Early spring housing market delivers strong volume of new listings, active buyers, and higher prices across metro area and state

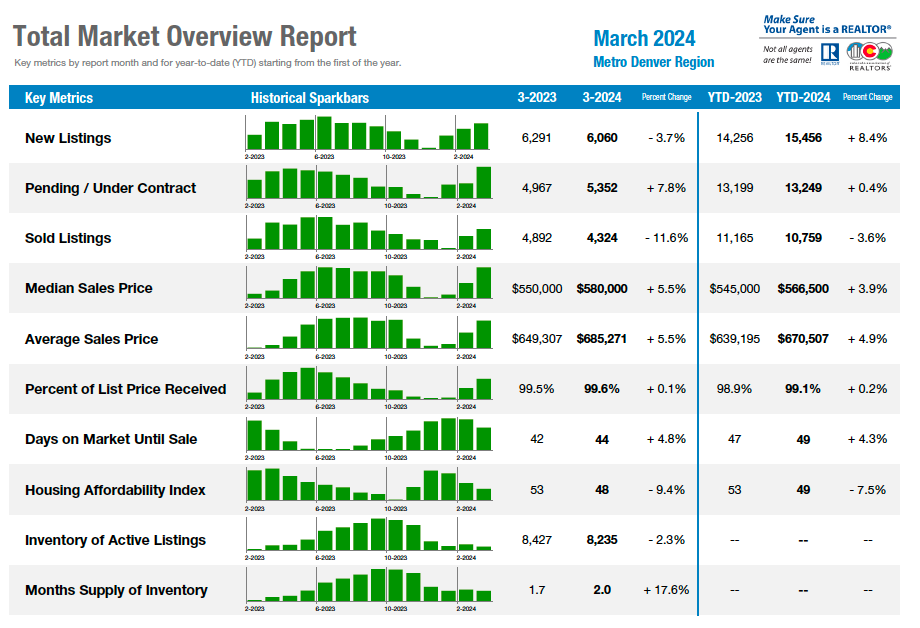

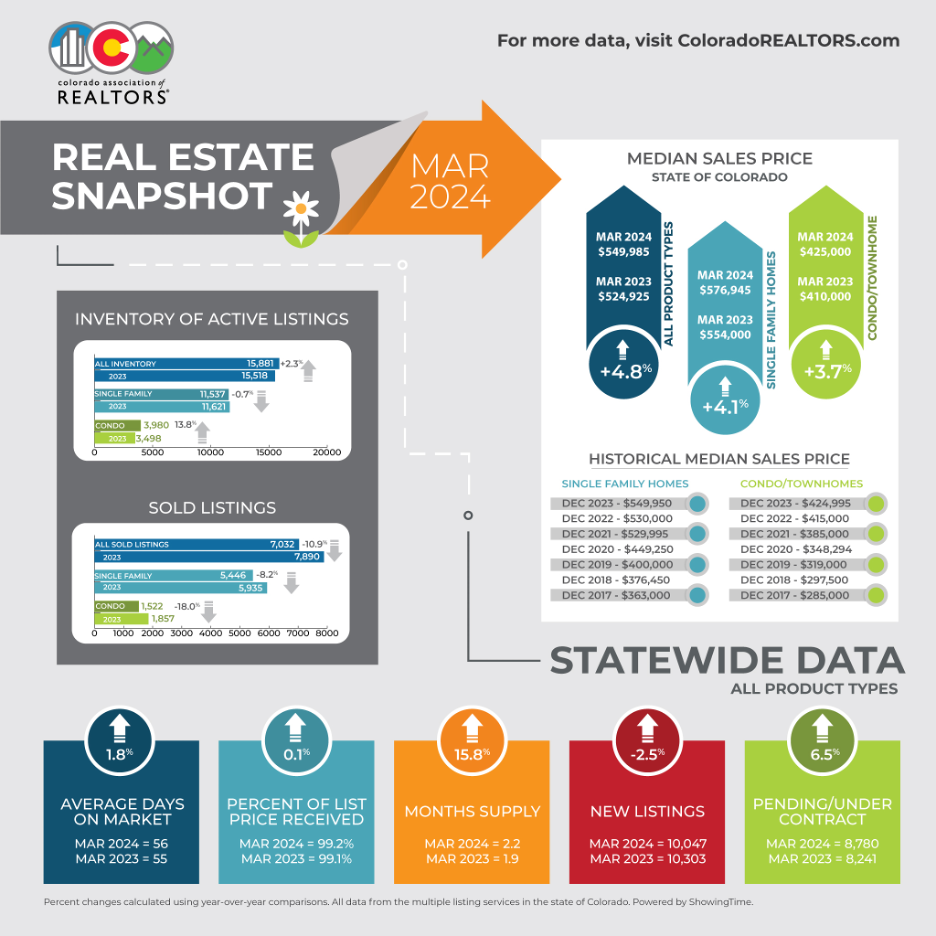

ENGLEWOOD, CO – The early spring housing market kicked in during March with solid double-digit increases in new listings across the seven-county Denver metro area and state with a highly active buyer market, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state. The combination of factors drove up the volume of pending/under contract listings, drove down the average days on market as well as the inventory of active listings, and drove up median pricing.

