Colorado home sales slow in January as market recalibrates, buyers grow more selective

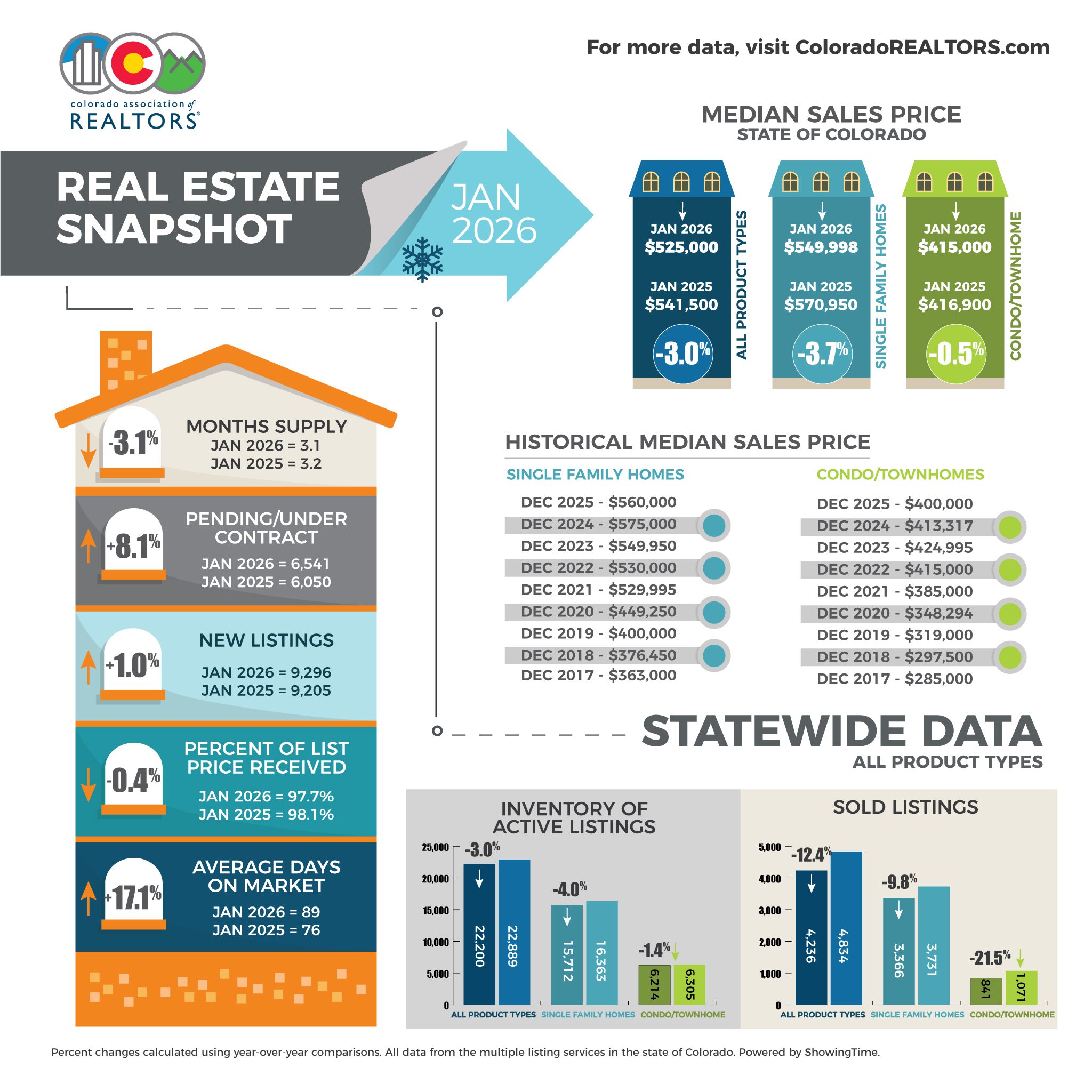

ENGLEWOOD, CO – Colorado’s housing market began the new year in a period of recalibration with January data reflecting a slower, deliberate pace across a majority of markets, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR). While demand remains, buyers are increasingly selective and payment-sensitive while sellers continue to adjust to a market defined by negotiations, extended selling periods, and a need for realistic pricing with many areas reporting flat to slightly lower year-over-year sale prices.

