Buyers and sellers exercising patience as they hibernate through the winter

ENGLEWOOD, CO – A combination of economic factors magnified the typical seasonal slowdown in the housing markets with new listings plummeting more than 25% across all property types in the seven-county Denver-metro area and statewide markets, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

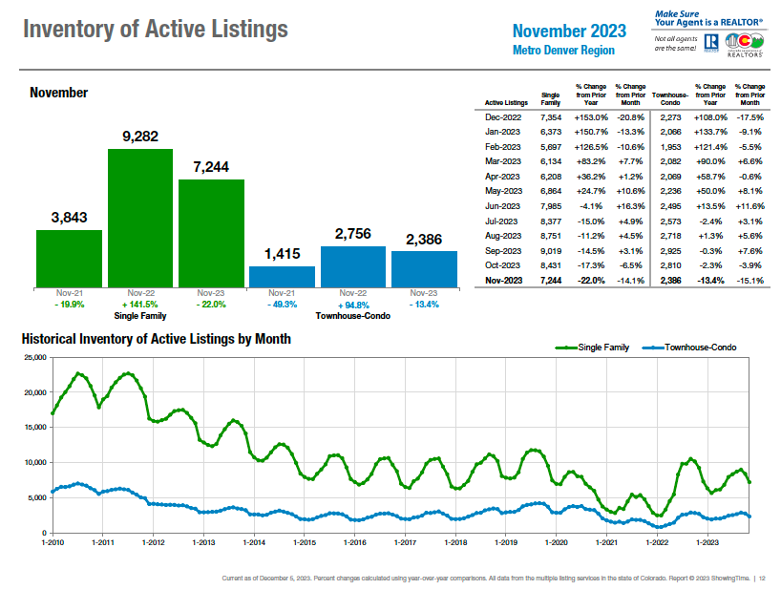

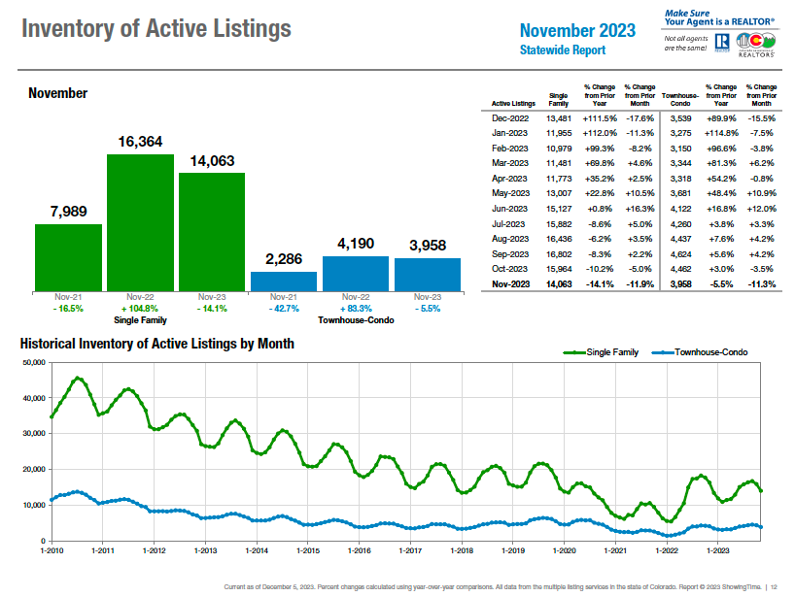

And, while interest rates dipped slightly during the month of November, the movement was not nearly enough to motivate potential sellers to abandon their locked-in low rates and add to the inventory of active listings, which are down more than 20% in the Denver-metro area and -12.5% statewide over the same time last year.

