Housing pipeline begins to fill as sellers step off the sideline

ENGLEWOOD, CO – New listings continued to fill the housing pipeline as the spring selling season ramps up and sellers step off the sidelines, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

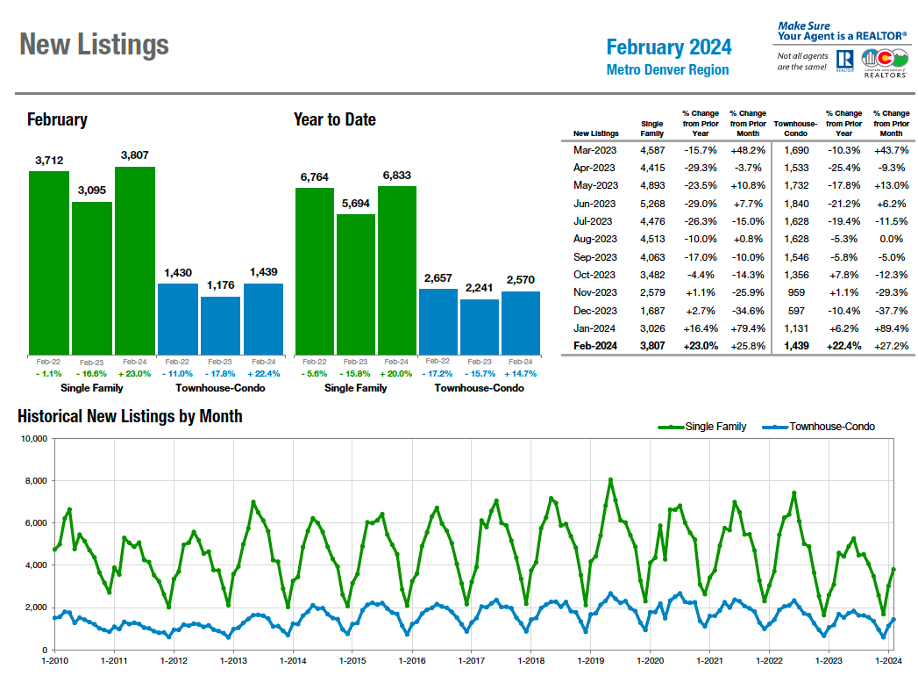

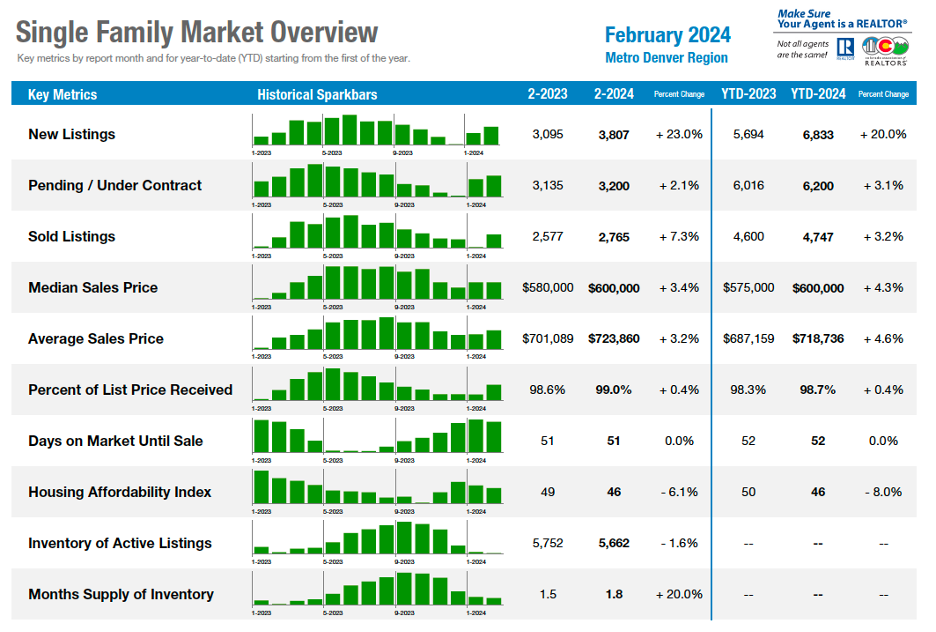

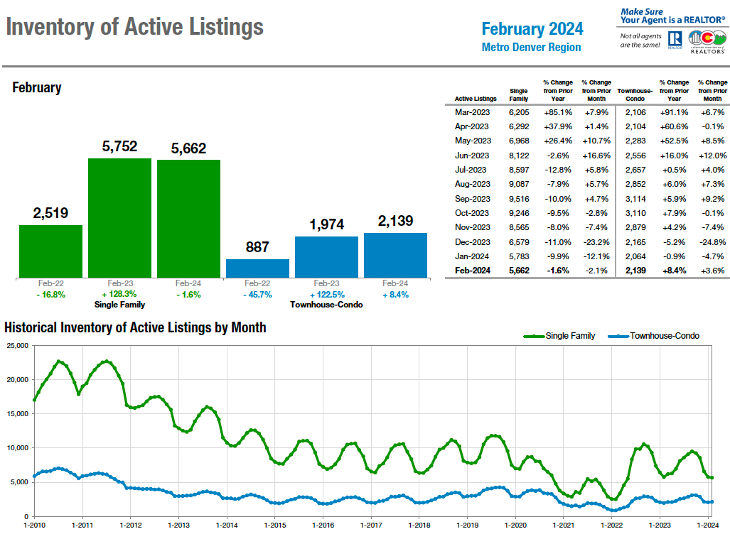

February’s 3,807 new single-family listings in the seven-county Denver metro area represented a nearly 26% jump from January and are up 23% from a year ago. Townhome/condo new listings shared a similar increase at 27.2% month over month and 22.4% year over year, respectively.

