Colorado Housing: A buyer’s market minus the buyers

REALTORS® say conditions not likely to change for the remainder of 2025

ENGLEWOOD, CO – While active inventory, interest rate dips and seller concessions continue to create enticements for would-be housing buyers, stubbornly high pricing and overall economic uncertainty – including employment, inflation and tariffs – continue to keep a majority of buyers on the sidelines, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons working in markets across the state.

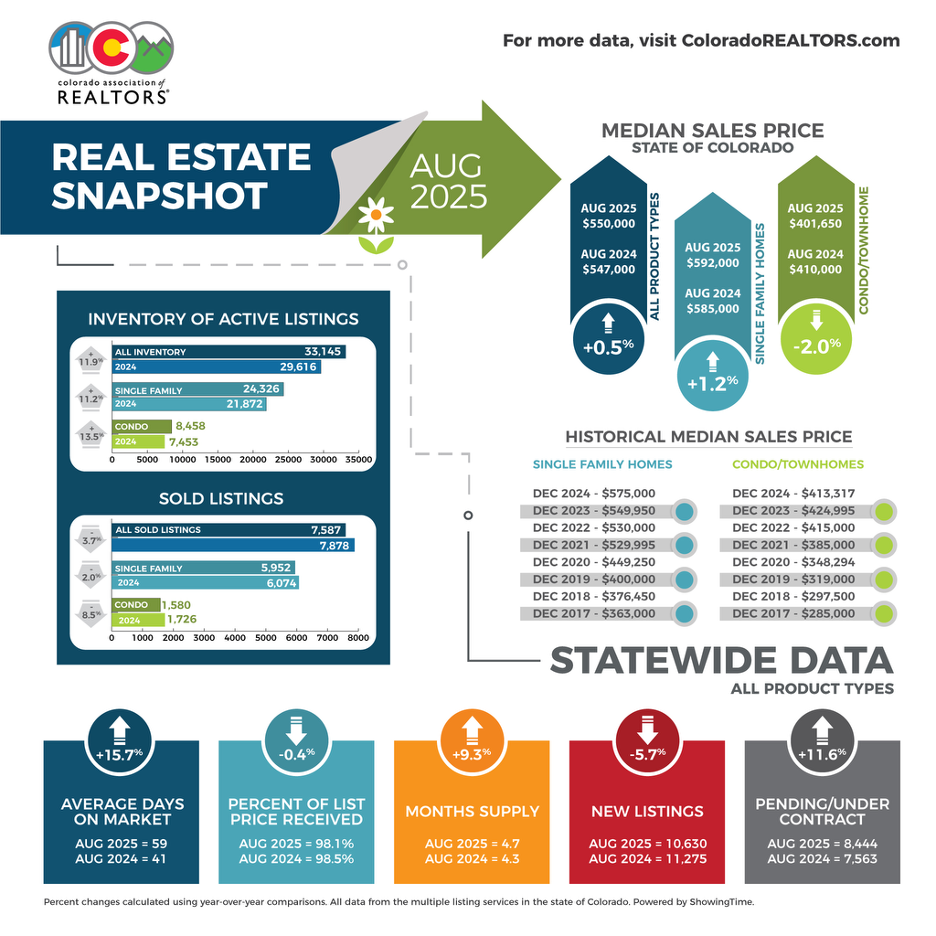

Statewide, the 8,184 new single-family listings were down 12% from July and -4.5% from August 2024. The 2,365 condo/townhome news listings were off 15.4% from a month prior and -10% from a year ago. Buyers across the state purchased a total 7,587 properties, down 3.7% from a year prior. Of those, single-family homes dipped 5.2% from July to August and are down 2% from August 2024. Condo/townhome solds rose slightly from July to August (+1.7%) but remain down 8.5% from a year prior.

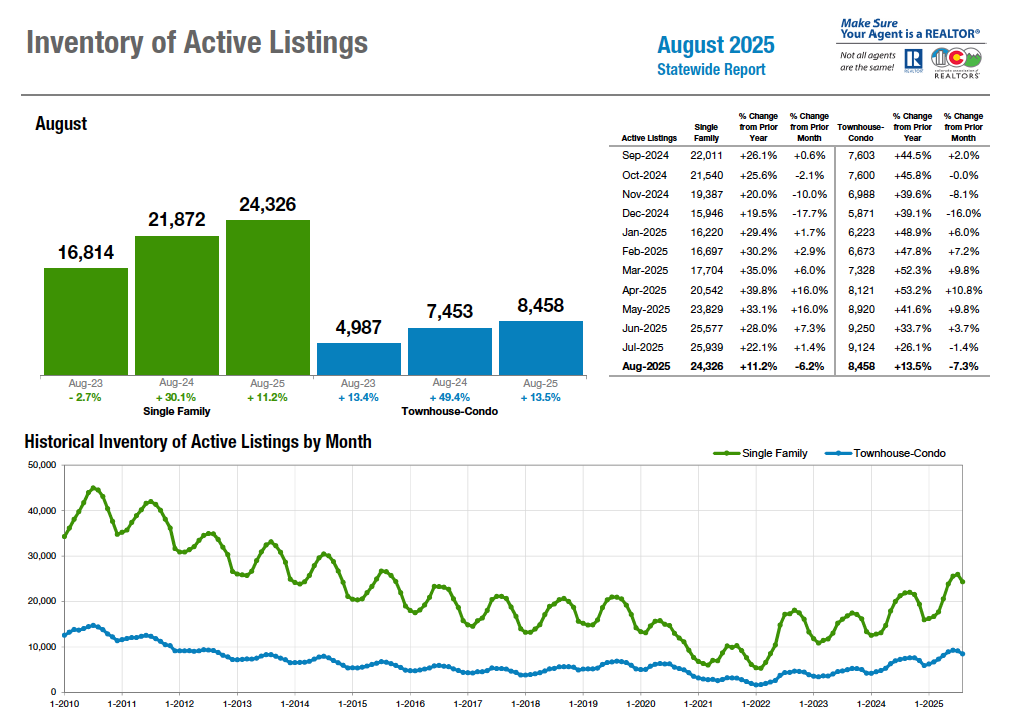

The combination of declining news listings and dwindling sales helped push the inventory of active listings down for both single-family homes and condo/townhomes, -6.2% and -7.3%, respectively. However, the 24,326 active single-family listings across the state are up 11.2% from August 2024 and the 8,458 active condo/townhome listings are up 13.5% from a year ago.