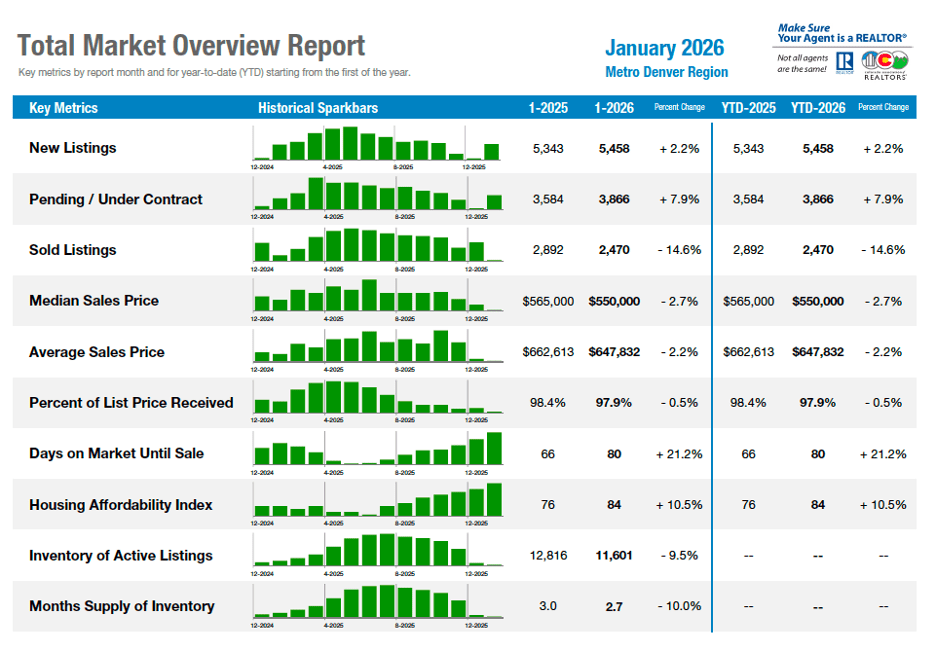

Along the Front Range, inventory levels increased or remain at elevated levels, moving the leverage toward buyers. In the seven-county Denver-metro area, new listings rose 2.2% year over year, while pending contracts were up almost 8%, showing improving buyer activity. Closed sales, however, fell 14.6%, an anticipated early season pattern. The Denver metro median sale price fell 2.7% to $550,000 while average days on market rose 21% to 80 days, a reflection of the slowed, negotiation-driven conditions where sellers received an average of 97.9% of list price.

“These metrics underscore a more deliberate, negotiation-driven market where leverage is shaped less by headline inventory counts and more by execution. Homes priced realistically and presented well are still transacting, while listings anchored to prior-cycle expectations are encountering longer marketing timelines and greater resistance,” said Denver County-area REALTOR® Cooper Thayer.

Mountain and resort markets faced additional challenges resulting from unseasonably light snowfall and reduced winter visitors.

“We’ve seen the impact from the lack of snow for the resorts and the cancellation of visitors from the Christmas season,” said Vail-area REALTOR® Mike Budd. “Reports indicate a minimum cancellation level of 25%. This is very significant as it impacts all aspects of the resort community from an economic standpoint including real estate. Regretfully, it is impossible to make up for this shortfall as January continued with snow issues and the three months left in the season would require extraordinary snow fall to close the gap.”

Despite the slow start, there is cautious optimism heading into the rest of 2026.

“Buyers appear to be waiting for the right moment and may reengage as confidence improves. Sellers, however, must be realistic. Properties need to be well-prepared, presented and accurately priced from the outset. This is not a market for testing ambitious pricing as pricing correctly has become more critical than ever for achieving a successful sale,” said Gunnison/Crested Butte-area REALTOR® Molly Eldridge.

Statewide, attached housing continues to lag behind with condominiums and townhomes impacted by rising HOA dues and insurance costs leading to longer and more challenging sales cycles and overall softer demand.

“High HOA fees driven largely by rising insurance premiums are significantly impacting affordability and limiting buyer interest in these property types,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

As spring arrives, a growing inventory and interest-rates will be critical factors to watch.

“The traditional jolt we often see at the beginning of the year has been softer than expected,” added Moye. “As 2026 unfolds, sellers may need to recalibrate expectations while buyers continue to benefit from increased leverage, longer decision timelines and stable pricing.

The coming year may be defined by steady but uneven activity, disciplined pricing, and successes driven by value and preparation rather than that sense of urgency.

Colorado Housing Markets – December Snapshot

Based on analysis from REALTORS® working in markets across the state

(for a more in-depth analysis by market, see full content in report):

Aurora – Aurora’s housing market is shifting toward buyers as inventory rises across all ZIP codes and prices decline. The median single-family price is $490,000 with 65 days on market and roughly 750 active listings. Arapahoe and Adams counties both saw modest year-over-year price declines, while Southeast Aurora prices fell about 7%. Buyer activity is increasing, with more showings and contracts. Well-priced, move-in-ready homes are selling, but sellers must remain competitive to succeed.

Boulder and Broomfield counties – Boulder and Broomfield counties began 2026 on different paths, though both remain buyer-leaning. In Broomfield, single-family listings jumped 26%, but closed sales fell 20%, pushing days on market to 68 while prices stayed flat. Boulder sellers were more cautious, with listings down 5.4%, yet buyers remained patient, extending days on market to 84 with no price growth. Condos and townhomes lag due to rising HOA costs. Overall, buyers retain leverage as sellers adjust expectations

Colorado Springs – The real estate market entered 2026 sluggish and in the red, continuing the softening seen in 2025. Sales fell 10.8% year over year, median prices dipped 1.9%, and listings rose 4.9%, pushing days on market higher across the Pikes Peak Region. Buyer demand remains weak amid higher interest rates, rising layoffs, and increasing foreclosures. Inventory is expected to grow this spring, but buyers are likely to stay cautious, putting further pressure on prices and time on market.

The market is entering a more balanced phase after experiencing years of tight supply and soaring prices. During this current phase, while sales activity has slowed, the combination of high inventory and softening prices creates one of the most buyer-favoring markets seen in over a decade

Denver Metro – Denver Metro entered 2026 with improving buyer engagement but continued price discipline. New listings rose 2.2% and pending contracts jumped 7.9%, while closed sales lagged seasonally. Median prices dipped 2.7% and days on market increased, reinforcing a negotiation-driven market. Single-family homes led demand with rising pendings and tighter supply, while attached housing lagged due to HOA and insurance costs. Buyers remain selective and payment-sensitive, favoring well-priced homes as the market trends toward steady, value-driven conditions similar to 2025.