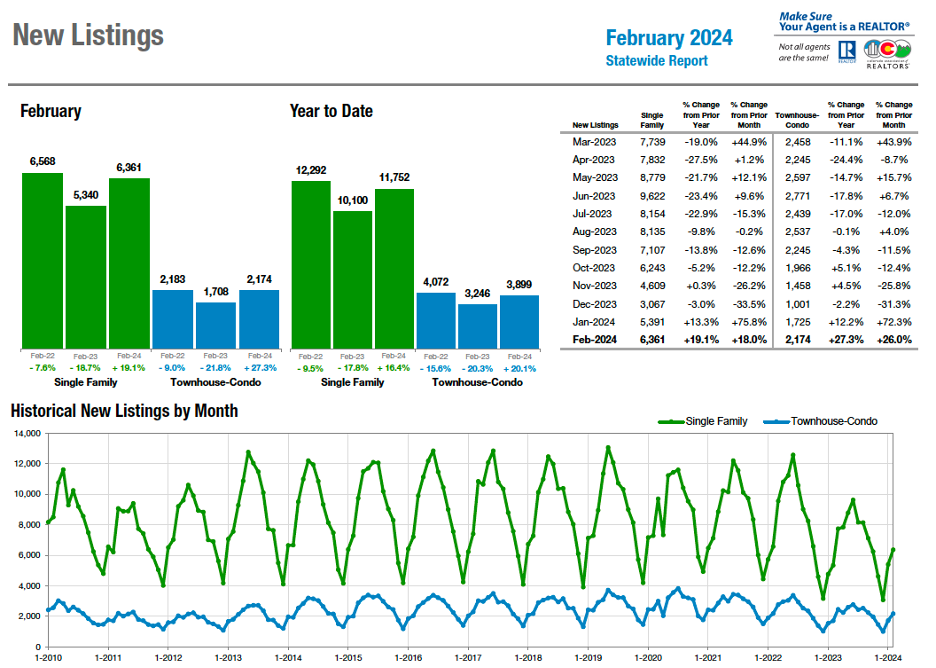

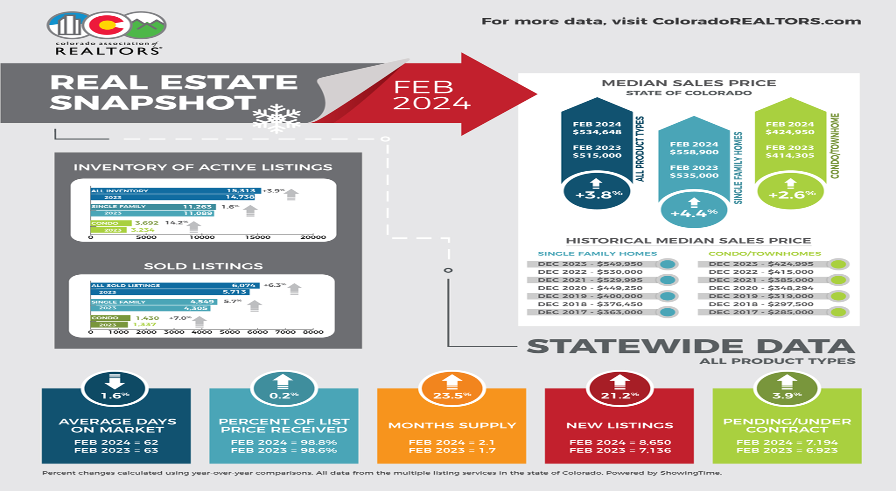

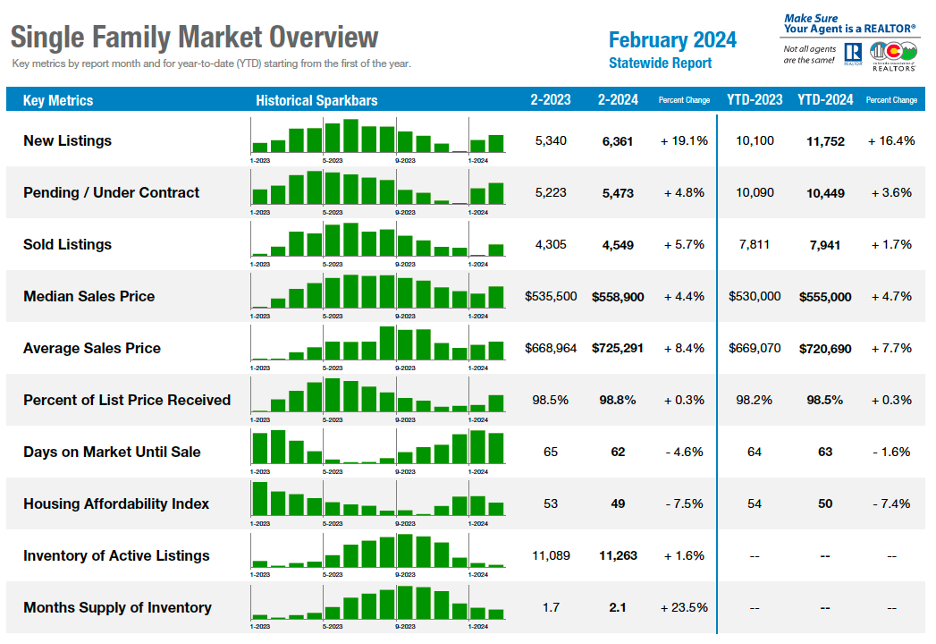

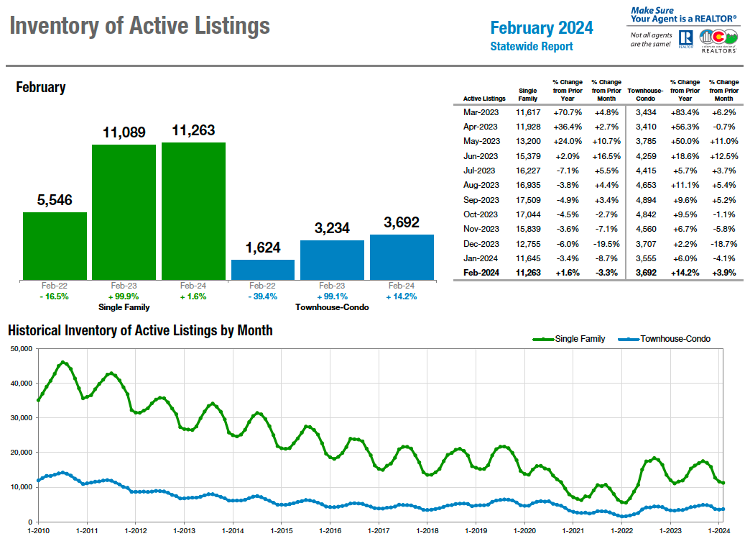

Statewide, the 6,361 new single-family listings signaled a 18% increase from February and are up 19% from a year prior. The 2,174 new townhome/condo listings in February represented a 26% month over month and 27.3% year over year increase.

“The spring market has brought optimism while everyone waits to see if the rates will adjust again. Those who need move have adapted to the rates and have come off the sidelines,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

Single-family home sales also rose sharply from January to February, up just shy of 40% in the seven-county Denver-metro area, while townhome/condo sales also rose 32%. Statewide, single-family home closings rose 34% in the past month and are up 5.7% from a year prior. Townhome/condo closings were up more than 38% month over month and are up 7% from February 2023.

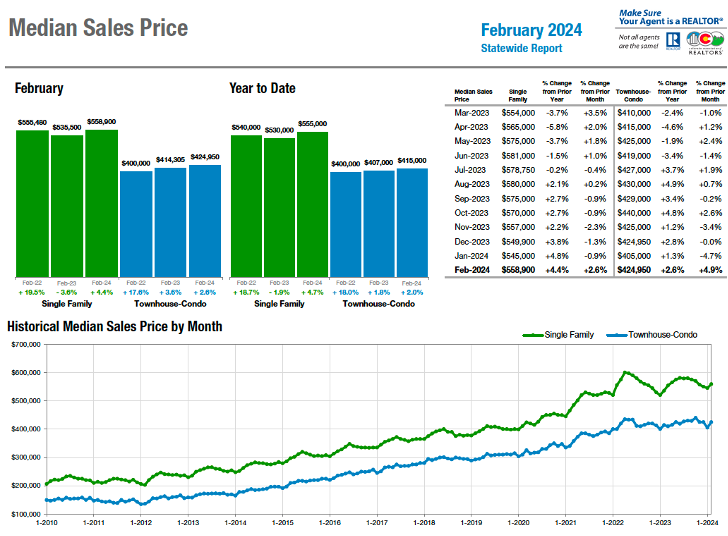

