expected to continue declining into November and December as buyers purchase within more moderate price brackets.

“Total inventory increased 20.4% compared to last year, largely driven by new high-end listings. This influx has pushed the months’ supply of inventory to 8.7 months (up 22.5%) and extended the days on Market to 149 days, indicating slower turnover, particularly in the luxury segment.

“While demand for mid-range properties remains steady, the upper-tier market faces challenges stemming from excess supply rather than a lack of qualified buyers. The abundance of million-dollar listings—more than 70 currently active—has intensified competition among sellers.

“As of October, 51 homes over $1 million have sold, with six pending, positioning the market below the 2024 total of 75 sales in this price category. Given the current pace, many high-end properties are expected to remain on the market well into 2026. Sellers in this segment must adopt a buyer-oriented approach, emphasizing realistic pricing, strategic incentives, and patience to achieve successful outcomes.

Pagosa Springs continues to operate as two distinct markets:

- A seller’s market for homes priced below the median and average, where competitively priced listings move efficiently.

- A buyer’s market for homes above those thresholds, where elevated supply creates downward pressure on prices.

“Overall, homes are selling at 96.5% of list price, reflecting continued negotiation leverage for buyers. As conditions evolve, both buyers and sellers will benefit from professional guidance to navigate pricing strategies, timing, and market positioning effectively,” said Pagosa Springs-area REALTOR® Wen Saunders.

STEAMBOAT SPRINGS/ROUTT COUNTY

“While September new listings mirrored the prior year’s figures, October inventory rose in Steamboat Springs. The month brought 19 more single-family homes to the Steamboat market, raising the year-to-date count to 247 — a 9.3% increase, signaling a 2.8% raise from the 6.5% figure the month before. Our 19 sales were equivalent to last year; median and average sales prices came up slightly under 2%. The highest sales price for the month was $7.5 million and the lowest was $1.275 million, bringing the accumulated median sales price to $2,050,000 (down 8.8%) and the average sales price to $3,093,246 (up 6.3%).

“October saw an increase in new listings for multi-family. This segment of the market is where there is new construction development which attributes to the 33.1% increase for the year. Number of sales fared well for the period with an increase of almost 22% and up 4.7% incrementally. Median sales price is $875,000 reflecting a 3.4% increase, while average sales price decreased 3.5% to $1,062,921. Months’ supply for both single and multi-family is now 7.8 and 6.4 months respectively, which is a significant difference from the same time last year.

“There are 22 homes for sale and months’ supply for single-family in the Oak Creek/Stagecoach area echoes Steamboat at 7.3 months. Five homes sold at an average sales price of $986,763. Three condos/townhomes came to the market to total 7 choices for Buyers to choose from. With median prices at $441,500 and average sale prices at $459,750, this slice of the market is more affordable for the Routt County area.

“The Hayden community is holding very steady with total number of new listings (55) and sold listings (29) the same as last year. With 20 homes on the market, the months’ supply is 6.5. The median sales price is up 2.1% at $620,000 and the average is $668,828 – homes priced above $700,000 typically can expect to endure longer days on market. To date, the multi-family market has had less listings come on the market and even at that, there has been one more sale with a median sales price of $394,000 and average of $553,500. Only 2 units are on the market, creating a 1.3-month supply with an average days on market 55.

“Summer activity in Steamboat seemed a bit unusual; the buyers were there, but the bustle was different. The last three months have shown improvement in the number of home sales thus reducing the months supply from over 9 months to 7.8. The story for condos/townhomes is similar with August showing 8.9 months supply and October now at 6.4. Interest rates could have impacted that some, but there is still a significant number of transactions completed with cash. Fall sales can present an opportunity where a summer listing did not sell, and a better deal can be had.

“There is not a one size fits all strategy for buying and selling in Routt County. Sellers need to look through a ‘buyer’s eyes’ for pricing according to condition, location or combination of the two. Overall, the months’ supply levels for Routt County are significantly more than last year and as a result, the playing field is more level and negotiations are back – not only on price but inspections,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT AND PARK COUNTIES

“As ski season kicks off and the lifts at A-Basin, Keystone, Breckenridge, and Copper Mountain begin to hum, the local real estate market is carving its own early-season tracks and finding balance, momentum, and a touch of altitude adjustment as we head into winter.

“Like the lift lines on the first powder day, activity is picking up in Summit County.

