Buyers and sellers settling into the new normal

ENGLEWOOD, CO – Whether in the seven-county Denver metro area or in housing markets statewide, continued higher mortgage interest rates have kept many buyers on the sidelines, as sellers face a growing pressure to adjust pricing and make concessions to get deals completed, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

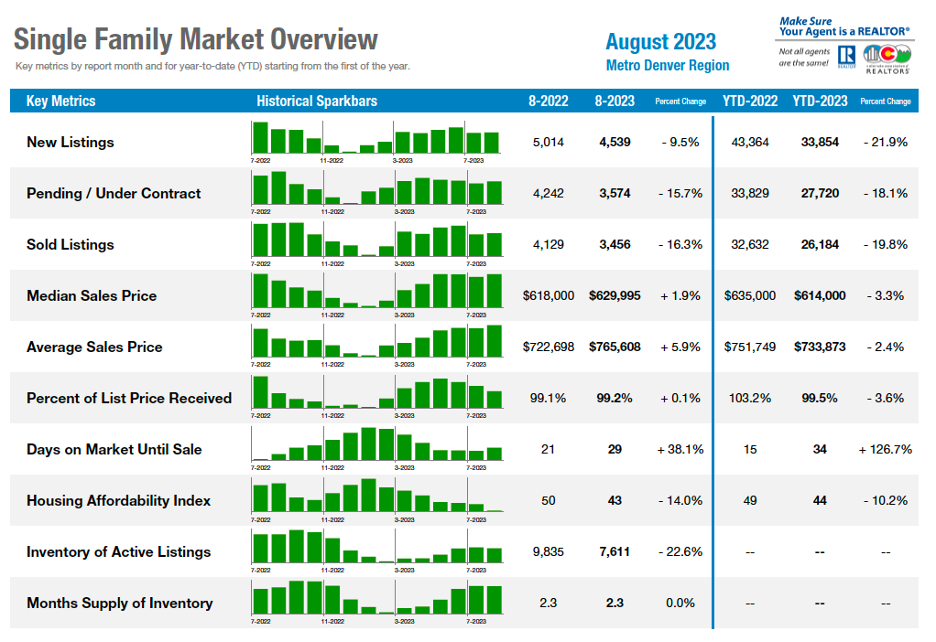

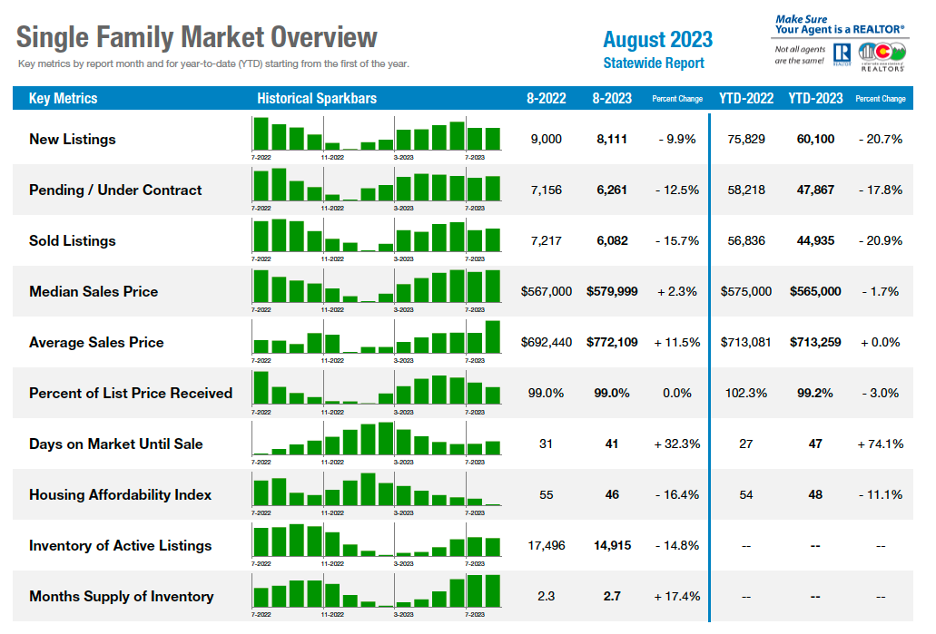

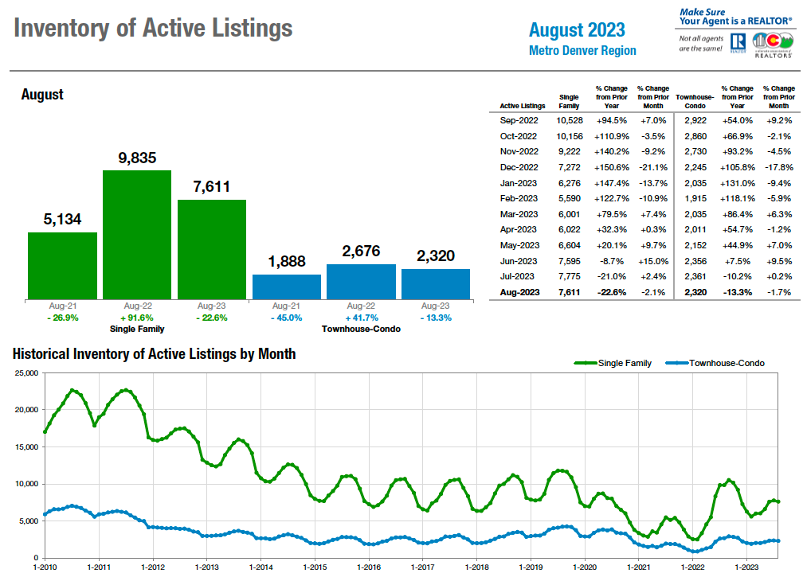

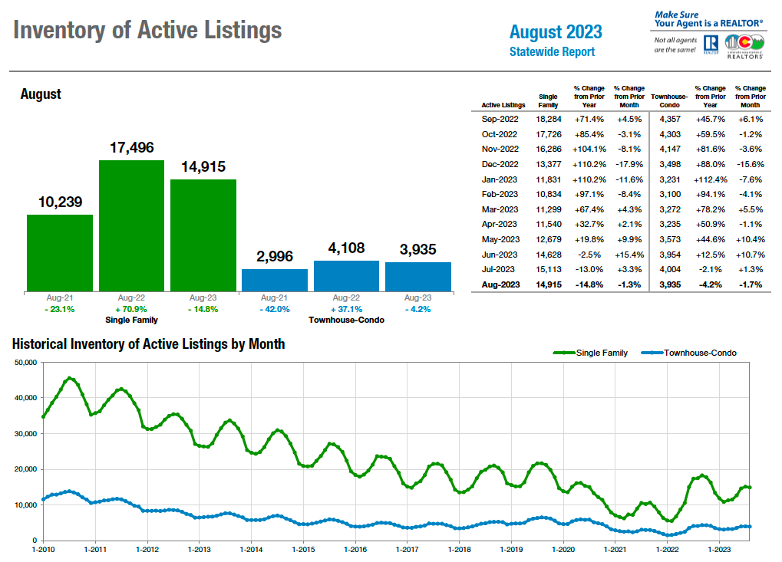

