2022: A year of change in real estate

A long-term, frenzied housing market shifts in second half of 2022

ENGLEWOOD, CO – The robust, fast-paced real estate market that has dominated Colorado for the past several years and into the first half of 2022 changed significantly in the second half of the year and was punctuated by a December freeze that saw new listings fall to all-time lows statewide, according to the December 2022 Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR). With REALTORS® using terms like “frenzied,” “volatile,” “unpredictable,” “tumultuous,” “bipolar,” “unprecedented,” “schizophrenic,” and “the year of change,” market conditions across the Denver-metro area and statewide pushed wary buyers and sellers to sit on the sidelines as interest rates climb and uncertainty prevails.

“If mortgage rates doubling in one year have only slowed but not stopped the demand from buyers, 2023 will look very much like the ‘normal’ market we haven’t seen since 2019, and still slightly in favor of sellers,” said REALTOR® Jarrod Nixon. “Buyers will benefit in 2023 with more inventory options, less competition, fewer multiple offer situations, and more time to evaluate properties to make sure they are the right fit. We may see a return of greater stability and predictability in the housing market if inflation and mortgage rates stabilize.”

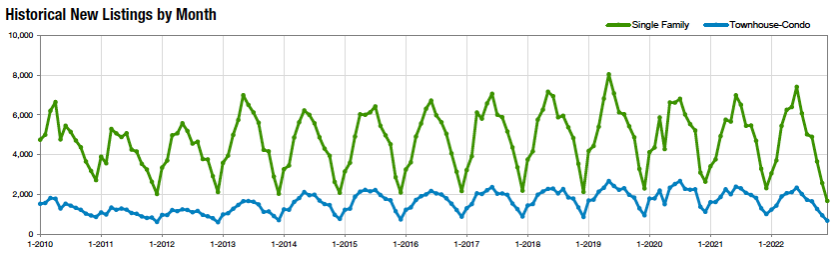

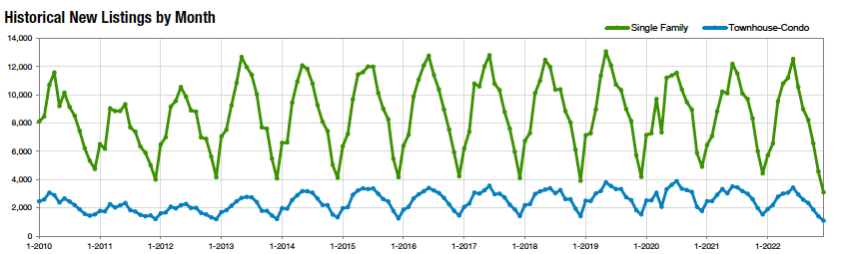

Looking back at December, new single-family listings fell to 1,661 in the seven-county Denver metro region, down more than 35% from November, and down 28% from a year prior. Townhome/condo new listings (667 total) were off 29% from November to December and down more than 33% from a year prior. Statewide, the 3,105 new listings for single-family homes were down more than 30% from a year prior and -28.5% for townhome/condos (a total of 1,095 properties). All represent new listing lows since CAR began tracking the data in January 2010.

