House sellers re-engaged in January and buyers responded

Conditions set the stage for a busy, competitive spring market

ENGLEWOOD, CO – With the turn of the calendar and a dip in interest rates improving both attitude and buying power, sellers re-engaged, and buyers responded, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state. The near immediate reaction from both sides of the transaction leaves REALTORS® feeling optimistic about the spring housing season as a spark for the year ahead.

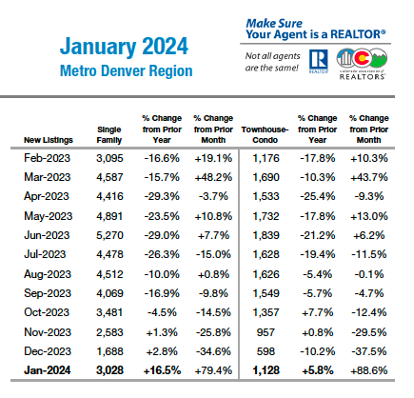

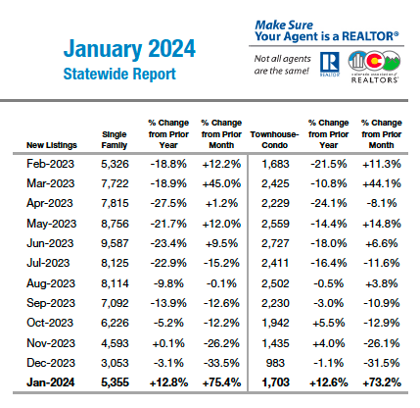

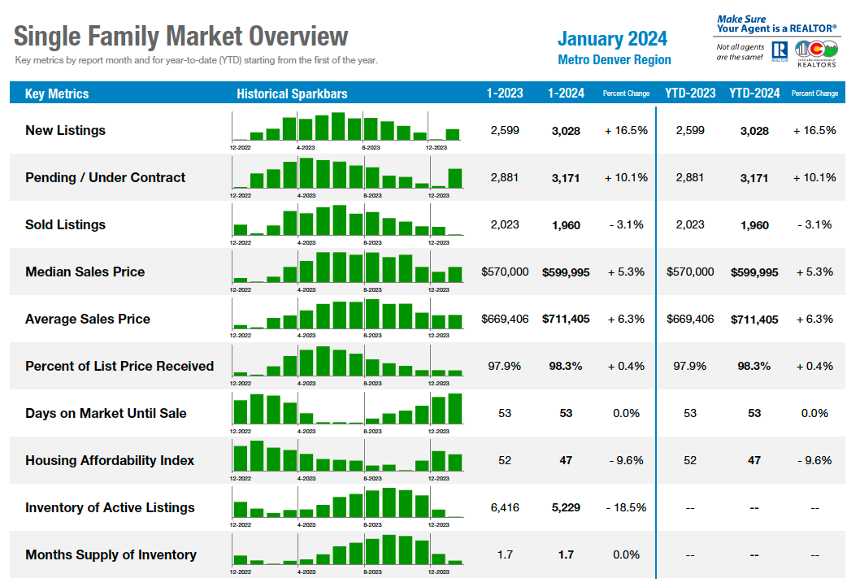

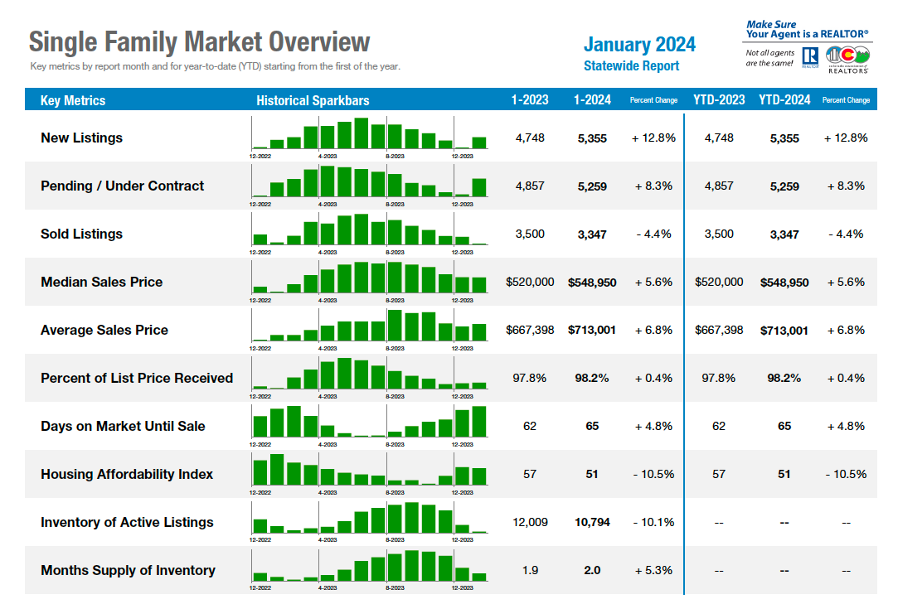

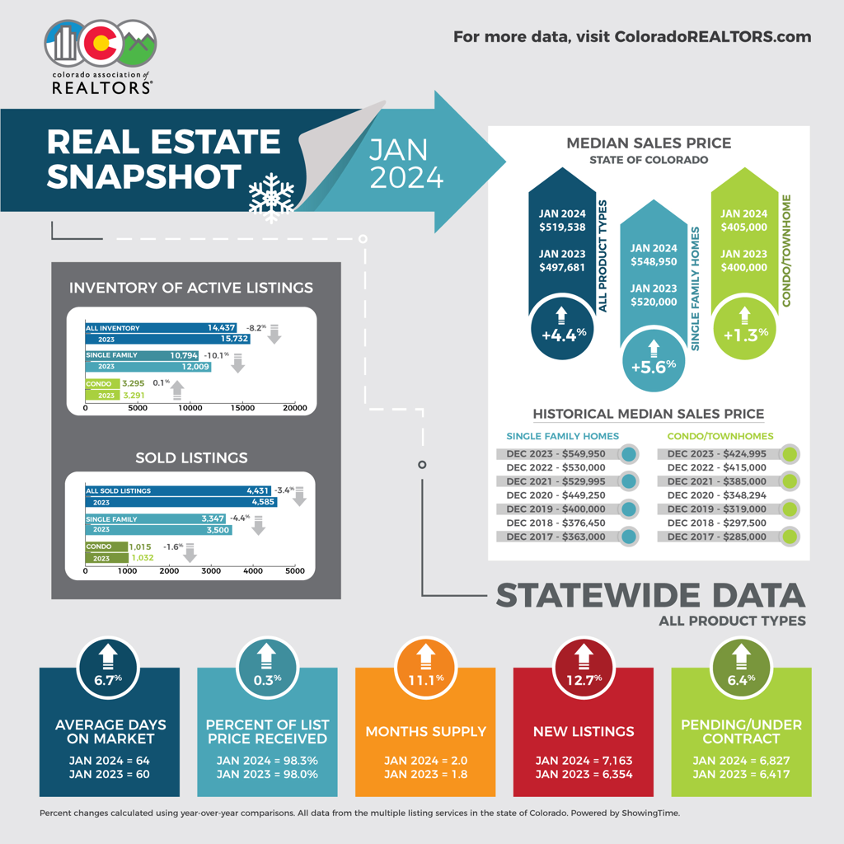