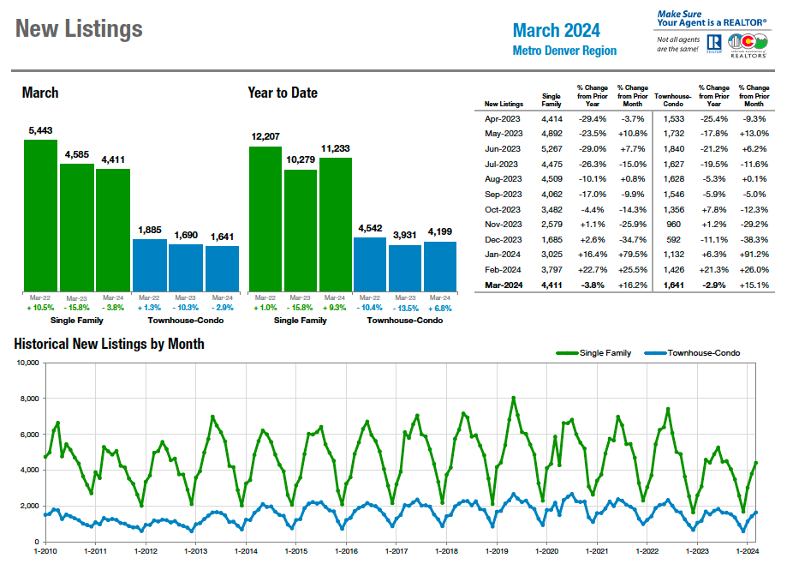

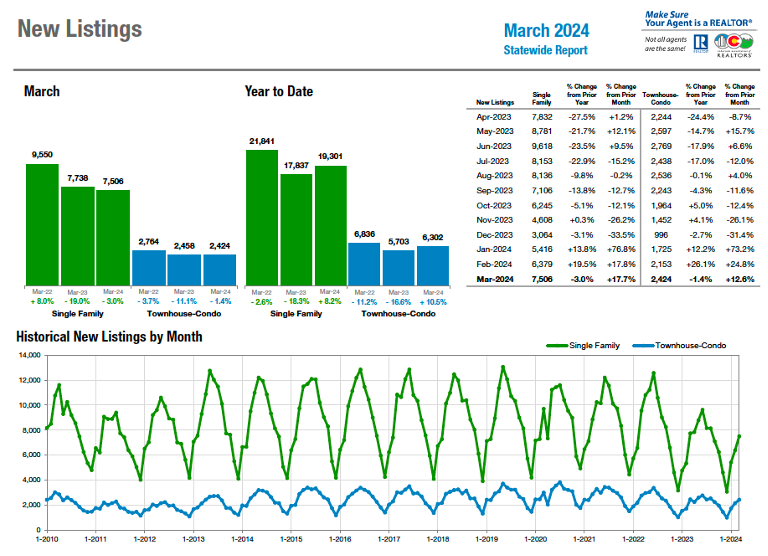

The month of March delivered 4,411 new single-family listings in the seven-county Denver metro area, more than 16% jump from February, but down 3.8% from a year ago. Townhome/condo new listings shared a similar 15% increase from a month prior but is down 2.9% year over year. Statewide, the 7,506 new single-family listings signaled a 17.7% increase from March but are down 3% from a year ago. The 2,424 new townhome/condo listings in March represented a 12.6% month over month increase but a 1.4% dip from a year ago.

