Home Sales Drop Across Colorado as Mortgage Rates Continue to Stymie the Market

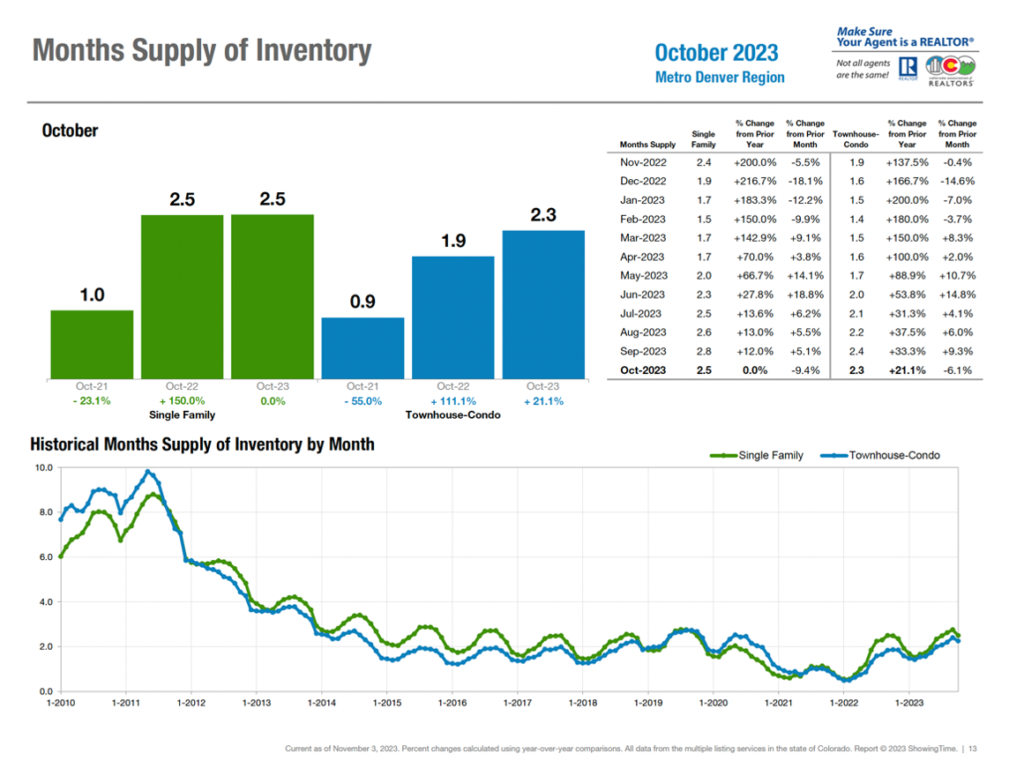

ENGLEWOOD, CO – Despite inventory beginning to reach healthier levels in select metro and mountain areas of the state, other markets are seeing reductions in inventory of up to -63% in some neighborhoods due to the lack of new listings, proving yet again that all real estate is local, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state. Statewide, inventory is down -12.7% for all product types from one year ago compared to this time last year as potential sellers elect to stay in their homes and not take on a higher interest rate by purchasing a replacement home.

Sales continue to fall statewide, down -14.7% across Colorado for all product types. However, most areas of the state are watching median prices climb, ticking up +2.9% for all product types across the state from this time last year. REALTORS® attribute this dichotomy to limited inventory in lower price points rather than heightened demand. “Combined with a scarcity of homes for sale in the most affordable price ranges, the segments of the market with the most activity are in the $600’s and up – driving median price incrementally higher from October of last year,” said Fort Collins-area REALTOR® Chris Hardy.

Mortgage interest rates continue to stymie the market, as average buyers are either priced out of the market due to extreme affordability challenges caused by higher interest rates and continued price appreciation or are reluctant to enter the market in the hopes that interest rates will eventually go down. “Unequivocally, inconceivable affordability challenges due to a staggering combination of high interest rates and record high home prices are the most daunting barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

In most markets, sellers are finding that they need to come to the table with pricing concessions and interest rate buydowns to get their homes sold and may find they need to adjust their pricing to meet buyer’s expectations. This remains the case even in cash-sale heavy resort areas like Pagosa Springs, where average days on market is now at 96 days, and, according to Pagosa Springs-area REALTOR® Wen Saunders, correct pricing and seller concessions mindset is imperative to meet the days on market period desired by sellers.