January’s 3,028 new single-family listings represented a nearly 80% jump from December in the seven-county Denver metro area, while the 1,128 new townhome/condo listings represented a more than 88% increase in the same time period. Statewide, the 5,355 new single-family listings represent a more than 75% increase from January with the 1,703 new townhome/condo listings are up 73.2% in the past month.

New Listings – Metro Denver

New Listings – Statewide

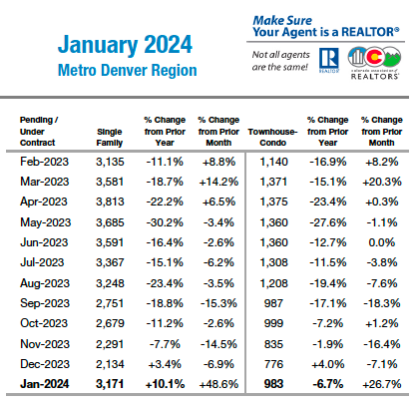

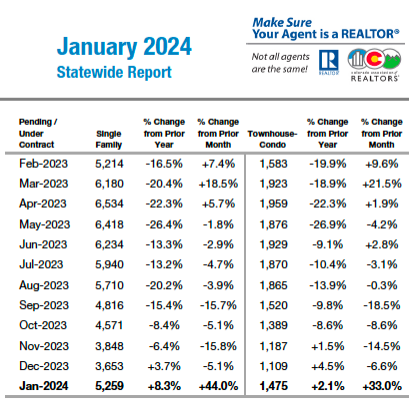

Buyers patiently waiting through the fall and early winter months for any increase in inventory responded quickly to the options, gobbling up the precious inventory at rates equal to or exceeding the new listings.