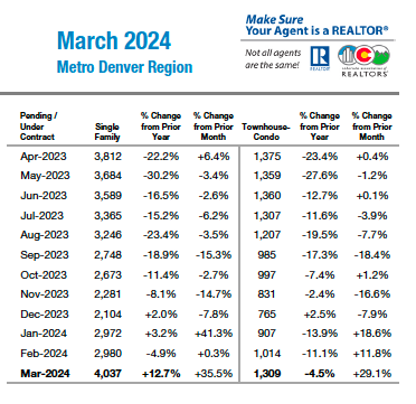

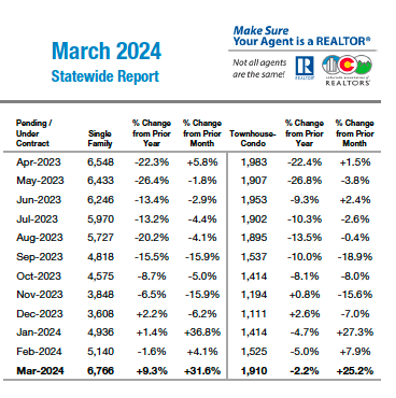

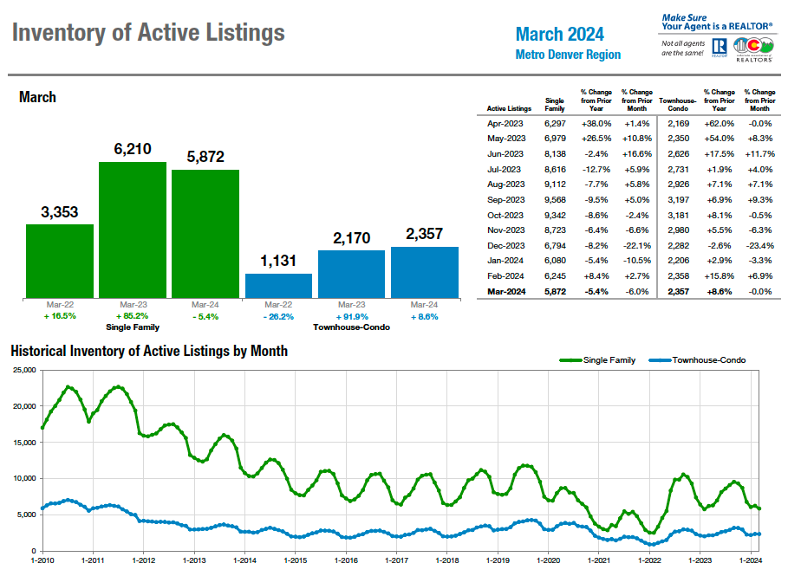

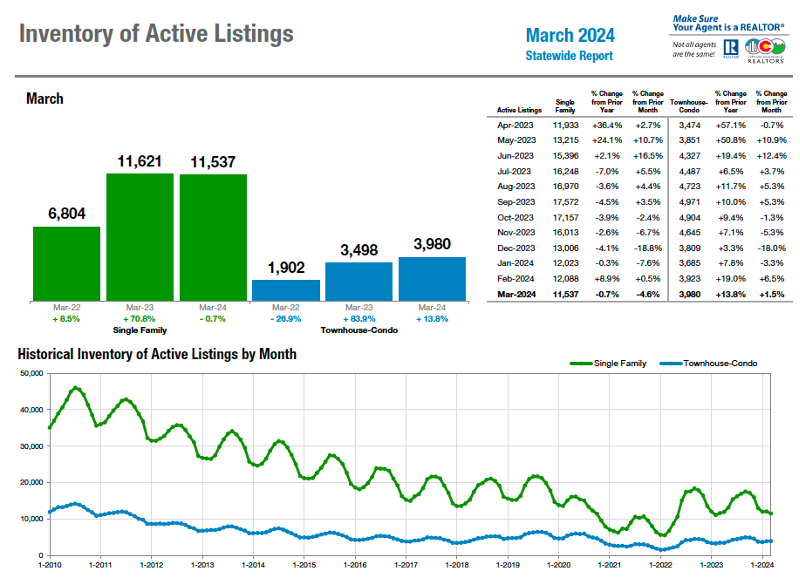

Pending/under contract listings rose 35.5% for single-family homes in the seven-county Denver area while townhome/condos rose more than 29% from February to March, respectively. Statewide, single-family rose 31.6% with townhome/condos up more than 25% month over month. As a result, the inventory of active listings in the Denver area fell 6% for single-family and remained flat for townhome/condos from February to March. Statewide, single-family active listings fell 4.6% with townhome/condos up 1.5%, month over month.

