Homes stay on market longer, prices flatten as buyers and sellers wait out rate hikes

ENGLEWOOD, CO – Both home buyers and sellers continue to feel the effects of the Federal Reserve’s interest rate hikes designed to help curb inflation and slow the market, according to the January 2023 Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR). Housing prices across the seven-county Denver-metro area and state continued to fall slightly as buyers struggle to justify higher monthly payments and weakened buying power, while sellers, locked into lower interest rates, don’t see the value of a move just yet.

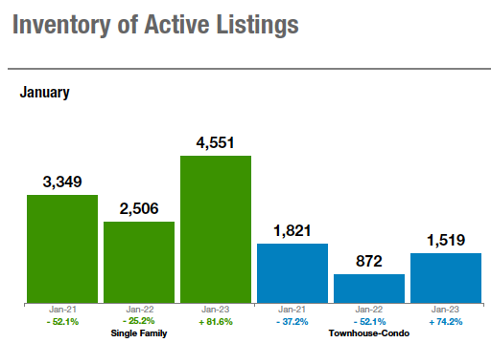

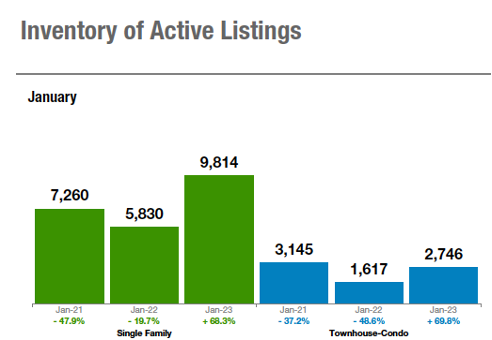

Although the combination of factors has led to some nice bumps in active inventory and months supply of inventory, overall inventory remains extremely low across a majority of price points. The supply and demand equation is helping keep prices from falling significantly keeping many buyers on the sidelines while others are getting a little more time to consider a purchase, make offers and complete inspections.

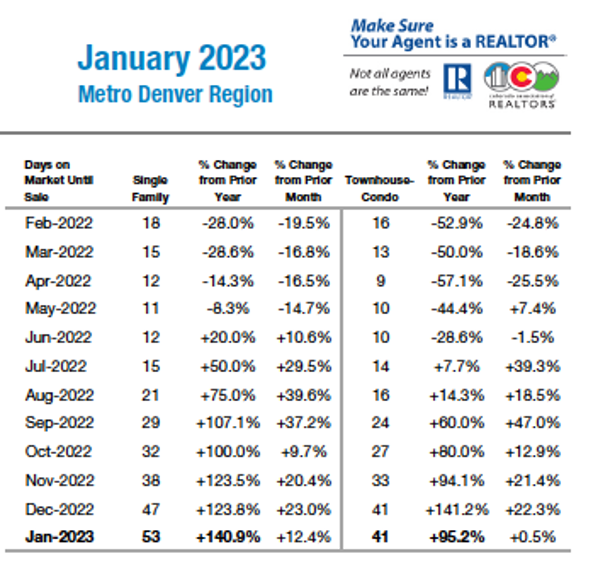

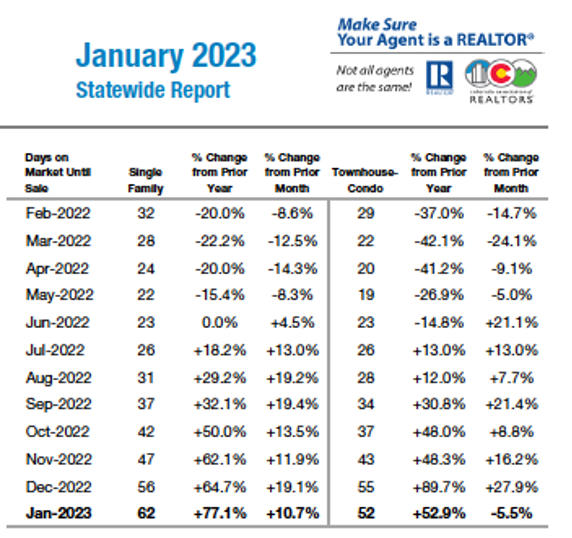

The average days on market has doubled or more in the seven-county Denver metro area and has increased approximately 60% statewide compared to the same time last year. On the opposite side of that scenario, in some markets across the metro area and state, bidding wars have re-emerged after taking a few months off, demonstrating once again the local variables across all product types and price points.