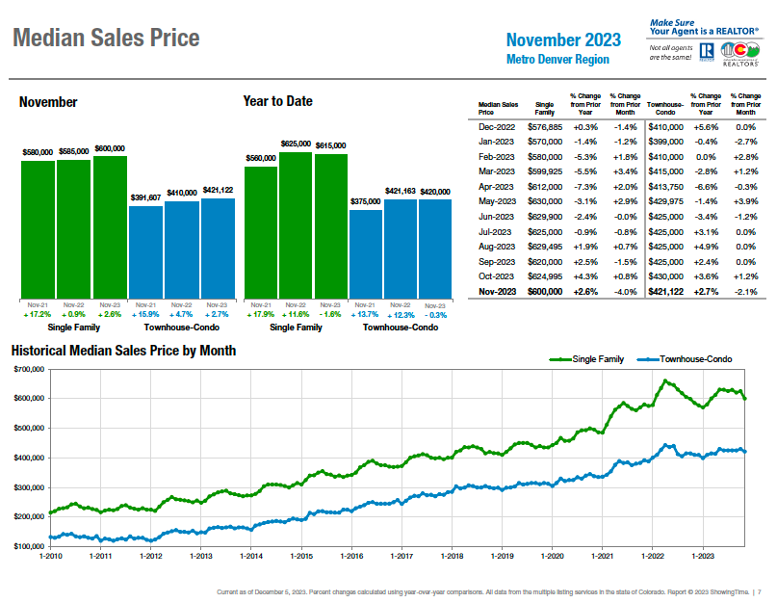

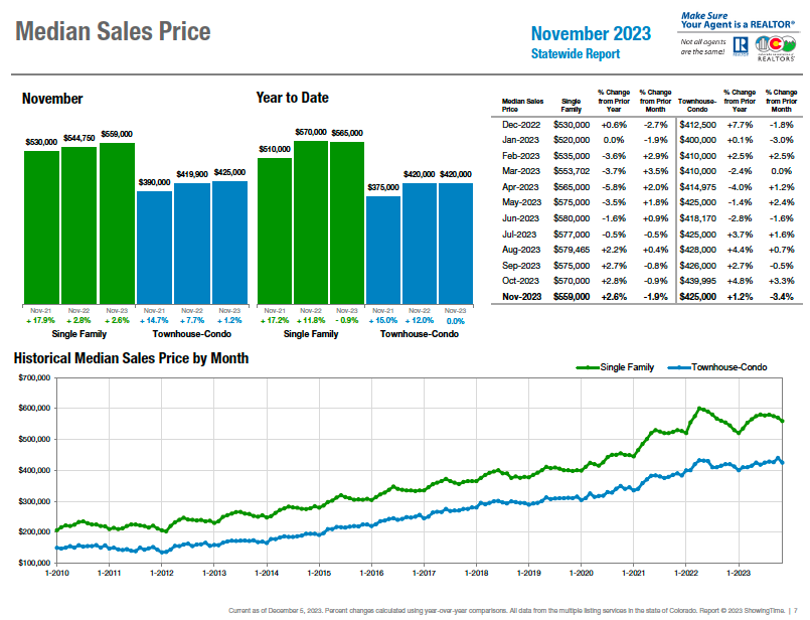

The conditions helped push median pricing down marginally from October to November however, the overall lack of inventory has kept those prices up about 1% in the Denver-metro area ($600,000 for a single-family home and $421,122 for a condo/townhome) and +2% statewide ($559,000 for a single-family home and $425,000 statewide) compared to the same time last year.

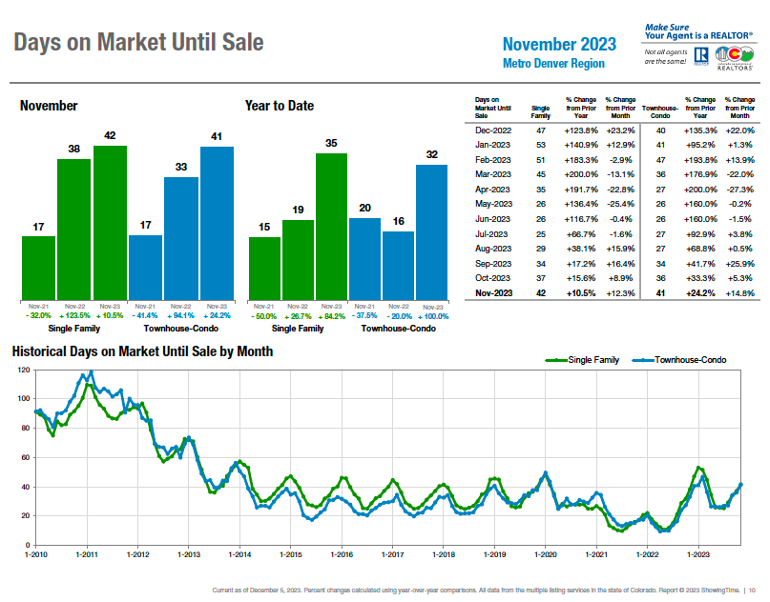

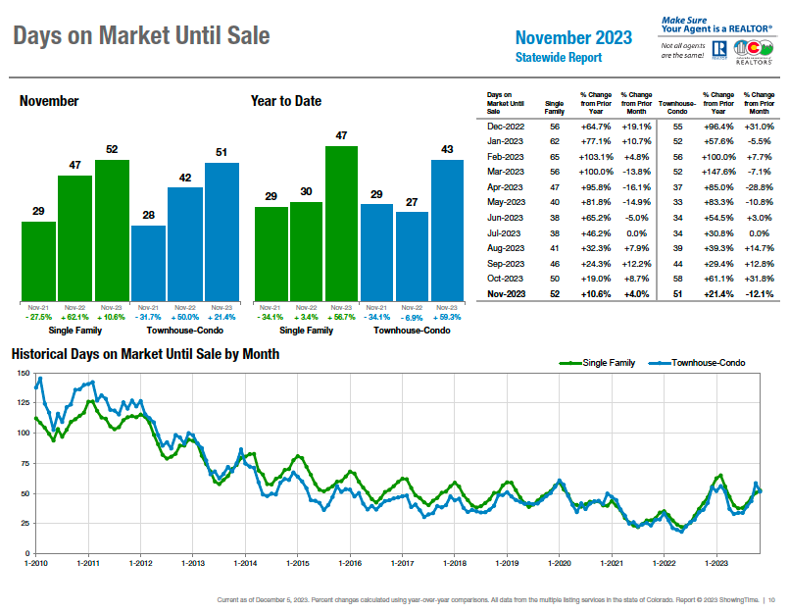

For those homes that do hit the market, the consensus is that they must be in move-in condition and have an on-point asking price to sell in a timely fashion. Sellers are still receiving more than 98% of their asking price across Colorado however, the more discerning buyers pushed average days on market to 42 days in the Denver-metro area and 53 days statewide, up 13.5% and 15.2%, respectively.