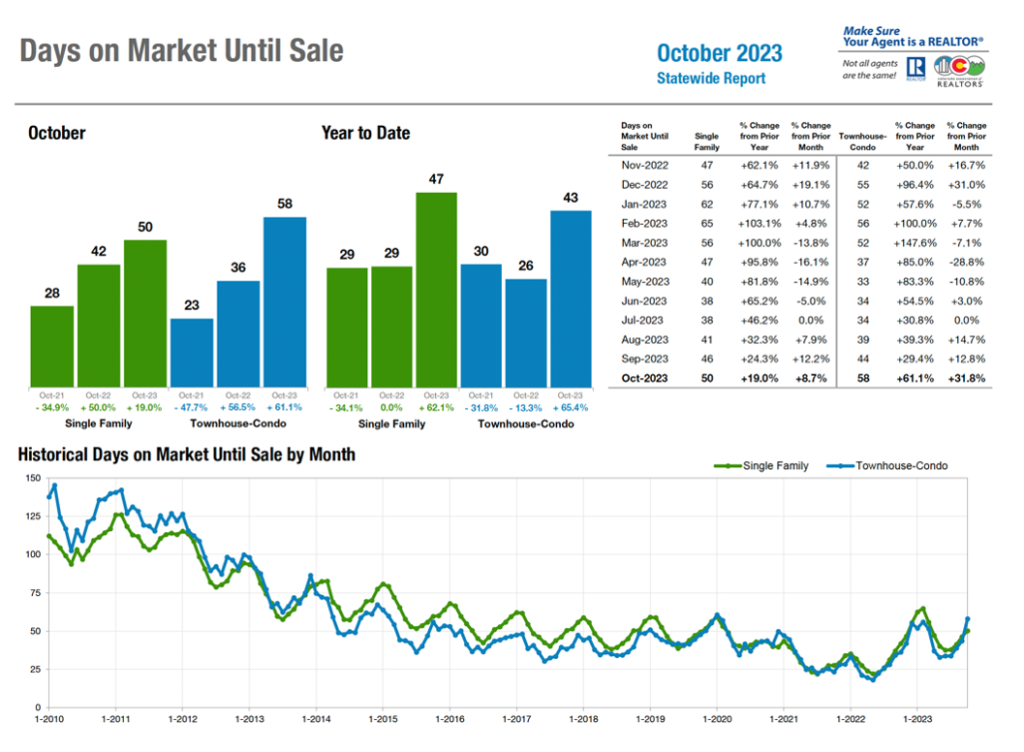

Opportunity exists for those buyers who are willing to take on higher rates in favor of less competition in the market and better negotiation with sellers, especially as homes sit on the market longer with days on market until sale going up +29.3% statewide from this time last year.

“Savvy buyers are taking advantage of the fall price reductions and the seller’s willingness to offer concessions. Those waiting on the sidelines may be disappointed when the rates go down and competition goes up. Most believe the interest rates will decline next year and if so, the demand from buyers will exceed the numbers of home for sale which could create another seller’s market as we move into the new year,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

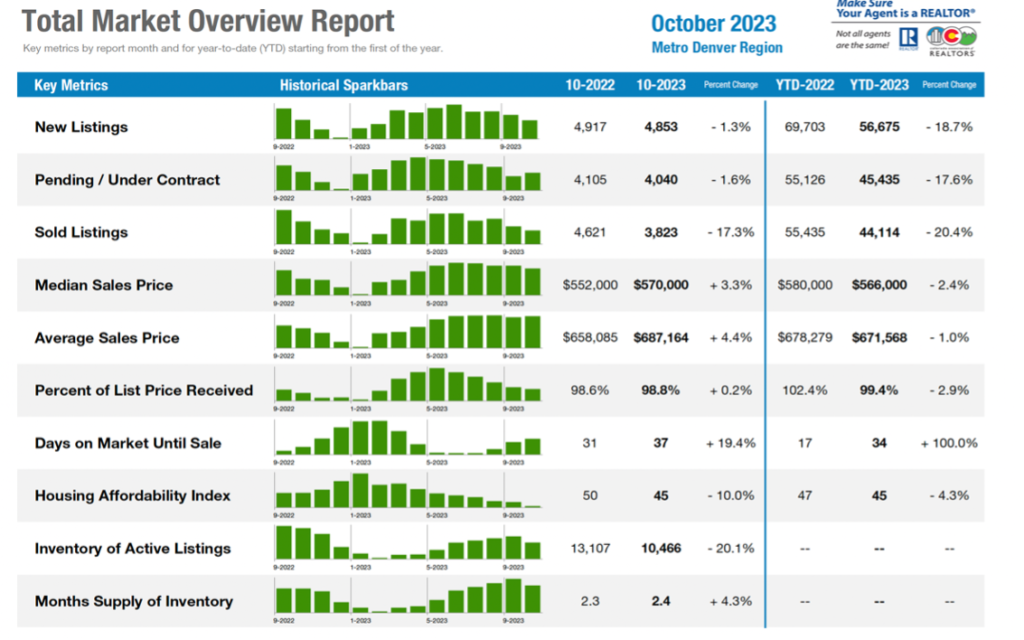

Seven County Denver area Market Overview:

Statewide Market Overview:

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“As we move into the holiday season, we are going into it with a lower housing inventory by as much as 63% in some Aurora, Centennial, Greenwood Village zip codes. The 80010-zip code has inventory down by 63% over 2022 and a median price up from one year ago by 1.3% at $405,000 for a single-family residential home. This is probably one of the most affordable zip codes in the Aurora-Denver metro area. This zip code is near the CU Health Science center and Children’s Hospital. Heading south to 80013, inventory is down by 34% and median price is $487,000. This is a more central Aurora location with easy access to Buckley AFB. 80015, in the southeast area of Aurora, shows an inventory drop of 43% over last year at this time and a median price of $567,700, which is a price up just slightly over last year. The far southeast area, 80016, shows inventory down by 24% and a median price of $770,000. The median price for a townhome is $345,000 with inventory down 14% from a year ago.

“For buyers waiting for the interest rates to drop, it is important to remember that when the rates drop, if they do, we will see another frenzy and very high demand for the low number of homes that are on the market. This is the time of year when sellers are a little more giving, like Santa Claus. We are seeing sellers that are more negotiable on price and seller concessions. The motivated sellers that are not wanting to have their home on the market during the cold and blustery winter months are usually more open to consider an offer. It just takes the right seller and a well-qualified buyer. Buyers – now might be the best window of opportunity,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“As we head into the end of what was a tumultuous year in the real estate market, Boulder and Broomfield counties actually rallied a bit and showed signs of optimism and strength in the market. Each county was down in median price 3-4% in September and now, Boulder is down just 2.6% since the beginning of this year and Broomfield is up 2.2%. While it may not be a trend, the stronger numbers can be attributed to low inventory and seller’s willingness to work with buyers to buy down the interest rate for the sake of the sale.