“It has been well over a decade since buyers have had the kind of choices they currently have. Many sellers will consider paying seller concessions to help offset closing costs or buy down the interest rate,” said Aurora REALTOR® Sunny Banka. “Builders and sellers seem more motivated and adjust pricing accordingly. In addition to lower prices, we are seeing a slight reduction in interest rates. For buyers, this is the best buying market they’ve had in many years.”

“As we get ready for the pumpkin spice season, it seems buyers are also snuggled in and not motivated to buy into one of the better buyer’s markets we have seen in a long time,” said Colorado Springs-area REALTOR® Patrick Muldoon.

“’I can’t even buy a showing on my listings right now,’ a colleague complained the other day. Buyers are gold and sellers are wishing for the good old days when they have 20 showings in a weekend,” said Boulder/Broomfield-area REALTOR® Kelly Moye. “The tables have turned. It’s clear that the market is in a long overdue correction phase, and that’s likely to continue into the final months of the year.”

Reflecting the stubborn pricing, the median price for a single-family home in Colorado ticked up 0.5% in August to $592,000 and is up 1.2% from a year ago. Condo/townhomes also ticked up slightly (0.4%) from July to August but are down 2% from a year ago at $401,650. In the seven-county Denver area, the median price dipped 0.3% from July to August and is exactly even with the August 2024 price of $625,000. Condo/townhome median pricing in the Denver metro area was off 0.6% over the prior month and is down 2.4% from August 2024 at $390,000.

“Buyers have many properties to choose from and more time to make a decision, but sellers have been resistant to lower the price of their precious commodity,” said Fort-Collins are REALTOR® Chris Hardy. “Combined with high costs for a mortgage (interest rates during August were still hovering at 6.8% range), buyers are still being painfully stretched on the affordability front, leaving many, many buyers sitting fallow.”

“Buyer behavior reflected a more deliberate approach to the market. A growing share of buyers prioritized move-in-ready listings, while properties requiring updates or priced above market expectations saw extended market times and more frequent price adjustments,” said Denver County-area REALTOR® Cooper Thayer. “As fall approaches, buyers continue to benefit from favorable negotiating conditions. While the pace of sales has softened, pricing has shown resilience, and the combination of higher inventory and strategic seller incentives is keeping the market active. For buyers navigating high costs, the current environment offers rare flexibility. For sellers, pricing accuracy, home presentation, and willingness to negotiate remain key to success in a market where options are no longer scarce.”

