May Delivers “Virtual Reality Reset”

Roar of record-setting pending sales reflect the opening up of restrictions and strong demand across Colorado’s housing markets

Marty Schechter for CAR

303-882-4585 cell marty@schechterpr.com

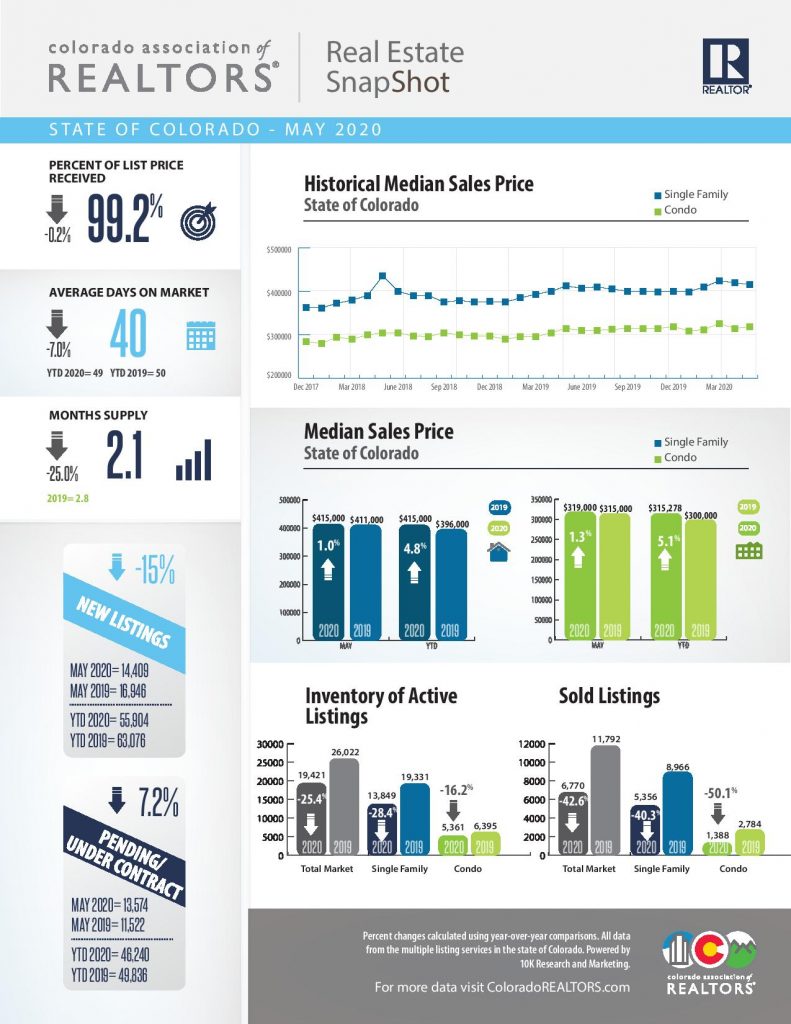

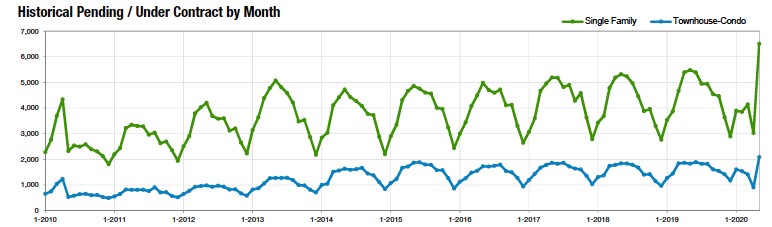

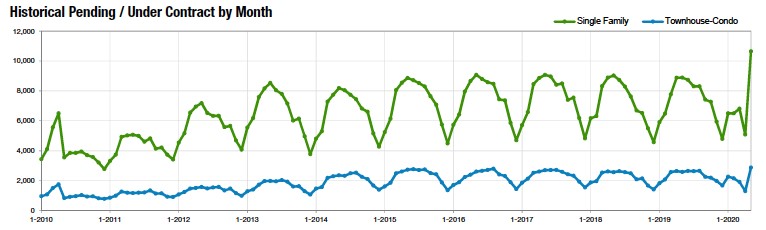

ENGLEWOOD, CO – June 10, 2020 – Virtual tours, virtual open houses, sight unseen purchases, and virtual closings have helped shape a new reality for real estate transactions across the Denver metro area and state as demand remains high and long-term inventory challenges continue to shape the markets, according to the latest monthly housing data from the Colorado Association of REALTORS® (CAR). The month of May delivered record highs for pending/under contract properties in both the seven-county Denver metro region (6,502 single-family and 2,080 townhome/condos) and across the state (10,645 single-family and 2,878 townhome/condo) since CAR began tracking the data more than a decade ago.

Pending/Under Contract – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Pending/Under Contract – Statewide

Other measurements of the seven-county, Denver-metro and statewide housing markets were mostly predictable given the conditions created by the Coronavirus pandemic and a near shutdown of the economy. The environment has caused many in the business to hit their own virtual reality reset when looking at the state’s housing performance since in-person showings were once again allowed beginning in late April. Despite the challenges, the age-old formula for supply and demand remained the key driver pushing prices up slightly over a year ago and maintained the overall strength of the state’s housing markets.

