Single-Family Housing Prices Level Off in Much of CO

New listings, sales and inventory continue to challenge most markets

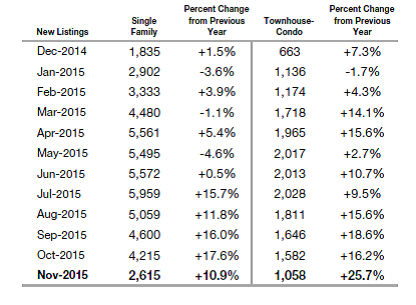

The median price of a single-family home statewide in Colorado decreased to $300,900 in November, down about $17,000 from the year’s high in June according to market statistics released today by the Colorado Association of REALTORS®. Even so, compared to a year ago, single-family home prices were 9 percent higher last month. Condominium/townhome median prices continued their steady three-year rise to $232,000 in November, up 17 percent over November 2014 and $10,000 higher than in October of this year.

Home sales were considerably lower in November compared to October, down 26 percent to 5,266 single-family homes and -27 percent to 1,765 condominiums/townhouses. In addition, single-family home sales were down 5 percent compared to November of 2014 while condominium/townhouse sales declined 1 percent compared to last year.

Together, lower median prices and declining sales in October and November may indicate market factors that go beyond the normal seasonal drops seen at this time of year. At the same time, year-to- date both of these measures are higher than in 2014 confirming a better year in 2015 for Colorado’s real estate markets.

New listings statewide dropped 35 percent to 5,292 for single-family homes and -28 percent to 1,723 for condominiums/townhouses compared to October. Moreover, they are down 55 percent and 48 percent respectively since June. However, compared to last year these low numbers are still better than at this time in 2014.

Properties are taking a bit longer to sell than earlier in the year and inventory is declining such that in November there was less than a 3-month supply of single-family homes and a 2-month supply of condominiums/townhouses in our state. Both levels of supply are significantly below the 5-7 months generally considered a balanced market that puts buyers and sellers on a level playing field.

For the full reports on each region, please visit: www.coloradorealtors.com/real-estate-statistics/

![]()

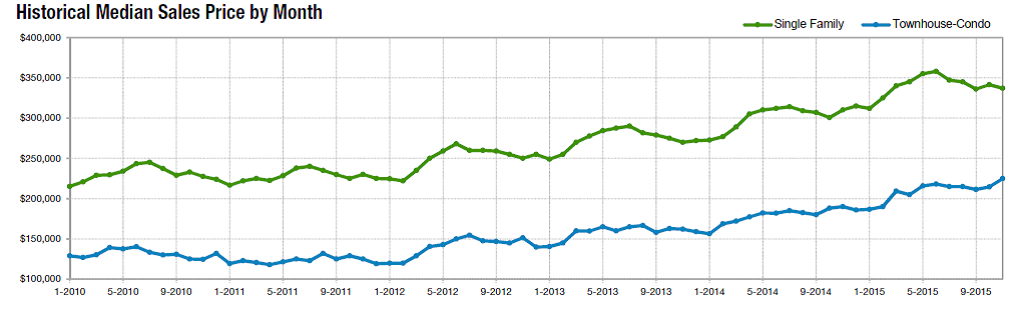

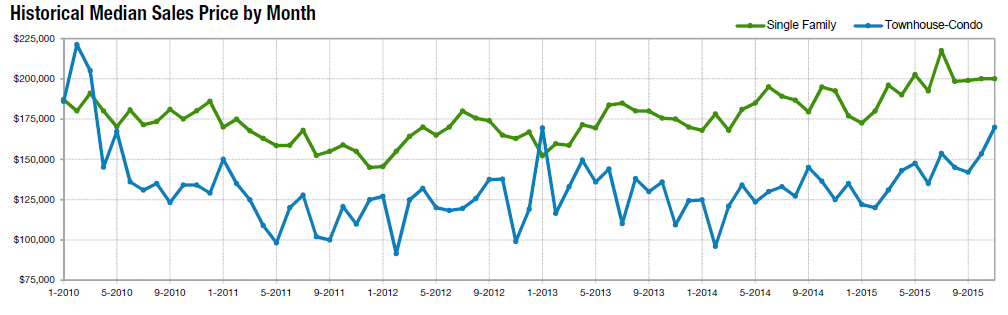

In the Metro Denver Region (Denver, Jefferson, Adams, Arapahoe, Broomfield and Douglas counties) new listings of homes for sale were lower for the fourth consecutive month. From October to November new listings of single-family homes dropped 38 percent and for condominiums/townhouses declined 33 percent. Even so, the closing months of 2015 are an improvement over 2014. Single-family home listings are 11 percent ahead of last November and condominium/townhouse listings are up 26 percent.