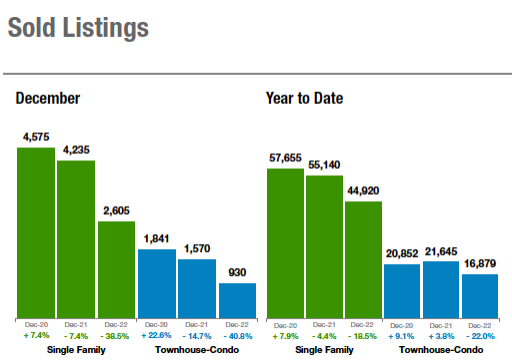

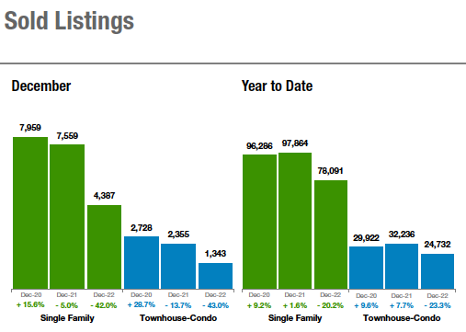

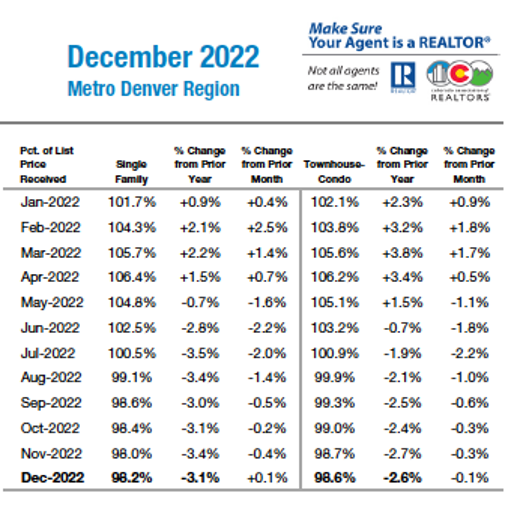

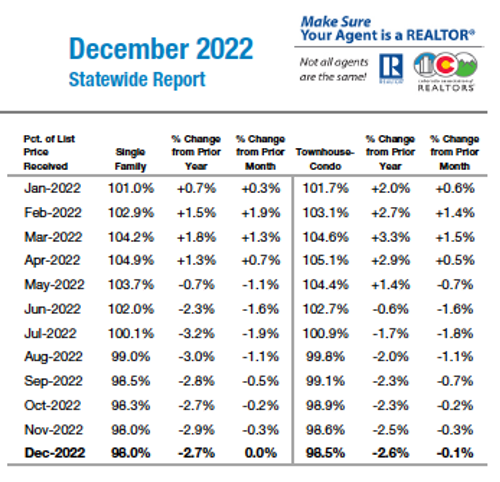

Although it’s typical to experience slowdowns across the winter holidays, December sold listings were down approximately 40% for both single-family homes, as well as townhome/condos in both the Denver-metro area and statewide. The slower pace helped push the average percent of list price received down 2.5-3.1% for properties across the metro area and state and increased the average days on market anywhere from 62% for single-family homes statewide to as much as 141% for townhome/condos in the Denver metro region.

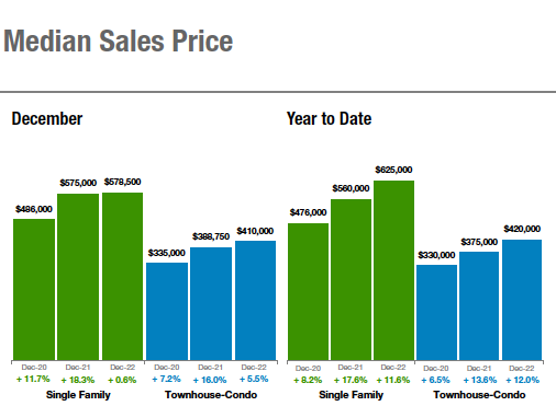

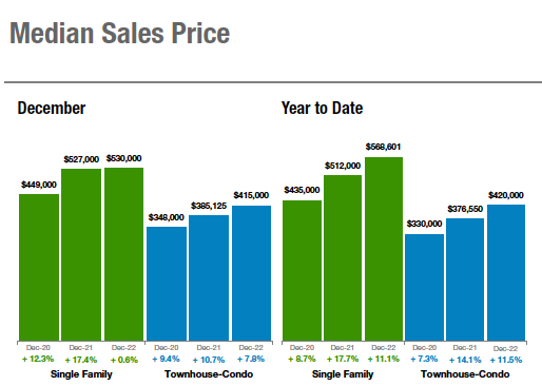

The low inventory seems to be keeping median sales pricing relatively flat across the single-family home category compared to a year ago, up roughly 0.5% to $578,500 in the Denver-metro area and $530,000 statewide. Townhomes/condos are up 5.5% in metro Denver and 7.8% statewide to $410,000 and $415,000, respectively, compared to December 2021. All are well off the double-digit, year-over-year gains the market was experiencing as recently as June 2022.

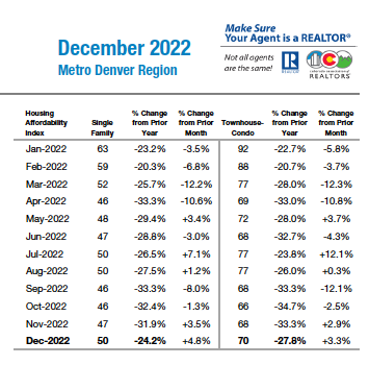

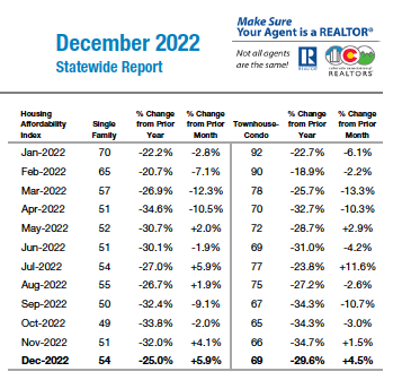

Despite the second half slowdown in 2022, the CAR Housing Affordability Index – a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county – continues to hover around its all-time lows set in the fall of 2022 for both the Denver-metro area and statewide, according to the CAR report.

Looking at the seven-county Denver metro area Single-Family Overview:

Statewide market Single-Family Overview:

REALTORS® across the metro area and state shared these highlights (expanded summaries of each market are included in the following pages):

- Aurora – It was the year of change in 2022. Many were questioning when we would see the market shift and this past year provided the answer. The first quarter of 2022, buyers stood in line for their 15-minute time slot to view a home. By June, that had all changed. Showing times were available and sellers realized that they were not going to get the aggressive price they were hoping for.

- Boulder/Broomfield counties – The 2022 real estate market can be summed up in one word…. pivot. We marched from winter into spring with the same seller’s market filled with bidding wars, removal of contingencies, and epic disappointment from buyers who tried and tried again to purchase a home. The abrupt change in interest rates swerved our market into another direction and we all had to…well, pivot.

- Colorado Springs – To say this was a strange year for housing would be the largest understatement. What started out as another year of record-breaking price increases and buyers getting slaughtered, ended as a year where sellers saw values flip, buyers began getting concessions, price drops, and double the inventory to choose from. And the guess is, 2023 is in for more of the same.

