Colorado Markets See Double-Digit Declines in Active Inventory

Wide range of local ingredients are flavoring housing markets across the metro area and state

Contact: Marty Schechter for CAR

303-882-4585 cell

marty@schechterpr.com

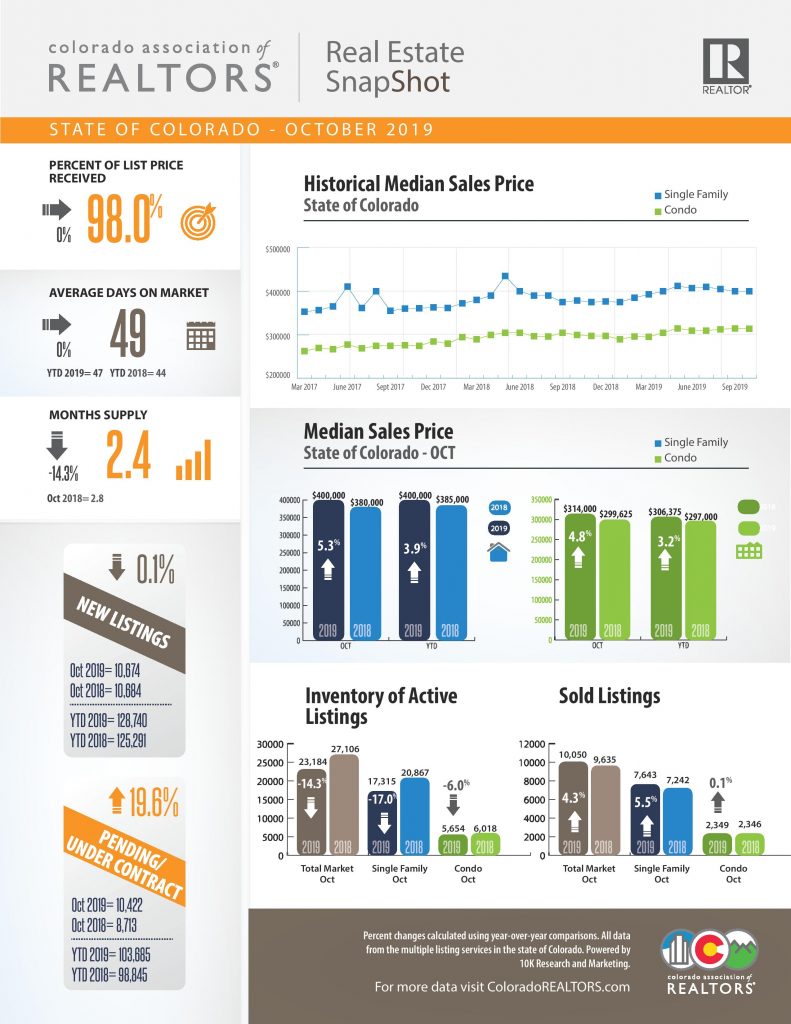

ENGLEWOOD, CO. – Nov. 12, 2019 – The anticipated seasonal slowdown in the housing market’s new listings has been met with strong pending/under contract numbers creating 13-20 percent declines in the inventory of active listings across the Denver-metro area and statewide, according to the latest monthly market data from the Colorado Association of REALTORS® (CAR). With that base recipe, a wide range of local ingredients are flavoring housing markets across the state.