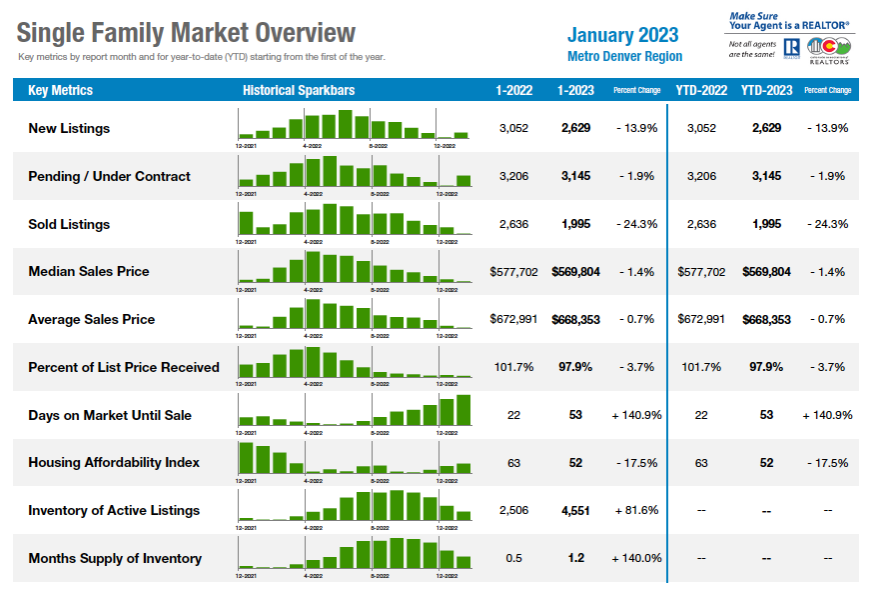

A look at some key metrics –

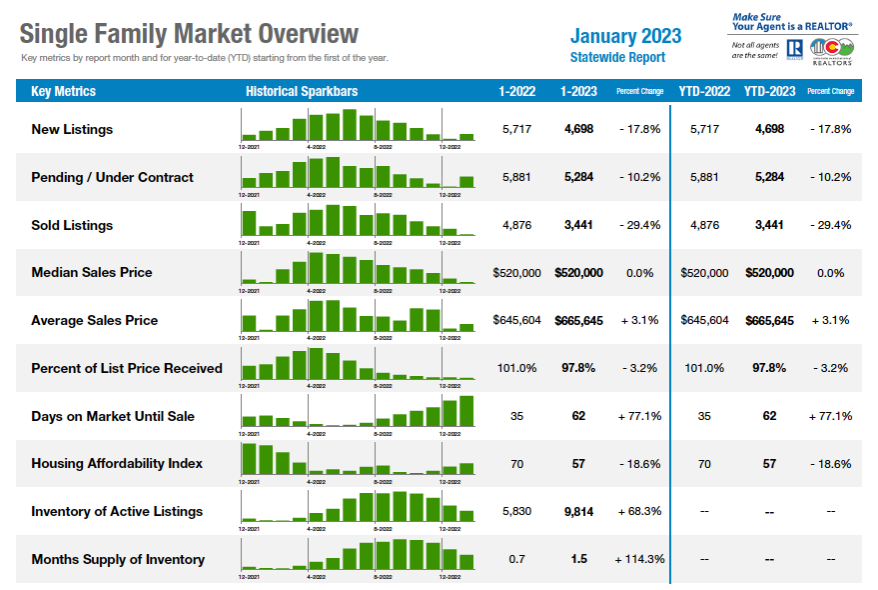

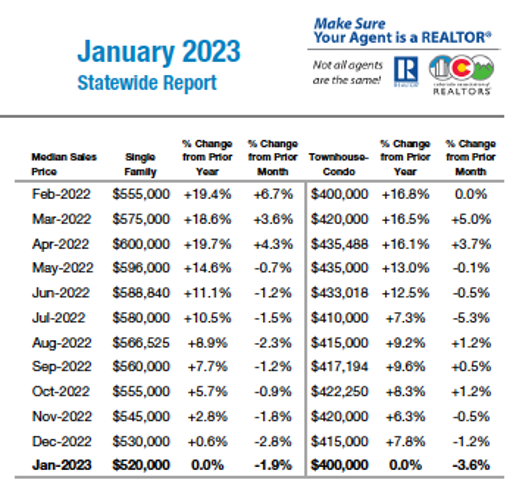

Statewide:

