Rising interest rates and inflation fears help pump the brakes on housing market pushing inventories higher and keeping median pricing flat

https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

ENGLEWOOD, CO – Buyer trepidation fueled by rising interest rates and inflation fears continued to contribute to an improving bottom line for housing inventory and helped keep median pricing relatively flat across the seven-county Denver-metro area and in markets statewide, according to the May 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

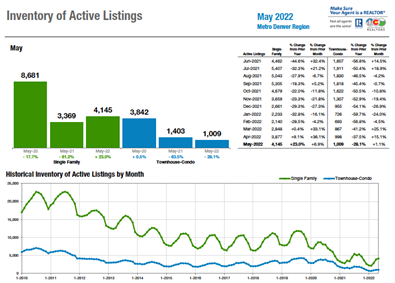

New listings for single-family homes and townhome/condos in the Denver-metro area rose 2.7% between April and May to 6,430 and 2,097, respectively. The inventory of active listings also rose from April to May, 6.9% for single-family homes but just 1.1% for townhome/condos.

“Mortgage interest rate hikes and fears of continued inflation have put many buyers on pause,” said Fort Collins-area REALTOR® Chris Hardy. “Buying a home at an already escalated price is just that much farther out of reach. More homes are coming on the market as evidenced by the 2.5% bump from last May but, it’s a mixed bowl of nuts. Also, homes that are not in the best shape are coming to market and the shifting dynamic is proving that homes in the best shape with the best amenities command the best prices and quickest sales. Homes in average or below average shape will linger now that many buyers are on pause or taking time to go on vacation and those buyers active in the market can be a bit pickier.”

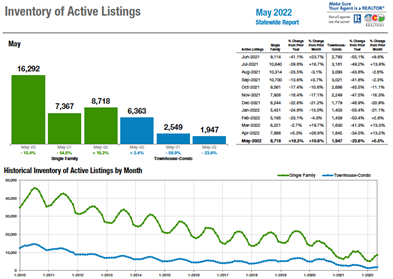

Statewide, the 11,169 new listings for single-family homes represented a 3.6% in the past month, with townhome/condos slightly less at 2.3% and totaling 3,044 properties. The statewide inventory of active listings for single-family homes rose 10.6% from April to May and is up more than 18% from a year prior with 8,718 active properties. The townhome/condo market also rose 5.5% in the prior month however, the 1,947 active listings in May are down 23.6% from a year prior and may further reflect the decreased buyer power due to rising interest rates and other rising costs of living.

Median pricing for all property types in the Denver-metro area dipped slightly (-1.5%) in May but maintain double digit percentage increases over the same time last year – up 13.5% for single family and 12.6% for townhome/condos. Statewide, median pricing fell less than a quarter of a percent for all property types but also remains up over a year prior, 15.2% for single-family homes and 13% for townhome/condos.

“With the real estate market this year feeling like a long, seemingly never-ending climb of a rollercoaster, the month of May began feeling as if we are now reaching the peak of that vertical climb,” said Douglas County-area REALTOR® Cooper Thayer. “A slight decline in median sales prices is the first sign of a leveling-off in the track. With consumer confidence in the economy decreasing and high mortgage rates pricing out many prospective buyers in the Denver-metro area, I wouldn’t be surprised if we look back at May 2022 as the turning point away from one of the strongest sellers’ markets in recent history. While it has been a struggle for many to buy a home this year, I’d remain optimistic as the market cools and the steep climb of our rollercoaster begins to flatten out.”

While market factors helped bring down the median pricing, the percent of list price received still remains 3.7 – 5% north of asking price across all property types and locations.

“Make no mistake, the market has not shifted to a buyer’s market and there is a not a bubble that burst. The interest rate hike did exactly what it was designed to do – cool a frenzied market that needed a correction. Our real estate market is still steady, appreciating, and healthy. It’s just moved from red-hot to a warm, orange glow,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

The CAR Housing Affordability Index (HAI), a measure of how affordable a region’s housing is to consumers based on interest rates, median sales price, and median income by county, improved slightly in May but remains down 30% from where we stood a year ago.

With diverse and local factors playing out across the state, REALTORS® across the metro area and state are expressing hope as more signs and conditions point to a shift in the market on the horizon.

- Aurora – Rising interest rates are definitely having an impact as the market is a little slower, sellers a little more reasonable, and buyers have an opportunity. Over the next few months we will see more creative financing options to help with the higher mortgage rates.

