An already slow summer housing market pumps the brakes a bit more in July as inventory grows but buyers choose to stay on the sideline

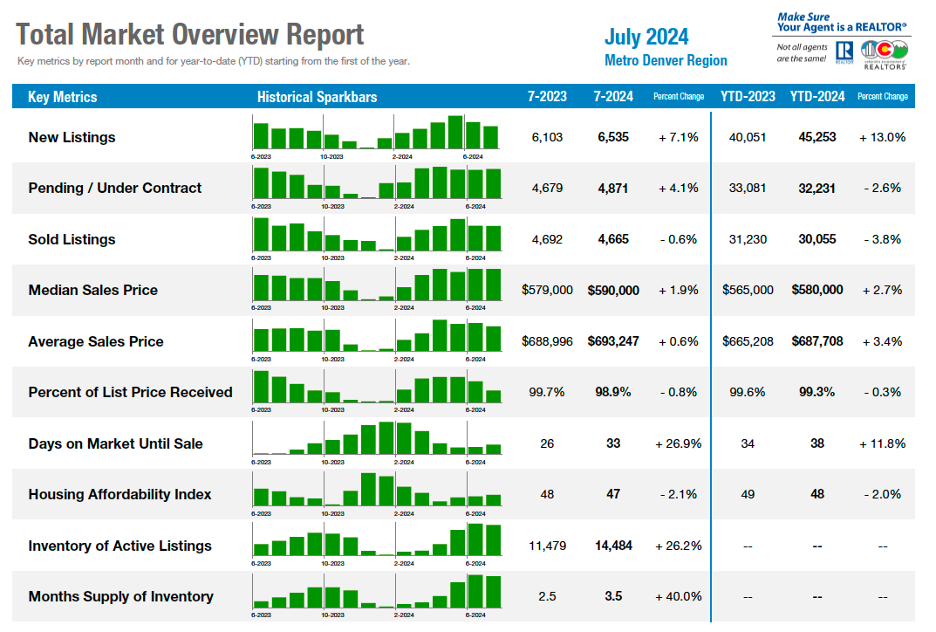

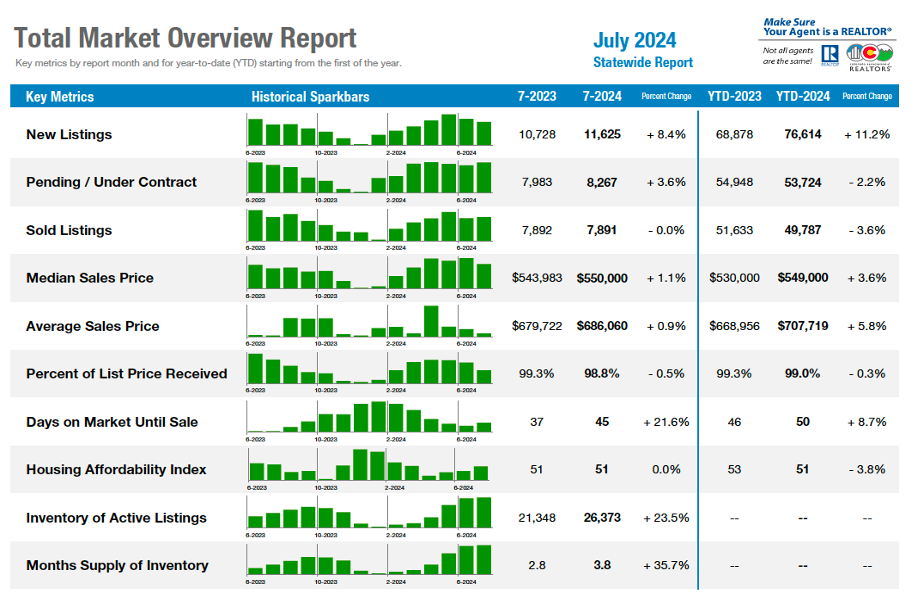

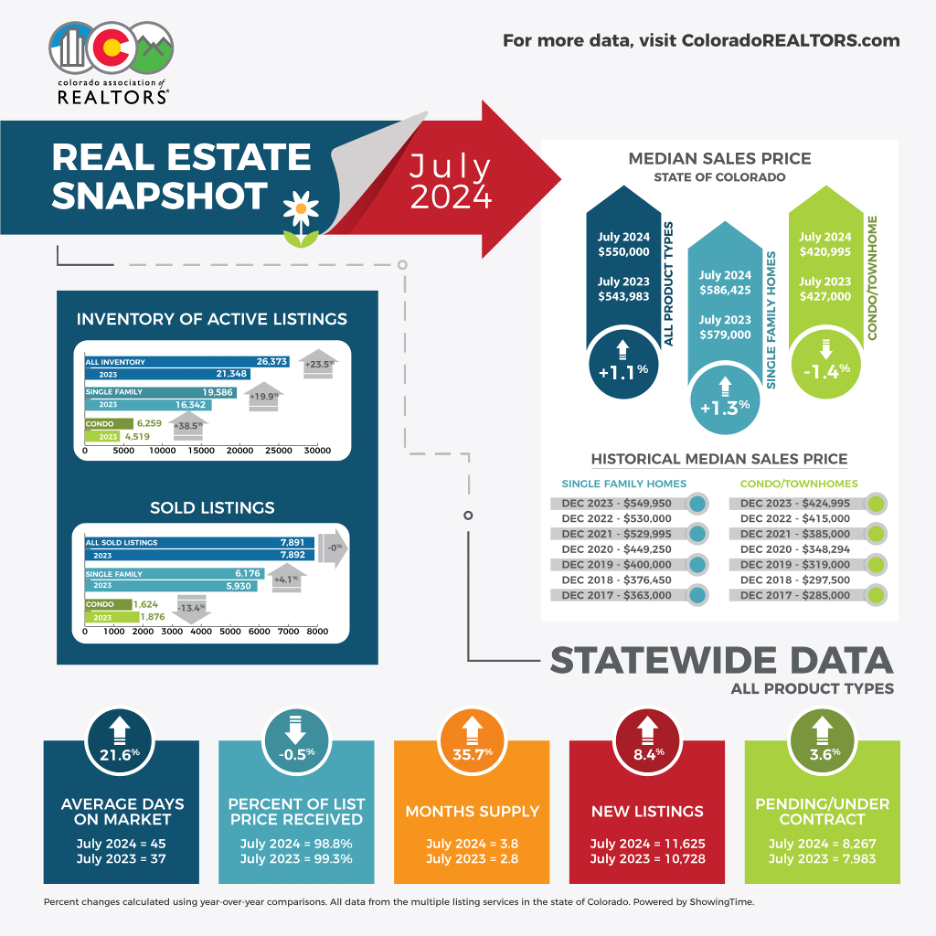

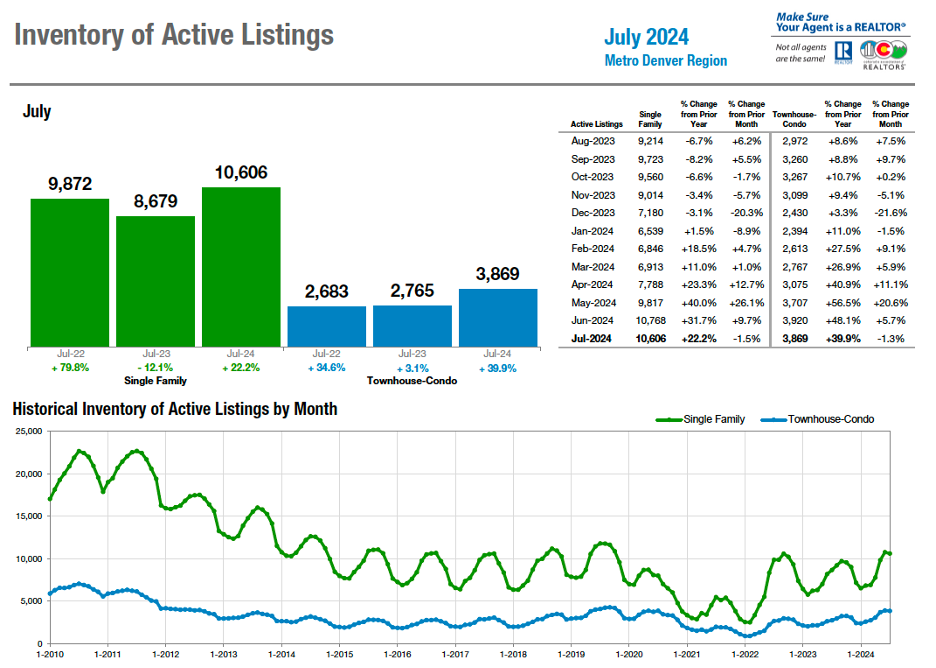

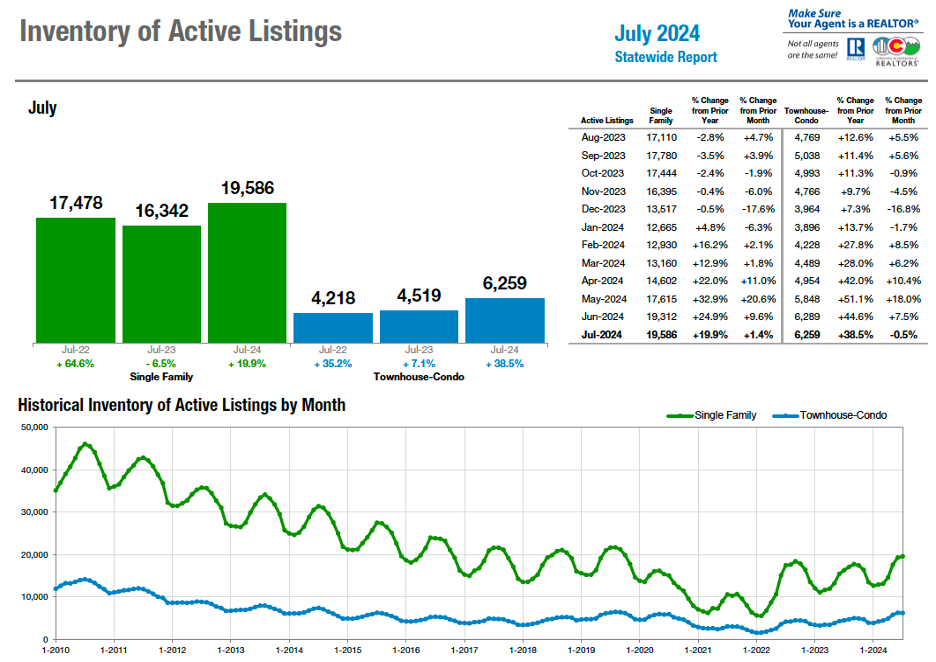

ENGLEWOOD, CO – An already slow summer housing market pumped the brakes a little more in July as higher mortgage interest rates and a hesitant pool of buyers pushed the inventory of active listings up approximately 20% in both the seven-county Denver metro area and in markets across the state, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado.