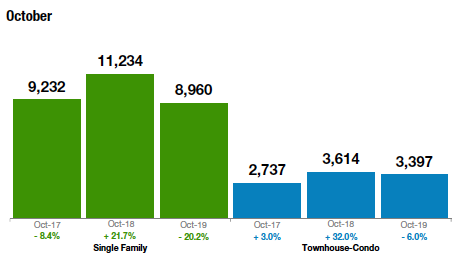

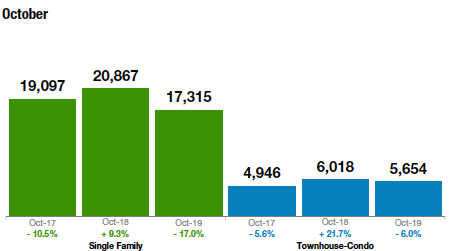

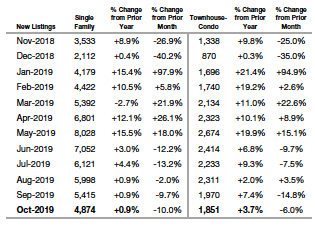

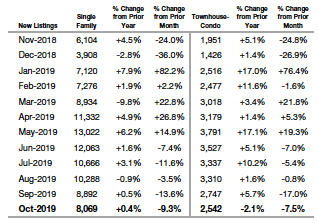

In the seven-county Denver metro area, buyers faced a 10 percent decline in new single-family listings between September and October as the inventory of active listings dipped more than 15 percent month-over-month and is down 20.2 percent from this time last year. Statewide, new listings for single-family homes were down 9.3 percent from September to October and the inventory of actives dropped more than 13 percent month-over-month and -17 percent year-over-year.

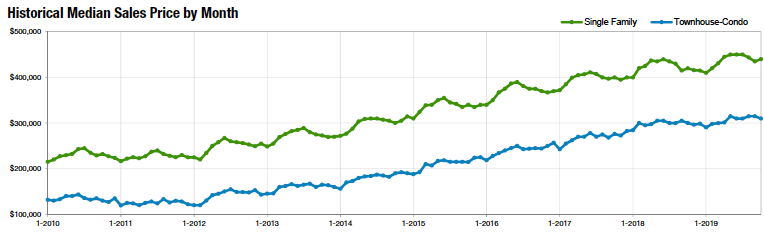

Once again, the overall lack of inventory is eliminating pricing relief as single-family homes in the metro-Denver area ticked back up 1.1 percent to $440,000 and are up nearly 5 percent over October 2018 pricing. Townhome/condos dipped slightly from September to October (-1.6 percent) to $310,000 but remain 3.3 percent higher than this time last year.

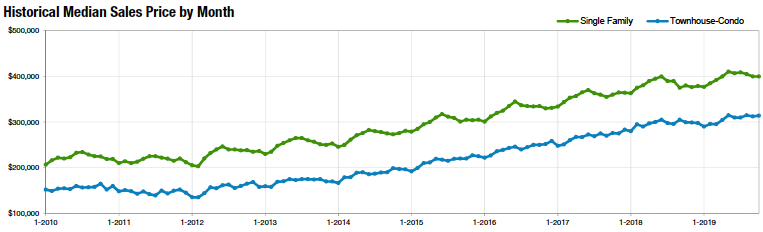

Looking statewide, the median price of a single-family home remained at $400,000, a 5.3 percent increase over October 2018. Townhome/condo median pricing across the state rose half-a-percent to $314,000 and is up 4.8 percent over this time last year.

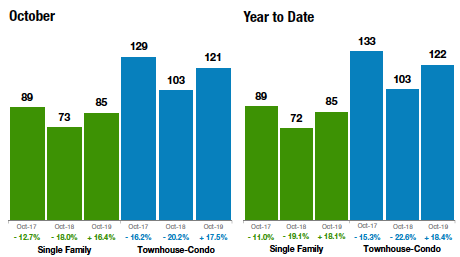

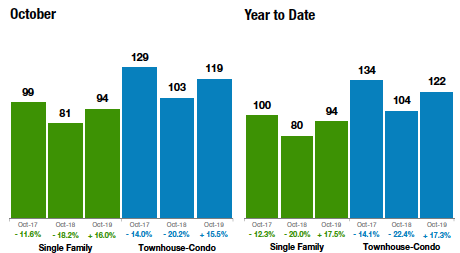

Despite declines in inventory, the CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – improved 16-plus percent year-over-year for single-family homes both in the Denver metro area and statewide to 85 and 94, respectively. The higher the number, the more affordable a region is considered to be. For townhome/condos, the affordability index improved 17.5 percent to 121 for the seven-county Denver metro area, and 15.5 percent (119) statewide from October 2018 to October 2019.