- Boulder/Broomfield counties – The hot seller’s market with bidding wars reaching more than 20% over list price and buyers waiving all conditions was no doubt unsustainable for both the market and the buyers who were in it. Still, stats continue to show a strong, steady market with a handful of new listings and a healthy 13% appreciation in the median sales price. Townhomes and condos are taking it one notch further and have shown appreciation of 20% as compared to last year. Increased activity in this part of the market is likely due to the relative affordability compared to their single-family counterparts.

- Colorado Springs – Will May 2022 be the month we look back on as the month the market changed? The biggest part of that data is the 52% increase in active properties. And, even though the median sales price was up again by 13.3% for single-family residents, and days on market for them remained flat, we saw a 20% increase for townhomes and condos days on market.

- Denver County – Up until the last month, Denver was in the fast lane to a $1 million average. We’re still likely to hit that mark but there has been a large and very noticeable course change on that path. Inventory is creeping back into the picture. Prices, though still up, are less-up and those in the mega or average category may very well have decided to take a step back and see what those in the median range, the bungalow-buyers decide to do next.

- Douglas County – A slight decline in median sales prices is the first sign of a leveling-off in the track. In April, the median sales price of single-family homes in Douglas County reached an all-time high of more than $773,000, concluding an eight-month consecutive streak of price increases. In May, single-family sale prices declined just under 1%, signaling a shift in the supply and demand mismatch that has characterized the post-pandemic market.

- Durango/La Plata County – Many people have been ratcheting up the rhetoric about how the impending recession, high interest rates, and global conflicts might stall the housing market. As a ‘boots on the ground’ observer, I have not seen these factors curbing demand or home values in the Durango area. The average sales price, year to date is up more than 30% from May 2021 to just over $900,000. Roughly 39% of the 2022 transactions have been cash, compared to 47% in 2021.

- Estes Park/Larimer County – Larimer County is showing some signs of change from this crazy and tiring market. New listings are coming on the market a bit more now than they had been. Single-family homes have increased 11% compared to May last year, but year-to-date still no growth at a negative 9.3% overall.

- Fort Collins/Northern Larimer County – Mortgage interest rate hikes and fears of continued inflation have put many buyers on pause. Buying a home at an already escalated price is just that much farther out of reach. More homes are coming on the market as evidenced by the 2.5% bump from last May but, it’s a mixed bowl of nuts.

- Glenwood Springs/Garfield County – The standout community this month is Carbondale where the median sale price for single-family rose 129.3% to $1.8 million. New and sold listings in Carbondale did not change much from last May with new listings up by 5 single-family homes and solds down by 2 homes. There was one new listing and two less sold listings in May in the townhome condo sector. If the single-family jump in median sale price wasn’t enough, the median sale price for a townhome in Carbondale saw a 145% increase to come in at $1,214,159.

- Grand Junction/Mesa County – May 2022 was a fairy tale compared to previous years in Mesa County. May 2022 compared to May 2021 had new listings down 2.4%, at a time when inventory typically grows, solds decreased 9.5% and the affordability index fell to 60. Interest rates are slowing some sales, but not prices. May’s median price was up 17.9% to $395,000, and the average sold price was up to $426,548.

- Jefferson County/Golden – The seller’s market has softened a bit thanks to rising interest rates that have pushed buyers to do a little rethinking on what they can afford to purchase. Buyers are sitting back a little bit more and waiting to see what the market will do, hoping the prices will come down.

- Pagosa Springs/South Fork – Because of higher interest rates, we are seeing more cash offers, leaving buyer financed offers not so appealing to sellers. With a continued insignificant gain in new inventory together with the higher demand of relocating buyers desiring to work remotely, this market has not fully evolved to a buyer’s market. The market has simply adjusted or corrected to a more normal market

- Pueblo – Despite a few changes in the marketplace, we remain well entrenched in a seller’s market. New listings were up nearly 21% from May 2021 to 2022 and are up 17.6% year-to-date. The new listings increase has helped however, buyers aren’t finding the home they want and there is simply not much to choose from under $250,000.

- Steamboat Springs/Routt County – Inventory is still very low, with no relief in the foreseeable future and we are likely to remain a sellers’ market for some time. However, the tide is changing with respect to pricing and the market is experiencing price reductions and sale contingency offers being accepted. Is it a market correction? That’s what buyer’s naturally hope for, but more likely what is on the horizon is the slowing of appreciation – not depreciation.

