March housing stats may look scary but could be most normal we’ve seen since pre pandemic

ENGLEWOOD, CO – March housing numbers for the seven-county Denver metro area and statewide may look scary at first glance however, they may also be some of the most normal statistics and market conditions seen since the beginning of the pandemic, according to the latest Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR).

“Median sales prices are down, days on market have skyrocketed, and homes are back to selling below asking prices on average,” said Douglas County-area REALTOR® and CAR spokesperson, Cooper Thayer. “However, it’s important to remember that the last few years were an anomaly, and we are currently in an arguably healthier market than before. In fact, last month’s market may have been the most ‘normal’ we’ve seen since the beginning of the pandemic. Higher mortgage rates have humbled parties on both sides of the transaction. Buyers are generally no longer able to buy average homes with non-contingent, over-asking-price offers. The result is a taming of the market, with modest pricing becoming a requirement for sellers to move inventory.”

A few key highlights:

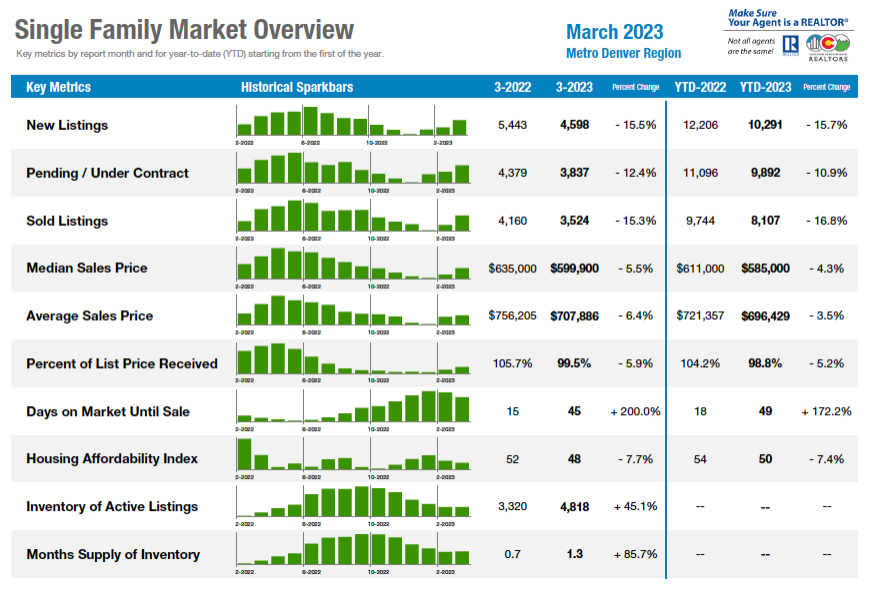

Seven County Denver Metro Area (March 2023 compared to March 2022)

- Single-Family Median Sales Price fell 5.5% from March 2022 to $599,900. Condo/townhomes dipped 2.6% to $415,000.

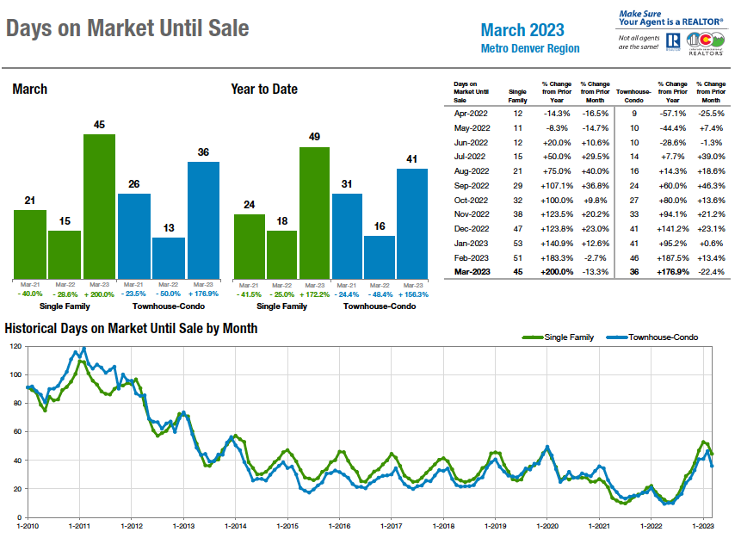

- Average Days on Market rose 200% from March 2022 to 45 days for single-family homes and 177% for condo/townhomes to 36 days.