“Sellers deciding to stay in their home and not take on a higher interest rate by purchasing another has led to an inventory shortage with Broomfield’s new listings down 20% and Boulder’s down 9 %. Still, there are buyers who want to buy and homes in each county are selling in an average of 50 days and about 99% sales price to list price.

“Savvy buyers are taking advantage of the fall price reductions and the seller’s willingness to offer concessions. Those waiting on the sidelines may be disappointed when the rates go down and competition goes up. Most believe the interest rates will decline next year and if so, the demand from buyers will exceed the numbers of home for sale which could create another seller’s market as we move into the new year.

“But for now, activity on both buying and selling sides is low as many wait to see what the future brings,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“What it is, and how it feels, is different. You may ask what that even means. Looking at the statistics, you would probably be drawn directly to the fact that the median sales price increased year-over-year and moved on down the road with that in your mind as good news. But that is not how it feels. For those of us selling in the market, it feels very different than one easy 2.6% increase in value year-over-year. We are meeting with buyers who cannot buy. Or they can buy but are not going to buy in this market at these rates because they can rent for far cheaper. Which explains the year-over-year drop of 23.9% in sales. And that drop in sales is despite a drop in active properties, down by almost 10%.

“The market has also seen double the number of properties that have been withdrawn/cancelled from the market. Yes, we are selling homes. Yes, the median price is up. But no, it is not what most feel is a healthy market. How can we say this is healthy when mortgage demand nationwide is now at 1995 levels and interest rates hit 2007 levels? As we look around for the first time in years, we are seeing apartments offering three months free rent. Or security deposits are waived. I can’t even take a guess at the last time I saw those large yellow and red banners on multi-family units with freebies and concessions. Home sales are competing with rentals for the first time in years on affordability. I can rent a home for far less of a monthly payment than buying that same home at these prices and these rates. And that is what many buyers are choosing to do. I cannot blame them and often recommend them to consider their comfort level and then decide if owning a home is right for them at this time. Because the economy does not feel good to most. It’s that sense of change one gets going from Summer to Fall. We have had five banks collapse in 2023. Layoffs are now making headline news. Corporate bankruptcies have doubled. And the average consumer confidence is low. Fannie Mae’s home purchase sentiment index (HPSI) showed a record 82% of consumers did not think it was a bad time to buy as recently as August.

“Where does that take us? Housing has been far more resilient than most thought. But can it withstand the coming changes into 2024 as we discuss a ‘soft landing?’ FEDEX and UPS have seen shipping plummet and Union Pacific saw a 19% fall in profits due to a drop in freight. Typically, these are foreshadowing of a worsening economy. And M2 money supply continues to contract, a complicated indicator that also points to further economic issues. Unemployment edged up to 3.9% and the FED maintains its stance that they will correct shelter costs. With the leading indicators beginning to show an economic slowdown, I believe 2024 will see unemployment begin to head north and that will begin to correct an otherwise resilient housing market here in Colorado and across other areas of the county. But this is one man’s opinion and as we move forward, we will continue to watch the leading indicators to try to predict the lagging indicator, housing,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Sadly, it is difficult to find a silver lining in the Colorado Springs area housing market analysis of single-family/patio homes in October 2023. While the active listings supply elevated to a healthy level, almost 3 months, unfortunately, the sales had a drastic 22.6% decline over October 2023 with over 45% increase in the days on the market.

“In October 2023, there were 1,185 new listings compared to 1,243 last month and 1,239 in October last year, representing a decline of 4.7%% month-over-month and 4.4% compared to last year. There were 2,505 active listings in October 2023 compared to 2,484 last month and 2,645 last year, representing a drop of 5.3% over October last year.

“There were 851 sales in October this year compared to 1,008 last month and 1,100 last year, representing a decrease of 15.6% month-over-month and 22.6% over last year. The monthly sales volume is down by 19.1% and the year-to-date Sales volume by 23.9%. The days on the market were 45 days on average compared to 38 days last month and 32 days last year, representing an increase of 18% month-over-month and 45% year-over-year. Unsurprisingly, almost 50 percent of the El Paso County single-family/patio homes active listings in the Pikes Peak MLS had price reductions.

“Last month, the average sales price was $556,964 compared to $540,882 last month and $532,488 in October last year, representing an increase of 3%% month-over-month and 4.6% compared to lastyear. The median sales price was $485,000 compared to $475,000 last month and 465,000 last year, representing an increase of 2.1% month-over-month and 4.3% year-over-year.

“Last month, 55.3% of the single-family homes sold were priced under $500,000, 31.1% were between $500,000 and $800,000, and 13.6% were priced over $800,000. Year-over-year in October 2023, there was a 31.8% drop in the sale of single-family homes priced under $400,000, a 18.6% drop in homes priced between $400,000 and $600,000, a 24.3% drop in homes priced between $600,000 and $1 million, and a13.3% increase in homes priced over $1 million.

“Unequivocally, inconceivable affordability challenges due staggering combination of high interest rates and record high home prices are the most daunting barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER COUNTY

“We tell our children that baby steps are the best way to make big strides, but we’ve clearly forgotten to share that with the Denver real estate market. It’s quite near impossible to have an uneventful month whether you’re comparing it month-to-month or year-by-year. During the wildest months of 2020 and 2021, the month-by-month numbers were staggering, showing double-digit price appreciations, and shocking inventory data that previously seemed impossible on yearly snapshots. Now, fast-forward a few years and that volatility has now switched to staggering yearly comparisons. With peak seller opportunity come and gone, the downhill slide into a buyer’s world shows a nearly flip flopping of data which differs considerably from what many assumed would now be a ‘down’ or ‘bad’ market. What we see today, with a 15.7% decrease in year-over-year sales in Denver County is a long-awaited inventory climb – now 2.3 months of supply.