“Now that we are out of total lockdown, we have seen buyers back in the market,” said Colorado Springs-area REALTOR® Patrick Muldoon. “Many believed that with 40 million unemployed nationwide that there would be an opportunity to buy. But, once again, many buyers were let down when they re-entered the market to find multiple offers were still coming in and cash was still king. The lack of new listings has kept supply short and prices on the rise. It appears much of the bad news from COVID has left the local housing market unharmed.”

Metro-Denver Market

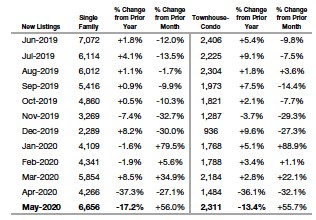

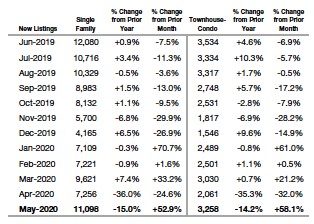

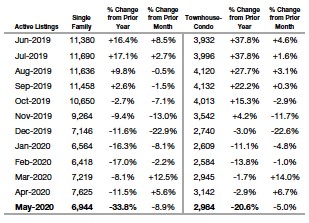

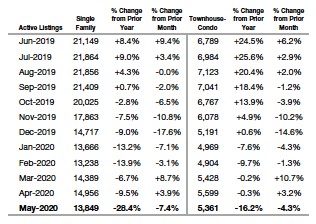

Although up 56 percent from April to May, the 6,656 new listings for single-family homes are down more than 17 percent from a year ago. Inventory of active listings is down nearly 34 percent from a year ago and the supply of inventory dipped to 1.6 months, down 36 percent from last year.

The number of pending/under contract single-family homes rose nearly 115 percent from the prior month and the 6,502 properties represent an 18.7 percent increase over May 2019 and is the highest number of pending/under contracts in more than a year. The delays caused by the shutdowns in March and April are reflected in the dip in sold listings, down more than 11 percent from April to May and are nearly -42 percent from a year prior.

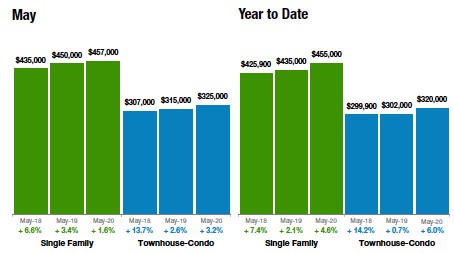

All of this was happening as the median sales price for a single-family home remained flat from the prior month at $457,000 which is up 1.6 percent from May 2019.

Statewide Market

Looking at the markets across the state, new listings rose nearly 53 percent from April to May. The 11,098 new listings are the most seen since June 2019 for single-family homes but remain down 15 percent from a year ago. Inventory of active listings is down more than 28 percent from a year ago and the supply of inventory remained flat from April to May at 2 months but is down 26 percent from last year.