Sales in both categories also dropped over the last several months. Compared to October, sales of both single-family homes and condominiums/townhouses were down 27 percent. Of some concern is that sales are down -8 percent for single-family and -5 percent for condominiums/townhouses compared to November 2014.

The median sales price for a single-family home in this region slipped about $4400 to $337,000 from October and is down nearly $21,000 since June. At the same time condominium/townhouse prices continued to move upward reaching a new high for the year of $224,950. Compared to last year, median prices are up 9 percent and 18 percent respectively for the two categories.

The number of days homes are on the market before they sell (DOM) has been rising in this region since mid-summer: up 57 percent for single-family homes and +64 percent for condominiums/townhouses. The inventory of single-family homes available for purchase during November was significantly down from October (-25 percent) and from November of 2014 (-26 percent). Similarly, condominium/townhouse inventory dropped 26 percent from last month and 29 percent from last November. Rising prices and low inventory have led to a steady decline in affordability over the last three years.

![]()

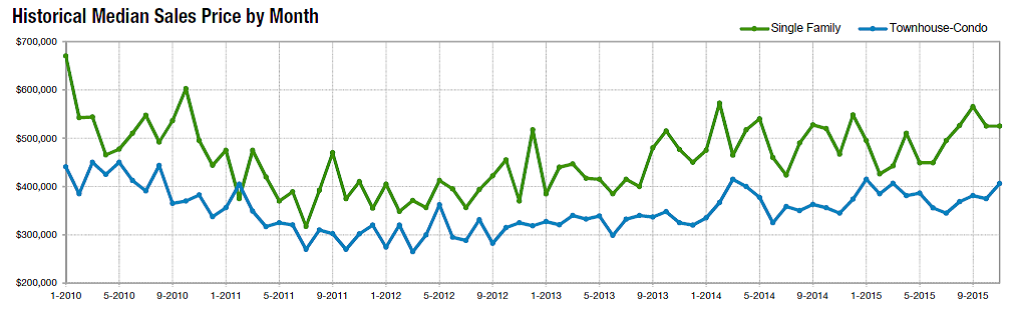

In the Mountain Region (Garfield, Grand, Gunnison, Jackson, Pitkin, Routt, San Miguel and Summit Counties) new listings follow a seasonal pattern with most of the activity taking place in the second and third quarters of the year. From October to November new listings were down 28 percent for single-family homes and 6 percent for condominiums/townhouses. Compared to a year ago, single-family listings decreased 13 percent while condominium/townhouse listings improved 14 percent.

Sales during November were slightly better than November 2014, up 2 percent in both categories. Compared to October, sales of single-family homes were down 18 percent and condominiums/townhouses dropped 34 percent.

The median sales price for a single-family home in this region in November was $525,000, the same as last month but 12 percent higher than a year ago. Condominiums/townhouses sold in November of this year outpaced the price a year ago by 18 percent, up to $406,250. In this regard, the Mountain Region follows a somewhat different sales and pricing pattern than other areas of the state.

The number of days that homes are on the market before selling (DOM) has been rising since July but are quite a bit lower than a year ago.

The inventory of single-family homes available for purchase in November was down 13 percent compared to October and -18% from a year ago. Similarly, inventory for condominiums/townhouses declined 11 percent in November as is down 27 percent from the same time last year. The supply of homes available for purchase is at the lowest level in 14 months – at around 9 months for single-family homes and 6 months for condominiums/townhouses.