- Crested Butte – While the recent interest rate increases have certainly made an impact, the Crested Butte market has been strongly impacted by a lack of inventory. Thankfully, the frantic pace of the market from summer 2020 through early 2022 has slowed. We are still seeing multiple offers for things that are priced to sell and, as long as inventory remains so low, that should continue well into 2023

- Denver County –December 2022 was rather remarkable – at last, not simply for unbounded record setting but for the opposite, remarkable regression. Both the freestanding and condo/townhome markets saw the least amount of new properties hit the market in over 7 years. The drop was most significant in the freestanding category with 33% less than 2021 and 50% less than 2020.

- Douglas County – As we enter 2023, many unknowns remain. With economic conditions weakening and rampant inflation, many speculate a market correction is overdue. Others predict we may have another frenzy in the summer if the economy can squeeze out yet another year of rapid growth. Either way, if you’re a homeowner in Douglas County – you likely have no need to worry. As local economic growth rapidly continues, your home is probably not losing value in the long run in most feasible economic scenarios.

- Durango/La Plata County – If mortgage rates doubling in one year have only slowed but not stopped the demand from buyers, 2023 will look very much like the ‘normal’ market we haven’t seen since 2019, and still slightly in favor of sellers. Buyers will benefit in 2023 with more inventory options, less competition, fewer multiple offer situations, and more time to evaluate properties to make sure they are the right fit. We may see a return of greater stability and predictability in the housing market if inflation and mortgage rates stabilize.

- Fort Collins/Northern Larimer County – For 2022, it was all about timing. If you sold your home in the first half of the year, you likely sold it for top-dollar with competing offers for an average of 5% over asking in a matter of days. If you sold your home in the last quarter of the year, you likely sold it for less than asking (or had to reduce the list price to solicit offers) and it probably took several weeks or more to get it sold.

- Glenwood Springs – While many expected a slight slowdown of the wave of out-of-state buyers and second homeowners, the opposite occurred. What little inventory we had on the shelf was quickly consumed, creating a spike in pricing and a panic to acquire whatever the buyer could get their hands on. Multiple offers with appraisal gap language and no contingencies became the norm as we moved through a frenetic summer selling season.

- Grand Junction/Mesa County – New listings were down just over 14% in December, but active listings were up 78.1% to 641 properties – nearly double the number of active listings a year ago. Both pending sales and solds were down, yet prices continue to be up. We now have a 2.2-month supply of inventory, the best it has been for a long time. Average days on market is also improved giving buyers a little more opportunity to find the right home

- Jefferson County – Buyers are in a holding pattern right now with an eye on interest rates and waiting for prices to drop even more or level out. Even if home prices drop and the interest rate continues to increase, buyers may still be priced out of the home they want.

- Pagosa Springs – Pagosa Springs experienced six real estate market challenges: a short-term rental (STR) moratorium, inflated STR fees, doubled interest rates, doubled mortgage payments creating less buyers, low inventory, and pricing increases. These factors created the perfect real estate ice age and a low number of units sold at 456 in 2022 (compared to 615 units in 2021). However, these factors also created a slight ice age thaw with the high record Average Sold Price of $658,007 (up 11.5% from 2021 at $590,268) and Median Sold Price $538,000 (up over 13% from 2021).

- Pueblo – We begin 2023 very much the opposite of the manner in which we began 2022. December put an exclamation point on a quiet and slowing market with new listings down 18.8% compared to December 2021. Pending sales were down 33.6% in December 2022 compared to a year prior and sold listings fell 48% for the same period. Sales volume was down 10.7% with 340 fewer sales.

- Steamboat Springs/Routt County – Unprecedented. 2022 will go down in history as the year that the Fed doubled 30-year fixed mortgage rates within a single year. January 2022 may have come in like a lamb with a 3.2% interest rate, but December went out like a lion at 6.42%. Factor in high inflation, stock market volatility and talks of recession and the result became national uncertainty.

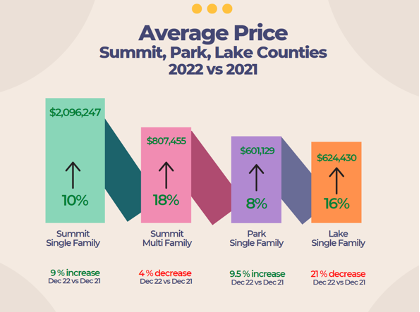

- Summit, Park, and Lake counties – In 2022 have prices gone up, or have they gone down? The answer is yes. For the up, the average price of all residential properties sold in Summit in 2022 was 13% higher than 2021. For the down, the average price in January 2022 was about $1.5 million and in December about $1.2 million for a drop of almost 23%.

- Telluride – Gross sales for the Telluride region (San Miguel County) in 2022 hit $1.1 billion, down 22% from 2021 but up in average sales price by more than 26%. The 582 sales in 2022 were down significantly from 2021’s total of 944. With rising interest rates, an up-and-down stock market and a likely recession of some duration, predicting the real estate market for the Telluride region in 2023 is nothing more than a wild guess.

- Vail – The 2022 market was truly unpredictable as the macro-economic issues of inflation and rising interest rates conflated to cause significant swings. When we throw the lack of inventory in key pricing niches into the mix, volatility and unpredictability ruled the market.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“It was the year of change in 2022. Many were questioning when we would see the market shift and this past year provided the answer. The first quarter of 2022 buyers stood in line for their 15-minute time slot to view a home. By June, that had all changed. Showing times were available and sellers realized that they were not going to get the aggressive price they were hoping for. The drastic interest rate increase played a big part. Suddenly, a buyer’s potential house payment went up $200 – $1000 a month, depending on the loan amount.