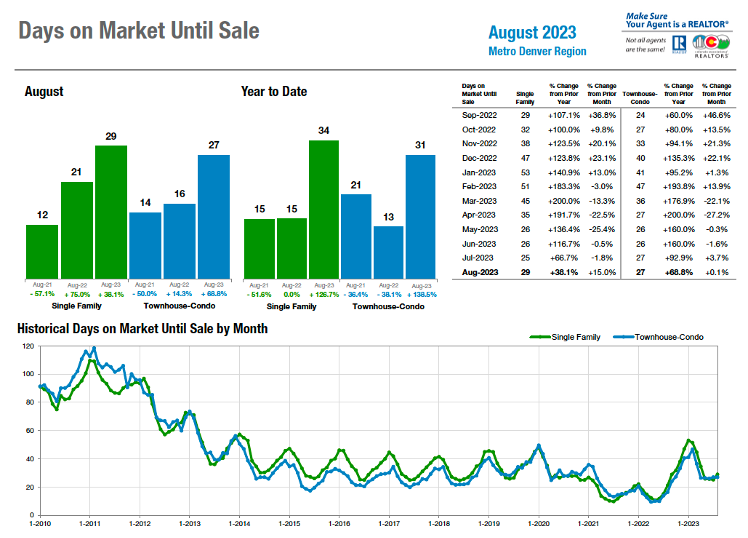

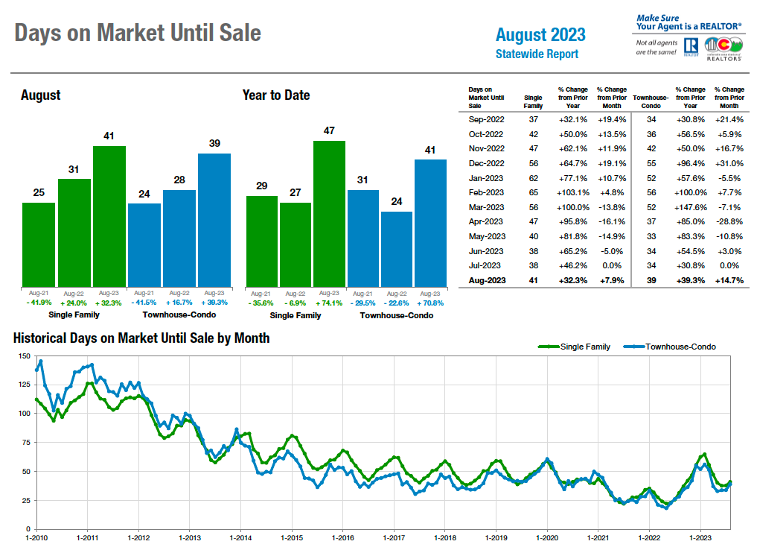

While dipping just slightly from July to August, the inventory of active listings is off nearly 15% statewide and is down 22.6% in the seven-county Denver metro area. For those listings that are moving to close, the average days on market rose just shy of 8% to 41 days from July to August and is up more than 32% from a year ago. In the Denver-metro area, the average 29 days on market reflects a 15% month-over-month increase and is up more than 38% from August 2022.