Despite the rise in inventory, strong buyer demand, coupled with higher interest rates has kept median sales pricing relatively flat to up slightly. In the seven-county Denver-metro area, single-family pricing stayed level from January to February at $600,000, up 3.4% from a year prior. The townhome/condo pricing rose 3.8% from January to February to $415,000, up 1.2% from February 2023. Statewide, the median price of a single-family home rose 2.6% in the past month to $558,900, up 4.4% from a year ago. Townhome/condo median sales pricing rose nearly 5% from January to February and is up 2.6% from February 2023 at $424,950.

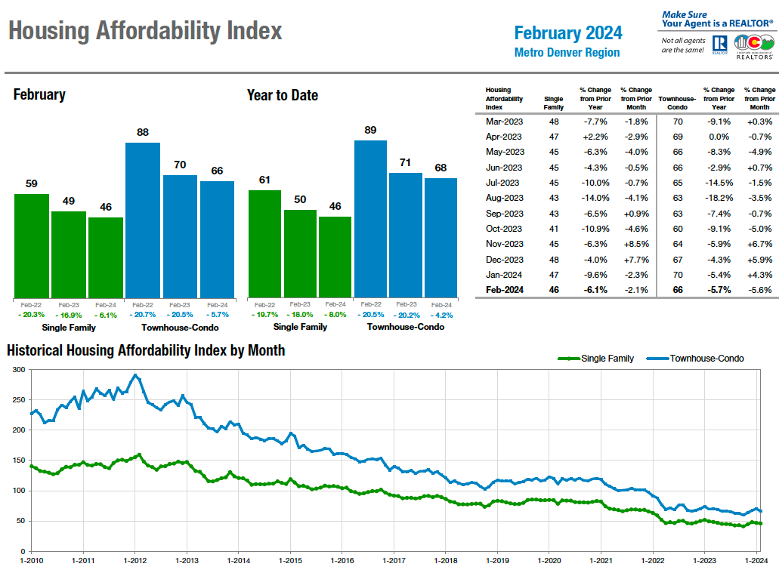

“While elevated interest rates continue to make headlines and create affordability pressures, they don’t seem to be curbing the massive demand for housing in Denver,” said Denver-area REALTOR® Cooper Thayer. “As more buyers become acclimated to higher interest rates, the increase in demand has changed negotiation dynamics on a transaction level. Growing demand has sparked a more competitive market and escalated the perceived scarcity of housing. If the market continues to follow these trends, we can expect sales prices to continue to increase, time on market to decrease, and more overall activity in the coming months.”