“’Retraction’ remains the key word driving our market, with inventory growing and demand shrinking. The rumor of the Fed Reserve lowering the interest rates in September has spurred some lower rates already, and buyers are talking about it. If rates do lower in September, we could see many of those buyers back in the market and the balance may shift again. But until then, sellers who need to sell are pricing competitively and adding a load of patience while they navigate this changing market,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

“As banks begin to lower interest rates in anticipation of the Federal Reserve’s expected rate cut in September, buyers are presented with more options than they have seen in some time, potentially setting the stage for another market shift,” said Summit-area REALTOR® Dana Cottrell.

Seller concessions and price reductions are prominent but have not slowed the rising inventory which continues to push supply number toward a more balanced market with the metro Denver supply now sitting at 3.4 months overall, up more than 30% from a year prior. Statewide, the 3.7-months supply is up 27.6% from July 2023. With more inventory and a hesitant buyer pool, average days on market sits at 32 days in the seven-county Denver metro region, up 28% from a year ago, while the statewide average rose to 43 days, up more than 13% from July 2023.

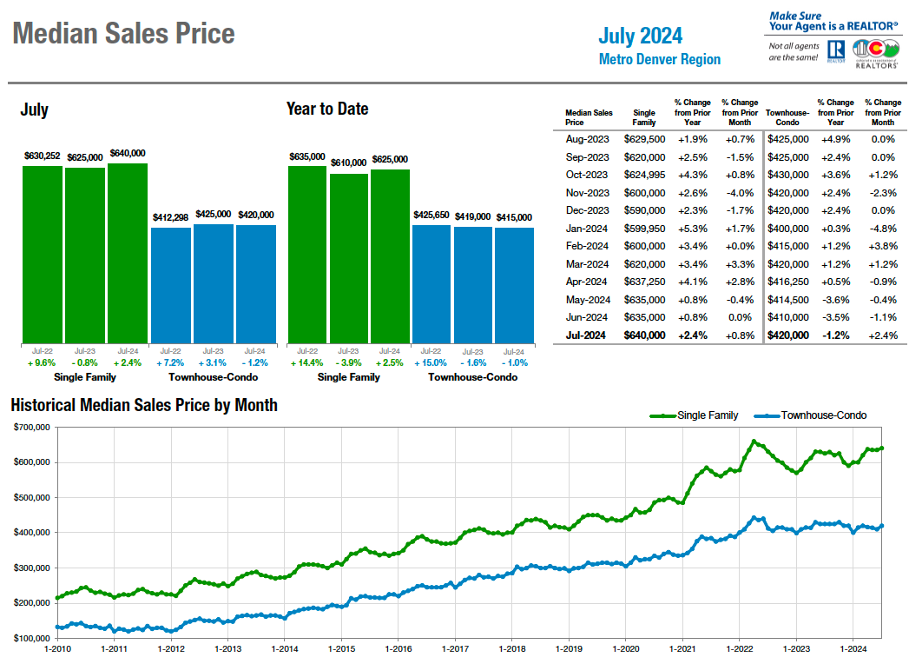

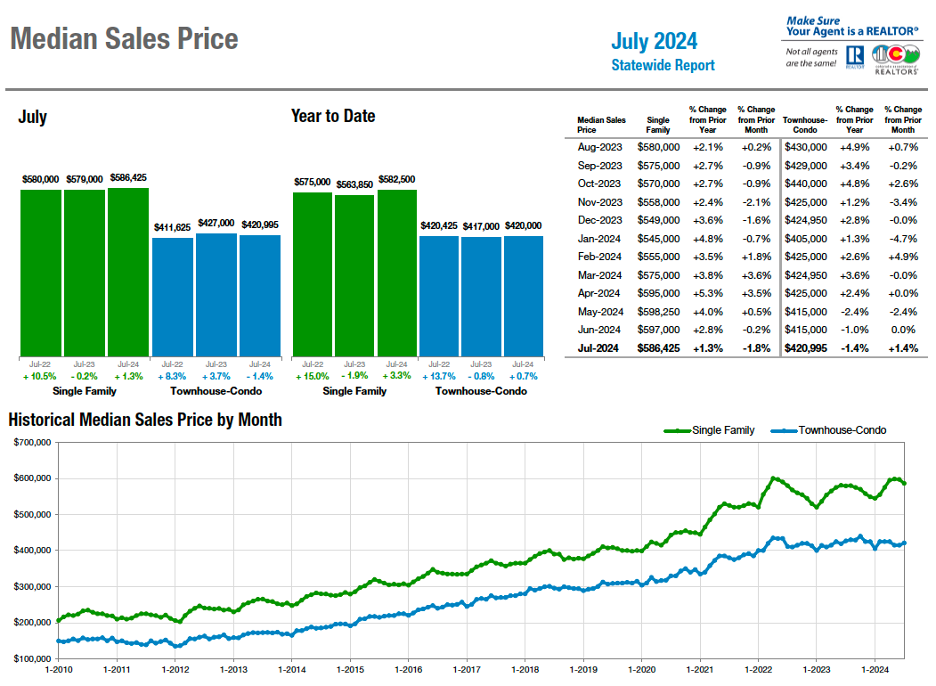

Once again, despite the inventory increases across property types, median pricing for single-family homes in the Denver-metro area ($640,000) and statewide ($586,425) remains at or within striking distance of their all-time highs, up 2.4% and 1.3% year-over-year, respectively. The townhome/condo market has held strong as well with a dip of just 1.2% year-over-year dip to $420,000 in the seven-county Denver area, and a 1.4% dip statewide to $420,995.

“Affordability challenges continue to be the primary concern of both buyers and sellers, and as inventory increases those challenges have become more evident. Buyers, who may have more options to choose from, are still hindered by continually rising insurance premiums, HOA dues, and 30-year mortgage rates consistently above 6%. Sellers, many of whom are still locked into the ‘golden handcuff’ interest rates of years past, now face increased competition in the market. It’s understandable that without a compelling reason to move, such as a job change, many sellers continue to show reluctance to jump into a tougher market than the COVID-era,” said Denver County-area REALTOR® Cooper Thayer.

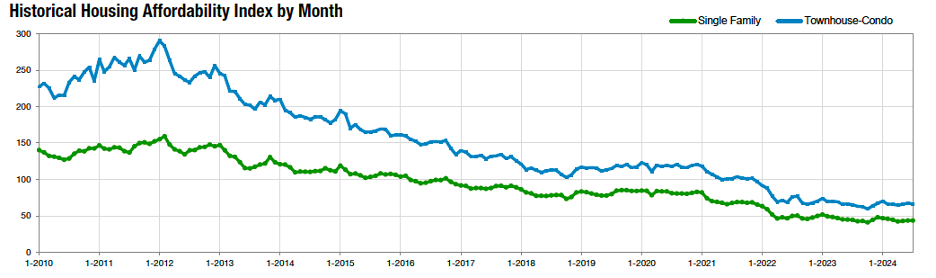

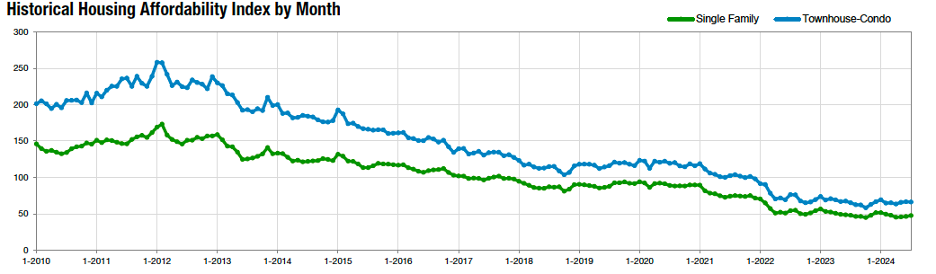

The CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – remains at or near its all-time lows, down 2.1% in the metro area year over year while statewide, the index remains even with a year prior.

Denver Metro Region

Statewide

