Colorado Housing Markets Have A Demand Problem

Double digit appreciation and over-asking price records shattered in this ‘new norm’

Regional and Statewide Statistics

ENGLEWOOD, CO – June 10, 2021 – Having shrugged off any potential effects of the past year, including COVID-19, massive unemployment, economic uncertainty and the typical seasonal fluctuations, Colorado’s housing market continued an historic run through the month of May, according to the latest data from the Colorado Association of REALTORS® (CAR). The most fundamental elements of supply and demand – mostly demand – remain entrenched as median pricing for both single-family homes, as well as condo/townhomes, rose 2 – 3.5% in May and have appreciated as much as 25% from this time last year, once again hitting record highs.

While the supply side new inventory held its own in May, the prolonged lack of inventory overall, coupled with extreme competition among buyers, continued through the month and pushed over-asking price contract offers to new highs.

“While new listings have remained stable in comparison to 2020, the real culprit is the demand of buyers ready to pounce when a new property comes to market,” said Glenwood Springs-area REALTOR® Erin Bassett.

Circumstances have driven the Housing Affordability Index (HAI), by far the most talked about aspect of housing conditions in any corner of the state, to record lows. The CAR HAI, a measure of how affordable a region’s housing is for consumers based on interest rates, median sales price and median income by county, dipped again in May and is down between 15-19% year-over-year for all property types statewide.

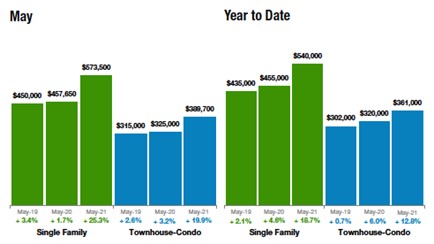

In the seven-county Denver metro area, the $573,500 median price of a single-family home is up $115,850 compared to May 2020. Condo/townhomes saw a 2.6% bump from April to May and are up just shy of 20% compared to a year prior at $389,700.

“Are we all just getting used to the ‘new normal?’” asks Boulder/Broomfield area REALTOR® Kelly Moye. “We aren’t using words like ‘unprecedented’ or ‘insane’ to describe our market anymore. The scramble for buyers to find a home and the prices they are willing to pay for them, are becoming the norm. The public is used to listings selling in 3 days for 10%-15% over list price and almost all conditions in the purchase contracts are now waived.

In Fort Collins, REALTOR® Chris Hardy said, “…Fort Collins saw its highest median price on record spike 20% in May to $533,718. In spite of all the reporting of low active inventory numbers, the Fort Collins market is selling more homes each month than in each of the past two years. Nearly every home that comes on the market is sold in the same month and there isn’t much left to choose from. As I heard one mortgage lender say the other day, ‘We don’t have a supply problem, we have a demand problem.’”

And the staggering numbers are only magnified in resort communities like Telluride.

“May 2021 broke all historical records for one month of sales coming in at $201 million with 90 transactions,” said Telluride REALTOR® George Harvey. “…up 591% over May 2020. Yes, that is not a typo.”

This monumental achievement was buoyed by the largest residential sale in San Miguel County history when Tom Cruise’s 10,000-square-foot home on approximately 320 acres about 12 minutes from downtown Telluride sold for $39.5 million.

“While January to February in years past has shown giant appreciations, this year saw its biggest yet with a $55,000 one-month appreciation for a freestanding Denver house,” said Denver-area REALTOR® Matthew Leprino. “That number trickled back down to a far more palatable $5,000 increase from April to May. With a staggering $125,000 Denver home appreciation just this year, it’s hard to call anything stable but this indication is finally showing that our market is less and less susceptible to unpredictable pandemic-related factors and is far more navigable and perhaps, dare we say, a little more predictable.”

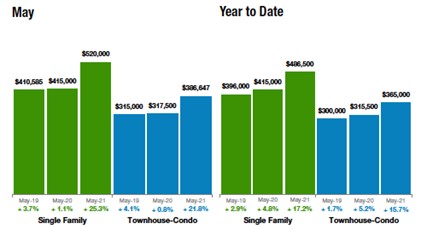

After breaking the $500,000 median price barrier in April, single-family homes across Colorado also experienced a more palatable 3.6% increase from April to May. The $520,000 median price tag is up $105,000 since May 2020.