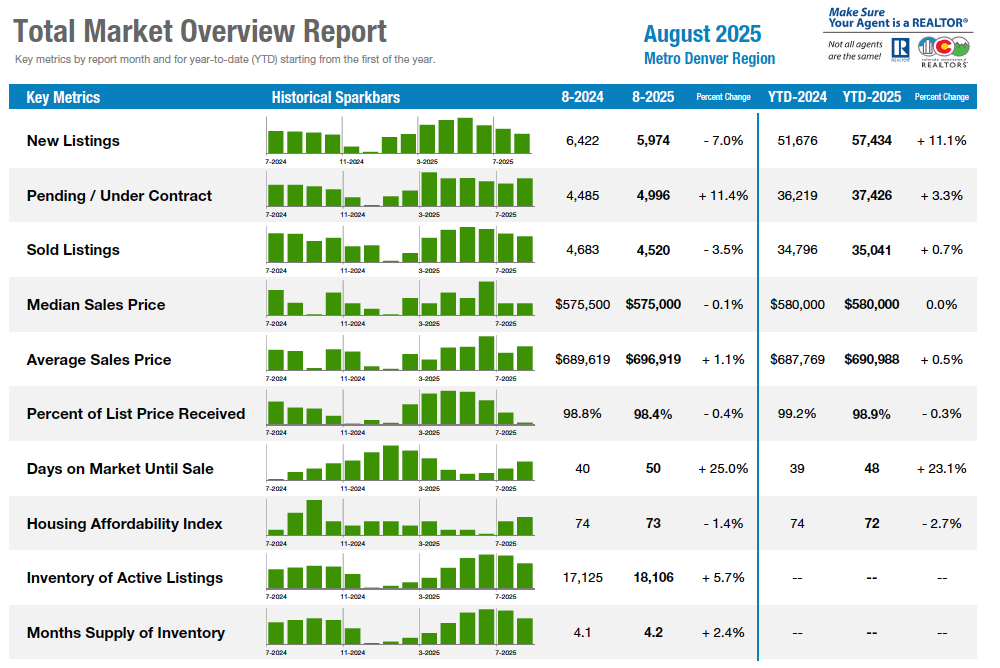

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

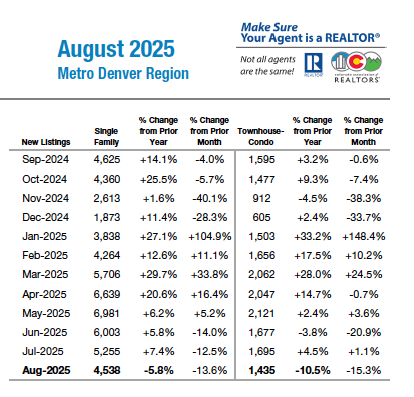

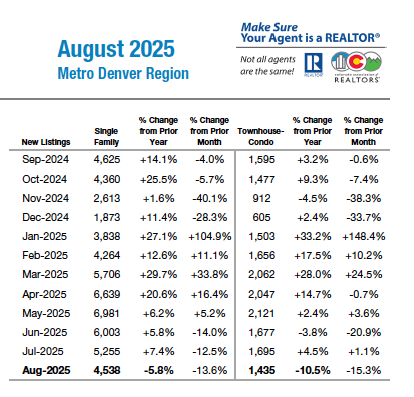

NEW LISTINGS – DENVER METRO AREA

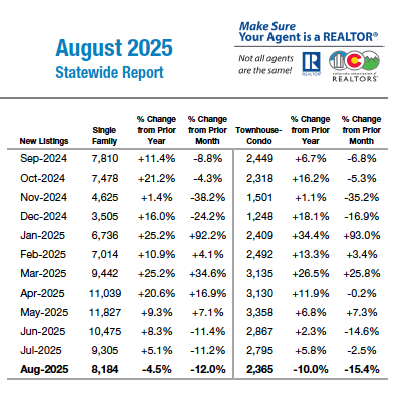

NEW LISTINGS – STATEWIDE

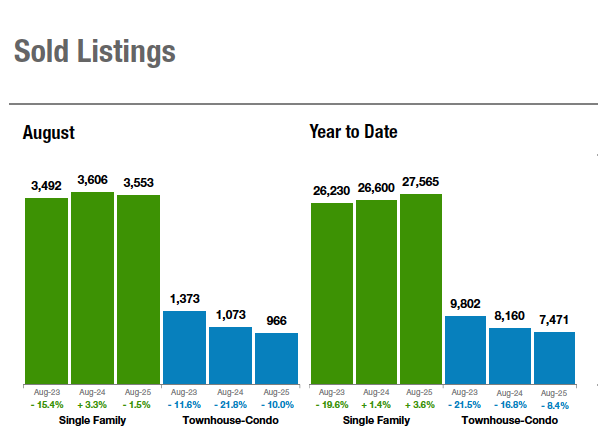

SOLD LISTINGS – DENVER METRO AREA

SOLD LISTINGS – STATEWIDE

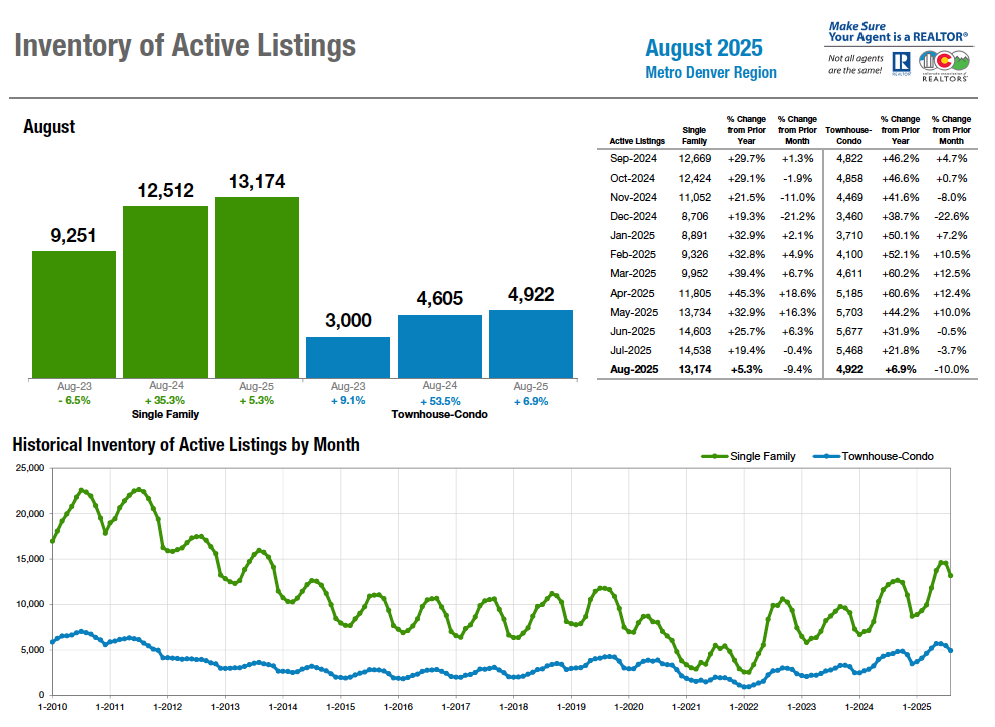

INVENTORY OF ACTIVE LISTINGS – DENVER METRO AREA

INVENTORY OF ACTIVE LISTINGS – STATEWIDE

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Buyers are discovering Aurora as the affordable option with a median price of $474,000 and a growing inventory. As always, real estate and pricing is about location and Aurora offers options. The 80010 and 80011 zip codes near the medical campus and Children’s Hospital continue to be the best buy with a median price of $390,000 in zip code 80010 and $448,000 in 80011. The very large and popular 80013 zip code currently has a median price of $500,000. A buyer can easily purchase a 3–4-bedroom home with 2-3 baths and a 2-car garage for under $500,000 here. Generally, the closer you get to $400,000 in this zip code, the more work a buyer may need to put into the home. This area provides great opportunities for buyers and a choice of Aurora or Cherry Creek Schools. In the south Aurora area, zip code 80015 has 180 homes to choose from with a median price of $578,000. These homes tend to be newer than previously mentioned areas. If you are looking for new, higher-end homes, 80016 is the place. The median price of $825,000 gets you plenty of new construction with available inventory.