Durango/LaPlata County – January saw strong buyer activity despite fewer new listings. Single-family inventory rose 13% year over year, with pending sales up 13% and closed sales up 9%. Condos and townhomes followed a similar trend, with inventory up 27% and pending sales jumping 35%, though days on market stretched to 148 days. Durango Rural led sales growth, while Bayfield Rural remained quiet. The Purgatory Resort condo market now carries an 11-month supply, firmly favoring buyers.

Evergreen/Foothills – The Colorado Foothills market entered 2026 feeling active but operating less efficiently. Showings and contracts remain strong, yet fewer closings and longer timelines reflect affordability constraints and increased friction. Prices have held steady, supported by higher-end homes, while days on market and inventory have risen, giving buyers more leverage. Negotiation is now common, with softer list-to-sale ratios. As mortgage rates stabilize, success in the Foothills increasingly depends on precise pricing, strong presentation, and realistic expectations rather than momentum alone.

Fort Collins – As 2026 begins, Fort Collins real estate shows cautious optimism driven by inventory, buyer demand, and lower interest rates. January activity was steady, with fewer new listings and slightly higher single-family sales, while prices dipped modestly and affordability improved. Days on market increased but supply tightened. The condo and townhome segment saw stronger buyer competition and record median pricing due to limited inventory. Sellers should price competitively, as spring inventory levels and interest rates will shape market momentum.

Grand County – In January 2026, Grand County’s median prices ranged from $730,000 to $760,000, remaining flat to slightly down year over year as the market stabilized after the 2021–2022 surge. The market shifted to a balanced-to-buyer-leaning environment, with accurate pricing critical and many homes selling below list price. Inventory was higher, days on market stretched to 60–90+ days, and buyers were active but selective. Luxury homes remained strong, while condos softened, and townhomes stayed price-sensitive.

Gunnison/Crested Butte – The Gunnison–Crested Butte market began 2026 quietly, reflecting low winter activity, limited snowfall, and broader economic uncertainty. Sales and dollar volume declined year over year, largely due to fewer high-end transactions, not falling values. Showing activity has picked up, but buyer caution and contract terminations remain elevated. Inventory has edged higher, and more listings are expected ahead of summer. Sellers must price accurately and present homes well, as buyers are selective and unwilling to engage with aspirational pricing.

Mesa County – In January, Mesa County’s housing market saw declines in both new and sold listings compared to January 2025, with closed sales down 10%. While the median price held steady at $395,000, a slight dip in the average price reflects fewer upper-end sales; with 688 active listings and average days on market rising to 121, buyer interest remains present but tempered by inventory levels and interest rates heading into the warmer February months.

Pagosa Springs – January market activity picked up with warmer weather and low snowfall, drawing serious sellers and strategic cash buyers. All-cash offers helped keep prices elevated, pushing average and median prices higher as higher-end homes closed. Sold listings rose 26.7% year over year, while new listings surged 53.8%. Despite rising inventory, days on market improved slightly. Buyer momentum increased into February, with strong pending activity in both Pagosa Springs and South Fork, where lower home prices continue to attract buyers and drive new listings.

Steamboat Springs/Routt County – After a busy fourth quarter, January brought a typical slowdown to Routt County’s real estate market. Steamboat Springs saw fewer new listings and modest sales activity, with longer days on market and sellers accepting a lower percentage of list price, signaling increased buyer leverage. Multi-family inventory rose, pushing supply to six months despite higher prices. Activity in Oak Creek, Hayden, and Clark remained limited. As winter conditions improve, market activity is expected to increase, reflecting pent-up demand after the seasonal lull.

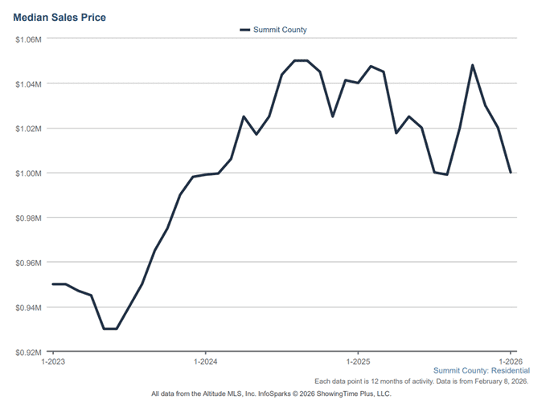

Summit, Lake and Park counties – January brought sharp-looking declines in prices, sales, and new listings across Summit, Park, and Lake counties, reflecting typical seasonal slowing and a lighter snow season that also impacted tourism and local businesses. Inventory totals 550 homes, nearly half priced above $1 million, with an average list price of $1.87 million. Sixty-three homes closed in January, 38% above $1 million and 33% cash. Despite short-term volatility, long-term resort market fundamentals remain solid.

Telluride – San Miguel County recorded 27 sales totaling $53.84 million in January 2026, down 7% in sales volume but up 5% in dollar volume year over year. Activity remains well below the five-year January average, signaling a slower market. High-end homes and condos continue to dominate sales, though some luxury properties have reduced prices 5–10% amid economic uncertainty. Meanwhile, the new Four Seasons Mountain Village project is seeing strong pre-sale activity ahead of its 2028 opening.

Vail – January continued late-2025 trends, with poor snowfall hurting resort communities and causing holiday cancellations of at least 25%, weighing on the local economy and housing market. Closed sales fell 15.9% year over year, though pending sales improved, especially for single-family homes. Inventory rose modestly, pushing supply above balanced levels. Lower mortgage rates may help entry-level buyers, but inventory will drive market direction. Upper-end sales remain cash-driven, influenced by economic confidence, lifestyle demand, and investment motivation.