Pending/Under Contract – Metro Denver

Pending/Under Contract – Statewide

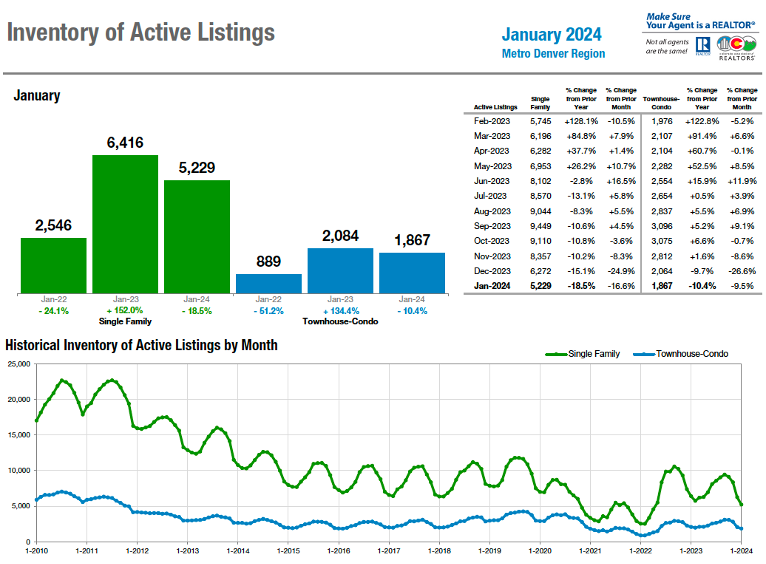

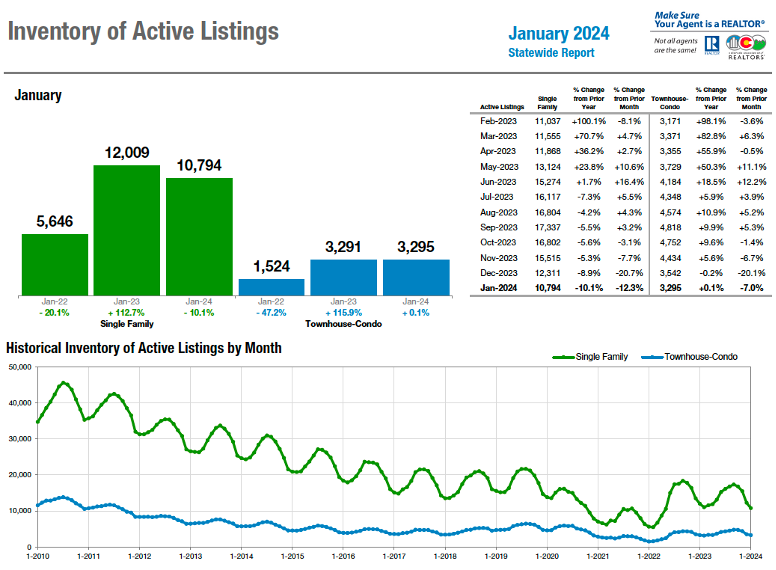

The pent-up demand and lower interest rates once again combined to push inventory of active listings down both month-over-month (-16.6% for single family and -9.5% for townhome/condos) and year-over-year (-18.5% for single family and -10.4% for townhome/condos) in the Denver-metro area. Statewide, active listings of single family homes fell 12.3% from December to January and are off 10% from a year prior while townhome/condo actives fell 7% from December to January but remain flat compared to a year prior.

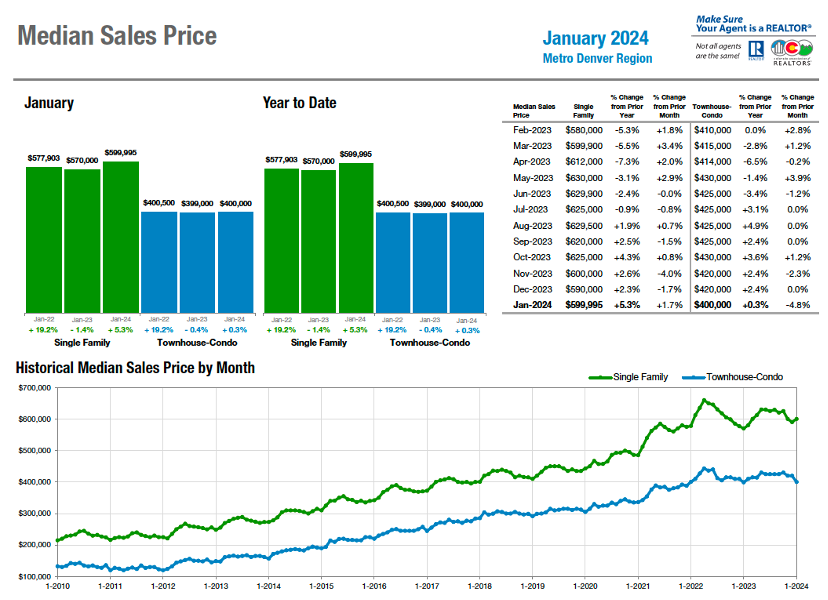

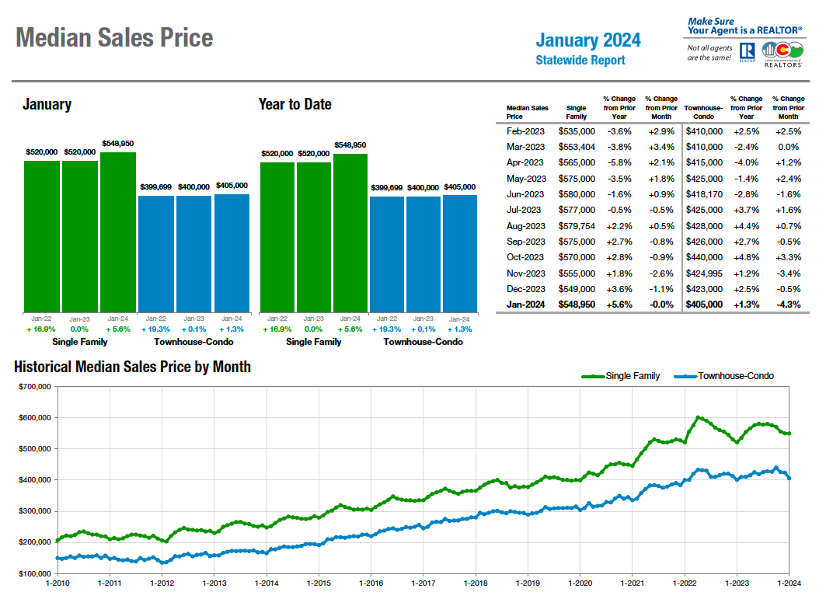

Inventory continues to impact pricing movement as well with the single-family median creeping back up to just shy of $600,000, up 1.7% in the past month and up 5.3% over a year prior. For townhome/condos, median pricing fell nearly 5% from December to January at $400,000, basically flat (+0.3%) over January 2023. Statewide, the $548,950 median pricie for single-family homes was flat from December to January but reflects a 5.6% increase from January 2023. In the townhome/condo market, the statewide median price fell 4.3% in the past month however, at $405,000, it is still up 1.3% from a year prior.