“As the year draws to a close, the real estate market struggles to hold its head above water as the interest rates and general consumer confidence affects buyers and sellers. They are both adopting a cautious approach, anticipating more favorable interest rates before engaging in any transactions,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

“November had an undertone of anticipation, causing agents, buyers, sellers, and industry professionals to wait patiently for something to change. With the upcoming presidential election year, the expectation of Federal Reserve rate cuts, and numerous buyers and sellers eagerly awaiting an opportunity to make their move, this winter seems to be the tranquil period preceding an impending storm. If the spring season from the past few years has taught us anything, we should be prepared for a potential frenzy come March, given that economic conditions allow for affordability and confidence. Currently, we’re advising our clients that patience and caution are the keys to success. Real estate professionals and active buyers and sellers will attest to a ‘hibernating’ market this winter, but the feeling of anticipation for a busy year ahead is impossible to ignore,” said Douglas County-area REALTOR® Cooper Thayer.

“Recent sales statistics reflect the reluctance on the part of a large percentage of buyers and sellers who have stepped away from the market. Sellers are reluctant to try and sell as prices are somewhat suppressed, but the prospect of moving up and taking on even a smaller mortgage at what feels like a high rate is prohibitive. Buyers are reluctant because qualifying to purchase at this current interest rate benchmark is difficult and, although prices have stabilized and even come down somewhat, it hasn’t been enough to motivate a majority of those who could buy but are choosing not to,” said Fort Collins-area REALTOR® Chris Hardy.

“Despite high interest rates and a lackluster economy, the month of November reported the highest ever median sales price in the Aspen/Glenwood MLS. The median sales price for a single-family home increased by 12.2% in November, coming in at $846,8500,” said Glenwood Springs-area REALTOR® Erin Bassett.

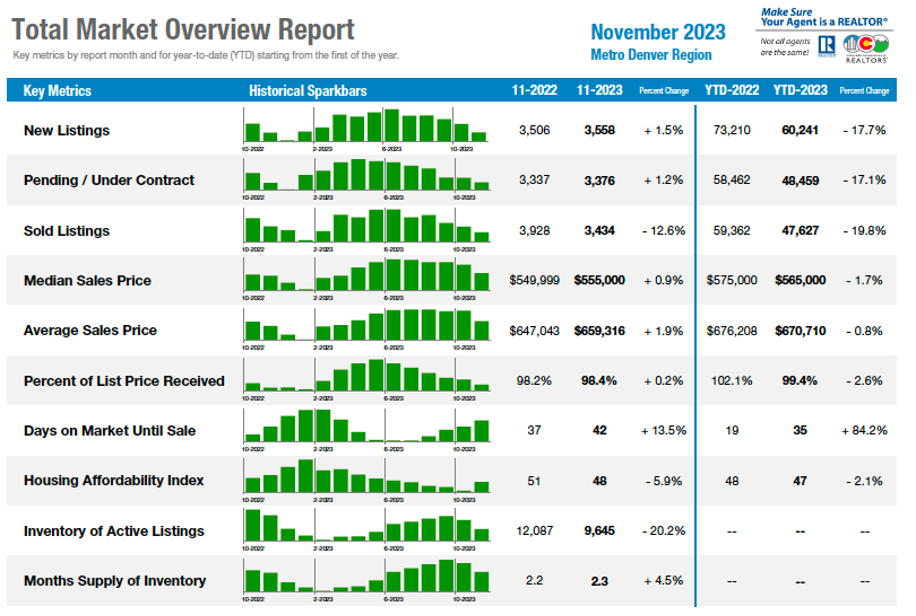

Seven County Denver area Market Overview:

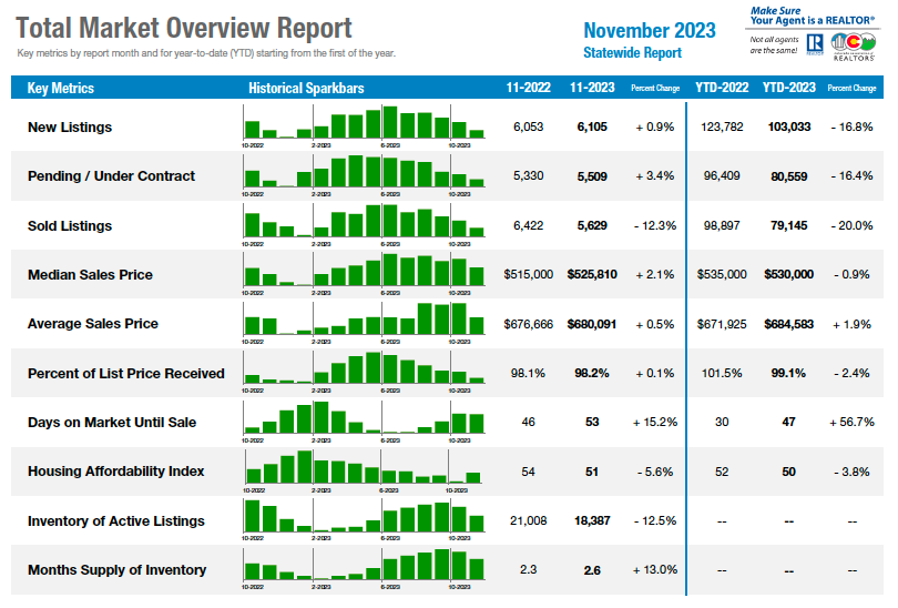

Statewide Market Overview

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“November and December are holding true to the traditional holiday time of year, and it seems slower than the fall market. The reality is listings are down considerably and overall Inventory numbers are down anywhere from 30% in zip code 80012 to 65% fewer homes on the market in 80017. Homes are selling, however, solds are down in comparison to 2022. That is to be expected when the inventory is down. Overall, there is much less for buyers to buy.