New Listings – Metro Denver

New Listings – Statewide

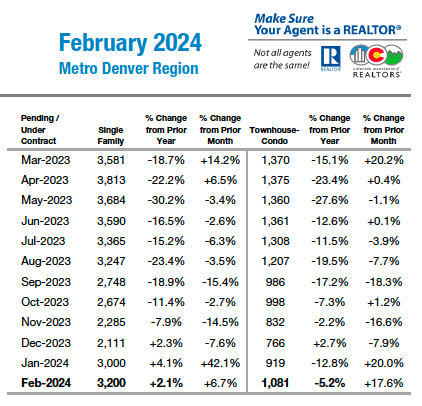

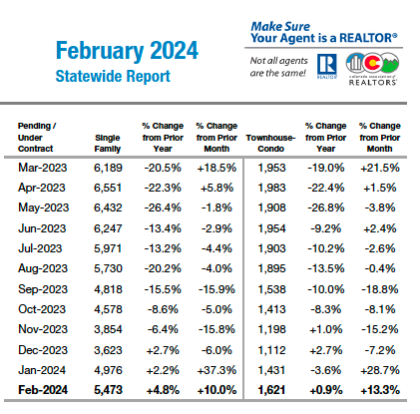

Buyers patiently waiting through the fall and early winter months for any increase in inventory responded quickly to the options, gobbling up the precious inventory at rates equal to or exceeding the new listings.

Pending/Under Contract – Metro Denver

Pending/Under Contract – Statewide

Seven County Denver area Single-Family Market Overview:

Statewide Market Overview

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The February market in Aurora/Centennial looks very much like it did in 2023. With continued low inventory, prices are up 3% to 4% across all zip codes with average days on market hovering around 30. As we move into the spring buying season, we are seeing cases of multiple offers and over-bidding. Interest rates moved down just slightly this past week which is good news for buyers who still face a general lack of inventory.

“In the original Aurora area, median price is $465,000, which is up from last year. Moving to the south and central Aurora area, zip code 80013 shows a median price of $500,000 and approximately 69 homes on the market. In 80015, the south Aurora area has 90 listings to choose from and a median price of $565,000, while the 80016 zip code in southeast Aurora has a median price of $780,000, up 3% over a year prior. Looking to the 80111 zip code, which encompasses Greenwood Village and Englewood, we have a median price of $910,000 with inventory down 63%.

“Overall, the market remains very strong. More inventory is coming on the market, however, not enough and therefore, buyers still have to be competitive and relatively quick with their offers,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“In Boulder County, homeowners who need to move have finally decided to put their homes on the market. With 35% more listings than this time last year, buyers are finally seeing some inventory from which to choose. Sold listings are up 55% and average days on market continue to dwindle. With an average of 65 days on the market, it is still taking a bit longer to sell from this time last year, but the excitement for the spring market is in the air. The median sales price remains about the same as sellers are aware of the challenges that higher interest rates bring to the market. Those that are priced well are moving at a fairly decent clip.

“Broomfield County has been a bit quieter than its Boulder neighbor. New listings are about the same as last year and the prices haven’t budged. With only 48 average days on the market, the few homes that are on the market are selling fairly quickly at about 98% sales-price-to-list price. Townhomes and condos in this area have seen a huge spike in inventory with 65% more listings on the market. Prices have come down a bit as many new townhome communities hit the market and have diluted it, leaving some opportunities for buyers.

“The spring market has brought optimism while everyone waits to see if the rates will adjust again. Those who need move have adapted to the rates and have come off the sidelines,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Is February an anomaly or are we seeing a new trend play out as we enter 2024 across the Pikes Peak Region? We have seen a pre-spring surge that increased our inventory 9.9%. With new inventory hitting the market, it appears the buyers also stepped up and pushed median prices up 3.8% year over year across all properties. The interesting tidbit in this data is nationwide mortgage applications were at 30-year lows. But in our region, we were up 7% on sold properties in February. You may draw the conclusion that we are in for a busy summer. But let’s step back and see what else is out there to help us along our path.

“Buyers are going to continue to have it tough if this is the trajectory. The Federal Reserve has pulled back from talking about interest rate cuts to realizing inflation has not curbed and that rates are not likely coming down anytime soon. With the Fed rate staying higher for longer, once again, we are going to see consumer credit cards, car loans, and other short-term debt tied to it stay higher for longer. This is putting pressure on many consumers. Mortgage rates did pull back a bit during February, but a far cry from the lows we had gotten used to prior to this hiking cycle.

“Housing starts plummeted nationwide in February and building permits dropped 1.5% month over month, according to ZEROHEDGE. Multifamily permits also dropped back to their lowest number since October 2020. We can assume that builders and developers are being cautious as new home sales inventory remains elevated. Despite homes being built, buyers aren’t showing up.

“Housing locally and nationally is giving mixed signals. Are we booming, or busting? Is it a seller’s market, or a buyer’s market? Are rates going up, or going down? My guess is 2024 will be the year that we remember a decade from now. This could be the calm before the storm. We are just now getting to year two of the tightening cycle. In the past, this is when things got interesting,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Last month, 1,830 single-family/patio homes for sale in the Colorado Springs area represented the highest level of inventory in February since 2016, with a 4.6% increase month-over-month and a whopping 26.8% increase year-over-year. The months supply of active listings was at 2.3 months, for homes priced under $400,000 at 1.9 months, homes between 400,000 and $600,000 at 1.8 months, homes priced between $600,000 and $1 million at 3.2 months, and 8.2 months for homes priced over $1 million.

“There were 792 sales of single-family/patio homes in February 2024, compared to 668 last month and 778 in February last year, representing an increase of 18.6% month-over-month and 1.8% year-over-year. The monthly sales volume was up 16.0% month-over-month and 4% year-over-year, respectively. The 53 averagedays on the marketcompared to 54 days last month and 54 days in February last year. Last month, 28.4% of the El Paso County active listings in the Pikes Peak MLS had price reductions compared to 26.1% in the previous month.