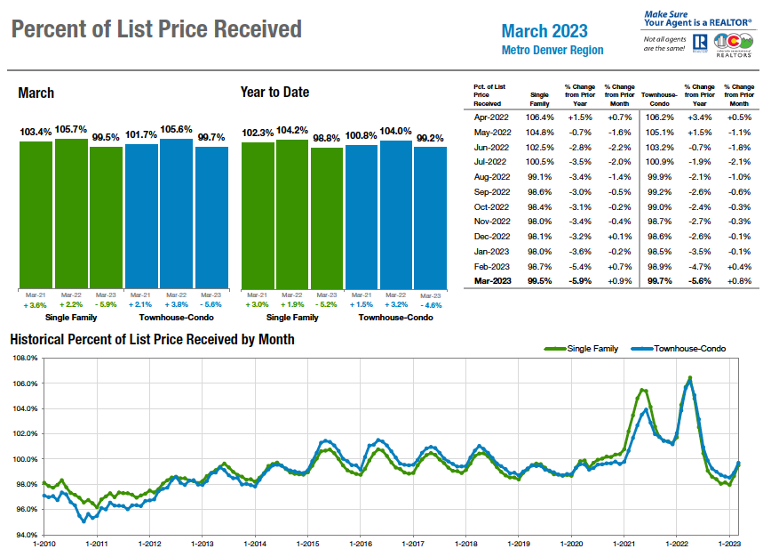

- Percent of List Price Received fell 5.9% for single family homes to 99.5% of list price. For condos/townhomes, the amount received was down 5.6% to 99.7% of list price.

- Months Supply of Inventory nearly doubled from 0.7 months to 1.3 months for single family and doubled for condo/townhomes from 0.6 to 1.2 months.

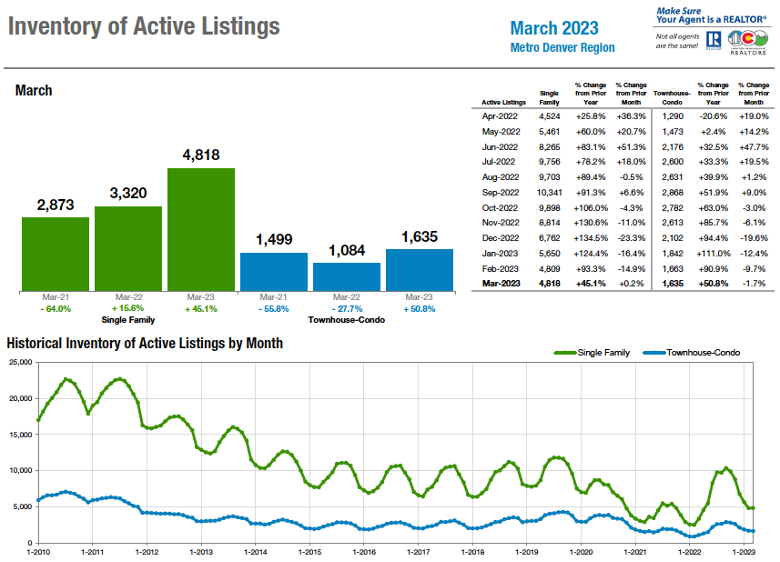

- Inventory of Active Listings was up more than 45% in March 2023 compared to a year prior with 4,818 single-family homes and up 50.8% for condo/townhomes with 1,635 properties.

