Housing market balance of power tilts towards buyers

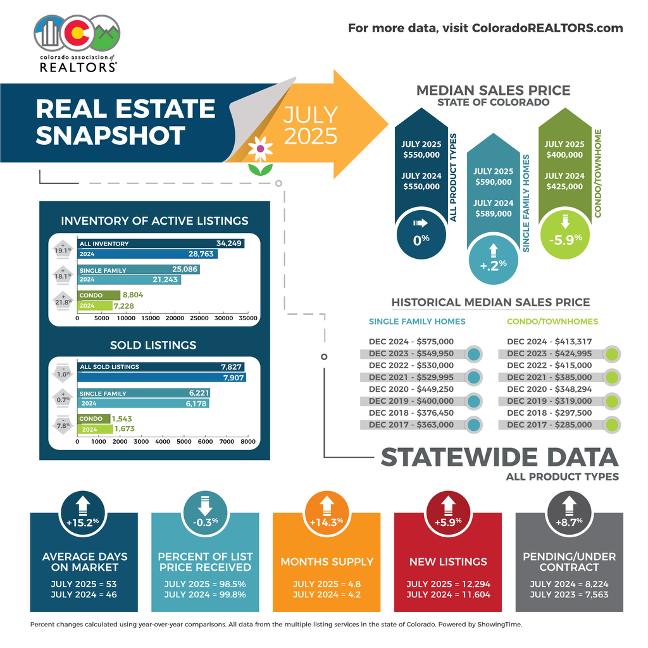

ENGLEWOOD, CO – Pricing on single-family homes, as well as condo/townhomes, dipped slightly in markets statewide in July as inventory continued to pile up, sales volume slowed, and the seasonal fall slowdown came into view, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons working in markets across the state.

“As the market heads into the fall, the balance of power remains tilted toward buyers. Elevated inventory, slower sales velocity, and the prevalence of meaningful concessions create conditions that allow buyers to negotiate terms that fit their needs while still benefiting from stable home values,” said Denver County-area REALTOR® Cooper Thayer. “For sellers, success will depend on accurate pricing, strong property presentation, and a willingness to be flexible. For buyers, this is one of the most favorable negotiating climates in more than a decade, and one where opportunities are abundant if you know where to look.”