“Last month, the average sales price was $511,272 compared to $522,379 in the previous month and $500,483 in February last year, representing a decrease of 2.1% month-over-month and a 2.2% increase year-over-year. The median sales price was $455,950 compared to $450,000 in the previous month and 440,000 in February last year, representing an increase of 1.3% month-over-month and a 3.6 year-over-year.

“From an analysis of the single-family/patio homes sold by price range, last month, 28.5% of the homes sold were priced under $400,000, 48.9% between $400,000 and $600,000, 19.1% between $600,000 and $1 million, and 3.5% over $1 million. Year-over-year in February 2024, there was a 4.5% drop in the sale of single-family homes priced under $400,000, a 10.6%increase in homes priced between $400,000 and $600,000, an 18.9% increase in homes priced between $600,000 and $1 million, and a 12.5% drop in homes priced over $1 million.

“Sadly,inconceivable affordability challenges due to a staggering combination of high-interest rates, record-high home prices, and inflated cost of living remain the most daunting barriers for the Colorado Springs-area homebuyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“Statistically, the Crested Butte and Gunnison markets have started the year slightly better than 2023 with a few more sales overall and higher dollar volume across the board. The number of sales didn’t increase much, but our average and median prices continue to increase. Anecdotally, things are picking up with a lot more showings overall, more properties coming on the market, and the return of multiple offers for properties that are priced right, in good shape, and well located. Depending on the area, we have 20-37% more properties for sale now than we did at this time last year. Buyers – now is a good time to take a look as I would anticipate more properties coming on the market as we head towards our busy summer season. It is typical for sellers to have properties for sale during the summer when there is no snow covering up the ground. Buyers will have more to choose from so sellers need to carefully consider recent sales and price accordingly. While there are some properties receiving multiple offers, there are others languishing on the market because the asking price does not match the condition of the property,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“In February, we experienced more new listings, more closings, and higher inventory, all indicative of a strong year ahead in the Denver real estate market. New single-family listings rose 42.4% month-over-month to 652, a notable 50%-plus increase over February of last year. Sold single-family listings matched new listing pace, up 50.7% since January, with a total of more than $378 million in sales volume last month, exceeding the February 2023 figure by more than $50 million. The median sales price for single-family homes last month climbed over 5.5% since January to $675,000.

“The condo/townhouse (attached) segment has been a bit slower to wake up, hindered by increases in HOA and maintenance costs associated with higher insurance premiums and an overall inflationary environment. With more attached homes currently for sale than single-family homes, and attached homes sitting 38% longer on the market on average, there is approximately 35% more attached inventory relative to the single-family segment.

“While elevated interest rates continue to make headlines and create affordability pressures, they don’t seem to be curbing the massive demand for housing in Denver. Despite interest rates remaining relatively unchanged since February of last year, the number of closed listings overall has increased 13.5%, even as prices have climbed approximately 1.8% overall.

“As more buyers become acclimated to higher interest rates, the increase in demand has changed negotiation dynamics on a transaction level. While sellers had a challenging winter, February marked the first month since October where the median close price was just about 100% of the list price. Growing demand has sparked a more competitive market and escalated the perceived scarcity of housing. If the market continues to follow these trends, we can expect sales prices to continue to increase, time on market to decrease, and more overall activity in the coming months,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“For the first time since 2014, Douglas County experienced a slight decline in median close prices for single-family homes between January and February. Prices slid down about 2.2% to $700,000 in the county as inventory increased to 1.7 months. Closed listings, however, improved to 470 sales, up 37% since January and up 10% over last year. Days on market remained relatively stable, reaching 52 days, down from 56 days in January.

“The condo/townhouse (attached) market, conversely, experienced a relatively opposite trend compared to single-family listings. Prices rose 2.3% from last year, while average days on market continued its five-month increasing trend to 61 days, topping the two-month benchmark. With affordability challenges disproportionately affecting entry-level housing, climbing prices have counteracted any increases in demand the market may be experiencing from buyers becoming more acclimated to higher interest rates. However, the inherent lack of attached inventory within Douglas County (just 14% of all listings) will likely prevent prices from any more significant downward movement.

“Within the county, certain sub-market performance was notably different from others last month. Highlands Ranch reached a median time on market of just 5 days, a significant disparity from Castle Rock and Parker at 43 and 42 days, respectively. Closed prices throughout those three areas were relatively similar, ruling out price as a primary factor in the disparity. Inventory, however, was significantly lower in Highlands Ranch than in Douglas County as a whole. The lack of available homes has created a more competitive market where buyers feel pressure to act quickly when they find a home they like. As the year progresses, it will be interesting to see if prices in the Highlands Ranch community follow the competitive trend and disproportionately increase, or if the market will stabilize to fall in line with the norms of the rest of the County,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“La Plata County continues to deliver significant challenge for buyers, especially first-time homebuyers and our workforce. The need for more inventory continues to push prices upward and out of reach for most of our local buyers. There were just 15 single-family transactions for February 2024 compared to 33 in February 2023. The median price jumped almost 20% to $638,000, with an average sales price of $872,753. The townhome/condo segment saw significant gains for the same period, with the median price increasing 50% to $535,000 from $356,000 in February 2023.