“So where did we land in December? In Aurora, listings were up 133%, under contract or pending properties were down 20%; sold price was down 36% and days on market was up 206% to 46 days. Yes, in many cases, the buyer could actually have time to think about their purchase. Single-family homes saw a median price of $535,000. For townhomes/condos, active listings were up 76% to 430 active listings. The median price closed out the year at $359,000. Of course, real estate is all about location, location, location, and location reflected in the range of median prices and options across our market, including zip code 80010 where single-family homes are $380,000; 80013 is $480,000 with townhomes at $359,000. In 80015, the median price for single family is $554,900 with townhomes at $380,000. In 80016, single family is $750,000 with townhomes at $417,500.

“Listing inventory is up over last year in all areas, however, inventory is still relatively low. I believe that we are in a more balanced market with sellers that need to be realistic about pricing and buyers willing to take advantage of a more ‘normal’ market,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The 2022 real estate market can be summed up in one word…. pivot. We marched from winter into spring with the same seller’s market filled with bidding wars, removal of contingencies, and epic disappointment from buyers who tried and tried again to purchase a home. The abrupt change in interest rates swerved our market into another direction and we all had to…well, pivot.

“Buyers had to get re-approved at a higher rate or recognize they couldn’t buy at all. REALTORS® had to adjust in order to counsel their clients properly as the same rules suddenly didn’t apply. But sellers had to pivot the most. They had to accept that almost overnight, they wouldn’t sell in a weekend and not for more than list price. That adjustment takes some time, and the second half of the year has been sellers trying to catch up to the new market.

“In Boulder and Broomfield counties, most of the appreciation gained in the first half of the year was lost in the 2nd half. Boulder’s single-family home prices finished with a small increase of just 1.9% compared to this month last year. Broomfield squeaked out more appreciation at 8.4% and both increased their month’s supply of inventory by over 180%. That said, the month’s supply is still only 6 weeks and houses are still selling in 2-3 months. However, it is a far cry from the market just 7 months ago.

“The uniqueness of this market is that in any other market, there can too many buyers or too many sellers. Markets move through cyclical changes which is normal. In this market, sellers aren’t selling because they don’t want to give up their low interest rate. Buyers aren’t buying because they don’t want to take the high interest rate and they hope prices and rates will go down. So, at the end of December, we were left with no one doing anything at all.

“If inflation declines and interests go down even just a little bit, there will likely be some pent-up buyer demand and sales will start to happen again. Until then, we are stuck in somewhat of a market gridlock,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“To say this was a strange year for housing would be the largest understatement I could say about housing. What started out as another year of record-breaking price increases and buyers getting slaughtered, ended as a year where sellers saw values flip, buyers began getting concessions, price drops and double the inventory to choose from.

“The Fed said stop the presses with interest rate hikes. The economy, along with housing, listened. Days on market shot up 173.3% on single-family homes and the median price dropped 2.2%. Gone are the days of monthly appreciation that has been known for over two years. In fact, sellers who waited to list watched appreciation and value begin to evaporate at breakneck speed as buyers opted out of house buying. And the buyers have not stepped back in. Even the buyers who were waiting for this exact turn now are waiting for the prices to correct more. And patience will pay off as prices continue do correct.

“The housing shift was not just in the Pikes Peak region. Nationwide, mortgage demand plummeted to 2008 levels. Builder sentiment dropped month after month. Economists went from bullish sentiment to a neutral sentiment only to have many say that the economy is not going to have a soft landing, a term the Fed used earlier in the year. Hedge funds went from buying real estate, to stopping investors from pulling out of their REITS. Layoffs began to hit the industry direct and then the broader market. And my guess is 2023 is in for more of the same. So, grab that popcorn, your beverage of choice and buckle up, because 2022 is just the beginning of what just may be the biggest unraveling of housing since 2008,” said Colorado Springs-area REALTOR® Patrick Muldoon.

“The Colorado Springs housing market experienced unprecedented swings across all data points in 2022, primarily due to extraordinary interest rate fluctuations. In the early part of the year, the record-setting low-interest rates fueled the buying frenzy resulting in bidding wars. Then, sudden, shocking increases in the interest rates in the middle of the year quickly pushed buyers back to sidelines due to affordability challenges. Last April, we received 101 appointment requests over three days on one of my listings and 28 offers over the listing price. In July, I listed another property in the same area at the same price. We did not receive any showing requests for three weeks, until after two price reductions.

“Year over year in December 2022, active listings of single-family/patio homes were up 189.7%, catapulting the months’ supply to 2.2 months compared to 0.5 months in 2021, the sales were down by 41%, the average price was down 3% at $490,910, the median price down 2% at $441,000, the days on the market was up at 41 from 16 days a year ago. The year-to-date sales were down by 16%, and the sales volume was down by 8.5%. Last year, there were 27.4% fewer sales priced under $500,000 compared to 2021 but 18.6% more sales priced over $800,000. In El Paso County, 21% of listings had price reductions from January to May. That figure went to 57% from June to December.

“The future of the real estate market will depend on interest rate impacting affordability either positively or negatively, inflation, and consumer confidence,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE

“As 2022 went on, it became clear that we should not be comparing our most recent statistics to those of 2021. From the beginning of the year, sales volume was 50-100% lower than 2021, but on par with 2018 and 2019. Sales statistics from 2021 are unparalleled and it will be tough to match them in the near future. So, to better analyze 2022, it is helpful to look at what has changed since before the pandemic.