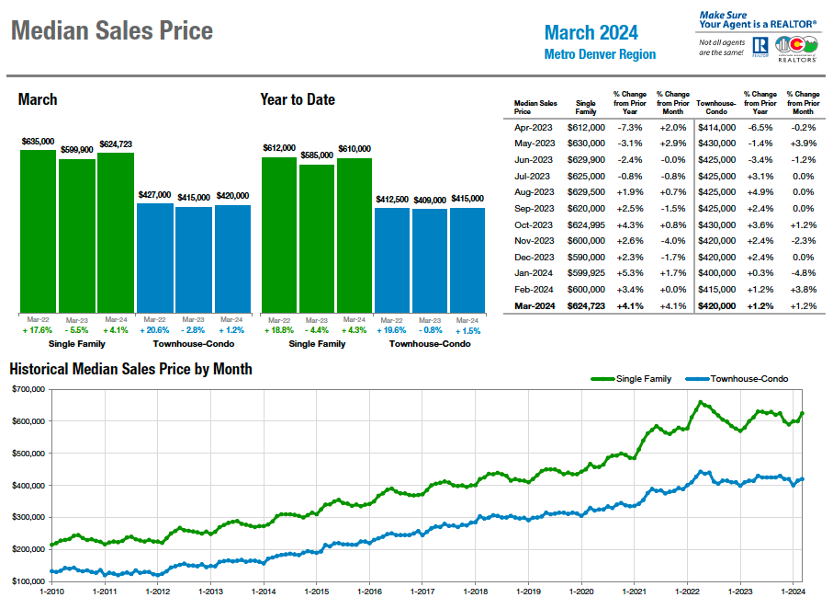

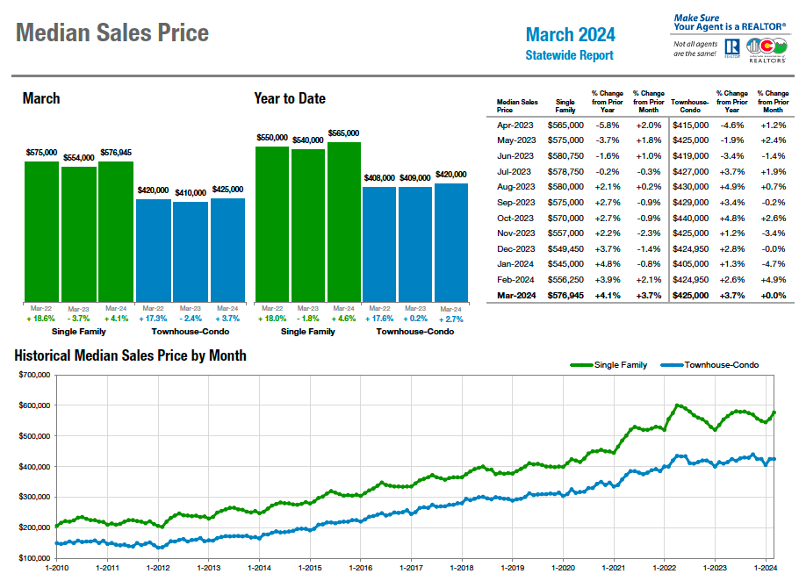

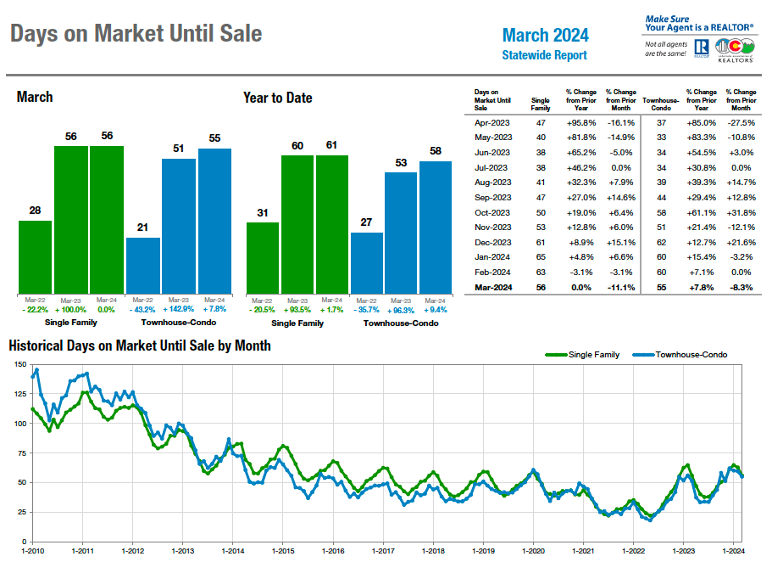

The active buyer market also contributed to drops in the average days on market for single-family homes, falling from 52 to 44 days in the Denver market and falling from 63 to 56 days statewide. It also helped push the median pricing for single-family homes in the Denver area up 4.1% month over month and year over year to $624,723. Statewide, the median price for single-family homes rose 3.7% month over month and is up 4.1% year over year at $576,945. The townhome/condo market saw median pricing rise 1.2% from February to March and year over year to $420,000 while statewide, the median price stayed from month over month but is up 3.7% from a year ago at $425,000.

New Listings – Metro Denver

New Listings – Statewide

Pending/Under Contract – Metro Denver

Pending/Under Contract – Statewide

Seven County Denver area Single-Family Market Overview:

Statewide Market Overview

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“We have entered the spring buying and selling frenzy. Well priced homes in good condition are being quickly purchased and usually with multiple offers. We still have an inventory shortage. The best recommendation is to buy now, as the probability of the interest rates being lowered seem to be slim. With the low inventory, home prices continue to rise, perhaps not as much as we saw two years ago, but enough that being a homeowner is still proving to be a sound investment.

“March brought increased inventory in most Adams and Arapahoe County zip codes and pricing rose 2% to 8% based on location. Sold properties were down 10% to 28% with 80019, bordering the airport, as the only zip code delivering an increase. Taking a closer look, 80010 saw inventory fall 24% and sold properties were up 3% with a median price of $411,000. In the 80013 (central Aurora), we saw an increase in inventory with 84 listings available and a median price of $506,800.

“Looking to the 80015 zip code (south Aurora), there was an inventory increase with 82 listings available and a median price of $579,900. The Englewood/Greenwood Village 80111 zip code has the highest median pricing on the southeast side at $1.16 million.

“Overall, pricing is up over 2023, inventory is up slightly, and the number of sold properties is down. Buyers have the opportunity for more inventory choices and sellers are clearly hanging on to their low interest rates,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The spring market doesn’t disappoint. With more inventory to choose from, prices are correcting, and buyers finally have some options.

“In Boulder County, we have 23% more listings on the market, but buyers are snatching them up as soon as they become available. Still, the prices are down 5.9% as sellers who need to move recognize the need for aggressive pricing. Because the interest rates haven’t moved as planned, sellers are having to be more assertive with their pricing and concessions offered in order to sell their home. There are more townhomes and condos on the market, too. We are up 18% and the prices are also down about 5%. There are some deals to be had for buyers who have decided to accept the current rates and move forward with a purchase.