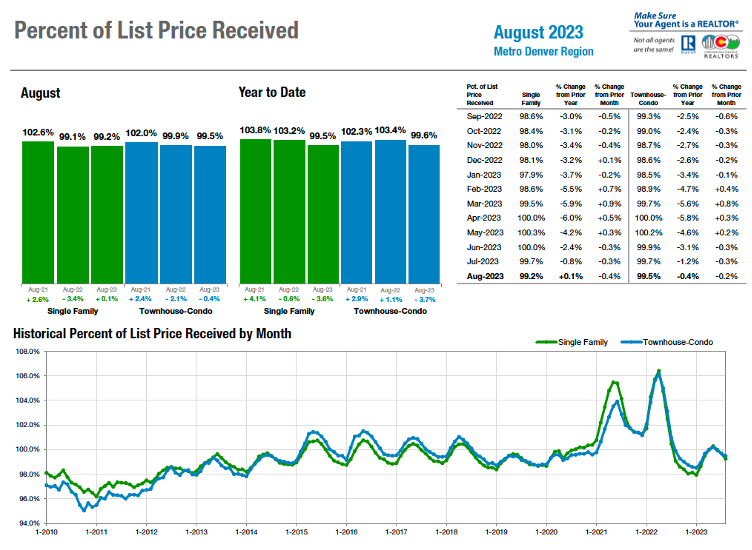

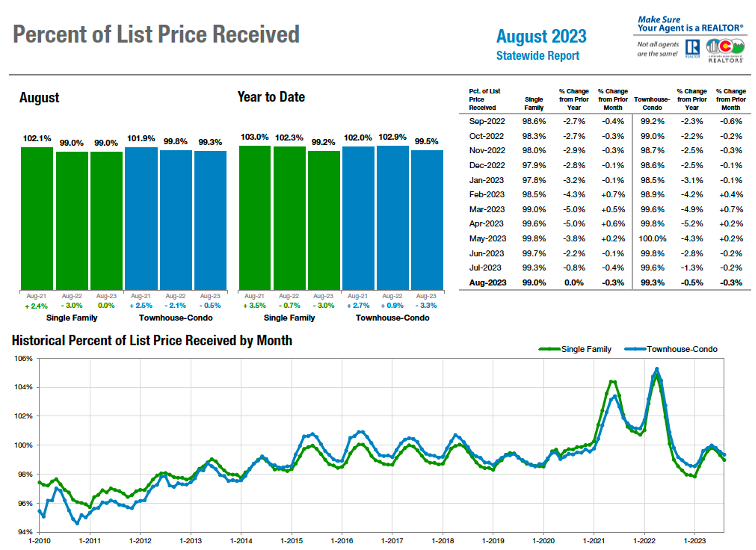

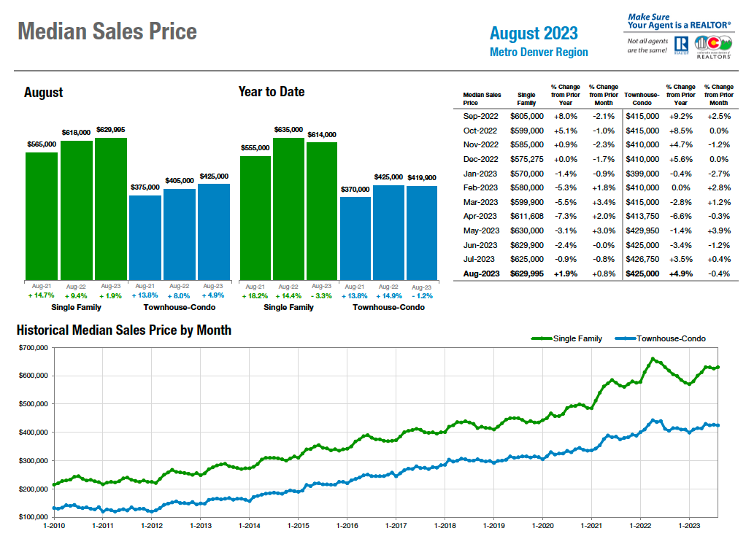

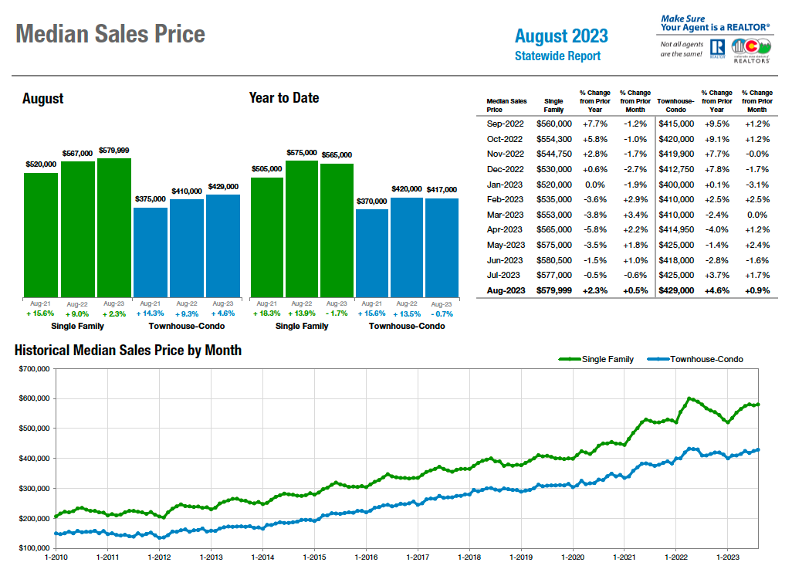

No matter where you are in the state or what type of property – single-family or townhome/condo – the percent of list price received remains between 99% to 99.5%. The combination of conditions pushed single-family median sales pricing up a tick between July and August where it now sits up 2.3% from a year ago at $580,000 statewide, and up just shy of 2% in the Denver-metro area to $629,995.

“Suffice to say that while demand for housing is steady, high interest rates are still dampening potential home buyer’s eagerness to buy, and sellers continue to adjust their expectations for how quickly and for what price they can sell their homes. The correction to the once hot-as-blazes housing market continues,” said Fort Collins-area REALTOR® Chris Hardy.

With hopes of lower interest rates in 2023 disappearing into thin air, buyers and sellers have adapted to and settled into our new market.

“Sellers who really need to sell are listing their homes while those who just want to move are sitting tight. It’s not just about wanting to move; it’s often driven by life-changing events such as births, deaths, divorces, or changes in job status. Despite a shrinking buyer pool due to higher interest rates and affordability challenges, the tight inventory has resulted in average and median home prices holding steady, without the usual seasonal retractions we’ve seen in the past,” said Boulder-area REALTOR® Kelly Moye.

With the exception of higher interest rates, “the opportunity for homeownership is better than at any time over the last 3 years. Mellow is good, mellow is predictable and while we all know it’ll never last, it’s always better than either too hot or too cold,” said Denver-area REALTOR® Matthew Leprino.

As the year progresses with no major economic events or decreases in mortgage rates, sellers are beginning to face a more challenging market.