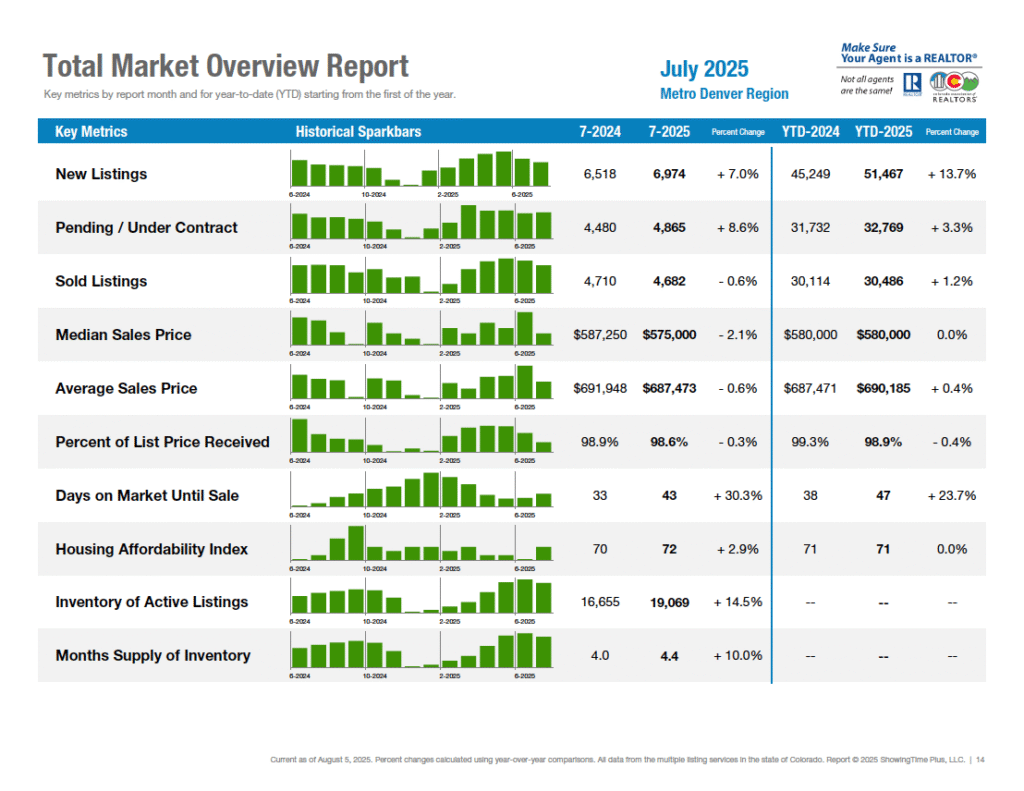

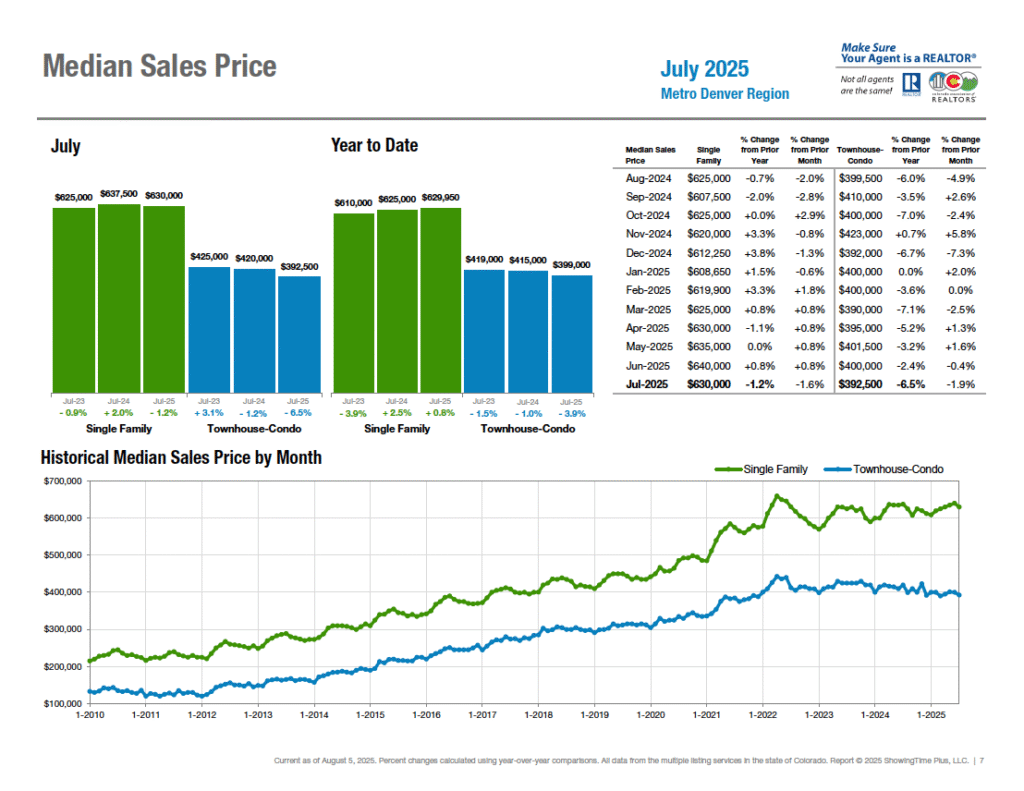

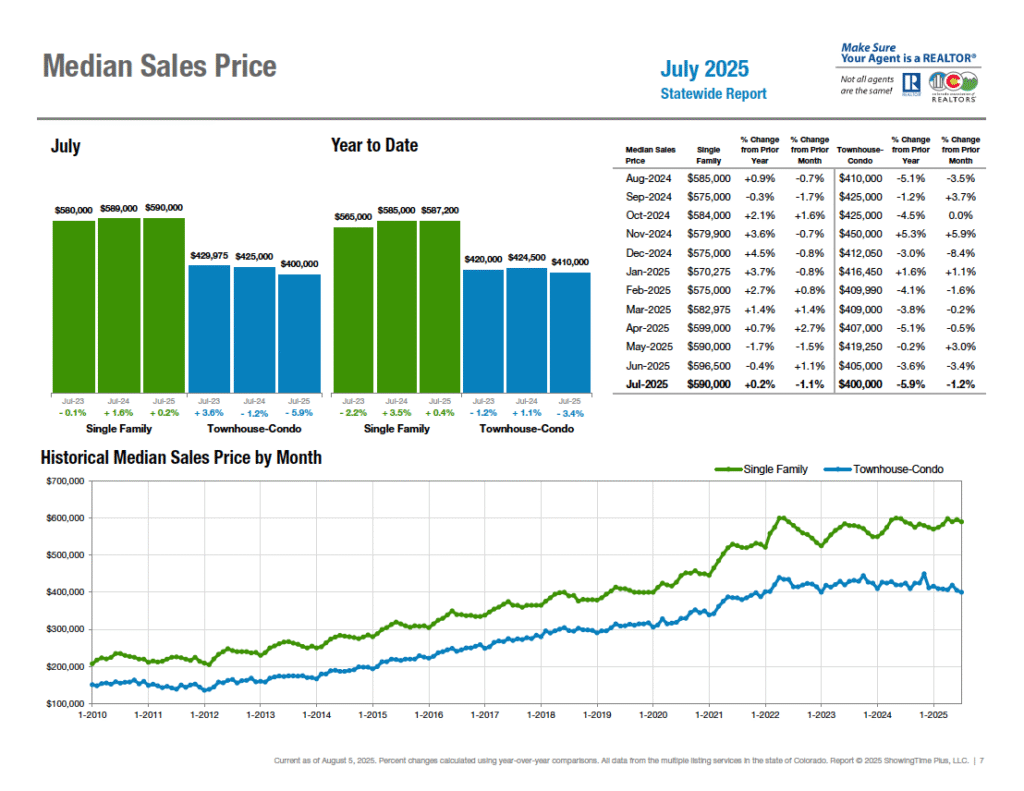

Median pricing for single-family homes in the seven-county Denver area dipped 1.6% from June to July to $630,000, down 1.2% from a year ago. Townhome/condos in the Denver area fell just shy of 2% over the past 30 days and are down 6.5% from a year ago at $392,500. Statewide, the median price of a single-family home fell just over 1% to $590,000 but remains relatively flat with median pricing from June 2024. Townhome/condo median pricing slipped 1.2% from June to July and is down just shy of 6% from a year ago at $400,000.

“Across all market segments, fewer homes are selling at full list price, and many sellers are offering concessions during the inspection period to keep deals intact. Homes in convenient locations and those fully updated and move-in ready continue to sell quickly, while properties that need renovations or are situated in remote areas tend to linger, especially if they are priced too high from the start,” said Evergreen-area REALTOR® Julia Purrington Paluck.

July’s 3,686 single-family sales in the Denver-metro market were down 8.8% from June to July, while statewide, the 6,221 sales were off 7.4% for the same period.

Sellers seem to want last year’s prices and buyers want next year’s prices, and the disconnect is culminating in fewer sales,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

