Colorado Association of REALTORS® Shares 2025 Recap and Outlook for Statewide Markets in 2026

ENGLEWOOD, CO – Colorado’s housing market closed 2025 in a more balanced and cautious position after years of disruption and volatility, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR).

Higher inventory levels, longer days on market, and cost-sensitive buyers reshaped negotiations across the state, giving buyers more choice while forcing sellers to recalibrate pricing and expectations. While conditions varied by region and property type, the dominant theme was stability within a healthier, more sustainable market pace.

“2025 felt like a reset year for housing across Colorado,” said Jared Reimer, Fort Collins-area REALTOR® and CAR spokesperson. “There were no dramatic advances or retreats, just a market that stayed resilient and balanced despite ongoing economic uncertainty.”

Single-family homes generally outperformed condos and townhomes statewide, as rising HOA fees and insurance costs weighed heavily on attached housing. Many markets reported steady or modestly declining prices paired with resilient demand for well-located, well-priced, move-in-ready homes. Luxury and resort markets continued to show insulation from broader economic pressures, while entry-level segments remained constrained by affordability and limited inventory.

“The days of listing a home and selling it in a weekend are largely behind us,” said Julia Purrington Paluck, Evergreen-area REALTOR®. “But that’s not a negative, but rather a sign of a healthier market where pricing accuracy and preparation matter more than urgency.”

Metro markets, including Denver, Aurora, Boulder, and Colorado Springs, leaned buyer-favorable for much of the year, marked by longer marketing times, price reductions, and increased concessions. Buyers became more deliberate, while sellers anchored to prior-cycle expectations often faced longer timelines.

“We have more supply and less urgency than in past years, and that has brought negotiation back into the process,” said Aurora-area REALTOR® Sunny Banka. “For buyers, this is a window of opportunity. And for sellers, they must be realistic.”

In contrast, mountain and resort communities such as Steamboat Springs, Summit County, Telluride, and Vail remained supported by high-net-worth and cash buyers. While sales volumes fluctuated, pricing held firm in premium locations, and luxury properties continued to dominate the share of dollar volume.

“The affluent buyer segment is far less sensitive to short-term economic swings,” said George Harvey, Telluride-area REALTOR®. “That has brought a level of stability to our market that simply didn’t exist five years ago.”

December activity followed typical seasonal patterns, with fewer new listings and pending sales, though several regions posted stronger than expected closings as contracts moved to completion. Inventory remains elevated heading into 2026, though some markets reported historically low numbers of homes under contract.

Looking ahead, mortgage rates easing into the low 6% range have improved sentiment among buyers who had been sidelined by affordability concerns. While demand is not expected to surge, improved alignment between pricing, inventory, and expectations is likely to support steady activity in the year ahead.

“2026 is shaping up to look a lot like 2025—but with better alignment,” said Denver-area REALTOR® Cooper Thayer. “It’s a market that rewards patience, preparation, and smart strategy on both sides of the transaction.”

Overall, Colorado’s housing market enters 2026 on solid footing. While challenges remain, particularly around affordability, insurance costs, and broader economic uncertainty, the state’s diverse markets are adjusting to a more normalized environment defined by balance, negotiation, and long-term sustainability.

Colorado Housing Markets – December Snapshot

Based on analysis from REALTORS® working in markets across the state

(for a more in-depth analysis by market, see full content in report):

Aurora – Aurora, Centennial, Adams County, and Arapahoe County closed 2025 with a clear shift toward a buyer-friendly market. Pricing fell 5–8%, with some homes selling more than $100,000 below 2024 expectations. Inventory dipped seasonally in December but rebounded quickly in January, benefiting buyers. Interest rates in the low 6% range, builder incentives, and abundant townhome and condo supply add leverage, though rising HOA and insurance costs pose challenges. Sellers must price competitively and present move-in-ready homes as 2026 is expected to mirror 2025 with even more inventory.

Boulder and Broomfield counties – Boulder and Broomfield counties ended 2025 with muted results. Boulder saw a stagnant market, with flat home prices, longer days on market, and increased seller flexibility as buyers slowed late in the year. Negotiation returned as sale-to-list ratios dipped below 98%. Broomfield fared better, posting roughly 4% price growth and faster sales driven by more affordable homes. Condos and townhomes struggled, dropping about 10% amid new supply and rising HOA fees. Early signs suggest 2026 will remain balanced, with modest appreciation and steady activity.

Colorado Springs – The 2025 housing market frustrated everyone. Median prices fell 5.2%, listings rose 6.4%, and sales barely increased, creating an unpredictable, sluggish year with longer days on market and rising withdrawals. Condos and townhomes were hit hardest by HOA and insurance costs. Rate-cut hopes faded as buyers waited or rented and sellers misread conditions, even as short sales returned. Looking ahead, 2026 is expected to bring continued softening, weak demand, economic uncertainty, and potential volatility despite political and monetary intervention.

Denver Metro – The 2025 housing market proved frustrating across the board. Median prices declined 5.2%, active listings rose 6.4%, and sales saw only modest gains, resulting in a slow, unpredictable year marked by longer days on market and more withdrawn listings. Condos and townhomes suffered most due to rising HOA fees and insurance costs. Buyers delayed purchases amid fading rate-cut hopes, while sellers misjudged market shifts and short sales reappeared. Heading into 2026, expectations point to continued softening, muted demand, economic uncertainty, and heightened volatility.

Durango/LaPlata County – La Plata County’s 2025 housing market felt uneven month to month but proved stable overall, closely mirroring 2024. Buyer demand held steady while inventory rose sharply, extending days on market and giving buyers more leverage. Single-family sales edged up year over year, while condos and townhomes softened slightly. Well-priced, show-ready homes continued to sell, with urban Durango outperforming rural areas. Resort markets faced added pressure from high supply and dry winters. Looking ahead to 2026, expectations call for a balanced, resilient market with modest growth and continued competition.

Evergreen/Foothills – The foothills market ended 2025 with a typical December slowdown after a stronger fall, reinforcing a year defined by gradual rebalancing. Inventory improved, days on market lengthened, and pricing largely held steady, especially in Evergreen and Conifer. Buyer activity narrowed but remained committed, with no signs of distress. Mortgage rates easing into the low 6% range supported engagement despite affordability challenges. Well-priced, prepared homes continued to sell, while fatigue—not optimism—helped keep transactions moving. The market enters 2026 slower but healthier and well balanced.