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The Aurora housing market is entering a long-awaited shift in favor of buyers. Inventory is rising across all Aurora ZIP codes, bringing with it more frequent price reductions. As a result, buyer activity is increasing, showings are up, contracts are rising in several areas, and new listings are hitting the market daily. Prices have declined in nearly every Aurora ZIP code, creating meaningful opportunities for buyers.

“The median single-family home price in Aurora now sits at $490,000, with homes averaging 65 days on market and approximately 750 active single-family listings. In Arapahoe County, the median price is $565,000, down 1.7% year over year. Adams County currently has 1,116 single-family homes on the market, with a median price of $500,000. Southeast Aurora has seen some of the most notable adjustments, with prices down roughly 7% from last year. ZIP code 80015 now carries a median price of $520,000, while 80016 stands at $755,000, also reflecting a 7% annual decline.

“This environment is generating optimism. Sold listings are increasing in many ZIP codes signaling that well-priced homes in good condition are still moving. Buyers will find solid deals available, while sellers must remain competitive on price and presentation to succeed,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“While Boulder and Broomfield counties typically move in lockstep due to their close proximity and shared buyer pool, the start of the new year tells a very different story. January market data shows a surprising divergence between the two counties, underscoring a market that continues to favor buyers.

“It appears that in Broomfield County, sellers entered the new year with notable optimism. New listings for single-family homes are up 26% compared to the same period last year. However, that confidence has not yet been rewarded. Buyer activity lagged significantly, with closed sales dropping 20% over the same timeframe. The imbalance between supply and demand pushed average days on market to 68 days, signaling a slower pace of transactions. Home prices in Broomfield remain flat, unchanged from this time last year.

“Boulder County tells a contrasting story. Sellers there appear more cautious, with new listings down 5.4% year over year. Even with tighter inventory, buyers are still in no rush. Average days on market have climbed to 84 days as buyers continue to take a careful approach before committing to a purchase. Similar to Broomfield, Boulder home prices have remained flat, with no change year after year.

“Across both counties, the townhome and condominium properties remain particularly sluggish. High HOA fees driven largely by rising insurance premiums are significantly impacting affordability and limiting buyer interest in these property types.

“The traditional jolt we often see at the beginning of the year has been softer than expected. Despite differences in seller behavior between Boulder and Broomfield, both markets remain firmly in buyer territory.

“As 2026 unfolds, sellers may need to recalibrate expectations while buyers continue to benefit from increased leverage, longer decision timelines, and stable pricing,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“The real estate market began 2026 sluggish and firmly in the red. Despite what would normally be considered excellent January weather, the market remained in a deep freeze with no real signs of an early spring thaw. Overall sales declined 10.8% year over year, while the median price slipped 1.9%. At the same time, listings increased 4.9% across all property types. When we narrow the focus to single-family homes, sales were down 3.1% year over year. The Pikes Peak Region also saw an increase in days on market across all properties, reinforcing the ongoing softening trend that carried over from 2025 into 2026.

“According to ATTOM Data, Colorado now ranks among the top 15 states for foreclosure starts, with Pueblo County, south of Colorado Springs, ranking in the top three counties statewide. This marks a notable shift after many years of virtually no short sales or foreclosures. As we’ve expanded our local searches, both are now appearing more frequently. Locally, we’re also seeing hedge funds bring former rental properties to market. Inventory that would have been desperately needed just three years ago is now sitting, as buyer demand remains subdued.

“On the national level, interest rates have stabilized but remain higher than what many buyers need to comfortably reenter the market. There was some encouraging news in the third quarter of 2025, when U.S. labor productivity surged 4.9%, the fastest pace in two years and a positive signal for the broader economy. However, that optimism has been tempered by rising layoffs, including 16,000 job cuts at Amazon tied to AI-driven restructuring. Student loan delinquencies are also climbing to levels not seen since the Great Recession. In January alone, U.S. employers announced 108,435 layoffs, up 205% from December and the highest January total since 2009.

“Housing will likely remain uncertain until the broader economy finds more stable footing. Until then, the trajectory for 2026 points toward softer prices and continued low demand. I expect spring to bring a sizable increase in inventory, but buyers are likely to remain on the sidelines. If these trends persist, days on market will continue to rise, and further price pullbacks are likely as sellers become more motivated to close deals,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The Colorado Springs housing market had a slow start in January, which contributed favorably to the market’s recalibration process. The sales of single-family and patio homes dropped to 637 homes, marking the lowest level for January since 2016. This represents a 29.9% decline from December 2025 and an 8.5% decrease compared to January 2025. The monthly sales volume fell by 28.1% from the previous month and 9.3% year-over-year, reaching the lowest January figure in the past six years. The average home price dropped to $543,847, reflecting a year-over-year decline of 0.9%, while the median price was $496,950, with a 2.6% decrease.

“Additionally, homes took longer to sell with the average days on market increasing to 74 compared to 65 days in December and 68 days in January 2025. Meanwhile, the number of active listings surged to 2,843 homes, the highest level for January since 2015, showing a 13.1% increase year-over-year.

“Supply remains healthy across all price tiers with single-family and patio homes at 4.5 months, 3.7 months for homes priced under $400,000, 3.9 months for those priced between $400,000 and $600,000, 5.4 months for homes priced between $600,000 and $1 million, and a generous 9.4 months for homes over $1 million.

“Homes priced between $400,000 and $600,000 dominated sales, accounting for nearly 45% of all transactions, though this segment experienced a 9.5% decline year-over-year. Properties under $400,000 represented 29% of transactions, while homes priced between $600,000 and $1 million made up 21%. Luxury homes priced above $1 million comprised 5% of total sales, experiencing a significant 27% decline year-over-year.

