March spike in new listings does little to offset home buying demand, record appreciation, and sale price

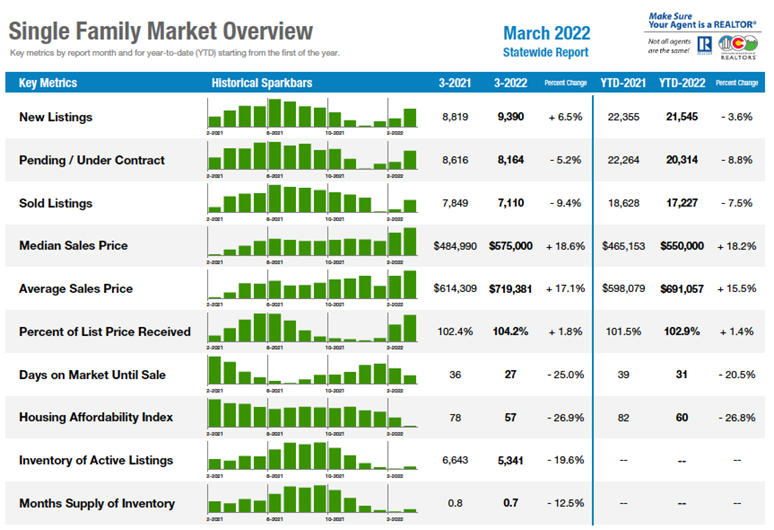

ENGLEWOOD, CO – A much-needed spike in new listings from February to March did little to quell the continued insatiable appetite for housing in markets across the state, according to the March 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

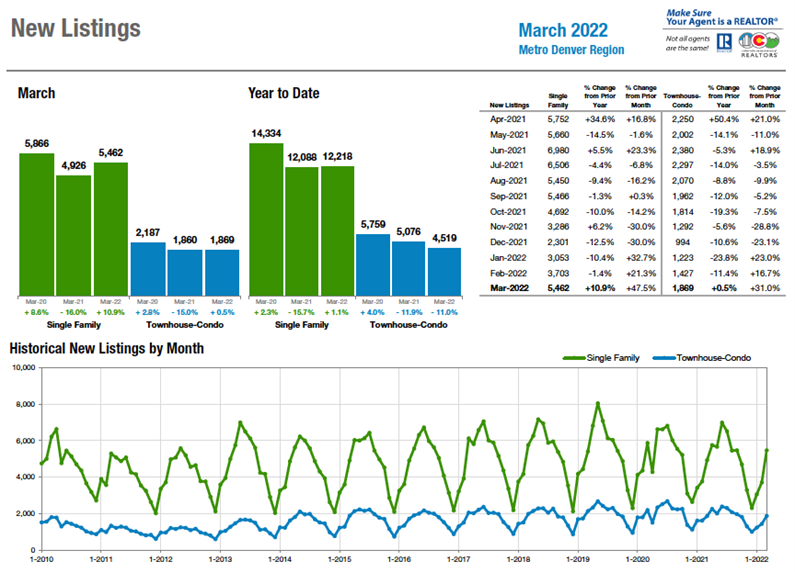

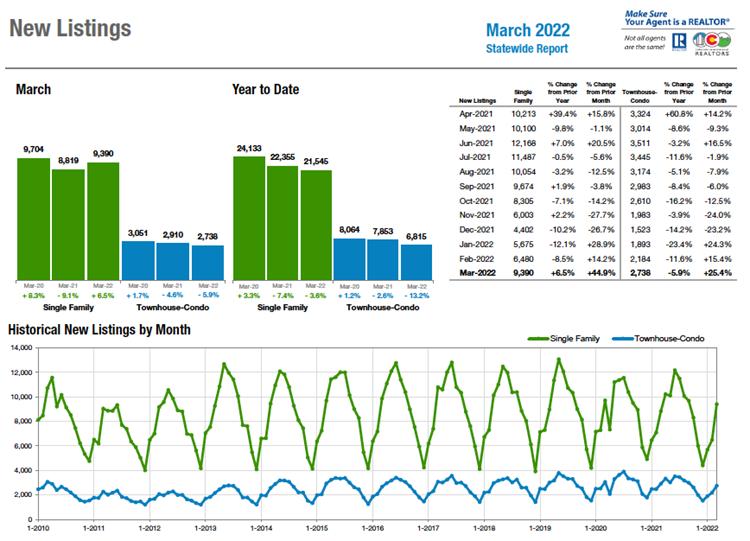

New single-family listings in the seven-county Denver metro area rose 47.5% percent from February to March 2022, while statewide new listings rose 45%. Yet the increases did little to offset buyer demand that, once again, pushed most sales over-asking price and ultimately, median and average pricing to new record highs as well.