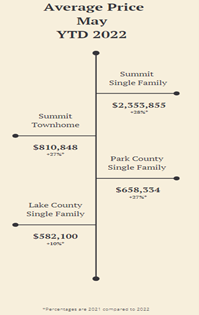

- Summit, Park & Lake counties – Summit County’s stats tell a mixed story. On one hand, the number of sold and pending sales are down 29%, yet median sales prices are up 31% in Summit and Park counties. Where the change is happening is the number of active listings with a one-year increase of 19%.

- Telluride – The trend is clear, fewer sales but at new record prices. Assisted by the lack of home and condominium sales, we are seeing an enormous increase in construction throughout our region. With 287 vacant lot sales throughout the San Miguel County in 2021 and another 67 vacant lot sales so far this year, the construction industry is seeing its biggest boom since the 2005 – 2007 era.

- Vail – May brought a new trend into the market and has created some confusion. Inventory popped up from the first four months of the year however, we are still down 25% from May 2021 and at approximately 40% of historical numbers. The mix of inventory is following the trend of the last year relative to price niches which obviously factors into many variances to historical trends.

Taking a more in-depth look at some of the state’s local market data and conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“They say that things never stay the same and the housing market is certainly an indicator of truthfulness of this statement. We are seeing changes, more homes on the market, price reductions, and homes on the market a little longer. All of this means that buyers may have a better chance of getting that home that they are looking for. The numbers show that home listings in Aurora are up a little over 8% over this time last year and prices are up 12.5% from 2021. The median price in Aurora is $562,000 and of course this median varies from between zip codes. Average days on market sits at eight days.

“Looking to the townhome/condo market, listings are down approximately 12% over 2021 and the median townhome price is up 20% at $365,000. As of today, there are 518 single family active listings in Aurora. This is still a significantly low inventory given the demand. There are 921 listings under contract in just the Aurora area.

“The median home price in Arapahoe County is $627,000 for a single-family residential home. As the saying goes: Location, location, location has a large impact on pricing. The current median price in Adams County is $570,000, up 17.7% compared to 2021.

“The rise in interest rates is definitely having the impact that the government hoped for. The market is a little slower, sellers a little more reasonable, and buyers have an opportunity. I am sure that over the next few months we will see more creative financing options to help with the higher mortgage rates,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“We knew it was coming, we just didn’t know when. The hot seller’s market with bidding wars reaching more than 20% over list price and buyers waiving all conditions was no doubt unsustainable for both the market and the buyers who were in it. Still, in Boulder County, the stats continue to show a strong, steady market with a handful of new listings (3.4% more than this time last year) and a healthy 13% appreciation in the median sales price. The bidding wars are not over as the numbers show buyers are paying about 7% over list price. Townhomes and condos are taking it one notch further and have shown appreciation of 20% as compared to last year. Increased activity in this part of the market is likely due to the relative affordability compared to their single-family counterparts, and perhaps the return of many students to the CU Boulder campus.

“Broomfield County is still painfully low in inventory as new listings are down another 2.5%. Prices shot up 10% for single-family homes and the days on the market remain at around 10 – an unusually low number, even for this market. Townhomes and condos have had more activity with 11% more listings, but they are selling as fast as they hit the market. Prices have soared up 19% compared to last year.

“So, where’s the turn? Where’s the shift? The market statistics illustrate buyer and seller activity over the last few months that culminate in May sales. In reality, the market is changing. It changed right around Easter Sunday, April 17. Interest rates went up right before that weekend and the rate hike was more significant than we’ve seen since the 1990s. The market’s reaction was a swift rebellion with buyers quickly becoming uninterested or unable to play the game. Showings slowed and offer deadlines were quickly removed from broker remarks on the MLS. The change was felt almost overnight. The June and July statistics will likely show a much slower, more traditional market than we’ve seen for the last 2 years.

“But make no mistake, the market has not shifted to a buyer’s market and there is a not a bubble that burst. The interest rate hike did exactly what it was designed to do – cool a frenzied market that needed a correction. Our real estate market is still steady, appreciating and healthy. It’s just moved from red-hot to a warm, orange glow,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Is the party over? It reminds me of the song Closing Time by Semisonic. It’s been a good run, lots of fun had by all, but at some point, the party stops, the lights turn on, and you stumble into the Uber dreading the next morning. Will May 2022 be the month we look back on as the month the market changed? Will this be my last article where the sellers win every play and the buyers blink, only to lay down their cards and fold? Some of the data shows that just may be the case. The biggest part of that data is the 52% increase in active properties. And, even though the median sales price was up again by 13.3% for single-family residents, and days on market for them remained flat, we saw a 20% increase for townhomes and condos days on market. This is a pattern I have seen before. And it leads me to believe that by June’s report, the days on market for single family will likely increase.