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“The question for the October numbers in Aurora would clearly be, where did all the listings go? Inventory in Aurora is down almost 30 percent from October 2018. One year ago, single-family listings in Aurora were at 876 properties compared to this October’s 619 listings. The number of new listings verses the number of sold listings is almost the same, indicating that listings are still selling quickly, despite snowstorms and typical seasonal slowdown. The median home price is at $380,000, up from $365,000 one year ago,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Boulder County’s market appears to be

frozen in time. For the first time in a long time, the median price for a

single-family home remained flat, and the market is completely flat when it

comes to appreciation. Buyers are enjoying 10 percent more listings on the

market now than we had in January. Sales are still moving briskly with an

average of 46 days on the market. Our housing market appears to be in that

fragile balancing point between a buyer and seller’s market. Condo/townhomes

are experiencing the same conditions with no appreciation since last year and a

modest increase in units for sale.

“Broomfield County, on the other hand, is enjoying a strong market with 13 percent more listings for sale, 19 percent more sold properties and a healthy 4.6 percent appreciation this year for single-family homes. With an average of 34 days on the market, Broomfield is experiencing a faced-paced seller’s market. Condos and townhomes are right there with single-family homes and it appears that this fairly affordable area in our state is attracting buyers and holding on during what seems to be a slowing market elsewhere,” said Boulder-area REALTOR® Kelly Moye.

BRIGHTON

“As the temperatures are dropping, the active inventory is rapidly following suit. With active listings in Weld County down almost 10 percent through October compared to last year, and Adams County down 39.1 percent, it’s leaving clients wondering what the next few months hold in store for the market after seeing declining inventory back in September as well. The good news is though, despite the decreasing inventory, home appreciation is still occurring with the year-to-date in Weld County’s median price up 4.2 percent to $359,418 and Adams County’s median price up 6.6 percent to $399,900. With appreciating home values, this gives buyers the confidence to know now is still a good time to buy and grow equity in the purchase of a home despite the softening market,” said Brighton-area REALTOR® Jody Malone.

COLORADO SPRINGS/PIKES PEAK AREA

“As the weather cools, the housing market does not as the Pikes Peak Region is not allowing the ‘off season’ to disrupt a strong housing market. In fact, we saw the average days on market decrease by 9.7 percent for single-family homes and 5.3 percent for townhome/condos. That is probably due to the fact that active listings for all mentioned properties were down 26.2 percent over last year at this time, leaving buyers less to choose from and paying more if they did find the right home. Sellers who think they should wait until spring to put their property on the market may want to reconsider as the lack of competition may boost their selling price.

“At the national level, starting in September the FED took some emergency precautions and pumped more than $50 billion into the REPO market in one night. This has turned into its own form of quantitative easing as they inject $100 billion a day into the REPO market to keep liquidity moving. Reason for concern? Most people don’t know it has happened and it is business as usual. But Chase and Bank of America both voiced concerns. Remember, quantitative easing was used in the 2008 housing crises. This is a ‘good’ economy and they are having serious issues with liquidity. It is clearly something to watch as the economy slows down. Also, the FED did lower rates again, showing it sees issues in the U.S. economy. The word recession continues to grab headlines as weaker than expected numbers hit from U.S. manufacturing, automotive sales, retail sales and freight. But hey, if the stock market is good, all is good?

“Worldwide, it is becoming messy. Germany admits it is likely in a recession now. Hong Kong has entered a recession. BREXIT is stirring up its own problems in Europe and the trade war with China rages on despite promises of solutions and agreements. The current administration will do all it has to in order to keep the economy looking as good as it can coming into the 2020 elections. Look for more interest rate drop talk among a divided FED and devaluation of the dollar. All options will be available to push this economy into next year. The creativity at the Federal Level will be something to marvel,” said Colorado Springs-area REALTOR® Patrick Muldoon.

“The Colorado Springs-area housing market for single-family/patio homes remains steady and strong. The year-over-year single-family home sales activity in October 2019 saw a 10 percent increase in monthly sales, an 18 percent increase in the months’ sales volume, a 7 percent increase in the year-to-date sales volume, an 8 percent increase in the average sale price, ascending to $372,037, a 10 percent increase in the median sale price rising to $335,000, and a 9 percent increase in new listings with a more than 18 percent decline in the active listings.