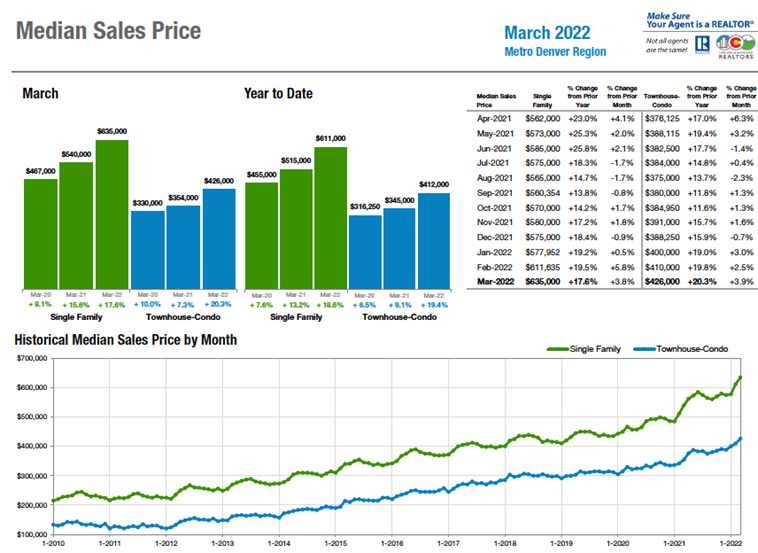

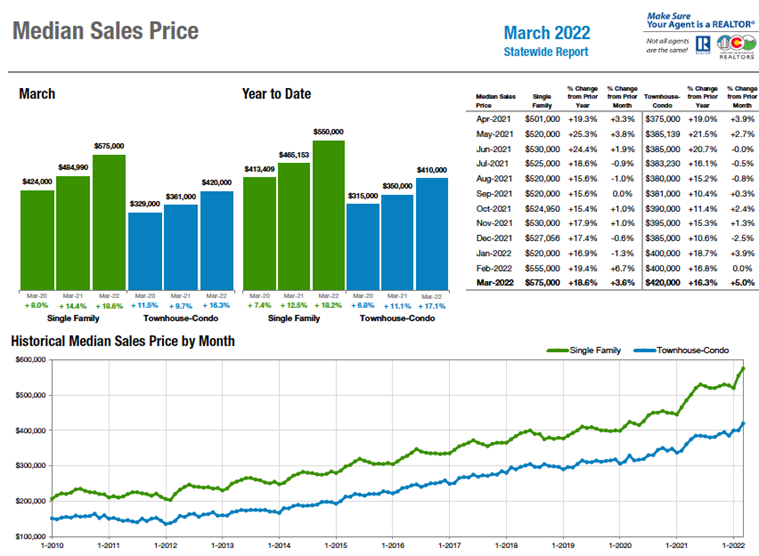

The Denver-metro single-family median price hit a record high of $635,000 in March, up 17.6% from March 2021 while townhome/condos reached a record $426,000, up more than 20% from a year prior. Statewide, the median price of a single-family home hit $575,000, while townhome/condos rose to $420,000, up 18.6% and 16.3% from this time last year, respectively.