“The news, simply, stinks. I have often reported that the real estate market will be the last to be hit. This is not 2008 and the housing bubble that led to the collapse of an entire world economy. No, this time it is the reverse. An entire world economy in collapse that may lead to the collapse of housing. It is impossible to believe that inflation at 8.5%, a negative growth GDP in the first quarter, gas and food prices soaring, and housing remains this high. Affordability is far beyond what the local population can support. In the past, housing was a hedge for inflation. But this is a very different time. We ran home prices up artificially with low interest rates for a decade and then inflated more with FOMO (Fear of Missing Out) during the pandemic, then interest rates spiked. We got here because of ‘Free’ money and low rates. That money had to find a place to go. Investors were all in. Every chip was on the table and every chip was on real estate and stocks. But at some point, the free money dries up, investors go and find a new place to invest their money, and what that holds for the future of housing is anyone’s guess.

“But all markets have cycles. The FED chair has stated that although they want a soft landing, they are willing to do what it takes to get the inflation they caused back under control. With that said, the landing is not likely going to be soft since we have no examples in our history of the FED getting it right. That means we should brace for impact. Maybe it’s not now, but sometime in the future, the landscape of housing is likely to look very different than May 2022. And with that change I may be writing articles on how our buyers got a home with no competition, $10,000 below purchase price, and $5,000 in concessions. It is hard to predict markets. Many will read this and laugh, thinking that cannot happen here. Colorado is too amazing. Everyone is moving here. Our market cannot be touched because we have the military. And with that I will simply respond, I have heard that before, and that year was 2007. Never say never, it always makes us look foolish,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“Continuing with the ‘well, that was fun while it lasted’ tumble cycle of real estate statistics, the Denver real estate market threw us another curve that, frankly, we should stop and pay attention to. Since what feels like the beginning of time, we have been saying ‘low inventory, high prices’ and those who tired of that byline, no matter how hard we tried to jazz it up, may now rejoice.

“Now, before we get to the good part, you must remember that looking at trends you must remember that, not at all dissimilar to the economy, there is one heck of a wide ship to turn and slow down. Two thirds of a month worth of inventory this month in the freestanding category may sound awfully small, and it is, but this time last year, it was just a third of a month. In 2020, we were one-and-a-half and the year before that – the year before everyone went ‘mad’ in 2019 – was a nice and cool, though still seller-heavy, two months. We doubled the availability this year over last but that’s still 50% short of the year before. Whether you consider it an upturn or a decline, the writing still suggests that we are rebounding from what could have been the peak not just last month, but perhaps last year.

“The median and average prices this month cooled and actually dropped from April to May – but that isn’t actually all that remarkable looking at past years. Over the last seven years, three of those saw a dip in the same time period, while the other four only recognized modest increases. What is rather remarkable though is that the $28,000 jump from March to April in the average column, the $108,000 jump from February to March and $101,000 jump from January to February even before that had everyone, including me, predicting that the $1 million average was a mere month or two away. The jumps were unprecedented in both size and percentage and the insatiable appetite seemed to be growing even more unrelenting – all of that is, until the interest rate hike of May 2022.

“Though potentially just a coincidence, as these pauses do naturally occur, or perhaps a byproduct of the media coverage surrounding it, the average price actually dropped $34,334 in May. Did the buyers panic and stop buying? Did the extra cost on a mortgage knock many would-be buyers out of the game? The answer, probably yes to both. What we can absolutely say is that April and May of 2022 seem to be the months where the mega buyers cooled their heels and stepped away from the volatility. See, it’s the mega buyers (in Denver, I classify that as $3 million and up) who are the ones that most heavily influence the average. It’s not the 1,000-square-foot brick bungalows scattered throughout Denver that make up the middle, or median, but the luxury real estate trading that makes up for the $100,000 swings in average price. The median, by contrast, is what *does* include those turn-of-the-century bungalows that make up our city and it’s those homes that tell the true story of what is happening in our city. The median is up $75,000 over this time last year, 12.3%, so very much still a healthy and active market, but the drastic changes up top, the mega real estate trading hands that appears to have slowed, a lot.