“Further, here on the upside-down side of things, the ratio of sold listings to new listings is taking giant, not baby, steps downward. At fall’s peak of the madness, October of 2020, 150% of new listings were selling. That means that all and another 50% of lingering home sales were gone before anything came to replenish them. Now, fast forward exactly 3 years, we see just 71.8% as many new listings selling. At an average of 96.6% over the last seven years, you see a sharp decrease in demand and, a resulting 15.7% decrease in sales.

“Sales are down, sharply and inventory is up, wildly but that doesn’t mean we are in a bad circumstance, and it also doesn’t mean the sky is falling for all those who wish to play. As we engage our big steps up in interest rates, the horizon promises baby ones back to what we consider comfortable and, while that happens, terrific opportunities exist with increased inventory. The buyer is finally back in the negation seat with an inverted sales ratio and when that happens, a long-awaited harmony of prices and choices re-enters the market, one baby step at a time,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“Activity in the real estate market has slowed as we all patiently await an economic soft landing. In the past 10 years, there have typically been over 600 transactions per month this time of year. This October, just 462 homes sold, a historically low figure. While buyers have shied away, discouraged by 7%+ mortgage rates which show no signs of relenting, sellers continue to list their homes for sale at a normal pace. The result is a change in the supply-demand equilibrium in the market, pressing prices down.

“For the third consecutive month, median sales prices in Douglas County declined, reaching $747.9K for single-family homes and $499.8K for condominiums and townhouses. For the buyers remaining in the market, they’re using their newfound leverage to not only negotiate lower prices but receive seller concessions at an atypically high rate. We’re preparing our sellers to anticipate paying $5K-$10K on average in their transactions to get the deal to the finish line. Average days on market has also continued to climb, reaching 38 days last month. As more homes sit on the market for longer, inventory has returned to pre-pandemic norms at around two months.

“With the home-buying craze of the COVID era confidently behind us now, things are beginning to feel “normal” once again in the market. Douglas County and Colorado as a whole are still highly priced, highly desirable markets, but intervention by the Federal Reserve has generally kept buyers from excessive spending and bidding wars. Will the Spring bring back buyer demand and higher transaction volume? Probably. But will we see the fast-paced, wild market of the previous two years again? Probably not, and that’s a healthy change of pace for now,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The real estate market in Durango and La Plata County is experiencing a period of stabilization due to a decrease in buyer demand and a reduction in new listings compared to the previous year. Some key points highlighted in the market analysis:

- Decrease in Single-Family Units and New Listings: Single-family units sold dropped by nearly 7% compared to last year, and new listings fell by almost 9% compared to last October.

- Increased Median Home Prices: Median home prices rose by 1.8% despite the high interest rates. This increase is mainly attributed to the limited inventory rather than heightened demand.

- Local Reluctance Due to High-Interest Rates: Many locals hesitate to make real estate moves due to the current high interest rates. The existence of mortgages with interest rates below 4% makes it difficult for some individuals to move, impacting the market activity.

- Moderate Appreciation: Year-to-date appreciation sits at just over 6%, which aligns closer to historical averages. This stability is favorable compared to more volatile increases in recent years.

- Hopes for Relief in 2024: Prospects for 2024 are linked to a potential reduction in interest rates and the introduction of additional inventory. This might provide relief to homebuyers and potentially alter the market landscape.

- The unpredictability of Forecasting: Forecasting the local market is as unpredictable as the weather in Southwest Colorado. Economic changes, interest rates, and supply-demand dynamics contribute to this unpredictability.

“The market’s state combines reduced inventory, high interest rates impacting local decisions, and an uncertain forecast. The anticipated relief in 2024 is contingent upon factors like interest rate adjustments and increased inventory,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“High mortgage interest rates continue to dampen the overall housing market and it is no different in the Fort Collins area. Combined with a scarcity of homes for sale in the most affordable price ranges, the segments of the market with the most activity are in the $600’s and up – driving median price incrementally higher from October of last year.

“The amount of time it takes to sell a house has also continued to increase, pushing up to just over 2 months from the time a property goes on the market until it closes. Sellers who need to sell quickly are finding that a combination of price reductions and cash concessions are required to attract buyers to take action. The list price to sale price ratio remains off by a bit more than 1% which on a $600,000 sale equates to $6,000 less in sale price not including what may have been offered to help a buyer temporarily reduce their mortgage interest rate or any interim price reductions from the initial list date of the property.

“Interest rate relief may be on the horizon as key economic indicators seem to be predicting a softening in the bond market which the National Association of REALTORS® and other economists point to as a sign that interest rates may fall below 7% as early as the second quarter of 2024. Should rates make meaningful and sustained drops, pent up demand for housing will drive competition for inventory and make for a very challenging housing market in the Spring,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“Mesa County feels like it has gone to sleep! Comparing October 2022 to October 2023, the only thing that is up is both the median and average sold price. Our median is now at $397,450 and our average sold was $432,559. Other than that, all statistics are down. Active listings are down 16.5% and solds are down a big 32.1%. There is a little glimmer of hope if the interest rates soften. Otherwise, agents need to use the slow time to prepare for 2024,” said Grand Junction-area REALTOR® Ann Hayes.

GUNNISON/CRESTED BUTTE

“As we head into ski season, the MLS for the Gunnison – Crested Butte area has had a lot of “temporarily off the market” and “price reductions” in the last month or so. Sellers want to present their property in the best light, so they are hoping to restart the “days on market” clock again in December by taking them off the market for this slower time of year. Our inventory has gone down about 15% from last month, but I anticipate it going back up as we get into the winter and visitors come back to town. The majority of price reductions are properties that were listed for above recent comparable sales and are now being reduced. In some cases, these reductions are resulting in multiple offers demonstrating that there are buyers who are ready to buy if the right property, at the right price, comes along. Real estate sales in the Crested Butte area continue to be much slower than they were in 2021 and 2022, but the number of sales is getting closer to what we saw in 2019 rather than tracking with 2012-2013 as they had been for much of this year. Prices are staying put for now. We haven’t seen a bit drop in prices due to the lack of inventory on the market. As we see more properties come up for sale, it seems likely that prices will go down a bit, but nothing indicates a huge drop is coming,” said Crested Butte-area REALTOR® Molly Eldridge.