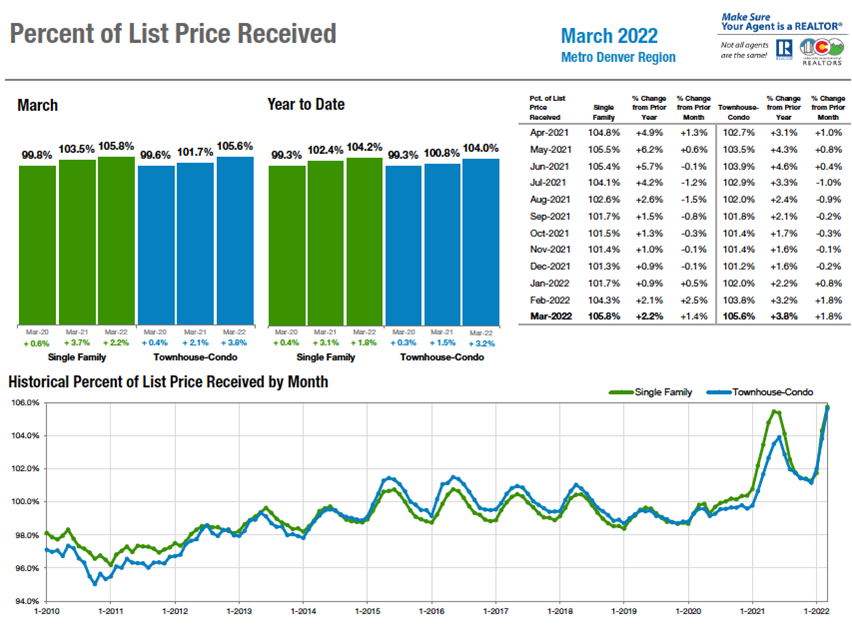

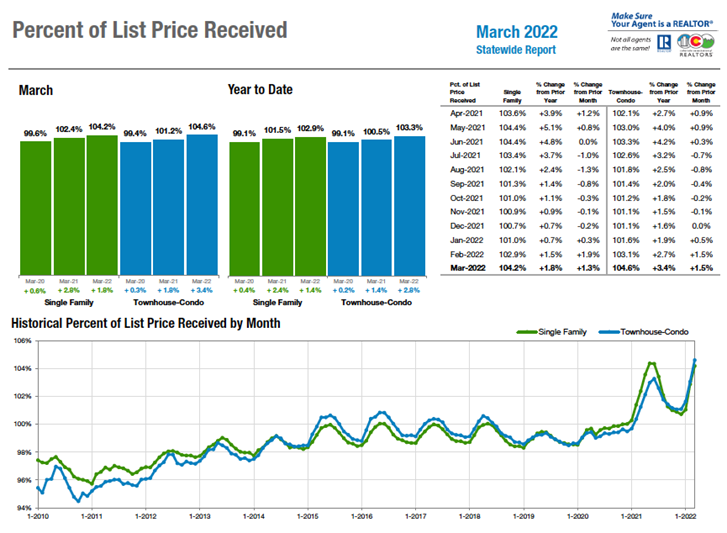

Whether in the Denver-metro area or statewide, the percent of list price received also spiked back up in March with record highs set for single family – 105.8% and 104.2%, as well as townhome/condos, 105.6% and 104.6%, respectively.

The changing economic and market conditions also had an expected impact on the CAR Housing Affordability Index (HAI), a measure of how affordable a region’s housing is to consumers based on interest rates, median sales price, and median income by county. The HAI took a double-digit hit from February to March in markets statewide and has also fallen to new record lows.

With diverse and local factors playing in across the state, here is a snapshot of select local market numbers and summaries:

- Aurora – A $100,000 price increase from March 2021 to March 2022 was no joke as the calendar turned to April 1. In almost every Aurora zip code, we saw an annual price increase of just +/- $100,000 including:

- 80011: In 2021, median price was $399,500, today, $484,000 with only 24 active listings;

- 80013: Boasted a median price of $450,000 in 2021, today $550,000 with 62 active listings;

- 80015: In 2021 had a median price of $502,500, today it is up to $632,000 with 43 total listings.

- Boulder County – Prices are up 16% since the beginning of the year ending in March with a median sales price at a whopping $1.45 million. The more affordable townhomes and condos are up 14% and holding their own. Showings are down and the number of multiple offers is lower. It does make you ask, is the slowdown right around the corner?

- Broomfield County – Single-family homes were up 7% but townhomes/condos saw only a 3% appreciation since the beginning of the year. Exhausted buyers and rising interest rates may have started a much-needed slowdown in the market but for now, buyers still battle it out and sellers enjoy inflated prices.

- Colorado Springs – Median sales price was up 17.1% on single-family/patio homes and we saw days on market decrease 7.7% on those same properties. This is occurring while we are also seeing consumer debt rise, interest rates increase, and inflation continue. Due to a lack of inventory, it seems that this is sustainable.

- Denver County – From February to March in Denver County, the average price went from $810,914 for a freestanding home to an astronomical $918,850. The median – better representing where the bulk of transactions are occurring – lags only slightly, rising from $659,000 to $745,000 – an 18.3% and 16% annual increases, respectively. With only an 8.84% increase required for the average to top $1 million, at the current monthly rate of monthly appreciation at 3.2%, we will reach that milestone as we celebrate Memorial Day 2022.