Similar to the seven-county metro-Denver market, the number of pending/under contract single-family homes rose 109 percent from the prior month and the 10,645 properties represent a 19.7 percent increase over May 2019 and is also the highest number of pending/under contracts seen in well over a year. Reduced activity and closing delays throughout the spring resulted in a nearly 12 percent dip from April to May and are down more than 40 percent from May 2019.

The statewide median sales price for a single-family home dipped just more than 1 percent for the month to $415,000 but is up 1 percent from May 2019.

“May was a month of opportunity with buyers that chose to be in the housing market finding unique opportunities to secure a home with potentially less competition than they may have seen in previous months and the potential to have a bit of room to negotiate on price. The challenge for buyers continues to be a shortage of homes to pick from. With active state inventory down 25.4 percent, choices are significantly limited. This market continues to offer great opportunity for sellers who are ready to make a move, as seen in the May pending/under contract data where we were up nearly 18 percent from a year ago. Despite ‘safer at home,’ guidelines more buyers were in the market looking to buy than this same time last year and were able to successfully get a contract. Rest assured, the data supports a strong housing market as we move into summer and continued great opportunities for sellers to help meet the needs of buyers by getting their homes on the market now,” said Denver-area REALTOR® Karen Levine.

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“Sold listings in throughout Aurora and Centennial reflect the activity across most of the Denver-metro area over the past few months as COVID and the stay-at-home orders impact the market and the ongoing issues around our lack of inventory. In Aurora, inventory was down between 42-61 percent in zip codes 80010 to 80016. The 80013 zip code, which encompasses central Aurora, saw the largest dip in inventory at 61.1 percent. In May 2019 we boasted 108 active listings compared to only 42 actives in May 2020. The demand is clear to see as average days-on-market ranged from 11 to 17 days. Mix in some record low interest rates and properties are selling very quickly.

“Aurora’s median sale price was $410,000, up just more than 5 percent from May 2019. Looking a little further to the south, the median price ranged from $568,000 in zip code 20016 to $436,000 in zip code 80015.

“Active listings in Centennial were down nearly 59 percent with just 104 active listings in May that were gobbled up quickly once showings were allowed. Ironically, the median price was down 6.4 percent from last year which may reflect a stronger demand in the more moderate price range.

“As we move further into allowable showings and the market opening up with various precautions, we are noticing an uptick in listings. Demand is strong and once again, the very low interest rates are appealing to a wide range of home buyers,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Life may have pushed the ‘pause’

button, but for real estate in Boulder County, the effects were minimal and

seemingly temporary. With no showings allowed for the first two weeks of

the month, the May sold numbers were down 45 percent from last May – but prices

held their own with a modest 3.7 percent increase since last year. Even

with no opportunity to show in person for the first part of the month, 240

properties were sold and days on the market held at just under 52 days on

average. Once showing restrictions lifted, buyers in the more affordable price

ranges made a run for it, gobbling up the already limited

inventory. However, the higher end market is still experiencing the

drudgery of the pandemic as showings and sales have not yet picked up like they

did for the lower priced market. We are expecting our spring market to push

into the summer and fall.

“In neighboring Broomfield, the numbers clearly show that sellers decided to wait to list their homes, with more than 50 percent fewer listings on the market since last May. The homes that did sell, did so quickly, holding the days-on-market to around 30 days. Townhomes and condos enjoyed an 18 percent price appreciation since last May, indicating a strong demand for affordable housing. With only 1.3 months of inventory available, this area remains a seller’s market and it will be interesting to see the June sales statistics and how many sellers decided to take advantage of the high demand in this area,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS/PIKES PEAK AREA

“In the Colorado Springs area housing market, there is pent-up demand, and buyers are well aware of the dreadful shortage of inventory. So, they are competing to get the first showing and get the property under contract before all others. Unfortunately, in May 2020, housing activity was drastically restrained by the COVID-19 restrictions and requirements on showing properties to prospective buyers. Last month, there were 1,546 active listings and 1,132 sales of single-family/patio homes. The average sales price rocketed to $393,517, and the median price escalated to $350,000. The year-to-date number of sales was 5,518, with a sales volume of $2,144,046,490, the highest level in any month of May on record. The average days on the market dropped to only 21 days.

