Colorado Housing Market Shows Seasonal Slowdown, Growing Balance Across Regions

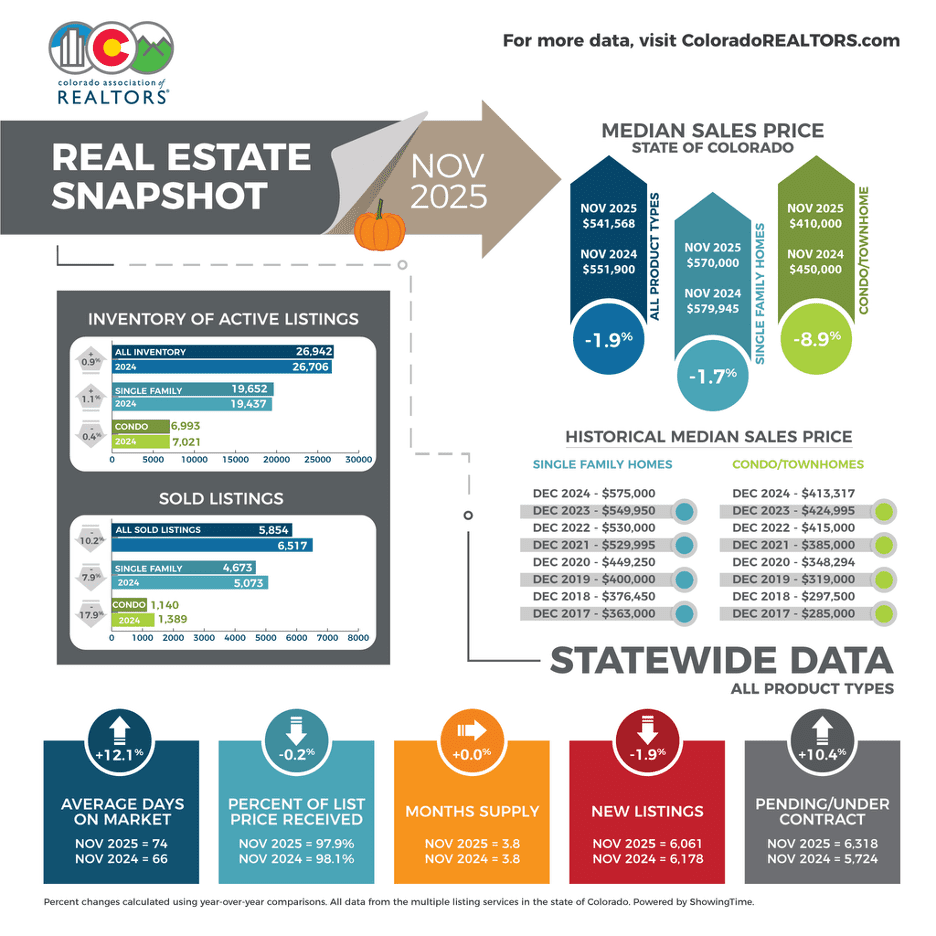

ENGLEWOOD, CO – Colorado’s housing market continued its steady recalibration in November, closing out the fall season with softer sales activity but growing signs of balance across much of the state, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR).

Statewide, November followed October’s pattern of moderation. Homes are spending longer on the market, averaging 68 days, up 12% from last year, giving buyers renewed negotiating power. Many are closing at roughly 5.7% below original list price, and sellers offering concessions are finding the most success. Active inventory sits at 30,803 listings, about 4.3 months of supply, while the statewide median sale price of $550,000 remains essentially unchanged year over year. With interest rates hovering in the mid-6% range and cost pressures still influencing affordability, value and pricing precision continue to drive buyer decisions.

“As the year progresses, the real estate market continues to lag. This November felt far more seasonal than in recent years, with many agents noting that buyers seemed to ‘pack up for the holidays.’ The data supports that perception,” said Colorado Springs-area REALTOR® Patrick Muldoon.

Across all markets, REALTORS® report a consistent theme: buyers now have more time and choices, while sellers who price realistically and prepare strategically remain well-positioned for success. As Colorado moves into winter, the state’s housing market is settling into a more balanced, functional rhythm heading into 2026.