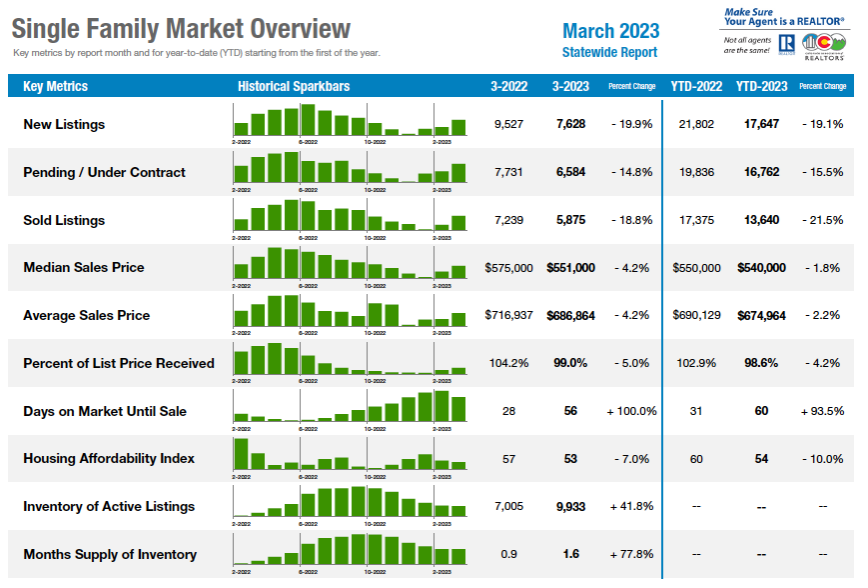

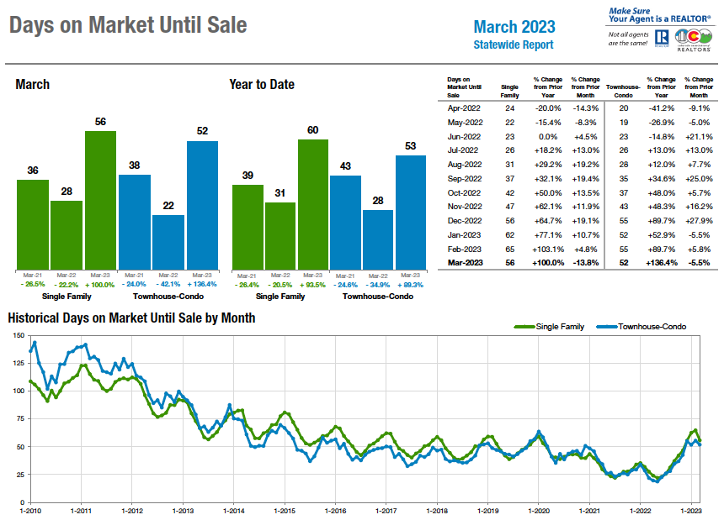

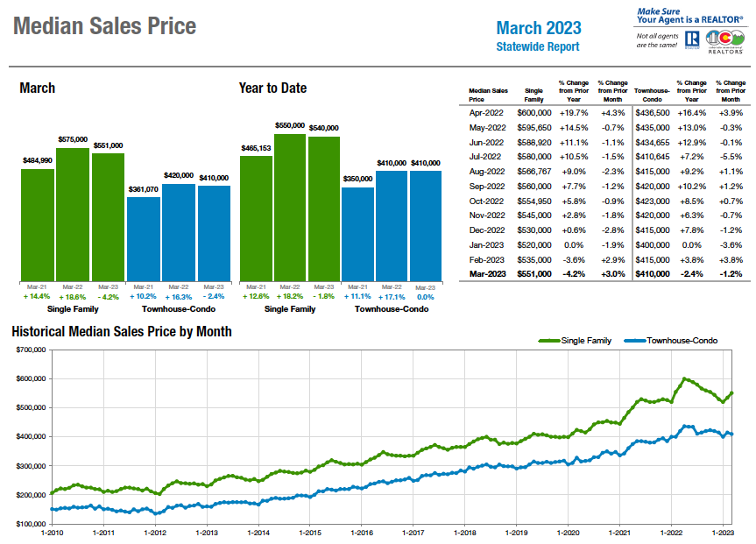

Statewide (March 2023 compared to March 2022)

- Single-Family Median Sales Price fell 4.2% from March 2022 to $551,000. Condo/townhomes dipped 2.4% to $410,000.

- Average Days on Market rose 100% from March 2022 to 56 days for single-family homes and 136% for condo/townhomes to 52 days.

- Percent of List Price Received fell 5% for single family homes to 99% of list price. For condos/townhomes, the amount received was down 4.8% to 99.6% of list price.

- Months Supply of Inventory rose from 0.9 months to 1.6 months for single family and more than doubled for condo/townhomes from 0.7 to 1.5 months.

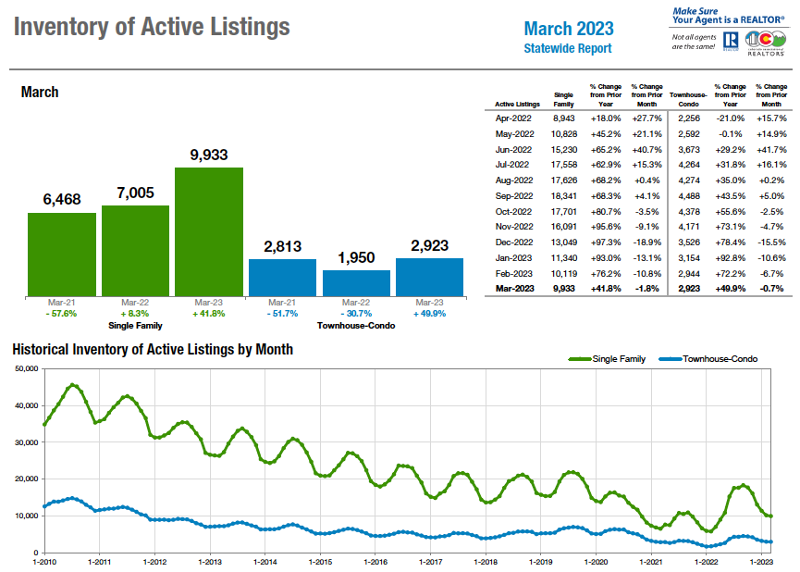

- Inventory of Active Listings was up more nearly 42% in March 2023 compared to a year prior with 9.933 single-family homes and up 50% for condo/townhomes with 2,923 properties.

“The normalized market may feel challenging coming off a hyperactive period the past few years. Supply constraints will continue to place positive pressure on home values regardless of mortgage rate movement, and buyers are still very active despite less ideal economic conditions,” added Cooper Thayer. “The key moving forward this year is pricing homes modestly to keep transactions flowing, and being prepared for a little more time on market than we are used to.”

CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county, finished the month of March down 5.4% compared to the same time last year for the Denver metro area and is down nearly 10% statewide.

Seven-county Denver metro area Single-Family Overview:

Statewide Single-Family Overview:

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The Aurora, Centennial, Adams County, and Arapahoe County numbers all tell the same story for March. Inventory was up and pricing was down. What is important to note is, as of today, inventory is down, and pricing is moving back up. The long, cold winter and high interest rates all played into having a delay in the activity however, today, with flowers coming up out of the ground, demand is returning and we’re seeing buyers coming out. Multiple offers and numerous showings in a short period of time are back in play. I can only imagine that the April numbers will look somewhat different. A good example of the market is Aurora, where there are 409 active single-family homes for sale, 418 pending sales, and 880 closings in just the past 30 days. Inventory is quickly going under contract,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“What happened to the spring real estate market? The market cycles over time but one thing is typically constant – a robust, busy spring market. In Boulder and Broomfield counties, new listings are way down in what would normally be the time when sellers decide to sell. Median sales prices are stagnant. Broomfield’s prices are up a measly 2.7% for the year and Boulder’s are slightly down. Average days on the market hasn’t just increased a bit, they’ve more than doubled.