- Median price for a single-family home is identical to January 2022 at $520,000

- Average Days on Market goes from 35 last year to 60 in January 2022

- Solds fell 30% from January 2022 with at 3,441

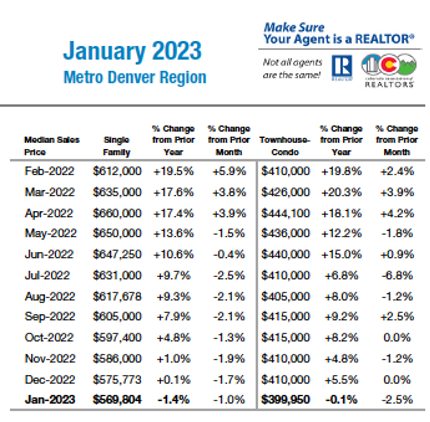

Seven County Denver Metro Area:

- Median price for single-family and condo/townhome combined is down 1.4% over last year, $525,000 vs $531,000. That represents the first year-over-year decrease since December 2019.

- Average Days on Market more than doubles from last year, 50 days in January 2023 vs 22 days in January 2022.

- There is four times the Months Supply of Inventory from this time last year, 1.2 months vs. 0.3. At the same time, new listings fell to 3,709 from 4,300.

Looking at the CAR Housing Affordability Index, a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county, the reports show slight improvements over the past three months however, affordability continues to be a major issue for many potential buyers across the state.

Seven-county Denver metro area Single-Family Overview:

Statewide Single-Family Overview:

REALTORS® across the metro area and state shared these highlights (expanded summaries of each market are included in the following pages):

- Aurora – January was off to a colder, snowier, gloomier start in more ways than just the weather. Adams and Arapahoe County were almost double the inventory with pricing down 5% in all zip codes. This would make January an ideal time for buyers, experiencing more choices and lower home prices.

- Boulder/Broomfield counties – As interest rates dip down a bit, the pent-up demand from buyers who have been waiting on the sidelines seems to have sparked more activity in the market. The lower price points are experiencing bidding wars again, but nothing compared to this time last year. We head into 2023 with a more conservative, almost sluggish start.

- Colorado Springs – The Pikes Peak region saw no change in pricing for median sales price year over year. A stark contrast to last year when the market was red hot, and prices headed north every month. The easing of the market can be attributed to higher interest rates and a 108% increase in listings which has increased the days on market 264% for single-family homes and 117% for townhomes.

- Denver County –Average days on market for a freestanding home in January 2023 was 48, a Colorado Association of REALTORS® seven-year record high and only the third month that the number has surpassed 40. While 48 might not sound like a lot, consider that last January, that same number was a stark 17 while in April of 2022, the month before we started to see a seismic market correction, that number was 7 days.

- Douglas County – The Douglas County market continued to slow down slightly, but inventory constraints make a strong spring selling season appear imminent. Median sales price in the single-family and townhouse/condo segments decreased slightly to $680,000 and $479,000, respectively. The population of serious buyers at any given price point is smaller, and competitive pricing is the key to attracting attention to a listing amongst a market flooded with high prices.

- Durango/La Plata County – New listings were down almost 55%, and sold listings were down more than 50% compared to January 2022. Lack of inventory continues to drive up prices with the median sales price up 11% to $750,000 compared to $675,000 last January. Inventory increased more than 40% compared to January 2022. Percentage of list price to sold price, fell to 94% compared to 99% last January – an indication that buyers are demanding more concessions from sellers and are not willing to participate in multiple offer situations.

- Fort Collins/Northern Larimer County – When the rates dipped briefly below 6%, the flurry of buyers created an instant multiple offer situation for many properties. Of the first 10 January transactions done in our office, 80% involved multiple offers; an open house in west Loveland commanded nearly 40 visitors on a sunny Saturday and a competing offer situation. Median prices in Fort Collins remained in the mid-$500s which has not provided any relief in the affordability category.

- Grand Junction – The market is showing the effects of interest rate hikes. Year-over-year, solds are down more than 40% to 143, and the downward trend extends to median sold price down 2.7% to $360,000, Average sold price is down 4.7% to $378,664, and pending sales were down 27.3% to 224. New listings were also down, 23.6% to 220, but because of the lower number of contracts and sales, active inventory is at 583.

- Pagosa Springs – In January 2022 the median sales price was $390,000. A year later, the median sales price rose more than 33% to $520,000. Average sales price in January 2022 was $542,719 and by January 2023 it escalated $705,773 (up 30%).