METRO DENVER REPORT

STATEWIDE REPORT

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“The question for buyers remains the same, ‘where are all the choices?’ Active inventory is down 81% from a year ago in Aurora free-falling from the 597 listings in May 2020 to just 110 active, single-family listings today. Our median sale price is up 21% from a year ago and has broken through the $500,000 barrier. That said, Aurora still proves to be a more affordable choice than some of our surrounding communities. The townhome/condo market reflects the same low number of choices with 43 active listings in May 2021 and a median price of $305,000.

“The City of Centennial provided only 31 active listings in May and a median price of $608,000. Centennial townhomes and condos came in with a median price of $409,000 and overall sold listings are up more than 100% from May 2020.

“Booming Adams County closed out May with just 139 active listings, down 81% from May 2020.

Builders have a buyer wait list and are not guaranteeing a final purchase price due to lumber, labor and other construction costs. Plan to wait almost a year for your new home to be constructed and that is once your name comes up to the top on the list.

“Just as the rest of the Denver-metro area, buyers need to prepared for a bidding war and offers well over listed price. Patience and persistence are the name of the game,” said Aurora-area REALTOR® Sunny Banka.

BOUDER/BROOMFIELD

“Are we all just getting used

to the ‘new normal?’ We aren’t using words like ‘unprecedented’ or ‘insane’ to

describe our market anymore. The scramble for buyers to find a home and

the prices they are willing to pay for them, are becoming the norm. The public

is used to listings selling in 3 days for 10%-15% over list price and almost

all conditions in the purchase contracts are now waived.

“Boulder County is holding up that trend with listings down 14% and days on market declining every day. Boulder County experienced appreciation in the single-family home sector of 32% since the beginning of the year and while prices climb, buyers snatch up every listing they can in hopes of catching the market before it goes up further.

“The attached dwelling market is a different story in Boulder. While the numbers look strong for any typical year – sold listings up 28%, prices up 8% and days on the market down to 52 – they don’t look like the rest of the front range areas. With the university bringing the majority of the townhome and condo inhabitants, COVID significantly affected that population. Many students returned home once learning went remote and the condo townhome market in Boulder experienced a slow down while the rest of the market ramped up. I expect this will shift again in the next year as students return to campus.

“Boulder’s neighbor, Broomfield County, enjoyed 18% appreciation in single-family homes and attached dwellings so far this year. Days on market fell to around 17 days in both categories and new listings are down. The relative affordability of Broomfield continues to buoy its real estate market as buyers find it an attractive place to live, right in between Denver and Boulder,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS/PIKES PEAK AREA

“Are we headed into the roaring 20s or a great depression that followed? As everything begins to open up, we have a lot of money that has been on the sidelines, and it appears people are ready to get out and spend it. Bars and restaurants are full, theme parks across the country are coming back online and the cruise ships are ready to hit the high seas with passengers again. Summer could not come fast enough after the cold, dark, COVID winter.

“But wait, housing never even realized COVID-19 hit nor that we had a winter. And as spring came around, housing sprung up like the newly blooming flowers and just kept picking up steam through April and into May where we experienced a 22% increase in median price over the previous year and we fell more than 60% in active listings. Cash offers, appraisal gaps, escalation clauses all were in full swing as the snow melted and the rains began.

“The question many ask is how long this goes and do these high prices continue? The FED is starting to give hints that interest rates will have to come up with inflation beginning to creep in. And many would argue that inflation did not creep in, it jumped in with both feet and is now crushing the middle class with higher prices in many areas of our lives. Food prices, car prices, housing and many other areas of our lives affected by higher costs and yet are not included in the inflation numbers.