Up until the last month, Denver was in the fast lane to a $1 million average. We’re still likely to hit that mark but there has been a large and very noticeable course change on that path. Inventory is creeping back into the picture. Prices, though still up, are less-up and those in the mega or average category may very well have decided to take a step back and see what those in the median range, the bungalow-buyers decide to do next,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“With the real estate market this year feeling like a long, seemingly never-ending climb of a rollercoaster, the month of May began feeling as if we are now reaching the peak of that vertical climb. A slight decline in median sales prices is the first sign of a leveling-off in the track. In April, the median sales price of single-family homes in Douglas County reached an all-time high of more than $773,000, concluding an eight-month consecutive streak of price increases. In May, single-family sale prices declined just under 1%, signaling a shift in the supply and demand mismatch that has characterized the post-pandemic market.

“Market conditions began looking slightly more optimistic for single family buyers, with inventory up 50% compared to May of last year. However, the townhouse/condo market remained tight, as Douglas County inventory supply stayed below one month. Despite those shifts in the market, we still saw a strong lean towards sellers in May as prices remained elevated and mortgage rates (a rollercoaster of its own) generally climbed. Closings above list price decreased from April, but remained a common occurrence, with a 103.7% list to close price ratio for single family properties and 105.1% for townhouses and condos.

“With consumer confidence in the economy decreasing and high mortgage rates pricing out many prospective buyers in the Denver-metro area, I wouldn’t be surprised if we look back at May 2022 as the turning point away from one of the strongest sellers’ markets in recent history. While it has been a struggle for many to buy a home this year, I’d remain optimistic as the market cools and the steep climb of our rollercoaster begins to flatten out,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Everyone wants to know if the market has reached its peak. So far, no one has been able to answer that question definitively. Many people have been ratcheting up the rhetoric about how the impending recession, high interest rates, and global conflicts might stall the housing market. As a ‘boots on the ground’ observer, I have not seen these factors curbing demand or home values in the Durango area. The average sales price, year to date is up more than 30% from May 2021 to just over $900,000. Roughly 39% of the 2022 transactions have been cash, compared to 47% in 2021. Evidently, the lure of Durango’s lifestyle and quality of life outshines the negative portrayals and speculation.

“Buyers are beginning to see the needle move ever so slightly in their favor, even if it is only in the number of available properties coming on the market. The total number of homes for sale in May was 150 compared to 111 in April. This is good news for buyers. The bad news is that the average home price continues to climb. April’s average sales price was $737,180 compared to May’s $910,354. The condo market softened a bit in May with a decrease in the average sales price to just over $442,000 compared to April’s $597,000. Market seasonality should mean more options for buyers over the next few months and (hopefully) some market stabilization” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK/LARIMER COUNTY

“Larimer County is showing some signs of change from this crazy and tiring market. New listings are coming on the market a bit more now than they had been. Single-family homes have increased 11% compared to May last year, but year-to-date still no growth at a negative 9.3% overall. Townhome/condos aren’t doing much better. Compared to May 2021, new listings are down 3.5%, year- over-year, down 24%. Almost a quarter fewer condos coming on the market creates a really tight inventory.

“The average sales price continues to climb with single-family homes up 21.3%, and condos have increased 10.4% year-to-date. Single-family homes are selling almost as fast as we can get the sign in the yard and lenders/title companies can get their paperwork together. Single-family homes are closing at an average of 32 days, a 22% decrease in time on the market compared to May last year. Townhome/condos are falling behind with closing at an average of 76 days, a 68.9% lengthening from May last year. Townhome/condos are not suffering by the length of time on the market, they are still fetching 104.2% over list price, a 1.9% increase. Single-family homes are fetching 0.5% over list price. Pretty interesting difference in price and time on the market,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“The May numbers for the northern Colorado housing market are very much like the bowl of mixed nuts so popular at parties and holidays when I was a kid. The contents, as a whole, are quite attractive yet, shortly into the party, all the favorite and most tasty contents have been picked through leaving the walnuts, brazil-nuts, and pecans all alone at the bottom until the host replenishes the bowl with more mixed nuts. By the end of the evening, the bowl is nearly full of the least favorite nuts and the remaining guests grudgingly consume the less desirable remains. Our late spring housing market is much the same.