Seven County Denver area Total Market Overview (single family and condo/townhome):

Statewide Market Overview

Inventory of Active Listings – Metro Denver

Inventory of Active Listings – Statewide

Median Sales Price Denver Metro Region

Median Sales Price Statewide

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“A summer slowdown is in full effect in zip codes across Arapahoe and Adams counties. Listings are up compared to a year ago in many areas, with the exception of 80011 in the north, or original Aurora area, which provides easy access to Children’s hospital, CU Health Science Center, and the airport. July sold properties in 80011 were the same as 2023 and the median price sits at $443,000, one of the most affordable housing options in the metro area and well below both Adams County, $535,000 and Arapahoe County, $623,000.

Looking to the 80013-zip code, primarily central Aurora, Arapahoe County, we see one of the most active areas with 147 active listings and a median price of $500,000, with options in both the Aurora Public Schools and Cherry Creek School District. Another very active zip code with a median inventory of $556,000 is 80015. Zip code 80016 inventory is up 10% from 2023 which does not include the new builder inventory. The median price in this southeast, Arapahoe County, Aurora area is $805,000. Looking to zip code 80019, in the newer part of Aurora housing and Adams County, inventory is up 95% from 2023 with a median price of $570,000. These homes provide very easy access to E-470, I-70, and Pena Blvd and you will find some very lovely developing Adams County neighborhoods here as well.

“Overall, our market seems to be a little more balanced. Buyers have a few more options and a little more time to contemplate one of their largest purchases. Interest rates have been in the 6.3-6.8% range, which is a great rate when you look at the 10-year average interest rate. The market is looking better for buyers,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Where are the buyers? In Boulder and Broomfield counties, new listings continue to hit the market but buyers are still sitting it out. With 16% more listings on the market in Boulder than we had at this time last year, prices have declined 4% as buyer demand is weak and seller motivation begins to grow. Over the past decade, many buyers have been sidelined by challenging market conditions. However, we are now witnessing a significant shift. Buyers today have more inventory to choose from than they’ve had in the past 10 years. Sellers are increasingly willing to negotiate, make repairs, offer concessions, and consider contingent offers to close deals. This presents a remarkable opportunity for buyers to make moves that may have been unattainable for a long time. Listings that are offered at very competitive prices are selling in about 30 days in Broomfield and 54 days in Boulder County. Prices are trending down as the supply and demand balance has shifted.