<

Fort Collins – The Fort Collins real estate market closed out an unusually complex 2025 with overall stability despite political and economic uncertainty. December activity was calm, with modest price gains and limited sales typical of the holiday season. Single-family homes saw increased listings and sales year over year, while attached homes faced tighter inventory and slightly softer pricing. Overall performance earned a “satisfactory” grade. Looking to 2026, falling interest rates, shifting inventory levels, and renewed buyer confidence could turn recent market stability into sustained strength.

Grand County – Grand County ended 2025 in a cooler, more balanced market. Median listing prices fell about 8.4% to roughly $838,000, inventory increased, and days on market extended into the 87–100 day range, giving buyers more negotiating power. Winter Park and Granby reflected similar trends, with softer pricing and slower sales after a strong start. Higher mortgage rates and increased supply tempered demand, while premium properties held value. Looking ahead to 2026, expectations call for stability, modest price movement, healthier inventory, and a market driven by accurate pricing and buyer leverage.

Grand Junction/Mesa County – Mesa County ended the year largely unchanged from 2024, with flat sales and median prices. New listings and average prices rose due to increased inventory above $500,000, while homes under $500,000 remained scarce, pushing more buyers toward townhomes and condos. Interest rates continued to heavily influence buyer behavior, contributing to a quiet December as sellers delayed listings. Looking ahead to 2026, buyer demand exists, but affordability and monthly payment concerns remain key obstacles.

Gunnison/Crested Butte – The Gunnison–Crested Butte market ended 2025 slightly ahead of 2024, with total sales up nearly 8% and dollar volume up 3%, while average prices remained mostly stable. December closings were boosted by long-planned subdivision sales, masking softer underlying activity. Crested Butte saw modest sales growth and higher prices, especially for single-family homes, while Gunnison posted strong sales gains despite slight price declines. Heading into 2026, inventory is mixed, contracts are historically low, but improving interest rates are expected to drive increased buyer activity and steady pricing.

Pagosa Springs – The Pagosa Springs market ended 2025 slightly ahead of 2024 in total sales, despite a quiet December typical of the holiday season. Increased inventory, lower interest rates, and more realistic pricing supported buyer activity, though affordability remained a challenge for local, financed buyers. Cash and second-home buyers continued to drive much of the market. Annual median and average prices declined modestly, creating a more balanced environment. Looking ahead to 2026, proper pricing and preparation will be critical for sellers as inventory remains elevated.

Pueblo – Pueblo County ended December 2025 with a stable, balanced real estate market. Inventory stood at 4.6 months, offering buyers options while keeping prices steady. Single-family average prices rose 9.5% month over month, and condo prices increased both monthly and annually. New listings, pending sales, and active inventory declined, reflecting typical seasonal slowdowns. Homes sold for about 97% of list price, and days on market remained sustainable, positioning Pueblo for a solid start to the new year.

Steamboat Springs/Routt County – After a slow start, the Steamboat Springs market rebounded in late 2025 as buyer activity shifted into the fall, allowing single-family sales to finish 2.5% above 2024. Inventory tightened, prices held firm overall, and sellers adjusted to longer timelines and modest price concessions. Multi-family inventory expanded significantly, driven by new construction, though well-priced properties continued to sell steadily. Outlying Routt County markets saw mixed results but tighter year-end inventory. Entering 2026, a more balanced market and major resort-area development are expected to support continued stability.

Summit, Lake and Park counties -The Summit, Park, and Lake County markets closed 2025 with resilience as inventory growth brought better balance and buyers became more deliberate. Summit County led activity, with strong gains in single-family and modest growth in multi-family sales despite slight price declines. Park County saw fewer sales but higher prices. Luxury homes remained a major driver, with a large share of sales above $1 million and significant cash activity. Heading into 2026, the market appears stable, favoring informed buyers and realistically priced listings.

Telluride – The Telluride real estate market remained stable in 2025, posting $868 million in sales across 448 transactions—closely matching 2023 levels despite a decline from 2024. The market’s strength reflects a lasting shift that began in 2020, when affluent buyers sought remote resort communities like Telluride. These high-net-worth buyers, largely insulated from economic volatility, have brought long-term stability to the market. With strong equity performance and continued wealth-driven demand, Telluride is well positioned to remain resilient in 2026.

Vail – The 2025 real estate market remained stable overall, with consistent trends and a clear split between single-family/duplex and condo/townhome performance. Single-family/duplex sales outperformed both in December and for the year, while condo/townhome activity declined following the sellout of major developments. Market share continued to shift toward higher price points, particularly $5 million-plus homes, which dominated dollar volume and remained less sensitive to broader economic pressures. Looking to 2026, falling mortgage rates may help entry-level buyers, but limited inventory, population declines, and potential workforce changes could pose challenges.

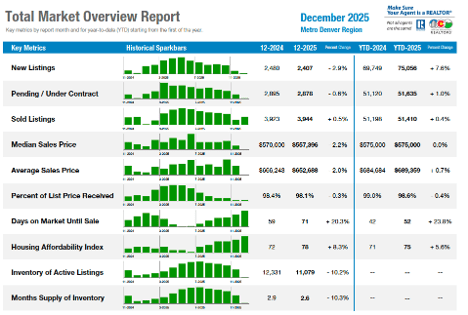

Total Market Overview – Seven-County Denver Metro

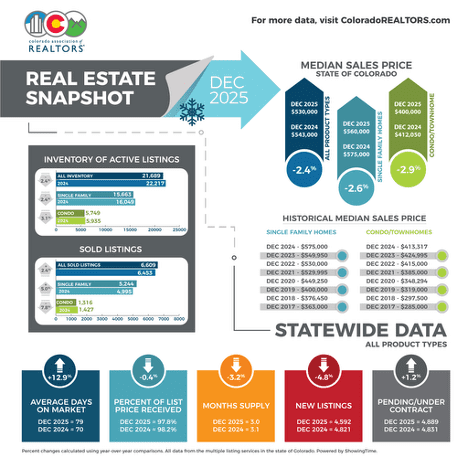

Total Market Overview – Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Aurora, Centennial, Adams County, and Arapahoe County all ended the year with sellers needing to look at the new reality. December showed a very typical inventory decline for the holiday time, but it will come back. In fact, in the first week of January, there were already 1500 new listings on the market, many likely back on the market after sellers withdrew them in December. There are more sellers just waiting a week or two to get their property on the market. This is great news for our buyers.