“It has been well over a decade since buyers have had the kind of choices they currently have. Many sellers will consider paying seller concessions to help offset closing costs or buy down the interest rate. Builders and sellers seem more motivated and adjust pricing accordingly. In addition to lower prices, we are seeing a slight reduction in interest rates. For buyers, this is the best buying market they’ve had in many years,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“’I can’t even buy a showing on my listings right now,’ a colleague complained the other day. Buyers are gold and sellers are wishing for the good old days when they have 20 showings in a weekend. The tables have turned.

“The real estate market in Boulder County is seeing more homes hitting the market, with new listings up around 11% this month. Sellers are staying active, but buyers are taking their time, which means that while sales have risen 3%, it’s not enough to keep up with the growing number of homes for sale.

“Prices have remained flat all year, with no significant increase in home values. On average, homes are sitting on the market for about 60 days. For some sellers, this feels like 60 years as they work through multiple rounds of price reductions and suffer through weeks with no showings, before finally landing a buyer.

“In Broomfield County, the situation is somewhat similar. New listings are up 16% but sales are flat, and supply is out-pacing demand. Homes are selling faster than in Boulder—an average of just 37 days. Prices in Broomfield have gone up about 4% since the beginning of the year but we are down 12% since this time last year.

“One area that’s really been struggling is the townhouse and condo market. These properties have seen an 11% drop in value, mainly due to high HOA fees and rising insurance costs which make these once affordable properties harder to attain for first time home buyers.

“For REALTORS® working in the area, the market feels sluggish, with many buyers and sellers waiting to see what happens with interest rates. While everyone’s anticipating rate cuts next week, the market has already factored them in with lower rates this week. It’s clear that the market is in a long overdue correction phase, and that’s likely to continue into the final months of the year,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“August remains an interesting month for the Pikes Peak region. Buyers continue to have more options with active listings up 15.9%. We saw some easing in values year over year, down 3.2% and units sold stayed level. We slid into fall without any real changes in the market. But what may be ahead could be a cold winter in real estate. As we get ready for the pumpkin spice season, it seems buyers are also snuggled in and not motivated to buy into one of the better buyer’s markets we have seen in a long time.

“Although rates did ease a bit, mortgage applications fell 34% from pre-pandemic levels which put us worse off than even the great financial crisis of 2008. We are witnessing consumer confidence and affordability issues that we cannot shake. And this affects retail sales, freight, manufacturing, and the fast-food market. Consumers drive the economy, and right now they are not motivated at many levels, and this includes housing in our region and across much of the United States.

“What was a low inventory issue during the pandemic has now become too much inventory during all of 2025. Despite it appearing to be more in balance, we just don’t have the demand we would like to see. Sellers are having to be more aggressive on pricing, and buyers will then still end feedback that the home is priced too high.

“By the end of August, everyone was talking about rate cuts in September. The Federal Reserve is set to meet, and my guess is, with recent data, there is a good chance of a 50 basis-point drop in the Fed rate. While many will cheer this move, and I believe the equity markets will celebrate with new highs being hit, I don’t believe this is going to motivate buyers very much. Watching social media posts from local lenders and seeing the feedback by would-be home buyers, they are not engaged in housing at these prices. Consumers move markets, and if the local buyer pool believes home prices and our payments are too high, that will have to change before we see buyers really stepping up. As I write this, a massive revision to job creation hit and PPI came in lower than expected. The Fed will have to move because the economy, along with the job market, is showing signs of weakness that we cannot afford at this time. The Fed could be 6 months late to these drops now that we have revised job data and that doesn’t look good for our economic future,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Last month, the inventory level of single-family and patio homes in Colorado Springs reached 4,139 homes, the highest for August since 2014, representing a healthy supply of 4 months. A total of 1,039 single-family and patio homes were sold during this period. These inventory and sales figures are quite similar to those from August 2014, which recorded 4,104 active listings and 1,111 sales, resulting in a supply of 3.7 months.

“However, there were significant increases in both the average and median home prices as well as in the monthly sales volume. The average price rose from $258,398 in August 2014 to $ 566,443 in August 2025, and the median price increased from $ 230,000 to $480,000 during the same period. Additionally, the monthly sales volume surged from $287,080,178 to $588,535,088. These figures represent remarkable escalations of 119.2% for the average price, 108.7% for the median price, and 105.0% for the monthly sales volume. Additionally, the interest rate increased from 4.26% in August 2014 to 6.25% in August 2025.

“The abundance of available homes presents a great opportunity for buyers to find properties that suit their preferences and negotiate better deals with motivated sellers. With declining interest rates, it has become more affordable for buyers to enter the market. Now is an excellent time to purchase a home before buying activity increases and creates more competition among buyers.

“Due to the record high number of active listings, sellers must ensure that their properties are in good, presentable condition and competitively priced as the fall market begins. This approach will help avoid the need for repeated price reductions and attract motivated buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

Key Highlights from the Colorado Springs Market in August include:

- Active Listings – Supply: There were 4,139 single-family and patio homes available for sale in the Colorado Springs area, according to the Pikes Peak MLS. It marked an impressive year-over-year increase of 24.7% and a colossal 284.3% rise compared to August 2020. The inventory level was the highest for August since 2014.

The overall months’ supply of active listings was at a highly desirable supply level of 4 months. For homes priced under $400,000, the supply was 3.5 months. For homes in the price range of $400,000 to $600,000, the supply was slightly higher at 3.6 months. The supply for homes priced between $600,000 and $1 million was healthy at 5 months. Meanwhile, for homes priced over $1 million, the supply was more abundant at 5.9 months.

- Sales – Demand: Last month, a total of 1,039 single-family and patio homes were sold. It represents a slight decline of 2.3% from the previous year and a more significant decrease of 41.3% compared to August 2020, 5 years ago.

The monthly sales volume experienced a marginal decline of 0.9% compared to the same month last year and a substantial drop of 23.8% compared to August 2020. However, year-to-date sales volume showed a healthy increase of 14.6% from the previous month and 7.1% compared to August of last year. And, compared to August 2015, the year-to-date sales volume has escalated dramatically, with an increase of 88.5%.