“As inventory reached record levels, price reductions became more common in El Paso and Teller Counties. Sellers needed to price their homes realistically from the beginning to avoid repeated reductions. Properties need to be in good and attractive condition to draw buyers.

“The Colorado Springs market is entering a more balanced phase after experiencing years of tight supply and soaring prices. During this current phase, while sales activity has slowed, the combination of high inventory and softening prices creates one of the most buyer-favoring markets seen in over a decade,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER METRO (Seven County)

“Denver metro entered 2026 with a clearer pickup in buyer engagement compared to last year, even as pricing remained stable and negotiations continued to define outcomes. January posted 5,458 new listings, up 2.2% year-over-year, while pending contracts jumped to 3,866, a 7.9% increase. Closed sales lagged at 2,470 transactions, down 14.6% from a year ago, a gap that is typical early in the year as contract activity leads completed closings. The widening spread between pendings and sales points to improving demand rather than deteriorating conditions. Buyers are active, but they remain disciplined and highly payment-sensitive, stepping in selectively when pricing and terms align rather than acting out of urgency.

“Pricing trends continue to reflect recalibration. The January median sale price came in at $550,000, down 2.7% from last year, while the average sale price declined 2.2% to $647,832. At the same time, market velocity slowed, with average time on market rising to 80 days, a 21.2% increase year-over-year, and sellers receiving an average of 97.9% of list price. These metrics underscore a more deliberate, negotiation-driven market where leverage is shaped less by headline inventory counts and more by execution. Homes priced realistically and presented well are still transacting, while listings anchored to prior-cycle expectations are encountering longer marketing timelines and greater resistance.

“Single-family homes accounted for most of the momentum, with pending contracts rising 11.4% year-over-year to 3,082 and inventory tightening to roughly 2.4 months of supply. Closed sales in that segment declined 11.7% to 1,956, with a median price of $589,000 and an average of 77 days on market. Attached housing remains the affordability pressure point, with pending contracts declining 3.9%, closed sales falling 23.9%, and average time on market stretching to 89 days. HOA dues and insurance costs continue to weigh heavily on buyer qualification and confidence in that segment. As the market moves toward spring, the key signal to watch will be whether stronger pending activity converts into higher closings. If it does, 2026 is shaping up to closely resemble 2025: steady transaction flow, flat-to-slightly soft pricing, and a market where value and affordability determines success,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Despite 20% fewer new single-family listings entering the market in January, total available inventory increased 13% compared to January 2025. Buyer activity has been strong early this year, with pending sales up 13% and closed sales rising 9% year over year.

“Condominiums and townhomes are showing similar patterns. New listings declined 19%, yet total inventory climbed 27%, while pending sales surged 35% compared to last January—an even larger increase than seen in 2024. The hope is that many of these pending transactions will close in February, helping this slower-moving segment, where days on market jumped 72% year over year to an average of 148 days.

“Regionally, Durango rural led the market with a 54% increase in sales, while Bayfield Rural saw minimal activity as many sellers opted to wait until spring, adding just one new listing. The Purgatory Resort area continues to see strong showing activity in January, though sales typically lag until spring break. Condo inventory there has reached an 11-month supply, up 65% from last year, firmly placing the resort condo market in buyer’s territory,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“The Colorado Foothills market entered 2026 with elevated levels of activity, but January data highlights a key distinction shaping conditions. The market feels busy, yet productivity is constrained. Showings, new listings, and contract activity point to strong engagement, while fewer transactions and longer timelines reveal a market still working through underlying friction.

“Evergreen and Conifer continue to act as bellwethers for this region. Detached single-family pricing has remained stable year over year, even as days on market increased notably. This suggests that higher-end activity is supporting prices, while more typical homes are experiencing longer marketing periods, price sensitivity and increased negotiation. Affordability remains a defining challenge, with average detached home prices in the Evergreen–Conifer area still more than $1 million.

“Across the broader area, inventory conditions help explain these dynamics. Months’ supply rose roughly 9% year over year, giving buyers more options and reducing urgency. While pending activity shows ongoing buyer interest, closed sales have lagged, highlighting a growing gap between contracts and transactions completed. Days on market increased approximately 40% year over year to 82 days, reinforcing that deals are taking longer to reach the finish line and not every contract closes.

“Negotiation has become central to today’s market. Median list-to-sale price ratios softened from 98.8% in January 2025 to 96.5% this year, as price adjustments and concessions are increasingly common. These trends explain why the market appears active, open houses and steady showings, yet we see fewer closed sales than surface-level activity might indicate.

“Mortgage rates continue to influence buyer behavior. While rates have stabilized, affordability constraints persist, particularly for move-up buyers. Buyers are taking more time to evaluate options, while sellers are adjusting expectations and strategies.

“REALTOR® sentiment across the Foothills reflects our reality. The market is active but less efficient. As 2026 begins, success increasingly depends on precise pricing, property condition and favorable terms rather than momentum alone,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“As the new year begins, real estate professionals across Northern Colorado have a sense of optimism in the market as we’ve weathered the holidays and can now focus on the business at hand, helping clients take advantage of the best options and opportunities on either side of the transaction. This optimism, whether founded or not, comes after years of stagnant market progress in Fort Collins and hinges on a few key factors including, inventory, buyer demand and interest rates.