“While the recent interest rate increases have certainly made an impact, the Crested Butte market has been strongly impacted by a lack of inventory. The inventory levels hit a low point in March 2022 with only 197 properties of all types for sale at the north end of the valley. That number doesn’t mean a lot until you compare it to the 518 properties that were for sale in March 2019. The number of properties for sale has increased since March however, it remains less than half of what we had in January 2020.

“Another major factor is average price. Pre-pandemic, you could still buy a home in the Crested Butte area for well under $1 million. While there were a handful of sales between $3 – $5 million in 2019, today, there are 23 homes listed for over $3 million and one for $15 million. Condos have also undergone big changes when it comes to pricing. In 2019, you could buy a two-bedroom condo at the base of the ski area for as little as $200,000. In 2022 the lowest priced two bedroom sold for $406,000 and the majority were over $500,000.

“Thankfully, the frantic pace of the market from summer 2020 through early 2022 has slowed with days on market and months supply of inventory both increasing. Sellers need to have realistic expectations, different from what their neighbors may have experienced if they sold one year ago. Buyers can take some time to think about things, but still need to be ready to act when the right property, at the right price, comes on the market. We are still seeing multiple offers for things that are priced to sell and, as long as inventory remains so low, that should continue well into 2023,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER COUNTY

“December 2022 was rather remarkable in Denver – at last, not simply for unbounded record setting but for the opposite, remarkable regression. Both the freestanding and condo/townhome markets saw the least amount of new properties hit the market in over 7 years. The drop was most significant in the freestanding category with 33% less than 2021 and 50% less than 2020. So, what does that mean? Well, it means that although prices are beginning back down hill, a 1.6% decrease over December 2021, there are still fewer to choose from. Interestingly enough, while the freestanding category reduced in price year-over-year by 1.6%, the condo/townhome category increased by 2.7% during the same time period, lending some credibility to the lower-priced homes reducing in price at a much slower pace. What this means is that with economic factors changing over the last six months, interest rates chief of those, the cost to own has gone up and consumers are choosing less expensive properties to compensate,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“The number of home sales and prices continued to decline in December as we approached the conclusion of one of the most tumultuous years in real estate history. The winter trough in the Douglas County real estate market typically occurs in January and lasts just one month before bouncing back sharply as the spring season begins. Last year, that trough came early and persisted, with closed listings below 500 units/month for October, November, and December. Does this indicate the market will bounce back into spring earlier this year? Or are we in for a prolonged season of inactivity?

“If you’ve been looking to buy a home, December may have been the month for you with more deals hitting the market. The average percent-of-list-price received, one of my favorite metrics, fell from all-time record highs in April (105%+) to lows not seen since 2014 in December (98.8%). Despite relatively slim levels of inventory at around 1.4 months, many sellers have resorted to drastic price reductions to attract attention to their homes. Average days on market, one of the key drivers of price reductions, has spiked to 51 days, up 21% from last month and over four times longer than last spring’s peak.

“As we enter 2023, many unknowns remain. With economic conditions weakening and rampant inflation, many speculate a market correction is overdue. Others predict we may have another frenzy in the summer if the economy can squeeze out yet another year of rapid growth. Either way, if you’re a homeowner in Douglas County – you likely have no need to worry. As local economic growth rapidly continues, your home is probably not losing value in the long run in most feasible economic scenarios. The Denver Metro Area has continually proven to be one of the world’s most desirable places to live – and I don’t see that changing anytime soon,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The 2022 real estate market has been described by some as schizophrenic. The market underwent a major shift as economic uncertainty, mid-term elections, and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices. The Durango market did see a decrease in the total number of single-family homes sold compared to 2021 (-25%), partially due to fewer new listings (-9.5%). The average sales price hovered just over $910,000, up 16% from 2021. The townhome/condo market saw similar decreases in units sold (-21%) and new listings (-22%).

“Despite the challenges, the La Plata County market is doing well. If mortgage rates doubling in one year have only slowed but not stopped the demand from buyers, 2023 will look very much like the ‘normal’ market we haven’t seen since 2019, and still slightly in favor of sellers. Buyers will benefit in 2023 with more inventory options, less competition, fewer multiple offer situations, and more time to evaluate properties to make sure they are the right fit. Experts agree, we may see a return of greater stability and predictability in the housing market if inflation and mortgage rates stabilize. Durango is weathering better than most resort markets because we are buffered by our college, regional airport, and bustling city center with its own economic hub. Supply and affordability will still be issues for us in 2023,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“For 2022, it was all about timing. If you sold your home in the first half of the year, you likely sold it for top-dollar with competing offers for an average of 5% over asking in a matter of days. If you sold your home in the last quarter of the year, you likely sold it for less than asking (or had to reduce the list price to solicit offers) and it probably took several weeks or more to get it sold.

“What was driving these bipolar real estate markets? Two words: Interest Rates. The real estate market has long been a textbook example by which economists and policy wonks demonstrate the law of supply and demand. When there is high demand (home buyers) and low inventory (houses for sale), the price for those limited number of houses will go up. And go up it did. We saw double digit price appreciation each month throughout the spring.