- Days on the Market: The average number of days on the market in August 2025 rose to 43, increasing from 40 days in July and 34 in August of last year.

- Sales by Price Range: Last month, 26.7% of homes sold were priced below $400,000, while 43.8% were sold for between $400,000 and $600,000. Homes priced between $600,000 and $1 million accounted for 22.4% of the sales, and those priced over $1 million represented 7.1% of the total sales.

In August 2025, there was a minor 1.6% increase in the sale of single-family homes priced under $400,000 compared to the previous year. Homes priced between $400,000 and $600,000 also saw a modest 3.6% drop in sales. There was a bigger 9.7% decline in the sale of homes priced between $600,000 and $1 million. However, the homes sold for over $1 million experienced an incredible 13.8% increase in sales.

- Average & Median Sales Prices: The average price of single-family and patio homes has continued to escalate every year in August since 2011, reaching a historic high for August this year at $566,443. It marked a slight increase of 1.4% compared to last year and an impressive escalation of 29.9% compared with August 2020, just 5 years ago, and an astounding increase of 123.9% compared to August 2005.

The median sales price experienced a slight year-over-year decline of 2%. However, it showed a significant increase of 26.3% compared to August 2020 and an extraordinary escalation of 128.3% compared to August 2005.

- Price Reductions: Last month, 47.9% of active listings in El Paso County and 37.8% in Teller County saw price reductions. With the current record high volume of active listings, sellers must price competitively from the start to avoid repeated price reductions and ensure their properties are in good repair and attractively presented to draw buyers.

CRESTED BUTTE/GUNNISON

“It is feeling more like fall in the Gunnison – Crested Butte area. Typically, September and early October are a busy time for real estate here as people who may have visited with their family and friends earlier in the summer come back to town to take a serious look at property. This year, we have seen an earlier and sharper decline in showings, offers, and contracts than usual. The summer market also picked up later in July than usual which resulted in a very short busy time for real estate.

“Looking at sales, prices and inventory numbers, some areas and property types are up, and some are down. In general, 2025 is still very similar to 2024. Most REALTORS® in the area will tell you that it is a challenging market because there don’t seem to be any trends to point to for guidance. Inventory for condos in the Town of Crested Butte has doubled since last year at this time, but the number of condos for sale in the Town of Mt. Crested Butte is exactly the same as last year. Average and median prices for condos in the Gunnison area are substantively the same from year to year. Those numbers for single-family homes in the Crested Butte area are split with the average sales price up 8% and the median sales price down 11%. I share these numbers to emphasize how important it is to have a skilled REALTOR® on your team to help make sense of the numbers to guide your decisions.

“In the overall Gunnison-Crested Butte Association of REALTORS® area, there have been 6% more sales through August than we had last year, but the total dollar volume is down 5%. Twelve percent more single-family homes have sold this year than last for 7% more total dollar volume. The same number of condos and townhomes sold in 2025 and 2024, but there was a slight decline in the dollar volume (1.3%).

“In the Crested Butte area, total sales were down 6% and the dollar volume is down 2.3% overall. Sales of single-family homes are down 6%, but dollar volume is slightly up by 1.5%. Condo sales are down more significantly – 70 sales in 2025 vs. 86 last year at this time (19% decrease) and subsequently, the dollar volume is down 13%. The average price for both single-family homes and condos/townhomes is up 6-8%, but the median price for condos and townhomes is up a modest 2.8% while the median price for single-family homes was down 11%.

“The number of sales in 2025 continues to be higher than that in 2024 and there are 28% more properties under contract now than at this time last year. The overall number of sales is up 24% with dollar volume up 13%. Twenty three percent more single-family homes have sold in 2025 for 15% more total dollar volume. Condos and townhomes in the Gunnison area have seen the most significant increase of all the categories we usually discuss. There were 73% more sales this year than last (38 vs. 22) and also 73% more dollar volume. These sales continue to grow even as the average and median prices stay the same year over year.

“As is true for the entire area, prices in the Gunnison area went up significantly during Covid, but they remain more affordable than in the Crested Butte area and that is certainly help drive the sales. The average price of a single-family home is $761,227 vs. $2,562,499 in the Crested Butte area. We continue to have more properties for sale this year than we did last year, but in some specific areas and types, the numbers are the same. Properties that are in a great location, with good views and nice finishes and priced well relative to recent comparable sales are receiving multiple offers and selling quickly. Those that are pushing the envelope with their price are staying on the market longer. Buyers are not in a hurry and sometimes are missing out on opportunities because they think everyone else is waiting, too.

“Sales and purchases are happening so if you are seller who has something else to do with the money you would gain from a sale, a good REALTOR® can help you achieve your goal. If you are a buyer who has dreamed of owning a place in the mountains, there are opportunities to be found if you know where to look. An investment in Crested Butte/Gunnison real estate has been a good bet for a long time so get a good advisor to help make it work for you,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER METRO (11-County)

“August marked a continuation of buyer-friendly conditions in the Denver-metro housing market. Inventory remained elevated while home prices held relatively stable, giving prospective buyers more time, choice, and negotiating leverage than in recent years.

“Active listings across the 11-county region declined slightly from July but still represented 4.7 months of supply, well above the inventory levels that defined the past decade. Single-family homes spent an average of 56 days on the market in August, while condos and townhomes averaged 69 days, both up significantly year-over-year. Despite slower sales velocity, prices remained steady. The median sale price for single-family homes was $592,000, up 1.2% year-over-year. Attached homes experienced a moderate annual decline, with the median price for condos and townhomes falling 2% from last August to $401,650.