“Townhome and condo sales in both areas are down 25% and sales price/list price is under 100%, which is the first time we’ve seen this kind of negotiation in years. Undoubtedly, sellers are holding onto their low interest rates and deciding to wait to move in hopes they go down. Buyers are doing the same – sitting on the sidelines watching and waiting for those rates to provide some relief to higher payments. The rates are unlikely to adjust significantly, meaning a somewhat stalled market for both buyers and sellers.

“The lack of consumer confidence with recent news regarding our banking system has further dampened what would normally be a brisk time of year for real estate sales. The question is, how long will it take for buyers and sellers to adjust to the new normal for interest rates and finally get this market moving again?” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“A tale of two stories. On one hand, REALTORS® were thinking, along with sellers, that the spring season would start out with a rush of business. They were right, sort of. If you have a home in the right price range, in good condition, and priced well, we have multiple offers occurring. Agents are standing in line again, and buyers trying to figure out how there are so many other buyers waiting for that special home. But the market is far different than one year ago. Total unit sales were down a whopping 24.1%, or about what we were selling in 2015. Active listings were up 64% and median prices pulled back 2.4% across the MLS. Days on market rocketed up almost 300% for single-family homes. And, although inventory remains low, the tide continues to turn.

“On the national level, as of December, the Case-Schiller National home index now showed 11 months of consecutive home sales dropping and, as of February, home prices fell for the first time in 11 years. As we have discussed, a housing slow down takes time. Mortgage applications hit a 28-year low. Hardly good news for the future of housing. We continue to see mortgage companies lean out, or close. Builder sentiment seems to flow with interest rates, and although builder sentiment rose 7 points in February, the highest increase since 2013, it remained at 42 which puts in firmly in negative territory. By March, it rose to 44, still negative. We are reminded on a weekly basis that the housing market continues to struggle, and the mortgage industry is shedding lenders and closing lending options.

“As we wade into the changing economy I believe housing across the front range, and the nation will continue to slow down. Former Treasury Secretary Larry Summers recently came out and said the likelihood of recession was increasing as a series of weak economic indicators have hit the news. And the IMF came out recently stating that we have 5 years of sluggish global growth ahead. If you Google tech layoffs, you will find that in the first quarter of 2023 we had 158,000 jobs lost. Typically, higher paying jobs, those layoffs will ripple throughout the areas that are heavily tech based. With the Federal Reserve still in a tightening cycle, more layoffs are bound to come. And it appears they may still have one more .25 rate hike left in them. The Fed typically overshoots the economy looking backwards for data that is past as we slam into a recession headfirst. I suspect that will occur again. And as companies then lay off more people, housing will take the brunt of that later in the year. For now, we will simply digest data as it comes in, and try our best to figure out what path that takes us on. If history mimics itself, once the Fed pivots, we can likely expect the economy to then show how bad things are going to really get. And my guess is, it is going to be a hard landing,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS/PIKES PEAK

“In the Colorado Springs area, March 2023 delivered the highest level of inventory of single-family/patio homes in March since 2017 and the lowest level of monthly sales in March since 2016. We experienced the first year-over decline in the monthly and year-to-date sales volumes, and the average and median sale prices in March since 2014. In March 2023, the year-over-year inventory of single-family/patio homes was 110% higher, the days-on-the-market has gone up from 14 to 48-days, while the monthly sales were down 21%, sales volume was down more than 23%, and the median and average sale prices declined 2.9% and 3.2%, respectively. In March 2023, 30% of the El Paso County active listings in the Pikes Peak MLS had price reductions compared to 10.8% in March 2022.

“Last month, 58.5% of the single-family homes sold were priced under $500,000, 32.5% were between $500,000 and $800,000, and 9% were priced over $800,000. Year-over-year, there was a 31.6% drop in the sale of single-family homes priced between $400,000 and $600,000, a 23.5% drop in homes priced between $600,000 and $1 million, and a more than 21% drop in homes priced over $1 million.

“When looking back five years and comparing single-family/patio homes sales in March 2023 with March 2018, the active listings were up over 8%, and monthly sales were down 13% however, the monthly sales volume is up by more than 34%, year-to-date sales volume is up more than 28%, and the average and the median sale prices are up over 53%. Compared with March 2013, the average and the median sale prices have escalated over 117%.