- Durango/La Plata County – Hit another all-time high for both single-family and condo average sales prices in March 2022 with single-family average sales price just under $1.1 million and condo/townhome at $531,000. With a current inventory of only 71 single-family homes on the market in La Plata County, prices are not predicted to go down anytime soon as Durango continues to morph into a true resort town. The days of bargain bin prices are behind us.

- Estes Park/Larimer County – Single-family homes have risen in price 21.6% since this time last year. This has homes sitting at approximately $675,028. Townhomes/condos are climbing the grade quicker at a 24.5% increase to $456,135 compared to 2021. Some buyers, due to the feverish climate, are choosing to stay put and continue renting. Some wait in hopes of a cooler atmosphere with less competition, others are now simply priced out of purchasing altogether.

- Fort Collins/Northern Larimer County – In the Fort Collins under $700,000 price point, every home that comes on the market has between 30-70 showings in a span of just four or five days. The median price for a single-family home exceeded $600,000 for the second month in a row. The numbers would show that, on average, a home listed at $580,000 likely sold for $603,000. The over-asking numbers for many homes however, are much, much higher – often selling for $70,000 – $100,000 over asking price.

- Glenwood Springs/Garfield County – The March standout came in the Glenwood Springs community where the median sales price for a townhome/condo was up 61% from $375,000 in March 2021 to $605,000 in the same period this year.

- Jefferson County/Golden – Homes come on the market on either Thursday or Friday and they are under contract by Monday. The median sales price increased for single-family homes to $700,000 and for condo/townhomes to $436,000.

- Pueblo – With a 99.6% sale to list price figure, the median price was up 19.2% over last March to $310,000. Inventory remains incredibly low with just a few homes under $200,000 and not too many fix-and-flips available either. New home construction is still moving forward with 174 permits pulled in Q1 2022.

- Steamboat Springs/Routt County – Saw 34 single-family active listings in March, with 30 new listings coming on and 28 going under contract – barely a month’s supply. Multi-family had 25 active listings with 45 new listings and 47 units that went under contract, putting months supply at two weeks. Average sale price for single-family was 8.8% lower this year compared to last, with year-to-date almost the same as last year at $1,479,315; multi-family average sale price for this period was slightly less than March 2021 at $775,758 however, still up 13.6% YTD equating an average sales price of $900,358.

- Summit, Park & Lake counties – Current listings range from a low-price, single-family home in Park County for $269,900 to a high price, single-family home in Breckenridge at $18.99 million. In Summit County, an average priced home is now $2.46 million

- Telluride – San Miguel County closed out the first quarter of 2022 setting an all-time sales record of $335.55 million, besting the $287.67 million in first quarter 2021.

- Vail – Although starting to feel a bit like a broken record with not enough inventory, transactions down, pending sales up, and dollar volume up, March is the first month in over a year we saw a bit of variation in components and what may be a trend toward more traditional market dynamics.

Taking a more in-depth look at some of the state’s local market data and conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“A $100,000 price increase from March 2021 to March 2022 was no joke as the calendar turned to April 1. In almost every Aurora zip code, we saw an annual price increase of just +/- $100,000 including: 80011 in 2021, median price was $399,500, today, $484,000 with only 24 active listings; 80013 boasted a median price of $450,000 in 2021, today $550,000 with 62 active listings; 80015, in 2021 had a median price of $502,500, today it is up to $632,000 with 43 total listings.

“This $100,000 median price increase is true across Adams and Arapahoe County, Aurora, and Centennial. Current inventory in Aurora is very close to the same active inventory numbers as in March 2021. Another big change is the interest rates; since January 2022, the rates have jumped almost 2%, a significant jump in just two months. For those who purchased a home a year ago, you are now enjoying some significant equity due to the price increases.

“In my 43-year real estate career, this is not the first time we have seen housing prices increase to this level. Major price increases occurred in the 1980s, the late 1990s and 2012. Just like all other goods that are increasing, we may see a decrease, but it is very rare that those price drops ever get back down to where they were. An easy way to describe the housing market is three steps forward and maybe one step back. Housing has always proven to be a good long-term investment, regardless of the interest rate,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Is this market sustainable? Lately, there has been speculation that there is a housing ‘bubble’ on the horizon. There has been a lot of talk about an upcoming recession and eventual decline of the housing market. When considering the factors that contribute to something like this – the job market, local economy, inventory vs. demand, etc., it doesn’t appear we are in for any kind of bubble to burst. That being said, interest rate hikes are doing exactly what they are designed to – slow down a market that may be out of control. The most recent hikes have taken some buyers out of the market. Boulder County’s prices are up 16% since the beginning of the year ending in March with a median sales price of a whopping $1.45 million. The days on the market continue to creep down. The more affordable townhomes and condos are up 14% and holding their own right up next to single-family homes. Showings are down and the number of multiple offers is lower. It does make you ask, is the slowdown right around the corner?