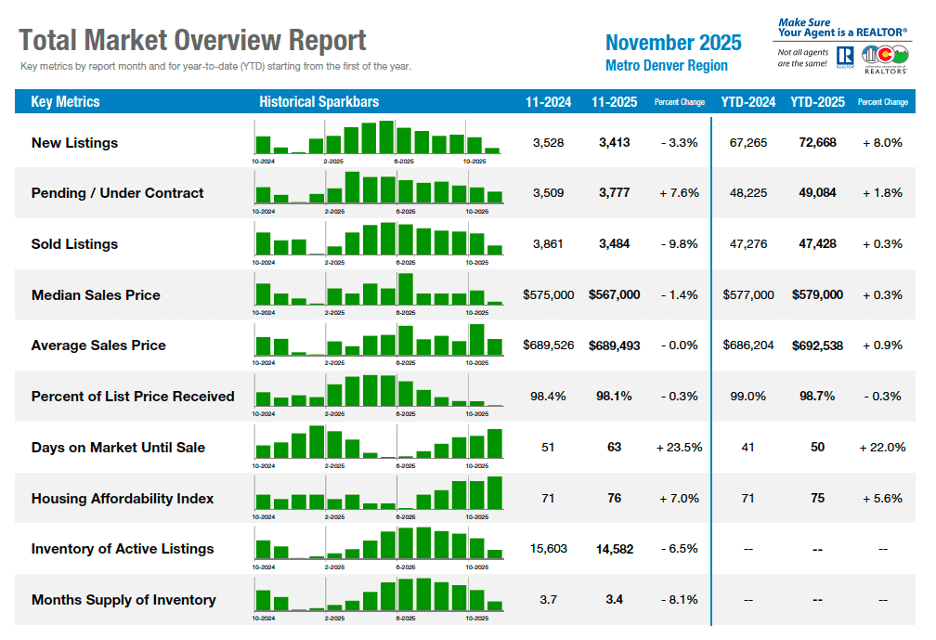

“As 2025 winds down, the Denver Metro housing market shows signs of a typical seasonal cooldown rather than systemic weakness,” said Denver County-area REALTOR® Cooper Thayer. “As we approach 2026, expectations for dramatic market swings are giving way to something more stable. Importantly, many of these dynamics reflect a recalibration rather than a downturn. Buyers who understand the value of negotiating power, and sellers who are prepared to meet the market where it is, are still making deals happen. As long as affordability constraints remain elevated, driven not just by prices and rates, but also by taxes, insurance, and HOA dues, markets will continue to reward preparation, patience, and realistic pricing.

Across Colorado’s diverse markets, November brought a clearer picture of how this transition is unfolding:

Colorado Housing Markets – November Snapshot

Based on analysis from REALTORS® working in markets across the state

(for a more in-depth analysis by market, see full content in report):

Aurora – Aurora’s housing market remains sluggish, with many sellers pausing listings until spring. Active single-family inventory has dropped to 986, while November sales rose 6%. Median prices continue to fall—now $519,000 citywide, with most zip codes down about $50,000, plus average seller concessions of $8,000. Although buyers benefit from lower prices, rising insurance, taxes, and HOA fees increase monthly costs. With fewer buyers in the market, competition is currently at its lowest.

Boulder and Broomfield counties – Boulder and Broomfield are defying the usual fall slowdown. Despite a 9% rise in new listings, home prices remain steady or slightly higher than early 2024. Homes sell faster in Broomfield (42 days) than Boulder (62), yet Boulder prices continue to hold. Condos and townhomes have gained 2.5% in Boulder but dropped 9.6% in Broomfield due to increased new construction. This added supply offers first-time buyers more affordable options and builder incentives, creating stability in both counties with different advantages.

Colorado Springs – The market slowed in November, with sales down 8.4% and listings up 8.8%, creating a sluggish, buyer-light environment despite a slight 1.9% rise in median price. Condos and townhomes face the most strain as demand weakens and high HOA costs hinder sales. Economic indicators also show softening: job losses are mounting, manufacturing has contracted for nine months, and mortgage rates remain elevated. While buyers now hold more leverage than in recent years, many lack the confidence or financial stability to act.

Denver Metro – The Denver Metro housing market is experiencing a normal seasonal slowdown rather than a downturn. November saw declines in new listings, sales, and prices for both single-family and attached homes, with inventory also dipping from October. Despite softer activity, year-to-date prices remain stable, reflecting a continued normalization after the rapid appreciation of 2020–2022. Longer days on market, increased concessions, and more balanced negotiation dynamics signal a functional, steadying market. As affordability pressures persist, success increasingly depends on realistic pricing, preparation, and patience from both buyers and sellers.