“Unequivocally, inconceivable affordability challenges due to a staggering combination of high-interest rates, step home prices, and inflation are the most daunting barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE

“As is true throughout Colorado, 2023 real estate continues to be slow in the Gunnison – Crested Butte area. The first quarter of the year brought the lowest number of sales that we have seen since 2011 and our inventory remains less than half of what it was in 2020. There has been more activity in the Gunnison area where prices are more affordable than in Crested Butte. Because of this, the reports are showing a decrease in the average and median sales price, but looking at prices in specific areas, they actually are holding steady. In many cases, sellers are starting out with high asking prices and then having to come down in order to sell. The percent of list price received for single-family homes was at 98% last year and is down to 94% year-to-date. Condos and townhomes are still selling for closer to their asking price at 99%. It is taking longer for properties to sell in general, but there are still many cases of multiple offers and properties going under contract within days of coming on the market. Sellers who want to sell can, but they need to ask the right price. Now may not be the time to test the market with a high asking price. Buyers need an agent who is paying attention for them because when the perfect property comes along, you need to be ready to act quickly or you will miss out,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER COUNTY

“March is and has been an incredible benchmark for the health of Denver’s real estate market. Traditionally (you know, before 2020…), March ushered in a spring homebuying season where, with the snow melting, the market began to thaw, and we saw which plants survived the winter. The price declines that, again, we traditionally see from October through February begin to reverse and happy home buyers emerge as happy home sellers ready their home for peak transaction season. That is/was tradition.

“This year however, as a bookmark to our 3rd successor to the fateful March 2020, is anything but traditional. In Denver County, for the freestanding home category, the median price plummeted 12.6% from last year. This isn’t simply noteworthy because of the time of year but rather because, at this same time last year, we were discussing an 18.3% increase in the median price over 2021 which preceded two other years’ double-digit price increases. Furthermore, with the ’traditional’ year-over-year comparisons only recently dipping into negative territory for 3 of the last 4 months, we have never, I repeat never had a double-digit, year-over-year decrease in the Colorado Association of REALTORS® history tracking of the Denver market. Tradition is officially ‘out the window.’

“A reasonable person would think, ‘well, with prices taking a nosedive, inventory must be flying up’ – not so. While the months supply of inventory now hovering at 1.1 months in Denver for a freestanding home, that number is still paralyzingly low in the long run of history’s comparison. While true that last year’s 0.4 months matched 2021s and is now nearly tripled, the ‘traditional’ multi-month preference for a balanced market appears to be evaporating in the, dare I say it again, 2020s ‘new normal.’ Never before has our market sustained low inventory and dropping prices at the same time. The easiest explanation, but not necessarily the most accurate at this point, falls on interest rates but one could also say that the overall cost of living must also play a factor. The battle-weary buyer and all their tales could also scare off would-be buyers as the ever-prevalent issue with home sellers becoming home buyers in a low inventory situation proves less and less desirable.

“March is and has been simply a benchmark – one we look at to compare years and while March 2023 could be a simple talking point over the duration of this year and further prove a pithy ‘year over year’ commentary, it could also be the point where its year, like 2008, proves infamous. Has Denver’s peak come and gone or is this simply a blip on a scatter graph? Worse still, could we be on a mountain freeway to a real reversal of Denver’s housing boom? In that case, March 2024 will tell us for sure,” said Denver-area REALTOR® Matthew Leprino.

DENVER METRO

“As inventory continues to be a challenge, we are seeing fewer sellers than last year at this time jumping into the market. New listings for single-family homes are down 15.5% compared to March 2022. New listings for townhouse/condos were down 10.5%. As expected with fewer homes on the market, there are less homes under contract. The median sales price for homes has also fallen 5.5% from last year at this time, landing at just shy of $600,000. Townhouse/condos experienced less of a price drop of just 2.6%, putting the median price at $493,079.

“Spring brings opportunity, and this spring should be no exception. There are currently 45% more single-family homes on the market than this time last year and 50% more townhouse/condos on the market. That should create more activity in the market as we move into April. Properties that have been prepared for sale and priced correctly are selling quickly. Other homes which have not been priced appropriately, due to condition, location, or both are sitting on the market longer, causing the days on market to have tripled since last March going from an average of 15 days to 45 days this past month.

“Due to the rise in interest rates, which has affected the overall affordability of properties, buyers are being more discerning in their buying decisions and are willing to wait until that right home comes on the market. When it does, they are willing to pay full price or better, but they have not been as willing to settle as they were when interest rates were in the 3% range. Housing affordability continues to challenge the metro-Denver market. Affordability can be addressed best by adding inventory to the market. With more choice there is more competition and the potential for pricing to soften, but we continue to see not enough available inventory, so although prices have adjusted downward slightly, it has not been enough to move the affordability needle,” said metro-Denver-area REALTOR® Karen Levine.

DOUGLAS COUNTY

“Compared to last March’s statistics, the market may look scary at first glance. Median sales price is down, days on market have skyrocketed, and homes are back to selling below asking prices on average. However, it’s important to remember that the last few years were an anomaly, and we are currently in an arguably healthier market than before. In fact, I believe last month’s market has been the most ‘normal’ we’ve seen since the beginning of the pandemic. Higher mortgage rates have humbled parties on both sides of the transaction. Buyers are generally no longer able to buy average homes with non-contingent, over-asking-price offers. The result is a taming of the market, with modest pricing becoming a requirement for sellers to move inventory.