“Broomfield County is up 7% but townhomes and condos saw only a 3% appreciation since the beginning of the year. The exhausted buyers and rising interest rates may have started a much-needed slowdown in the market. It’s too hard to say now as the only way to know whether you’ve reached the top, is to see when it starts to decline. For now, buyers still battle it out and sellers enjoy inflated prices but wonder where to go next. REALTORS® hone their skills at negotiating and wonder if this market can last for much longer,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“I was not expecting a slowdown as we entered March. The writing was on the wall. Low inventory and high demand were going to continue to cause the same hikes we had seen. As the snowy season came to an end and spring was nearing, there was almost nothing that could happen to slow down rising housing prices. Sure, inflation is at 40-year highs. Sure, food prices are surging, gas is up, rents are up, and home prices still marched onward and upward. The trend has not stopped, regardless of wars, recessions, or more inflation coming as we head into the second quarter.

“With large amounts of cash out there and demand for higher R.O.I., investment firms are buying up large amounts of real estate and trying to turn profits. As they do, the middle class is getting squeezed. Since most buyers are competing now against cash buying giants like Black Rock or heading to rent from them as well, investors are in many ways controlling markets and the non-stop pursuit of profits has the average American getting pushed out of owning homes. The very fabric of America is going through changes in this sector.

“Watching home prices push up double digits again, year-over-year, is a real struggle as we approach summer. Median sales prices were up 17.1% on single-family/patio homes and we saw days on market decrease 7.7% on those same properties. This is occurring while we are also seeing consumer debt rise, interest rates increase, and inflation continue. Due to a lack of inventory, it seems that this is sustainable. I just keep feeling that at some point something has to give. Americans are getting hit on every side with cost increases and their savings are depleting. What is the straw that breaks the camel’s back?” asked Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“Remember when you were a kid and whilst skipping, you’d see just how wide of a step you could take? Sometimes it was so as to not ‘step on a crack and break your momma’s back,’ and other times it was just to see how much more your growing body could accomplish. This is, quite literally, the only way I can think to describe the housing market in Denver today. The month-to-month data isn’t something we usually follow, preferring rather to look at the greater picture and the year-over-year numbers, but that simply doesn’t work like it used to. As all real estate is local, so-too is the statistics reporting game – more like all of real estate is monthly nowadays. From February to March in Denver County, the average price went from $810,914 for a freestanding home to an astronomical $918,850. The median, better representing where the bulk of transactions are occurring, lags only slightly with a rise from $659,000 to $745,000. Both numbers represent 18.3% and 16% annual increases, respectively, and both show that the boiling atmosphere out there has transitioned into a white-hot volcano of real estate-sized proportions.

“Of note, the month’s supply, or availability of active homes, has doubled during the same February to March timeframe. Going from an impossible to comprehend 0.2 months to an equally outlandish 0.4. Now, that may not seem like much but, in real-life terms, that means 856 freestanding homes came on in March vs. February’s 475. A small, though powerful improvement.

“With the ‘million’ number beginning to be knocked around in our minds, we know that, barring anything else rising to this level of growth madness, we will reach that average number milestone sooner rather than later. With only an 8.84% increase required for the average to top $1 million, at the current monthly rate of monthly appreciation at 3.2%, we will reach that milestone as we celebrate Memorial Day 2022, skipping merrily down the road to the nearest barbeque,” said Denver-area REALTOR® Matthew Leprino.

DURANGO/LA PLATA COUNTY

“La Plata County hit another all-time high for both single-family and condo average sales prices in March 2022. For single-family homes, the average sales price came in at just under $1.1 million. The average condo/townhome sales price was $531,000. These figures are mind-blowing to locals who were able to purchase a single-family home in Durango proper 10 years ago for a paltry $384,000 or a condo or townhouse for a meager $268,000. How we wish we would have snatched those bargains up when we had the chance. Buyers who are waiting on the sidelines for prices to come down may want to consider this real-life example of what is happening in the Durango market: A luxury home closed at the end of November 2021 for $1.125 million and was never occupied by the new buyer. It went back on the market in February 2022 for $1.375 and will close later this month for very close to the asking price. More amazing, it actually appraised for the contract price.