“Mortgage interest rate hikes and fears of continued inflation have put many buyers on pause. Buying a home at an already escalated price is just that much farther out of reach. More homes are coming on the market as evidenced by the 2.5% bump from last May but some of these homes are more like walnuts rather than peanuts. It takes a particular type of palate to enjoy walnuts and so these homes are lingering slightly longer on the market than the coveted peanut homes. Peanut homes are still enjoying competing offers and over-asking sale prices. Walnut homes are seeing fewer showings, fewer offers, and sales prices closer to list price (or on some occasions, less than list price).

“May showed a drop in the average list-price-to-sale-price figure at 104.9%. Clearly, there’s still a lot of peanuts in the bowl of houses for sale. However, the months supply of inventory has crept up to almost a full month of inventory available from its low point of less than two weeks earlier this year. I believe this is an indicator of the less desirable homes taking a bit longer to sell than the most desirable homes. Also, homes that are not in the best shape are coming to market and the shifting dynamic is proving that homes in the best shape with the best amenities command the best prices and quickest sales. Homes in average or below average shape will linger now that many buyers are on pause or taking time to go on vacation and those buyers active in the market can be a bit pickier. The months supply of inventory is likely to continue to creep up as we approach the Independence Day holiday in July – which is a perfect event for a big bowl of mixed nuts to watch the fireworks,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/GARFIELD COUNTYY

“April showers have brought May flowers but that’s about all. Inventory continues to be at a record low in Garfield County and the only thing increasing besides the interest rates are the prices. The Roaring Fork and Colorado River valleys have not yet started to experience the slow down other markets are starting to experience. In the single-family sector new listings continued their downward trend with 17.8% fewer than May 2021. Pending sales also decreased 20%, while the median sale price hit a record $775,350, 33.9% higher than last year. Days on market was up a slight 2.9% to settle at 36 and the affordability index is currently at 40, another record for Garfield County.

“The townhome-condo market did not fare any better with new listings down 10.5%, pending sales decreasing 29.2% and the median sale price up to $402,500, a 10.6% increase over May 2021. Days on market did increase 56% over last year, but that increase was only a total of 14 days from 25 last year to 39 this year. The townhome-condo affordability index fell 28% from last May to settle in at 77.

The standout community this month is Carbondale where the median sale price for single-family rose 129.3% to $1.8 million. New and sold listings in Carbondale did not change much from last May with new listings up by 5 single-family homes and solds down by 2 homes. There was one new listing and two less sold listings in May in the townhome condo sector. If the single-family jump in median sale price wasn’t enough, the median sale price for a townhome in Carbondale saw a 145% increase to come in at $1,214,159.

“It remains to be seen whether our valley will slowly start to soften along with the stock market or if the buyer influx from out of state and the front range can weather a little storm,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“The story for May continues to be a fairy tale compared to previous years in Mesa County. May 2022 compared to May 2021 had new listings down 2.4%, at a time when inventory typically grows, solds decreased 9.5%, and the affordability index fell to 60. Interest rates are slowing some sales, but definitely not prices. May’s median price was up 17.9% to $395,000, and the average sold price was up to $426,548.

“Multiple offers are still occurring on almost all listings under $500,000, and cash is still king. Buyers are coming from multiple states bringing the equity from those areas. One thing helping buyers to compete with the cash offers is having the buyers go completely through underwriting and having complete approval subject to a suitable property. That allows a small glimmer of hope in the under $300,000 market especially,” said Grand Junction-area REALTOR® Ann Hayes

JEFFERSON COUNTY/GOLDEN

“The seller’s market has softened a bit thanks to rising interest rates that have pushed buyers to do a little rethinking on what they can afford to purchase. Buyers are sitting back a little bit more and waiting to see what the market will do, hoping the prices will come down. At the end of May, homes are sitting on the market a bit longer, especially those not priced correctly. Sellers may see only two offers on their home instead of 10, or they may look to reduce the asking price. Now more than ever homes will need to be priced right or the home may not sell in the first weekend. For single-family homes, there was a 6.9% increase in new listings to the market. The median sales price still showed an uptick to $715,000 and homes are on the market for an average of 10 days. For condo/townhomes, there was an inventory increase of 21% although the median sales price increased to $429,250 year-over-year, and average days on market decreased 25%, most likely due to that decreasing buyer price range for single-family homes,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS/SOUTH FORK