“The median price is up only slightly from last year at this time which is great news for buyers. Overall, the median Aurora price of $549,500 is $500 higher than this time in 2022. In north Aurora, zip code 80010, near the CU Health Sciences area, provides buyers the best price with a median $435,000. In 80016, higher-end homes can be found with a median price of $789,900. Central Aurora enjoys a median price of $500,000,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“As the year draws to a close, the real estate market struggles to hold its head above water as the interest rates and general consumer confidence affects buyers and sellers. They are both adopting a cautious approach, anticipating more favorable interest rates before engaging in any transactions. In Boulder, sales are down 14% since the beginning of the year and prices are down 2.4%. It is worth noting that prices were down about the same amount in the summer and have held steady since then. It’s not a crash by any means, just a slowdown and a much-needed correction. Homes are still selling in about 50 days and for 99% sales price to list price. Sellers are learning to price properly and offer concessions to buy down the buyer’s interest rate.

“Broomfield continues to shine over its neighboring counties. There are 20% fewer listings compared to the beginning of the year, but the ones that are listed are being gobbled up pretty quickly as the average days on the market is only about 30 days. Prices are actually up a modest 2.2%, but it is one of the only areas in the front range to show a price increase.

“Since sellers and buyers both seem to be exercising patience, it has resulted in a temporary slowdown in market activity. REALTORS® and economists remain optimistic that 2024 will see a surge in pent-up activity and create an active market once again,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Home prices remain stubborn despite decade low sales. In the Pikes Peak region, we are sitting at 2012/2013 levels of units sold and yet finish November with a 2.5% increase in median sales price. This continues to be frustrating for the buyer waiting for an affordability pivot. That elusive pivot that just has not hit, yet. But will it? Looking at today’s numbers, you see a 25% drop in sold homes year-over-year and 5.2% less active homes to choose from. What gives, and what may unfold as we go into 2024?

“The real meat and potatoes is what is happening now and how that may influence the economy moving forward. November added more data that helps us try to predict that path. Knowing that housing is a lagging indicator, we would then want to look at those leading indicators to see if we can figure out the direction for housing and if the Federal Reserve pivots on rates, what that means for the economy. Manheim’s price index has shown a drawdown on the used car market of 18%, the largest in history. Lumber prices have fallen back to pre-COVID levels. New home sales dropped 12.3% as of October, the largest decline since 2009, and by November, Reuters reported a 17.3% drop. We’re also seeing new home builders cut pricing or offer incentives not seen since going into the last recession. The JOLT report (Job Openings and Labor Turnover) showed job openings declining, and I am guessing the fourth quarter will reveal an uptick in unemployment. Corporate bankruptcies continue to rise, consumer spending continues to drop, and savings accounts are almost depleted. Retirement account withdrawals are alarming and hedge funds are now selling homes across the country.

“I continue to be bearish on housing and believe the state of the economy is worse than most people think. I believe unemployment will go up next year, inventory in housing will increase as would-be sellers realize home prices have room to fall and list their homes trying to lock up equity. Which brings me back to the point of a Fed pivot on rates – a tell-tale sign that the economy is hurting, and bad things typically happen after the pivot despite many in the industry claiming that it will bring the buyers back and house prices will continue up. If the past rhymes with the future and the Fed has six rate drops next year as traders are betting, then I am betting it’s because they see a dumpster fire beginning and are trying to get ahead of that before it gets out of control. The U.S. economy will be the last to correct, but will follow Germany, Japan, and China which are all showing severe economic issues already,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Following the historically low interest rates during the pandemic housing market, spiral increases in interest rates pushed many home buyers to the sidelines with expectations of dramatic downturn in the average and median prices. To the dismay of everyone waiting for lower prices, the prices of homes in the Colorado Springs market shockingly continued to climb upwards and the affordability challenges became much more difficult. Traditionally, the holiday season usually is a favorable time for buyers due to less competition as many buyers take a break for the holiday events, celebrations, and traveling, etc. Recently, the interest rates have moved downwards and there are motivated sellers, so it is a good time for willing buyers who are ready to buy.

“Analyzing the single-family/patio homes market in the Colorado Springs area, in November 2023, there were 895 new listings compared to 1,185 last month and 953 in November of last year, representing a decline of 24.5% month-over-month and 6.1% compared to last year. There were 2,397 active listings in November 2023 compared to 2,505 last month and 2,430 last year, representing a drop of 4.3% month-over-month and 1.4% over November last year. The months supply of active listings is between 2.2 and 3.1 months for homes priced under $600,000 and between 4.3 and 9.7 months for homes priced over $600,000.

“There were 715 sales in November this year compared to 851 last month and 936 last year, representing a decrease of 16.0% month-over-month and 23.6% over last year. The monthly sales volume is down by 19.4% month-over-month and the year-to-date Sales volume by 23.7% compared to last year. The days on the market were 40 days on average compared to 45 days last month and 34 days last year, representing a drop of 12.5% month-over-month and an increase of 15% year-over-year. Understandably, 41.6 % of the El Paso County single-family/patio homes active listings in the Pikes Peak MLS had price reductions.

“Last month, the average sales price was $554,784 compared to $556,964 last month and $525,923 in November last year, representing a drop of 0.4%% month-over-month and an increase of 5.5% compared to last year. The median sales price was $466,535 compared to $485,000 last month and 453,000 last year, representing a drop of 3.8% month-over-month and an increase of 3.0% year-over-year.