“Buyer behavior reflected a more deliberate approach to the market. A growing share of buyers prioritized move-in-ready listings, while properties requiring updates or priced above market expectations saw extended market times and more frequent price adjustments. More than 62% of metro area closings in August included a seller concession, averaging $10,989, funds commonly used for rate buydowns or closing cost coverage. These concessions have played a critical role in improving monthly affordability, especially as ownership costs beyond mortgage rates, including HOA dues and insurance premiums, remain elevated.

“As fall approaches, buyers continue to benefit from favorable negotiating conditions. While the pace of sales has softened, pricing has shown resilience, and the combination of higher inventory and strategic seller incentives is keeping the market active. For buyers navigating high costs, the current environment offers rare flexibility. For sellers, pricing accuracy, home presentation, and willingness to negotiate remain key to success in a market where options are no longer scarce,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Compared to August 2024, fewer new listings of single-family homes in La Plata County are coming on the market. That’s great news for Sellers, as it may allow us to soak up some excess inventory, which is 21.5% higher than in August 2024. Left untamed, having more supply than demand will start affecting the price of homes in the region. Similar to what we experienced in July, 11.8% more single-family homes sold than the same period in 2024. Also like July, the Months Supply of Inventory is 10.5% higher than last year and stands are 6.3 months currently.

“There were 12% more new listings of condos and townhomes coming on the market in August than in August 2024. Sales are still sluggish for the amount of inventory we have; number of sales is -7% down from August 2024, which is similar to July. Months Supply in this segment is up a whopping +25% from last year, and the Days on Market rose the same as single-family homes, +10%.

“YTD, Single-Family New Listings entering the market are up in number 9.4%, and sold number of homes are +7.4%, demand roughly keeping up with this new supply. The median price has risen 6.5%, and Days on Market has risen just 10 days. Townhome and condo demand, on the other hand, is not keeping up with new listings, with 7.2% more homes coming on the market and 8% fewer sales.

“Single-family homes in-town Durango are on the market 55% longer than last August, a sign either Sellers are pushing their prices beyond what the market can bear, or the tumultuous economy is taking a toll. YTD median price is -11.5%. Sales of condos and townhomes jumped in number in August, making up for their poor performance in July, but the median is -6.7% YTD. Days on market are up 30% in August vs. August 2024, and take 33 more days to sell.

“In rural Durango, there are 20% more homes on the market than in August 2024, and homes are taking 44% longer, or 34 days longer to sell.

“The In-town Bayfield market is as strong as we experienced in July, but it’s taking homes a lot longer to sell with the same amount of inventory as we had in 2024. Days on the market is up 66%, a full 35 days more time to sell than in Aug 2024.

“Rural Bayfield’s performance looks like August of 2024, except again, it’s taken 40% longer (27 days more) for a home to sell. Along with the Vallecito Lake area, it’s the only region in the county that has less inventory of homes for sale than in August 2024.

“The Purgatory Resort area had a strong month. Condos and townhomes are on pace with the numbers we saw in 2024. Single-family inventory is +148% with new construction and new inventory on its way. Based on last year’s demand, there are currently one year of homes supply on the market, up from 5 months in August 2024. It’s a bet from the developers that the region will continue to have higher demand than we have homes available, as our resort community continues to grow. As we know, buyers especially love new construction.

“The outlying areas of Ignacio and San Juan County CO are seeing more severe change. San Juan County includes Cascade Village, condos and homes just a mile north of Purgatory Resort, plus the town of Silverton many miles to the north. While Ignacio is too small a sampling to draw conclusions from yet, single-family homes in the two areas of San Juan County (Silverton and just north of Purgatory Resort) are seeing inventory that’s climbed 31% in number over August 2024-it’s currently an 18-month supply of homes for sale. Condos and townhomes in San Juan County, on the other hand, are selling as strongly as in August of 2024.

“It’s interesting to ponder on the extra days on the market homes take to sell over the same time last year. It’s close to an extra month in every area of La Plata County. The rates this year were similar to last August, hovering about 6.5% for the month. Is there truly less demand when the number of sales are fairly similar? It’s common this year to see homes go under contract with Buyers who wait months after seeing a home to decide to move forward. Is it purely because there is more inventory to choose from? Or is this rather a quantifiably larger number of days it’s taking Buyers to decide on a home this year compared to last with our stagnant economy and the unease Buyers are feeling? It seems the latter is what we are seeing this season,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“As summer winds down in the Colorado foothills, the housing market continues to shift in ways that highlight both resilience and cooling momentum. August data shows that buyers have more choices than they’ve had in years, but they are also taking their time. Sellers, meanwhile, are adjusting to a market where price sensitivity and longer days on market are becoming the norm.

Inventory up, new listings starting to slow

“Across the foothills, single-family inventory rose 25 percent year over year, with 2,654 active listings at the end of August. While that’s a welcome change from the historically low levels of 2021–2023, new listings actually fell nearly 12 percent compared to last August. That signals a shift: many homeowners are still reluctant to sell given their existing low-rate mortgages, while others may be waiting to see if interest rates ease further this fall. The net effect is more available homes, but not necessarily a flood of fresh supply. Buyers who have been watching from the sidelines still have options and they are moving carefully.

Prices steady overall, but mixed locally

“The median sales price for single-family homes across the foothills came in at $713,000, up about one percent year over year. That stability, however, masks some very different local stories.

- Evergreen/Conifer: Prices softened significantly, with the median down 13 percent to $859,950. At the same time, average prices dropped more than 16 percent. Buyers here are showing strong resistance to higher list prices, and properties that need updates or are remotely located are taking longer to move.

- Jefferson County (foothills west of C-470): The median held essentially flat at $725,000, while average prices dipped slightly. This market remains one of the most balanced in the region, though days on market stretched to 40, up almost 50 percent from last year.

- Park County: A standout in August, where sold listings jumped 39 percent compared to last year, even as days on market nearly doubled to 65. Prices here dipped modestly, with the median at $600,000, down about nine percent.