JEFFERSON COUNTY – ARVADA/GOLDEN

“We are fully into the holiday season now with November hosting Thanksgiving and December hosting Christmas. Stats have shown that the real estate market cools down quite a bit in these cooler months, year-after-year. The focus now turns to home gatherings for family and friends. The interest rate did drop slightly, and the FED’s have not increased the rate however, they are threatening to do so again by year’s end. For buyers this is a good time to buy with less competition and sales prices seeming to stabilize. The median sales price for October for single family homes is $674,975 a slight increase from this time last year. Inventory is down by 34% but you can still find homes to view.

“For condo/townhomes the median sales price sits at $415,000 with a slight increase including new listings up by 4.2%. With interest rates staying high people are rethinking what they can afford and possibly looking at purchasing a townhome over a single-family home. Or they are waiting it out until the rates drop hopefully next year,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS

“Change is among us. With chilled evenings, shorter days, and first snowfall, both sellers and buyers are headed into another change with the winter sales season. Change should be no surprise to buyers and sellers. The year 2023 continues with an abundance of change- prices, high interest rates creating escalating mortgages, inventory, home affordability. Expectations for both buyers and sellers have changed.

“Like the change of season, today’s market is significantly different from last year. With consideration our rural Average Days on Market is now at 96 days, correct pricing and seller concessions mindset change is imperative to meet the average days on market sale period desired by sellers. Buyers and sellers in today’s market are both faced with reality and affordability. Cash sales continue to keep home sales prices strong, as interest rate hikes have little effect on cash buyers. Buyers are either adjusting their expectations or are likely placed out of the market, unless they are willing to spend an Average to Date Sales Price of $665,626 (up 1.1% from last year). Although compared to home pricing in other Colorado resort towns, Pagosa Springs still consistently has the value of lower pricing, especially in higher end luxury home price points. Sellers are finding it difficult to find a replacement or move-up home. Many sellers are cashing out of their 2nd homes and upgrading their current first home or paying off 1st home mortgages from their 2nd home real estate wealth proceeds. Some sellers are not obtaining their desired home sale proceeds and time-to-sell windows. Their strategy is offering seller concessions, accepting home sale contingent offers, or maybe a price reduction to sell before the serious snow occurs.

The Largest Gains (October 2023 compared to October 2022) are sales price and inventory: Median Sales Price at $600,000 (13.2%) ($525,000 in 2022). Average Sales Price $672,778 (+4%) ($646,940 in 2022). Inventory of Homes at 203 Units (+15.3%). Months Supply 6.1 (+41.9%)

“As home prices are up over 46% since the pandemic, buyer comfort price level for homes under $500,000 (due to higher monthly mortgage payments knocking buyers to a lower home price) are not even close to such an inventory supply. True, inventory is at a year high, just not in the price range (or reach) of many buyers. Several homes priced in the “comfort buyer price level” are not meeting the buyer expectations as they may be a further distance from town and not quite the buyer’s desired neighborhood location. Additionally, most homes in comfort level pricing need maintenance, repairs, or updates. These projects can be costly and overwhelming to a buyer in a rural area seeking a first, second, or retirement home. Even with an abundance of price reductions, sellers and buyers in all price points are challenged with changes in the real estate market to meet their desires and needs. With new interest rates, making average monthly mortgage payments higher and pushing the second home and short-term rental buyer off the sidelines. The Pagosa Springs home buyer reality is almost 60% of homes are priced well over $600,000. Higher end sellers (priced above $900,000) are faced with serious competition for buyers, as about 40% of the home inventory is priced above $900,000 with sales tracking Year-To-Date down over 6%.

“Cash buyers may have a little negotiating leverage with sellers, as less buyers are previewing homes. Relative to higher interest rates, with less buyers -some home prices will continue to decelerate for sellers desiring to sell within the average days on market, the onset of winter home showing demands, and before the new year. Price adjustments are not of abundance in the “comfort price point”, as the main inventory exists in the higher price points. Winter season has historically offered buyers in higher price points discounted pricing- and perhaps their best time to buy!

“Vacant land is also tracking the same as home sales. Higher inventory volume at higher prices. Land buyers are purchasing with the intent not to build right away. Historically, winter does not bring on inventory due to snow. We shall see how long Mother Nature will run this winter. Last year was an epic snowfall and ski season. Weather predictions appear the same for the 2024 season! Change is alive in the southwest Colorado real estate market,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The Pueblo real estate market in the first 10 months hasn’t changed its direction. Each month has been down with the numbers. New listings in October were down 27.8% 2022 to 2023. Pending sales up in October 9.1% compared to 2022 but still down 18.9% year-to-date. Solds are the big indicator. Total solds so far this year is 1930 compared to 2563 in 2022. Median price was up 5.6% in October but down 1.3% year-to-date. The percent of list price received was down .08% in October and down 1.2% year-to-date to 98.3%. Days on market was up to 84 days compared to 2022.

“Agents are doing more open houses for the public and doing more broker opens for the agents. The BIG BUT is, the buyers are still on the sidelines watching the mortgage rates stay up in the 7 & 8%. The builders are still being cautious with only 17 permits pulled in October. This is down 45.9% for the year compared to 2022. Pueblo West is at 108, about half of last year. The Pueblo West Metro set aside 200 permits for 2023.