- Pueblo – The market continues its trend from the past few months with new listings down 13.5% from January 2022, pending sales down 29% from last year, and solds down more than 50% from the same time last year. The combination of factors helped push the median price down 1.2% to $293,302 in January with the sale-price to list-price ration falling 2.1% to 97.2%.

- Steamboat Springs/Routt County – The New Year started off with 17% less inventory in single-family homes with little assistance from new listings, down 12.5% from January 2022. Multi-family started the year with 12 more units on the market than a year prior but received four fewer new listings for the same time last year. Some buyers felt optimistic when properties were on the market for ‘extended periods’ only to become dismayed when they still found themselves in a multiple-offer situation.

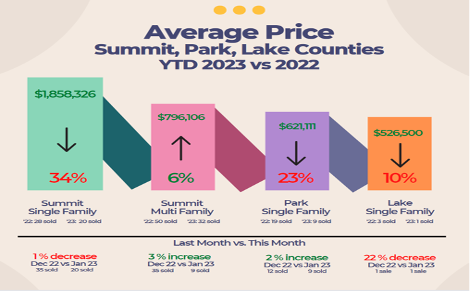

- Summit, Park, and Lake counties – Started the year with the average single-family home price in Summit County dropping to $1.85 million in January, down 35% from a year prior, but up 23% from January 2021. Barring something unexpected, don’t see our market dropping dramatically, more likely flattening. Buyers are waiting and when the Federal Reserve is done raising rates and they drop to 5.5%, expect to see buyer activity pick up.

- Telluride – we’re starting the year off by returning to elements of the pre-pandemic market of January 2020, and more similar to 2018 and 2019 with one exception. Prices have not retreated that much. Generally, prices in the last quarter of 2022 and January of this year are down about 10%. We still have a few buyers for the high end, $5-$10 million range but 75% of January’s 32 transactions totaling just shy of $45 million, were at much lower price points.

- Vail – Forecasting the market moving forward is more pragmatic with moderate price depreciation in certain niches. zmovement will not be in all segments as demand is still strong and supply/demand will drive pricing. Moderation is the word that will be the catalyst for the market.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“January was off to a colder, snowier, gloomier start in more ways than just the weather. Adams and Arapahoe County were almost double the inventory with pricing down 5% in all zip codes. This would make January an ideal time for buyers, experiencing more choices and lower home prices. That all said, January is typically a little slower. The better numbers will be February and March. As the sun is shining and the crocus start to pop up, we are seeing more inventory. With increased inventory, we are seeing more buyers. My personal experience is that some sellers are very motivated after sitting on the market for the past couple of months. Buyers have the opportunity to negotiate on pricing and seller concessions. As we move into spring, that option will be a thing of the past. As of the first two weeks of February, we are seeing more showings, more motivated buyers and the phone ringing. I look forward to seeing the January numbers which I’m sure will not be as good as February 2022 however, I’m also sure they will look much better than what we had in January,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The January stats confirm what REALTORS® have been experiencing for the last few months – a sluggish market, prices decreasing and a change in the way buyers and sellers negotiate a sale. In Boulder County, prices went up throughout the first half of 2022 and then the appreciation was quickly lost due to rising interest rates. That, coupled with a typical seasonal slowdown, held prices to what they were at the end of 2021. Officially, Boulder prices went up about 1.8% and in Broomfield, they went down 11%, the first time we’ve seen a downturn in median sales price in years.

“Days on market doubled in Boulder from 39 to 80 days and anxious sellers have started taking less than list price and offering concessions to buyers to help buy down their interest rate. Sales price to list price in January was 98%, the lowest we’ve seen in years. Broomfield County fared a bit better than its neighbor with 67 days on the market but that still is double what we saw at this time last year.

“As interest rates dip down a bit, the pent-up demand from buyers who have been waiting on the sidelines seems to have sparked more activity in the market. The lower price points are experiencing bidding wars again, but nothing compared to this time last year. We head into 2023 with a more conservative, almost sluggish start. With new listings down 12% in Boulder and a whopping 23% in Broomfield, those buyers who have been waiting don’t have much in the way of selection. February will be interesting to watch as low inventory and delayed demand may push us right back into a seller’s market this spring,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Are we picking up, stabilizing, or pausing before more declines?

“The Pikes Peak region saw no change in pricing for median sales price year over year. A stark contrast to last year when the market was red hot, and prices headed north every month. The easing of the market can be attributed to higher interest rates and a 108% increase in listings which has increased the days on market 264% for single-family homes and 117% for townhomes. As spring begins, it seems likely that we will see more inventory hit as sellers realize the market of last year is not coming back.