“Summer is going to be hot in both temperature and housing if interest rates and inventory stay low. If either of those change, we can expect that to work itself into the housing market quickly. Personally, I do not see how the FED raises rates. The economy now is being run on cheap money and any change to that will end the ‘fun.’ So, summertime in the Rockies will be filled with concerts, fairs, and a tight housing market,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“Every year, there is a ramp-up in price that occurs until roughly this time of year. Prices come out of hibernation in January and steadily climb through the spring months until either the highest the market can withstand halts the price or homebuying season hits its peak. This year, thankfully, the market is beginning a more predictable streak and shows signs of a further stabilized market. While January to February in years past has shown giant appreciations, this year saw its biggest yet with a $55,000 one-month appreciation for a freestanding Denver house. That number trickled back down to a far more palatable $5,000 increase from April to May.

With a staggering $125,000 Denver home appreciation just this year, it’s hard to call anything stable but this indication is finally showing that our market is less and less susceptible to unpredictable pandemic-related factors and is far more navigable and perhaps, dare we say, a little more predictable,” said Denver-area REALTOR® Matthew Leprino.

DURANGO/LA PLATA COUNTY

“The Durango /La Plata County market numbers for May look suspiciously like April, March, February…you get the point. The story here has been the same for over a year now: extreme demand outpacing critically low supply, multiple offers, homes selling over asking price, many homes being sold before ever hitting the open market, and median home prices skyrocketing to new heights.

“For single-family homes in May, new listings were down 18% from May 2020. Sold listings were up 24%. The median sales price went up more than 46% ($655,000 up from $469,000 last year), and inventory levels were down over 68%. Our townhome/condo market is even crazier, with new listings up just 2%, sold listings up 92%, and average sales price up 47% ($360,000 up from $255,000 last year). Current inventory levels are still being measured in days rather than months.

“The questions on most people’s minds are: when is this going to stop, when are prices going to come down, and of course, when is the bubble going to burst? Unfortunately, my crystal ball stopped working about a year ago, and replacement parts are on backorder due to COVID. In my humble opinion, demand is not going to slow down until interest rates begin to rise. I do not foresee prices falling in our market due to the high cost of building and continued demand for new construction, which is hovering just over $300 per square foot, according to several local builders.

“Unlike 2008, our market today is being driven by demand, not questionable financing practices. I do not think that there is a bubble looming on the near horizon. I see this as a demand issue. Durango, like the rest of the country, is years behind in meeting current housing needs. COVID has sparked new demand from urban buyers looking for a healthier, more active lifestyle in mountain towns like Durango. I believe this is the new normal for us: you will have to pay to play.

“On a more positive note, Durango is open for business, and the tourists are coming in droves. Durango expects a busier than usual summer with the historic Durango-Silverton Railroad resuming service, a better than average rafting season, and restaurants operating at full capacity. Purgatory is open with a variety of summer activities to meet all of your outdoor needs,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“Larimer County is in the same boat as other areas of Colorado with a tight, fast-paced market. Multiple offers, offers over asking, escalation clauses and waiving inspections to sweeten the deal have become the norm.

“The average sale price for a single-family home has jumped 21.9% compared to last year, townhouse/condos also saw an increase of 29.6%. While this is not quite as rapid of growth as other areas of Colorado, it is an incredible increase to the overall pricing in an already tight market. New listings are down 22.7% for single family and down 6.3% for condos.

“Overall, inventory has dropped 76.9% for single-family homes and an even bigger drop for condos at 80.6%, bolstering the frustration to snag that perfect piece of the Rockies. While fun to see the growth and desirability, working with buyers has become much harder as the competition is tough,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“The real estate market is like a wet cappuccino from Starbucks – with homes going under contract in 4 days or less, closing in 50 days or less, and for an average of 4% over list price, this market is pricey, hot, and frothy. Fort Collins saw its highest median price on record spike 20% in May at $533,718. In spite of all the reporting of low active inventory numbers – the Fort Collins market is selling more homes each month than in each of the past two years. Nearly every home that comes on the market is sold in the same month and there isn’t much left to choose from. Buying a home is literally like waiting in line for your favorite coffee at the drive-thru: if you want the coffee, you wait in line and hopefully they don’t run out before it’s your turn.