“Interest rates, the national economy, concern for job security are just a few items buyers are waiting for to get more stable before looking for a new home,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“New listings in October for single-family in Routt County were up 11.8% and 31.8% for multi-family. More inventory is a welcome sight, but the reality is that the increase is a difference of two and seven units respectively over last year – not a big game changer – especially when active listings are down almost 29% for homes and 52.2% for condos/townhomes. Median sales prices year-to-date for single and multi are about 2% higher than last year at this time, with average sales price for multi up about 2% to $1,110,629 and single-family up 10% to $1,883,634. Days on market for houses is consistent with the same period as last year at 52 days with months’ supply at 3.7 months – which is about the same as last year. Days on market for condos/townhomes increased slightly from 39 to 43 days, yet months’ supply sits at 1.7 months – which is less than last year’s 2.5 months. The market is realizing some price reductions on properties where location, condition, or other variables weigh in; however, when the list price is within an appropriate range, homeowners received 96.8% of their list price and multi-family owners received 101.1% of their list price – both a tad higher than last year. As we enter the holiday season, we can expect to see few new listings come on-line. Like most places, affordability is a struggle in Routt County and high Interest rates add to that strain,” said Steamboat Springs-area REALTOR® Marci Valicenti.

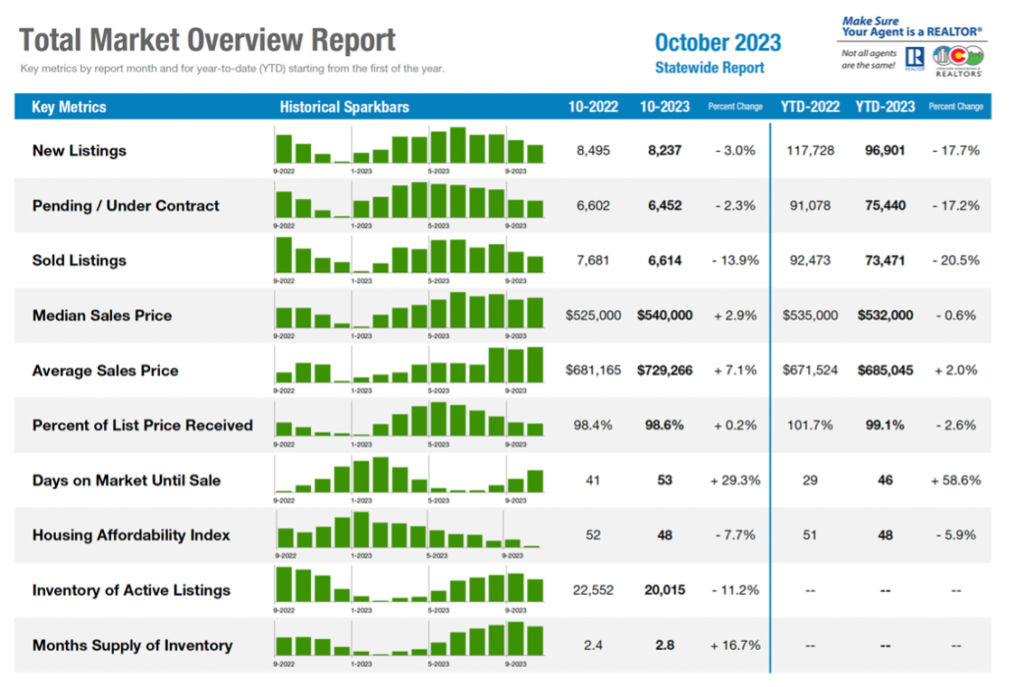

SUMMIT, PARK, AND LAKE COUNTIES

“Interest rates don’t seem to be quelling the thirst of a buyer’s willingness to pay for a multi-family home, which is getting almost 3% on average over the asking price. There are 15% fewer sales than this time last year, yet the median sales price for all properties is up almost 20%. The number of listings is dropping off too. Last month there were 620 active residential listings and this month there are 528, an almost 15% drop. Listings normally slow down this time of year. Even with these numbers for October, for the year prices are pretty much flat.

“In Summit, October 23 vs. October 22, the average sale price for single family homes was $2,017,121, which is less than a 1% difference. Townhouse-condo property average sales prices were up 6.2% at $855,197. Year-to-date, the numbers are still down 3.6% for single family homes and up 3% for townhouse-condos. Sellers received about 97.4% of their list price.

“Park County’s YTD average single family home price was $653,895, while Lake County’s was $676,235.

Out of the 528 active listings the least expensive property is a mobile home in Grand County for $75,000 and the most expensive price is a single-family home in Breckenridge for $19,499,000 (on the market for 1,161 days). Out of the 158 sales in October, the lowest was a mobile home in Kremmling for $120,000 and the highest was a single-family home in Breckenridge for $5,995,000. About 37% of sales were cash. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

VAIL

“October is the mid-point in the shoulder season for the Vail Valley market. Thus, a modest percentage of annual sales and this October fit the description. Closed transactions were positive 4% versus 2022. However, dollar volume increased approximately 40% driven by a jump in the $1mil-$3mil segment which represented 62% of the transactions. This appears to be driven by inventory in the pricing niche and a high percentage of cash purchases which aren’t impacted by current mortgage rates. Overall, the inventory in gross units is basically flat versus 2022 however, the upper pricing niches represent a significant portion of total inventory. New inventory was negative 4% for the month compared to previous years inventory. Pending sales increased by 22.5% versus a year ago which, bodes well for the impending ski season market. The Days on Market are down 10.6% versus a year ago which is a good sign for market activity. Another indicator of market stabilization is Months of Supply at 4.4 which is the closest we have been to the 6 months that historically indicates a stable market.