“There are a handful more listings to choose from in Broomfield and for the first time in a long time, prices are down there, too. The more affordable homes are moving, and the pricier ones are having to adjust their list price in order to attract their buyer. Days on market still hovers around 50 days for both attached units and single-family homes. The big spike in new listings for townhomes is due to a few brand-new construction projects that just hit the market.

“Buyers seem to have acclimated to the new norm in terms of interest rates, and sellers are recognizing that their home prices have not appreciated in the last year and they need to be aggressive in order to sell. All in all, a good time to be a buyer in this spring market,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“The spring rush is off to a slow start as we look at March numbers. We begin with no change in values up or down across all property types median pricing. Sellers have started to come to the market though with a 13.4% increase in active listings year over year. Despite that inventory hitting, we are down almost 14% on all properties sold. A staggering amount, which places us around 2014 levels. Once again, I beg the question, have we mislabeled a housing recession as being based only on values?

“Our market is heavily affected by interest rates. A few weeks ago, when rates pulled back, we saw a good amount of business stir up. The phones began to ring, offers started to come back in, and there was a buzz and excitement among local agents. Until rates spiked, then the reverse happened. Showings and offer slowed, and agents’ tone changed. The only ones working around this seem to be new home builders. They are buying down rates which is helping move some inventory. Nationally, however, builders have cut prices at the fastest rate in 40 years. Even faster than the 2008 recession period. The median price point is down nearly 20% from the peak of the housing bubble as reported by Reventure Consulting. That drop does not include rate buydowns which can run an additional $30,000 – $40,000.

“Mortgage demand stalled in March despite the pullback. Applications to refinance were 9% lower than in the same week one year earlier and home purchase applications were down 16% year over year. The bond market continues to stay elevated, and the Federal Reserve has moved its stance from six potential rate cuts in 2024, to three. Higher forever, may be the new outlook. This would mean very little help is coming to the consumer and would continue to stall out the housing market.

“Sellers can expect longer days on market and lower buyer demand if the numbers going into April remain the same. Buyers, we know you are tapped out. Rates have consumer savings at lows not seen in many years. Credit card and other debts continue to rise, and we have not begun to see the damage to the banking system that the commercial real estate world could be. If gold is the indicator of what is going on, then this year looks like more of a bumpy ride than smooth cruising. Gold has continued to hit all-time highs weekly. A hedge against rough times, and a go-to for those looking for stability in unstable times. Let’s see how April goes, but if we don’t see an uptick in sales, I am afraid the 2024 selling season is going to be very challenging,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The number of single-family/patio homes for sale in the Colorado Springs area in March 2024 was 1,868, representing a 26.2% year-over-year increase and the highest level of inventory in March since 2017. Overall months’ supply of active listings was at 2 months, for homes priced under $400,000 at 1.7 months, homes between 400,000 and $600,000 at 1.5 months, homes priced between $600,000 and $1 million at 2.6 months, and 7.6 months for homes priced over $1 million.

“There were 941 sales of single-family/patio homes in March 2024, compared to 792 last month and 1,075 in March last year, representing an increase of 18.6% month-over-month and a 12.5% decrease year-over-year. The monthly and year-to-date sales volumes were at the highest level in March except in March 2021, 2022, and 2023. The 56 averagedays on the marketcompared to 53 days last month and 48 days in March last year. Last month, 38.8% of the El Paso County active listings in the Pikes Peak MLS had price reductions compared to 28.4% in the previous month.

“Last month, the average sales price was $527,629 compared to $511,272 in the previous month and $523,972 in March last year, representing an increase of 3.2% month-over-month and 0.7% year-over-year. The median sales price was $470,000 compared to $455,950 in the previous month and 460,000 in March last year, representing an increase of 3.1% month-over-month and 2.2% year-over-year.

“From an analysis of the single-family/patio homes sold by price range, last month, 26.2% of the homes sold were priced under $400,000, 49.1% between $400,000 and $600,000, 21.4% between $600,000 and $1 million, and 3.3% over $1 million. Year-over-year in Mar 2024, there was a 13.4% drop in the sale of single-family homes priced under $400,000, a 7%decline in homes priced between $400,000 and $600,000, an 18.9% increase in homes priced between $600,000 and $1 million, and a 31.1% drop in homes priced over $1 million.

“Unfortunately,inconceivable affordability challenges due to a staggering combination of high-interest rates, record-high home prices, and inflated cost of living remain the most daunting barriers for Colorado Springs-area homebuyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“The statistics for the first quarter of 2024 are mostly up from 2023. We have 35% more properties for sale then we did at this time last year and buyers have come back to the market, even as average prices continue to rise. It is also evident that high-wealth individuals find the Crested Butte/Gunnison area intriguing given that the overall number of transactions are up just 6%, but dollar volume is up 87%. The Gunnison Crested Butte Association of REALTORS® had 89 transactions with just over $64 million in sales in 2023 vs. 2024 with 95 transactions at just over $120 million. This is well off the 264 transactions that happened in first quarter 2021 with a dollar volume of just over $191 million.