“Price reductions have become more common with a higher percentage of units going under contract following a price cut. This trend, coupled with longer days on market and fewer pending transactions, suggests a challenging environment as we head further into the fall. Notably, this is the highest level of inventory we’ve seen since 2014.

“’Retraction’ remains the key word driving our market, with inventory growing and demand shrinking. The rumor of the Fed Reserve lowering the interest rates in September has spurred some lower rates already, and buyers are talking about it. If rates do lower in September, we could see many of those buyers back in the market and the balance may shift again. But until then, sellers who need to sell are pricing competitively and adding a load of patience while they navigate this changing market,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“It’s a unique time in real estate and the industry has a ton of changes on the way. The spring season was not nearly as busy as many would have liked. The summer went by quickly and now we look up and find ourselves in August and a time of year that activity really begins to slow down as vacations wrap up and schools start back up. While the July market felt slow, it was interesting to review the statistics and see that we were up on sold properties a hair, 3%. The median price of homes pushed up again, this time 5.4%. But inventory piled on to the market in July, increasing 35.5%. Quite a jump year after year and adding competition across the region.

“The Pikes Peak region is now sitting at inventory not seen since 2015/2016. Buyers have plenty of options now but are not eagerly taking advantage of the new opportunities. The economy is weak at best, and maybe we are in a recession already. Revisions and time will tell. The consumer knows this. Unemployment jumped once again to 4.3% and jobs created missed the mark. Layoffs continue to hit the news cycle along with store closures and a lackluster earnings season. The poor sentiment is real. The economy is front and center everywhere we go. From the barber shop to the restaurant owner, people are nervous.

“As I scan the MLS (multiple listing service) some things are very clear. Price drops are hitting, and many homes that close have sellers paying buyer concessions. The days of home buyers waiving home inspections are now traded for a laundry lists of wants and wishes. Appraisal waivers are being replaced by tide water, and the once forgotten term ‘short sale’ is slowly entering back into the vocabulary of agents. Agent sentiment has also changed. Social media is flooded with talk of slower markets, emotional clients, and much harder sales.

“The Federal Reserve is now talking about a rate cut at its September meeting. Many expect this to give housing the push it needs. But history shows us that once the Fed pivots, stocks rally before crashing. The market gets excited before the layoffs hit, and the Fed has yet to prove they can have a soft landing. Maybe this time is different, but I’m not so sure,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Last month, homebuyers in the Colorado Springs area had more favorable opportunities due to the highest level of inventory in July since 2016. Additionally, the interest rates were softening, and 52% of active listings in El Paso County saw price reductions. However, despite these conditions, sales remained stagnant. Unfortunately, homebuyers continue to face inconceivable affordability challenges due to record-high home prices, high interest rates, and inflated cost of living. These are the most daunting barriers for potential homebuyers.

“The number of single-family/patio homes for sale in the Colorado Springs area in July 2024 was 3,273, representing a 10.1% increase month-over-month and a whopping 45.2% year-over-year, and the highest level of inventory in July since 2016. Overall months’ supply of active listings was 2.9 months in July. For homes priced under $400,000, supply was 2.4 months; homes between 400,000 and $600,000 at 2.4 months, homes priced between $600,000 and $1 million at 3.8 months, and 5.2 months for homes priced over $1 million.

“There were 1,127 sales of single-family/patio homes in July 2024, compared to 1,115 in the previous month and 1,119 in July last year, representing an increase of 1.1% month-over-month and 0.7% increase year-over-year. The monthly sales volume was up 6.4% and year-to-date sales volume was down 5.4% compared to last year. However, looking back 10 years to July 2014, the monthly and year-to-date sales volumes are up 100.9% and 136.6%, respectively. The 34 average days on the market compared to 32 days last month and 27 days in July last year. Last month, 52% of the El Paso County active listings in the Pikes Peak MLS had price reductions.

“Last month, the average sales price was $571,152 compared to $564,406 in the previous month and $540,443 in July last year, representing a 1.2% increase month-over-month and a 5.7% increase year-over-year. The median sales price was $499,000 compared to $499,000 in the previous month and 472,000 in July last year, representing no change month-over-month and 5.7% increase year-over-year. Last month, the average and median prices reached record high levels in July 2024 compared to any July previously.

“From an analysis of the single-family/patio homes sold by price range, last month, 23.5% of the homes sold were priced under $400,000, 46.3% between $400,000 and $600,000, 23.9% between $600,000 and $1 million, and 6.3% over $1 million. Year-over-year in July 2024, there was a 12.4% drop in the sale of single-family homes priced under $400,000, a 3.1% decline in homes priced between $400,000 and $600,000, a 15.9% increase in homes priced between $600,000 and $1 million, and a 26.8% increase in homes priced over $1 million,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“Summer in Crested Butte and the Gunnison Valley is amazing and also quite busy. Real estate sales reflect that with September, October, and August historically having the highest number of closings of the year. The number of sales in 2024 is trending 18% higher than 2023 but remains below every year since 2011. The coming months look to be busy, but pending sales are down 11% from this time last year. The total number of properties for sale is up 10%, but it is interesting to look more closely at that number. Properties are sitting on the market longer so while active listings are up, the number of new listings in the month of July is actually down. Prices continue to rise – more significantly for condos and townhomes than for single family homes – but buyers are also patient and will wait until they feel a property is priced correctly to make an offer so be sure to look at your specific comparable sales and not just consider the overall trend.