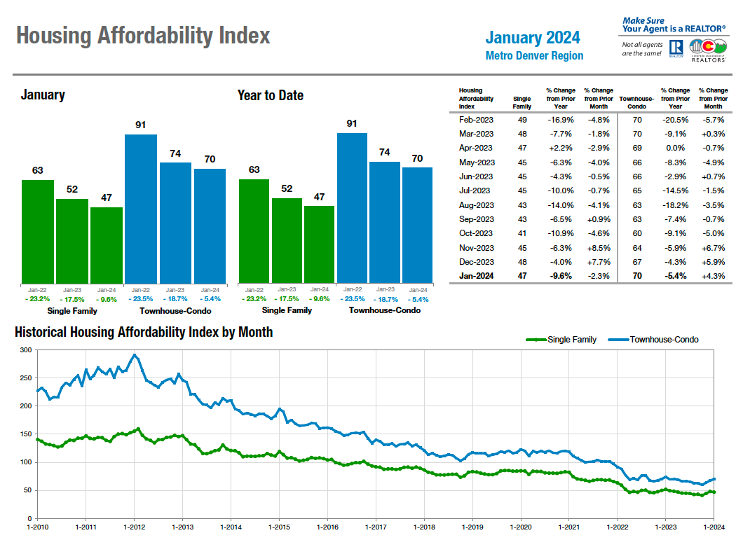

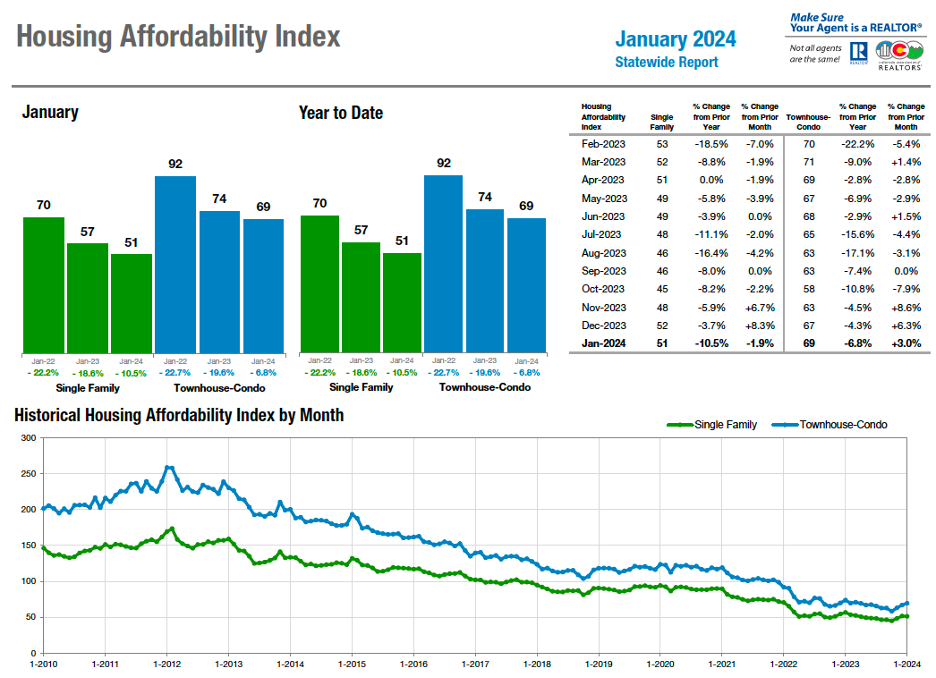

Overall, higher median prices continue to be a defining challenge to homebuyers as the Housing Affordability Index (HAI), a measure of how affordable a region’s housing is for consumers based on interest rates, median sales price, and median income by county, continues to hover at or near its lows since CAR began tracking the data in 2010.

Seven County Denver area Market Overview:

Statewide Market Overview

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“January is always an interesting month. With the snow and cold weather we endured, one would think a slower market. Not so much in Aurora where the cold and snow did not stop buyers looking for a good deal before the spring market heats up. Across all zip codes, the theme was the same. Inventory was lower than January 2023 and pricing was higher, in most cases by 10% or more. Average days on market was about the same as a year prior.

“Taking a more in-depth look at specific zip codes, the median price in 80011 rose to $450,000 as the neighborhood experiences rapid change due to the easy access to the CU Health Sciences Center and Children’s Hospital. Average days on market was actually down in that zip code as demand is high and inventory low. Looking to 80013, inventory was down 33% compared to last January as prices moved up 10.5% to a median of $525,000. This area is the central Aurora location with easy access to Buckley Space Force, and the feeder highways to Denver International Airport and DTC. In southeast Aurora, the median price in zip code 80015 rose to $605,000, a 10.4% increase compared to January 2023. Also in the southeast area, 80016 boasts a median price of $769,000, up 5% over Jan. 2023. Take a look at 80019 and you will see significant growth in new builders and perhaps even some new builder inventory. This is a great area to secure a new home under $650,000 in many cases. In the 80111 Greenwood Village area, we see a median price of $945,000 and a 50% inventory reduction over Jan. 2023. Homes in this zip code are flying off the market despite the high median price.

“If the spring buying season is anything like past spring markets, we will most likely see multiple offers and shrinking average days on market as our housing shortage continues,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“In Boulder and Broomfield counties, the real estate market woke up on January 2. The combination of lower interest rates and general optimism of a new year brought buyers out to look and sellers ready to list. In Boulder, we saw 41% more new listings in January than we had the year before. It is worth noting however, that there was pent up inventory from sellers who wanted to move but waited through 2023 to see if the rates would change or if the market would improve. Those sellers, who either just needed to move or saw a glimmer of light at the end of the tunnel, decided to pull the trigger. Many of those listings were gobbled up quickly with 32% more sales than the prior January. The prices even went up a bit (1.4%) but the days on market remain the same at about 76 days. From a boots-on-the-ground perspective, we are seeing houses sell much quicker than that but if they started in November or December, they aren’t seeing real activity until just now. February numbers should give a more accurate feel as to how long it is taking house to sell in this new, 2024 market.

“Broomfield also saw a boost in inventory with 25% more listings and the median price jumped a surprising 13% since last January. Sellers are getting close to their list price and, as we head into February, we are starting to see bidding wars start up again. The quiet end of 2023 seems to be in the rearview mirror as we navigate a market with pent-up demand as buyers as sellers finally decide to move regardless of the interest rates,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“We began the year with a marginal increase in values across all properties. Active listings dipped 2.2% and we were down 8.8% year over year in sold units. This inventory strangulation continues to keep prices elevated. Mortgage rates softened a bit in January, but then started to work themselves back up as we hit the end of the month and began February. You can feel the shift when rates begin up. It has an almost immediate effect on showings.