“While January is a pretty tame month with a lower sample size of transactions to project a trend, the market had no major moves. In the single-family realm, there were 199 new listings, down 9.1% compared to January 2025. Fewer new listings impacted overall inventory, which sat at 327 listings, down 6.8% from January 2025. There is a delicate balance between too many listings and not enough. We saw progress in total home sales on the heels of December decline in interest rates that brought in more buyers with January closings, up to 113, or 1.8% more than January of 2025. Median value declined ever so slightly from $600,000 last January to $589,990 this year. Remaining statistical points show some good and some bad. Days on market are up to 110 days across Fort Collins, which is the highest mark we’ve seen in at least the last 3 years but, monthly supply is down 15% to 1.7 months, along with affordability increasing 9.7% as compared to January 2025. Lower interest rates and slightly lower prices are the factors helping affordability.

“In the attached condo/townhome market, we are seeing a slightly different story. This market has been much more volatile in the last 12 months with big swings in many metrics across 2025 and little rhyme or reason. Let’s hope for more stability this year. New listings are down to 79 homes, or 4.8% less than January 2025. Active listings were also down to just 138 homes, 17.9% less than January 2025. It would appear that because the condo/townhome market is a more value-conscious and affordable option, there is more buyer competition, evidenced by a 13.6% increase in median value, the highest median value we’ve ever seen in the condo/townhome market in Fort Collins. While I do think this is a flash in the pan and prices may relax as more balanced inventory hits the market, it could be an opportunity for those attached home sellers to strike while the iron is hot.

“As it sits now, inventory levels in both attached and detached homes are at lower levels than last year. We’re keeping a careful eye on those levels as we head through February and March. If expired/withdrawn listings from 2025 get dumped back on the market in the spring, the cycle of too much inventory bogging down the market will repeat. Hopefully, interest rates, that are nearly 1% more advantageous for buyers, will be enough ammunition to take down any inventory glut we see. Sellers should stay keenly aware of their competition and price their homes competitively from the start. This is not a test-the-waters kind of market,” said Fort Collins-area REALTOR® Jared Reimer.

GRAND COUNTY

“In January 2026, Grand County’s median pricing ranged from approximately $730,000 to $760,000 across all property types. Prices were flat to slightly down year over year, showing stabilization following the surge seen in 2021-2022. Market conditions were value-sensitive with accurate pricing essential for homes to sell. By early 2026, the market has shifted to a balanced-to-buyer-leaning environment, with many homes selling slightly below list price.

“Buyers remained active but selective, with a priority on updated homes, strong views and sound pricing. Inventory levels are higher than during pandemic years, contributing to longer days on market (60-90 days) and more inventory. Reports show our months of supply above normal again reflecting slower absorption as buyers took additional time to evaluate options and negotiate.

“Luxury and resort single-family homes continue to see strong interest, particularly in Winter Park and areas with ski-access. Condo demand softened with lower volume while townhomes showed steadier activity but remain very price-sensitive,” said Grand County-area REALTOR® Monica Graves.

Grand County Resort Markets

January 2025 vs January 2026 Market Comparison

Winter Park

January 2025

- Median price roughly $1.4 – $1.5 million range

- Inventory elevated from pandemic lows

- Market slightly buyer-leaning with longer marketing times

- Typical days on market: 120–140+

January 2026

- Median price approximately $1.45M (flat to slightly down YoY)

- Inventory tightened (down 14%)

- Months supply 4.1 (more balanced)

- DOM increased to 146 days

Trend is seeing Stable pricing with improving supply balance; luxury and ski-access segments remained strongest.

Fraser

January 2025

- Median values around mid-$800,000

- Inventory moderate

- Buyer negotiation common

January 2026

- Average value approximately $790,000, down 2% YoY

- Listings stable but absorption slower

- Demand steady for townhomes and newer builds

Trend is Softening pricing but steady buyer activity; entry-level resort inventory still in demand.

Granby

January 2025

- Median price roughly mid-$500,000

- Strong new-construction and Granby Ranch activity

- Sales volume improving mid-2025

January 2026

- Prices largely flat YoY

- Continued steady demand for townhomes and ski-area properties

- Market functioning as value alternative to Winter Park

Trend is stable pricing with gradual long-term appreciation driven by affordability.

Grand Lake

January 2025

- Median values approximately $600,000 range

- Seasonal-second-home demand moderate

- Higher inventory than pandemic period

January 2026

- Pricing generally flat to slightly up

- Demand steady for lake-view and luxury cabins

- Longer marketing times vs peak 2022 market

Trend is continuing to be Balanced Market with stable second-home demand tied to recreation buyers.

GRAND JUNCTION/MESA COUNTY

“January in Mesa County was a sleeper. Everything from new listings to sold listings were down from January 2025, with solds being down 10%. The median price stayed basically the same at $395,000 but the average did slip a little , reflecting less sales in the upper price categories. We have strong indicators of buyers who want to buy, but the available inventory and interest rates are not yet getting them to actively search and put properties under contract. We do have a total of 688 active single family, condos and townhomes, and average days on market has grown to 121lly will encourage more activity in the market.

GUNNISON/CRESTED BUTTE

“The Gunnison–Crested Butte real estate market was a little lackluster to open 2026, a result that is largely unsurprising given the limited number of properties under contract at the end of last year. Prices have generally remained steady, but inventory has ticked up slightly compared to both last month and this time last year. With below-average snowfall reducing winter visitor traffic, more properties are expected to come to market, while contract activity may remain muted until the traditionally stronger summer season.