“Buyers hope the mild winter and early spring weather will encourage sellers to enter the market earlier than usual, increasing competition and creating more buying options. Something to note is that even with the increase in the median and average sale prices, the gap between the list price and sold price expanded to 95%, indicating that sellers are becoming more motivated to negotiate, a good sign for buyers,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“Is March really coming in like a lion? According to the latest numbers on housing sales in northern Colorado, March is shaping up to be a very active month with no sign of lambs anywhere to be seen. The inventory of active listings at the end of February is up nearly 20% for both single-family detached homes and townhomes and condos (attached single-family). Sales activity for February was up more than 3% year-over-year in the detached category but far more active than in January. Just 93 homes sold in January, yet 130 sold in February and the trend appears to be continuing into the first week of March.

“But what about interest rates? Yes, the question on everyone’s mind is when, not if interest rates will go down. The most recent commentary by Federal Reserve Chair, Jerome Powell, hinted that there may be a reduction of the Fed Rate as early as spring – but it is still too early to see how that will affect mortgage interest rates, if at all. The consensus among those economists brave enough to make predictions is that mortgage interest rates may not see a sustained drop until third quarter of 2024.

“That’s not to say there won’t be some ups and downs along the way. The most recent data from Friday, March 8 showed interest rates below 7% for a 30-year fixed rate (depending on buyer qualifications, of course). In the recent past, anytime rates have dipped below 7%, buyers have jumped back into the market snatching up the limited available inventory. It appears that March may indeed be roaring to life.

“All that being said, don’t be fooled by the list-price-to-sale-price data standing at 98.9%. Keep in mind that measure does not include cash concessions made on behalf of the buyer courtesy of the seller. The rate-buy-down concession activity is still a key component of a savvy home seller’s marketing strategy. Sellers can prop up their asking prices but still entice potential buyers via this temporary reduction in the buyer’s interest rate – sometimes by as much as 3 percentage points in the first year.

“For those unaccustomed to a more balanced market, seeing seller concessions and buyers exerting some limited leverage may come as a surprise – but if more buyers jump back into the market should interest rates remain at the mid-six-percent threshold, the highly competitive seller’s market may very well roar right back and on into summer,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“Two months into the 2024 real estate market in Fremont County shows a 10% increase in new listings over the first two months of 2023. We sold 12.3% fewer residential units this February over last. Our average 99 days on market is up 13.8% year-over-year, the highest we have seen in several years. We currently show 3.3 months of housing inventory available in the system. February’s median price of a single-family home came in at $317,500 while the average sales price logs in at $340,754. The median price residential property year-over-year fell 4.1%.

“Slower sales are likely due to buyers sitting on the fence anticipating an interest rate reduction. New listings and sales in Fremont County increase beginning in March and lasting through September each year.

“Fremont County’s median sales price of $317,500, as compared to the statewide median price of $558,900, makes this quiet community ‘very’ affordable to our state’s retirees coming from the metro areas or those professionals who can work from a home office,” said Fremont County-area REALTOR® David Madone.

GLENWOOD SPRINGS

“The Glenwood Springs market data for February 2024 shows some interesting trends in the Garfield County real estate market. The supply of single-family homes increased significantly, with 53 new listings hitting the market, up 35.9% from the same month last year. The demand for these homes also rose as pending sales increased 7.3% to 44 sales. The median sales price of a single-family home in Garfield County jumped to $625,000, a 30.5% increase from February 2023. The average time on market for these homes was 13% lower than last year, indicating a fast-paced market. At the end of February, there were 145 active listings of single-family homes, or a 2.7-month supply, which is still below the balanced market threshold of six months.

“The townhome and condo market in Garfield County saw a decline in both supply and demand in February. There were only 16 new listings of townhomes and condos, down 23.8% from last year. Pending sales also dropped 39.1% to 14 sales. However, the number of sold properties increased 20% to 18 sales, suggesting that buyers were quick to close on the available inventory. The median sales price of a townhome or condo in Garfield County rose 25% to $564,250, reflecting the high demand and low supply. The active listings of townhomes and condos at the end of February were only 29, or a 1.8-month supply, which is very low and indicates a strong seller’s market.

“As the spring season approaches, we hope to see more listings come on the market to meet the buyer demand and create a more balanced market,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“The Mesa County/Grand Junction market is seeing a little glimmer of increased activity as buyers jumped on the little decrease in interest rates. Pending sales were up 17% from last year, and solds were up 7.2%. As new listings stayed flat not only compared to last year, but also last month our inventory of active listings fell 11.8%. The greatest level of sold activity, 70%, was in the $250,000-$500,000 range. This cuts into the properties available in our most affordable range. Both median and average prices were up a little compared to last year. As spring is definitely making its way into the western slope, let’s think positive for a strong spring market,” said Glenwood Springs-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“The February groundhog who predicted an early spring apparently must have had the same mindset as buyers and sellers with early real estate activity. Just like spring bulbs popping upward toward a beaming bloom, so are the popping market numbers in February. Buyers and sellers are migrating toward a new real estate life cycle. Numbers surpassed (or held) 2023 and chased the higher 2022 real estate market numbers. Sold listings up 45.5% at 16 homes compared to February 2023. New Listings up 84.4% at 59 units. Average Sales Price of $652,351 held, just dollars over the 2023 price of $652,176.

“Not such an adequate climbing number, for sellers, are days on market. February climbed to six months compared to 3.9 months in 2023 and supporting inventory is up at 149 homes (almost 42%). With consideration of 104 active listings in 2021, 50 in 2022, and 105 in 2023, inventory is staying on the market longer. Over 60% of inventory is priced over $700,000 and is contributing to longer days on market in view of the fact that fewer buyers in these price points are willing to finance a purchase with the monthly payment that accompanies. In 2021, the median Sales Price was $375,000 (with an abundance of homes) compared to $505,950 today. Today, that price and under will produce a handful of smaller homes, a few older (maybe updated) condos, and older manufactured homes.