“I often wonder if we have mis-defined a housing recession to only be about pricing, not units sold. We continually talk about how prices are staying up across the region, but we typically don’t talk about how much business has been removed from the region. With real estate being 20% of GDP, when does that number start to reflect in the national numbers? And at some point, when/if rates fall will we see sellers come back to the market? What seems like a strong economy can be overshadowed quickly when we begin to see owners underwater, short selling or selling to investors leaving tens of thousands of dollars on the table. Is a good economy one in which a middle class American must work three jobs to get by? Or one where credit card debt is at all-time highs? People just scraping by to make it each month?

“One area of relief is the rental market. We are seeing more rentals staying on the market for longer amounts of time and tenants having a chance at softening rents. Locally, property managers are all talking about the softening of the rental market. Can home prices stay elevated in a market where rents are dropping, and more inventory is coming online each day? I personally don’t believe so, and I think we will see home prices start to follow rents. I’m one of few that believe that.

“From a 30,000-foot view, it looks as if everything is fine. At this time, you are able to sell a home in the Pikes Peak region if it is priced right, and well kept. But, when you dig in to some of the numbers and you see builders offering 8% concessions, and you chat with appraisers who admit they are having issues hitting values in some areas, it raises questions. We’re also seeing home prices stay elevated and, in some price points and with some homes, a buyer may even find themselves competing. For now, we will sit back and wait for the spring rush and see how we do moving forward,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Analyzing the single-family/patio homes market for January 2024 in the Colorado Springs area, there were 1,749 active listings, representing the highest level in January since January 2017 and a 6.7% increase year-over-year. The months’ supply of active listings was 2.0 months for homes priced under $400,000, 2.2 months for homes priced between $400,000 and $600,000, 3.7 months for homes priced between $600,000 and $1 million, and 6.9 months for homes priced over $1 million.

“There were 668 sales in January 2024, representing the lowest level in January since January 2016, compared to 777 in December 2023 and 739 in January last year, representing a decrease of 14% month-over-month and 9.6% year-over-year. The monthly and the year-to-date sales volumes were down 13.6% month-over-month and 10.1% year-over-year, respectively. The 54 average days on market compared to 46 days in December 2023 and 50 days a year prior. Unsurprisingly, the sluggish sales led to 26.1% of the El Paso County single-family/patio homes active listings in the Pikes Peak MLS having price reductions.

“Last month, the average sales price was $522,379 compared to $519,961 in December 2023 and $525,254 in January last year, representing an increase of 0.5% month-over-month and a drop of 0.5% year-over-year. The median sales price was $450,000 compared to $455,000 in December 2023 and 445,000 last year in January, representing a drop of 1.1% month-over-month and an increase of 1.1% year-over-year.

“From the analysis of the single-family/patio homes sold by price range, last month, 30.8% of the homes sold were priced under $400,000, 46.6% between $400,000 and $600,000, 18.0% between $600,000 and $1 million, and 4.6% over $1 million. Year-over-year in January 2023, there was an18.3% drop in the sale of single-family homes priced under $400,000, a 2.0%drop in homes priced between $400,000 and $600,000, a 14.9% drop in homes priced between $600,000 and $1 million, and a 22.5% drop in homes priced over $1 million.

“Devastatingly, inconceivable affordability challenges due to a staggering combination of high-interest rates, record-high home prices, and inflated cost of living remain the most daunting barriers for the Colorado Springs-area homebuyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“If you just look at the basic number, the Gunnison Crested Butte market area looks busier than it was in 2023. However, the main areas near Crested Butte and the City of Gunnison are actually statistically flat from 2023 to 2024. January sales were up from 26 last year, to 34 this year but, all eight of those sales were in areas outside of the main Crested Butte and Gunnison areas. The dollar volume was more than double. However, this is mostly attributable to two ranch sales on the outskirts of our area – one for $11.98 million and one for more than $5.4 million. If you remove these two sales, the dollar volume is only up $5.5 million which isn’t a lot considering that our average prices continue to increase.

“On a positive note, we continue to see more properties come on the market and currently have 20% more properties for sale than we did at this time last year. The number of existing contracts is down slightly from last year at this time, but we are entering the busy part of the ski season so it will be good to see how the rest of the first quarter stacks up. The first quarter of 2023 was pretty dismal, so it shouldn’t take much to come out ahead in 2024, but with January statistically even for the main sale areas, February and March will need to pick up the pace,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“The turn of the new year marked a quick change of pace for the real estate market. After a quiet Q4 2023, Denver saw 838 new listings come to market this January, indicating a newfound confidence in sellers. The single-family segment experienced a 22.8% increase in new listings compared to January last year. The combination of more new listings and, on average, homes taking a bit longer to sell, has resulted in an increased inventory of 1.7 months (+7.7% YOY), providing buyers with more options and less pressure to move fast.

“The median single-family home in Denver closed for just under $640,000 last month, an 8.4% increase over January 2023. However, the townhouse/condo market has proved to be slightly more challenging entering the new year. Increasing carrying costs such as insurance, maintenance, and property taxes have continued to uphold barriers to entry-level housing. Affordability remains at the forefront of buyer concerns, especially as average 30-year mortgage rates sustained levels in the high-6% range.