Durango/LaPlata County – November delivered weaker single-family home activity in La Plata County, with listings down 31% and sales down 20%, while condo and townhome activity strengthened. Durango and Bayfield buyers shifted toward more affordable attached homes, driving major gains in condo/townhome sales and inventory. Rural Durango saw higher single-family prices, while Rural Bayfield and Purgatory experienced steep drops in new listings and condo sales. Year-to-date, single-family homes remain stable with rising prices, while the condo/townhome market shows softer sales, lower prices, and growing inventory favoring buyers.

Evergreen/Foothills – The Colorado Foothills market slowed seasonally in November but remained more active than typical for late fall. From September to November, the region showed steady, functional conditions as buyers adjusted to higher rates and expanded inventory. Pricing has largely held, with Evergreen–Conifer up 3.7% year-to-date and Clear Creek and Park counties also ahead of 2024. Days on market rose sharply, reflecting slower decision-making and the need for precise pricing. With mortgage rates easing and market fatigue nudging participants forward, the Foothills enter 2026 on stable, balanced footing.

Fort Collins – The Fort Collins market is showing mixed signals that may reflect seasonal slowing, broader economic uncertainty, or both. November sales dipped just over 3% year-over-year, driven by rising days on market and shifting listing activity. High interest rates have slowed buyer demand, while new listings fell more than 15%, and many unsold homes were withdrawn. These trends suggest a market that’s not fully healthy. For buyers and sellers, strategic pricing, planning, and negotiation remain essential to navigating current conditions.

Grand County – Grand County’s median home value sits at $756,592, down 1.1% year over year, while single-family prices remain higher at $1.09 million due to larger mountain properties. Days on market have climbed to 129, and inventory levels indicate a shift toward a balanced market. Yet long-term prospects are strong, driven by Winter Park’s $2 billion resort expansion, increased inventory, steady rental demand, and continued interest in updated, well-priced homes. The region now offers stable, strategic opportunities for buyers, while sellers succeed with realistic pricing and strong presentation.

Grand Junction/Mesa County — Mesa County’s November market showed mixed signals: pending sales increased, but closed sales fell 13.8% from last year. Median and average prices also declined as sellers offered more concessions. Year-to-date sales are up only 2%, reflecting ongoing sluggishness. Inventory continues to grow, reaching 841 active listings, including 750 single-family homes and 91 condos or townhomes.

Gunnison/Crested Butte – In 2025, the Gunnison/Crested Butte region is slightly ahead of last year, with transactions up 6% and sales volume up 4%, led by single-family homes. Crested Butte sales are mostly flat, though high-value deals boosted dollar volume 2%. Gunnison is stronger, with total sales up 21% and notable growth in both home and condo sales, despite small price declines. Inventory remains steady, and ski season may offer buyers reduced competition and opportunities as more listings emerge.

Pueblo – Pueblo County’s housing market showed typical seasonal cooling in November, with pending sales down 20% from last month and new listings declining month-over-month and year-over-year. Active inventory fell 21% from last year, and homes are taking longer to sell, averaging 104 days. Prices also softened, with the median single-family home price dropping 18% to $266,000, though sellers still receive about 98.1% of list price. Inventory stands at 840 listings, and months’ supply has risen to 6.5, indicating a more balanced market.

Steamboat Springs/Routt County – Routt County is set to finish 2025 strong, with Steamboat Springs single-family sales improving in November and narrowing the yearly deficit. Luxury activity remained notable, including a $12.7 million Lake Catamount sale. Multi-family listings and sales continue to grow, supported by new construction and tightening inventory. South Routt saw more listings but fewer sales, while Hayden remains steady and is boosted by Amazon’s planned micro-center. North Routt stays limited with very low supply. Looking to 2026, several developments and Steamboat’s new affordable housing project will shape the market.

Summit and Park Counties – Summit County’s market settled into its winter rhythm, highlighted by a notable 25% drop in average single-family prices for November, though year-to-date pricing is down only 2.3%. Single-family sales increased 13.9%, while condo and townhome activity dipped slightly, and inventory remains balanced at five months. Park County saw rising prices, increased closings, and an eight-month supply, marking a clear buyer’s market. Across Summit, Park, and Lake counties, 644 listings and 143 November closings show steady activity as motivated holiday buyers and strategic sellers keep the market moving toward a competitive spring.

Telluride – San Miguel County’s Telluride-area market returned to a more typical pace in November 2025, recording 33 sales and $65.7 million in volume—down 16% in dollars and 38% in transactions from last year. Telluride and Mountain Village continued to drive activity, with strong condo/townhome sales and notable single-family closings totaling more than $395 million combined year to date. Rural areas performed comparatively well, with sales down just 13% thanks to greater affordability outside the core resort communities.