“Last month, 57.5% of the single-family homes sold were priced under $500,000, 30.9% were between $500,000 and $800,000, and 11.6% were priced over $800,000. Year-over-year in November 2023, there was a 9.7% drop in the sale of single-family homes priced under $400,000, a 29.9% drop in homes priced between $400,000 and $600,000, a 28.2% drop in homes priced between $600,000 and $1 million, and a 6.2% drop in homes priced over $1 million.

“Sadly, inconceivable affordability challenges due staggering combination of high interest rates and record high home prices remain the most daunting barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER COUNTY

“In real estate, a lot of people look at conflicting lines on a chart as ‘signs’ or ‘clues’ into what seems like a mysterious chain of events. People think ‘bad economy’ equals bad real estate market and, while true in 2008, real estate shifts can also occur in less of a parallel path from other economic factors. The Colorado Association of REALTORS® numbers for November 2023 show just that, seemingly unrelated figures that should be on such a linear path.

“The median price is down, 2.2% from last year. At first glance, that headline sounds doom and gloom but for buyers, it’s a welcome relief. November’s freestanding home median price, now $653,001 – and don’t forget the $1 – is now tied for the second highest ever November, lower only over last year’s $675,000. What’s curious, and is dissimilar from a ‘sign’, is that while prices are lower, the ratio of list-price-to-sales-price is identical to last year’s, 98.2%. In other terms, houses are still selling for 98.2% of asking. This means that either A, houses are being listed at realistic amounts or B, nothing has really changed in overall value in a year’s time, or C, all of the above.

“Marketing is different from last year and it points to an industry that is rolling with the changes far better than in previous movements. With supply of inventory up exactly 50% from last year as it corresponds with demand, so-to is the average days on market, up 20% year-over-year.

“To summarize, prices are relatively stable, there is a slightly extended marketing time for houses as compared to previous years, and buyers have more options when selecting ‘the one.’ Daring to say it, even with 6 and 7% interest rates, which are still historically low, all we need is either a reduced price, which is sure to follow with increasing inventory, and we are knocking at that rare intersection of ideal for everyone at the table. On this path, does that project an ideal spring and summertime season?” asks Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“November had an undertone of anticipation, causing agents, buyers, sellers, and industry professionals to wait patiently for something to change. The market continued its natural seasonal slowdown, with the number of new and sold listings in Douglas County declining to familiar November figures. Median sales prices came in at $725,000 for single-family homes, just 1.3% below that of 12 months prior. Month-over-month, the days on market and months of inventory statistics remained unchanged at 43 days and 2.1 months, respectively.

“With the upcoming presidential election year, the expectation of Federal Reserve rate cuts, and numerous buyers and sellers eagerly awaiting an opportunity to make their move, this winter seems to be the tranquil period preceding an impending storm. If the spring season from the past few years has taught us anything, we should be prepared for a potential frenzy come March, given that economic conditions allow for affordability and confidence. In the past few weeks, Wall Street has begun speculating a recession will force the Federal Reserve to cut interest rates by 1-2% in the second half of the year, which could encourage those on the sidelines to enter the market to buy or sell. In Colorado, property taxes continue to be a contentious issue, and will likely see significant discussion in the upcoming legislative session.

“Currently, we’re advising our clients that patience and caution are the keys to success. Listings may not sell right away, nor have dozens of showings, but Douglas County homes are still an incredibly hot commodity. With market-stimulating news expected in the first months of next year, there is certainly a potential for a boom in the late spring months. However, for now, the market is indicating a ‘wait-and-see’ attitude, with showing volume and transactions slowing down. Real estate professionals and active buyers and sellers will attest to a ‘hibernating’ market this winter, but the feeling of anticipation for a busy year ahead is impossible to ignore,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“In November 2023, the real estate market in La Plata County experienced a notable decline in the number of sold listings, coupled with a continued scarcity of new inventory. The market dynamics, including rising home prices and limited options for buyers, present challenges that are reshaping the landscape,” said Durango-area REALTOR® Jarrod Nixon.

Some key metrics:

- Sold Listings:

The number of sold listings in November decreased 7%, signaling a slight slowdown in market activity.

- New Inventory:

New inventory remains scarce, with only 27 new listings in La Plata County in November. This represents a significant, 23% decrease compared to the same period last year, exacerbating the ongoing inventory shortage.

- Affordability Challenges:

Affordability continues to be a major concern, as the median home price for November increased 8% to nearly $900,000. This increase underscores the growing difficulty for prospective buyers to enter the market.

- Average Sales Price:

The average sales price experienced a remarkable 43% increase, largely attributed to 14 closings of over $1 million in November. Notably, a $10 million sale, the second highest this year, contributed to this surge.

- Appreciation Rate:

The lack of inventory and strong buyer demand has driven appreciation at a rate of 6% year-to-date, reflecting the ongoing competitive nature of the market.

- Condo/Townhome Market:

The condo/townhome market remains fiercely competitive, with the average sales price surging over 38% compared to November 2022. However, townhome/condo sales are down more than 25% year-to-date, compounding affordability challenges for potential buyers.

“Several new projects addressing the affordability issue are in progress; however, these initiatives are not expected to yield results until late 2024 or early 2025. The anticipation for these projects underscores the region’s long-term commitment to creating more attainable and affordable housing options,” added Nixon.