“Despite affordability obstacles, the negotiation dynamic has begun to change as buyers have more inventory to choose from, driving sellers towards moderate pricing. Homes don’t quite sell themselves anymore, and employing a competent marketing strategy is the key to a successful transaction this year. Looking forward, I anticipate inventory to begin to decrease and stabilize in the coming months. The spike in activity last month is evidence of a large backlog of buyer and seller demand, and we can expect to see a strong, competitive market as we move into the spring season,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“While patience was essential for buyers in the Douglas County market last year, we’re starting to see the return of quick transactions and massive activity in the top tier of desirable listings. Nearly 500 new listings went active in January, similar to the levels experienced just before the hyperactive 2021 and 2022 spring markets. Just 282 single-family homes sold in January, leaving about 587 homes of inventory, or about 1.4 months, entering February. Last year, inventory did not dip below 1.5 months at any point in the year.

“The townhouse/condo segment continues to tell a different story in the suburban market. Median sales prices fell to $399,000, approximately a 7.9% decline from December and a 7.2% decline from January 2023. The historically thin multifamily inventory has climbed to higher levels over the past year, and as of January, there were 54 more townhouse/condo homes for sale in Douglas County than single-family homes.

“Year to date, closed transactions are tracking last year within a 5% margin. However, with the spike in activity we’ve seen since the new year, I’m anticipating we will see an increase in sales volume this spring. Buyers are becoming acclimatized to the new interest rate baseline in the 6% range, and sellers are shifting their mindset away from trying to time the market and back towards acting based on wants and desires rather than needs,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The Durango/La Plata County housing market didn’t see significant changes in several metrics compared to January 2023. The median home price remained exactly as it was a year prior at $750,000. Days on market increased just two days to 116. The current inventory of homes decreased just two units to 122 active listings, and months supply of inventory increased slightly from 2.2 months to 2.5 months. The number of new listings fell to 24 compared to 29 in January of 2023, while the number of sold units increased from 17 to 25 due to a brief surge in activity in the fourth quarter of 2023.

“The big story for January was in the condo/townhome segment, where we saw a whopping increase in the number of new listings, from 10 units in January 2023 to 26 in January 2024, a 160% increase. The demand did not follow suit, with sold units staying virtually unchanged at 14. The glut of new inventory has pushed prices downward from a median price of $565,000 to $486,000. The inventory in this segment has increased by 50%, and the number of months of inventory has also doubled to just over three months compared to 1.7 last January. The change in inventory is partially due to newly constructed units coming to market. In addition, owners engaging in short-term rentals are witnessing decreased occupancy rates, making their units less attractive as investments, and prompting more units to be listed for sale. The prices are being affected by unprecedented increases in HOA dues at some of the larger condominium communities due to skyrocketing insurance premiums. One community in particular saw their rates increase tenfold, tripling monthly HOA dues.

“Affordability continues to be a pressing concern for homebuyers in La Plata County, exacerbated by higher taxes, escalating insurance premiums, and rising HOA fees. The current landscape indicates no immediate relief for these affordability challenges,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“The San Francisco 49ers did not easily concede their loss to the Kansas City Chiefs however, the same cannot be said for today’s home sellers in this interest-rate constrained market. Seller concessions, in the form of cash given by the seller to help a buyer reduce their mortgage interest rate, has been an increasingly popular strategy ever since interest rates nearly tripled between January 2021 and November 2023. Yes, median prices have continued to creep up, topping out at $605,000 for the month of January in the Fort Collins market which is 10% higher than January 2023 and 3.4% higher than last month. That doesn’t necessarily mean that sellers are walking away with more cash in their pockets.

“For the month of January in the greater Fort Collins area (northern Larimer County) there were a total of 196 single family detached home sales (excluding new construction). Of those sales, 60% involved a seller concession of some amount. The average seller concession for those 117 sales was nearly $11,000 or 1.65% of the purchase price. Looking at the published ‘percent of list price received’, you’ll see that it is 98.6% of the last published list price. If you pull out the 1.65% in concessions (which isn’t reported as a reduction in purchase price but has the same net effect on seller proceeds) that list-price-to-seller net price ratio is more like 96.95%. In several of the transactions reviewed for this report, buyers received in excess of 3% of the purchase price in interest rate reduction assistance from the seller.

“Interest rates have stabilized over the last several weeks in the mid to high 6 percent range. This is bringing more buyers out of hibernation and creating pressure within an already inventory-challenged environment. That being said, more sellers are seeing advantages of putting their homes on the market with prices inching upward and using the seller concession strategy for their own replacement property that eases the pain of giving up an existing mortgage with a sub-three percent interest rate. Should interest rates slide even slightly lower as we get closer to spring, activity in the real estate market will heat up quickly,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“Fremont County’s January start is slightly lower than in 2023 with 2.7% fewer new listings and 9.3% less sales. The median price residential property remained stable at $310,000. We are showing days on the market prior to sale lower by approximately 17%. Total inventory of available residential properties is down 13.2% with a total inventory of 217 units. Months supply of inventory is up 0.1% showing a total supply of 3.4 months. The average days on the market is down 16.9% which indicates that properties are selling a bit quicker. A typical listing took 74 days to market and close this past month as compared to 89 days in January 2023. New listings and sales in Fremont County see an increase in units available for sale beginning in March and lasting through September of each year,” said Fremont County-area REALTOR® David Madone.

GLENWOOD SPRINGS

“The housing market in the Roaring Fork and Colorado River valleys remained stable this January compared to the same month last year. The single-family market had a 13% decrease in new listings for a difference of 6 homes (40). Pending sales were down 10.9% or 5 homes (41) and sold listings showed a decrease of 20.6% (27). Single-family homes were on the market an average of 55 days which is a decrease of 6.8% or 4 less days on market (55). January ended with a total of 143 homes listed, a decline of 14.9% over last January’s 168 homes. The one statistic that continues to increase is the median sale price. The median sales price increased 12.2% rising from $557,225 in January 2023 to $625,000 at the end of this month.