- Clear Creek County: Sales slowed, but prices held firm. The median single-family price matched last August at $625,000, while the average jumped more than 23 percent, driven by a handful of higher-end sales.

Longer days on market and concessions on the rise

“Perhaps the most striking trend is how much longer it is taking homes to sell. Across the foothills, days on market jumped 57 percent for single-family homes, averaging 44 days compared to 28 a year ago. In Evergreen/Conifer, the average stretched to 48 days, a 65 percent increase. A general note here is that homes that are turnkey- completely move-in ready are still selling fast, while homes that need some updating are taking a huge hit in pricing and sitting much longer on the market. Lingering listings are causing a lot of Sellers despair.

“Buyers are negotiating harder both during contract and during inspection as well. The percent of list price received dropped across nearly every county and inspection negotiations are also becoming more common, with many sellers offering larger credits to keep deals intact.

What’s driving the trends?

“Several forces are converging. Mortgage rates remain in the six percent range, which continues to discourage discretionary sellers from listing and makes buyers more deliberate. Insurance remains a key challenge, particularly for properties in high wildfire risk zones or in condo/townhome complexes facing premium hikes. At the same time, the finally growing inflow of new construction plus increasing inventory keeps the supply healthy as demand is not as strong as it has been the last few years.

The luxury tier is also having an outsized influence. Sales above $2.5 million remain relatively healthy, often purchased with cash or less sensitivity to borrowing costs. These transactions can skew averages upward, even as the median price better reflects the cautious middle of the market.

Looking ahead

“Historically, inventory in the foothills peaks in August or September. With active listings already at their highest levels in more than a decade, the next few months will test whether buyer demand can keep pace. If mortgage rates ease slightly, as most economists predict, we could see a modest surge in buyer sentiment and therefore activity this fall. If not, sellers may need to continue adjusting expectations around pricing and timing for home sales.

“One thing remains clear: this is no longer the frenzied market of 2020–2022. It’s a market that rewards well-priced, well-presented homes and requires patience from both sides of the table. For REALTORS®, the opportunity lies in helping clients interpret the noise—understanding where prices are truly holding, where they’re softening, and how to navigate concessions and insurance hurdles,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“If the sales data looks so rosy, why are buyers and sellers still dissatisfied? The short story: Inventory and Interest Rates. With total sales of single family detached homes in the Fort Collins area up year over year by just more than 17% and median price pegged at $650,000 (2nd highest rate this year) one might deduce that everything is actually rosy. However, a deeper look at the numbers reveals some wilting conclusions.

“Inventory is up. At 660 units, the last time there were this many homes available for sale at the end of a month was during the height of the pandemic lockdown in 2020. Combined with a 60-plus days on market stat, homes are sitting on the market longer. Even though sales are up, there is still a 3.5 month backlog of inventory (it’s 5 months, nationally). For sellers, the bloom is off the rose as a true buyer’s market takes root.

“One might think that buyers are blooming – not so fast. Buyers have many properties to choose from and more time to make a decision, but sellers have been resistant to lower the price of their precious commodity. Combined with high costs for a mortgage (interest rates during August were still hovering at 6.8% range), buyers are still being painfully stretched on the affordability front, leaving many, many buyers sitting fallow. Sellers in the Fort Collins area who are unable to sell for a price they can afford are quite often choosing not to sell and pulling their houses off the market.

“Fort Collins isn’t alone. Across the country, the number of homes that have ‘de-listed’, (i.e., been on the market for sale, don’t sell, and then are removed from the market) is up over 57% from a year ago, according to data reported by Realtor.com. Although many homes have shown price reductions in the sales data, many sellers draw a line in the sand and prefer to pull their house off the market rather than sell at a deep discount.

“The pressure is on for sellers whose homes remain for sale. The list-price-to-sale-price ratio was at 98.6%. in August. In real dollars, let’s say a house is listed for $450,000. A 1.4% decrease is a six-thousand-dollar reduction. For a median price home at $650,000 that loss to a seller is over $9,000, which is in addition to any seller concessions made during the transaction negotiations (buyer broker fees, buyer mortgage rate buy-downs, inspection repair costs, etc.). Sellers are at the mercy of the buyers still willing and able to make the financial commitment to buy.

“With mortgage interest rates showing a downward trend, more buyers may be willing to dip their toes into the home buying pool. Showings are likely to tick upward as rates move downward. Sellers prepared to de-list may be encouraged to hang in there if rates do indeed drop to the low sixes or high fives,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND COUNTY

“The market leaned toward buyers again! Inventory had been building all summer, and absorption slowed—carryover conditions from July flowed straight into August. Grand County’s active listings were up ~27% year over year and months’ supply was near 12 months, both very elevated for the county, setting the tone for August closings and listings,” said Grand County REALTOR® Monica Graves.

- Prices looked mostly flat at the county level: The county-wide home value index was essentially unchanged year over year (-0.1%), which fits with what Grand County agents on the ground reported—more price cuts to win buyers, while the best-located/newer product still moved.

- On-the-ground read: In late August, we noted higher sales volume in the Winter Park area (+26%) and Granby (+15%) compared with the very recent times, but we also emphasize that older or ambitiously priced listings needed reductions to sell. That mix—stronger activity in select sub-markets with more negotiating room overall—is consistent with a market tilting toward buyers.

Compared to Aug ’24:

- Inventory: materially higher in Aug ’25. Last year at this time, Grand County and much of Colorado hadn’t yet hit today’s inventory levels; the state association’s summer/fall 2024 reports described inventory still building into autumn, whereas by mid-2025 levels were notably larger.

- Speed & leverage: slower in Aug ’25 (more days on market, more concessions/price cuts) vs quicker in Aug ’24. Statewide narratives and local commentary both point to 2025 being less seller-friendly than 2024.