In Douglas County last month, closed single-family homes received 99.4% of list price at a median sales price of $701,250, down about 4% from March of last year. The minor pricing correction we are experiencing right now is quite healthy, and far from the ‘crash’ many feared would happen last year. Inventory is sitting around 1.3 months, up from 0.7 months this time last year, still indicating a moderate seller’s market, reflecting the inherent desirability of living in Douglas County.

“The normalized market may feel challenging coming off a hyperactive period the past few years, but we are certainly still far from it being a bad time to buy or sell real estate here in Douglas County. Supply constraints will continue to place positive pressure on home values regardless of mortgage rate movement, and buyers are still very active despite less ideal economic conditions. The key moving forward this year is pricing homes modestly to keep transactions flowing, and being prepared for a little more time on market than we are used to,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO

“The big chill continues in southwest Colorado. Listings are as scarce as snow shovels. New listings were down 38% compared to this time last year. There were just over 100 single-family homes for sale in March 2023 (about a 2-month supply of inventory). The decrease in new listings is partially due to the severe weather and heavy snowpack. Pending sales were also down over 46% compared to last year. The median price of single-family homes increased 3% year-over-year to $775,000, with the average sales price still hovering at just over $1 million. The percentage of list price to sold price fell about 5% to 96%, an indicator that some sellers are beginning to negotiate and offer concessions.

“The townhome/condo market is performing similarly to the single-family market, with new listings down 33%. There was a significant, 25%, jump in the median price over this time last year, with units selling just above $500,000, primarily due to new construction hitting the market. The current inventory of townhomes and condos is just 37 units (1.5 months supply).

“Buyers are hoping April will not only bring spring showers but a much-needed thaw to the market with fresh listings and more options. Buyer demand continues to outpace available inventory, keeping prices elevated and options limited,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“Warm, cold, hot, cold. Not quite there yet for the spring fever to hit the real estate market, but there is motion starting. Townhouse/condos have begun to stir and bring the season to life with new listings over and above this time last year. Compared to March 2022, new listings are up 31.7% and sold listings are up 8.8%. Days-on-market are slushy at best with an increase 105 compared to last year’s 63. Prices are also on the frigid side with a 10.9% decrease in average sales price.

“Single-family homes are still stuck in the winter freeze. New listings are down 11.8% from March 2022 and sold listings are down 6.2%. Days on market has lengthened 75%, from 36 this time last year to 63 at the end of March. Even the average sales price has declined, not surpassed, list price by negative 2.8,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“With the recent monthly housing data fresh off the wires, here’s a quick assessment of what’s happening: Hurry up and wait. Inventory is piling up. Okay, ‘piling up’ may be a stretch but, with more than 6 weeks of inventory on the market, comparatively speaking, that’s a lot of housing waiting eagerly to be snapped up – except that sellers are having to wait a bit for the snapping to start. Days on market has gone up 40% year-over-year to nearly 70 days.

“These competing data points tell a tale of the recalibration we talked about a month ago, but buyers are recalibrating faster than sellers – so the number of homes available for sale are still priced out of the reach of what most buyers are willing or able to pay. With list-price-to-sale-price ratios below 100%, it is clear that many sellers are having to accept a bit less than what they may have originally expected when putting their house on the market at a premium price.

“Where’s the Easter Egg, you ask? I think it is hidden in plain sight as the median price. The median price for single-family homes in the Fort Collins area rose to $623,522 for March – the third highest median price in the last 12 months. Peeling back the shell a bit deeper illustrates that the Baby Boomers remain the demographic cohort with the most money to spend on real estate regardless of whether interest rates are above or below a 7% interest rate breaking point. The National Association of REALTORS® reported at the end of last month that Boomers made up 39% of the buyers nationwide; an increase of 10% over last year as this still-powerful economic group leverages existing home equity and accumulated wealth to make real estate purchases at the upper end of price points, thus driving the median price measurement higher.

“When will interest rates come down? Again, it’s a hurry-up and wait scenario. Unexpected volatility in the banking sector in March created more challenges for the Federal Reserve as it considered how to proceed with its mandate to curb inflation with an economy still quite robust but showing signs of recession despite a resilient jobs market. A sub-6%, 30-year fixed mortgage rate may not reveal itself until late summer and I don’t want to put all my eggs in one basket but I’m holding out that we may see an easing of interest rates a bit sooner which will bring hundreds of thousands of millennials (and their younger cohorts) back into the housing market. We’ll have to (hurry-up-and) wait and see,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“March snow brings April listings. This is the hope for the Roaring Fork and Colorado River Valleys. We saw a slight increase in the number of single-family homes that came on the market in March, up 6.5% or 4 homes more over last March. The townhome market took a bigger hit with a decrease of 53% for a total of 15 listings versus the 32 listed in March 2022. Pending sales were down 5.3% for single family and a whopping 53% for multifamily mirroring the lack of listings. The continued lack of inventory has kept the market values pretty stable, with a slight decrease in the median sale price of single-family homes of 2.4% to $560,000. We are seeing a few signs of a slight softening locally, days on market increased 56% for single-family homes and 27% for multifamily.