“As I heard one mortgage lender say the other day, ‘We don’t have a supply problem, we have a demand problem.’ Demand is outstripping historic trends by leaps and bounds and from an economic and demographic standpoint, this demand issue is going to be with us for the foreseeable future. The building materials and appliance shortage isn’t helping as builders scramble to build what they can – but material costs have tripled in the last 6 months; ovens, refrigerators, furnaces, and air conditioning units all need to be ordered 90, 120 to 180 days in advance of the completion date of the house. You might be able to order your house – but the completion date (and final cost) is anyone’s guess,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT/CUSTER COUNTIES

“As it is across Colorado and much of the country, it continues to be a hot seller’s market in Fremont and Custer counties. The difference is that our market prices are lower than other parts of the state. Fremont County’s median year-over-year price of $285,650 is up 24.2% over last year. So, if $285,000 is the median price in the area, it begs the question, ‘what will $500,00 or $600,000 get me in the Royal Gorge Area market?’ The answer, 3,000 to 4,500 finished square feet on a 3/4-acre lot with a great view and high-speed internet. The Royal Gorge Market always lags behind the more populous areas of the state by maybe 1 to 2 years; but as retirees in those metro areas decide to cash in on the high gains being made and discovering our affordable market, we may be catching up a bit quicker these days,” said Fremont and Custer County-area REALTOR® David Madone.

GOLDEN/ARVADA – JEFFERSON COUNTY

“For Jefferson County the numbers have been trending in the same direction since the beginning of the year. New listings for single-family homes are down 4.6%, days on market is down 66.7% followed by inventory down 73.3%. The median price for a single-family home is up 45.5% from this time last year to a record $625,000. Looking at the townhome/condo market, new listings fell 15% with days on market down 68%.

Overall, inventory is off 84.6% from a year prior as the median sales price hit $371,739.

“Builders are working as quickly as possible with a mixed bag of marketing. Some are on a lottery system that allows the buyer to put their name in the hat with hope that it’s picked when a new lot is released. Other builders have buyers bid on the lot/house when the lot becomes available. And other builders are staying with a more traditional new build buying process where the buyer comes in, picks a lot/house and signs the contract. However, most builder lot fees these days are quite high in price, another factor the buyers must take into consideration,” said Golden/Jefferson County-area REALTOR® Barb Ecker.

GLENWOOD SPRINGS/GARFIELD COUNTY

“As a REALTOR® with boots on the ground it is nothing short of a frenetic hustle out there. The Garfield County market is on fire with what appears to be no end in sight. We are experiencing a surge of homebuyers from across the state, as well as the nation. Waiving of our standard due diligence has become the norm, with multiple offers on nearly every listed property. Days on market have shrunk 61% to 35 days in the single-family sector, with townhomes being even more drastic at 27 days, a reduction of 64% over May 2020. Median sales price has risen 32% to $577,500 for single-family homes and $364,000 for townhome-condo properties, a nearly 20% increase. New listings were up 1% for single-family homes but decreased 8% in the townhome-condo sector. While new listings have remained stable in comparison to 2020, the real culprit is the demand of buyers ready to pounce when a new property comes to market. The one-year change in all properties sold was down 58.8% bringing the active listings category down a significant 62% over last year.

“The questions remain ‘How long will it last? Will inflation effect our historically low interest rates and stall the frenzy? Will the cost to build a new home continue to rise keeping sellers from trading up and allowing a healthy re-sale market?’ The future remains to be seen,” said Glenwood Springs-area REALTOR® Erin Bassett.

PUEBLO

“The Pueblo market hasn’t changed much from January, record low inventory, price appreciation, multiple offers, and an excessive number of buyers still looking. Looking at the month of May, new listings dipped 4.8% from a year ago but remain up 5.3% year-to-date. Our pending sales are also up 6.6% this year despite the median price rising 19.1% from last May and 21.3% to $265,000 year-to-date. Properties sold in May fetched 101.7% of list price.