- Prices: flatter to slightly softer year over year in Aug ’25 at the county index level, versus firmer pockets in Aug ’24 (several sub-areas reported higher volumes/prices last August). Translation: pricing power shifted from mild seller advantage (’24) toward neutral/slight buyer edge (’25).

What this means for Buyers and Sellers in Grand County

- Sellers: Expect more competition and a wider spread between list and sale on anything not turnkey or well-located; strategic pricing and visible condition upgrades matter.

- Buyers: More choice, more negotiating room (price, repairs, rate buydowns), but the “A-tier” listings—newer builds, big views, walk-to-amenities are still moving quite quickly.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Single-family homes in Steamboat Springs realized five more new listings than they did in August of ’24, attributing to 111 homes on the market – a 46.1% increase from the previous year. Sold listings were a bit lackluster, with 14 sales compared to the prior year of 27. So far, there have been 20 less homes sold this year vs. last. Two homes closed during this period for $7.65M tying for the fifth and sixth highest sales prices in 2025 and upping the average sales price 17.9%. Median sales prices decreased 8.2% to $2,042,894 with the sellers percentage of list price received rising slightly to 97.3%.

“For the year, multi-family new listings in Steamboat are up 34.5% with two fewer sales than last year. There is significantly more inventory than last year with 246 units on the market, ranging from a 295-square-foot condo for $259,000 to a newly constructed, 5041-square-foot, walk-to-ski condo for $9.5 million. Without question, there is great variety in the offerings.

“The number of new listings for homes in the Oak Creek area is almost double that of a year ago, and inventory is three times more at 33. Sales are not keeping pace with the increased inventory and there are four fewer sales for the year than last year, with the days on market until a sale at 81 days versus 10 for the 2024 period. Multi-family in Oak Creek paints a totally different picture, with only one new listing and three units on the market, a two-month supply and average sales price of $431,000. The town of Hayden also has limited townhomes/condos for sale with four units – the same as last year and only one new listing that came on. There are 24 homes on the market in Hayden representing 6.9 months’ supply of inventory. Sold listings are up 21.1% and the median sales is $620,000.

“What is happening elsewhere in the state for real estate is happening in Steamboat. There are Buyers who can and do move quickly and are willing to pay the price tag for condition, location, or combination of the two. There can be more inventory options within certain price ranges and less for others. Many Sellers have had to take price improvements to become more competitive. The inspection negotiations are back to where they were pre-Covid, where a Seller should anticipate having to make a consideration. Fall typically represents the time of year where if a property has been on the market for the summer and did not sell, then there is likely a better deal to be had. I certainly think there are some listings in Routt County where sellers are ready to sell and a buyer opportunity may exist,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“With the first leaves turning, a forecast of snow up high, and cooler days ahead, the mountains are signaling that summer is nearly behind us. As we shift into fall, here’s a snapshot of how the Summit, Park, and Lake County real estate market performed in August.

“Everything depends on location and condition, but it does seem like we have tipped toward the buyer’s side in the market. Sales were down slightly (1.7%), and the median price fell 1.7%. Sellers averaged about 97% of their list price. Single-family homes spent about 40% more time on the market compared to last year, and multi-family days on market stretched 87% longer. Patience is the new mountain currency for sellers, while buyers are finding more breathing room to make decisions.

Luxury Market Highlights (Year-to-Date)

- Single-family homes over $10M surged 150%

- Single-family homes in the $1.5–$2M range climbed 79%

- Multi-family properties in the $2–$2.5M bracket rose 52%

High-end buyers are still very much in the game, keeping the luxury segment a bright spot even as overall sales soften.

Average Sale Prices – August 2025

Single-Family Homes:

- Summit County: $2,148,178 (–4.9%) | 39 sales

- Park County: $705,142 (+8.9%) | 21 sales

- Lake County: $625,250 | 10 sales

Multi-Family Homes:

- Summit County: $993,084 (+7.2%) | 95 sales

Figures exclude timeshare, deed-restricted, land, and commercial properties.

“Across the three counties, 1,015 listings are on the market, ranging from a $95,000 mobile home in Park County to a $21 million ski-in/ski-out Breckenridge home. Nearly half (45%) are priced above $1 million, with 58 listings over $5 million.

“In August, closings in Summit ranged from a $135,000 mobile home to a $6.2 million Breckenridge luxury home. More than half (52%) of sales closed above the $1 million mark, and cash deals rose to 45% of all transactions.

“Like the changing aspens, the market is shifting—cooler in pace, but still bright with opportunity,” said Summit-area REALTOR® Dana Cottrell.

VAIL

“The valley begins its wind down to the summer sales season in August. The trend we have been experiencing for the past months has continued. The single family/duplex market and the condo/townhome are performing differently. The single family/ duplex market for August was positive 22.2% in closed sales, pending sales were 30.4% and new listings 7.8% all positive. The Townhome/condo market was negative 21.4% in closed sales, and 24.3% in new listings. The Pending Sales were positive 18.4%. for the month.

“Inventory reached levels we haven’t seen since pre-Covid days. Once again, significant variances in the two segments of product. Single family/duplex units are 31.2% higher than 2024 at a total of 366 listings, which is 10.4 months of supply. The Townhome/condo inventory is positive 33.6% higher at 290 units or 7.1% supply. The single family/duplex market has remained stable from a pricing standpoint with the sales in the pricing niches the have been the key market year to date. The Townhome/condo market has been more volatile as several new developments in 2024 impacted both sales and pricing niches.

“As we look forward to our shoulder season and the beginning of the winter season in November, I am optimistic the market will continue its current trends. The only catalyst that could modify things would be some major Macro Economic factors disrupting the economy. The importance of a knowledgeable real estate advisor to help their clients through the trends can’t be emphasized enough,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The August 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.