FORT COLLINS

“Waiting for interest rates to come down? Join the club. With mortgage rates flirting briefly in the low 7% range last week, there was a glimmer of hope that rates may finally be on a trajectory that we can celebrate. The recent jobs numbers were modestly positive, unemployment came down a bit, and inflation continues to wane. That being said, the Federal Reserve is not likely to drastically lower rates in an effort to maintain the overall economic ‘soft landing’ which leaves the 30-year mortgage pegged at 7% (plus or minus a couple of tenths of a point) for the foreseeable future.

“Recent sales statistics reflect the reluctance on the part of a large percentage of buyers and sellers who have stepped away from the market. Sellers are reluctant to try and sell as prices are somewhat suppressed, but the prospect of moving up and taking on even a smaller mortgage at what feels like a high rate is prohibitive. Buyers are reluctant because qualifying to purchase at this current interest rate benchmark is difficult and, although prices have stabilized and even come down somewhat, it hasn’t been enough to motivate a majority of those who could buy but are choosing not to. Median price in Fort Collins dropped by just over 2% from last November and is down a touch from last month’s mark of $580,000.

“For sellers, even with the pent-up demand for homes bubbling away beneath the surface, it is taking longer to sell a home (approximately 2 months from list to close) and sellers are netting less as the demand for cash concessions to buyers to ‘buy-down’ their interest rate has pushed the list-to-sale ratio down, causing sellers to accept, on average, nearly 2% less than their asking price (not including concessions that may have been made).

There are deals to be made for those intrepid souls braving a market that is less competitive than in years’ past. For those in the ‘I’m just going to wait’ club – they may find that when the rates actually do come down into substantially more favorable territory, everyone in that club will emerge from hibernation at the same time and gobble up the disproportionately few houses that will be available for sale. The old advertisers’ adage of ‘So don’t delay, act now; supplies are running out’ has never been truer for housing than right now,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“Despite high interest rates and a lackluster economy, the month of November reported the highest ever median sales price in the Aspen/Glenwood MLS. The median sales price for a single-family home increased by 12.2% in November, coming in at $846,850. New listings were up 66.7% which equals 45 additional single-family homes, bringing the months’ supply of inventory to 3.1 or a total of 162 single-family homes available. Pending sales were up as well, 51%, equaling 47 homes under contract. All in all, probably one of the most balanced months we have seen in a while.

“The townhome/condo market showed similar signs of resilience with new listings up 7.1% (15), pending sales up 42% (10) and sold listings up by 50% (15). The median sale price rose by 10% over last November coming in at $426,100, however, this is a reduction of 32% over October of this year. Days on market for multi-family were dramatically down over last year, 69.8% or 19 days to close a townhome/condo, likely indicating cash offers. November ended with a 2.6-month supply or 42 active townhome listings.

“While the Roaring Fork Valley remains a desirable location and inventory continues to be low, agents on the street are seeing price reductions become more common. The days of appraisal and inspection waivers are in the rearview mirror. Buyers are breathing a little easier and learning to accept the higher rates to get into the home they desire,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Our Mesa County real estate market remains in its long sleep. New listings, pending sales, and solds are all down, between 14.3 % and 19.4% depending on category. November had the lowest number of new listings since January 2023. There was only one month in 2023 when sold listings were greater than the same month in 2022. Prices, however, are holding with the median at $390,000 and average at $428,927. A good reason for that is the number of active listings that those buyers in the market have to choose from – currently 677, down 100 since same time last year. An easing in the interest rates would gladly be welcome, as right now, our affordability index sits at 52,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Tis the season and tis the emotion in the real estate business. Both buyers and sellers are experiencing pent up desires. November sold listings were down more than 34% due to lack of inventory in the median price range and interest rate spikes. December real estate sales have been active due to slight interest rate drops. Consider this similar to the before Christmas retail buying discounts. Much like the real estate market, supply and demand make the consumer purchase market. What has not changed in the real estate world are the elements of buyer and seller demands such as household formation, change in life and work, and housing spaces (upsize or downsize), or working from what was an original vacation home (and selling original residence). Artificially high interest rates and higher home prices have created higher priced mortgages and pushed many buyers out of the market. Nationwide, new home builders have thrived with home sales as they offer rate buydowns and have proven the magic number below a 6% interest rate produces sales. Many sellers have taken the same strategy. Sellers may love their low interest rate however, if they do not love the home which now may not meet their current life demands, they come back into the market. With a year of record home prices and lowest sales numbers since the early ‘90s, both buyers and sellers are searching for some peace of mind in a challenging market. Nonetheless, the average sales price remains strong in Pagosa Springs and the days on market continue to climb with months inventory up over 39% from last November.