“The persistent high-interest rate environment combined with home prices remaining elevated has prevented excitement from buyers, causing inventory to begin to pile up. Looking at seasonal trends, both the single-family and multi-family markets appear to have passed their annual peak as the summer comes to an end. For the rest of the year, expect prices to slightly decrease as more inventory is added to the market without an increase in demand. Barring any major changes in financial markets, buyers are likely to remain cautious and patient throughout the winter before the market picks back up next spring,” said Douglas County-area REALTOR® Cooper Thayer.

“Many sellers have likely recalibrated their expectations for what the market will bear and are starting out listing their homes for less than they would have a year ago or are reducing the original list price of the home until the price attracts a buyer,” said Fort Collins-area REALTOR® Chris Hardy.

Seven County Denver area Market Overview:

Statewide Market Overview

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Not much has changed over the past couple of months. Sadly, the interest rates have not offered buyers any relief and sellers are continuing to hold on to the good interest rate they have. It takes a pretty significant life change for sellers to sell. We are seeing more of the younger buyers who have accepted that interest rates are probably not going to see much change through the balance of the year.

“That said, it is consistent throughout Aurora, Centennial, as well as Adams and Arapahoe counties that listings are down. Listing inventory has seen a drop of almost 40% in many of the zip codes for Adams and Arapahoe counties. Prices are also down slightly in the same areas. 80111 zip code has seen a 4% increase and a median price just over $1 million. Aurora zip codes show prices down about 5% with median price varying from one location to another. 80010 zip code has a median price of $415,000, 80013 is at $500,000, 80015 is reporting a median price of $580,000 and 80016 is the highest median price in Aurora, at $830,000.