“Nationally, we are hearing about layoffs in the high tech, banking and financial worlds. The retail industry had a terrible fourth quarter. But then the jobs report for January hit at 517,000 jobs added and lowered the unemployment rate. The mixed reports are hard to figure out. Between high inflation, gas prices starting to move back up, and the constant talk about recessions, buyers are simply disengaged.

Most of the data shows we are far worse off as an economy goes than many would like to admit. Car delinquencies rose to levels not seen since 2009. Consumer credit debt hit an all-time high and Americans savings accounts are being depleted trying to keep up. Builder sentiment did rise in January, and that was the first time in a year, thanks to some reprieve on interest rates. But that could be dashed if rates rise again. And the National Association of Home Builders did forecast a decline for single-family starts in 2023 and KB Homes saw a 68% cancellation rate in Q4. Even during the 2008 crisis, that number was only 47%.

“As we progress into 2023, we have a lot of mixed messaging going on, but my gut tells me the end of the year is going to be hard on the economy and housing is a lagging indicator. So, while many remain bullish, I lean bearish. The constant headlines of more layoffs, manufacturing declining, freight not being moved, new builds slowing down just tend to lead to more softening in the real estate market. While many feel that this is the bottom, past recessions have shown us that it takes years to find that point. 2006 was our last peak and we bottomed out in 2011. So, is this the bottom, or just the beginning of a long path there? Time will tell,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS/PIKES PEAK

“The housing market in Colorado Springs is no longer the same old story, no longer stricken by an acute shortage of active listings. After a long stretch of six years, in January 2023, the monthly supply of Single-family/patio homes has finally ascended to over 2 months, looking back to any previous month of January since 2017. During January 2022 and 2021, the monthly supply was at 0.5 month.

“Last month, there were 1,639 active listings of single-family/patio homes and 739 sales with 50 days on the market, compared to 549 active listings and 1,058 sales with 15 days on the market in January 2022. Consequently, this caused over 36% single-family/patio homes’ active listings in El Paso County to have price reductions. In January 2023, the average price was $525,000, and the median price was 445,000 compared to the average price of $494,954 and the median price of $445,000 in January 2022. Year over year, there was a 26% decline in the monthly sales volume.

“Last month, 61.8% of the single-family homes sold were priced under $500,000, 29% were between $500,000 and $800,000, and 9.2% were priced over $800,000. Year-over-year in January 2023, there was a 22% drop in the sale of single-family homes priced under $300,000, a 44% drop in homes priced between $400,000 and $600,000, a 10% drop in homes priced between $600,000 and $1 million but a hefty over 21% increase in homes priced over $1 million.

“When looking back 5 years and comparing single-family/patio homes sales in January 2023 with January 2022, active listings are up over 32 percent, monthly sales and sales volume are down by over 21% and 24% respectively, average sales price ascended 58 percent, and median sales price rose 51%.

“Unequivocally, confounding affordability challenges due staggering combination of high interest rates and record high home prices are the most difficult barrier for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER COUNTY

“The average days on market for a freestanding home in January 2023 was 48. That sets a Colorado Association of REALTORS® seven-year record high and also marks only the third month that the number has surpassed 40. While 48 might not sound like a lot, consider that last January, that same number was a stark 17 while in April of 2022, the month before we started to see a seismic market correction, that number was 7 days. The reason we care about a ‘day on market’ trend is its reliability of describing how in-demand a home or type of home may be. Freestanding homes almost always trend lower days on market than condos suggesting, statistically speaking, attached homes are lower in desirability. With both numbers on the rise, we can conclusively state that desirability overall has fallen in our market – condos now lingering 8 days longer than last year.

“Of further interest is our current price trend, cooling its brakes considerably over the last year. With many months in 2021 coming in north of 20% year-over-year in appreciation – further cooling to the teens last year, we are back to the single digits ushering in 2023. At just 2.6% higher than January 2022 for a freestanding Denver home, price growth is far more palatable and clearly less panic-inducing for buyers who are now reflecting that in their need to snatch up desirable homes before the next guy does,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“The Douglas County market in January continued to slow down slightly, but inventory constraints make a strong spring selling season appear imminent. Median sales price in the single-family and townhouse/condo segments decreased slightly to $680,000 and $479,000, respectively. Single-family listings are continually spending more time on the market, up to 57 days on average in January, nearly 1.3 times that in January 2022. Inventory decreased month-over-month, causing supply-side pressure which will likely keep prices elevated into the spring.