Vail – November closed out the valley’s shoulder season with softer sales but growing activity ahead of winter. Closed sales declined across segments, while pending sales and inventory increased, creating stronger opportunities as ski-season demand builds. Anticipated lower interest rates may bolster the more affordable buyer segments, while higher-end, largely cash purchasers remain focused on resort communities. With new developments underway and renewed snowfall boosting tourism, the market enters 2026 with an optimistic, well-balanced outlook.

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The numbers tell the story: Aurora and Centennial continue to experience a sluggish housing market year over year and month over month. As expected, many sellers have pulled their listings for the holidays, and we anticipate they’ll return in the spring. Aurora currently has 986 active single-family listings, down from 1,157 in October. November saw 322 sold single-family homes, up 6% from 2024, yet prices continue to soften.

“Aurora’s median price peaked at $550,000 in March and has since dropped to $519,000. In zip code 80010 (original Aurora), the median price is $405,000; in central Aurora (80013), it’s $460,000; and in south Aurora (80015), it has fallen to $545,000 from a high of $590,000 in September 2025. Overall, sellers have seen declines of roughly $50,000, not including concessions—now averaging about $8,000—to cover buyer closing costs or interest-rate buydowns.

“From a pricing standpoint, buyers are well-positioned, with purchase prices at their most favorable levels since before the pandemic. However, rising insurance premiums, property taxes, and HOA fees continue to push monthly payments higher, and these costs are unlikely to decrease anytime soon.

“One positive for buyers is that this time of year brings the fewest competitors in the market, reducing pressure when the perfect home hits,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“Fall usually brings a bit of a cooldown in the real estate world, but Boulder and Broomfield aren’t following the script this year. Even with new listings up about 9% in both counties, home prices have basically stayed right where they were at the start of the year—some even a touch higher.

“A lot of people expected prices to slip this season, especially with more homes coming on the market, but that hasn’t really happened. Instead, both counties seem to be settling into a pretty steady rhythm.

When it comes to how fast homes are selling, Broomfield is moving a little quicker. The average home there is spending about 42 days on the market, while Boulder’s closer to 62 days. Still, even with homes taking longer to sell in Boulder, prices have held firm.

“Condos and townhomes are showing their own trends too. In Boulder, they’ve actually appreciated by about 2.5% since January. Over in Broomfield, though, prices in this category are down roughly 9.6%. A big reason is the number of new neighborhoods that have popped up lately—there’s simply a lot more to choose from, and that extra supply is keeping prices from climbing.

“For first-time buyers, that might actually be great news. Broomfield has a bunch of brand-new homes hitting the market at more approachable price points, and many builders are sweetening the deal with interest-rate incentives. It’s a good moment for anyone looking to get started in a fresh, new place without feeling priced out.

“As the year winds down, both counties are showing their own version of stability—Boulder with strong values, and Broomfield with opportunities for buyers who want something new and affordable,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“As the year progresses, the real estate market continues to lag. This November felt far more seasonal than in recent years, with many agents noting that buyers seemed to ‘pack up for the holidays.’ The data supports that perception: overall sales fell 8.4%, while new listings unexpectedly rose 8.8%, an unusual increase for this time of year. With more homes hitting the market and fewer selling, activity slowed notably. Although higher-priced properties are still moving, pushing the median price up 1.9%, agents report that every transaction feels like a challenge in today’s unpredictable environment.

“Condos and townhomes are facing the most pressure. Values slipped slightly by 0.1%, but the bigger concern is declining demand and persistent price reductions without resulting sales. Elevated HOA fees and soaring HOA insurance costs, part of a nationwide issue, are making these properties increasingly difficult to move and likely to see further declines.

“Looking ahead, December brings another Federal Reserve meeting. Betting markets indicate an 85% chance of a quarter-point rate cut. With economic data softening more than expected, a reduction seems likely; if not, the Fed may cite limited government data from the shutdown.

“Recent national indicators reflect a weakening economy. Non-farm payrolls have fallen, private-sector job losses have increased, and although the government added 10,400 jobs, October’s numbers were revised downward. Over the past four months, the U.S. has lost 158,800 jobs. Manufacturing has been in contraction for nine straight months. Despite these signals, the 10-year treasury remains above 4%, keeping mortgage rates stubbornly high. Consumers aren’t seeing relief, yet sellers no longer hold the upper hand. Buyers today have more leverage than they’ve had in years, but many lack the financial confidence to fully capitalize on it,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER METRO (Seven County)

“As 2025 winds down, the Denver Metro housing market shows signs of a typical seasonal cooldown rather than systemic weakness. November brought declines in new listings, closed sales, and pricing across both attached and detached segments, yet underlying indicators point to a stabilizing and more functional market environment. New listings declined 3.6% for single-family homes and 2.3% for condos and townhomes year-over-year, while sold listings dropped 18.9% and 7.3%, respectively last month. These patterns align with historical behavior, where many sellers delay listing until the new year and buyers reduce urgency heading into the holidays.