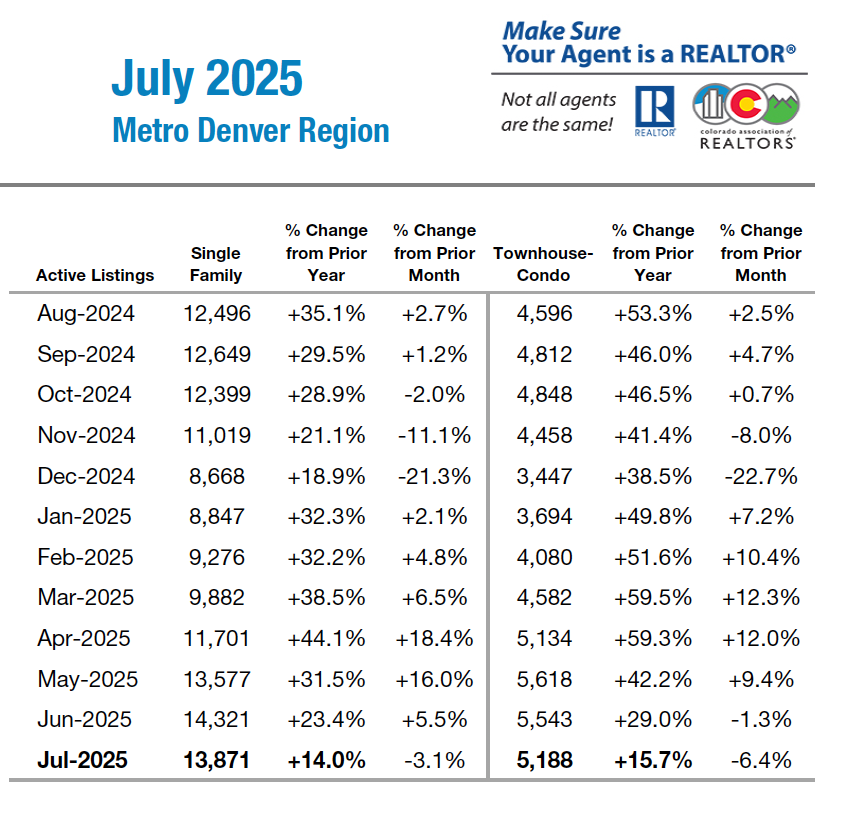

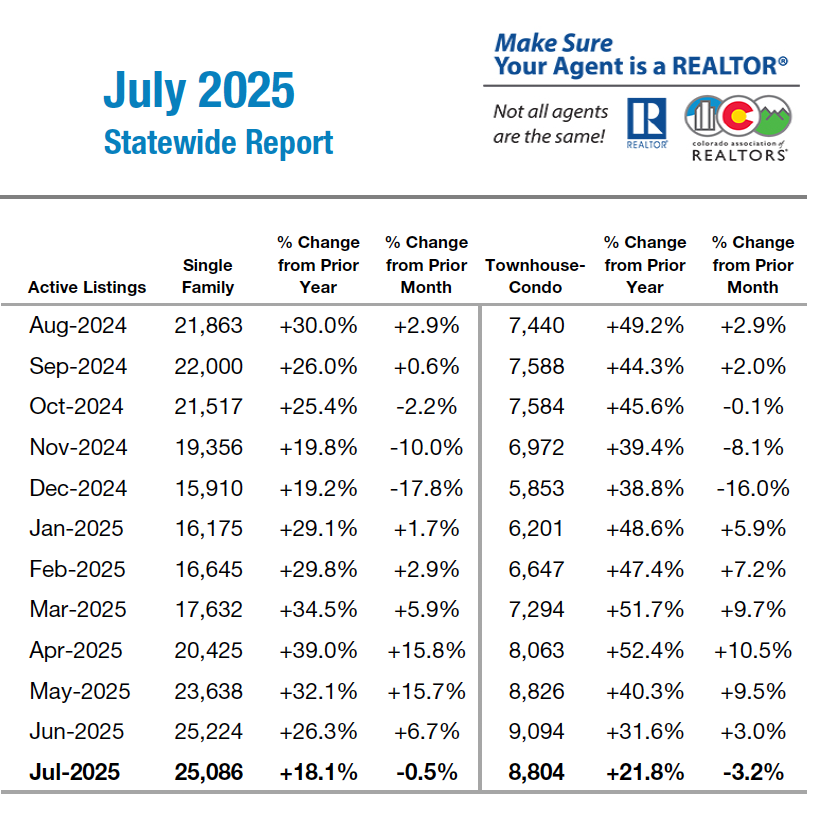

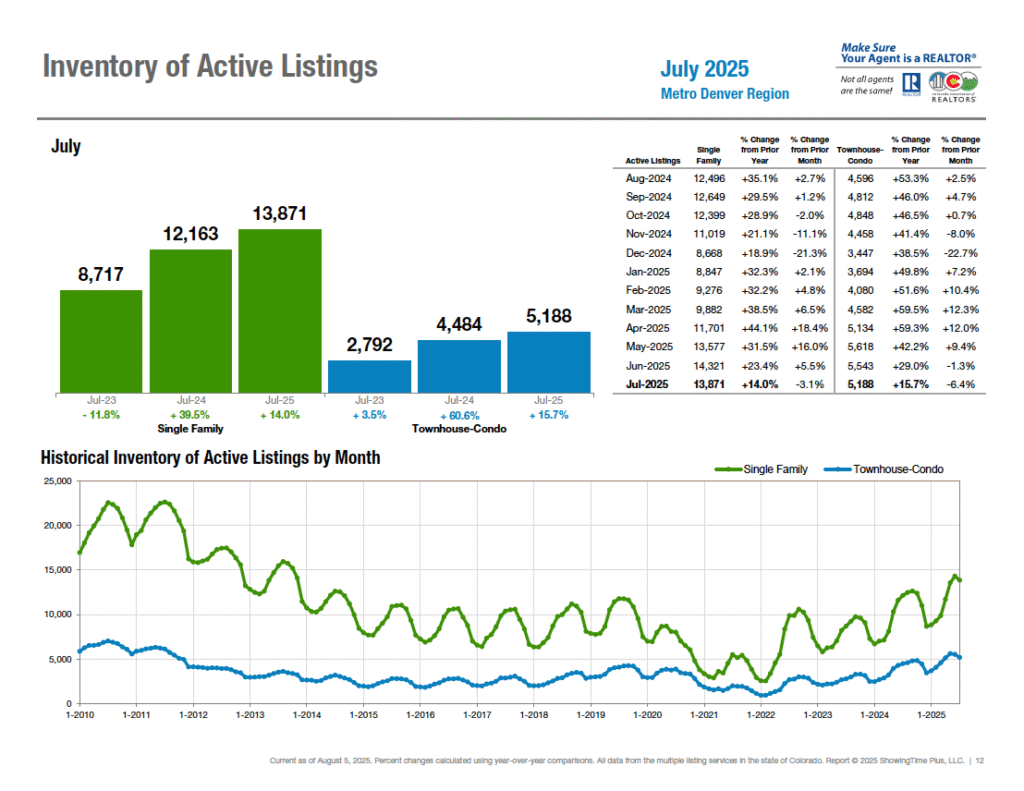

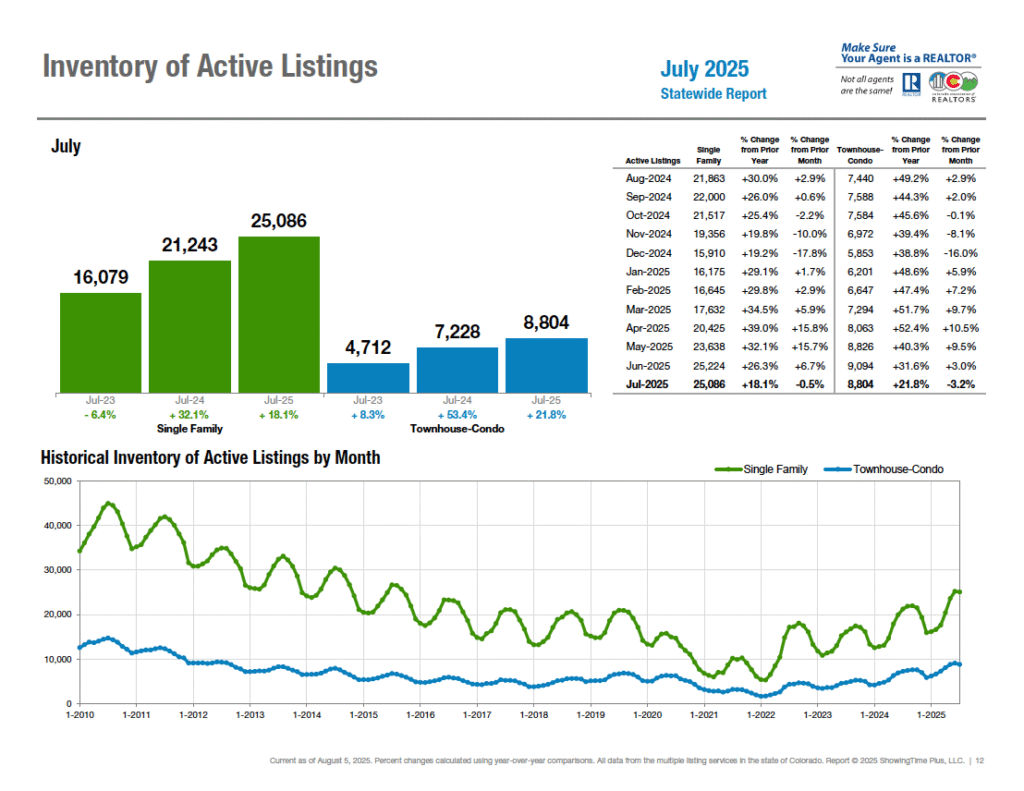

Despite the pullback in new listings and slower sales, the volume of active inventory remains well up over the same time last year in most markets and product types.