“With a current inventory of only 71 single-family homes on the market in La Plata County, prices are not predicted to go down anytime soon. The general consensus from locals is that Durango is morphing into a true resort town, and the days of bargain bin prices are behind us. I thought it would be interesting to compare Durango’s prices to those in other resort counties. What I discovered is that for buyers looking to invest in resort markets, Durango is by far the most affordable and features a diverse economy including Fort Lewis College, a regional medical center, and a plethora of great restaurants to choose from. Adding to the appeal, Durango is a year-round oasis for outdoor enthusiasts,” said Durango-area REALTOR® Jarrod Nixon.

March 2022 Housing Statistics By County

| County | Average Price Single-Family | Average Price Condo/Townhouse | # of Single-Family Homes for Sale |

| La Plata / Durango | $1,098,620 | $531,078 | 83 |

| Pitkin | $15,051,667 | $3,684,105 | 66 |

| San Miguel | $2,725,000 | $1,907,750 | 33 |

| Summit | $2,274,421 | $759,628 | 73 |

| Gunnison | $1,982,798 | $523,688 | 54 |

| Routt | $1,515,254 | $775,758 | 43 |

ESTES PARK/LARIMER COUNTY

“It’s hard to identify the most staggering aspect of the Larimer County real estate market right now although, the first thing that comes to mind is the dramatic uptick of the average sales price in the last year. It’s not a slow and gradual incline, but rather a steep grade with no visible ceiling. Single-family homes have risen in price 21.6% since this time last year. This has homes sitting at approximately $675,028. Townhomes/condos are climbing the grade quicker at a 24.5% increase to $456,135 compared to 2021.

“The constant battle with low inventory has driven our prices higher and higher. The demand is also obvious in the percent of asking price the homes are closing at – 103.3% for single-family homes while townhomes/condos are fetching 104.3% over asking compared to last year. New listings in the single-family category were up 4.3% in March compared to a year prior however, I believe this is due to the hot market and normally slower sales during winter and early spring months in the mountains, not that more homes are actually being listed. Year-to-date, single-family homes are still behind pace, -21.2% year to date. Townhouse/condos are creeping at a turtle’s pace. Year to date new listings are down 36.1%.

“Maybe the more notable or scary figure is the months supply. If we figure the demand of homes at the pace they are selling, and how many are or aren’t on the market, the figure is scary. In Larimer County, single-family homes have 0.6 months of supply. Townhouse/condos are really suffering with a 72.7% dip in months supply compared to March 2021 and sit at 0.3 months. With interest rates on the rise, monthly mortgage payments increase with every point increase. Paired with drastically increasing prices, low inventory, and clear demand that is outmatched the real estate market, we are in for an interesting ride. Some buyers, due to the feverish climate, are choosing to stay put and continue renting. Some wait in hopes of a cooler atmosphere with less competition, others are now simply priced out of purchasing altogether. This shift in the market pricing is also being pushed down to tenants through rent payments by landlords with now increased property taxes, or by new landlords who purchased at higher prices, causing a dramatic increase in the rents being asked. The housing market in general is very tight,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“The housing market in northern Colorado continues on what feels like a never-ending slog toward higher-and-higher prices and less-and-less affordability for home buyers. Over the first 90 days of the New Year, 25% fewer homes have been available to purchase, funneling buyers in the market to aggressively compete for the scant number of homes that come on the market for a matter of days before being snatched up like Tickle Me Elmo doll shortage of the 1996 Christmas Shopping Nightmare.

“The lack of inventory, in spite of a spike in mortgage interest rates, is sustaining pent-up demand. In the Fort Collins under $700,000 price point, every home that comes on the market has between 30-70 showings in a span of just four or five days. Not only does this demonstrate that there are likely at least 30 buyers for each house on the market – but given the limitations of some listing’s showing schedules, not all the buyers that want to tour a property for sale are getting to see the house before an offer is accepted.

“This is creating a log-jam of want-to-be home owners willing to offer tens of thousands of dollars over the original asking price of a property just to have a shot at catching the seller’s eye and having their offer selected from a dozen offers presented. The median price for homes sold in the Fort Collins area exceeded $600,000 for the second month in a row. The numbers would show that, on average, a home listed at $580,000 likely sold for $603,000. The over-asking numbers for many homes however, are much, much higher – often selling for $70,000 – $100,000 over asking price for well-kept and nicely updated homes.