November Median Sales Price $530,000 (Year to Date $546,700)

November Average Sales Price $657,595 (Year to Date $665,060)

“As sellers adjust their expectations in today’s market, they are experiencing longer days on market, now 121 days. Sellers and buyers are experiencing more inventory at 5.7 months (although a lot less in median price points). Pending sales were up more than 50% from November 2022. Historically, the second quarter will bring new listings as the snow melts. Buyers will have steep competition in 2024, as pent-up buyer demand will surpass inventory availability. This will especially be true in the popular median and average price points. Savvy sellers considering selling in 2024 will undoubtedly spend the first quarter making their homes move-in ready with updates. Buyers paying today’s prices have demonstrated they have few dollars left over to make updates and repairs, leaving those sellers the option for price reductions and even longer days on the market. Sharp-witted buyers are not waiting to purchase but taking advantage of interest rate drops and placing homes under contract, with closings scheduled in January. January promises to bring on more buyers who are over the holiday retail frenzy and now focused on their 2024 New Year’s goal to purchase a home. Buyers should fine tune their lender pre-qualification financing as well. Onward to the next real estate season. Real estate consumers better shop early to meet their real estate desires. It appears the shelves (inventory) will be barren throughout 2024, as inventory has a long climb to meet buyer demand in southwest Colorado,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“We were happy to show a very small uptick in new listings during November, up 04%, however, we remain down 16.5% for the year compared to 2022. Sold listings were down 13.8% compared to November 2022 and down 23.6% year-to-date. This is a small decline compared to the last six months of 2023. Median sales price hit $300,000, down just $2,000 year-to-date, but exactly where we sat last November. The percent-of-list-price received was up .03% compared to November 2022 and down 1.1% to 98.3% year-to-date. Average days on market sits at 94 in November and we now have a 3.6-month supply of inventory.

“Our sellers are still having to lower expectations and prices to get their homes sold as buyers continue to wait for interest rates to drop and our local REALTORS® are holding a lot of open houses to get buyers off the sidelines.

“Compared to last year, new construction permits are down 222 through November, a fall of 42.7%. Only 275 permits have been pulled this year. It looks like everyone in the real estate business is waiting for the new year to start and hoping for interest rates to go down,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“What do weather and interest rates have in common? Well, it might be similar to the common idiom, ‘if you don’t like the conditions, wait and it will change.’ And change we have seen in November with rates at three-month lows and conforming loan limits up to record highs. Along with the lower interest rates came the gift of more new listings than last year; 20 each in single- and multi-family, which was twice the number of homes and 54% more condo/townhomes to hit the market. Even with the increase in new listings, there were 10% fewer active listings for single-family and 42% less for multi-family. Given the lower inventory, the number of pending sales for the month had dissimilar results for single-family with an 81% increase, while the number of sold listings were down almost 21%, indicating that the increase of pending sales will be seen in December’s sold numbers. Multi-family experienced 23.1% fewer pending sales in November and sold listings were the same as November of last year.

“With 71 active single-family listings in all of Routt County, days on market increased to about 2.5 months with less than a four-month supply – this is up from three-months supply in November 2022. Year-to-date, sellers have received 96.2% of their list price which is 2.1% less than 2022. The story is different for multi-family with only 50 units to choose from; days on market decreased by 6 days to 45 and months supply went from 2.5 to 1.9. Through November, sellers have received 99.8% of list price which is 1.4% less than 2022.

“Unlike the market of 2020 – 2021, the Yampa Valley has experienced some property price reductions, and the percent-to-list price does reflect the current list price at which it sells. When properties are listed too high for condition, location, or combination thereof, they incur price reductions and add to the days on market and months’ supply. Buyers should know that there are properties selling for the original list price and multiple-offer situations still occur,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“It seems like not even the snowflakes can cool down the hot demand for mountain properties. There were almost 13% more sales, with homes selling at just over a 10% higher price this November as compared to last November in Summit and Park counties. The median sales price was $1.4 million for single-family homes and $760,000 for multi-family properties. To put perspective on this slower time of year, it is taking over 42% longer to sell a property.

“In Summit, when comparing November 2023 to November 2022, the average sales price for single-family homes was nearing $2.3 million, which is 5.8% higher. Townhouse-condo property average sales prices were up 3.2% at $846,894. Year-to-date, the numbers are still down 1.8% for single-family homes and up 3% for townhouse-condos. Sellers received about 97.4% of their list price.

Park County’s year-to-date average single family home price was $647,669, while Lake County’s was $688,773. Out of the 471 active listings, the least expensive property is a mobile home in Grand County for $64,500 and the most expensive price is a single-family home in Breckenridge for $19.5 million (on the market for 1,194 days). Out of the 127 sales in November, the lowest was a single-family home in Park County for $127,000 and the highest was a single-family home in Breckenridge for $6.5 million. About 37% of sales were cash. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The number of November sales in the Telluride regional market, 33, was the lowest since November 2011. The dollar amount of sales hit $63.39 million with three homes sales making up almost half of the overall sales volume for the month. Despite the overall slowdown, the average sales price in the county has continued its upward trajectory, registering a 2% increase as compared to last year. This increase underscores the persistent impact of limited inventory, establishing the Telluride area as a seller’s market. There is one very large exception to this trend and that is the rural market starting 30 minutes west of Telluride and continuing to the Utah border. We suspect that is because more buyers in the lower price range need a mortgage to buy a home and of course interest rates are still high, historically.

“On a positive note, interest rates have been declining for about a month and most economists see that trend continuing through next spring. Inflation is trending downward for several months and is now below 4% with the overall economy still strong. Lastly, with fear of what happened between 2008-2012, builders are still pulling back on construction of new homes. Lack of inventory will likely be a challenge for years to come,” said Telluride-area REALTOR® George Harvey.

VAIL

“With the past three months showing signs of stability in the market, we saw slippage in November. The macro-economic factors have not significantly changed, however, in the mountain market we experience the end of what is referred to as the shoulder season. This season prior to the winter season when we see a bump in activity from ski visitors in the valley. Quantifying the performance helps in seeing the true effect. Dollar sales for November versus 2022 were negative 8.9% and transactions slipped 17.9%. The year-to-date comparisons are -8.6% in dollars and – 20.7% in units. The effect is the year-to-date and November activity is closer to one another than any time in 2023.