“Pricing is down 5 – 8% depending on location. The reality of many of the transactions I have closed or am aware of: prices may be down over $100,000 from what they would have listed for in 2024. For example, a listing that would have gone on the market for $640,000 in 2024, sold for $535,000 with $8,000 in seller concessions in late 2025. For buyers, this is your time. Interest rates are in the low 6% range. As we move into spring, I am sure that we will see more inventory come on the market. Inventory consistently increases this time of year. New builders are still offering tremendous incentives to help move the standing inventory that they have. Townhomes and condos have a very large amount of inventory available. In some cases, insurance rates have forced some very large increases in the HOA fees which makes it hard for buyers to get qualified.

“A good rule to remember is the old supply and demand you learned in high school. We have a lot of supply compared to past years and the demand is just not there at this time in Adams and Arapahoe counties, including Aurora and Centennial areas.

“For sellers, properties that are selling are well priced, clean, have some updating done and do not need repairs. The average age of a first-time homebuyer is 41-years-old, and Baby Boomers represent the majority of buyers in the market. Boomers are typically looking to downsize. They want one level, no stairs, and not to have to do a lot of work when they move in.

“I anticipate 2026 will look very much like 2025 but with more inventory available to buyers. If you are one of many thinking of selling, you need to fix it up, clean it up, declutter, be prepared to price competitively, and realize that buyers now have a lot of choices,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“Boulder and Broomfield counties wrapped up the year with a shrug. As 2025 came to a close, Boulder and Broomfield counties told two slightly different stories — but neither one sparked excitement.

“In Boulder County, the market basically went nowhere. Home prices stayed flat month after month and ended the year at the exact same level they started. Buyers checked out early for the holidays, pushing days on market higher as house hunting took a back seat to travel, family, and year-end fatigue. Sellers became more flexible than they’ve been in years. For the first time in a long time, the sales-price-to-list-price ratio dipped below 98%, a clear sign that negotiation is officially back on the table.

“Broomfield County, on the other hand, managed a bit of a late-game rally. Prices finished the year up about 4%, thanks to steady demand and more affordable price points. Homes here are moving faster too, averaging just 42 days on market (vs. Boulder’s 63), an indicator that buyers are responding to available inventory and lower price points.

“That said, not every segment had a win. The condo and townhome market took a hit, depreciating roughly 10% by year-end. A wave of new construction inventory combined with soaring HOA fees — driven by increased insurance premiums — made buyers wait, even in an otherwise active area.

“Looking ahead, 2026 is already showing signs of renewed activity. There’s a fresh-start energy in the air, and buyers and sellers alike are re-engaging. Still, the forecast for 2026 looks a lot like 2025: a balanced market, slight appreciation, and no clear advantage for either side,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“We look back at 2025 as a year that brought a lot of grief to buyers, sellers, lenders and REALTORS®. One of the first years in a long time where everyone in housing was equally frustrated. Median prices fell 5.2% year over year, active listings increased 6.4% and we had a slight 2.2% bump on sold properties. In a nutshell, the entire year was an unpredictable grind. The spring rush did not rush. Summertime heat brought little heat to housing. The fall added properties when we usually lose them. Townhome and condos felt the brunt of the hard times thanks to HOAs working to cope with insurance issues. We saw all areas of housing add to average days on market, or in many cases, the withdrawn/cancelled market rose as homes did not sell.

“Looking back, we grasped on to the false hope of rate drops. Buyers opted to rent over buying to save money. Sellers knew the housing market shifted this year, but many thought that it didn’t affect their home, just the other seller’s properties. Buyers were waiting for further price drops or rate drops and then gave up. One home would sell fast; another wouldn’t get a showing and then would pull from market. We saw short sales come back into the market and agents started to learn what an REO was (Real Estate Owned Foreclosure). Something we hadn’t seen in more than 7 years, locally.

“2026 is here and we have already begun with President Trump stating he won’t allow big institutional investors to buy single-family homes. He wants to force Fannie Mae and Freddie Mac to use 200B dollars to lower rates. Less than two weeks into 2026 and we are already trying to predict rate drops from the Federal Reserve. Some relief for the consumer who quite literally is drowning in debt and has little chance of survival if we don’t figure the economy out. Gold and silver rallied to all-time highs in 2025 and look likely to do so into 2026. I expect home values to continue to soften in 2026. I do not believe buyer demand is going to blow up, but likely trudge along at best. Consumers are down and out and that won’t flip fast. We are in mid-term election year, and we expect President Trump to do anything to avoid a recession. I would expect the Fed to try and buy down the long end of the yield curve to avoid even further debt racking up for our out-of-control spending. I will even toss out there some bank failures, hedge fund issues, and look for the AI bubble to let some steam out, if not all out fall apart. We are in a very historic time now. Fed rates dropped in September 2024 and that is usually the start of hard times within 18 months of that. Which puts us smack dab at that time where things usually get hairy. Do we avoid that? Is there a black swan event? Does the Japan carry trade take down entire banks and funds? I expect it to be a very exciting year and will probably provide some surprises many are not expecting and give me some content to keep you informed about,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The Colorado Springs single-family and patio home market in 2025 was defined by a notable rebound in inventory alongside resilient buyer demand. Active listings climbed steadily throughout the year, peaking in July with 4,227 homes for sale and marking the highest level of inventory since July 2014. By year-end, inventory settled at 2,837 active listings, placing the market in a far healthier balance than in recent years.

“By December 2025, supply levels varied significantly by price point. Homes priced under $400,000 remained relatively tight, with 2.7 months of supply, while the $400,000 to $600,000 segment showed a similarly balanced 2.9 months. Inventory expanded substantially at higher price ranges, with homes priced between $600,000 and $1 million reaching an exceptional 9.8 months of supply. Properties priced above $1 million also reflected abundant availability, with 5.6 months of supply, giving buyers in these segments considerable negotiating leverage.

“Despite the increase in inventory, buyer demand remained strong. In June 2025, 1,197 single-family and patio homes were sold—the highest monthly sales total since July 2022. Year-to-date sales reached 11,788 homes, the strongest pace recorded since 2022, underscoring continued interest from buyers even as market conditions shifted.

“Sales volume reflected this activity, with year-to-date dollar volume totaling $6.59 billion in 2025, up from $6.32 billion in 2024. While still below the extraordinary levels seen during the pandemic-era surge, this performance highlights a market that remains fundamentally healthy.