“In Arapahoe County, the median price for a condo/townhome is $377,000, a 2.7% increase over the same time in 2022. Condo/townhome inventory is down approximately 10% over last year. Buyers looking for affordability should consider a condo or townhome. There are good square footages on some of these condos and prices are the most affordable way to enter home ownership. Condos/townhomes in Aurora have seen 2.7% appreciation over this time in 2022,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“With hopes of lower interest rates in 2023 disappearing into thin air, buyers and sellers have adapted to and settled into our new market. It’s one where sellers who really need to sell are listing their homes while those who just want to move are sitting tight. It’s not just about wanting to move; it’s often driven by life-changing events such as births, deaths, divorces, or changes in job status. Despite a shrinking buyer pool due to higher interest rates and affordability challenges, the tight inventory has resulted in average and median home prices holding steady, without the usual seasonal retractions we’ve seen in the past.

“In Boulder County, new listings continue to diminish, down 11% since January. Prices are down 4%, which is actually a stronger number than the typical fall price reductions due to the lack of inventory. Sellers are negotiating a bit on price as sales-price-to-list-price hovers around 99% and days on market continues to climb to an average of 49 days. Sellers who are used to quick sales and bidding wars are facing the harsh truth about realistic pricing and timing.

“Broomfield County continues to outshine its neighbor as it’s one of the only counties actually showing prices up by a modest 3% and time on the market averaging 30 days. Affordability may be a factor as Broomfield’s $700,000 median price could be easier for some buyers to stomach with rising interest rates. An interesting trend to note is that the market is cooling at higher price points, while remaining highly competitive at lower price points. This makes the fall and winter seasons an opportune time for move-up home buyers,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“The housing market along the Pikes Peak region continues to create frustration for many buyers and sellers. Despite having active listings fall 14% year-over-year for all properties, we have now seen the median sales price slip 2.1%. This may not seem like it is substantial, and maybe it isn’t, but the trend continues, and housing corrections take time, so it is worth noting. Average days on market increased 70% on single-family/patio homes and was up 133% on townhomes. The total number of units sold saw a decrease of 22.7%.

“What we don’t see in these numbers are the homes not selling, owners who could not sell, or the buyers who could not buy. Weekly we receive 5-10 inquiries now for property management because a seller cannot sell. When we talk to them, 50% of those would-be landlords will be upside down on the rent plus costs vs their payment. So, despite the above numbers showing values dropping 2.1%, we have owners upside down on home mortgages and cannot sell. That is new, and something we have not seen for many years.

“Nationally, the Federal Reserve met at Jackson Hole. Fed Chair Powell has stated that they are watching the inflation numbers closely. He did not close the door to another increase on rates. Also, in August we saw a slight up-tick on nonfarm unemployment payroll from 3.6-3.8%. Job openings also shrank. Both of these are statistics the FED will continue to watch as they move forward. August also saw the 10-year yield stay elevated. That translated to higher mortgage rates and the lowest demand in mortgages since 1996. We are now in the most unaffordable housing market since 1984.

“As we move into September, you can feel fall in the air for housing. As leaves begin to fall, homes are sitting on the market longer and sellers are dropping prices. Interest rate buy-downs are being offered by builders struggling to move inventory. And despite low inventory, average days on market continues to increase. Buyer demand is quite weak, and many buyers are now saving money by renting vs buying. In many areas, people can save $500-$1000 a month by renting instead of buying a similar house on the same street. It is hard to argue that kind savings in an economy that also saw credit card delinquencies rise, consumer savings drop, and automobile payment delinquencies rise. Add to that student loans begin again in October with an average payment of $200 per month. Winter could prove to be a struggle if rates stay elevated. The banking industry also continues to struggle with deposit flight, and elevated corporate bankruptcies. We will watch the data as we move from fall to winter and see where it takes us,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

In the Colorado Springs area, August 2023 delivered a 21.9% year-over-year drop in the sale of single-family/patio homes and an 8.3% decline in the number of active listings. Average days on market climbed to 29 days compared to 17 days in August 2022, as the average price escalated to $553,000, while there was a 25% decrease in the year-to date sales volume.

Last month, 53.9% of the single-family/patio homes sold were priced under $500,000, 33.7% were between $500,000 and $800,000, and 12.4% over $800,000. Year-over-year, there was a 22% drop in the sale of single-family/patio homes priced under $300,000, a 27% decline in homes priced between $400,000 and $600,000, a 22.6% decrease in homes priced between $600,000 and $1 million, and an incredible 12% increase in homes priced over $1 million.

“The inconceivable affordability challenges culminating from a staggering combination of high-interest rates, steep home prices, and daunting inflation, continue to be the most formidable barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

An analysis of the lowest and highest levels in the Colorado Springs market during the month of August from 2000 to 2023:

- Lowest Level of Active Listings: 1,009 in August 2021

- Highest Level: 7,052 in August 2007

- Lowest Level of Months Supply: 0.5 in August 2021

- Highest Level of Months Supply: 8.1 in August 2008

- Lowest Level of Monthly Sales: 778 in August 2008

- Highest Level of Monthly Sales: 1,870 in August 2021

- Lowest Level of Monthly Sales Volume: $169.3 million in August 2010

- Highest Level of Monthly Sales Volume: $933.6 million in August 2021

- Lowest Level of Monthly Median Price: $145,900 in August 2000

- Highest Level of Monthly Median Price: $480,592 in August 2022.