Inventory of Active Listings Denver Metro

Inventory of Active Listings Statewide

The combination of market factors helped buyers with pricing as well with the average percent-of-list-price received down slightly to 98.7% for single-family homes and 98.3% for condo/townhomes.

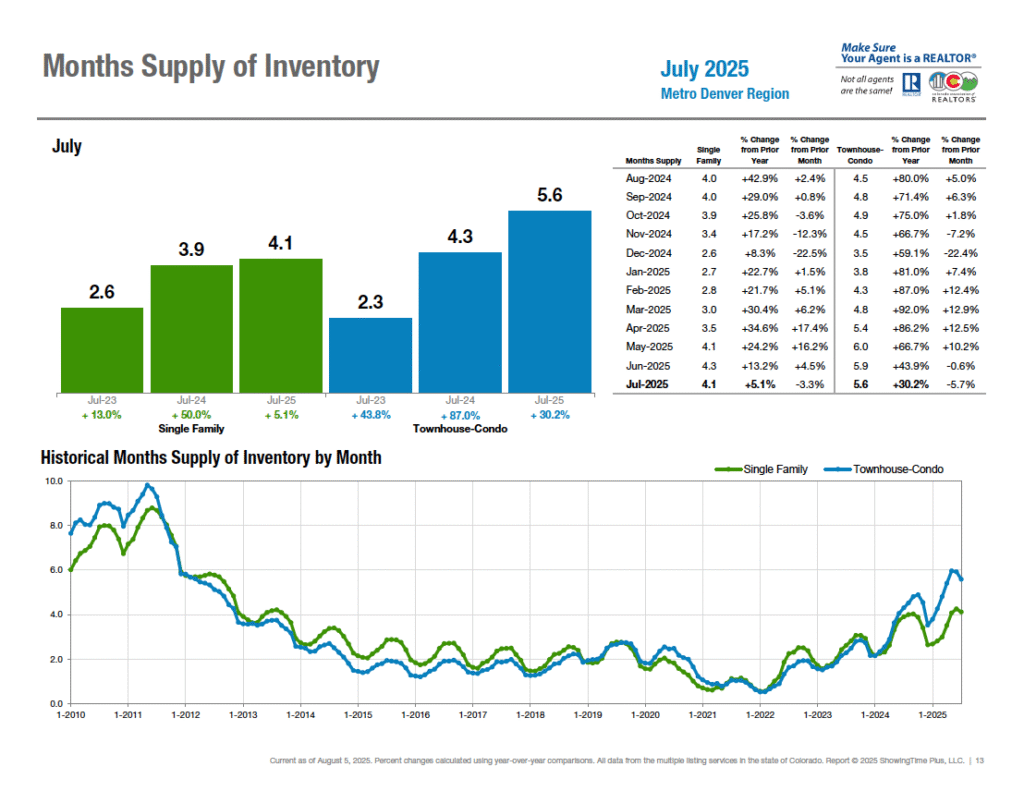

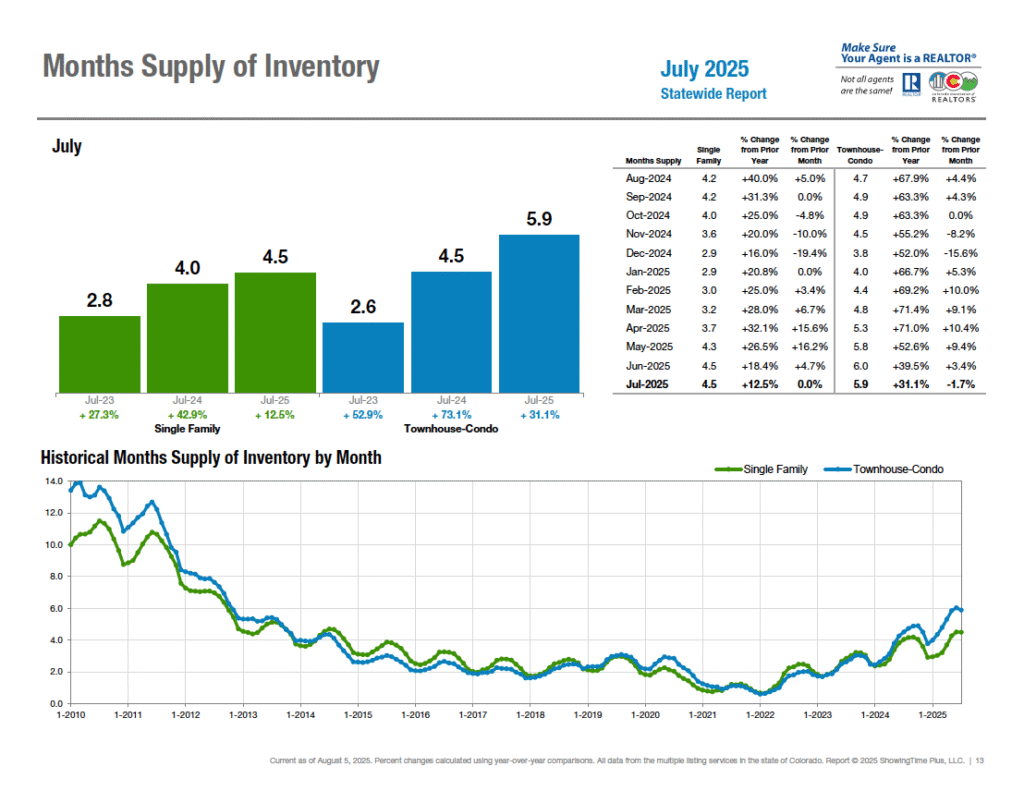

The overall months’ supply of inventory continues to favor a buyer’s market as well with 4.1 months’ supply of single-family homes in the Denver-metro area, up 5.1% from a year prior, while condo/townhome inventory hit 5.6 months, up more than 30% from a year ago. Statewide, the months’ supply of single-family inventory remained flat at 4.5, up 12.5% from July 2024. Condo/townhome supply dipped 1.7% from June to July but also remains up more than 31% from a year ago.

Now is possibly the best time in the past 14 years to be a buyer. Interest rates may not be perfect, but all the other buying conditions are close to perfect for buyers who can always look ahead at refinance options if interest rates go down,” said Aurora REALTOR® Sunny Banka.

“The abundance of available homes presents a fabulous opportunity for buyers to find properties that suit their preferences. It also allows them to negotiate more favorable offers with motivated sellers,” said Colorado Springs-area REALTOR® Jay Gupta.