“When looking back 5 years and comparing the single-family/patio home sales data of the month of October 2014 with October 2019, the monthly sales are up 49 percent, year-to-date sales plus 43 percent, monthly sales volume up 116 percent, year-to-date sales volume up108 percent, average sales price up 45 percent, and median sales price up 49 percent. All of this while active listings are down 45 percent. Last month recorded the highest level of monthly sales, monthly and year-to-date sales volumes, as well as average and median sales prices compared to any month of October on record. The average days on market were 29 days and the sales-price to list-price ratio was at 99.5 percent.

“Last month, 86.7 percent of the single-family/patio homes sold were priced under $500,000, while 11.0 percent were between $500,000 and $800,000, and 2.3 percent were priced over $800,000. Year-over-year, there was a 18 percent drop in the sale of single-family/patio homes priced under $300,000, primarily due to the inventory shortage, while we had a 28 percent increase in homes priced between $300,000 and $400,000, a 52 percent increase in homes priced between $400,000 and $500,000, a 27 percent increase in homes priced between $500,000 and $600,000, and a 57 percent increase in homes priced between $600,000 and $1 million. For the first time during the past 2 years, 3 homes priced over 2 million sold in one month.

“Even in a strong real estate market, buyers generally purchase properties offering competitive values. Predictably, over 37 percent of the El Paso County and 26 percent of the Teller County active listings in the Pikes Peak MLS had price reductions. The Colorado Springs area housing market continues to be plagued by low inventory and affordability challenges due to ever-soaring prices,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER

“News from the Colorado Association of REALTORS® this month points to our seasonal slowdown also having a dash of ‘full-market-slowdown’ on top. While the ingredients still don’t point to days of gloom, the proof is in the snapshot between this year and last.

“In October of this year, the median price for Denver was down, yes, down, 1.6 percent over the last year. While that is hardly movement to write home about, it’s noteworthy to know that the previous 12-month period saw the opposite appreciation of 8.4 percent. Sellers can also expect a moderate amount of days on market this year, rising from 25 to 31. Finally, the median sale price was 115 percent of September’s in October 2018, while the same period this year, the median sale price in Denver was just 98 percent that of the previous month. Certainly not panic-inducing, but rather more evidence that the peak of the market has passed and that a leveling out of prices could project even small depreciations in the near future,” said Denver-area REALTOR® Matthew Leprino.

DURANGO

“October year-to-date residential sales numbers are almost exactly the numbers seen in both 2017 and 2018, with 969 sales in 2019, 964 in 2018 and 955 in 2017 for total residential. On the surface, our numbers are steady, with caveats. Residential sales were boosted in 2019 because of a great snow year and busy summer tourist season at the resort, lower rates than the last two years, and our largest gas company moving out of the La Plata County area. Steady and equal numbers to last year combined with a small tick up in median price are telling signs of a market continuing to shift. Geographically, sales are shifting to Bayfield from Durango (experiencing sales numbers of plus 150 percent in 2019), which could be a price squeeze of buyers out of the Durango market,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“As temps drop, the real estate market for October 2019 was still warm in the Estes Valley. New listings are popping up at 13.8 percent for townhouse/condos and a slight 1.6 percent gain for single-family homes over October 2018. With these new listings there may be continued warmth into November. The average days on market, however, is showing signs of slowing down. Single-family homes are up to 71 days and townhouse/condos lengthened their duration 3.4 percent to an average of 91 days on the market. Sold listings are indicating the same. Townhouse/condos are down 0.4 percent and single-family homes are down 3.1 percent year-to-date. The increase in new listings, longer time on the market prior to closing, and historically low mortgage rates indicates a buyer’s market in the Estes Valley,” said Estes Park-area REALTOR® Abbey Pontius.

FREMONT/CUSTER COUNTIES

“Last minute flurries before the snow flies in the high altitudes of the Sangre-de-Cristo Mountains show Custer County sold residential units up 13.3 percent over October 2018 and new listings up a little over 50 percent as well. The median priced home in the area comes in at $230,000 for the month of October. Current inventory in the area is up slightly from last year by about 5.3 percent.