“The story is the same for buyers, patience is the key with a willingness to go above list price. FHA and VA buyers are being left behind as sellers are taking cash or conventional financing because of fewer inspection and loan requirements.

New building permits are still strong, up 53 in May for a total of 321 year-to-date and puts us on a pace to pass last year’s 573 permits. Pueblo West has 183 permits for the year,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“’Should I stay, or should I go?’ That is the million-dollar (plus) question with median and average sales prices for single-family in Steamboat Springs surpassing seven digits. With inventory of only 39 homes for sale, 19 new listings in the month of May and 14 sales; median prices of $1.28 million and average of $1.44 million; selling now can certainly be enticing to those who have skied their last run. More affordable housing in Steamboat is achievable with townhomes and condos, with median prices for the month/YTD at approximately $650,000 and the May average sale tipping at just over $760,000. The multi-family segment saw an increase of 23% more listings than the same period last year – a time when we were unsure of what the COVID ramifications would be, and no one was traveling to the mountains to look at real estate because hotels and rentals were closed.

“Like other world-class resorts, if you want to find more affordable options, you need to go to the nearby bedroom communities, and for Steamboat those are Hayden, Oak Creek/Stagecoach & Clark. In Routt County, only the town of Hayden received more single-family listings in the month of May than the previous year. The average sale price is teetering around $400,000 and looking to climb.

“As we enter the month of June, buyers and their agents are hopeful for more inventory – reminiscent of thoughts we have about snow – when it is going to come and how much we are going to get? The law of economics of low supply is driving prices upward for existing housing inventory as well as for lumber. This has triggered even the more cost-conscientious builders to say that the starting price to build new construction is now at $500 per square foot in Steamboat. As most new construction is custom, it is providing little inventory relief. It will be interesting to see how many buyers who purchased land in the last nine months are going to be patient enough to wait for an available contractor or decide it is too expensive to build. When all is said and done, the Steamboat Springs area remains more affordable than many other world-class resorts and has the potential to become the second largest ski resort in North America if the resort is successful in its endeavors,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“We are taking a deep breath and enjoying the fresh air not filtered through masks, at least for those who have been vaccinated. Summit, Park and Lake counties are open for business which means more people will be heading up to enjoy all the summer recreational opportunities and more properties will be sold.

“Unsure of what would happen this year and anticipating that, per the norm, more properties would be listed, we were not disappointed. New listings for single-family homes in Summit were up almost 25%, pending sales were up 99% and there were 73% more homes sold for an average of 45% more money in May this year as compared to last year. Condo stats were even higher across these categories with the average sales price up 12.3%

“Even with all this activity, active listings are down almost 58%. When you exclude new construction, the median days on market is just 3 days. So, it is great news for buyers that so many more properties are coming on the market. We hope this trend continues through the summer,” said Summit-area REALTOR® Dana Cottrell.

Average Prices (% change YTD from Previous Year)

| Single Family | Year to Date | Average Price YTD |

| Summit County | 38% é | $ 1,810,804 |

| Park County | 13% é | $ 464,630 |

| Lake County | 79% é | $ 540,502 |

| Townhouse / Condo | Year to Date | Average Price YTD |

| Summit County | 12% é | $ 697,142 |

TELLURIDE

“I really thought that the Telluride regional market would start to soften a bit this year with some price resistance. Boy was I wrong. May 2021 broke all historical records for one month of sales coming in at $201 million with 90 transactions. This monumental achievement was buoyed with the largest residential sale in San Miguel County history at $39.5 million. Yes, that was that ‘Top Gun’ pilot’s 10,000-square-foot home on approximately 320 acres about 12 minutes from downtown Telluride. Additionally, a beautiful valley home about 20 minutes from Telluride in its own private valley surrounded by public land with no neighbor in sight sold for $15.9 million. May 2021 sales were up 591% over May 2020. Yes, that is not a typo. Like the first quarter of this year, buyers are reaching out of town to the beautiful valleys and mesas 15 – 40 minutes from downtown Telluride. Properties are contracting in days, not weeks. Transactions in the Mountain Village alone are up 285% in dollars and 280% in number of transactions in the first 5 months of 2021 over the same period last year.