Homes did take longer to sell in 2025, with the average days on market increasing to 53 days, up from 45 days the prior year. This shift reflects buyers becoming more selective as inventory expanded and competition eased.

“Sales distribution by price range further illustrates market dynamics. Homes priced between $400,000 and $600,000 dominated activity, accounting for nearly 45% of all sales. Properties under $400,000 represented just over a quarter of transactions, while homes priced between $600,000 and $1 million made up 23%. Luxury homes above $1 million accounted for 6% of total sales.

“Pricing continued to trend upward, albeit at a moderating pace. In June 2025, the average sales price reached a record high of $574,276. This milestone reflects a long-term trajectory of appreciation, with average prices crossing $500,000 in 2021, $400,000 in 2020, and $300,000 in 2017.

“As inventory climbed to record levels, price reductions became more common across El Paso and Teller Counties. Sellers increasingly needed to price homes correctly from the outset, ensure properties were in good condition, and present them effectively to attract buyers and avoid repeated reductions.

Looking ahead to 2026, several positive factors support market stability. Inventory remains elevated, price growth is slowing to a more sustainable pace, mortgage rates are gradually easing, and there is meaningful pent-up demand waiting on the sidelines.

“At the same time, affordability challenges persist. Rising property taxes and insurance costs continue to strain buyer budgets, and a potential slowdown in immigration could weigh on household formation and long-term demand.

“Balancing these strengths and challenges, the outlook for 2026 is for conditions to closely resemble those seen in 2025, a market characterized by healthier inventory levels, steady demand, and a continued transition toward greater balance between buyers and sellers,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER METRO (Seven County)

“After two years of elevated borrowing costs and mounting affordability friction, the Denver-metro housing market settled into a more sustainable and predictable rhythm in 2025. Buyer activity in the single-family segment improved modestly as households adjusted to mortgage rates in the 6% range as the new normal, and as marginal improvements in rates gave some buyers the confidence to re-enter the market. Rather than signaling a renewed surge, pricing trends reflected stability, with values largely holding steady as buyers remained highly payment-sensitive and sellers competed for attention in a more deliberate, measured environment.

“Against that backdrop, 2025 leaned more buyer-favorable than what many Denver metro participants had grown accustomed to over the past decade. Market velocity slowed, listings spent more time on the market, and negotiations evolved accordingly. Price reductions became more common as sellers worked to align with current demand, while concessions emerged as a routine mechanism to close the affordability gap, whether through rate buydowns, closing cost credits, or other incentives. Sellers anchored to prior-cycle expectations often faced longer marketing timelines, while buyers benefited from increased leverage, greater choice, and more time to make informed decisions.

“The townhouse and condominium segment remained the clearest pressure point for attainability in 2025, underperforming the single-family market by a wide margin. Although attached housing is often viewed as the entry-level on-ramp to homeownership, rising HOA dues and insurance costs significantly challenged total monthly payments, limiting both qualification and buyer comfort. Year-to-date, townhouse and condo closed sales declined 8% to 10,794 transactions, while single-family sales moved in the opposite direction, increasing 3% to 40,606 homes sold. Pricing followed a similar divergence, with the townhouse and condo median price falling 3.7% year-over-year to $395,000, compared to essentially flat median pricing on the single-family side at $624,990.

“Differences in market tempo further underscored the growing separation between segments. Attached homes spent an average of 59 days on market year-to-date, up 31.1% from 2024, compared to 50 days for single-family homes, which rose at a slower 19% pace. Negotiating dynamics also tilted more clearly in favor of attached-home buyers, with sellers receiving 98.4% of list price, on average, year-to-date, versus 98.7% for single-family listings. In practice, HOA and insurance costs increasingly acted as a barrier to entry, narrowing the pool of qualified buyers and forcing attached-home sellers to compete more aggressively on both price and terms.

“Looking ahead to 2026, the most likely outcome is a market that closely resembles 2025, with changes similar in scale to those observed from 2024 to 2025. Pricing is expected to remain relatively steady, transaction activity should continue at a slower and more negotiable pace, and affordability constraints will remain a defining influence on buyer behavior. Consumer sentiment stands out as a key swing factor, as it remains subdued and continues to weigh on household willingness to make large financial commitments, though any improvement would likely translate into healthier motivation on both sides of the transaction. Prices are expected to remain broadly stable, and a modest price decline would not be inherently negative for the market, as a slight correction could improve access for buyers without meaningfully eroding equity for most sellers, helping restore balance in a market defined by payment sensitivity. Continued progress on non-mortgage ownership costs, particularly insurance premiums and HOA burdens, remains one of the most effective levers for improving attainability and supporting longer-term housing demand across the Denver-metro region,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“La Plata County’s 2025 housing data reveals a year that felt erratic in real time but proved remarkably stable in hindsight—much like 2024. There was no single “snapshot” moment, as buyer activity fluctuated throughout the year and differed by property type. A dry winter and absence of mud season pushed many sellers to list early, resulting in higher January–June inventory than any year since 2020, with some listings effectively pulled forward from later months.

“Overall buyer demand remained steady. Single-family home sales finished 12 units above 2024 and just two below 2023. Condo and townhome sales dipped by 21 compared to 2024 but still exceeded 2023 by 10 units. This balance reflects a consistent buyer pool rather than demand loss. The major shift occurred on the supply side: inventory rose 21.8% for single-family homes and 38.3% for condos and townhomes, lengthening days on market and giving buyers more leverage and choice.

“Increased inventory created stronger competition among sellers. Homes that sold were typically well-priced and show-ready. Rural areas slowed more than Durango’s urban core, a typical pattern in shifting markets, likely amplified by rising insurance costs. Importantly, inventory levels remained below pre-COVID norms, though sellers—accustomed to recent fast-moving markets—felt the adjustment more acutely.

“Regional performance varied. Durango In-Town remained the county’s strongest market, with single-family sales up 9.4% despite an 8.4% drop in median price. Condo and townhome sales declined 11.9%, yet their median rose 7%, illustrating how medians often reflect the mix of homes sold rather than pure appreciation. Rural Durango softened noticeably: average days on market rose 13.7%, and December closings took 64 days longer than the prior year. While the median price climbed 10.9% to $937,500, this was heavily influenced by a 51% increase in $2M+ luxury sales, indicating strength at the high end despite softer overall momentum.