“So, what happened in late summer? Did demand for housing suddenly dry up? Not hardly. There is one variable not controlled directly by supply and demand when it comes to the US housing market and that is the interest rate buyers must pay on the money they borrow to purchase a house. When that rate doubled from roughly 3.5% in January 2022 to 7% by October, a home buyer’s cost to purchase a home slipped beyond their ability to qualify for a mortgage at the price homes were listed. This put thousands upon thousands of buyers across the county on the sidelines.

“Why did rates go up? This is actually a complex question, and for the sake of brevity, this is an over-simplified answer – again, two words: Federal Reserve (the FED). In an effort to quell rising inflation as a result of supply chain shortages, and a consuming public anxious to spend the money they saved during the pandemic’s various lockdowns, the Federal Reserve began raising the federal funds rate that banks charge for short term loans. This rate has a ‘trickle-up’ effect, increasing the cost of credit card balances, automobile loans, and ultimately, mortgage interest rates. The FED knew that if they could curb consumer spending, that would reduce demand for goods and services. Since shelter represents nearly 40% of core inflation, increasing the cost to borrow money to purchase a home would stall the real estate market.

“And stall it did. By October, homes that hadn’t sold were being withdrawn from the market or selling for much lower prices than the same homes selling in the spring. First time home buyers (generally those buyers with the least amount of cash-in-hand and most reliant on large mortgages) were ineligible for loans as their debt-to-income ratios could not support the much higher monthly mortgage payments the higher interest rates created. Historically, first time home buyers represent 25-30% of the home-buying market. Within the span of 90 days, these buyers had vanished. Not because they no longer needed homes – but because they could no longer afford to buy one. Timing was everything. When you see the year-end numbers showing drops of 30% or more in the number of homes sold and the number of homes on the market – it’s because and equivalent segment of the home buying market was artificially put on the sidelines by the strategic increase in interest rates by the FED.

“When you look at the sales graph for the 2022 housing market, it likely resembles viewership of a hit television series. The series is released, and viewership increases as more and more viewers rave about the show. Since all the episodes are available from the outset, viewership explodes as more and more viewers ‘binge-watch’ all the episodes. This was the spring market. There was a market binge of purchasing houses. With low interest rates, buyers with some savings all wanted a house of their own. More and more buyers got in on purchasing homes. Fortunate sellers whose homes were ready for market in March, April, and May enjoyed massive ‘viewership’ as buyers competed for the limited bandwidth of available homes and those buyers paid huge premiums to win those bidding competitions. Again, timing was everything.

“If you’re a buyer in the market right now – take advantage of the fact that you are competing against fewer buyers than you will be this spring. Find the house you love and if you can afford it – BUY IT. Most indications are that interest rates will settle down into the 5% range over the next 12-18 months and the interest rate you secure now may not have to be the interest rate you’re stuck with for the lifespan of the time you’re in your home. Watch the clock and when the timing is right, you can refinance to a lower interest rate. If you’re a seller, watch the clock. The moment interest rates drop below 6%, the buyers who have been on the sideline will come forward with the pent-up demand that only having a place to call your own can drive. It’s not location, location, location. It’s timing, timing, timing,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“If I had to choose one word to describe the last year in real estate, it would be ‘frenetic.’ You would be hard pressed to find a REALTOR® in our vicinity that was not taken by surprise by the energetic pace that developed early in 2022 and continued until the hike in interest rates brought a more docile energy to our local market. Coming out of the pandemic, most brokers expected a slight slowdown of the wave of out-of-state buyers and second homeowners. Quite the opposite occurred, it seemed like the word was out that the Roaring Fork Valley affords a lifestyle that is hard to find in the rest of the country. What little inventory we had on the shelf was quickly consumed, creating a spike in pricing and a panic to acquire whatever the buyer could get their hands on. Multiple offers with appraisal gap language and no contingencies became the norm as we moved through a frenetic summer selling season.

“In Garfield County, 2022 saw new single-family home listings down 18.9% and multi-family down 26.5% over 2021. Of the 845 homes listed in 2022, there were 677 closings or 80%. The townhome/condo market had an even better percentage with 265 or 98.5% of those listings closing. Prices increased in both categories with the median sale price of a single-family home up by almost 12% and townhome/condos up 22%. With those price increases, our local affordability has dropped to the lowest index in the last 12 years. The affordability index for a home was 46, multi-family came in at 49 at the end of the year.

“What’s to come in 2023? While the rise in interest rates has given the market a minute to catch its breath, the lack of inventory of homes to sell has kept our prices up. We are starting to see a slight softening of days on market and the occasional price reduction with a motivated seller, but we are not experiencing a tremendous change in our local market at this point. Wish we had the proverbial crystal ball to predict what is to come in the year ahead,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Looking at our Mesa County year-end housing statistics, you have to ask, ‘Is it good news or not so good news?’ Depends on how you choose to look at it. New listings were down just over 14% in December, but active listings were up 78.1% to 641 properties – nearly double the number of active listings a year ago.

“Both pending sales and solds were down, yet prices continue to be up. Year-to-date for 2022, the median sale price is up 16.6% to $384,900, and average sold price is up 14.5% to $424,301. Sellers in 2022 received an average of 99% of list price and affordability continues to be a significant issue.