“Whether the softening is due to the continued volatility of interest rates or just exhausted buyers not finding a suitable residence in what continues to be a high-price market remains to be seen. As the snow melts and the sun comes out, we remain hopeful for an active spring,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“The Grand Junction market continues to be challenging with new listings, pendings, and solds all down, both year-to-date, and in March 2023 vs. March 2022, with solds being down 30%. However, even with the continual down numbers, prices are holding. The median is down only .05% at $368,000 and the average is actually up to $415,395. That reflects the fact that activity in the $500,000-$600,000 was up. The strongest bracket was $300,000-$400,000, second was the $400,000-$500,000 and then the $500,000 bracket.

“Days on market have increased a little to 97 days, but affordability remains a major issue. Inventory has increased a little, and we now have a two-month supply, but a lot of sellers are not coming on market because of the interest rates. There is still optimism that the market will have a traditional spring bump in activity, and interest rates will gradually get better,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“The Jefferson County market continues its decline in most categories from this time last year. However, there are homes – if priced right with a lot of popular upgrades – that are receiving multiple offers, waiving inspections, adding escalation clauses, and covering the appraisal gap. For other single-family homes, they are sitting a little longer as evidenced by our average 32 days on market – an increase of 255% year over year. Other key categories that have decreased from this time last year include; new listings down 9.4%, sold listings -19.8%, and median sales price -7.1% to $650,000. Some buyers are coming back into the market now that the weather is getting warmer. Buyers can also buy down their interest rate or look for loan programs that may assist them.

“The condo/townhome market is seeing year-over-year decreases in most categories as well including new listings -17%, sold homes -12.8%, and median sales price -7.8% to $400,000. Days on market increased 106.3%,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS

“With real estate market conditions evolving from frozen to icy and then muddy, whose market is it – buyer or seller? Spring is usually an exciting time for the Pagosa Springs housing market, as snow melts. Coming out of hibernation, property searches and listings were up in March. While active snowfall and spring skiing conditions were exciting buyers this year, the real estate market continues to lack momentum with added disappointment.

“There is still a standoff between buyers and sellers as they emerge from frozen to icy (and even muddy) home buying and selling mindset conditions. Many buyers are no longer able to pay higher prices or purchase a home in need of work, and sellers are not willing to cut their home’s real estate wealth (price) or lose a low mortgage interest rate. In many cases sellers are not willing to sell. That mindset, together with an abundance of spring snow conditions, resulted in fewer listings, down 41.7% from this time last year. Sellers are not receiving offers on overpriced homes and land, and buyers are not receiving sizable savings on the higher prices. The standoff result is longer days on market, now tracking at almost six months. Good news on homes competitively priced shows percentage of list price received up slightly in March at 97.4%. Sellers entering this market must understand they must have patience, price right, and plan longer time periods to sell their homes. In a predominant second home real estate market, sellers desire a reason to sell their investment. Qualified financed buyers are understanding the new norm for interest rates tracking to 8%. Current home purchasing interest rates save a buyer $600 a month or more (depending on price) compared to predicted 8% rates.

“The standoff comes with higher home prices and little inventory. While the March median sales price dropped to $555,000 (from $608,200 March 2022) and March average sales price $604,316 (from $760,948 March 2022), the year-to-date 2023 median sales price gained 7.1% to $529,900 (from YTD 2002). 2023 year-to-date sales are down 45%. Of the 16 homes sold in March, 10 were priced between $500,00-699,999. Apparently, buyers are accepting the new 2023 year-to-date average sales price of $634,346 or, as cash buyers, the interest rates are not an influencer on their buying decision. There are currently 10 homes in this price group on the market. Higher priced homes are at 46, with a total of 83 active homes on the market (2.9-months of inventory).

“The Pagosa real estate market is just like buyers and sellers trying to decide who has the upper position. There is not a clear winner to declare whose market it has become. Substantial inventory volume in all price points will bring some sunshine to a disappointing market (chasing away the frozen, icy, and muddy mindsets) and present a clearer market picture,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The most positive sign in Pueblo’s March housing report is inventory, up more than 60% from last March to 524 homes for sale and pushing the overall inventory supply to 2.4 months, double what we had in March 2022. Buyers have more to look at and less pressure to make a quick decision. Homes are on the market longer. Still a seller’s market but not as strong as the past three years as sellers need to demonstrate a little bit of patience with buyers who are taking their time making decisions. Interest rates are keeping buyers from writing a quick offer.

“New listings were down 11.9% from March 2022 and are down 13.3% year-to-date. Pending sales dropped 5.9% from March 2022 and are -24.9% year-to-date. The big number so far this year is solds, down approximately 40% from last March and year-to-date. The percent of list price received was down 1.9% to 97.8% from March 2022 and is down 1.7% to 97.9% year-to-date. Despite all of that, the median price still rose to $323,450 up 2.5% from March 2022 and up 3.1% to $315,000 year-to-date.