“Inventory also declined from October levels. Active listings in the single-family segment dropped to 10,328 (–6.9% YoY), while condo/townhome inventory dipped 5.8% to 4,243. Supply of inventory dropped notably for single-family homes to 3.1 months, suggesting a tightening that may be temporary but worth watching. Year-to-date median sale prices have remained stable, unchanged for single-family and only modestly lower for attached properties. Rather than signaling a weakening market, this reflects a normalization after years of rapid appreciation. From March 2020 through early 2022, prices surged at unsustainable rates. Since then, the market has moved toward balance, with slower price growth, longer days on market, and more room for negotiation. November’s average of 63 days on the market is higher than recent norms but consistent with a market adjusting to more deliberate buyer behavior.

“As we approach 2026, expectations for dramatic market swings are giving way to something more stable. The Denver-metro area is experiencing a return to functional conditions: buyers have more time and options, sellers are adjusting pricing strategies, and transactions increasingly include concessions, particularly in the attached segment.

“Importantly, many of these dynamics reflect a recalibration rather than a downturn. Buyers who understand the value of negotiating power, and sellers who are prepared to meet the market where it is, are still making deals happen. As long as affordability constraints remain elevated, driven not just by prices and rates, but also by taxes, insurance, and HOA dues, markets will continue to reward preparation, patience, and realistic pricing,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“November was quiet for single-family home sales in La Plata County, but noticeably busier for condos and townhomes. New single-family listings fell 31% from November 2024 and sales dropped 20%. In contrast, condo and townhome listings rose 11% and sales increased 15%.

“Durango in-town was particularly slow, with fewer new single-family listings, though sales matched last year’s pace. Buyers leaned heavily toward attached housing, driving an 83% jump in condo and townhome sales.

“In-town Bayfield showed a similar shift, with buyers opting for more affordable condos and townhomes. Single-family sales fell 29% from November 2024 (and 15% YTD), while condo/townhome inventory surged 50%.

“Rural Durango saw higher-priced activity: the median single-family price rose 41% over last November and is up 12% year to date. Rural Bayfield inventory grew 13% year-over-year, but new listings dropped sharply, down 60% compared to November 2024.

“In the Durango Mountain/Purgatory Resort area, November was sluggish. Only three single-family homes sold, and condo/townhome sales fell 61% from last November (down 14% YTD). Lower-priced units dominated, reflected in a 60% drop in median price for the month and 14% year to date.

“Across La Plata County this year, the single-family market has remained stable: new listings are up 9%, sales up 3.5%, and median prices up 7% bolstered by twice as many $2 million plus home sales and increased new construction. Active single-family inventory has grown only 6%.

“Condo and townhome activity tells a different story, with 4.7% more new listings but 5% fewer sales. Median prices have declined 7.5%, and inventory has grown significantly, up 28% with an additional month of supply—making this a more favorable market for buyers than for sellers,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“The Colorado Foothills housing market continued its seasonal slowdown in November, yet activity remained steadier than typical for late fall. Viewed across September through November, the region reflects a measured, functional market adjusting to higher borrowing costs, expanded inventory, and more deliberate buyer decision-making. Demand has softened month over month, but pricing has largely held year-over-year, and well-prepared homes continue to draw solid interest.

“Evergreen and Conifer, the area’s largest submarkets, highlight this resilience. After 48 closings in September, sales rose to 58 in October before easing slightly to 56 in November—a pattern seen in recent years as buyers work to finalize purchases before the holidays. This consistency stands out against broader metro-area slowdowns.

“County-level results tell a similar story. Jefferson County’s foothills communities maintained stable pricing heading into November, even as days on market increased and inventory remained above historical norms. Clear Creek County experienced a sharp rise in days on market, while Park County saw a more moderate increase and held its year-to-date price gains, supported by strong demand for its comparatively affordable mountain homes. Across the foothills, the median single-family price in Evergreen–Conifer is up 3.7% year to date, with the average rising 1.7%. Clear Creek and Park County also remain ahead of 2024 benchmarks.