“What is the Telluride market going to do the rest of the year? Who knows for sure, but a $16 million home in the Town of Telluride just went under contract at $2800 per square foot. But the most astounding thing I heard today was from the top home insurer in our area who pointed out that buyers are having to immediately insure homes they buy here at 20% to 25% more than they paid just to cover replacement cost. Where cost of construction for a premium home was about $700 – $1000 per square foot two years ago, those costs are up 50% today. Most architects and luxury contractors are booked two to four years out,” said Telluride-area REALTOR® George Harvey.

VAIL

May was an interesting month as in 2020 the market began the climb back from the abyss of March and April. Thus, we are moving toward a better baseline for sales when comparing 2020 to 2021. May 2020 was nothing like the second half numbers. However, in May 2021 we experienced a positive 218% increase in unit sales versus the same period in 2020. On a year-to-date basis, we show a gain of 94.8% versus 2020. The dollar value for year-to-date is $1 billion plus versus $560 million through June 30, 2020, clearly demonstrating the appreciation that has occurred from an upward mix in sales at higher price niches. The top two price niches which historically represented 4% of unit sales hit 9% of unit sales year-to-date in May. Thus, dollar volume is up more than proportionate unit sales. As June begins, it would appear that the 12-month performance from July 1, 2020 through June 30, 2021 will hit an all-time record period for sales in the valley. The pending sales for May are positive 5.7% versus May a year ago, indicative of the market movement as the year-to-date pending sales are up 90.5%.

“The causal effect of this equalization of the market trend is driven by inventory. Overall market inventory is down 59.6% while individual market niches have varying inventory levels – all negative with the exception of the top niche which has an increase of 36% availability. We are entering the traditional period of increased inventory and feel it will improve but it is anyone’s guess as to what degree. This low inventory is a catalyst to the months’ supply of inventory which would normally be 10-12 months in the market. The current months of supply for single family/duplex is 2 months, townhouse/condo is at 1.3 months for an overall market availability of 1.6 months. This compares to 6.8 months for single-family/duplex and 6.6 months supply in May 2020.

“The strong demand in the market continues and the opportunities for buyers and sellers are excellent if the objectives of both sides of the transaction are thoroughly researched and an action plan is established,” said Vail-area REALTOR® Mike Budd.

Median Sales Price – Seven-County Denver Metro Area

Median Sales Price – Statewide

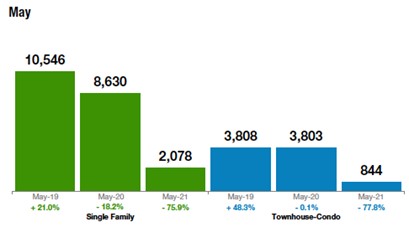

Inventory of Active Listings – Seven-County Denver Metro

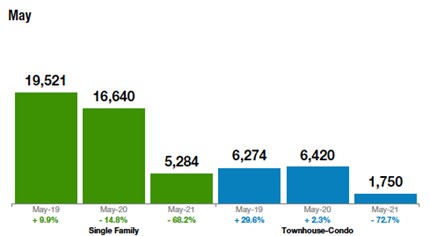

Inventory of Active Listings – Statewide

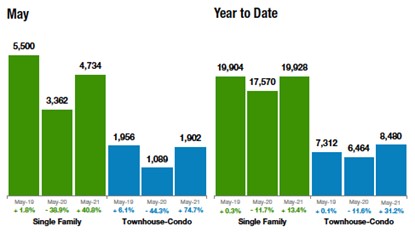

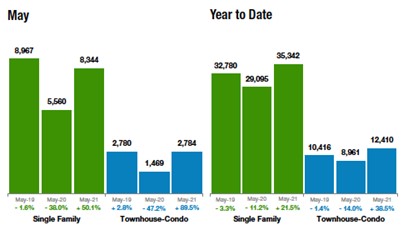

Sold Listings – Seven-County Denver Metro

Sold Listings – Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The May 2021 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems. Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 28,500 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.