“New building permits for homes jumped to 40 pulled in March. A little more than the first 2 months combined. This is a good sign for buyers,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“The month of March was met with 53% fewer single-family homes and over 44% fewer townhome/condo properties entering the market from the prior year. There were 42 active listings in the county for single family, down 22% from 2022; multi-family had 33 units, which was similar to 2022. With less inventory than last year, it would be silly to think anything but that pending and closed sales would also be significantly less. Low inventory is certainly a culprit to the housing slowdown, but the higher interest rates have also played into the psychology of investing in real estate. With six months of interest rates hovering over 6%, buyers are beginning to wrap their heads around the anomaly of the 2-3% interest rates of the past and the realism of rates that are now slightly below the 30-year average.

“The spring market brings a new energy with more listings that are sure to come and hope of a mortgage payment that will be one’s own and not their landlords. Buyers and sellers will each have to adapt their expectations to avoid disappointment. While we can expect some inventory to come on in the next month or so, we can also expect pricing to be similar to first quarter results that exhibit average sales prices holding – in spite of outside influencers. Of course, factors for how a property is received and how many showings and/or offers it receives are impacted by location, finishes and more. For the first quarter of this year, single-family supply remains to be about 2 months and townhomes/condos have about a 1-month supply,” said Steamboat Springs-area REALTOR® Marci Valicenti.

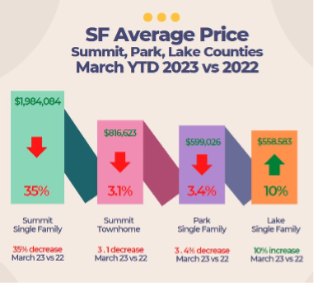

SUMMIT, PARK, AND LAKE COUNTIES

“Spring breakers rejoiced with the great snow at the ski areas, while buyers rejoiced at the lower prices this March in Summit County. Another unexpected March market stat for Summit County was the average sales price for single-family homes falling 35% from February to $1.78 million. This is also 35% lower than March 2022. Although this sounds dramatic, the median sale price on all residential properties is up 6.5% over last year. Average price for all residential properties was $1.18 million while median price was $875,000. Condo sale prices averaged $741,252 in March with an average 56 days to sell a property.

“Despite 34% more listings, there were 13% fewer sales than a year before, but that number is about 6% better than we did last month. Breckenridge had 92 listings in February and 100 in March, Dillon had 10 and 15. Another sign of our market flattening is sellers received about 97% of their list price and are entertaining negotiations.

“Park County’s average single-family home price was $584,825, while Lake County’s was $485,000.

“There are 353 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $139,900 and a high price single-family home in Breckenridge for $19.5 million. Out of the 137 March sales, the lowest was a single-family home in Leadville for $90,000 and the highest was a single-family home in Keystone for $4.29 million. These numbers exclude deed restricted, affordable housing. In Summit County, an average-priced residential property was $1.48 million and the average price of the 25 single-family homes was $1.78 million, down $990,835 from last month,” said Summit County REALTOR® Dana Cottrell.

TELLURIDE

“Historically, the Telluride real estate market has never had a lot of transactions monthly nor annually. Up until the Pandemic Market, the number of sales annually would range from about 500 to 600. During the pandemic they surged to 700 to 900 annually. For the first two months of 2023 the combined total number of sales was 48. The number of sales in March was 38, a very big jump with $74.57 million in total sales. Since Telluride has become an expensive market over the last decade and very expensive during the pandemic, it seems that the wealthy have jumped back in the market strongly in March. That may be due to two things. One, they still like the beauty and privacy of the Telluride region and, the alternative investment choices in the stock market and global economies just look too scary.

“I’ve said in the past that one can’t really predict what annual sales might be like until you see a full quarter sales report. This year, volatility means even a quarter’s sales aren’t enough track record to guess at the rest of the year. Resort property purchases are a luxury, not a necessity. Hence, this year’s sales predictions are mostly ‘put your seat belt on and enjoy the ride,’” said Telluride-area REALTOR® George Harvey.

VAIL

“Spring is just beginning to emerge in the mountains, albeit historically our two snowiest months are March and April. We have snow depths above historical averages which is wonderful news for the drought we have been experiencing. The month of March continued the trend we have been experiencing since July 2022. Unit sales for the month were negative 25% versus March 2022. The dollar volume declined 17% which follows the trend of sales shifting to the higher price points. Inventory improved slightly on single family/duplex however, the inventory on condo/townhomes had basically a flat inventory for the month.

“On a first quarter basis, new listings were negative 40% however, months supply improved to 3.1 months. The variable in new listings and months supply is an indicator of a softer market environment driven by volatility of mortgage rates and concerns with the economy.

‘First quarter transactions were negative 37% and dollar volume was down 30% following the past trend and driven by the macro-economic factors. Pending sales are showing similar sales with March negative 46.9% and year-to-date pending sales down 38.7%. Days on market have also escalated for the month with a plus 69% and positive 43% year to date.

“The extension of the mountains being open until May 1will continue with more traffic than normal however, the current trends may well continue as we enter our annual shoulder season that leads the summer market stimulus,” said Vail-area REALTOR® Mike Budd.

DAYS ON MARKET – SEVEN-COUNTY DENVER METRO AREA

DAYS ON MARKET – STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

MEDIAN SALES PRICE – SEVEN-COUNTY DENVER METRO AREA

MEDIAN SALES PRICE – STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The March 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing nearly 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.