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

MEDIAN PRICE – DENVER METRO AREA

MEDIAN PRICE – STATEWIDE

INVENTORY OF ACTIVE LISTINGS – DENVER METRO AREA

INVENTORY OF ACTIVE LISTINGS – STATEWIDE

MONTHS SUPPLY OF INVENTORY – DENVER METRO AREA

MONTHS SUPPLY OF INVENTORY – STATEWIDE

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“It seems that the market has been considerably slower than a year ago however, the numbers do not reflect that in all areas. The activity continues to be hyper-local and the adage location, location, location still holds true. While seeing increased inventory, some of our higher-priced neighborhoods are also experiencing price increases – not just from a year ago, but one month ago. In the 80016 zip code the 254 active listings are up slightly from the prior month and the $830,000 median price is up 2.5% a year prior. However, the median price last month was $800,000.

“More moderately priced areas have some very deep reductions. In Central Aurora’s 80012 zip code the median price is $480,000, while just one month ago the median price was $499,000. Buyers seem to have more leverage in the more moderately priced areas. In addition to the deep price cuts, we are seeing more sellers willing to offer concessions to help buyers with short-term lowering of interest rates or funds for closing costs. Without much movement in the interest rates, it appears that sellers will have to determine their motivation level. Do they want to sell now, or do they want to hold through the winter? If they want to sell now, they need to be the best price, with the best house and possibly still offering concessions to help buyers get into the property at a payment that they feel is reasonable. Generally, now is possibly the best time in the past 14 years to be a buyer. Interest rates may not be perfect, but all the other buying conditions are close to perfect for buyers who can always look ahead at refinance options if interest rates go down. Getting into a home and building equity may not be as easy once the rates start to move down. Buyers need to take another look and rethink their strategy. Sellers need to be more reasonable about the true value of their home right now,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“The real estate markets in Boulder and Broomfield Counties are tipped in favor of buyers, as new listings are popping up faster than homes are selling.

“In Boulder, new listings are up 14% compared to this time last year, but sales have only increased 1.4%. In neighboring Broomfield, listings have jumped 17%, while sales are only up 2.6%. This growing gap between supply and demand is making it easier for buyers to take their time and shop around — a clear sign the market has shifted. Sellers seem to want last year’s prices and buyers want next year’s prices, and the disconnect is culminating in fewer sales.

“In Boulder, prices have stayed mostly flat compared to last year. Homes are sitting on the market for around 60 days, showing that sellers are waiting longer for offers. Broomfield is seeing quicker activity, with homes averaging 37 days on the market, and prices are currently up 6% year-over-year. But with inventory climbing, that price appreciation may not last. We expect to see prices go down by the end of the year.

“As we head into the fall season, all signs point to a buyer’s market. Sellers will need to cut prices to attract the serious buyers. Sales price/ list price ratio still remains tight at about 99%, but that doesn’t take into consideration the concessions sellers are paying to buyers to buy down their interest rate. The average sale concession is 3% of the list price, bringing that number down to about 96% sales price/list price, a noticeable difference from past years,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Are the tides turning in favor of buyers? We have some signs that it may be true. July proved to be a frustrating month for sellers. What is normally summer selling season was lackluster at best. Increased inventory, up 21% from the previous year, gave buyers more selections. But they didn’t show up to buy. Median prices dropped 1% and units sold were off -6% year over year. Affordability continues to be an issue.

“Part of the issue we are feeling about housing relates to overall debt, in my opinion. Student loan payments, car payments, credit card payments, food bills, gas, insurance. All weigh on the economy and that carries over to housing. American households need to earn $112,000 per year to afford a home. We have a median income of $84,000, per Nick Gerli, of REVENTURE. This is a large spread and something must give. Either wages must increase, interest rates must drop, or home prices must come down. And in many areas, the housing shift on prices has begun. But here in the Pikes Peak Region they continue to stay elevated, and many would-be buyers opt to save money by renting.

“The economy continues to be fragile. Economic data from jobs to manufacturing show that we may be for a bumpy ride this winter and into next year. The betting odds of a rate drop from the Federal Reserve in September are running around 85%. Four Fed presidents have now come out publicly for rate cuts. Forty-one percent of consumer spending goes to housing, utilities, healthcare, medications, and insurance. In 1980, that was only 30%. Buyers are sitting on the sidelines because they are nervous. Until we see a better alignment between wages and home prices, I think you will see potential buyers sit longer. I imagine this winter will feel colder than many in our past when it comes to the housing market locally,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The home prices continue to edge up month after month. Last month, the average sales price of single-family and patio homes reached a historic high of $574,276. Two of the most crucial components in home building are lumber and labor, both of which are currently in massive turmoil. Recent data from Cotality (formerly known as CoreLogic) shows home prices increased 1.7% year-over-year. Cotality is projecting a healthy 4.2% increase over the next 12 months. The continued appreciation trend points out that real estate is still one of the most outstanding ways to build long-term wealth. A home of average price of $574,276 with a 4.2% increase would appreciate $24,119 in just one year.

“Warren Buffett is renowned for his investing philosophy, which is summarized in his famous advice: buy when others are selling and sell when others are buying.

“With the current historic level of active listings, sellers must price competitively from the start to avoid repeated price reductions and ensure their properties are attractively staged to draw buyers.

“On the other hand, the abundance of available homes presents a fabulous opportunity for buyers to find properties that suit their preferences. It also allows them to negotiate more favorable offers with motivated sellers,” said Colorado Springs-area REALTOR® Jay Gupta.

July Key Highlights from the Colorado Springs Market:

- Active Listings – Supply: In July 2025, Colorado Springs area had 4,227 single-family and patio homes available for sale, according to the Pikes Peak MLS. It represented a remarkable year-over-year increase of 29.1% and a substantial 204.1% increase compared to July 2020. The inventory level was the highest for July since 2014, matching the same count from that year.

The overall months’ supply of active listings was 3.7 months. For homes priced under $400,000, the supply was 3.1 months. Homes in the price range of $400,000 to $600,000 the supply was at 3.2 months. The supply for homes priced between $600,000 and $1 million was more plentiful at 4.4 months. However, for homes priced over $1 million, the supply was robust at 5.7 months.

- Sales – Demand: Last month, a total of 1,152 single-family and patio homes were sold. It reflects a slight decline of 3.8% from the previous month, but it shows a modest increase of 2.2% compared to the same time last year.

The monthly sales volume also experienced a minor increase of 2.8% compared to the last year but an astounding 106.6% increase compared to July 2014. Year-to-date sales volume showed a healthy increase of 19.7% compared to previous month and 8.4% compared to July of last year. In comparison to July 2014, the year-to-date sales volume escalated amazingly with an increase of 150.1%.

- Days on the Market: The average number of days on the market in July 2025 decreased to 39 days, down from 40 last month but up from 34 days in July of last year.