“We now have a 2.2-month supply of inventory, and that is the best it has been for a long time. Average days on market is also improved giving buyers a little more opportunity to find the right home,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – GOLDEN/ARVADA

“Buyers are in a holding pattern right now with an eye on interest rates and waiting for prices to drop even more or level out. Even if home prices drop and the interest rate continues to increase, buyers may still be priced out of the home they want. In Jefferson County, new listings for single-family homes decreased 35% and sold listings were down 42.4%. The median sales price for single-family homes ended the year at $633,000, a slight uptick from this time last year. Average days on market increased 126.3%.

“For condo/townhomes, new listings decreased 28.7% and the number of sold homes fell 22.9% year over year. The $407,649 median sales price reflects a jump of 6.6% from last year. Average days on market is up 157% from a year ago,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS

“Pagosa Springs in southwest Colorado, recognized as one of the best mountain town bang-for-your-real -estate-dollar, shows 2022 as the year of change — prices, interest rates, inventory, home affordability, and inflated gas, grocery, and utility prices. Even expectations for both buyers and sellers changed.

“Pagosa Springs experienced six real estate market challenges: a short-term rental (STR) moratorium (thru April 2023), inflated STR fees, doubled interest rates, doubled mortgage payments creating less buyers, low inventory, and pricing increases. These factors created the perfect real estate ice age and a low number of units sold at 456 in 2022 (compared to 615 units in 2021). However, these factors also created a slight ice age thaw with the high record average sold price of $658,007 (up 11.5% from 2021 at $590,268) and median sold price $538,000 (up over 13% from 2021). Chronically, pending sales in Pagosa Springs going into a new year usually hover at 150 units. 2023 emerged with only 47 pending home sales and solidified the real estate ice age. Land purchases also mimicked housing sales.

“Activity is already slower than the historical first quarter averages due to higher mortgage rates, less buyers, and limited housing inventory below six months (3.4 months). There are 133% more homes (134) for sale than in 2021. Despite that, there are less buyers who can afford or desire 2023 pricing! Savvy and cash buyers have a little more leverage in the first few months of 2023 with more increased inventory than in 2022, allowing them to make slower buying decisions with longer days on market (84 days) for homes. Price points higher than $500,000 are on the market even longer. Home hunters should examine the opportunities and obstacles of holding off compared to moving forward to avoid paying even more later. Pagosa real estate ice age indicates the supply-and-demand of housing inventory will continue to be a problem in the first quarter and probably throughout 2023, not benefiting buyers. Perspicacious buyers who find a home meeting their needs are purchasing. They understand rates are always changing, but the purchase price is fixed (with the thought of a refinance).

“Sellers are still sitting on a lot of equity built up in their homes, and they may not be as motivated to cut current prices. This, together with inflation adding $500 or more to buyer monthly expenses, contributes as a big reason why first-time and affordable housing buyers continue to remain on the sidelines. Sellers are advised to get real about pricing. This is especially true if selling their home and needing a loan to finance the purchase of a next home. Will the seller be able to afford the new interest rate? Those sellers are thinking it makes more sense (and dollars) to shelter in place against this ice age real estate market until rates go down, subsequently warming the market with more buyers. Sellers must weigh this decision against prices possibly reducing to achieve a faster home sale. Currently, any decrease in pricing by sellers is simply not enough to compensate for the increase in interest rates and inflation items to create purchasers.

“The short-term moratorium has discouraged many second home buyers from purchasing in Pagosa Springs. With high pricing and higher STR fees, STR availability gives many buyers the opportunity to purchase, off-setting increased pricing and fees. These buyers have moved on to other purchase opportunities in other states or parts of Colorado. Many sellers indicate they are waiting for the market to warm up with buyers. New Listings down 25% in December 2022 (with only 12 new listings) supports their shelter in place mindset.

“Today’s real estate market has buyers and sellers. The year 2023 will present challenges for both. Buyers and sellers should connect with real estate brokers who truly understand today’s real estate scene, as opportunities are available. Perhaps mother nature and the Fed will be kind and give us an early Spring to help melt the real estate ice age, bringing on more sellers and buyers,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“We begin 2023 very much the opposite of the manner in which we began 2022. December put an exclamation point on a quiet and slowing market with new listings down 18.8% compared to December 2021. Pending sales were down 33.6% in December 2022 compared to a year prior and sold listings fell 48% for the same period. Sales volume was down 10.7% with 340 fewer sales.

“While our December median price was down $15,000 from a year prior, we remain strong at $310,000. The months supply of inventory improved to 2.4 months, a 60% increase from where we sat just a year ago and continuing to inch towards that more balanced market of 4-6 months.

“Although still a seller’s market, sellers are waking up to the fact that their home price is often too high and are quickly seeing the need to drop the price to get things sold. They are patiently waiting for buyers, still concerned about interest rates, to get back into the market. With much less competition and more time to write a contract, buyers are finding some long-lost opportunities to get back in the market,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Unprecedented. 2022 will go down in history as the year that the Fed doubled 30-year fixed mortgage rates within a single year. January 2022 may have come in like a lamb with a 3.2% interest rate, but December went out like a lion at 6.42%. Factor in high inflation, stock market volatility, and talks of recession and the result became national uncertainty.

“The single-family market ended with 18.7% fewer new listings than 2021 and multi-family, 25.5% less. Active listings for homes are 51 for Routt County, 20.3% less than the prior year; townhouse-condo market has 68 listings, up 78.9%. Months’ supply for single-family is hovering around two months (same as last year) while multi-family month supply has increased from just under a month’s supply in 2021 to just over two months’ supply in 2022. Days on market in December nearly doubled that of December 2021. With less new listings and less active listings, it is not surprising that there would also be a decrease in the number of pending sales and sold listings. Single-family ended the year at $1.325 million median sales price (+12.8%) and $1.7 million average sales price (+10.8%); the median sales price for multi-family was $855,784 (+32.8) with average sales price $1.114 million (+37%).