“The townhome-condo sector also experienced similar statistics this January compared to last year. New listings were up 2 or 12.5% for a total of 18, pending sales had the same numbers, up 2 over last year at 18 units. The sold category lost 1 home for a reduction of 7.7% equaling 12 sales. Days on market increased 20% to 42 up from 35. January ended with a total of 31 active multi-family units, a decline of 38% or 31 listings vs. 50 last January leaving buyers to choose from a 1.9-month supply. This sector did experience a 16.6% reduction in the median sale price coming in at $415,000.

Overall, sales activity in the MLS was low, with only 39 sales out of more than 1200 participants,” said Glenwood Springs-area REALTOR® Erin Bassett.

PAGOSA SPRINGS

“As of January 2, locals and out of town buyers were not as distracted as they were in 2023 from home buying and fun such as skiing and other snow sports. Their 2023 hesitation to wait-see- sell-buy ambitions are moving forward to buy and sell. No surprise January new listings were up 60% at 24 new listings. Listings sold in January 2024 were up 9.5% and pending sales were also up 52.9% in January, compared to last year. Pricing indications show prices are softening and stabilizing:

Median Sales Price $505,000, down 2.9% from January 2023 at $520,000

Average Sales Price $635,239, down 10% from January 2023 at $705,773

“Buyers may be settling with the new norm of somewhat stabilizing interest rates. Unfortunately, their buying decisions still struggle against higher home prices and when financing coupled with higher mortgage payments. Cash buyers have no issues with purchases and driving the 2024 Pagosa Springs market. Sellers are realizing their real estate wealth window may be now narrowing and the time to place properties on the market.

“Homes priced under $425,000 (condos and manufactured homes) show the least inventory. Condo price appreciation is also strong and less days on market due to shortages of inventory. The reality shows about 70% of current homes for sale are priced higher than $500,000. Most inventory is $700,000 and higher. Land sales were also lower in January due to an abundance of snow. Land inventory is climbing better than last year, but at higher prices presenting the same challenges to land buyers as home buyers. New construction still has the same challenges as last year with work force, materials pricing, and shorter building months (due to snow). Additionally, those homes built requiring septic and water systems are experiencing higher prices.

“Overall, if you can find an existing home or condo close to your needs- buy it now and make some updates. Sellers should consider the right updates before selling or aggressively pricing the home to sell and expect longer days on the market as indicated by January 2024 days on market increased to 4.3 months. If you are considering selling, review what updates will give you the most bang for your buck. Historically, April and May bring more land and housing inventory with the melting snow. With current pricing, buyers and sellers are evaluating their pricing expectations. It will be fascinating to see the real estate market as it evolves from winter hibernation to the vibrance of Spring and meeting those expectations,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“Although a new year for the Pueblo real estate market, the conditions and activity are similar to the end of 2023. New listings in January were down 5.4% 2023, pending sales fell 16.8% and sold listings were down 19.4%, as the slowdown from November and December continues. In January 2024, only 129 homes sold with the median price still strong at $322,500, up 10.4%. Although we have three-plus months of inventory in our market, the overall lack of inventory is keeping home prices up. New home building permits doubled from January 2023 numbers, which is a good sign. Looking back, permits in 2023 were down 200 from 2022.

“On the buyer side, we see a group waiting for rates to drop. The Pueblo Association of REALTORS® is holding a county wide open house weekend February 17 and 18 to encourage buyers to get out and see homes and learn about the interest rates. At least 185 homes will be open for buyers to explore,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

In Alamosa County, new listings increased from 0 in January 2023 to 6 in January 2024. Closed sales surged 300%. The median sales price rose 2%, moving from $255,000 to $260,000, while the average price showed a slight decrease from $255,000 to $254,750.

Conejos County experienced a 66.7% rise in new listings from January 2023 to January 2024. The area maintained a steady median/average sales price of $211,500.

Costilla County witnessed a 33.3% increase in listings from the previous year, but closed sales decreased by 60% from January 2023 to January 2024. The median sales price increased by 25%, from $160,000 to $200,000, while the average fell from $256,580 to $200,000.

In Rio Grande County, new listings increased by 50% in January 2024 compared to January 2023, while closed sales decreased 50%. Both the median and sales price declined, with the previous price in January 2023 at $211,250 and the new price in January 2024 at $105,000.00.

Saguache County saw a 100% increase in new listings from January 2023 to January 2024. Closed listings remained unchanged. The median sales price increased 18.6%, from $360,975 to $405,000, and the average rose 49.6%, moving from $360,000 to $540,000.

– Buena Vista experienced an 8.3% decrease in new listings from January 2023 to January 2024, with stable sales. The median sales price grew 16.3%, from $490,000 to $570,000. However, the average sales price fell 8.4%, from $603,314 to $552,714.

– Fremont/Custer County witnessed a 19% increase in new listings and a 14% rise in closed sales from January 2023 to January 2024. The median sales price fell 35%, from $517,500 to $332,750, and the average sales price dropped even further 44.7%, from $637,714 to $352,641.

– Lake County had a 33.3% increase in new listings and no change in closed sales from January 2023 to January 2024. The median sales price fell 6.1%, from $505,750 to $475,000. The average sales price grew 13.9%, from $464,417 to $529,000.

– Mineral County experienced 100% growth in new listings from January 2023 to January 2024, accompanied by a 66.7% drop in closed sales. The median sales price fell 49.9%, from $799,000 to $400,000, and the average sales price dropped from $672,667 to $400,000.

– Nathrop had no change in new listings or closed sales from January 2023 to January 2024. The median sales price and average sales price both increased 14.1%, from $700,000 to $799,000.

– Park County saw a 6.3% increase in new listings and a slight 4.2% decline in closed sales from January 2023 to January 2024. The median sales price increased 2.2%, from $460,000 to $470,000. The average sales price fell 7.5%, from $557,819 to $515,722.