- Sales by Price Range: Last month, 23.8% of homes sold were priced below $400,000, while 44.9% were sold for between $400,000 and $600,000. Homes priced between $600,000 and $1 million accounted for 24.2% of the sales, and those priced over $1 million represented 7.1% of the total sales.

In July 2025, there was a modest 3.0% increase in the sale of single-family homes priced under $400,000 compared to the previous year. Homes priced between $400,000 and $600,000 also saw a tiny 1.0% drop in sales. There was a modest 3.3% increase in the sale of homes priced between $600,000 and $1 million. The homes sold for over $1 million experienced a healthy 6.2% increase in sales.

- Average & Median Sales Prices: Last month, the average sales price of single-family and patio homes reached a historic high for July at $574,276. It marks a slight increase of 0.5% compared to last year and an impressive escalation of 34.3% compared with July 2020, just five years ago. Additionally, there has been an exceptional 108.5% increase compared to July 2014.

The median sales price saw a marginal decrease of 0.3% year-over-year. Nevertheless, it had a huge 32.7% increase compared to July 2020 and an astounding 104.7% escalation compared to July 2014.

- Price Reductions: Last month, 52.8% of active listings in El Paso County and 46.6% in Teller County saw price reductions. With the current high volume of active listings, sellers must price competitively from the start to avoid repeated price reductions and stage their homes attractively to draw buyers.

CRESTED BUTTE/GUNNISON

“The real estate sales statistics for the Gunnison Crested Butte Association of REALTORS® area continue to track pretty closely to 2024. Overall, there are more sales (up 12%), but lower total sales volume (down 6%). The number of listings is up slightly (6%). Average prices in the larger area for residential properties are down – only 1% for condos and townhomes and 16% for single-family homes. However, as is always the case, these trends are not the same in all areas.

“The Crested Butte area is down both in number of sales (134 vs. 137) and dollar volume (less than 5% – $159 million vs. $167 million). Average prices continue to rise for residential properties in the Crested Butte area. Single-family home prices are up 2% on average this year vs. last and the average price of condos and townhomes are up 8%. Inventory is up 6%, but if you are in the market for a single-family home in this area, there are 16% more for sale this year than in 2024. Importantly, the number of residential properties under contract is up 20% over last year, so the increased inventory in this area is allowing buyers who have been waiting to find something they want to buy.

“As reported last month, the Gunnison area has a significant increase in the number of sales (32% more) and the dollar volume is up 18% as well. Average residential prices have gone down slightly. Single-family homes are selling for 17% less on average while condos and townhomes have remained steadier with only a 2% drop in average prices. The number of properties for sale is very similar to what we saw last year as is the number of properties under contract.

“Our biggest closing months are always September and October and it will be interesting to see if we surpass last year with things coming up. Anecdotally, there is a lot of activity right now and I would expect that to continue through September and into October. Sellers continue to put their properties up for sale and to reduce prices if they are not getting showings and/or offers. Buyers have more to choose from and should be working closely with their REALTOR® to get a feel for the trends in prices. If you find a property you like, don’t assume that the seller will take a significant amount less than they are asking. The trends seem to indicate that prices are not dropping significantly,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER METRO (11-County)

“Today may be one of the best times to buy a home in the Denver-metro area in years. The balance of negotiating leverage has shifted sharply in favor of homebuyers, and even though mortgage rates remain high, there are still plentiful opportunities to make homeownership attainable. More than 61% of Denver metro closings in July included a seller concession, averaging $10,826. That kind of concession can often fund a 0.5% – 1% interest rate buydown for the life of the loan, potentially saving buyers hundreds of dollars each month, and tens of thousands over the 30-year term of a mortgage. Combine that with the highest inventory levels we’ve seen in more than a decade, and this market offers buyers more options, more negotiating power, and more time to make thoughtful decisions than in recent years.

“The housing market began its typical annual slowdown in July. Total active listings declined slightly to 19,056, representing 4.4 months of supply. While this was a modest dip from June’s peak, supply remains well above the conditions that fueled the competitive markets of the past decade. Homes are also taking longer to sell, with the average days on market rising to 40 for single-family homes and 55 for condominiums and townhomes, a 25% and 44.7% increase, respectively, from a year ago. Prices, however, have remained relatively stable despite the slower pace of sales. The median close price for single-family homes in July was $630,000, down 1.6% from June and -1.2% from last year. Condos and townhomes saw a larger year-over-year decline, with the median price falling -6.5% to $392,500.

“Buyers are being more selective, often favoring well-priced, turn-key properties, while homes that need work or ask for a price too high are sitting longer and frequently require price reductions or incentives to attract attention. In the condo/townhome segment, rising HOA dues, often driven by increased insurance costs, are adding to affordability challenges. At today’s interest rates, each additional $100 in monthly HOA dues reduces a buyer’s purchasing power by roughly $15,400, making realistic pricing even more important for sellers in this segment.

“As the market heads into the fall, the balance of power remains tilted toward buyers. Elevated inventory, slower sales velocity, and the prevalence of meaningful concessions create conditions that allow buyers to negotiate terms that fit their needs while still benefiting from stable home values. For sellers, success will depend on accurate pricing, strong property presentation, and a willingness to be flexible. For buyers, this is one of the most favorable negotiating climates in more than a decade, and one where opportunities are abundant if you know where to look,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Compared to July 2024, sales of single-family homes in La Plata County were strong, +17%. Inventory of homes for sale was up 12% and the months’ supply of inventory was +5%, with the median price down 2%.

“Conversely, condo and townhome sales are down 39% from July 2024. The segment is suffering with 26% higher inventory of homes for sale, and 20% greater months’ supply of homes – this calculation measures how long it would take to sell the amount of inventory that exists on the market. Year-to-date, the segment has had +6% new listings enter the market, while sales are -9% in number. When comparing the health of the La Plata County condo/townhome market to every other county in Colorado with at least a reasonable amount of sales in the segment, our county has fared the worst. However, it’s not all bad news. While most counties experienced price decreases, La Plata County has seen an actual increase in median condo/townhome prices of 2% which speaks to the resilience of our markets. While other mountain towns and cities may swing wildly, La Plata County continues to hold its ground against changing economic factors better than most.

“In both single-family and condo/townhome segments and in all areas of the county. the average percent of list price to sold price is down to 97% from 98% and even 99% last year at this time.

“In-town Durango, our strongest and most resilient of our areas, is starting to see the effect of the slowing market, however small-single family homes are on the market longer (18%), there is 16% more inventory, and the list to sales price ratio (which was 100% a year ago) is down to 97%. Condos and townhomes are down 56% for July with +7% new listings coming on market when compared to July 2024, and the median is down 5% year to date.

“Rural Durango now has a 7-month supply of homes, up 13% over last July. This is completely buyer’s market territory.

“Bayfield is looking great-while sales here looked like they were struggling earlier this season, down 57% for May and -25% YTD, they turned around. Rural Bayfield doubled July 2024 sales, and the region is now +14% in number of home sales year to date.