“You can feel the hint of summer in Pagosa Springs, and South Fork, Colorado. The weather has finally morphed into crisp cool nights and warmer days. There were coffee shop talk rumblings of whether high gas prices would discourage the out-of-state travelers into Pagosa Springs and South Fork. There are no signs this area will have a slow summer! Just like the weather, the real estate market here is morphing. There is still an abundance of buyers desiring the lifestyle of Pagosa Springs and South Fork. Buyers are wrapping their heads around the new norm of higher interest rates, just like higher gas prices. New listings were just slightly down, as June is typically the biggest listing month as this area builds with high volume out- of-state buyers building to July 4 through summer. As weather temperatures rise in Texas and Oklahoma, visitors and buyers flock for an escape from summer heat. With an abundance of folks in town, June and July sales will continue to be competitive, especially in anything priced under $450,000 (typically condos and manufactured homes). The biggest gain in inventory is in the $600s and $1 million-plus which is almost 50% of home inventory. Sales of homes in the $1-million-plus are tracking with higher volume than 2021. With this in mind, it is no surprise the average sales price jumped 19.8% and to $657,801 (from $548,931 in 2021) and the median price hit $550,000, up 26.6% (from $434,500 in 2021).

“Days on market has adjusted from slightly over three months to a little over two months (although this is not consistent in higher price points). Buyers have gained knowledge they have less buyer power with relation to financing and interest rates. The buyer who could qualify for a $600,000 home in early 2022, now qualifies for just under $500,000. As active listings are up 13% from 2021, sellers are starting to understand the impact of higher interest rates and adjusting prices.

“The true picture of the market here, will be June and July sales. Those sales will report in July-September. Because of higher interest rates, we are seeing more cash offers, leaving buyer financed offers not so appealing to sellers. With a continued insignificant gain in new inventory together with the higher demand of relocating buyers desiring to work remotely, this market has not fully evolved to a buyer’s market. The market has simply adjusted or corrected to a more normal market (just as the Feds wanted). Buyers will find some new construction in the average sales price range and selling at price listed or above. Even with the recent drop in lumber prices, builders are forced to experience inflated prices in labor (due to shortages) and land costs. Land sales continue to increase, although due to inventory, not at the rate of 2021. In Archuleta County 65% of land consists of National Forest, BLM, or Ute Tribal lands, leaving only 35% for residential builds. Take away those land properties that are off grid, already built or bought, on a good inventory day there may be about 5% of land available for sale. Buyers are shocked at 2022 price gains, especially in town lots with water and sewer connections, as well as 3-5-acre parcels with water connections. Septic system and well rates have also risen significantly, adding to building costs. However, with low home and condo inventories and continued intake of buyers working remotely, buyers are deciding to grab now and build their dream home later. Apparently, buyers and sellers are still embracing the fireworks of the Southwest Colorado real estate market,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“Despite a few changes in the marketplace, we remain well entrenched in a seller’s market. New listings were up nearly 21% from May 2021 to 2022 and are up 17.6% year-to-date. The new listings increase has helped however, buyers aren’t finding the home they want and there is simply not much to choose from under $250,000.

“That said, when we look at sales figures, pending sales in May were up 8.1% over May 2021 and are up 14.4% year to date. Sold listings jumped 28% in May 2022 over May 2021 and are up 14.6% year to date.

A good sign that buyers are still buying homes.

“The median price hit $340,000 in May 2022 up 23.23% from a year prior. Year-to-date, it is up 18.9%. The percent of list price received came in at 100.3% for May and is 99.9% year-to-date. We are seeing more and more price reductions and transactions falling through as buyers can’t secure loans. Some buyers are looking to wait for interest rates to fall. That may not happen anytime soon. The price of homes will continue to go up.

“Turning to our new construction market, we continue to move ahead with strong numbers. Pueblo West had 46 building permits issues in May and another 16 were issued in Pueblo. The water issues in Pueblo West have improved since the Metro Board made some updates and decisions on how they will issue permits,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Nothing lasts forever. After a great run of incredibly low mortgage rates at 2-3%, then 3-4% and then 4-5%; here we are having to remind ourselves that an interest rate of 5.5% is still a good interest rate – at least, historically. This is another tough realization for buyers, while sellers are beginning to experience a different realization of their own. The effects of higher interest rates have eliminated some buyers in price ranges that they might otherwise have been engaged. Depending on the property, certain segments are seeing fewer showings, fewer offers, and more days on market before an offer comes in. The inventory is still very low, with no relief of that in the foreseeable future and we are likely to remain a sellers’ market for some time. However, the tide is changing with respect to pricing and the market is experiencing price reductions and sale contingency offers being accepted. Is it a market correction? That’s what buyer’s naturally hope for, but more likely what is on the horizon is the slowing of appreciation – not depreciation.