“To buy, or not to buy – that has become the philosophical question. As perspective starts to set in, the panic over interest rates is starting to subside. Note the average 30-year fixed mortgage rate from 2000-2021 was 5.28%. Speculation about home prices? There is not a consensus about that even amongst the experts, but history shows us home prices always recover from recessions- no matter how mild or severe. Steamboat has a bright future as we move towards becoming the second largest ski resort in Colorado. The current market has challenged some buyers who have stepped to the sidelines. So did the last market, which was so competitive that some felt it impossible to compete. For those buyers who can afford it and who plan to be long-term homeowners, they could find good opportunity to buy now with potentially less competition, perhaps more bargaining power and some good alternative means of financing to help with interest rates,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTIES

“In 2022, have prices gone up, or have they gone down? The answer is yes. For the up, the average price of all residential properties sold in Summit in 2022 was 13% higher than 2021. For the down, the average price in January 2022 was about $1.5 million and in December about $1.2 million for a drop of almost 23%. According to Warren Buffett, ‘though markets are generally rational, they occasionally do crazy things.’

“This crazy market trend takes a little looking into to explain. From December 2021 to January 2022, in just one month, the average single-family home in Summit County sky-rocketed up 65%. The average price came down steadily through July but started going up again in August. The December single-family average price is down 35% off that January high. That high number in January hikes up the 2022 year-to-date numbers. Even with that super high January 22, the month-to-month comparison of December 2021 to December 2022 is up significantly in all areas except Lake County, and the year-over-year average is up in Summit, Park, and Lake counties.

“Sales in Summit and Park Counties have decreased by 41% and there are about 38%, more listings to choose from. That sounds like tons of properties, but it is less than 40 properties in Summit. There is about 3-4 months of inventory. A balanced market is about 6 months of inventory. Statistically we are still in a seller’s market.

“There are 334 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $139,900 and a high price single-family home in Breckenridge for $19.5 million. Out of the 111 sales in December, the lowest was a home in Lake County for $130,000 and the highest was a single-family home in Breckenridge for $5.65 million. These numbers exclude deed restricted, affordable housing. In Summit County an average priced home is $2,096,247 down about $2,000 from last month,” said Summit County REALTOR® Dana Cottrell.

TELLURIDE

“Gross sales for the Telluride region (San Miguel County) in 2022 hit $1.1 billion, down 22% from 2021 but up in average sales price by more than 26%. The 582 sales in 2022 were down significantly from 2021’s total of 944. While the great urban exodus still affected the Telluride regional market in the first half of 2022, the second half of the year slowed down in sales due to two major issues, lack of inventory and the fear of the dropping stock market.

“Looking forward to 2023, purchasers now have to be concerned not only about an imminent recession but also a significant increase in short-term rental fees in the town of Telluride, huge proposed increases in employee housing mitigation in San Miguel County and a general lack of available general contractors in our region. Most contractors are booked out two to three years. Our team is predicting the total number of sales in 2023 to be 450 to 475 and the dollar amount of sales to be between $700 – $800 million. With so many variables in play, including rising interest rates, an up-and-down stock market and a likely recession of some duration, predicting the real estate market for the Telluride region in 2023 is nothing more than a wild guess,” said Telluride-area REALTOR® George Harvey.

VAIL

“The 2022 market was truly unpredictable as the macro-economic issues of inflation and rising interest rates conflated to cause significant swings. When we throw the lack of inventory in key pricing niches into the mix, volatility and unpredictability ruled the market.

“The beginning of the year was like 2021, but by the end of the first quarter we began to see a new trend in sales activity. This trend continued and accelerated as the second half of the year became a bit more predictable, albeit in a negative trend culminating in December with the most significant negative performance for the year. The month of December was negative 43% in transactions and negative 40% in dollar volume. The percentage-of-list-price received slipped to 97.3 % which is closer to historic norms within the market. The inventory of active listings is 50.3% higher than December 2021 but still significantly below historic norms for listings. The months’ supply of inventory is positive 115.4% but still at 2.8 months versus a stable market of 6 months.

“Comparing 2022 to 2021, we have a negative 31% in transactions and were down 24% in dollar volume. This performance has created a significant swing in market share of price niches. Historically, the less than $1 million niche represented approximately 65% of transactions. In 2022, it has declined to 41% of transactions. Inventory is a factor in this movement and the cost of new construction doesn’t look to be a catalyst for change in the trend.”

The chart below demonstrates the change in mix for the near term:

2022 performance by price niche:

Price niche Unit share $ share

< $ 1 million 41% 14%

$1-2 million 28% 19%

$2-3 million 11% 12%

$3-4 million 7% 7%

$4-5 million 5% 10%

$5 million + 8% 34%

“We look forward to stabilization in 2023 however, macro-economic factors, inflation, interest rates and the overall economy, coupled with our inventory, will drive the results,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA (Housing Affordability Index)

STATEWIDE (Housing Affordability Index)

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA (Percent of List Price Received)

STATEWIDE (Percent of List Price Received)

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The December 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.