“The Crested Butte area almost doubled the dollar volume from 2023 ($37 million+) to $70 million plus in 2024 with just 12 more transactions (49 vs. 37). Gunnison has always been the more affordable area, but prices there have increased along with the rest of the area. The number of sales in the first quarter actually fell from 43 to 29 this year, but the dollar volume was slightly up from $23.5 million to $24.2 million.

“The numbers included here give you the big picture, but it is important to drill down to your area, property type, subdivision, or condominium complex to see what happened with properties similar to what you are looking to buy or sell – the trends are not all the same. Prices are up significantly for single-family homes, but that could be that we have newer, larger homes coming on the market and selling and not necessarily that all homes can sell for more than they did last year. The condo and townhome market has a lot more properties coming up for sale than homes and prices are not going up as much for this type of residence as a result.

“We anticipate more listings coming on the market for the summer selling season which is great news for buyers. With interest rates staying put and prices holding steady or going up, now is a great time to talk with a professional about how you can achieve your goals,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Strong competition and rising inventory are yet to deter buyers in the Denver market, even as interest rates show little signs of retreating. Median close prices in the single-family segment rose nearly $25,000 to $699,750 last month, nearing 2023 highs. The pace of new listings on the market has begun to flatten, up just 6.7% month-over-month, while the number of listings that sold during the same period spiked 14.5% since February. Homes spent significantly less time on the market in March than in February, with the median days on market falling 59% from 22 days to just 9 days.

“The monthly supply of homes for sale within Denver has climbed more than 15% since the beginning of the year to 2.2 months, but it doesn’t seem the market has shifted in favor of buyers quite yet. The average percentage of list price received, a metric used to measure by how much listings close for compared to ask price, rose last month to nearly 100%, its highest level since last summer. This indicates that sellers continue to maintain robust negotiating power in transactions, and buyers are still financially strong, spending more money on homes as prices and interest rates remain elevated.

“While the real estate market nationally awaits a change in Fed policy to help ease interest rates, the Denver market’s persistence is a testament to its strength and the consumer’s desire to live and own a home in Denver. Despite recent years introducing higher property taxes, higher mortgage rates, higher home prices, and higher maintenance costs, Denver’s compelling attractiveness and high quality of life wards off struggles in the broader real estate market,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“March winds brought a gust of higher prices in Douglas County, as median close prices spiked 4.1% last month to $692,500, after a rather disappointing February. We also observed a drastic drop in time on market, with a nearly 50% reduction from 29 days in February to 15 days in March. Inventory has remained relatively stable since the turn of the new year, holding at around 1.8 months or approximately 800-900 active listings on the market.

While a surprising sense of stability marked the first quarter, the market remains slower than in the past few years. Typical total sales volume in March has averaged $513 million since 2021, with last month lagging moderately behind at $445 million. Modest prices compared to 2022 and lower transaction counts compared to 2021 make for a slower, yet healthy change of pace.

“The national economy remains robust, and inflation is yet to reach the Fed’s ideal pace, indicating we may see persistent elevated interest rates in the summer ahead. However, little has deterred buyers from remaining active in the Douglas County market. Showings have nearly doubled since December, and buyers are making quicker decisions to secure their perfect home once they find it,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“It was a sluggish start for home sales in La Plata County for the first quarter. Closed sales were down 12%, and pending sales were down 10%. Days on market rose 31%. Inventory has begun to improve month over month, with 59 new single-family units coming to market in March, a 45% increase over last year. The additional inventory doesn’t seem to be having much of an effect on prices, which continue to climb. The median home price YTD for La Plata County is up 17.4% to $689,500. In-town Durango home prices rose 3.7% to $777,500. The biggest shift in the local housing market has been in the condo sector, particularly in the resort area. Inventory levels rose almost 165% for March compared to the same time last year, with the monthly supply increasing from just under two months to nearly six. The primary driver for this increase has been the skyrocketing cost of insurance. Some communities have had their coverage canceled or not renewed, with several national carriers pulling out of the market. Premiums have gone up more than ten-fold in some cases, forcing some HOAs to more than double their monthly fees. This, combined with diminishing rental revenues, has prompted some investors to liquidate their assets. We are beginning to see prices soften in that sector.

“The challenges with obtaining insurance in La Plata County, particularly in rural subdivisions, are indeed concerning, especially considering the looming threat of the upcoming wildfire season. Insurance companies may become more cautious and selective in providing coverage to properties located in high-risk wildfire zones. This could further exacerbate the challenges faced by homeowners in rural subdivisions. The difficulty in obtaining insurance not only affects individual homeowners but also has broader implications for the community as a whole. Without adequate insurance coverage, homeowners may risk financial losses in the event of a disaster, which could have a ripple effect on the local housing market and economy. Finding sustainable solutions to address the insurance challenges will be crucial. This may involve working with insurance providers, local authorities, and community stakeholders to mitigate risks, improve resilience, and explore alternative insurance options,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“Compared to March 2023, the March 2024 numbers in Estes Park don’t quite reveal the feeling of optimism in the air, the year-to-date stats show a bit more vivacious picture.