“One of the clearest trends this fall has been extended marketing times. In Evergreen–Conifer, days on market jumped from 48 last November to 80 this year, with other foothills areas showing similar increases. Expanded inventory, slower buyer decision cycles, and shifting expectations between buyers and sellers are contributing factors. Pricing accuracy has become more essential, as updated, properly positioned homes continue to move while overpriced or outdated listings lag.

“Mortgage rates remain a key influence. After peaking above 7%, average 30-year fixed rates have eased into the low-6% range, offering modest relief and helping sustain buyer engagement. Still, affordability pressures are prompting greater selectivity and longer negotiation timelines.

“A more subtle factor emerging this fall is market fatigue. After prolonged uncertainty, many buyers and sellers seem ready to act, helping transactions progress more smoothly than earlier in the year.

As 2025 concludes, the Foothills market enters winter on stable footing: inventory is higher, pricing steady, and buyer activity comparatively strong. With rates stabilizing, the region is positioned for a balanced start to 2026, with neither side holding a clear advantage but both showing renewed willingness to engage,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“Is it a cold, the flu, or COVID? Many symptoms overlap, but severity, duration, and treatment differ greatly. The same question applies to today’s real estate market: are we seeing normal seasonal slowing, signs of deeper economic strain, or something else entirely?

“In the Fort Collins area, November sales were down just over 3% from last year, though still ahead of November 2024. Two factors appear to be driving the decline: rising days on market (DOM) and shifting listing activity. DOM has climbed to 85 days, two weeks longer than October and nearly 12% higher than last November.

“A surge of late-summer and fall listings, paired with persistently high mortgage rates, has slowed buyer activity and prolonged selling timelines. Meanwhile, new listings in November dropped by more than 15%. Fewer new listings, longer market times, and a higher number of withdrawn listings all signal that today’s market is not operating at what we’d typically consider ‘full health.’

“Are these trends simply seasonal? Probably. Are they also symptoms of broader economic uncertainty? Very likely. Determining whether this market is experiencing a mild cold or something more disruptive is harder to say.

“But for buyers and sellers navigating these conditions, the prescription is clear: careful planning, realistic pricing, and strategic negotiation – much like rest, hydration, and early treatment – can help reduce the severity and duration of challenges in a market that’s showing a mix of symptoms but no definitive diagnosis,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND COUNTY

“As of late October and early November 2025, the median home value across all property types in Grand County is approximately $756,592, a 1.1% decline year over year. This figure includes condos and townhomes. The median 30-day sale price for single-family homes is significantly higher at $1,090,000, reflecting the influence of larger, high-end mountain properties. Days on market have risen to around 129, and inventory levels suggest the area is shifting toward a more balanced market, with roughly six months of supply.

Several developments point to positive long-term momentum, particularly around Winter Park:

- Major resort expansion:A $2 billion Winter Park Resort expansion is underway, expected to boost tourism and spur buyer interest well before completion.

- Increased inventory:Buyers now have more options, with available inventory up roughly 30%.

- Strong rental and lifestyle appeal:Short-term rentals continue to benefit from consistent winter ski demand.

- Selective strength:New builds, updated homes, and well-priced properties are still selling efficiently.

“Grand County, including Winter Park, Granby Ranch, and the Grand Lake area, has transitioned from the frenzied boom of past years to a steady, balanced market with meaningful long-term potential. It remains attractive to buyers seeking mountain living, rental income opportunities, or long-term value growth, particularly when they choose carefully based on location, condition, and property type.

For sellers, success depends on realistic pricing, strong presentation, and targeting the right buyer—whether vacationers, short-term rental investors, high-end resort buyers, or families seeking a legacy mountain property,” said Grand County-area REALTOR® Monica Graves.

GRAND JUNCTION/MESA COUNTY

“November in Mesa County delivered a real estate market marked by mixed signals. While pending sales saw an uptick, closed sales told a different story, ending the month down 13.8% compared to November 2024. Both median and average prices also declined, reflecting increased price concessions and seller credits as homeowners worked harder to attract buyers. Year to date, the number of homes sold has risen only 2% over last year, underscoring the market’s sluggish pace. Active inventory has continued to climb, reaching 841 listings, including 750 single-family homes and 91 condos or townhomes,” said Grand Junction-area REALTOR® Ann Hayes.

GUNNISON/CRESTED BUTTE

“In 2025, the Gunnison–Crested Butte Association of REALTORS® region is tracking slightly ahead of last year, despite a slower November. Year-to-date, transactions are up 6% and total sales volume is up 4%. Single-family homes are driving growth with an 8.5% increase in sales and a 12% rise in dollar volume. The average single-family home price has climbed 3.5% to $1,338,643. Townhome and condo prices also edged up 1% to $746,481.