“When looking back 5 years and comparing single-family/patio home sales in May 2015 with May 2020, year-to-date sales are up 13 percent, monthly sales volume is up 15 percent, year-to-date sales volume soared 66 percent, median sales price rose 44 percent, and average sales price was up 42 percent. All of this escalation took place while active listings were down by more than 46 percent.

“Last month, 83.2 percent of the single-family homes sold were priced under $500,000, 14.0 percent were between $500,000 and $800,000, and 2.8 percent were priced over $800,000. Year-over-year, there was a more than 50 percent drop in the sale of single-family homes priced under $300,000, primarily due to the inventory shortage, while there was a 100 percent increase in homes priced over $1 million.

“Unequivocally, pathetically low inventory and affordability challenges due to ever-soaring prices continue to be the most problematic aspect of the Colorado Springs area housing market, especially for first-time homebuyers. For our local buyers, the current level of escalated prices presents a daunting challenge. However, for buyers from the Denver area, our housing prices are still very attractive. As a result, we are seeing a steadily increasing interest of Denver buyers in our Colorado Springs listings,” said Colorado Springs-area REALTOR® Jay Gupta.

“The obvious side effect of COVID was that people would keep properties off the market. In the Pikes Peak region, we saw a decrease on active listings of 12.4 percent for single-family homes and -8.8 percent on townhome/condos. No real surprise since we were in the middle of our first pandemic and a total shut down of our economy. Toss in the many unknowns and sellers were on hold. But for the sellers who did not hold off, it did not hurt them. Sight unseen showings, virtual tours, and virtual open houses took over and demand remained high. We were up 7 percent on median sales price despite the pandemic over this time last year. Supply and demand took over pushing prices up while inventory dropped.

“Now that we are out of total lockdown, we have seen buyers back in the market. Many believed that with 40 million unemployed nationwide there would be an opportunity to buy. But, once again, the buyers were let down when they re-entered the market to find out multiple offers were still coming in and cash was still king. The lack of new listings has kept supply short and prices on the rise. It appears most of the bad news from COVID has left the local housing market unharmed.

“Nationally, we hit record heights of unemployment and the FED was fast to pump in trillions of dollars of bailouts to anyone with a handout. From small business, unemployment supplements and stock buys, the Federal Reserve along with our central bank is flooding money to every sector. It is very difficult to know what the ramifications of printing so much money and then dumping it into circulation will be because we have never done it to this extent. We’ll have to keep an eye on that and see but as far as housing goes, buyers continue to struggle and sellers continue to be cashing in,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER

“The Denver Market is roaring back with a median price that in May, increased by 3 percent over last year. There were 16 percent fewer new listings compared to last year, but that number represents a 59 percent increase over the month prior. Closed sales were down a whopping 47 percent over May 2019 but that doesn’t necessarily represent a lost interest or paralyzed market. It instead reflects the two months where in-person showings were either disallowed or significantly decreased.

“Expect the delta of new listings to closings to drastically shrink next month as the absorption of these homes stays at a healthy 1.4 months of inventory in the single-family category, 2.6 for condos and townhouses,” said Denver-area REALTOR® Matthew Leprino.