“New listings for single-family were up almost 29% and there were the same number of homes sold this May as last May with sellers receiving on average 101.1% of their list price, up 3.3% from the same time last year; pending sales are up 20.8% over last year. Multi-family listings were up slightly (3.9%) with pending sales down 24.5% and sold listings down 36.2% with sellers receiving 103.1% of their list price – up 1.8% from last year. Days on market is interesting to note the discrepancies as single-family had substantially increased DOM at 74 versus 2021’s 44 days; whereas multi-family was substantially decreased at 16 DOM versus 33. In both classifications, months’ supply decreased from the prior period.

“As anticipated, this week city council approved short-term rental regulations and zones which will be implemented to the city’s development code within the coming week. After being in limbo for about eight months, local REALTORS® will now be able to better advise their clients on how these zones will or will not affect them. It has been reported that other ski towns, including Breckenridge and Telluride, have implemented similar restrictions. As I have stated previously, it will be interesting to see how the market reacts to properties that have free reign on short-term rentals versus those that do not,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“Summit, Park, and Lake county’s markets feel like riding a roller coaster. The past has been this amazing ride up and up. Now it feels like we are hanging at the top, not the big plummet at all, but the part where you keep wondering where the ride is taking you. Summit County’s stats tell a mixed story. On one hand, the number of sold and pending sales are down 29%, yet median sales prices are up 31% in Summit and Park counties. Where the change is happening is the number of active listings with a one-year increase of 19%. Days on market continue to decline.

“Residential active listings in the Summit MLS range from a low-price, single-family home in Park County for $149,900 to a high price, single-family home in Breckenridge at $18,999,000. The lowest priced sale in May was a single-family home in Park County for $318,500 and the highest was a single-family home in Copper Mountain for $5,431,074. In Summit County, an average priced home is now $2,353,844, down about $29,000 from last month, but up 28% from May of last year,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The trend is clear: fewer sales but at new record prices. The dollar amount of sales in May this year was down 54% compared to May 2021. That is mostly due to some very large sales in May 2021, including the sale of Tom Cruise’s estate for $39.5 million. However, May 2022 sales are still more than the last five years average of May sales by 32%. Assisted by the lack of home and condominium sales, we are seeing an enormous increase in construction throughout our region. With 287 vacant lot sales throughout the San Miguel County in 2021 and another 67 vacant lot sales so far this year, the construction industry is seeing its biggest boom since the 2005 – 2007 era.

“The first five months of this year produced $547.84 million in sales, down about 11% compared to the same period last year. Generally, we are seeing home listings in the Town of Telluride and Town of Mountain Village come on the market anywhere from $1500 per square foot to $2000 per square foot with some condominiums now asking close to $2500 per square foot,” said Telluride-area REALTOR® George Harvey.

VAIL

“May brought a new trend into the market and has created some confusion. Inventory popped up from the first four months of the year however, we are still down 25% from May 2021 and at approximately 40% of our historical numbers. The mix of inventory is following the trend of the last year relative to price niches which obviously factors into many variances to historical trends. The most significant change is closed sales and price niche market share. Historically, the under $1 million units represented 65% of transactions annually and the $5 million+ niche was 4% of unit sales. Year-to-date the under $ 1million niche is 40% and the $5 million-plus niche is 9%. Thus, the unit performance is negative 20.9% year-to-date while dollars are down only 15% with March-April the period of decline in dollars. May brought about a turnaround in dollar sales with a 25% increase versus May 2021 while units were negative 12%.

“As the summer selling season begins, we continue with only 1.8 months of supply at current sales trends. We are still seeing negative inventory trends which is holding back the acceleration of the market. This in concert with the rising mortgage rates and volatility of the stock market make predictability of how the market will react difficult if not impossible to hazard a prediction. Anecdotally, we seem to have strong buyer demand but not enough product in significant price niches to maximize market sales.

“The key driver for the market is its appeal for remote workers, and the lifestyle the valley affords for 12 months of spectacular outdoor activities,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE SNAPSHOT

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The May 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.