“New listings in Fremont County slowed and are down 8.3 percent over October of last year while sold listings for the month are up nearly 50 percent over this time last year. Both the median and average home prices continue to show positive increases in value. Months supply of inventory has been at or below 4.4 months for more than 2 years. It continues to be a buyer’s market with no indication of change coming in the near future,” said Fremont and Custer County-area REALTOR® David Madone.

GOLDEN/ARVADA – JEFFERSON COUNTY

“Jefferson County’s single-family home market is still going strong with a 2.5 percent increase in new listings, 13.7 percent more sold listings and a 10.5 percent increase for the median sale price from this time last year now sitting at $475,000. Home sales under $400,000 are still moving quickly with an average of 28 days on the market. Condo/townhomes are experiencing the same percentage increases for new listings and sold units except they are sitting much longer on the market at 25 days, an uptick of 31.6 percent from this time last year. The median sales price for condo/townhomes sits at $290,000.

“In the Golden-Arvada area, homes and condos are still seeing multiple offers if under $350,000, in good condition, have nice amenities, and a good location. Jefferson county is still a seller’s market however, moving more towards a balanced market,” said Golden/Arvada-area REALTOR® Barb Ecker.

GLENWOOD SPRINGS

“In Garfield County, new single-family home listings for the month of October were down almost 40 percent from October of last year. Sold listings were consistent across the same time frame, contributing to a reduction in inventory and months of supply, days on market was a brisk 59. The lack of inventory also contributed to a reduction in both the median and average sale prices.

“The townhome-condo market fared somewhat better in October. While new and sold listings stayed level, the median and average sale prices rose 38 percent and 25 percent respectively. Days-on-market was even brisker with units selling in an average of 39 days. Inventory followed the single-family market and dropped 18 percent with the months’ supply of inventory coming in at 2.9,” said Glenwood Springs-area REALTOR® Erin Bassett.

PUEBLO

“The October residential market for the Pueblo area is still coasting along without a lot of changes from September. New listings were up 5 percent, pending sales up 16.9 percent and sold listings down 10.8 percent.

Looking at year-to-date numbers, we’re feeling those changes a bit more as new listings are down almost 2 percent, pending sales are relatively flat and sold listings are down 4.2 percent. Low inventory is the big contributor as people are staying in their homes an average of 13 years compared to just 8 years in 2012, so fewer move up buyers. New home construction isn’t producing enough homes to meet demand and the new home price of $260,00 is leaving first-time home buyers out of the market,” said Pueblo-area REALTOR® David Anderson.

VAIL

“After a strong August and September, we would normally look to a decline as we begin to ramp up for ski season. However, the market continues on a solid basis and showed increases in transactions from September and increased the year-to-date sales level. The momentum is exciting, and Vail will open the mountain for skiing on Nov. 15. Just maybe we will maintain this performance through the ‘off season’ and roll into our winter sales market without skipping a beat. Pending sales are ahead of September and year-to-date we have maintained a healthy positive trend, which bodes well for November/December performance.

The only question mark is inventory as it has been lagging all year. We did show a slight increase October 2019 versus October 2018, but we are still negative for the year. Months’ supply of inventory is at 7.3 for single family/duplex which is a half a month below October 2018. The townhome/condo market is 5 months, down from 6.6 months in 2018. The inventory is particularly low in the lower sector of our price niches with a slightly better balance in the upper price points. As we start our Snow Dance for the season, we might start a dance for new listings as well,” said Vail-area REALTOR® Mike Budd.

Inventory of Active Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Inventory of Active Listings – Statewide

New Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

New Listings – Statewide

Median Sales Price – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Median Sales Price – Statewide

Housing Affordability Index – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Housing Affordability Index – Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2019 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.

CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

- Accuracy and Timeliness – MLS data are managed and monitored carefully.

- Richness – MLS data can be segmented

- Comprehensiveness – No sampling is involved; all transactions are included.

- Oversight and Governance – MLS providers are accountable for the integrity of their systems. Trends and changes are reliable due to the large number of records used in each report.

- Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 26,500 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.