DENVER COUNTY

“For a summer that never really got started, Denver’s last gasp of a homebuyer season ended with the same uneventful thud. That may seem melodramatic with violins whaling in the background but it’s not all that bad of a thing given the factors at play. No doubt interest rates and the overall cost of living increases played the biggest factors, but we saw some promising news that the decline, post market correction, may have mellowed – even if only for a short time.

“Denver’s months supply, a measure of how much inventory currently satisfies demand, hit a 51-month high at 1.9 for the free-standing home category, and a 34-month high, 2.4, for the condo market. Both numbers show that either demand is lessening or the frenzy of homebuying has officially ended in Denver – or both. While final sales prices vs. list prices still remain north of 99%, but below – to the resounding applause of would-be buyers – 100%, the opportunity for homeownership can confidently be said is better than any time over the last 3 years…you know, aside from that whole high interest rate thing. Mellow is good, mellow is predictable and while we all know it’ll never last, it’s always better than either too hot or too cold,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“As the year progresses with no major economic events or decreases in mortgage rates, sellers are beginning to face a more challenging market. The persistent high-interest rate environment combined with home prices remaining elevated has prevented excitement from buyers, causing inventory to begin to pile up. The number of single-family homes on the market in Douglas County climbed 6.6% in August, and average days on market held steady at around 30 days. However, if you’re thinking about listing a Douglas County home and feel deterred by the slowing market, don’t give up just yet.

“Despite the higher monthly housing costs associated with elevated mortgage rates, higher taxes, and overall inflation, single-family median sale prices have relentlessly climbed since January, nearing all-time highs at $759,000 in August (the record high was $772,000 in April 2022). Douglas County’s sale prices remain significantly higher than that of the entire Denver Metro Area, where the median sale price of single-family homes was just $650,000 in August, nearly 17% lower than Douglas County.

“The multi-family market segment tells a nearly identical story. While median sale prices did experience a very slight decrease month-over-month (-0.7%), the general lack of inventory in Douglas County has pushed sale prices of condos and townhomes up nearly 23% higher than the Denver metro area. Looking at seasonal trends, both the single-family and multi-family markets appear to have passed their annual peak as the summer comes to an end. For the rest of the year, expect prices to slightly decrease as more inventory is added to the market without an increase in demand. Barring any major changes in financial markets, buyers are likely to remain cautious and patient throughout the winter before the market picks back up next spring,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The Durango and La Plata County real estate market showed some notable trends and shifts in August. With prices experiencing a steady 3% increase over the past year, the market continues to evolve,” said Durango-area REALTOR® Jarrod Nixon.

Key highlights:

Price Trends:

- The median sales price is up 5% year-to-date at $749,000, making Durango increasingly less affordable for buyers, particularly in the lower price range.

- Prices increased approximately 3% compared to a year prior, indicating ongoing appreciation in the region’s property values.

Inventory:

- The months’ supply of inventory expanded to 4 months but remains below a balanced market range. However, this increase might indicate a shift towards a more buyer-friendly market in the future.

- Inventory below $1 million remains scarce, putting pressure on buyers in this price range.

- In contrast, inventory for properties priced at $1.5 million and above is rising, suggesting a potential shift towards a more saturated high-end market.

Market Dynamics:

- The percent of list price received stands at 99.5%, indicating that, despite some negotiation starting to occur, sellers are still generally achieving close to their asking prices.

- Sellers are beginning to negotiate more, while buyers are becoming increasingly discerning and have higher expectations. Properties must now be a perfect fit to attract buyers.

- New listings are entering the market later this season, causing a delay in the selling season. This delay might impact the overall market dynamics.

- The condo and townhome market has a notable 33% decrease in sold units in August, primarily due to limited inventory, suggesting a challenging environment for buyers in this segment.

ESTES PARK

“It’s been a long and slow summer here in the high country. Homes are selling, but the length of time on the market is staggering compared to the feverish pitch of the prior two years. Higher interest rates are holding off some buyers, and we are seeing price reductions where we hadn’t before.

“More single-family homes are coming to the market with a 1.6% increase compared to August last year, but inventory remains down 10.8% year to date. The days on market increased 27.5% year-over-year, and a staggering 58.3% increase year-to-date, going from 36 days to 57 days. Prices are still climbing even with some price reductions. The average sales price in Larimer County increased 1.8% from this time last year.

“Townhomes/condos are not feeling as cramped as single-family homes. New listings were up 35.6% from August last year, and 9.5% year-to-date. Average sales price rose 14.5% compared to August 2022, and year-to-date is up 5.1%. New listings are coming on like hotcakes, up 35.6% compared to August last year, and up 9.5% year-to-date.