“The resort market faced headwinds from another dry winter and delayed snowfall. New residential projects added supply, and inventory swelled to an 11.5-month supply for single-family homes and 10.4 months for condos. Medians declined, likely due to smaller, more affordable units selling, though desirable, well-priced listings continued to move quickly—even at premium prices.

“Bayfield emerged as a relative bright spot. Both in-town and rural markets showed stability, supported by new, more affordable inventory. With Durango Rural prices nearing $937,500 versus Bayfield’s $542,000 median, cost-conscious buyers increasingly favored Bayfield, particularly as insurance expenses rose. Ignacio In-Town also performed well, driven by the affordable Rock Creek subdivision, while Rural Ignacio slowed sharply, with days on market averaging 259 days—77% longer than in 2024.

“Nearby San Juan County mirrored resort-area trends. Single-family homes faced a 13-month supply, while condo sales increased at lower price points, driving a steep 40.7% median price drop—consistent with buyers favoring affordability across the broader region.

“Looking ahead to 2026, expectations point to another stable year barring major disruptions. Buyer demand should remain steady, inventory may rise modestly, and prices are likely to hold or see mild appreciation. Sellers will need strong pricing and presentation to compete. Risks include wildfire season, insurance pressures, and uncertainty around Federal Reserve leadership and rate policy. Still, Durango and La Plata County’s lifestyle, economy, and natural appeal continue to underpin a resilient market,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“The foothills market closed out 2025 with a predictable seasonal slowdown in December, following a slightly stronger-than-expected November. When viewed in the context of the full year, December’s performance reinforces a broader theme that defined the 2025 foothills market: a steady rebalancing marked by longer timelines, improved inventory, and pricing that mostly held its ground.

“Across September, October, and November, activity remained surprisingly resilient, particularly in Evergreen and Conifer, before easing in December as holiday schedules and year-end pauses took hold. December closings declined modestly from November, but the slowdown was orderly and consistent with long-term seasonal patterns. Importantly, the market did not show signs of distress or abrupt demand loss. Instead, buyer activity narrowed to a smaller, more committed pool, with contracts that did form more likely to close.

“Evergreen and Conifer continued to serve as bellwethers for the region. Activity softened in December after a stronger fall, but year-to-date results tell the more important story. For detached single-family homes, Evergreen-Conifer finished 2025 with pricing essentially flat compared to 2024, underscoring the area’s overall stability despite slower market conditions and longer days on market. Still, the average and median prices for detached homes in the area remain over $1 million, making affordability an issue in the Evergreen-Conifer area.

“The bright spot is that there is a growing attached market with some new townhomes and condos in Evergreen and along the I-70 corridor. While condominium and townhome activity contributed to some variation in monthly pricing, that segment remains a relatively small portion of the foothills market, but we see this segment increasing and hoping to make a dent in the affordable market.

“One of the most consistent trends throughout 2025 was the rise in days on market. That pattern continued into December. In Evergreen–Conifer, days on market increased meaningfully compared to last year, with similar trends observed across the rest of the foothills. Buyers took more time to evaluate options, and sellers faced a market where pricing accuracy and preparation were increasingly important. Listings remained active, but transactions took longer to materialize, reflecting a more deliberate pace rather than weakened demand.

“Mortgage rates remained a significant influence on market behavior. After peaking above 7% earlier in the year, rates eased into the low 6% range by late fall and early winter. This provided some relief and helped sustain buyer engagement, but affordability challenges persisted. As a result, buyers remained selective and price-sensitive, and negotiation dynamics became more balanced. Well-prepared homes priced appropriately continued to sell, while properties positioned ahead of the market faced longer marketing times.

“Beyond inventory and interest rates, a more subtle force shaped the foothills market in 2025: fatigue. After an extended period of fluctuating rates, changing expectations, and repeated recalibration around timing, both buyers and sellers increasingly chose to move forward without waiting for perfect conditions. That fatigue—rather than renewed optimism—helped keep transactions moving, particularly in the second half of the year. While hesitation remained, contracts held together more reliably than earlier in the year.

“The foothills market enters 2026 on stable footing. Inventory levels are higher than in recent years, pricing has largely stabilized, and buyer and seller expectations are starting to become more aligned to the market realities. The market feels slower, but healthier, positioning the region for a balanced start to the new year,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“With the holidays behind us and the frenetic pace of December in the rearview mirror, many real estate professionals finally have the opportunity to reflect on what was one of the most unusual years the housing market has seen in decades. The 2025 real estate landscape was shaped by a steady stream of political and economic forces that often pulled in opposing directions, creating uncertainty for both buyers and sellers. Short-term trends were difficult to interpret, and market confidence was frequently tested.

“December provided a relatively calm conclusion to the year, particularly in the single-family home sector. Sales were down 10.3% compared to December 2024, though this decline represents only 19 total transactions, a reminder of the limited sample size typical of a holiday month. The median sales price rose 5.9% year over year to $630,000, aligning closely with median values from the past three years. Active listings increased modestly to 361 homes, up 5.2% from the previous December. Overall, December closed out 2025 in a stable and non-volatile fashion for single-family homes.

“Attached homes painted a slightly different picture. Sales declined 17.5% year over year, driven largely by tighter inventory. Active listings dropped 15.1% to just 141 units, limiting buyer options and suppressing transaction volume, with only 47 sales recorded in December. Despite fewer sales, the constrained inventory helped push the median price up 1.5% to $419,990 compared to December 2024.

“If the Fort Collins real estate market in 2025 were to receive a grade, ‘satisfactory’ feels appropriate. The year brought neither dramatic gains nor major setbacks. While some months outperformed others, the market remained resilient and balanced overall.

“In the single-family sector, new listings increased 10.3% compared to 2024, signaling that more homeowners were willing to sell despite economic uncertainty. Total sales followed suit, rising 10.2% to 2,275 transactions. This balance between growing inventory and increased demand is encouraging, especially in a market that has felt constrained in recent years. Year-to-date median value edged up just 0.3% to $610,000, reflecting steady buyer interest but insufficient competition to drive significant price appreciation. Given the circumstances, stability was the best realistic outcome for 2025.

“The attached home market saw similar trends in inventory, with new listings up 9.8% year over year. Sales increased 2.5%, surpassing 700 transactions for the year. The primary weakness was a slight 1% decline in median value to $406,700. While attached homes are typically more affordable, higher interest rates and HOA fees reduced their relative appeal, narrowing the cost gap with single-family homes for many buyers.