“Anecdotally, showing activity feels more active than expected, even with fewer visitors in the area. Properties under contract increased modestly from December but remain historically low overall. At the same time, buyer hesitation is evident. Contract terminations have become more common, mirroring a national trend that saw more than 16% of contracts fall apart in December 2025. Broader economic uncertainty has made buyers more cautious, leading them to take longer to commit and walk away when conditions are not ideal.

“January data should be viewed in context, as transaction volumes in the valley are typically small during this time of year. In such a low-sample environment, one or two transactions, especially at the higher end, can dramatically impact dollar volume figures. Lower overall dollar volume this January does not necessarily signal declining values but rather a concentration of sales at lower price points.

“Across the Gunnison–Crested Butte Association of REALTORS® area, sales activity declined compared to January 2025. Nine single-family homes sold in January 2026, totaling nearly $18 million, compared to 13 sales and just over $27 million last year. Condo sales were more stable, with 10 transactions versus 11 a year ago, though total dollar volume fell from $10 million to $7.6 million due to lower price points.

“In the Crested Butte area, the numbers are a bit mixed. There were 19 sales in January vs. 17 last year, but there were less high-end sales resulting in a drop in overall dollar volume from $31 million to $26 million. Single family homes sales were down by one from last January, but it was a big one. With 5 vs. 6 sales, the dollar volume dropped from $21 million to $15 million. Condo and townhome sales were level with 7 sales each year, but again the price point was lower with a drop in dollar volume from $8.6 million to $7 million.

“Gunnison experienced a slower January compared to last year, though this market is typically quieter in winter. Total sales dropped from 13 to six and dollar volume fell from more than $7 million to $2.6 million. Only two single-family homes sold in January 2026, compared to five last year, with total volume declining from nearly $5 million to $1 million. Condo sales also decreased, with two sales totaling $423,000 versus four sales and $1.5 million last January.

“Despite the slow start, there is cautious optimism heading into the rest of 2026. Buyers appear to be waiting for the right moment and may reengage as confidence improves. Sellers, however, must be realistic. Properties need to be well-prepared, presented and accurately priced from the outset. This is not a market for testing ambitious pricing as pricing correctly has become more critical than ever for achieving a successful sale,” said Gunnison/Crested Butte-area REALTOR® Molly Eldridge.

PAGOSA SPRINGS

“January housing market activity emerged from its usual winter hibernation, aided by unseasonably warm temperatures and limited snowfall. These conditions brought serious sellers and strategic cash buyers back into the market. Cash buyers, often older homeowners with significant equity or buyers relocating from higher-cost markets, used all-cash offers to remain competitive, helping keep home prices elevated compared to last January. As a result, both average and median sales prices increased, driven by higher-priced homes closing. Sold listings rose 26.7% year over year to 19 homes, while new listings surged 53.8% to 40 units,” said Pagosa Springs-area REALTOR® Wen Saunders.

PAGOSA SPRINGS

Average Sales Price $651,148 (+11.4%, over the 2025 price of $540,000)

Median Sales Price $635,000 (+17.6%, over the 2025 price of $584,460)

Days On Market 126 (-5.3% from 133 Days)

SOUTH FORK

Average Sales Price $408,400 (-23.6%, over the 2025 price of $534,600)

Median Sales Price $295,000 (-38.5%, over the 2025 price of $480,000)

Days on Market 189 (+45.4% from 130 Days)

“Despite rising inventory, there is encouraging news for sellers as average days on market declined slightly from 133 days in 2025 to 126 days in January. Buyer activity has also picked up. In February, 32 homes were pending, with 25 of those going under contract in January. South Fork showed similar momentum, recording 17 pending homes, 15 of which went under contract in January. This activity comes even as days on market remain elevated and price gains in average and median values have softened. South Fork’s relatively lower home prices continue to attract both buyers and sellers, with new listings rising 40% to 14 homes.

“Spring inventory may arrive earlier than usual if lighter snowfall continues. In Pagosa Springs, more than half of the available homes remain priced above the median reinforcing the need for realistic pricing. Buyers are increasingly thoughtful, valuing long-term lifestyle benefits of this region. Sellers are adapting to longer marketing timelines, especially for homes priced above average and median levels. Competitive pricing, strong presentation, completed repairs, staging and, in some cases, concessions are once again essential to attract buyer interest.

“Land activity also remains strong in both markets, particularly among buyers planning to retire or build within the next five to seven years. Rising land prices have positioned landowners without building plans well for 2026. Early February data shows 15 land parcels pending in Pagosa Springs, with seven under contract in January, while South Fork recorded nine parcels pending, eight of which went under contract in January. Current inventory includes 280 land parcels in Pagosa Springs and 145 in South Fork, providing ample selection. Buyers, sellers and real estate professionals are encouraged by the strong engagement as 2026 gains momentum,” said Pagosa Springs-area REALTOR® Wen Saunders.

STEAMBOAT SPRINGS/ROUTT COUNTY

“After a blizzard of fourth-quarter activity, January brought its customary calm to the market. Single-family homes in Steamboat Springs saw just 11 new listings, down from 19 last January. Buyers had 61 homes to choose from across all price ranges, from $799,000 to $16.6 million, with an average list price near $5 million. Five homes closed during the month, three more than last year, taking an average of 103 days to sell at an average sales price of approximately $1 million. With reduced competition, sellers accepted an average of 92.4% of asking price, compared to 95.1% a year ago, signaling increased buyer leverage and more motivated sellers.

“Multi-family activity in Steamboat also slowed with fewer new listings and six fewer sales year over year. Despite lower transaction volume, the median sales price rose 4.3% to $897,000, while the average sales price jumped 36.2% to $1.4 million. Days on market increased to 122, and condo/townhome inventory climbed to 180 units, resulting in a six-month supply.