“Our strategy in this market has remained stable over the past few months, and boils down to one key point: modest pricing. ‘Average’ quality homes are still relatively overpriced given current market conditions, and we’ve found that pricing at the lower bounds of a listing’s range have resulted in multiple offers and a higher contract price than pricing at the higher end of that range. As interest rates remain elevated, the population of serious buyers at any given price point is smaller, and competitive pricing is the key to attracting attention to a listing amongst a market flooded with high prices,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Bitter cold and above-average snowfall put a big chill on new and sold listings in January 2023. New listings were down almost 55%, and sold listings were down more than 50% compared to January 2022. The lack of inventory continues to drive up prices. The median sales price rose 11% to $750,000 compared to $675,000 last January. The inventory of homes increased more than 40% compared to January 2022 but still hovers at just over a two-month supply, just a third of the supply of a normal market. One indicator that the market is beginning to shift a bit toward a more balanced market is the percentage of list price to sold price, which fell to 94% compared to 99% last January. This is an indication that buyers are demanding more concessions from sellers and are not willing to participate in multiple offer situations.

“It is anyone’s guess what effect thawing temperatures will have on spring inventory and prices. The demand for housing remains robust, and there is no indication that it will diminish in the coming months. Mortgage rates and inflation seem to have peaked and are predicted to stabilize in the coming months, which should fuel additional buyer demand. Inventory (or lack thereof) will be the big story for the upcoming selling season,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“The favorable winds that fueled the first half of last year’s insatiable housing market have been gusting intermittently for the new year. Lower inflation numbers, solid jobs reports and an early drop in the 30- year-fixed-rate mortgage breathed life into an otherwise hibernating real estate industry. Limited numbers of homes for sale coupled with motivated buyers willing to ride out the daily fluctuations in mortgage rates provided resuscitation to segments of the housing market which, for the previous 90 days, had remained comparatively lifeless.

“The statistics are a bit confounding and thereby divining a sense of what’s to come is a bit blurry. Days on market, a measure of how long it takes for a property to sell, has more than doubled from what is was in May 2022 where homes were selling on average in just over 30 days. In January this average has soared to 79 days. These are homes that came on the market in late Q4 2022 and suffered the worst of the interest rate spikes and home buyers opted to settle down for a long winter’s nap. The list price to sales price ratio has also declined from a high of nearly 6% over asking in April 2022 to an average of just under asking at 99.1% of list price. Again, houses that stay on the market for a long time rarely get full price from the eventual buyers. With less competition for the homes currently for sale, many buyers are finding sellers a bit more willing to negotiate terms such as price, seller concessions in the form of interest rate buy-downs or cash contributions to closing costs (or both).

“However, beware the dropping interest rate! When the rates dipped briefly below 6%, the flurry of buyers created an instant multiple offer situation for many properties. The following anecdotes illustrate a market emerging from doldrums: Of the first 10 January transactions in our office, 80% involved multiple offers; an open house on a high-end listing in a desirable neighborhood in west Loveland commanded nearly 40 visitors on a sunny Saturday and a competing offer situation. Median prices in Fort Collins remained in the mid-$500s which has not provided any relief in the affordability category. Such divergent experiences will be the rule rather than the exception in the coming weeks – but when interest rates settle in below 6% for a sustained period, the forecast is for blustery winds that will quickly fan the spark of active demand and buyers will awaken to spring and summer like bears emerging from their winter slumber and ravenous for something – anything to consume,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“The market is showing the effects of the slowdown since the interest rates increased. Year-over-year, solds are down more than 40% to 143, and the downward trend extends to median sold price down 2.7% to $360,000, Average sold price is down 4.7% to $378,664, and pending sales were down 27.3% to 224. New listings were also down, 23.6% to 220, but because of the lower number of contracts and sales, active inventory is at 583. Properties are staying on the market longer, which does give buyers more time to find the most suitable property for them. Meanwhile sellers are having to realize that they are not going to list today and be under contract in three days or less. And more and more often, they are also having to make concessions to help facilitate a sale.

“Looking back over 2022, sold properties have been steadily declining since last May when there were 356 sales. The median sold price is down from a high of $408,000 in June 2022 to where it is now, $360,000 and average sold is down from a high of $446,091 in September 2022 to January’s $378,664. This is likely due, in part, to the fact that when interest rates came down a little, helping more of the lower priced homes to sell, which is reflected in the greatest number of sales in January were in the $300,000-$399,000 bracket,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Great snowfall in December and January has kept local and out of town buyers distracted from home buying and more interested with fun such as skiing and other snow sports. Sellers also appear to be in hibernation with just 12 new listings in January compared to 32 in January 2022 and pushing days on market up to 124.