DURANGO

“La Plata County saw a dramatic decline in both new listings and sold listings due to the stay-at-home order that went into effect in March. Surprisingly, sold listings were down only 20 percent in single-family residences. Townhomes and condos were hit harder with a decline of 50 percent in sold listings. May showings increased significantly, and we are predicting a very busy summer season. Durango is well-positioned as a driving destination for summer travelers not wanting to fly. Bookings for June and July are strong for the vacation rental market, indicating that people will travel sooner than expected. With restaurants and businesses reopening in the central business district, Durango is ready for visitors. We are all hoping that the market will remain strong for the second half of the year, making up for lost sales in March and April. Prices are stable and remain in line with those during the pre-pandemic months earlier this year,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“The month of May has shown a clearer view of the current economic and mental status of our community in relation to home and condo sales. With many out of work, returning to work, staying home or realizing a major change in their day-to-day lives is on the horizon, there has been a shift. Low mortgage rates help and are benefitting those ready to purchase or refinance. Some home buyers and sellers are holding off until the pandemic, financial unrest, and protests pass. This has caused a drastic reduction in closed sales. In Estes Park, closed sales have bottomed out at 87 percent less for single-family homes, and 88.2 percent less for townhouse/condos compared to May 2019. Overall, Larimer County has seen a 46.4 percent decrease in sold single-family homes and 59.8 percent less sold townhouse/condos over last year. Desire for affordability has not waned, but rather become more prevalent as evidenced by the continual increases in townhouse/condo average sale prices. Estes Park had a 21.2 percent increase over May last year. Larimer County had a 6.7 percent higher average sales price year-to-date, continuing the trend. Days-on-market for townhouse/condos has also shortened, from 95 to 46, a 51.6 percent decrease compared to May last year. This is a trend over the entire county with the average days cut to 72 from 92. Single-family homes in Estes Park have been hit hardest but show promise. New listings are up 14.3 percent over May 2019, but down 3.3 percent year to date. Average sales price has been slashed by 31 percent over May 2019, and 3.5 percent year to date. Days-on-market grew 8.5 percent from 106 to 115 days. The percent-of-list-price received dipped 2.8 percent as well over last year, leaving a deficit of 1.2 percent year to date. Larimer County single-family home sales show a different picture than Estes Park specifically. New listings were down 4.2 percent over May 2019. The average sales price from May 2019 was $475,471, in May 2020 the average price reached $486,812, a 2.4 percent increase. Days-on-market slipped from 60 to 59 days year-over-year.

“The Larimer County real estate market, including Estes Park, has been directly affected by the current health order, financial confidence, and political unrest. Low mortgage rates are helping bolster consumer confidence and keep forward momentum. However, the long-term statistics will tell a more detailed story as we have merely begun to see how our lives will be reshaped,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“If you consider March 2020 as a global ‘CTRL/ALT/DELETE’ moment (aka “hard reset”), the statistics we are seeing in the real estate market must be interpreted from the moment showings were again allowed to be conducted in person, which was April 27. All of our regularly monitored data points – days-on-market, new listings, median price, sold listings – have been ‘reset’ due to the pandemic. To compare this year to last year just isn’t terribly meaningful because of the seemingly immeasurable impact of the COVID-19 issues.

“However, the reporting for northern Colorado and Fort Collins does indicate a substantial resurgence in activity among buyers. Post April 27, we’ve seen showings increase dramatically, even as traditional Open Houses remain a Public Health Order no-no. Median prices have continued to rise since inventory remains stunted due to a pre-existing condition of short supply, followed by a reluctance from sellers to put their homes on the open market due to COVID concerns. At $437,500, the median price is nearly 3 percent higher than May 2019. Days-on-market rose 23 percent year-over-year, quite obviously due to buyers having limited access to properties during the shutdown.

“Money is cheap! The encouraging 30-year interest rates remain at historic lows and have increased buyers’ purchase power. Refinancing has also been driving lenders to distraction as the volume in that sector continues to be above the average. Now may be a great time to buy or sell and take advantage of the keen interest of buyers with more purchase power or for sellers who may be able to garner multiple offers in competitive price points,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT/CUSTER COUNTIES

“Custer County’s new listings for May were down 11.2 percent year-over-year most likely due to COVID-19 restrictions however, year-over-year sales were up 7.3 percent. Average days-on-market jumped up to 200 days, an increase of more than 20 percent. The median price of homes continues to rise for the 11th month in a row and taps in at $293,500.