“Most recently, we’ve seen an increase in showings and price reductions. It’s the time of year that sellers get nervous about carrying their homes over winter, and buyers are thinking about motivated sellers to hopefully capture their home at an attractive price,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“How is it that with all other market indicators showing year-over-year decreases, median price continues to inch upward? In Fort Collins, the August median price ‘crept up’ to $595,000. Yet compared to this past July’s median price, year-to-date peak of $650,000, the August figure is down just over 9% on a month-to-month comparison.

“The piece of this that has me scratching my head is, why isn’t this number even lower? On average, houses are taking nearly a week longer to sell and there’s more inventory on the market than in previous months. Econ 101’s trope of ‘supply vs demand’ would dictate that with an increase in supply and decreasing demand, prices should fall. Clearly, with interest rates peaking at over 7.25% for a 30- year mortgage, buyers must still be balking at the cost of borrowing large sums to purchase a house.

“My guess as to why median price has remained elevated is due to a couple of factors; First, houses selling in the median price point were likely listed for higher prices last year at this time. Many sellers have likely recalibrated their expectations for what the market will bear and are starting out listing their homes for less than they would have a year ago or are reducing the original list price of the home until the price attracts a buyer. This number – original list price to sale price – is a bit harder to dig out of the data, as the standard list price to sale price ratio is reflective only of what the price of the home was at the time the offer was accepted not the price of the house when it initially came on the market. This number shows a mild decrease month to month.

“Second, many sellers are offering concessions to buyers that essentially ‘buys-down’ the interest rate the buyer may have to pay in the first one or two years of the loan. This concession is not always reflected in the purchase price as the seller’s contribution to the buyer’s interest rate reduction is reflected in the net amount of profit the seller makes on the sale. Therefore, purchase price sales data is not painting a complete picture of home values.

“Suffice to say that while demand for housing is steady, high interest rates are still dampening potential home buyer’s eagerness to buy, and sellers continue to adjust their expectations for how quickly and for what price they can sell their homes. The correction to the once hot-as-blazes housing market continues,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“As summer comes to an end in Garfield County, the market for single-family homes remains surprisingly steady. August added 90 new single-family home listings, a decrease of 6 homes or -6.3% compared to last year. Sold listings came in at the exact number as last August with 73 homes closed and pending sales had a 21.9% increase with a total of 78 homes, a difference of 14 homes over this time last year. Our days on market fell 10 days (19.6%) to come in at a reasonable 41 days to close a home. August closed with a steady 3.4 months’ supply of inventory or 184 homes. The median sale price for a single-family home increased 10% over 2022, coming in at $775,000.

“The multi-family market saw new listings up 21% or 5 more units than August 2022. Sold listings, however, were down by half to 15 multi-family units closed in August of this year. Pending sales were also down 33% or 16 units. There does appear to be some relief in the median sales price of the townhome-condo sector with a 20% reduction in price coming in at $425,000. August closed with a decrease of 39% in active listings, which equals 36 units or a 2.1-month supply.

“While the market seems quiet over this time last year, the numbers are very similar. We are still seeing multiple offers on some properties and cash is still king. Sellers that need to sell due to life-changing events can feel confident that if priced correctly they won’t have any issues moving on. Recently, I have noticed an influx of offers from buyers looking to upgrade and sell their current home to purchase in the same area.

“The old adage, ‘location, location, location’ keeps the Roaring Fork Valley desirable and thus the market remains steady,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County continues to see new listings, pendings, and solds go down, yet prices are holding. Year-to-date, new listings are down 23.7%, and solds are down 19.9%. Average days on market is up to 76, but affordability is down to 52. The majority of the 274 closings for the month were between $300,000-$600,000 and only 4 sales were over $1 million. Active listings at the end of August totaled 629, down 20.9% from the same time last year. While prices are holding, interest rates and their unpredictability are holding buyers on the sidelines. Some sellers are being creative and offering buydowns, but most sellers, especially if there is not a good reason to list, are staying off the market,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“The selling season for this year is over, the kids have returned to school, cooler temperatures are in the air, and there are even fewer homes on the market to choose from now than this time last year. For single-family homes, new listings year-over-year have declined 6% and sold listings down 22.3%. However, the median sales price ticked up 2.2% to $690,000 along with days on the market up 16.7% to 21 days. Sellers need to price their home correctly and have patience.

“For townhome/condos, new listings declined 8.4%, and sold listings dropped just shy of 27%. Once again, the median sales price increased 5.4% to $416,500 and days on market rose 46.7% to 22 days year-over-year. Buyers are still waiting for the interest rate to drop. The interest rate will most likely increase again by the end of the year to continue stabilizing the economy,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“The Pueblo real estate market hasn’t changed from the start of 2023. Sold listings were down 18% in August over the previous year and are down 25.5% year-to-date. Last year, there were 2,130 homes sold through August but only 1,586 sold this year. New listings are down 9% from last August and down 17.2% year-to-date.