“Interest rates have popped up to or above 5% for a 30-year-fixed mortgage. This has weakened the purchasing power for many buyers who may now be considering dropping out of the frenetic buying activity altogether. Time will tell, but sellers could be in for a bit of a slowdown come summer when folks are more widely dispersed for summer vacation and other priorities supersede the current drive to buy a home,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“The spring thaw has arrived throughout the Roaring Fork and Colorado River valleys. Spring is normally a time when sellers are sprucing up their homes in preparation for selling however, spring 2022 seems to have sellers still in hibernation. In the single-family home market, new listings were down 42.7 % to a spring low of 59, while the median sale price rose 1.4% to $583,000. Days on market decreased 28.4% or 48 days to closing. Pending sales decreased 40.6 % or 60 homes under contract on March 31.

“The townhome/condo market fared slightly better regarding new listings at 29, only falling by 6.5%. We saw a median sale price of $333,045 which is slightly below last year’s number of $357,000 or -6.5%. Days on market for the multi-family sector increased by 18.6% or 70 Days but the pending sales decreased by 6.9% or a total of 27 multi-family units under contract.

“The March stand out came in the Glenwood Springs community where the median sales price for a townhome/condo was up 61% from $375,000 in March 2021 to $605,000 in the same period this year.

The interesting take on a local level is the fight over continued development. Three local communities in the Roaring Fork Valley are seeing their citizens and, in some cases, local government standing up to stall the development which has hit us at a rapid pace. Many long-time valley dwellers are either speaking out to slow growth or cashing out before what some fear to be a looming market correction. It remains to be seen if the rising interest rates and inflation will affect our valley or if the lure of the mountains will sustain the increasing values,” said Glenwood Springs-area REALTOR® Erin Bassett.

JEFFERSON COUNTY/GOLDEN

“Cash remains the name of the game In Jefferson County as buyers must win the offer with a complete cash offer or use a lender program for cash offers, financing the home after purchase or providing the cash to cover any gap between the appraised price and the offer price. Homes come on the market on either Thursday or Friday and they are under contract by Monday. Even with rising interest rates, economists are saying there is no near-term foreseeable bubble and we will be in a seller’s market for quite some time.

“Once again, the median sales price increased for single-family homes to $700,000 and for condo/townhomes to $436,000. Inventory for both single-family homes and condo/townhomes is less than one month, and days on market for both are less than 16 days. The seasonal market now begins in February and continues through October. We will see the market shift a bit here and there but for the most part will continue to be strong for sellers,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“An active Pueblo market saw new listings rise 14.9% from March 2021 to March 2022, and they are up 8.1% year-to-date. Pending sales/under contracts are up 19.1% over last March and up 15.8% year-to-date and solds are also up 13.1% year-to-date. With a 99.6% sale to list price figure, the median price was up 19.2% over last March to $310,000. Inventory remains incredibly low with just a few homes under $200,000 and not too many fix-and-flips available either.

“New home construction is still moving strong. In the first three months, 174 permits were pulled, including 20 permits pulled by Richmond American Homes. Water permits in Pueblo West are non-existent due to recent policy changes and therefore, in-town permits are up.

“The big unanswered question is, what will rising interest rates do to buyers looking for homes?” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“It was closing weekend for the Steamboat ski area and the slopes saw the return of the infamous Cardboard Classic and Splashdown Pond Skimming Championships, signaling the end of yet another ski season. Buyers in and around Steamboat Springs may feel like they are in their own pond skimming competition as they delve into a limited pool of inventory. Those making offers for the first time might encounter their own wind factor, or even get blown out of the water by other buyers who are willing to pay more as sellers received an average of 100.8% of their list price on single-family homes and 103.5% on condos/townhomes. We had 34 single-family active listings in March, with 30 new listings coming on and 28 going under contract – barely a month’s supply; multi-family had 25 active listings with 45 new listings and 47 units that went under contract putting months supply at two weeks.

“Active listings, new listings, and properties pending sales are all significantly down from last year. Average sale price for single-family was 8.8% lower this year compared to last, with year-to-date almost the same as last year at $1,479,315; multi-family average sale price for this period was slightly less than March 2021 at $775,758 – however, still up 13.6% YTD equating an average sales price of $900,358.