“Fremont County’s new listings and sales lagged slightly over last year’s numbers due to COVID-19 restrictions. New listings were down 10.2 percent and sales were down nearly 13 percent. These lower numbers reduced the month’s supply of inventory to 2.7 months which is down 27 percent from a year prior. Even though the numbers are lower than they were in May 2019, they are up slightly from last month’s numbers. This indicates that business is picking up. Local businesses are opening their doors and traffic is increasing as nearly everyone is getting used to our new face-wear adornments. The increased traffic and temperatures will bring increased listings and sales in these next few months,” said Fremont and Custer County-area REALTOR® David Madone.

GLENWOOD SPRINGS

“The feeling of many in the local real estate world is that overall, the market in the Roaring Fork and Colorado River valleys barely missed a beat with the COVID 19 shutdown. Other than a temporary slowdown of under contracts due to the inability to show property, things seem to be back on track. We continue to be in a seller’s market with new listings down 32 percent in both the single-family and townhome/condo markets. The month of May brought pending listings up 17.6 percent over last year as buyers scramble to get a place in a market with a severe lack of housing that doesn’t look to be changing soon. On average, throughout the communities served by the Glenwood Springs Association of REALTORS®, the median sales price was up 0.6 percent, but if you look at the individual stats for each community, that data is somewhat skewed. In Carbondale for instance, the median sales price is up 57 percent over May 2019, coming in at $1,150,000 with half as many sold listings as last year. Another standout in our communities is the town of Silt, notoriously a sleeper community where housing tends to be more affordable overall, Silt saw a 45 percent decrease in new listings, a 73 percent decrease in sold listings and an 18 percent increase in the median sale price of $456,200. As the country is in a state of uncertainty, it seems that people are evaluating where they want to be live than ever and many want to be in the Roaring Fork Valley,” said Glenwood Springs-area REALTOR® Erin Bassett.

GOLDEN/ARVADA – JEFFERSON COUNTY

“In Jefferson County new listings to the market were down 57.1 percent in May with continued high demand and low inventory driving the median sale price to $485,000 for single-family homes. Sold listings were down 40.4 percent however, the days-on-market only increased 5.3 percent from this time last year to 20 days. Looking at townhome/condos, new listings also fell 19.1 percent along with sold listings decreasing 52.3 percent from this time last year. The median sale price increased slightly to $300,000.

“Brokers are once again seeing multiple offers on properties that have a good location and are in good condition. Homes and condos in the lower price range including properties in the luxury arena under $1 million are not staying on the market long. Sellers continue to have the market advantage,” said Golden/Jefferson County-area REALTOR® Barb Ecker.

GRAND JUNCTION

Grand Junction and Mesa County, although less impacted by COVID-19 itself, have definitely felt the effect on the real estate market. Comparing May 2019 to May 2020, solds are down 42.5 percent, active listings are down 27.2 percent and the median price is down 1.4 percent. One bright spot, pending sales were up 18.5 percent. However, if we look at year-over-year to date, the downs still have it. New listings are down nearly 16 percent, pending sales are down 10 percent and solds are down 12.3 percent. Currently, we have 2.2 months’ supply of inventory, but that is reflective of the down activity. If we see a strong resurgence of activity in June and July, without any significant increase in inventory, it will become a very difficult market for buyers as sellers will definitely hold the key,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS/SOUTH FORK

“After experiencing robust gains in 2020, COVID displayed its ugly self with relation to sales and listings. No surprise the average sales price slipped to about $379,000 in May (down almost 2 percent) and the median sales price came in at $325, 000 (up 1/2 percent), as inventory shortages below those prices are prominent.

“New listings were down a slacking 11.3 percent and active listings down 10.5 percent with 280 total homes on the market. Many out-of-state homeowners who would typically place homes on the market in April and May were faced with real estate broker and other field worker restrictions that complicated or eliminated the ability to photograph and market their home in traditional ways. Local sellers could take photos and provide to their brokers. Unfortunately, out-of-state sellers were on similar stay-at-home orders in their states with travel restrictions. Frankly, sellers (and buyers) were pre-occupied with COVID Stay-at-home orders applying to their day-to-day lives. Their homes were not placed on the market.