“Our market officially kicks off Thanksgiving weekend for the winter season and despite macro-economic uncertainty, the forecast is reasonably positive for the valley,” said Vail-area REALTOR® Mike Budd.

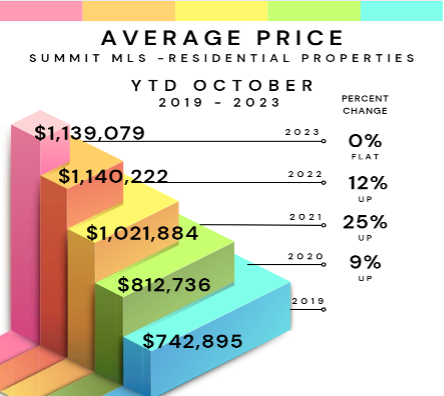

SEVEN-COUNTY DENVER METRO AREA – MONTHS SUPPLY OF INVENTORY

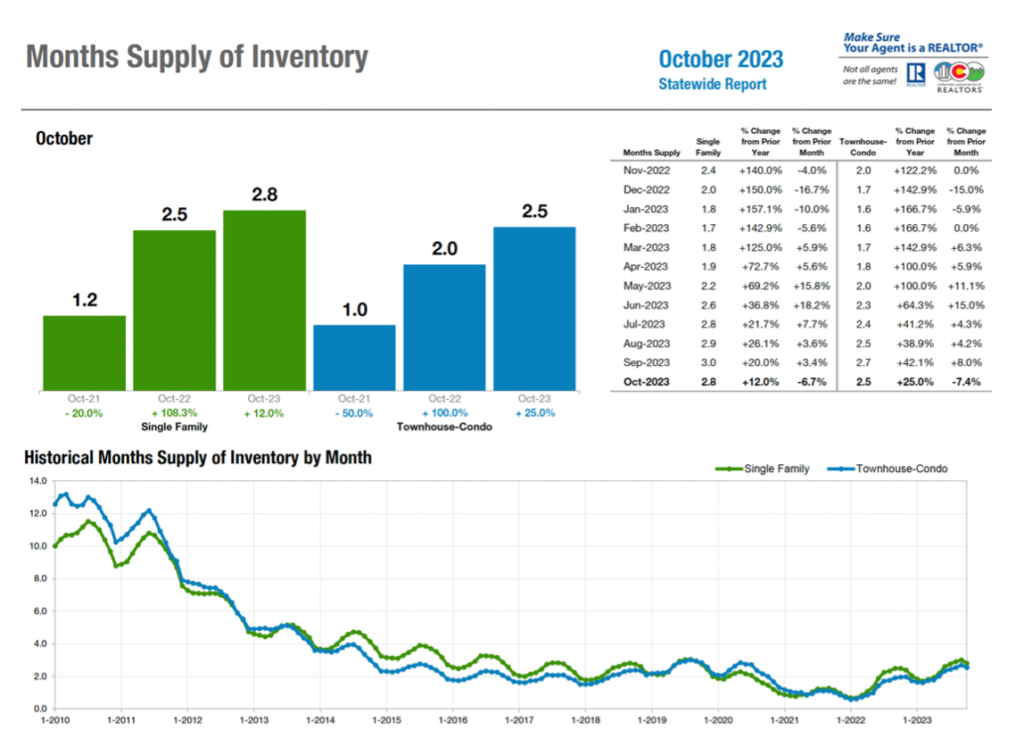

STATEWIDE-MONTHS SUPPLY OF INVENTORY