“Looking ahead to 2026, three key factors will shape the market: interest rates, inventory, and impressions. Interest rates dipping below 6% in mid-January have already sparked optimism, and economic indicators suggest rates will likely remain stable or decline modestly. Lower rates could bring sidelined buyers back into the market, increase competition, and encourage more sellers to list. Refinancing opportunities may also improve affordability for current homeowners.

“Inventory remains a concern. Many unsold homes were pulled from the market during the holidays, and there is a risk these ‘zombie listings’ return early in the year, potentially slowing momentum if demand does not keep pace. Finally, buyer impressions matter. After years of hesitation, improved affordability may finally motivate buyers to act. Fort Collins continues to attract residents across all life stages, and 2026 may be the year that recent stability evolves into renewed strength,” said Fort Collins-area REALTOR® Jared Reimer.

GRAND COUNTY

“Grand County closed 2025 with a noticeably cooler, more balanced real estate market. The median listing price was about $838,000, down roughly 8.4% year over year, while average values were mixed by location, signaling a flattening market compared with 2024. Inventory increased, days on market stretched into the 87–100 day range, and sale-to-list ratios fell below peak seller-market levels. Buyers had more negotiating power, while sellers adjusted pricing to match slower absorption.

“This trend was evident across submarkets. In Winter Park, the median listing price finished near $849,000, down 8.5% year over year, with days on market rising to about 104. Resort properties showed less upward pressure than earlier in the decade, though late 2025 saw renewed buyer activity and cash buyers accounting for roughly 25% of transactions. Granby experienced a front-loaded year, with sales up early before cooling in the fall as new construction pricing softened to compete with resale inventory. By late 2025, sales volumes were down compared with the prior year.

“Several factors drove the shift. Higher mortgage rates throughout much of 2025 reduced urgency and tempered demand, particularly in more price-sensitive segments. At the same time, rising inventory and longer market times gave buyers more choice. Premium homes—those with strong locations, ski or lake proximity, or standout condition—continued to hold value, while lower-tier or dated properties moved more slowly and often at softer prices.

“For buyers, 2025 brought more inventory, less pressure to bid quickly, and improved negotiating leverage, especially outside top-tier locations. For sellers, pricing and presentation mattered more than in recent years. Homes that were well-staged, realistically priced, and move-in ready performed best, while aspirational pricing led to longer market exposure.

“Looking to 2026, Grand County is expected to remain stable rather than surge. Most forecasts point to flat to modest price growth, generally within a narrow range, with greater sensitivity for condos, mid-tier homes, and properties with functional or location challenges. Sales volume is likely to improve modestly from late-2025 levels as buyers and sellers adjust to higher-rate realities. Inventory should remain healthier than in the boom years, keeping days on market longer but supporting a balanced market.

“Mortgage rates remain the key variable. With rates in the low 6% range entering 2026 and potential Fed cuts later in the year, even small declines could unlock additional buyer activity, particularly for locals and financed second-home buyers. Overall, 2026 appears to be a pricing-driven market: buyers will have leverage and options, while sellers who align condition and price with market realities should still see solid results,” said Grand County-area REALTOR® Monica Graves.

GRAND JUNCTION/MESA COUNTY

“Mesa County finished out the year essentially flat with sales and median price ending the same as 2024. The two things that did go up was new listings and the average price, as inventory has grown in the over $500,000 prices. Inventory under $500,000 is low, and that is where most of our buyers qualify. Because of the low attainable single-family inventory, it did result in more townhome condo sales.

“Interest rates are still a dominant factor in motivating people to step up and buy. December was a quiet month, with a big drop in new listings as sellers were waiting for a more positive time to list and come on market. Looking ahead into 2026 hopefully some of the issues we faced in 2025 will improve as there are multiple buyers who want to buy, but the monthly payment sticker shock is holding them back,” said Grand Junction-area REALTOR® Ann Hayes.

GUNNISON/CRESTED BUTTE

“The Gunnison-Crested Butte market closed out 2025 with quite a few closings and a relatively low number of new contracts. December brought 53 closings, 20 of which were a subdivision that had been in the works for 3 years, so those buyers had been waiting a while. If you removed those 20 sales, the number of closings was down about 18% compared to December2024. Overall, we ended 2025 up slightly over 2024 throughout the area. Total sales were up almost 8% (632 vs. 587), but the dollar volume was up only 3% ($557.2 million vs. $541.6 million). Average prices throughout the area stayed relatively stable with average single family home prices down 1.2% and condo/townhome prices up 1.9%.

“Focusing on the Crested Butte area, the number of sales were up slightly (5%) with 310 transactions vs. 295 in 2024. Dollar volume was up 8.3% ($397.6M vs. $367.2M) with the number of single-family home sales relatively flat (86 in 2025 vs. 87 in 2024) with a small increase in dollar volume reflecting some higher priced home sales. The average sales price of a single-family home was up 3.5% and is now just under $2.5 million. For condos and townhomes, sales were down 19% year over year, but average prices remained strong and went up 11.5% to almost $900,000.

“The Gunnison area was strong throughout 2025 and ended the year with 21% more sales than in 2024 (211 vs. 174) and dollar volume was up 13%. The market for single-family homes was busy with 21% more sales (115 vs. 95), but average prices were down 3.3%. The average price for a single-family home in the Gunnison area was just under $750,000 in 2025. Condos and townhomes also had a big year with the number of sales up 58% year over year (52 vs. 33). The average price stayed stable with a 3% decrease to $408,000.

“As we head into 2026, inventory remains strong. The numbers are not showing a consistent trend with some areas and property types up 20%, others with 10% more inventory and still others down 15%. The surprising number is that we have an historically low number of properties under contract. The last time we had so few properties under contract was in April and May of 2020. The reason for the low number was obvious then, but it is harder to explain right now.

“With improving interest rates and more properties coming up for sale, I would expect buyers to be more active as we start the year. I predict that 2026 will have more sales than 2025 and that prices will continue to hold steady. Sellers of condos and townhomes will need to evaluate their pricing based on the effects of increasing dues as influenced by insurance costs and the need for capital improvements,” said Gunnison/Crested Butte-area REALTOR® Molly Eldridge.