![]()

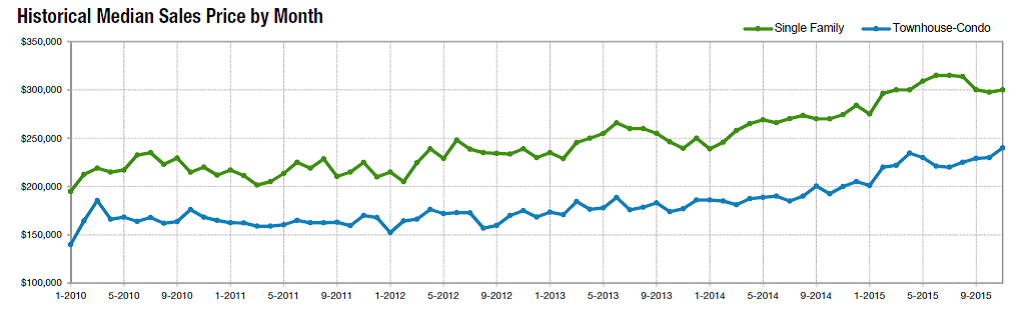

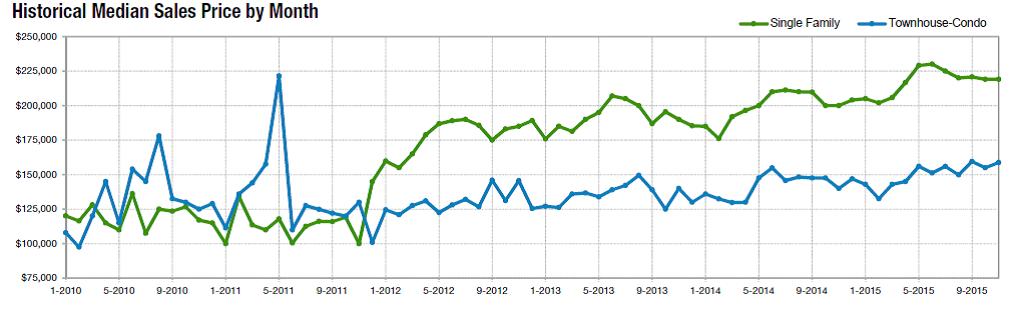

In the Northeast Region of Colorado (Boulder, Larimer, Logan, Morgan and Weld counties) new listings have dropped dramatically over the past four months. In November new listings for single-family homes declined by 34 percent compared to October while condominium/townhouse listings dropped 30 percent. The 1,106 new listings in November are less than half of what came onto the market in July of this year.

Sales of single-family homes decreased 26 percent from October to 915 while condominium/townhouse sales went down 23 percent to 208 units. Year-to-date sales are up 5 percent for single-family and 7 percent for condominiums/townhouses compared to the first 11 months of 2015.

The median price for a single-family home in the Northeast has been hovering around $300,000 for the past three months while condominium/townhouse prices have been steadily rising, hitting a new high of $240,000 in November. Prices are about 9 percent and 20 percent higher respectively over 2014.

The number of days that properties are on the market (DOM) before selling has been trending up in this region for the last several months. In November the average was 78 for a single-family home and 66 for a condominium/townhouse. The inventory of homes available has dropped significantly to the point where there was only a 2-month supply of single-family homes and 1-month supply of condominiums and townhouses.

![]()

In the Northwest Region (Delta, Hinsdale, Mesa, Moffat, Montrose, Pitkin and Rio Blanco counties) new listings of single-family homes are down 46 percent from their peak in June and condominium/townhouse listings are down 45 percent over the same period. At the same time, compared to November 2014, this region has seen an 8 percent increase in new listings for single-family homes and a 46 percent increase in condominium/townhouse listings. Year-to-date new listings are also above 2014 levels.

Sales are also down compared to October – dropping 23 percent for single-family homes and 53 percent for condominiums/townhouses. Condominium/townhouse sales are also running behind November 2014 figures, down about 12 percent.

The median price for a single-family home in the Northwest Region has been hovering around $200,000 since July with little month-to-month fluctuation. That was still 4 percent over November 2014. Condominium/townhouse median prices rose significantly over the last two months, up almost $28,000 to $169,900. Compared to last year prices in this category are up 36 percent.

Historically the Northwest Region has been one of the most affordable areas of the state in which to live. With rising prices condominiums and townhouses have been somewhat less affordable these last few months.