“Land inventory is also clambering up in price value and quantity. The 2023 tax assessments have reached owners with higher property values. Some tax assessments have tripled. Sellers owning land property who have no intent on building are in a strategic 2024 platform to sell. Buyers considering retiring and building within 5-7 years are aware purchasing land is an investment alternative to achieve their goal to live in Pagosa Springs. This produces the perfect bloom.

“Home prices are stabilizing at higher numbers than buyers desire. Buyers are faced with higher or holding prices by not purchasing in 2023. Some buyers are just tired of waiting and making life decisions to purchase. They have chosen to evolve into their purchase and understand the value and beauty of southwest Colorado lifestyle living. Even with snowfall, year-to-date pending sales are even with 2023 with 38 homes. Sellers are aware prices are still holding and 2024 is the opportunity to sell. Savvy sellers are adjusting into the actuality their homes will be on the market longer, similar to pre-COVID and 2021 sales. Sellers are now back to the days of having their homes priced well, show-ready with updates, upkeep repairs, decluttering, staging, and maybe even concessions to make their home competitive in the sales arena. With the onset of the Spring season, both buyers and sellers are bored with waiting and embarking on a new life cycle of real estate,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The Pueblo real estate market continues to chug along in the early months of 2024 with not much change and no real improvements over conditions we saw a year earlier. New listings are down 2.7% year-to-date and are down just one listing from February 2023. Our pending sales were up 9.6% in February 2024 from a year prior but are down 7.5% year-to-date. The big down category that most people look at is sold listings, down 19.1% year-to-date. The February 2024 median price was up 4.1% to $318,500 year-to-date. The percent-of-list-price received was up .04% year to date to 98.3%. Our average days on market is still in the three-month range.

“The Pueblo Association of REALTORS® held a successful county-wide, two-day open house in the middle of February to help buyers look at homes. Although higher interest rates remain a big obstacle for buyers, there were 186 homes participating with a good turnout of potential buyers and many homes going under contract. Builders are still cautious to start new homes with only 27 permits pulled in February 2024,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“Overall, the market in the San Luis Valley seems to be heating up. Here are some highlights of recent market conditions in each county across the Valley:

Saguache County: There have been more listings and closed sales from last year to this year, with the median price dropping 4% from $378,000 to $360,000.

Rio Grande County: This county has seen a 50% increase in listings, while sales have remained relatively stable. The median sales price dropped slightly from $211,250 to $201,000.

Costilla County: We witnessed a 75% increase in new listings from last year to this year, while sales have stayed the same. The median sales price also grew 51.9% from $160,000 to $243,000 year over year.

Conejos County: This county had the same February as last year, while year-to-date new listings have increased 40%. The median sales price dropped slightly from $160,325 to $160,000.

Our largest county, Alamosa County, is up 200% from last year in new listings and 300% in closed sales. The median sales price has gone from $255,000 to $260,000, representing a slight 2% increase.

The Valley continues to be one of the more affordable places to live in Colorado and is attractive to buyers from all over,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“Inventory, or lack thereof, remains the problem in Routt County. We have just 2.9 months supply for single-family and multifamily is a mere 1.5 – no change from February 2023. New and active listings were down for single-family in February. Active listings were also down for multi-family however, there were 29 new listings compared to 14 in February of last year. The number of pending sales for both single and multifamily properties was up for the period, while the number of solds were less. The first few months of the year are not when our market sees very many houses sell. Buyers often like to see the curb appeal and the yard once it is free from snow cover therefore, second and especially the third quarter is when we see the majority of houses trade. This said, a newly constructed $10.2 million home sold at $1,454 a square foot in Alpine Mountain Ranch.

“At first glance, median and average sales prices were up significantly over last year, but the Alpine Mountain Ranch sale heavily skewed the numbers, which is why it is important to look not just at percentages or prices, but the underlying data. Even with higher prices, buyers will appreciate that the percent-of-list-price received is slightly less to-date in 2024 than the same time in 2023, indicating some sellers are open to negotiating sales price and potentially concessions. In the past year, the ski-in/ski-out developments of One Steamboat Place and Edgemont, constructed in 2009, have reached an average resale price per square foot of approximately $1,900. The base area will see its first new construction since these two developments; Crawford Square at Burgess Creek – a six-unit townhome/condominium project currently under construction, and The Gamble – a 42-unit condominium with plans to break ground upon spring thaw. With more snow than any other Colorado ski area, the Steamboat Ski Resort has extended its season until April 21with locals heading for spring break thereafter. When they return, we will likely see some grass sprouting in areas of town and new for-sale signs hitting the ground,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

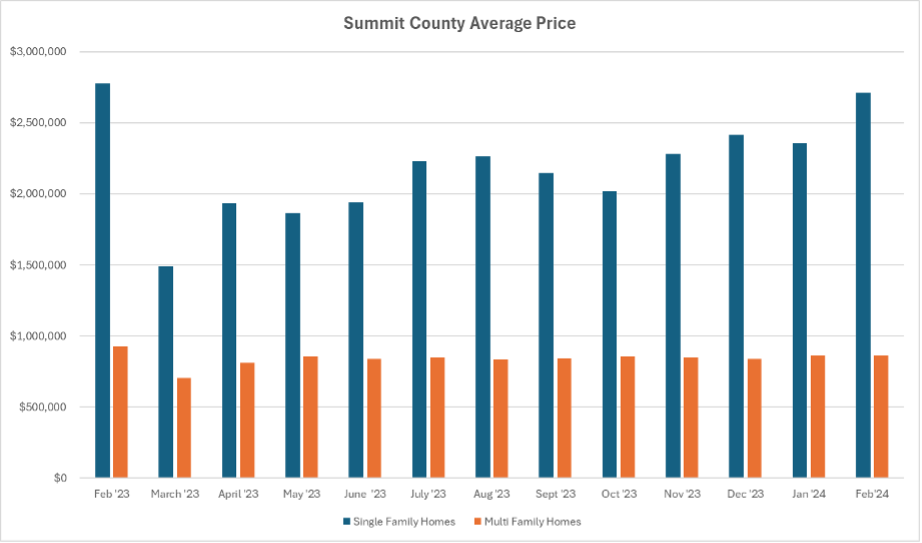

“Inventory is still the name of the game in the high country. Although its ability to drive price growth appears to be waning, with average prices down and median prices remaining flat. Comparing this February to February 2023, listings were down more than 25%. Additionally, the number of sales surged nearly 56%, indicating heightened activity in the market.