“Low inventory and interest in the 6% to 7% range are keeping buyers on the sidelines. The median sales price of $320,000 in August is the same as last August. However, the year-to-date sales price has dropped to $313,000. The percent of list price received remained flat at 98.5% and is down 1.3% year to date. Prices may finally be shoring up. Days on market is now closing in on 3 months and with fewer buyers out there looking, it remains a seller’s market, but those sellers are getting nervous about how long it takes to get their house sold.

“New home permits are down 47.4% from last year. Builders are being cautious about the rising levels of unsold inventory,” said Pueblo-area REALTOR® David Anderson.

SUMMIT, PARK, AND LAKE COUNTIES

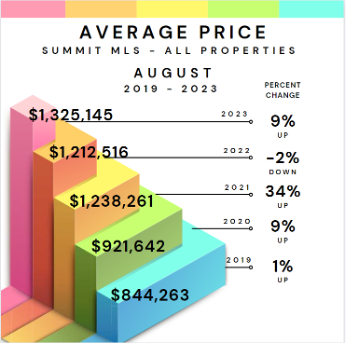

“Summit and Park counties continue to defy logic. Prices went up, and the number of sales and new listings went down. There were fewer listings to choose from and fewer buyers buying, yet prices went up compared to August 2022.

“In Summit, August median sale prices were up 24.6% and average sale prices up 20.9% ($2,264,691) for single-family homes compared to a year prior. Townhouse-condo median sales prices were up 5.5% while average was up 4.9% ($834,334). Year-to-date, the numbers are still down 4.2% for single-family homes and up 2% for townhouse-condos. Sellers received about 97% of their list price. So, even though the prices went up, there was some negotiating going on.

“Park County’s year-to-date average single-family home price hit $680,340, while Lake County’s was $574,788.

“There are 607 residential active listings in the Summit MLS that range from a low-price, mobile home in Grand County for $69,000 to a single-family home in Breckenridge for $19.5 million (on the market for 1,102 days). Out of the 163 August sales, the lowest was a condo in Grand County for $160,000 and the highest was a single-family home in Breckenridge for $5.9 million. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“Sales for the Telluride regional market in August 2023 were $117.4 million with 49 sales. That is an increase in the dollar amount of sales of 56% with the number of sales down 4%. A new, all-time home sale record was recorded in the Mountain Village at $18.9 million. Several other regional big ticket property sales also happened in August making that the first month this year with sales over $100 million. It seems like the affluent will still jump on a property if it is truly unique and of exceptional quality. That said, we are seeing the other 90% of the market continuing to drop prices if they are not so special. Total annual dollar volume of sales through August this year is $582.1 million.

“In August, 23% of the dollar volume of sales was in the Mountain Village, with 35% in the Town of Telluride. That is the first month this year that Telluride did more dollar volume than in the Mountain Village. For the first eight months of 2023, the Mountain Village has done 44% of the market volume and Telluride has done 34% of the market volume in dollars number of sales. For the first eight months of 2023, 77 out of 134 sales were over $2 million which accounted for 89% of the dollar amount of sales. In 2013, the average single-family home sale in San Miguel County was $1.3 million. For the first eight months of 2023, the average sales price of a single-family home was $4.69 million,” said Telluride-area REALTOR® George Harvey.

VAIL

“August was an interesting month for the market in the Valley. We saw a continued trend of stabilization and strong activity levels in most of the key categories of performance. New listings were positive 37.4% versus August 2022 which improves the year-to-date performance to -23.1%. Pending sales exhibited excellent growth, up 40.4% compared to 2022. Closed sales were positive 6.6% compared to August 2022 despite the higher mortgage rates buyers are experiencing.

“The segment of the market most impacted by mortgage rates, along with inventory, was the under $1 million category which declined from 47% of transactions in August 2022 to 32% in 2023. The closed units of +6.6% was surpassed by the plus 39.6% in dollars for the month. The strong monthly number helped to bring the year-to-date dollar volume to a -25% comparison, which is the best comparison of the year. Days on market increased 109.4% compared to August 2022. Inventory was relatively stable at -2.3% however, months of supply increased to 4.8 which is up 50% compared to 2022.

“The key to the dramatic dollar volume increase was pricing niches that have high levels of cash buyers thus, the mortgage equation becomes minimized. The $2 – $3 million niche increased from 8% market share to 14%. The $4 – $5 million increased from 3% to 6% and the $5 million-plus went from 5% to 12%. Obviously, these price niches are driven by the resort locations and follow the trend we have been seeing since the beginning of the year. The combination of inventory and cash buyers will continue to drive this segment of the market. These are lifestyle buyers and have the where withal to look at the investment and potential remote work opportunities to enhance their lifestyle.

“We look for a strong September based upon the existing pending sales and then we historically hit the shoulder season before things crank up for the ski season. If this prognostication holds true, we look forward to a solid winter season baring any drastic macro-economic surprises,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The August 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing nearly 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.