“Sellers should be sure to get good advice from their REALTOR® regarding pricing in order to take advantage of the next couple of months of selling season. There are still multiple offers being received and properties are selling for above asking, but only if they are priced competitively to begin with. Interest rates seem to be trending down, but since we have a lot of cash buyers, the stock market may be a better indication of what will happen going forward. We have started to see more showings happening in the last couple of weeks and I expect that to continue through September. If you are looking to buy, you should jump on properties that match your criteria because otherwise another buyer might. Inventory is growing but is still below where it was pre-Covid so it is tough to say when another opportunity will come along,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Sale prices experienced a sharp decline in Denver County last month as the annual selling season came to an end. July rounded out a relatively strong spring cycle, with total sales volume nearly identical to that of last summer, despite a seemingly ‘slower’ market. Median close prices of single-family homes declined 6.1% from June, spending an average of 27 days on the market, five more days than the prior month. The townhouse/condo market segment recorded similar conditions for July, with a -1.1% change in median close prices and slight slowdown in market velocity at an average of 38 days on market.

“Affordability challenges continue to be the primary concern of both buyers and sellers, and as inventory increases those challenges have become more evident. Buyers, who may have more options to choose from, are still hindered by continually rising insurance premiums, HOA dues, and 30-year mortgage rates consistently above 6%. Sellers, many of whom are still locked into the ‘golden handcuff’ interest rates of years past, now face increased competition in the market. It’s understandable that without a compelling reason to move, such as a job change, many sellers continue to show reluctance to jump into a tougher market than the COVID-era,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“July marked a fairly stagnant month in the Douglas County real estate market, with a theme of continuation from the June slowdown in sales. Median sale prices remained nearly identical to the prior month, coming in at $749,000 (-0.7%) and $460,000 (unchanged) for the single-family and townhouse/condo sub-markets, respectively. Also unchanged from June was the average time on market at 31 days, as well as supply of inventory at 3.1 months.

“Compared to last year, the inventory of active listings on the market has jumped around 27%, creating a significantly more competitive market. To combat the reduction of buyer demand stemming from affordability pressures, seller concessions have continued to be a major factor in many transactions over the past few months. Over 54% of closed listings in the MLS had a seller concession at an average value of $10,540 – primarily used to assist buyers with rate buydowns and other closing costs,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The pendulum is swinging toward a traditionally balanced market, with a current supply of inventory sitting at 5.8 months for single-family homes and 5.1 months for townhomes and condos. Historically, a six-month supply has been deemed balanced. Inventory continues to build in the single-family sector with 256 units compared to 214 units in July 2023, a 19.6% increase. The townhome/condo sector inventory has increased significantly to 99 active units versus 60 in July 2023. The large increase in condo units is attributed to skyrocketing insurance premiums, resulting in higher HOA dues and reduced rental revenue. Certain market segments are becoming somewhat saturated with inventory, something we haven’t seen since before COVID. The over $2 million price band has seen units climb from 40 to 60 since April, resulting in more than a 16-month supply. The $ 1.5 – $2 million market had more than a 14-month supply. Conversely, the under $600,000 segment remains competitive with just 2 months of available inventory.

“Single-family sales are down 13.2% YTD due to affordability. Higher prices, high interest rates, and increased insurance premiums continue to pause buyers. The year-to-date median price has remained unchanged compared to last year, even with more inventory choices for buyers. We see a trend of aggressive price reductions emerging as the summer selling season ends. Multiple six-figure reductions have been observed, especially at the higher end of the market. Seller concessions are also becoming more prevalent. Buyers are expecting more from sellers, and negotiations are favoring the buyers for the first time in several years now that more options are available. The days of sellers putting a sign in the front yard and naming their prices and terms are over. Pricing a home is more important than ever in this ever-changing market.

“Increased inventory and lower interest rates should motivate some buyers, especially locals who have been waiting to move up or down, to finally make the move. I anticipate an active fall selling season,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“July’s housing data in Fort Collins shows continued pressure on sellers to adjust price, negotiate concessions, and wait just a little bit longer for their homes to go under contract. For the multitude of buyers currently sitting on the sidelines waiting for interest rates to drop, that wait may be over. Keep in mind that the data I’m reporting on today is for homes that likely went under contract in June when average mortgage interest rates were still hovering near or above 7%. This 7% mark has been the bellwether of market activity for the last year or so. When mortgage rates drop notably below 7%, buyer activity springs into action.

“Back in June, buyers willing to brave the higher interest rates found a bit of leverage in a decade-long housing market that has not been particularly kind to buyers. Between price reductions and seller concessions to entice buyers to tour the growing inventory of homes for sale, would-be home buyers had the rare luxury of both negotiating power and time. Time to look at everything on the market; time to wait for another property to come on the market; and time to make a decision. Whereas just 18 months earlier, buyers of new cars spent more time on a test drive before they bought a car than buyers of homes spent touring a home before writing a contract that was competing with a dozen other buyers for the same home.