“Oak Creek recorded the county’s highest home sale at $5.375 million. The property, located near Steamboat city limits, featured a 5,702-square-foot estate on 37 acres with equestrian facilities. Time on market in Oak Creek has extended to nearly six months, with 11 active listings representing a four-month inventory. In the multi-family segment, seven properties are listed, with one additional unit under contract.

“In Hayden and Clark, each area added just one new listing. Hayden currently has 12 homes and five condos or townhomes available and recorded one home sale at $465,000. Clark posted two sales with an average price of $705,000. With only three homes on the market and an average of 81 days to sell, Clark’s months’ supply stands at a tight 1.4.

“Much like Colorado’s slow start to snowfall this season, real estate activity eased in January as both buyers and sellers waited for clearer conditions. As snowfall and seasonal momentum build in February, we anticipate a corresponding pickup in market activity, releasing pent-up demand following the winter lull,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT AND PARK COUNTIES

“Our January numbers look dramatic at first glance with a notable drop in average pricing, number of sales, and new listings. Seasonal slowdowns are expected and a lighter snow season has likely dampened some winter purchase enthusiasm while also softening tourism activity. Local businesses and housing related sectors felt the impact and community organizations reported increased demand for assistance from local families. Tourism remains the economic lifeblood of our region, so we are all doing our snow dances in hopes that the second half of winter delivers a strong snow cycle,” said Summit-area REALTOR® Dana Cottrell.

Summit County – January 2026 compared to January 2025

Single-Family Homes:

• Number of Sales: 25% fewer single-family homes sold

• Average Price: $1,764,489, a 30% decrease compared to January 2025, and down 7% compared to the full year average in 2025

• New Listings: flat compared to last year at 29

Multi-Family Homes:

• Number of Sales: 32% fewer sales

• Average Price: $765,369, down 25% compared to January 25, and down 15% compared to the full year average in 2025

• New Listings: Down 11% from January 2025

Park County – January 2026 compared to January 2025

- Number of Sales: 27% fewer sales

• Average Price: $419,338, a 32% decrease from January 2025, and down 38% compared to the full year average in 2025 - New Listings: Down 19% from last year

“Across Summit, Park and Lake counties, 550 residential listings are currently on the market, ranging from an $80,000 mobile home in Park County to a $21 million ski-in/ski-out Breckenridge home. Nearly half (48%) are priced above $1 million, with 42 listings over $5 million. The average list price is $1,872,663.

“In January, 63 residential closings ranged from a $226,700 single family home in Park County to a $3.8 million Silverthorne home. About 38% of sales closed above the $1 million mark, and cash deals were 33% of all transactions.

“While price declines may grab headlines, one month of data in a small sample market can create big percentage swings. Long-term fundamentals in our resort markets remain steady, supported by lifestyle demand, limited land supply and expected continued interest from second home buyers,” added Cottrell.

TELLURIDE/SAN MIGUEL COUNTY

“The January 2026 real estate activity in San Miguel County totaled 27 sales and $53.84 million in dollar volume, a 7% decline in the number of sales but a 5% increase in the dollar amount of sales compared to January 2025. Activity remains well below the five-year average of 39 sales and $70.06 million for the last five years January sales, reinforcing the trend of a slowing market pace. Pricing trends highlight a continuing concentration of the top of the market category both in homes and condominiums affecting the market. However, the last six months have noted some of the pricier homes and condominiums are starting to lower their initial pricing prices 5% to 10%. In my opinion, the wealthy are just responding to a national concern about the U.S. economy. When the economy gets harder to predict, some sellers and buyers get a bit cautious.

“The new Four Seasons Hotel and private condominiums have had robust pre-sale activity so far. The $1 billion project has 52 hotel keys and 69 residences located in the Mountain Village and is scheduled to open in 2028,” said Telluride-area REALTOR® George Harvey.

VAIL

“We’ve started the year following the trends that came to the fore in the second half of 2025. We’ve seen the impact from the lack of snow for the resorts and the cancellation of visitors from the Christmas Season. Reports indicate a minimum cancellation level of 25%. This is very significant as it impacts all aspects of the resort community from an economic standpoint including real estate. Regretfully, it is impossible to make up for this shortfall as January continued with snow issues and the three months left in the season would require extraordinary snow fall to close the gap.

“Closed sales were down 15.9% versus January 2025 with single family/duplex down 25.9% and town house/condo -11.1%. Pending sales for the two categories were up 36.7% and 2.6%, respectively. Inventory of active listings for single family/duplex were up 5.9% and townhome/condos were up3.8%, which translates to 6.7 months’ supply and 5.3 months’ supply for the categories,” said Vail-area REALTOR® Mike Budd.

Trends by pricing niche have been consistent at the lower and upper niches with fluctuations in between:

Price % units % dollars

< $1 million. 38 13

$1-$2 million 16 10

$2-$3 million 15 17

$3-$4 million 21 33

$4-$5 million 5 11

$5 million-plus 5 16

“As we move forward, lower mortgage rates will help the opening price points however, inventory will be the controlling factor. The upper price niches are predominately cash buyers and the general economy impacts them, along with the motivation for purchase. Lifestyle and investment are the two primary motivations and lifestyle is the more inclusive factor across all price points.

“We hope for more snow to improve the economy for the valley. If we don’t get the snow the economy will suffer across the board and businesses, along with jobs, will decline accordingly,” added Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The January 2026 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.