The inventory of homes available for purchase dropped a bit in November when compared to the previous month – down 9 percent for single-family homes and 2 percent for condominiums/townhouses. There was a 6-7 month supply of homes in the area in November, making for a balanced market, the only area of the state meeting that objective.

![]()

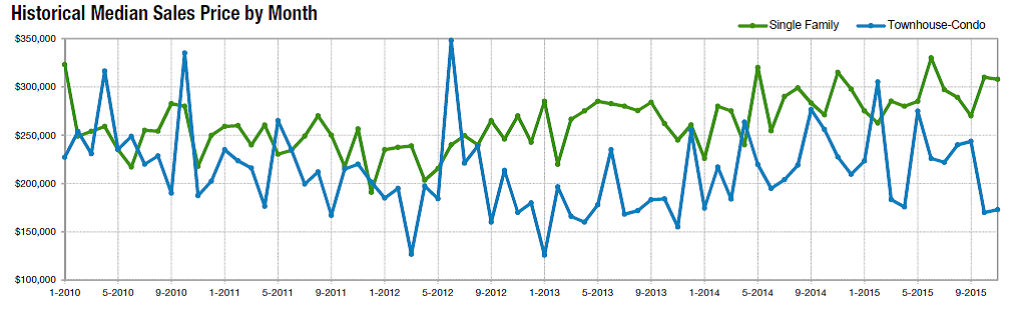

The Southeast Region of the state (Baca, Chaffee, Crowley, Custer, El Paso, Fremont, Huerfano, Las Animas. Otero, Pueblo and Teller countries) experienced a significant drop in new listings in November compare to earlier months. Single-family homes dropped 32 percent and condominiums/townhouses were down 30 percent compared to October. Single-family new listings are running about 4 percent behind November of last year while condominiums/townhouses are improved by 7 percent.

The 994 single-family homes and 139 condominiums/townhouses sold last month in this region are 26 percent and 15 percent, respectively, below October sales and considerably lower than the peak months of June and July.

For single-family homes, the median price of $219,000 in November is nearly identical to each of the previous four months. Condominium/townhouse prices are generally moving upward with November’s $158,792 nearly the highest of the year. Both categories are up compared to November 2014 – +10 percent for single-family and +13 percent for condominiums/townhouses.

The number of days that properties are on the market before selling (DOM) has dropped significantly over the year. Last month they were averaging 73 days for single-family homes and 57 days for condominiums and townhouses.

The inventory of homes available for purchase in this region has been steadily dropping since June. The 4,232 single-family homes available is 32 percent less than a year ago. And the 297 condominiums/townhouses is 47 percent less than November 2014. Together these represent about a 3-month supply, considerably less than experts recommend.

![]()

In the Southwest Region of the state (Alamosa, Archuleta, Conejos, Costilla, Dolores, Hinsdale, La Plata, Mineral, Montezuma, Saguache and San Juan counties) new listings of single-family homes dropped 31 percent in November compared to October. For condominiums and townhouses the trend is in the other direction with an increase of 12 percent over October. Compared to a year ago, both categories are doing better.

Sales of single-family homes in this region dropped 39 percent to just 89 properties in November and are down 9 percent from a year ago. Condominium/townhouse sales did a little better, rising in November and outpacing last year by 27 percent. Sales are generally lower at this time of year in this region, though the steepness of the drop in single-family homes is a little more severe.

The median price of $307,750 for a single-family home in November was down $2,250 from October and more than $22,000 from the peak in June. The median price of $172,900 for condominiums/townhouses is 24 percent less than a year ago and down significantly from earlier this year.

Already one of the most affordable areas of the state, single-family homes are a bit more affordable than a year ago (+6 percent) and condominiums/townhouses significantly so (+38 percent).

Inventory – the number of homes available for purchase during the month – dropped 11 percent compared to October for each category, approaching some of the lowest levels in years. The supply is equivalent to about 9 months of single-family sales and 6 months of condominium/townhouse sales.

![]()

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by 10K Research and Marketing, a Minneapolis-based real estate technology company, and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2015 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.

For the full reports on each region, please visit: www.coloradorealtors.com/real-estate-statistics/