“Summit County February 2024 compared to the same period in 2023 is a bit different than the overall area’s stats. New listings are the same, sold listings are up, percent-of-list-price received is about 97% while the average sale price for single family homes is flat at a -.7% change to $2,711,480. Townhouse-condo properties experienced a 7.3% decrease, with an average of $859,802. Park County’s 2024 average single-family home price fell to $596,506.

“Out of the 428 active listings, the least expensive property is a single-family home in Park County for $129,900 and the most expensive is a single-family home in Breckenridge for $19,499,000 (on the market for 1,284 days). Out of the 110 sales in February, the lowest was a condo in Summit County for $244,701 and the highest was a single-family home in Breckenridge for $8.75 million. Of the month’s sales, 47% were cash. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

The chart below reflects the greater month-to-month fluctuation of average pricing of single-family homes compared to multifamily home prices over the past year.

TELLURIDE

“The first two months of 2024 sales came in at a total of $175.3 million, 46% above the first two months of 2023. Frankly, I’m kind of shocked that the Telluride regional real estate market is still in a boom. It seems that the affluent have done so well financially in the last 10-plus years that many of them can buy whatever they want.

“Prices in the Mountain Village are about $1,628 per square foot for single-family homes sales in the first two months of 2024. In the Town of Telluride, prices per square foot for single-family homes this year are $1,841. On top of these stats, inventory is increasing too. It’s too early in the year to guess if this trend continues, but it seems like the affluent like the direction of the stock market and the overall economy. Put on your seat belt and enjoy the ride,” said Telluride-area REALTOR® George Harvey.

VAIL

“February was a good month for both the snowpack and the real estate market in the valley. The February market delivered an 85.7% increase in units versus 2023. The dollar value of sales increased 74% over February 2023. However, 35% of the unit increase and 57% of the dollar increase were generated by two developments that have been in the construction phase for the past two years and had these closings in February. If the development sales were removed, we would have seen approximately a 23% increase in units and 30% in dollars. Thus, a solid performance without the development sales.

“New listings for the month were positive 35% and are up 31.5% year to date. Pending sales for the month are positive 12.7% despite the closing of the development sales which had been in the pending category. Days on market decreased 22% due to the strong activity for the month. Active inventories increased 13.6%, a positive trend going into the spring. This inventory increase had a positive impact on our months of supply, which hit four months for the first time in a long time. All pricing niches of sales showed healthy increases and the $1-$2 million niche had a huge jump due to the development sales.

“An objective look at the first two months of 2024 gives indicators for a strong winter season and sets the groundwork for a healthy spring and summer. Macro factors are the only components that could alter the positive view going forward and we keep our fingers crossed against any negativity,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA – Median Sales Price

STATEWIDE – Median Sales Price

SEVEN-COUNTY DENVER METRO AREA – Inventory of Active Listings

STATEWIDE – Inventory of Active Listings

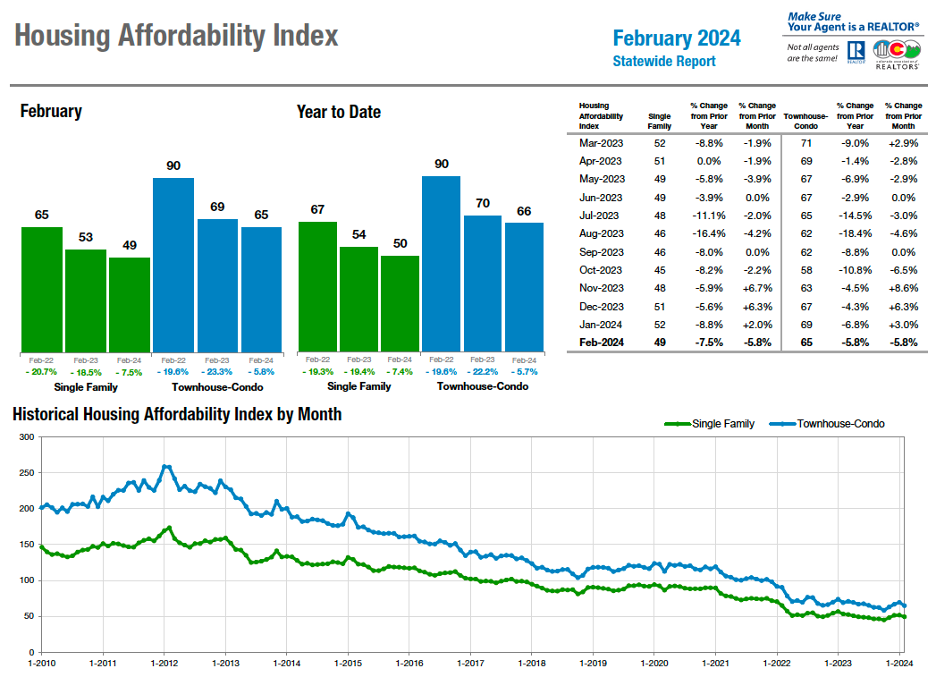

SEVEN-COUNTY DENVER METRO AREA – Housing Affordability Index

STATEWIDE – Housing Affordability Index

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The February 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.