“The largest price cuts are taking place in the luxury end of the market however, Pagosa Springs home price appreciation remains positive in registered growth. Buyers may be settling with the new norm of somewhat stabilizing higher interest rates. Unfortunately, their buying decisions struggle against higher home prices and, when financing, higher mortgage payments. Those factors have not impacted pricing. In January 2022 the median sales price was $390,000. A year later, the median sales price rose more than 33% to $520,000. Average sales price in January 2022 was $542,719 and by January 2023 it escalated $705,773 (up 30%).

January sales represent mostly mid-November and December buyers dealing with higher home prices than in 2022. In 2022, there were large numbers of homes priced in the mid $300,000 and $400,000 range which were gobbled up with low interest rates and cash buyers. That segment of the market price point has not been replaced in 2023 supported by pending sales down over 58% at only 18 homes in January. Condos continue to show the least inventory. Condo price appreciation is also strong and fewer days on market due to lack of inventory. The Pagosa Springs home purchase is tracking for the new median sales price to hit closer to $600,000. Less inventory in price points under $600,000 are still prevalent. Reports show there is almost a three-month supply and twice as many homes for sale (at 103) than January 2022. The reality shows about 70% of current homes for sale are priced higher than $500,000. Of the current 103 homes for sale, 63 are priced over $600,000 and 34 homes priced $1 million and higher. Home inventory under $525,000 is sparse and does not have market longevity creating a sense of urgency for buyers in this price category.

“Land sales were also low in January due to an abundance of snow. Land inventory is climbing better than last year, but at higher prices, it is presenting the same challenges to land buyers as home buyers. New and custom construction still have the same challenges as last year with work force, materials pricing, and shorter building months (due to snow). Overall, if you can find an existing home or condo close to your needs, buy it now and make some updates. Sellers should consider the right updates before selling or aggressively pricing the home to sell and expect longer days on the market. As many buyers are out of town buyers (2nd homes), most desire a move-in ready home to avoid the hassle of making home improvements from another state. For sellers, February and March present a grand opportunity. Historically, March and April bring on more land and housing inventory with the melting snow. It will be fascinating to see the real estate market as it evolves from winter hibernation to the vibrance of Spring and meeting those expectations,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The market continues its trend from the past few months with new listings down 13.5% from January 2022, pending sales down 29% from last year, and solds down more than 50% from the same time last year. The combination of factors helped push the median price down 1.2% to $293,302 in January with the sale-price to list-price ration falling 2.1% to 97.2%.

“The lack of buyer activity also helped push active listings up to 556 across Pueblo County, a jump of 58% compared to January 2022, and the months supply of homes rose to 2.4 months, up 84.6% from last January. This is still considered a seller’s market, but sellers are having to reduce prices to get buyer activity.

“We also experienced a big slowdown in building permits in January. With only 13 permits pulled across nine builders, we were down 79% compared to January 2022. In 2022, there were 41 builders in our market. A slow start for new homes,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“While other areas of Colorado may be experiencing increased inventory, the same is not necessarily true for Routt County. The New Year started off with 17% less inventory in single-family homes with little assistance from new listings, down 12.5% from January 2022. Multi-family started the year with 12 more units on the market than a year prior but received four fewer new listings for the same time last year. Single-family in Steamboat realized a decrease in days on market, while the outlying communities saw an increase, creating a month’s supply of about two months for the entire county. Days on market for multi-family increased 65% resulting in a month’s supply of a month and a half. The increase in days on market may create a false impression, as some buyers felt optimistic when properties were on the market for ‘extended periods’ only to become dismayed when they still found themselves in a multiple-offer situation.

“January saw seven homes sell compared to 20 previously; condos/townhomes had 19 transactions with a narrower margin to last year’s 23. Sellers of single-family received 98.1% of their list price, 1.2% more than the same period last year and a median sales price of $1.775 million. With fewer transactions, it is understandable that that number would be significantly higher than last years $811,250. Multi-family received 100.4% of their list price, down slightly down from 101.2%, and the median and average sales prices were up 2.3% to $753,250 and 5.5% $879,297 than last year, respectively.