“In the Crested Butte area specifically, total sales are nearly flat year over year (276 vs. 271), but several high-value transactions have pushed dollar volume up about 2%. Single-family home sales increased by just two units, yet their dollar volume rose 11%, lifting the average price 8% to $2,537,125. Townhome and condo sales fell 16% in the northern valley, but an 11% jump in average price to $898,785 helped limit the drop in total volume to 7%.

“The Gunnison area continues to outperform, with total sales up 21% compared to 2024. Single-family home sales increased 20% (108 vs. 90), while townhome and condo sales surged 63% (49 vs. 30). Although regional prices are generally rising, both the City of Gunnison and Rural Gunnison have seen slight price declines—down 2% for single-family homes (now $750,577) and 3.4% for townhomes/condos (now $404,574). After significant COVID-era appreciation, this correction is offering welcome relief for buyers.

“Inventory has remained steady heading into the holidays, and it’s typical to see more listings appear as the new year approaches. Ski season is a particularly active period for real estate, as visitors pursue the dream of owning a home in the Crested Butte and Gunnison winter landscape. For buyers, it can also be an advantageous time: with many people focused on the holidays rather than house-hunting, reduced competition may open the door to securing a property to enjoy during the final months of ski season,” said Gunnison/Crested Butte-area REALTOR® Molly Eldridge.

PUEBLO

“Pueblo County’s housing market continued to follow typical seasonal trends in November, with pending sales down 20% from last month and new listings declining both month-over-month and year-over-year. Active inventory also fell 21% compared to last year, and homes are taking longer to sell, now averaging 104 days on the market.

“Prices softened as well: the median single-family home price dropped to $266,000, an 18% decline from a year ago. Still, sellers are receiving about 98.1% of their original list price,” said Pueblo-area REALTOR® David Ramirez.

Pueblo Market Highlights:

Supply – Active Listings:

In November, active inventory decreased 20.6% year-over-year to 840. Last month saw 895 active listings.

Demand – Pending Sales:

Demand increased with buyers putting 10.5% more homes under contract year over year. A decrease of 19.8% compared to last month.

New Listings:

November saw 221 new properties enter the market, a 6% decrease month over month.

Percent of Closed Price to List Price:

November saw a 98.1% closed price to list price, a 0.5% increase month over month. Last year at this time we saw 98.4%.

Average Days on Market:

The average days on market was 104, an increase of 6.5% month over month and 6.3% increase year over year.

Months’ Supply of Listings:

Months’ supply of inventory was 6.5, up 13.6% year over year and a 17.0% increase month-over-month.

STEAMBOAT SPRINGS/ROUTT COUNTY

“As 2025 comes to a close, Routt County is on track for a strong fourth-quarter finish. In Steamboat Springs, single-family home sales rose in November, narrowing the year-to-date shortfall from 11.9% in October to 5.4%. Of the 26 homes sold, the standout was a 7,043-square-foot residence on 35 acres—one of only ten properties permitted a private dock on Lake Catamount. The home sold for $12.7 million in cash, or $1,803 per square foot, reflecting a 21% discount from its $16 million list price. Steamboat’s median single-family price sits at $2.15 million, slightly below last year, while months’ supply of inventory has tightened to six.

“Multi-family activity in Steamboat remains robust, driven largely by new construction priced above $1,200 per square foot. New listings are up 34.3% for the year, and sales have increased 4.6%. Inventory has contracted from 6.4 to 5.3 months. The top multi-family sale was a four-bedroom, five-bath townhome at The Porches, which closed for $3.8 million. Year-to-date, the median sales price holds steady at $857,500, while the average price has dipped 6.3% to $1,045,000.

“South of Steamboat, the Oak Creek and Stagecoach areas saw 57 new single-family listings this year—a 50% increase. However, sales have not kept pace, falling 25% and pushing months of inventory to six. November’s least expensive home sale countywide occurred in Oak Creek at $366,000. Both median and average prices remain close to last year at $882,000 and $962,437, respectively.

“In west Routt, Hayden is preparing for a busy winter as traffic increases through the Yampa Valley Regional Airport. Amazon announced plans in November to build a 40,000-square-foot warehouse and distribution micro-center near the airport, aimed at improving service to Northwest Colorado and southwest Wyoming. Hayden has recorded the same number of new listings as last year and one additional home sale. With 18 homes available, inventory stands at 5.6 months.