Contracts pending in May were also down (13 percent), with most of those reflecting transactions in March. It was as if April did not exist. Other home price points in 2020 are settling in the flat range. The exception are homes priced one-million dollars and higher, as there is a five-year inventory of homes. Overall, stats indicate there is an increased 7-month supply of homes.

“If there is a good light in the COVID crisis, it is that it has sparked buyers to evaluate what is important to them and their families and where they want to live (and work). Buyers are venturing to smaller communities from the larger cities. Some buyers have decided to sell their homes in larger cities (including the Front Range) and consider smaller towns like Pagosa Springs and South Fork. The Monopoly board is active and on the move,” said Pagosa Springs-area REALTOR® Wen Saunders.

STEAMBOAT SPRINGS/ROUTT COUNTY

“As expected, the month of May brought more activity as buyers and sellers started coming off of the sidelines. New listings for Steamboat single-family were down 20 percent compared to the month prior which was down 55.6 percent; however, new inventory for townhomes/condos is still very strained down more than 48 percent – slightly better than April 2020 which was down 50.9 percent. On average, sellers closing on Steamboat homes in May received 95 percent of their list price, consistent with YTD performance. Multi-family sellers received 95.8 percent of their list price with May closings and YTD at 97.1 percent. Routt County as a whole was down similarly, 21.4 percent in new listings for single-family and 48.8 percent in multi-family. Single family new listings in the first week of June totaled 22 – which is one-third of May’s performance. The town of Oak Creek and unincorporated Stagecoach was stable in May with 13 new home listings, equivalent to last year however, only three multi-family listings hit the market versus eight in the same period last year. Buyers look to Hayden, Oak Creek/Stagecoach, Clark/Steamboat Lake areas when searching for more affordable housing.

“It is interesting to note that in the last 30 days alone, there have been seven single-family homes that went under contract priced between $2 million and $5.25 million; this is in addition to five others that were pending closure prior to the quarantine. Through May of last year, there were nine homes that closed above $2 million with an average sales price of $3.1 million. Five sales have occurred above $2 million so far in 2020 with the average sales price of $4.489 million. After 9/11 – another fear-based recession – the Yampa Valley saw a surge in its upper-end real estate. Routt County is blessed with so much open space and activities that you can be naturally socially distant – I wouldn’t be surprised to have more people want to call Routt County ‘home,’” said Steamboat Springs-area REALTOR® Marci Valicenti.

TELLURIDE

“May is the first month of 2020 that COVID-19 had a big impact on Telluride real estate sales. The total number of sales was down 22 percent but, with several large monetary transactions, the dollar volume was actually up 15 percent. It appears that demand is still good, but inventory is down 29 percent year-over-year. There are 16 homes for sales in the Town of Telluride with only two of those listed under $2 million. With the cost of vacant residential lots at $1 million and up, it is hard to see homes under $2 million ever being for sale again.

“The two main items buyers are looking for are a rural setting and a separate home office room. A significant number of buyers are contracting property via live virtual tours remotely. Personally, I see this change directly affecting the way remote resort and international property is sold in the future,” said Telluride-area REALTOR® George Harvey.

New Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

New Listings – Statewide

Inventory of Active Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Inventory of Active Listings – Statewide

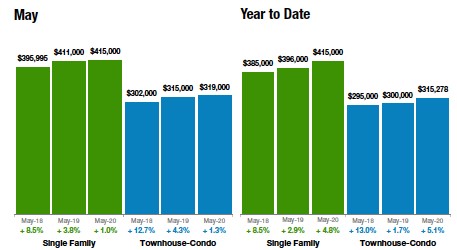

Median Sales Price – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Median Sales Price– Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The May 2020 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

- Accuracy and Timeliness – MLS data are managed and monitored carefully.

- Richness – MLS data can be segmented.

- Comprehensiveness – No sampling is involved; all transactions are included.

- Oversight and Governance – MLS providers are accountable for the integrity of their systems.

- Trends and changes are reliable due to the large number of records used in each report.

- Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 26,500 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.