PAGOSA SPRINGS

December was largely a hibernation month for the Pagosa Springs real estate market, as both buyers and sellers focused more on holiday travel and family time than on real estate transactions. New listings dropped sharply, down 52%, while pending sales slipped 5.6%. Closed sales, however, rose 23.1%, reflecting contracts written earlier in the year that closed before year-end rather than new December activity.

“For all of 2025, Pagosa Springs home sales edged just ahead of 2024, with 395 homes sold compared to 389 the prior year. Buyers experienced a more active and balanced market thanks to increased inventory and improved options. Success for buyers often depended on having the right strategy, as lower interest rates, greater inventory compared to 2024, and more realistic pricing helped draw participants back into the market and sustain overall activity.

“Affordability remained a defining challenge. Buyers who relied on financing felt the combined pressure of elevated home prices and monthly payments, and local buyers could realistically afford less than 25% of the available inventory. Cash buyers—particularly second-home purchasers—played a significant role in supporting market activity. Homes priced near the median and average ranges ultimately sold, but overall price trends softened on an annual basis. While December 2025 saw strong year-over-year price gains, full-year figures declined compared to 2024.

December 2025 Median Sales Price $575,000 (+44.7%)

December 2025 Average Sales Price $735,200 (+28.4%)

2025 Median Sales Price $570,000 (-3.4%%)

2025 Average Sales Price $690,347 (-8.0%)

“Sales of homes priced above $1 million fell notably in 2025, with just 50 sales compared to 66 in 2024, contributing to longer days on market for higher-end sellers. Other price segments saw more balanced inventory levels and modest gains in sales, creating a healthier overall market environment.

“Land sales declined year over year, with 246 transactions in 2025 compared to 283 in 2024. The slowdown was most pronounced in town lots with water and sewer access and in large acreage parcels with higher price points. Rising infrastructure connection fees, construction costs, and labor expenses discouraged buyers planning to build immediately. However, long-term land buyers—often planning for retirement within five to seven years—remained active throughout the year.

“Looking ahead to 2026, the market may begin to release the stagnation of the past three years for buyers, sellers, and renters. Affordability remains a concern for locals, as housing prices and incomes need to move closer together to prevent second-home buyers from dominating the market. Affordable housing programs and down payment assistance offer viable paths for local and younger buyers, though urgency will increase as inventory tightens and prices rise.

“For sellers, early preparation and accurate pricing are critical. With average days on market around 130 and inventory at 6.5 months or more, homes priced even slightly above market risk extended market time and larger price reductions. Well-priced, move-in-ready homes attract the strongest buyer interest, while properties needing updates tend to linger.

“South Fork and Rio Grande County also posted gains in 2025, likely benefiting from lower price points that placed the area on more buyers’ radar,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“Pueblo County closed out December 2025 with a stable, balanced market. Inventory sat at 4.6 months, giving buyers options while prices remain steady. The single-family average closed price was $316,900, a 9.5% increase from last month. The condo average and median closed price increased both MoM and YoY.

116 homes went under contract, a 26.6% decrease MoM, and active inventory decreased 22.4% YoY, as new listings also declined 19.1% YoY to 182. Sellers received about 97% of the list price, and homes are moving at a sustainable pace, setting up a strong start to the new year,” said Pueblo-area REALTOR® David Ramirez.

Pueblo Market Highlights:

Supply – Active Listings

In December, active inventory decreased 22.4% year-over-year to 729. Last month saw 840 active listings.

Demand – Pending Sales

Demand decreased 5.7% YoY. This was a decrease of 26.6% when compared to last month.

New Listings

December saw 182 new properties enter the market. This metric saw a 17.6% decrease month over month.

Percent of Closed Price to List Price

December saw a 97.2% closed price to list price – a 0.9% decrease month over month. Last year at this time we saw 97.2%.

Average Days on Market

The average days on market was 104 – an increase of 0.5% month over month. This was a 1.9% increase year over year.

Months Supply of Listings

Months supply of inventory was 4.6, down 14.6% year over year. This was a 29.0% decrease month-over-month.

STEAMBOAT SPRINGS/ROUTT COUNTY

“As the third quarter of 2025 came to a close, the Steamboat Springs single-family market appeared headed for a down year. Sold listings were nearly 15% lower than in 2024, while inventory had surged 47%, pushing supply to nine months. However, market momentum shifted unexpectedly in the fourth quarter. Buyer activity that typically peaks during summer instead materialized in the fall, leading to steady month-over-month improvement. By year’s end, single-family sales finished 2.5% higher than 2024, marking a notable turnaround. Of the 161 total transactions, 112 closed in the second half of the year.

“Home prices reflected mixed trends. The average single-family sales price rose 9.3% to $3,086,869, while the median price dipped 3% year over year to $2.095 million. Inventory tightened significantly, with months’ supply falling to 4.9 by year-end. Sellers adjusted to longer marketing timelines, implemented price reductions when necessary, and ultimately received 96.4% of list price, slightly below 2024 levels. The year’s highest single-family sale was a newly renovated 9,950-square-foot ski-in/ski-out home that closed for $17.75 million, or $1,754 per square foot, just under the year’s high of $1,803 per square foot.

“The multi-family sector saw a substantial influx of inventory in 2025. New listings increased 33.1%, and by December there were 172 condos and townhomes available—an 85% increase from the previous year. Much of this supply came from new construction in the mountain area, bringing months’ supply to just under six. Despite increased choices, demand remained steady. Across 356 transactions, average days on market rose to 65, indicating that well-priced, well-presented properties typically sold within two months. Sellers captured an average of 97.1% of asking price. The highest multi-family sale was a new construction, walk-to-ski residence that sold furnished for $6.35 million at $1,761 per square foot. One Steamboat Place recorded the year’s highest price per square foot at $2,377, one of only two 2025 sales exceeding $2,000 per square foot.

“Outlying areas of Routt County experienced more varied results. Oak Creek and Stagecoach saw a 46.2% increase in new single-family listings but recorded seven fewer sales year over year. Many homes were pulled from the market in December, leaving just nine active listings and a three-month supply. Prices showed modest shifts, with a median of $860,500, down 2.8%, and an average price of $1,018,493, up 7.9%. Multi-family activity slowed, with only four sales in 2025 compared to 13 the year prior.

“Hayden and Clark also saw fewer new listings. Hayden posted slight sales gains in both single- and multi-family sectors, though average days on market doubled to 76. Median prices fell 4%, while average prices rose nearly 13%. Inventory tightened to under four months. Clark closed the year with two sales and entered 2026 with just three active listings.