“The average days on market for a house that closed in July was just over 50 days. Almost two months from the time a house hit the market to when it closed. But here’s the real tell: the number of days until an offer was received was just over 3 weeks. In July 2022, for example, the average days to offer was just 11 days. This gives you a bit of insight into how sellers have had to react to a market that has cooled dramatically.

“With buyers having time and inventory to choose from, sellers have had to (reluctantly) adjust their sales strategies (and moving plans). With nearly 3.5 months of inventory on the market – which is to say, if no other homes came on the market and homes continued to sell at the current rate of market speed, it would take until the end of October for all 583 homes available at the end of July to sell. So, if a seller wants to be at the front of that queue of homes for sale, they’ve had to 1) reduce their price to get buyers to even look at their home and 2) offer additional enticements, aka ‘concessions’ to entice a buyer who has seen the property to make an offer. A seller concession is typically an amount of cash a seller pays on behalf of the buyer to the buyer’s lender to ‘buy-down’ the buyer’s interest rate. This has typically taken the form of what’s called a ‘2-1 buy-down’ where the concession amount temporarily buys down the mortgage rate of the loan by two points in the first year and one point in the second year.

“This arrangement provides the buyer with a much lower monthly mortgage payment for the next 2 years wherein interest rates may go down in which case the buyer can refinance to a permanently lower interest rate at that time. This has been a bet that the buyers who have remained in the market have found to be an advantage. Should interest rates float down to 6.5% or lower, many, many buyers will be back in the market, and we will see a return to the competitive offer scenario mentioned above and inventory will get snapped up fairly quickly. To put this seller concession strategy in perspective, nearly half of all sales with mailing addresses in Fort Collins had some sort of seller concession, averaging just over $8,000.

“With the most recent jobs data and commentary from the most recent meeting of the Federal Reserve, interest rates appear to be on the decline, for now. As with everything interest rate related, it has been quite the roller-coaster ride this year but perhaps that ride is coming to an end and we will see lower mortgage interest rates return throughout the latter portion of the year,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/GARFIELD COUNTY

“The real estate market in Garfield County has experienced a notable shift during the summer, with single-family home inventory increasing 26% compared to the previous year. This surge in listings has been accompanied by a 17% rise in pending sales and a 19% uptick in sold listings. Despite these positive trends, the median sale price has seen a slight decrease of 7%, dropping from $815,000 to $757,500. The adjustment in pricing is also reflected in the increased days on market, which rose 35%, although the months’ supply of inventory remained steady at four months.

“The multi-family sector displayed more fluctuation, with inventory climbing over 31%, yet pending and sold listings decreased 13% and 17%, respectively. However, the median sales price in this sector showed a modest increase of 7.6%, closing the month at $535,000.

“These statistics, while seemingly optimistic, contrast with the on-the-ground sentiments of REALTORS® who have observed a departure from the intense market activity that characterized the period since spring 2020. The competitive bidding wars and rapid sales are diminishing, as sellers who once expected to command prices 10-20% above recent comparable sales are finding such strategies less effective. Buyers, facing high interest rates and record-setting home prices, are becoming more selective, opting to wait for the ideal property that aligns with their financial plans. Consequently, REALTORS® are witnessing more price reductions and extended selling periods. For clients needing to sell, the advice is clear, accurate pricing is key to success in the current market landscape,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Activity in Mesa County was more positive in July. New listings, pendings, and solds were all positive, compared to a year ago. We have seen some price reductions in nearly all price ranges over $400,000 and more willingness to give concessions in order to get a transaction closed. However, prices are still gradually increasing as the year progresses. Many buyers are sitting on the sidelines, in the hope, probably, of rates improving more. The price ranges of greatest activity are the $300,000-$500,000 and currently we have a 2.7-month supply. A long way from a balanced market. The sellers are still in the driver’s seat,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“Without much improvement in the overall Pueblo real estate market, July delivered a 9% increase in new listings however, that number is still down 1.5% year to date. Pending sales were down 15% year to date and sold listings were down 17.8% month over month and 13.8% year to date. High interest rates, cost of living, employment concerns, and poor credit scores are keeping buyers on the sidelines.

“Sellers are reducing prices and offering interest rate buydowns. Our local agents continue to offer a lot of open houses but it’s often not enough to move buyers to purchase. Our median sales price moved up a little to $315,000, a 1.6% increase year to date. The percent-of-list price received has not changed at 98.4% and our days on market keeps getting longer – 93 days in July. The supply of homes sits at 4.5 months as sellers wait longer to get under contract.

“We saw just 19 new housing permits in July, the lowest month year to date. Of the 176 permits pulled so far this year, Pueblo West has 104,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“Costilla County: New listings are up 7.3% and sold listings have increased a staggering 250%. Consequently, the median sales price is up 69.6% from last year. You can find single-family properties in this market in the mid $200,000s.

“Saguache County: New listings are up 43% compared to last year, and up 16.7% from this month last year. However, year-to-date sold listings are 14% lower than at this time last year. The median price ranges from the high $200,000s to low $300,000s.

“Alamosa County: New listings are up 25% from last year, but median and average prices have decreased approximately 14%. This places prices in the high $200,000s to low $300,000s.