“January ‘days’ may more likely be remembered for how many days it snowed as the ski resort as we surpassed the 250-inches of snow accumulation for the season. Now, with 333” of snow and counting, there is speculation that we could see some increased inventory from those that have skied their last run or heaved their last shovel,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTIES

“Has 2023 started off with the sky falling? No, just a bit of a cloud deck. You know those days when the fog blocks our view of the soaring heights, but then we really notice the hills and valleys just out our windows. The soaring heights of our market in January 2022 make the 34% drop in the average single- family home price one year later seem dramatic. In Summit County, an average priced home at $1.85 million is down about $238,000 from last month. Prices dropped throughout the first half of 2022, but actually started to rise a bit after August of last year. These are signs of a market settling down.

“With buyers waiting to see what comes next in the world of prices and interest rates, Summit, Park, and Lake counties have shifted to more balanced markets. Negotiations are taking place with sellers sometimes making concessions. For well-priced properties, there are still multiple offers. In Summit, the percent of sales price compared to list price is strong at about 98% for single family and 97% for multi-family homes.

“We’ve started the year off with the average single-family home price in Summit County dropping to $1.85 million in January, down 35% from a year prior, but up 23% from January 2021. January 2022 was a unique month where the average price jumped 65% from the month before. Total sales continue to fall, and listings are rising compared to last year however, inventory is still tight which is why we have seen our prices and market flatten.

“Barring something unexpected, I don’t see our market dropping dramatically, more likely flattening. There are buyers waiting and when the Federal Reserve is done raising rates and they drop to 5.5%, I expect to see buyer activity pick up.

“There are 320 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $139,900 to a single-family home in Breckenridge for $19.5 million. Out of the 64 sales in January, the lowest price was a home in Park County for $165,000 and the highest was a single-family home in Breckenridge for $3.7 million. These numbers exclude deed restricted, affordable housing,” said Summit County REALTOR® Dana Cottrell.

TELLURIDE

“It appears we’re starting the year off by returning to elements of the pre-pandemic market of January 2020, and more similar to 2018 and 2019 with one exception. Prices have not retreated that much. Generally, prices in the last quarter of 2022 and January of this year are down about 10%. We still have a few buyers for the high end, $5-$10 million range but 75% of January’s 32 transactions totaling just shy of $45 million, were at much lower price points.

“The affluent are more concerned about the volatility of the stock market than they are about interest rates. Most are playing it safe for now and not making big ticket purchases. We see no signs of seller distressed sales and, in my opinion, probably won’t. If a seller needs to sell, there still seems to be enough demand to make that sale happen quickly. It’s too soon to read anything more into what the 2023 sales season will look like. However, by the end of the first quarter we should be able to read the market tea leaves much better,” said Telluride-area REALTOR® George Harvey.

VAIL

“The comparison of market performance versus same period in 2022 shows a significant downturn. However, when we look at performance from fourth quarter 2022, the trend is more stable with some ups and downs.

“Comparing closed sales January 2022 versus January 2023, we have a negative 29.4% on single family/duplex, and a negative 51.9% on townhome/condo. However, when we compare December 2022 with January 2023, single family/duplex is negative 14.3% and townhouse/condo is negative 28.6%. The phenomenal performance of 2021, and first half 2022, is moving back to a more normal trend. We have been trending this way since the second half of 2022 and is moving toward a more predictable market.

Factors driving this trend include increasing inventories, which in aggregate are positive 53.6% year over year. The only moderating factor of the inventory is the skew in price niches. The upper niches, from $2 million-plus represent approximately 68% of the inventory, with under $2 million representing 32% of inventory which impedes the opportunity to bring the market back to historic price niches. The inventory status, albeit positive, is skewed away from opening price product. Couple the inventory structure with mortgage rates and we see pressure against this segment of the market which relies more on mortgages than some of the upper price ranges.

“Pricing seems to be holding to the 2022 appreciation levels, but we are seeing some sellers making price moves. However, many of the moves are on properties that were aggressively priced above actual market.

“Forecasting the market moving forward is more pragmatic with moderate price depreciation in certain niches. However, this movement will not be in all segments as demand is still strong and supply/demand will drive pricing. Moderation is the word that will be the catalyst for the market and the importance of a real estate advisor will be key to success in this variable marketplace,” said Vail-area REALTOR® Mike Budd.

DAYS ON MARKET – SEVEN-COUNTY DENVER METRO AREA

DAYS ON MARKET – STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

MEDIAN SALES PRICE – SEVEN-COUNTY DENVER METRO AREA

MEDIAN SALES PRICE – STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The January 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.