“Inventory for November compared to 2022 is negative 7.1%. Months of supply is 4.3 months, an increase of 26.5% versus November a year ago. New listings for the month were negative 19.5% versus the year-over-year listings at -20.7%. The months of supply increase contributes to the days on market which have increased 15.4%. Pending sales are holding reasonably stable with November at -16.4% and year to date, -18%.

“We are optimistic that the resort business, which has been driving the market year-to-date, will continue and hopefully, perk up some more. This segment of the market has the least negative impact from the higher mortgage rates and somewhat more moderate impact from inflationary factors. The local market continues to struggle with the aforementioned factors coupled with limited inventory.

November was an extremely dry and warm month for the mountains. The snowpack for the resorts was limited which keeps the visitor base contracted. Early December temperatures have dropped for making snow and Mother Nature has been blessing us with regular snowfall,” said Vail-area REALTOR® Mike Budd.

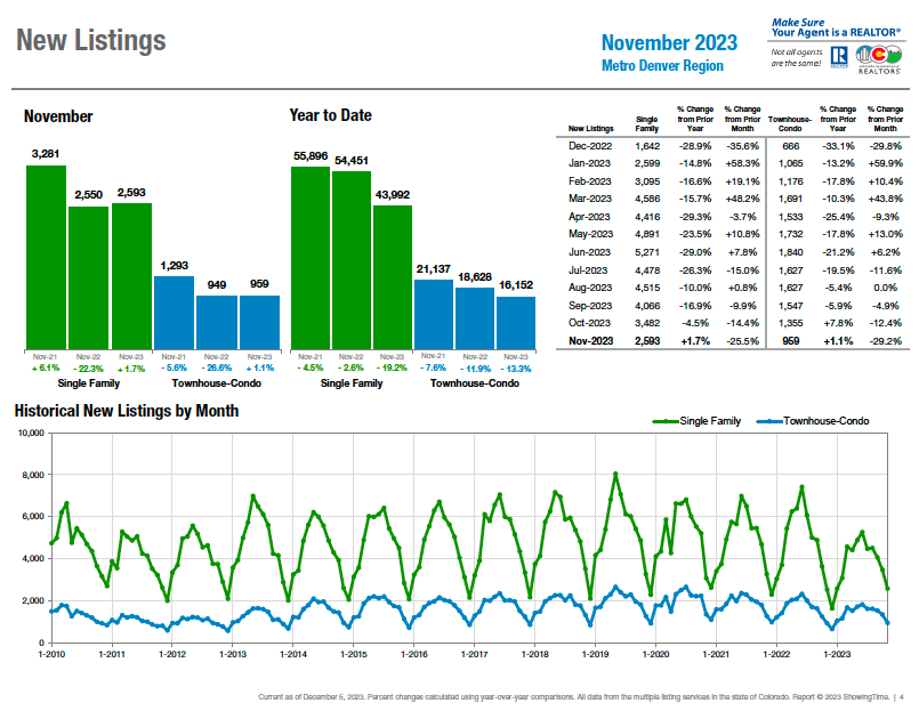

SEVEN-COUNTY DENVER METRO AREA – NEW LISTINGS

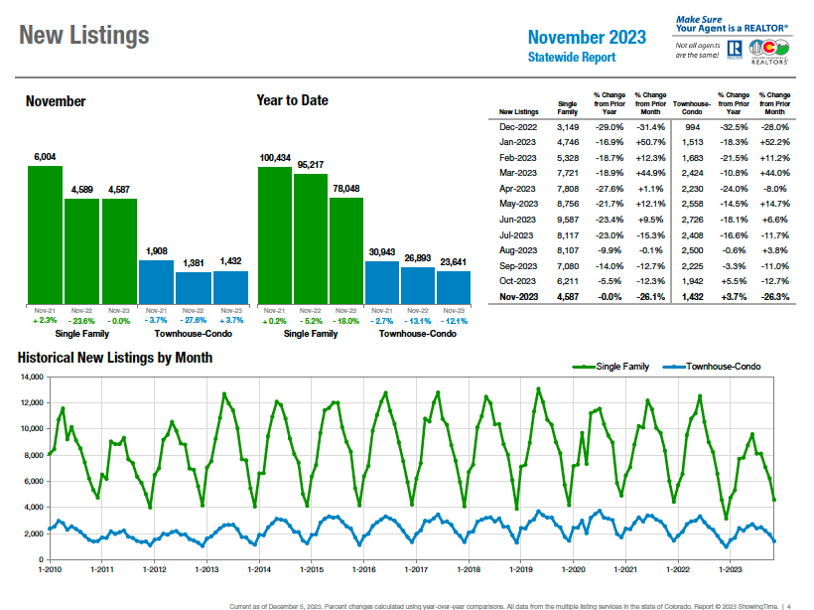

STATEWIDE – NEW LISTINGS

SEVEN-COUNTY DENVER METRO AREA – ACTIVE LISTINGS

STATEWIDE – ACTIVE LISTINGS

SEVEN-COUNTY DENVER METRO AREA – MEDIAN SALES PRICE

STATEWIDE – MEDIAN SALES PRICE

SEVEN-COUNTY DENVER METRO AREA – DAYS ON MARKET UNTIL SALE

STATEWIDE – DAYS ON MARKET UNTIL SALE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The November 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.