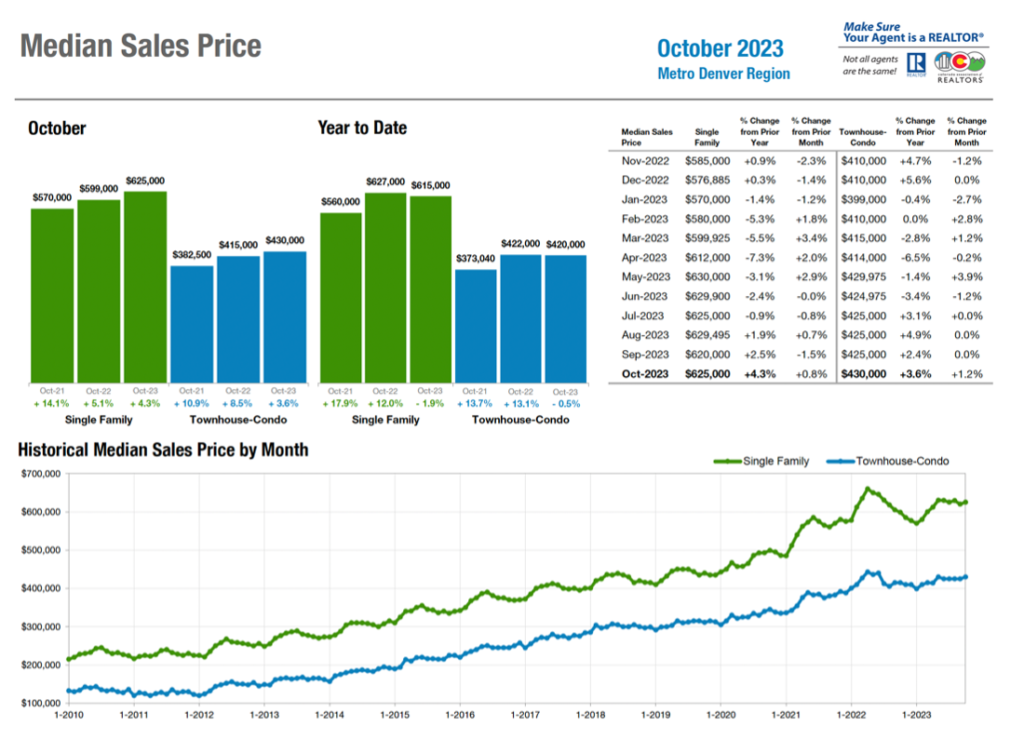

SEVEN-COUNTY DENVER METRO AREA – MEDIAN SALES PRICE

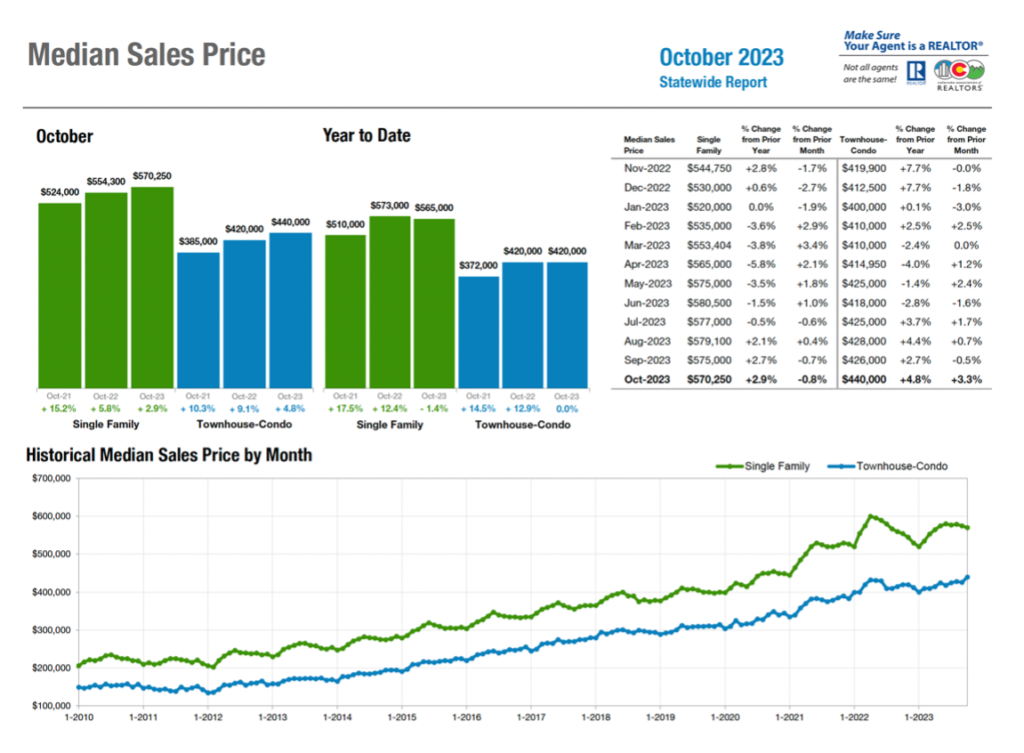

STATEWIDE – MEDIAN SALES PRICE

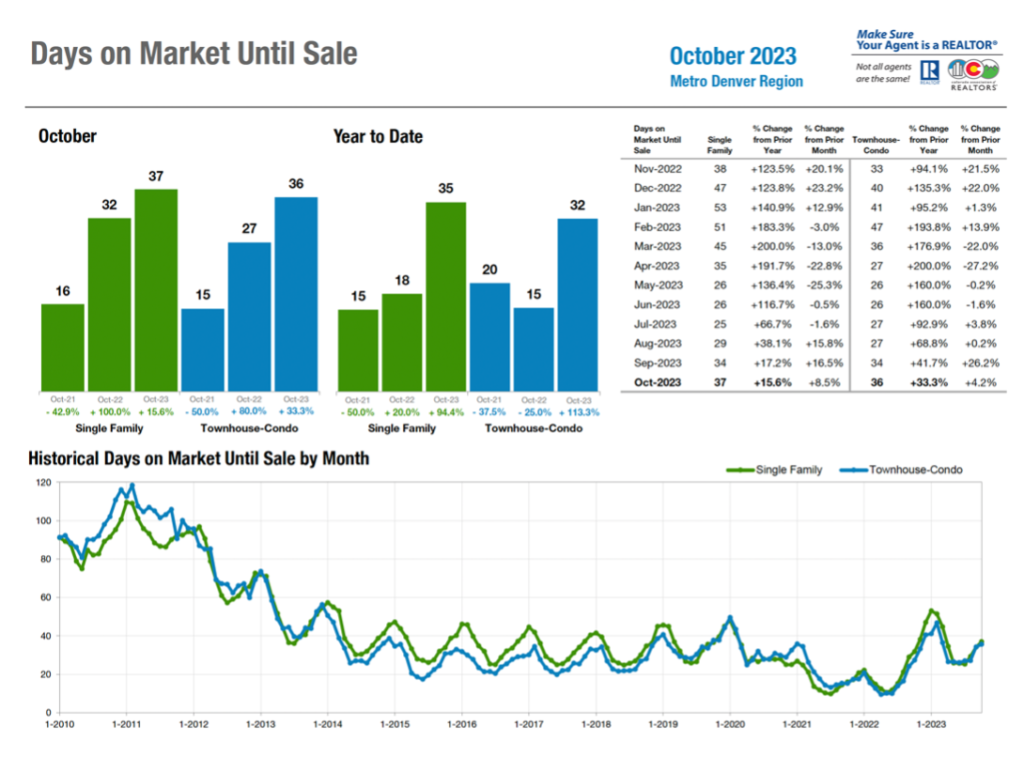

SEVEN-COUNTY DENVER METRO AREA – DAYS ON MARKET UNTIL SALE

STATEWIDE – DAYS ON MARKET UNTIL SALE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.