“If low inventory and rising prices weren’t enough for buyers to deal with, rising interest rates have compounded those feelings as many would have contracted and closed if the inventory had been there for them to do so. With interest rates on the rise, the number of homeowners refinancing is greatly diminished; local appraisers are less inundated and more available to complete new purchase appraisals with shorter timeframes. This shorter timeframe helps a financed buyer compete better in our market which has 50% cash buyers. The rise in interest rates reduces buying power, often hurting the entry-level buyer the most as they are also the ones who are trying to get housing stability through a fixed mortgage payment versus the vulnerability of the rising costs of a rental market,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“A ski condo, a mountain getaway, and a log cabin set in the woods are all ideal mountain properties. They are still there to be purchased but a buyer has to be ready. Hesitation in this market means you don’t get the property. There are fewer homes selling, down 30% over last year, and prices are still rising, up almost 25% so far this year over last year. Condo prices are up almost 29% over last year. Days on market continue to drop and are down 75% over last year.

“Buyer fatigue is real, and I constantly get the question, when is this market going to slow down? World events, rising interest rates, inflation, supply and demand will play their part in the coming months. In the meantime, buyers are putting forth offers with no inspection objections, appraisal gap coverage, and other creative ways to make their offer stand out.

“This gem was circulating on social media and gave everyone in the industry a cringe and a laugh:

‘Think of the real estate market as a game of musical chairs. During a buyer’s market you’ve got

10 chairs and 8 people playing. During a seller’s market you’ve got 8 chairs and 10 people playing. During today’s market you’ve got about 3 chairs, 37 people, but now the chairs are on fire, the floor is on fire, and you’re being chased around the room by an axe wielding psychopath.’

“Current listings in the Summit MLS range from a low-price, single-family home in Park County for $269,900 to a high price single-family home in Breckenridge for $18.99 million. In Summit County, an average priced home is now $2.46 million,” said Summit-area REALTOR® Dana Cottrell.

| Single Family | Average Price % March YTD 2022 vs 2021 | Average Price YTD 2022 |

| Summit County | 62% ↑ | $2,465,318 |

| Park County | 43% ↑ | $675,998 |

| Lake County | -8% â | $521,533 |

| Townhouse / Condo | Average Price % March YTD 2022 vs 2021 | Average Price YTD 2022 |

| Summit County | 29% ↑ | $756,899 |

TELLURIDE

“The demand for remote resort real estate has not waned. San Miguel County closed out the first quarter of 2022 setting an all-time sales record of $335.55 million, besting the $287.67 million in first quarter 2021. For perspective, this is 109% over the last five years average first quarter sales. While the sales of home and condominiums in the Mountain Village are still brisk, on March 31, there were only five homes for sale in the town of Telluride. In my 38 years as a Telluride REALTOR®, I never seen so few homes for sale in the town limits. However, this low inventory of homes and condominiums in our region continues to drive vacant residential and rural land sales through the roof, including our team’s sale of a 2,419-acre ranch on Specie Mesa for $32 million, the second largest dollar amount of sale in San Miguel County’s history,” said Telluride-area REALTOR® George Harvey.

VAIL

“I had begun to feel a bit like a broken record: Not enough inventory, transactions are down, pending sales are up, dollar volume is up. March is the first month in over a year we saw a bit of variation in components and what may be a trend toward more traditional market dynamics.

“March new listings are negative 19.5% for the month yet only -0.2% year to date. This slippage happened in spite of two very successful condo projects in the Avon market and a couple of other potential projects coming on board. Pending sales are off 9.8% versus March 2021 with year to date down 20%. The decline in pending sales is driven by lack of inventory in key price niches and not lack of demand. Closed sales took a hit in the March year over year at -46.5%, while the year-to-date unit sales are only -25.3%, thus the month had a significant impact on the 2022 performance. Regretfully, inventory in certain price points is driving this performance and those particular niches will find it tough getting the product in the near future. Days on market has remained consistent at -46.9% versus the years performance at -51.8%. Inventory of active listings is -45% versus March 2021 which is a trend that hasn’t changed for the past year.

“The most significant change in March was the overall dollar volume, down 39%, which was the first time the upper end of the market didn’t offset the lower pricing niches. We are still only -5% in dollar volume year to date in spite of the March drop. Although the upper end had increased unit sales, it wasn’t enough to offset the traditional unit niches that historically drive our market.

“We look forward to the potential of more product coming to market and the continued high demand for homes in the market. The ability for remote work has had a huge impact on the market. The opportunity to enjoy the mountain lifestyle and maintain a career remotely is certainly the best of both worlds,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA SINGLE-FAMILY SNAPSHOT

STATEWIDE SINGLE-FAMILY SNAPSHOT

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The March 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.

https://kdvr.com/news/data/homebuyers-record-amounts-above-asking-price/

https://kdvr.com/news/data/renters-buyers-need-to-make-to-afford-metro-area/