- Single-family home sales soared 73%, with 64 closings this October compared to just 37 last October.

- Prices adjusted slightly, the median single-family price dipped 7.5% to $1.85 million, while the average came in at $2.34 million, showing that while luxury homes still dominate, buyers are navigating toward value in a higher-inventory environment.

- Townhome and condo sales held steady (91 sold, down just 3.2%) with a median price of $755,000, down 7.4% from last year.

- The supply of inventory sits around 6 months, marking a balanced market

“Further south, Park County is taking a more measured pace into winter.

- Sold listings fell 46%, with 20 sales this October, compared to 37 October 2024, reflecting softer demand after a busy summer.

- Still, prices are holding firm with a median price of $610,000, only slightly below last year’s $646,000.

- Inventory grew 23%, and with a 10.5-month supply, buyers now have more choices which is a refreshing change after years of scarcity.

- The average sale price jumped 29% to $926,950, signaling continued appetite for higher-end mountain properties

“Across Summit and Park counties combined inventory expanded nearly 21%, providing more opportunities for buyers as interest rates settle into predictable patterns. Even as days on market lengthened, averaging 79 days, sellers continue to achieve over 96% of list price, underscoring strong interest in desirable properties

“In Summit, Park and Lake counties, 764 listings are currently on the market, ranging from a $82,500 mobile home in Park County to a $21 million ski-in/ski-out Breckenridge home. Nearly half (49%) are priced above $1 million, with 47 listings over $5 million.

“In October, 186 residential closings ranged from a $145,000 single-family home in Park County to a $7.2 million Dillon, ‘shell’ of a home, perched on the cliff at the Pinnacle at Summerwood. More than half (52%) of sales closed above the $1 million mark, and cash deals were 39% of all transactions.

“As skiers wax their boards and locals prep for the first powder days, the real estate market seems to be finding its rhythm: steady climbs, a few controlled turns, and a sense that the long glide of inventory buildup is setting the stage for a smoother ride ahead.

“Much like the early snow, market activity is uneven but promising. Buyers are back out exploring, sellers are adjusting expectations, and the market overall is showing healthy signs of equilibrium,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The best way to describe the Telluride regional real estate market is that it has come down from the Pandemic frenzy and leveled off to a balanced seller/buyer equal strength competition. Neither side is in control hence old fashion principles apply. Sellers need to price to the current market if they really want to sell and buyers have more properties to choose from with makes more negotiation possible. That being said, every seller and every buyer will have their own opinion about the market and price negotiations will be more challenging. We still have a lot of wealth in our market. That means most sellers don’t have to sell and most buyers don’t have to buy. There are exceptions. If a buyer finds their dream property, they may just pay the price. That will probably be the exception.

Now the stats. October 2025 dollar volume is down 1% to $78.68 million with the number of sales down 4% to 44 as compared to October 2024. Over the last five-year averages, the current real estate market is down about 31% in dollar volume and down about 36% in the number of sales. Meanwhile, year-to-date through October, total dollar volume was $720.31 million which is a decline of 17% with the total number of sales for the same period of time coming in at 377, down 4% as compared to the first ten months of 2024,” said Telluride-area REALTOR® George Harvey.

VAIL

“October is part of our window between the summer market and the beginning of the ski season market. Historically, it is a relatively quiet month and follows the slow summer trend.

“Single family/duplex sales were up 36% compared to last year and townhouse/condo sales were up the same. It’s unique in that both segments moved at the same percentage of activity. Pending sales for the single family/duplex were up 11% while townhouse/condo sales were down 24%. New listings for single family/duplex were up 2% with townhouse/condo listings down 11%. Active listings for single family/duplex were up 25% and listings on townhouse/condos were up 17%. Months’ supply of inventory for single family/duplex sits at 7.7 months with townhouse/condos at 5.3 months.

“When we combine both categories for a total market comparison it looks like this: closed sales up 36%, pending sales -9%, new listings -5%, active inventory up 22%, months’ supply at 6.4.

“The trend by pricing niche has continued in both sales and active inventory of units. This trend helps us look at future projections and shows a positive outlook for the pending ski season market which is a historic catalyst to overall performance. The macro-economic market is a factor in our ski season activity. Albeit we have a majority of buyers who are cash purchasers, the lowering of mortgage rates does have significant impact on the lower price niche purchasers and particularly with our local clientele,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.