“North Routt, by contrast, remains quiet and idyllic, with just 17 home sales so far this year and only four homes currently available—representing a tight 1.9-month supply.

“Looking ahead, 2026 will bring major development completions in Steamboat, Hayden, and Oak Creek, along with continued emphasis on affordable housing. The Cottonwoods at Mid-Valley, Steamboat’s first significant for-sale affordable housing project in nearly 20 years, is slated for early-2026 completion. It will offer deed-restricted condos priced below market for local workers, signaling meaningful progress in meeting community housing needs,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT AND PARK COUNTIES

“As the holidays arrive and snow settles across Summit County, the real estate market has eased into its familiar winter rhythm; quieter on the surface, yet still active beneath the season’s fresh snowfall. The most notable shift this month is a year-over-year decline in the average single-family price for November. Although year-to-date pricing is down only 2.3%, the single month drop stands out and will be closely watched as the market continues to rebalance.

Summit County

• Average single-family price decreased 25% to $2.06 million, suggesting a possible recalibration.

• Single-family sales rose 13.9%, reaching 41 closings.

• Condo and townhome sales dipped 3.4% to 84 units, while the median price held steady at $712,500 (–1.5% year over year).

• Inventory sits at roughly five months of supply, keeping the county in balanced-market territory.

Park County

• Closings rose significantly to 48, up from 32 last November.

• Average sales price increased to $647,406, indicating continued strength among primary and lifestyle buyers.

• Inventory expanded to eight months of supply, shifting the area firmly into a buyer’s market.

• Days on market lengthened in line with normal winter patterns.

“Across Summit, Park, and Lake counties, 644 residential properties are currently listed, ranging from an $80,000 mobile home in Park County to a $21 million ski-in/ski-out estate in Breckenridge. Nearly half of all listings are priced above $1 million, with 42 exceeding $5 million. November saw 143 closings, from a $145,000 Park County home to a $6.9 million Breckenridge sale. About 42% of transactions closed above $1 million, and cash buyers accounted for 37% of sales.

“As holiday lights illuminate mountain towns and ski season gains momentum, the real estate market is doing the same—adjusting to conditions, moving with intention, and setting the stage for a more competitive spring.

“Winter always brings a quieter rhythm, but not a silent one. Holiday buyers are serious, sellers are getting more strategic, and the market is finding balance in a way we haven’t seen in years,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE/SAN MIGUEL COUNTY

“San Miguel County’s Telluride-area market showed signs of returning to a more traditional pace in November 2025 after several highly volatile years. The month recorded 33 transactions totaling $65.7 million, representing a 16% decline in dollar volume and a 38% drop in sales count compared to November 2024.

“Activity continues to be anchored by the historic town of Telluride and the resort community of Mountain Village. In Telluride, the condominium and townhome sector remains the most active segment, posting 49 closings and $119.95 million in sales year to date through November. Mountain Village’s condo/townhome market followed with 35 sales totaling $66.66 million. Single-family sales also remained meaningful: Telluride recorded 19 closings totaling $89.97 million, while Mountain Village closed 22 single-family transactions totaling $205.27 million.

“Outside the two core communities, the rural areas of San Miguel County have held up relatively well. Year-to-date sales are down only 13% compared to the first eleven months of 2024 likely due to greater affordability beyond Telluride and Mountain Village,” said Telluride-area REALTOR® George Harvey.

VAIL

“November marks the end of the shoulder season for the valley, with the market preparing to shift into its winter rhythm as skier traffic increases and prospective buyers return to explore mountain lifestyle opportunities.

November Market Performance

| Category | Single Family/Duplex | Townhouse/Condo |

| Closed Sales | –15.4% | –24.5% |

| Pending Sales | +20% | +8.8% |

| Inventory | +22.4% | +19.6% |

| Months’ Supply | 7.2 | 5.4 |

“Looking ahead, rising pending sales and increased inventory suggest meaningful opportunity as we move into the ski season. Inventory levels are well aligned with current demand across price niches, setting the stage for healthy activity this winter.

“From a broader economic perspective, anticipated lower interest rates should benefit the market’s more affordable segments, where buyers typically rely on mortgages. Higher-end purchases, often made in cash by lifestyle or investment buyers, remain focused on resort communities and developments with strong amenities. Several new projects underway aim to support the lower-priced, locally oriented housing niches.

“Considering both market segments, the outlook entering 2026 is optimistic. As December begins, ski resorts are finally receiving the significant snowfall they had been missing, an encouraging boost for both tourism and real estate interest,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The November 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com