“Rio Grande County: New listings are up only 5% from last year, and down 25% from last July. While the median sales price has remained the same, the average price has increased. Consequently, single-family homes in this market are priced between the high $300,000s and mid $500,000s,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS

“New single-family listings for Steamboat, Hayden, and Clark for July were essentially the same as July 2023 and are up year-to-date; the same cannot be said for Oak Creek (Stagecoach) where there have been 41.7% less listings to come on the market this year. Steamboat multi-family listings doubled in July to 60 with the year at an increase of 42.3%. Even with the increased inventory, median and average sales prices are both up close to 40%. Steamboat inventory levels are up 23.8% over July 2023; however, Routt County is down about 11%. Like last July, months’ supply of inventory for single-family is 5 months for the county. Multi-family is almost four months- which is almost two months more than the previous year. These supply levels indicate that we are shifting to a more balanced market as realized with price reductions, price and inspection negotiations and seller concessions. Multiple offer situations still occur, but with less zeal than a few years ago. Aggressive list pricing has been met with price reductions or initial offers less than list price even in the first weeks of introduction to the market. In the end, sellers in Routt County have received 97.3% of their list price on homes and 98.4% on multi-family so far this year.

“The Stagecoach area is experiencing activity through the county planning process where new developments are at various stages of proposal. Given the applicants choose to comply and then satisfy the county’s requirements, Stagecoach could see new land listings come to market in 2025 and beyond to help with future housing. There are minimal multi-family developments in Oak Creek, Hayden and none in Clark. It is clear there is a void where there could be demand if the zoning and infrastructure were there to support multi-family (and affordability) in these towns,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“All the pressures that would seemingly bring down values, such as higher interest rates, insurance rates, HOA dues, property taxes, and a longer time for listings to sell are not impacting many buyers’ desire to own a mountain property or 2nd home. Sales statistics reflect when properties close, but they went under contract 4 to 6 weeks prior to that date. As banks begin to lower interest rates in anticipation of the Federal Reserve’s expected rate cut in September, buyers are presented with more options than they have seen in some time, potentially setting the stage for another market shift.

In Summit and Park counties, July saw 143 residential sales, mirroring the volume from the same period last year. However, the average sale price was 7% higher than in July 2023. Specifically, Summit County recorded the sale of 37 single-family homes, with an average price of $2,044,717, and 73 multi-family homes, averaging $920,246.

“This month also brought a notable 27% increase in the number of listings compared to last year, with over nine months of inventory now available, signaling a buyer’s market. Despite this, Summit and Park Counties have experienced a 10% increase in median sales prices.

“Among the 896 active residential listings in Summit, Park, and Lake Counties – an increase of 3% from last month – the spectrum of property prices is wide. The most affordable listing is a mobile home in Park County priced at $135,000, while the most expensive are a couple of luxurious single-family homes in Breckenridge, listed at nearly $20 million.

“July’s 141 sales in Summit, Park, and Lake counties saw a wide price range as well, with the lowest a mobile home in Park County for $125,000 and the highest was a single-family home in Breckenridge for $4,500,000. Around 48% of the transactions had a sales price exceeding $1 million and 43% of sales were cash. These numbers exclude deed restricted, affordable housing, land and commercial.” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“Total sales volume for the first seven months of 2024 was $564.39 million with the number of sales being 250 for the Telluride regional market. That is a 27% increase in the dollar amount of sales and a 6% increase in the number of sales over 2023. The Mountain Village recorded $248.7 million in the dollar amount of sales from 123 transactions. The town of Telluride did $163.9 million in sales from 48 sales.

“What is so astounding is the average price sales price in the town of Telluride increasing 34% this year, with the average sales price increasing from $2.54 million in 2023 to $3.42 million in 2024. The average sale price in the Mountain Village was down 14% mostly due to the increase in inventory most from new construction. Telluride’s overall limited inventory and its increased recognition for natural beauty, manageable size, and remoteness continue to be of high importance for buyers. In these troubling times internationally and somewhat nationally, buyers seek safety and smaller crowds. Telluride’s real estate market also looks to be a safe place to park some money as compared to other not so predictable investments categories,” said Telluride-area REALTOR® George Harvey.

VAIL

“July has been an interesting market to watch and see the significant variables by category that have evolved. The overall market had a 6% dollar increase in July versus 2023 with a 1.4%-unit decrease. The year-to-date status is positive 24% in dollars and 17.9% in units. Obviously, a bit of a slowdown comparing July to the previous year. The inventory of market listings is positive 5.7%, but when digging into activity by type of units, we see very different results. The inventory of single-family/duplex units is minus 4.2% while condo/townhome units is positive 20.5%. The closed sales in both categories are flat for the month but pending sales for single family/duplex are negative 32.3% and condo/townhome positive 39.6%.

“This dynamic in the market is caused by the new construction in multi-unit complexes over the past year. At current rates of sale, the single family/duplex market is at 6.7 months of supply which is basically a stable market rate. The current momentum in multi-units is driven by new product and months of supply are at 4.5 which reflects the pending contracts and activity.

“The recent turmoil in mortgage rates offer the possibility of a positive incentive for the market with the lowest rates in over a year. The market is positioned for a move however, August is usually the beginning of a slower period as schools start and our tourist exposure begins to taper off. We do see some trends in pricing that could be a stimulus in conjunction with mortgage rates causing the usual slowing to be minimized,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The July 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.