“Our resort had a strong July which was better than 2024. The number of single-family home sales were equal to those in July 2024, with more expensive homes selling. There were 15% more condos and townhomes that sold compared to July 2024. Still, the list-to-sales price ratio is down to 96% of the asking price versus 98% in July 2024. We can’t speak to pricing, since the average sales price is up as much as the median price is down.

“Across Colorado and the country, inventory of homes for sale is rising, and the market has transitioned from one in which sellers were in control to it being a buyer’s market. In La Plata County, compared to the rest of Colorado, we are sort of middle of the pack in the percentage change of inventory. What the changes feel like on the ground are timid buyers, and more contracts falling out than is usual. Well-priced properties will still receive quick offers, but those that are having a hard time getting showings are more and more common. Homes that are rural or in a less desirable location tend to sit on the market. With active wildfires in the area in July, it has become an everyday occurrence that home insurance is harder to locate, and it becomes teamwork for both sides to work together to get contracts across the finish line.

“Looking forward, we don’t see our economy turning around in the near-term. What we do hope to see are buyers feeling more secure as they determine the La Plata County real estate market is a safer and more secure investment than most other investments and help us succeed in finishing our summer market strongly,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“July 2025 witnessed a notable uptick in supply across the foothills. Active single-family listings climbed nearly 25% year over year to 2,329 homes, marking a slight increase over June’s figures. Historically, inventory peaks in August, so it will be telling to see if this pattern holds. With more options available and buyer competition remaining steady, the median days on market has exceeded one month, affording buyers a longer decision window.

“When we look at specific areas, Evergreen’s home prices have remained remarkably stable, with the median hovering around $1 million throughout the past year. This stability is helping keep the overall market strong. In contrast, more rural Conifer has experienced a 13.5% decline in median sales prices.

Meanwhile, new building projects along the I-70 corridor in Idaho Springs and Georgetown have driven a significant increase in condo and townhome inventory and sales. The influx of modern units is placing downward pressure on prices for older condos and townhomes in these areas.

“Across all market segments, fewer homes are selling at full list price, and many sellers are offering concessions during the inspection period to keep deals intact. Homes in convenient locations and those fully updated and move-in ready continue to sell quickly, while properties that need renovations or are situated in remote areas tend to linger, especially if they are priced too high from the start.

“Looking ahead, early indicators suggest that interest rates may be on the decline. Should this trend continue, we can expect a surge in market activity in August and September,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“For sellers, ‘cruel summer’ sums up this month’s market statistics for the Fort Collins area. Just like the old song by Bananarama, sellers are feeling left all alone – and they’re not alone. Across the entire Colorado front range and the western U.S., many homes are languishing on the market compared to the salad days of early 2023 before interest rates nearly tripled and homes sold in hours or days, not weeks or months. Days on market has increased to 61, the number of homes for sale has grown to levels not seen since the pandemic lockdown as there’s nearly 4 months of inventory for single-family homes and over 5 months of inventory for condos and townhomes. It’s as balanced a market as we’ve seen in a decade. A cruel summer, indeed – for sellers.

“But what about buyers? If sellers are having a cruel summer, then buyers must be basking in leverage? Not so fast. Thirty-year fixed interest rates remain in the high sixes, keeping many buyers from qualifying for the homes whose list prices remain elevated. Buyers who are active right now are willing to weather the high interest rate seas, betting on lower rates in the future and using what leverage they have to temporarily buy-down their interest rate and get other seller concessions like items needing repair or replacement. This has certainly given some buyers far greater negotiating power than just 24 months ago.

“That being said, some of these same intrepid buyers who took advantage of seller concessions to buy-down their interest rates 2 years ago are coming up on the end of the rate-buy-down honeymoon. Those buyer’s interest rates will be resetting in the coming months setting the stage for higher monthly mortgage payments and a search for refinancing loans that are pegged over 7%. As national economic policy unfolds, only time will tell the tale of which way mortgage rates go. Hopefully a cruel summer doesn’t lead to a fateful fall,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND COUNTY

“Grand County’s July 2025 housing market was characterized by higher inventory and more balanced conditions. Sellers faced some softness, especially in older or less strategically priced homes. Buyers benefited from greater selection and negotiating power, while desirable properties—like new construction or those with views—continued to move. The market is less frenzied than past summers but remains active and regional-specific, with Grand Lake outperforming in sales volume even as time-on-market increased,” said Grand County REALTOR® Monica Graves.

Highlights from Grand County include:

1. Inventory & Listings

- In July, inventory had already surged from June—we reported about 393 homes for sale, a 24.4% increase from May.

- Local insights confirm that single-family home listings continue to climb (especially with new construction in Granby Ranch and Grand Elk), while condo/townhome listings remain relatively flat.

2. Pricing & Trends

- June median sale price: Approximately $747,000, representing a 17.2% drop year-over-year. Price per square foot was around $538, up 4.4%.

- Listing prices: Median listing price appeared to hover near $849,000 in June.

- According to Grand County MLS, average home values through July were around $774,564, marking a modest 0.4% annual gain.

3. Buyer Behavior & Sales Velocity

- Summer brought more choices, with buyers—both locals and front-range investors—returning, but adopting a more selective approach.

- Homes are still selling, especially those well-priced and in desirable locations, but older or fixer properties are lingering longer.

- In Grand Lake specifically: July saw 80 homes sold, up from 55 the previous year. The median sale price was $771,000, and the average days on market reached 68 days, up from 56 last year.

MESA COUNTY

“Mesa County had an interesting July market. The average price of homes sold was $528,712, a new high for average price for the local market in one month and the most active part of the market was $500,000-plus. However, sales for the month were down 13.1%. Buyers in the more affordable categories are still cautious. We are seeing a small increase in new listings, bringing the current active, available inventory to 908. The months’ supply is at 3.6 months which moves a little more toward reaching a normal market. The heat this summer (many days between 97 and 100) has had a huge impact on open house traffic, both for existing and new construction,” said Mesa County REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Buyers and sellers in today’s market are faced with both reality and affordability. Cash sales continue to keep home sale prices strong as higher interest rates have little effect on cash buyers. New listing inventory volume is down slightly from July 2024 at 64 listings (compared to 68 in 2024). Most listings are entering the market at well above the average and median sales prices and supported by July’s 10.8% drop in sales. Increased inventory of active listings (+20%) and months’ supply of inventory (9.1) from July 2024 are attributed to most listings well over the median and average sales prices.

“Buyers in the median to average sales price pounce upon new listings, especially if they are move-in ready and have been seasonally maintained. July days on market decreased to 90 days (-17%) and can be attributed to buyers swooping up the homes in the July median ($668,000, +19.6%) and average price ($712,275, +10.5%), and price reductions bringing homes into the price points. Price adjustments are not of abundance in the ‘comfort price point,’ as the main inventory exists in the higher price points. Like any home, buyers in all pricing structures gravitate to those homes that are competitively priced and in updated condition. As the larger number of higher-priced home inventory lingers on the market for longer periods, days on market and months inventory will certainly climb to higher numbers. With the larger numbers of home inventory priced $800,000-$2 million, and fewer buyers proceeding with caution toward a purchase, sellers must compete for a buyer. Due to a sprinkling of showings and longer days on market, open houses and price reductions in 2025 have set record numbers.