“New listings for single-family homes are up 8.9% over last year. Month to date still seeing negative numbers at a dip of 5.8% from this time last March. Townhome/condos are not listing as fast, but year to date, much better than this time last year. March 2023 there has been a drop of 27.1%, and compared to March last year, down 2.8%, which isn’t altogether bad. Average sales price continues to increase for both townhome/condos and single family homes. Single family homes are up 8.2% from March 2023, and townhome/condos are also up 4.5%. Year to date both categories increased over 2023. single family homes up 2.9%, and townhome/condos up 2%.

While listings and average prices are up, the length of time for the property to close has lengthened notably for single family homes, but not for townhome/condos. Days on the market until sale has increased by 6.3%, to 68 on average for single family homes compared to March 2023. Year to date, the length has increased 2.9% to 71, compared to 69 days. That’s much different than the 30ish days being seen prior. Townhomes/condos have gone the opposite way, shortening the time on the market to 85 days from 105 in March 2023. Year to date, the length has dipped dramatically at only 86 days from 122, a 29.5% reduction in days on the market.

“The change in season should bring more activity. It will be interesting to see if the gap between townhomes/condos and single-family homes gets narrower, or if we are seeing a new trend,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“Are the current sales statistics lagging indicators or leading indicators? As many in the real estate industry understand, spring is the prime time for homes to come on the market. This spring is shaping up to match that seasonality expectation. For the whole month of March, there were a total of 182 new listings of single-family homes (lagging indicator). For the first seven days of April, there are 78 (compared to just 43 in the first 7 days of March). This statistic could be a leading indicator as the spring is shaping up to be a very busy time with more inventory for buyers to choose from.

“Further, when looking at the sales data for March and the number of sales that included a seller concession is still nearly half (48%) with concessions ranging anywhere from as much as 6% of the purchase price. When compared against the average list price to sales price which shows a robust 99% – if you subtract the seller concession, it leaves nearly half the sales showing that sellers have become somewhat expectant of providing some sort of concession to help buyers reduce their lending costs to get a deal done. The number of concessions is down from a high of 60% of transactions in January (lagging indicator) so clearly, there are more buyers submitting offers that are not asking for concessions which indicates demand remains quite brisk and competitive offers not uncommon.

“Interest rates aren’t likely going to stabilize below 6.5% any time soon with the most recent jobs data and inflation pressures still uncomfortably high for the Federal Reserve’s target of 2% – so buyers getting into the market now have either been relegated to use their increased wage gains to pay for a higher interest rate or are negotiating a seller concession to temporarily reduce a high interest rate. Either way, the pent-up demand for housing remains frothy and we are likely to see a brisk spring selling season,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“March new listings, down 23.1% from March 2023, did not see the expected increase that we would have liked. Our total inventory is higher than at this time last year which shows a slight slowing of properties making it to the closing table. Actual sold residential properties are down 10.8% over this time last year. Our affordable, $323,800 median sales price is down 6.8% while the average sales price of $346,873 is 8.5% lower than last year.

“Are buyers sitting on the fence waiting for interest rates to take another slight dip, or is the lack of newer inventory causing buyers to take a longer look at the market? Perhaps the answer is yes to both. Average days on market, year-over-year is down 3.3% indicating that the right priced homes are selling just a bit quicker as buyers sit that fence. When we stand our Fremont County median price home up to the statewide median price home, that is where the smart buyer says, ‘Hmm.’ Then when that buyer does the math and determines that they can buy 1.7 times the home in the Fremont County market than in the rest of the state they say, ‘Ah Ha,’” said Fremont County-area REALTOR® David Madone.

GLENWOOD SPRINGS

“Spring has been taking its sweet time getting to the Roaring Fork Valley this year, and it seems like the real estate market is feeling it too. Usually, this time of year is buzzing with activity, but it’s been a bit of a slow start.

“New listings for single-family homes are down 11.8% over last March. But interestingly, listings for townhomes and condos have gone up by the same amount. It seems like buyers who’ve been patiently waiting have jumped at the chance to grab these new listings. This has led to a pretty impressive increase in pending sales – 46.9% for homes and 18.8% for multi-family properties.

“As a result of the low inventory, the median sales price has gone up once again. It’s increased by 10% to $660,000 for single-family homes and a whopping 21.7% for multi-family units for a median price of $504,750. By the end of March, there were 126 single-family homes and just 28 multi-family units left to sell. Carbondale alone experienced a 45% increase with 10 sold listings bringing the median sold price for a single-family home to $2.76 million. The townhome/condo market doubled in price from last year with two sales and a median price of $1.34 million,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“Mesa County continues to deliver mixed results. Historically, spring has been one of the busiest seasons, but not so far this year. While new listings are up, not only March 2024 compared to March 2023, but also year to date, solds are down significantly for those same periods. March 2024 sales are down 23.4% compared to March 2023, and are down 11.2% year to date. Despite the low number of sales, prices continue to rise. Despite increases in new listings, both median and average prices are up, 3.9% and 3%, respectively, thanks to additional competition. Active listings were down 5.6% at 554. Historically, active listings were at a high the first part of 2016, at over 2,700, and have continued downward since then. Mesa County has a long way to go,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“We’re three months into the year and the Pueblo real estate market is not showing any signs of significant improvement. New listings were down 10.8% month over month and down 5.2% over last March, and our total inventory dropped 3.5% to just 602 properties. Pending sales are down 9.5% from March 2023 and are -11.3% year to date. Sold listings in March 2024 were off 6.6% and are -12.5% year to date. The median sales price fell 4.7% in March and is down 1.3% year to date to $311,000 as sellers continue to offer price reductions to help get their properties sold.