– Salida experienced a 26.7% decrease in new listings from January 2023 to January 2024, along with a 58.8% decrease in closed sales. The median sales price increased 42.9%, from $525,000 to $750,000, and the average sales price grew 18.6%, from $651,013 to $772,254,” said San Luis Valley-area REALTOR® Megan Fuller.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“January may bring a lot of snow in Routt County, but it does not bring a lot of new listings; single-family homes saw one new listing over January 2023 while multi-family homes saw a decrease from 21 to 12. Even with the number of active listings down 15.2%, pending sales for homes were slightly more than the same period last year and sold listings doubled; condos/townhomes realized a 35% decrease both for pending sales and sold listings with almost 47% less active listings. Median and average home prices rang in the New Year at $2.6 million and $3.14 million, respectively, and $900,000 and $1.1 million for multi-family. Seventy percent of the sales for houses and 100% of the condo/townhome sales occurred in Steamboat vs. the towns of Hayden, Oak Creek (Stagecoach) and Clark. Sellers received 96.3% of their list price for homes and 97.7% for condos and townhomes, which was slightly less than a year ago. Properties remained on the market for about 60 days with single-family having a less than three-month supply (same as last January), and multi-family slightly less than last year at about five weeks.

“May-August typically brings the most new listings to the Routt County market however, buyers seeking luxury condominiums will see a new development of 42 luxury condominiums come to market around mid-March which will more than double the current active listings for multi-family,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“While the economic principle of supply and demand maintained its stronghold in preventing a price downturn throughout 2023, the lingering question looms over whether the same scarcity of inventory will exert a similar influence in 2024. Despite a slight uptick in listings, it remains a drop in the bucket, with inventory levels still historically low.

“In comparison to January of the previous year, new listings saw a notable 28% increase for multi-family homes and 20% for single-family homes. Additionally, the number of sales surged nearly 40%, indicating heightened activity in the market. Single-family homes and townhouse-condo prices experienced an uptick. Properties sold faster than a year ago as well.

“Data from Summit in January 2024 compared to the same period in 2023 reveals the average sale price for single-family homes is up to $2,354,823, an increase of 27%. Townhouse-condo properties also experienced a price hike of 6%, with an average of $861,171. Sellers, on average, received about 98% of their list price. Park County’s 2024 average single-family home price fell to $568,850, while Lake County’s increased to $633,000.

“Out of the 432 active listings, the least expensive property is a mobile home in Grand County for $64,500 and the most expensive is a single-family home in Breckenridge for $19.4 million (on the market for 1,255 days). Out of the 90 January sales, the lowest was a single-family home in Park County for $280,000 and the highest was a single-family home in Breckenridge for $5.25 million. Thirty-seven percent of the sales were cash. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The dollar amount of sales for the Telluride regional market was $83 million in January 2024, an 85% increase over the dollar amount of sales compared to January 2023. The 29 sales were the lowest number of sales in our market area since January 2014. This anomaly is driven by high-priced homes selling in three areas: the Mountain Village, the town of Telluride and on our surrounding mesas 15 minutes from downtown Telluride.

“The number of homes sales over $5 million doubled to six as compared to only three in January 2023. We toured three Mountain Village homes during the first week of February, two listed at $21.5 million, and a third asking $19 million. The wealthy are able to buy whatever they want and yet there are fewer and fewer homes to pick from in our entire region above $5 million,” said Telluride-area REALTOR® George Harvey.

VAIL

“January 2024 was an interesting month to kick off the new year with interesting happenings on many different fronts. We experienced the gamut of weather conditions from snow and bitter cold to unseasonably mild temperatures. A couple of weekends when the snow was epic followed by mild sunny days.

“The real estate market in the valley was one area that maintained a positive trend which bodes well as we are positive despite some macro-economic factors. Buyers are optimistic and looking for their opportunity to enjoy the lifestyle,” said Vail-area REALTOR® Mike Budd.

The following are points of data that bode well for 2024:

- New listings are +27% versus January 2023. Albeit inventory is still low by historic numbers it appears to be finding a new normal.

- Pending sales are plus 44.4% which reflects the positive response and increase inventory options.

- Months supply is up to 3.9 months which is still below the 6 months considered stable. However, the improvement has been dramatic.

- Days on market increased to 62 days which is getting closer to a more stable trend and reflects the mix in price niches.

- Closed unit sales were positive 32.7% and dollar sales increased 41.7%.

The following chart represents the trend in sales by price niche that has evolved over the past couple of years:

| Jan. 2023 | Jan. 2024 | ||||||

| Unit Sales% | Dollar Sales % | Unit Sales % | Dollar Sales % | ||||

| <$1M | 38.8% | 14.3% | 30.8% | 10.5% | |||

| $1-$2M | 18.4% | 12.6% | 35.4% | 25.3% | |||

| $2-$3M | 18.4% | 22.2% | 16.8% | 19.2% | |||

| $3-$4M | 14.2% | 26.2% | 4.6% | 7.1% | |||

| $4-$5M | 8.2% | 17.8% | 3.1% | 6.1% | |||

| $5M+ | 2% | 6.9% | 9.3% | 31.8% | |||

| 100% | 100% | 100% | 100% |

“The trend in price niches obviously is aligned with the available inventory by the same price niches. The pending sales are higher than the closed sales for January and align with the price niches which looks positive again for February. A positive real estate market and good snow conditions bode well for 2024,” added Budd.

SEVEN-COUNTY DENVER METRO AREA – Median Sales Price

STATEWIDE – Median Sales Price

SEVEN-COUNTY DENVER METRO AREA – Inventory of Active Listings

STATEWIDE – Inventory of Active Listings

SEVEN-COUNTY DENVER METRO AREA – Housing Affordability Index

STATEWIDE – Housing Affordability Index

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The January 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.