“Overall, Routt County is moving toward a more balanced market, where negotiations hinge on property condition, location, and amenities. Looking ahead to 2026, Steamboat Springs is entering a major development phase, with nearly $1 billion in base-area projects underway, including the revitalization of Ski Time Square, reinforcing the resort’s long-term growth and global appeal,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT AND PARK COUNTIES

“As 2025 comes to a close, the Summit, Park, and Lake County real estate markets demonstrated notable resilience despite uneven conditions throughout the year. Sales activity strengthened in several key segments—particularly in Summit County—while pricing adjusted modestly and buyers became more deliberate in their decision-making. Steady inventory growth over the course of the year helped shift the market toward better balance, giving buyers more options and prompting sellers to refine their pricing strategies.

“High-end properties continued to play a central role in overall market performance, with luxury homes accounting for a significant share of both listings and closed sales. While affordability remains a challenge, especially for local buyers, the broader market showed signs of settling into a healthier and more sustainable rhythm. Looking ahead to 2026, momentum appears steady. Success will increasingly favor informed buyers and realistic sellers who focus on strategy rather than speed, making experience and local expertise more valuable than ever.

Summit County – 2025 Year-End Review

“The Summit County single-family home market posted strong gains in activity. Sales increased 23.6% year over year, even as pricing moderated. The average single-family sales price finished at $1.9 million, a 9.5% decline from 2024, reflecting buyer sensitivity to value amid growing inventory. New listings rose slightly, up 2% from last year, contributing to improved balance.

“Multi-family properties also saw modest growth. Sales increased approximately 4.1% year over year, while the average price dipped 3.1% to $898,188. New listings in this segment rose 1.6%, offering buyers more choices without overwhelming demand.

Park County – 2025 Year-End Review

“Park County experienced a different dynamic. Total sales declined 7.5% compared to 2024, but prices moved higher. The average sales price increased 7.5% year over year to $681,256, driven in part by limited availability at lower price points. New listings rose significantly, up 11.5% from the prior year, helping to gradually expand inventory.

“Across Summit and Park counties, luxury activity remained prominent. Nearly 64% of all single-family home sales closed above $1 million, with the strongest year-over-year growth occurring in the $10 million-plus segment. In the multi-family sector, 37% of sales exceeded the $1 million mark, underscoring continued strength at the upper end of the market.

“Currently, there are 551 residential listings available across Summit, Park, and Lake counties, ranging from an $80,000 mobile home in Park County to a $21 million ski-in/ski-out property in Breckenridge. Nearly half of all active listings (49%) are priced above $1 million, including 42 properties listed at over $5 million.

“December closed with 117 residential sales, ranging from a $250,000 single-family home in Park County to a $9.48 million Breckenridge property. Approximately 46% of December transactions closed above $1 million, and cash purchases accounted for 34% of all sales, highlighting the continued influence of well-capitalized buyers in the region,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE/SAN MIGUEL COUNTY

“The Telluride real estate market remained strong in 2025, closing $868.28 million in sales across 448 transactions. While this represented a decline from 2024’s $1.004 billion on 483 sales, 2025 closely mirrored the 2023 market, which totaled $865.73 million across 445 sales, underscoring long-term stability rather than weakness.

“The more compelling story is how dramatically the market has evolved over the past five years. Beginning in 2020, affluent buyers across the country sought out remote, safe resort communities, bringing a new wave of demand to Telluride. Its unmatched walkability, year-round gondola access, and free public transit, combined with its natural beauty, made it especially appealing.

“These buyers came from a higher economic tier than those who historically defined the market. They had the ability to purchase at virtually any price point and were often unaffected by short-term economic fluctuations. Their presence—and the network of similarly affluent buyers they introduced—has created a level of economic resilience previously unseen in Telluride. Strong equity market performance in 2025 further supported this buyer segment.

“Looking ahead to 2026, while broader economic forecasts remain mixed, Telluride is well positioned to remain insulated. Wealth-driven demand is expected to continue buffering the market from volatility, allowing Telluride real estate to benefit from sustained stability and long-term strength,” said Telluride-area REALTOR® George Harvey.

VAIL

“The 2025 real estate market was relatively stable, with clear trends developing and remaining consistent throughout the year. December performance was a pleasant surprise, though it largely reflected the ongoing divergence between the single-family/duplex and condo/townhome segments rather than a new shift in momentum. Closed sales for single-family/duplex homes increased 35% in December, while condo/townhome sales declined 2.1%. This mirrored the full-year pattern, with single-family/duplex sales up 4.1% and condo/townhome sales down 11.6%.

“A major factor influencing condo and townhome activity was the sellout of two large condo/townhome developments that had significantly boosted performance in 2024 and were fully absorbed early in 2025. Additionally, the closing of a substantial number of pending transactions in December may provide some early lift to 2026 activity.

“Looking ahead, several macroeconomic factors could influence market performance in 2026. Declining mortgage rates should provide support, particularly for entry-level buyers. However, much of the financed demand is concentrated in lower price points where inventory remains limited. Most of this inventory, located in the western portion of the market and primarily serves local employees, is in a segment not currently expanding.

“Further complicating the outlook, the area’s permanent population has been declining over the past few years. A weaker ski season could also place financial strain on small businesses, which would, in turn, affect employment and housing demand. Pressure on small businesses would likely translate into additional challenges for entry-level housing segments, making affordability and inventory key issues to watch as the market moves into 2026.

Following is a comparison of the 2024 and 2025 market shares in units and dollars which shows the relative total market stability with fluctuations within the niches:

| 2024 | 2025 | |||

| Price Point | Units | Dollars | Units | Dollars |

| <$1million | 33% | 11% | 30% | 10% |

| $1-2 million | 30% | 10% | 23% | 11% |

| $2-3 million | 12% | 12% | 12% | 12% |

| $3-4 million | 8% | 11% | 8% | 11% |

| $4-5 million | 8% | 10% | 8% | 10% |

| $5 million + | 9% | 46% | 19% | 46% |

“The sales market shares have continued to trend for the upper price point niches which historically are predominately vacation homes and focused on the mid valley east which is the best access for the resort markets. The major macro-economic issues as are currently represented have a little less impact on this segment of the market. The one unknown issue is the trend of corporations bringing people back to the office away from working at home. The impact of that directive could be significant,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The December 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.