Median Sales Price $565,000 (-1.6%) (year-to-date)

Average Sales Price $691,788 (-2%) (year-to-date)

Inventory of Homes at 305 Units (+20%)

Months’ Supply 9.1 (+19.7%)

“Compared to home pricing in other Colorado resort towns, Pagosa Springs still consistently has the value of lower pricing, especially in higher-end luxury home price points. Local sellers are finding it difficult to find a replacement or move-up home. Some sellers are cashing out of their second homes and upgrading their current first home or paying off first home mortgages from their second home real estate wealth proceeds and adding some inventory to the market. Leading into winter, those sellers not obtaining their desired home sale proceeds and time-to-sell windows, evolve the selling strategy into enticing seller concessions, accepting home sale contingent offers, and a price reduction to sell before the serious snow occurs. Relative to higher monthly mortgage and not enough buyers, some home prices will continue to decelerate for sellers desiring to sell within the average days on market with the onset of winter home showing demands and a sale before the new year.

“Land inventory has decreased slightly (308 parcels). However, days on market have increased, due to soaring rural building costs, higher water/sewer district connection fees, and escalation in well and septic systems rates. Higher land prices and those increased water/sewer connection fees are discouraging local home builders from placing new construction homes into the 2025-2026 market. Most land buyers are purchasing land (securing a price while still affordable) with the anticipation of building in later years.

“The game continues as to whether buyers will shift toward today’s higher price point homes versus the buyer’s comfort price of the past,” said Pagosa Springs-area REALTOR® Wen Saunders.

STEAMBOAT SPRINGS/ROUTT COUNTY

“New listings for single-family homes in Steamboat Springs are up 5.3% year-to-date with 7 fewer sold listings. The median price is down 7.7% to just under $2 million however, the average price is up to $3.36 million. The first 10 days of July saw three new homes come to the market priced in the neighborhood of $7 million rapidly go under contract – a first for that type of activity. Multi-family listings are up 37.2% with six fewer sales than last year. While there is ample high-end speculative new construction for multi-family, the inventory for single-family homes is very limited. The months’ supply for both homes and condos/townhomes is now approximately eight months. Both Steamboat and Hayden have more days on market until sale with the year-to-date averages at 75 and 55, respectively; DOM for Oak Creek and Clark are less than last year.

“Of the active listings in Routt County, 42% of them have realized a price improvement averaging 6%. These price reductions can be attributed in part to Sellers still wanting to test the market. Like other Colorado markets, buyer expectations are higher for condition of property and price and expect the price tag to match the condition,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“The July real estate market in Summit and Park counties was like a good day of sailing on Lake Dillon—steady winds, a few lively gusts, and a clear course ahead. Strong enough to keep sales and listings moving but calm enough to stay balanced at the helm.

“Sales were up a solid 9%, and prices held their line—or in some cases, tacked higher. Median price climbed 9.5% for single-family homes and 5.3% for multi-family homes. Sellers averaged about 97% of their list price. Single-family home listings dipped 9%, while multi-family listings rose 11%. Single-family homes spent about the same time on the market as last year, but multi-family days on market stretched 69% longer—a reminder that sometimes you have to trim the sails and be patient. Luxury waters saw the biggest swells:

- Single-family homes sales in the $5–$10 million range posted a 104% jump over the past rolling 12 months.

- Single-family home sales over $10 million surged 150% year-to-date.

- Single-family sales in the $1.5–$2 million range also saw strong currents, with a 92% gain.

- Multi-family sales in the $2–$2.5 million range rose 44% year to date.

July 2025 Average Sale Prices – Single-Family Homes:

- Summit County: $2,101,540 (40 sales, up 3 from July ’24)

- Park County: $574,445 (14 sales, up 2)

- Lake County: $574,133 (15 sales, down 1)

July 2025 Average Sale Price – Multi-Family Homes:

- Summit County: $864,882 (86 sales, up 13)

Residential closings ranged from a $120,000 single-family home in Park County to a $6.6 million Breckenridge luxury property. Currently, 1,081 listings are active—46% single-family—ranging from a $160,000 mobile home to a $21 million ski-in/ski-out estate, both in Breckenridge. Overall, 57% of listings are above $1 million, and 66 homes are priced over $5 million. Nearly half (48%) of July sales sailed above the $1 million mark. Cash deals dipped slightly, representing 37% of all closings,” said Summit-area REALTOR® Dana Cottrell.

Note: These figures exclude timeshare, deed-restricted, land, and commercial properties.

TELLURIDE

“The San Miguel County real estate market continued its slowdown in July 2025, posting $43.1 million in total dollar volume – down 24% year over year and 34% below the five-year July average. Only 33 sales closed, highlighting reduced activity across the market. Year-to-date volume reached $401.61 million, a 29% drop from both 2024 and the five-year average, making July the weakest performance since 2020. While the luxury market ($5 million and up) still accounts for 86% of the residential dollar volume, it is showing signs of fatigue. The average single-family home price has fallen 19% from $5.1 million to $4.1 million and no new developments closed in July. However, this doesn’t reflect underlying demand. There were 21 contracts at the Four Seasons Hotel and Residences and 10 contracts on the 12 preconstruction condominiums at the high-end Highline Condominiums. These pre-sales may have taken some sales from the existing market inventory. The town of Telluride and Mountain Village continue to dominate the market, representing over 70% of the county volume. Still, prices per square foot remain high – over $1,900 per square foot in Telluride and $1,500 per square foot in the Mountain Village,” said Telluride-area REALTOR® George Harvey.

VAIL

“As we have arrived at the mid-point of the summer selling season, it is apparent the macro market is very different from its components. On a macro basis, July sales unit were positive 2.7% however, the variance by product type was significant. Single family/duplex sales were positive 17.1% while townhome/condo sales were negative 10.5%. Pending sales, which will impact total sales for the balance of the season, were negative 25.4% for townhomes/condos and positive 117% for single family/duplex. New listings are following the same trend with single family/duplex up 39.2% and townhome/condos down 5%. The pricing impact varies dramatically by location in the valley and the existing inventory. One of the reasons for the decline in townhome/condo is the 2024 completion and sales of some developments which have not been replaced by new construction.

“The trend that has existed for the past year continues with pricing niches moving higher as lack of product in the lower niches continues to change market shares for the upper niches. The inventory trend has continued to grow and aligns with the current growth by niche. The growth by upper niches has been the catalyst for overall market dollars to increase pricing in the market greater than unit sales. Total inventory is 692 units, the highest level since pre-covid. Months’ supply of inventory is currently at 9.1, well above the 6 months considered as a stable market.

“Overall, our market isn’t experiencing the same level of volatility as other markets thus, the need for a trusted advisor to help guide our clients to their buying or selling objectives is extremely important,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The July 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.