“The two positive numbers in March were the percent-of-list-price received which improved 0.4% to 98.6%, and average days on market which dropped to 90 in March. We sit at three months’ supply of homes to sell with few buyers as higher interest rates continue to be a holdup for many potential buyers.

“Builders continue to move slowly with just 14 new housing permits in March,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“The San Luis Valley overall seems to be warming up with the Spring weather.

“New listings in Alamosa County were down 9.1% from last year, but for 2023 overall, new listings were up 20% from 2023 to 2024. Median sales price has grown 23% from $260,000 to $319,750.

“Conejos County had no change in new listings and sold listings from March 2023 to March 2024. The median sales price fell slightly from $159,000 to $146,500, only 7.9%.

“Costilla County had a 77.8% increase of new listings on the market from last March to this March. Sold listings were down 50% and the median sales price also fell slightly from $191,000 to $167,500.

“Mineral County had 50% less new listings than they did last year, and other than that the median sales price remained the same at $310,000.

“Rio Grande County had a drop of 15.4% of new listings on the market and 22.2% of a drop of just sold. However, the median sales price shot up 36.5% from $249,000 to $340,000.

“Saguache County is up 20% for new listings from last March, and down 50% for solds. The median sales price also fell slightly at 8.8% from 381,500 to $348,000,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“The first quarter had some similarities to that of one year ago, as well as some significant discrepancies, for single-family homes across the Yampa Valley. New listings and pending sales were basically the same, with the percentage of list-price received slightly higher at 96.2%. With seven sales, the median price for the month of March was 19.1% less at $910,000 and the average sales price 9.4% lower at $1.34 million. Even with the price decrease over the same period last year, the median sales price for the quarter ended up 37.8% and average sales price was up 42%. Days on market dropped almost 52% keeping the months’ supply below three months.

“In contrast, multi-family results for the first quarter had virtually no similarities to 2023. Pending sales in March were down 40.9% ending the quarter at -25%; sold listings were -61.5% and -40.5%, respectively. New and active listings were also lower than March 2023. Year-to-date, there have been 44 closings with the median price at $907,500 and average sales price at $1.29 millions, a 10.4% and 44.3% increase, respectively. Sellers received an average of 97.7% of their list price. Days on market dropped 17% to 39 days and months’ supply remains at less than two months.

“Insurance costs are adding to the factoring of affordability. Policygenius reports increases over the last year of 68% in Florida, 47% in New Mexico, 46% in Colorado/Texas/Idaho. Only three states saw no average increase. Multi-family developments that have wood-burning fireplaces or are older may have incurred a higher rate increase than newer ones that have fire suppression systems,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“In the scenic Summit, Park and Lake counties, the real estate market continues to face a shortage of available properties, driving prices upwards. Despite an increase in new listings and a dip in sales, inventory remains low, exerting upward pressure on prices. Prices, although significantly up when looking at the same month last year, continue to fluctuate month to month.

“In March, single-family properties in Summit and Park counties saw a substantial 57% increase in average sale prices compared to the same period last year. Year-to-date, prices have risen 20%, though they dropped about 7% compared to the previous month. Multi-family properties tell a similar story, with a 35% increase in prices from last March and an 18% rise year-to-date. Prices are up 5% from the previous month.

Average prices for March 2023 and March 2024 in these counties:

Summit County: 2023 2024

- Single Family $1,489,040 $2,323,150

- Multi-Family $ 707,134 $ 842,307

Park County:

- Single Family $ 584,826 $ 559,679

Lake County:

- Single Family $ 485,000 $ 747,500

“Out of the 425 active residential listings in Summit, Park and Lake counties, the least expensive property is a single-family home in Park County for $195,000 and the most expensive is a single-family home in Breckenridge for $19.49 million (on the market for 1,311 days). Out of the 101 sales in March, the lowest was a condo in Summit County for $282,000 and the highest was a single-family home in Breckenridge for $4.4 million. Forty-seven percent had a sales price over $1 million and 40% of sales were cash. These numbers exclude deed-restricted affordable housing, land, and commercial,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The Telluride regional market (San Miguel County) concluded the first quarter of 2024 with a total dollar volume of $245.67 million and 104 transactions. This marks a notable 46% increase in total dollar volume as compared to the same period in 2023, along with a 16% increase in the number of sales. The total dollar volume for first quarter 2024 ranks as the third highest of all time. This volume was propelled by six home sales in Telluride for a total of $33.65 million and six home sales in the Mountain Village for a total of $55.45 million.

“Sellers continue to control the market, setting a new average sales price of $2.36 million for all property types. There were two lot sales outside of both Telluride and the Mountain Village, lot L6 in the Idarado subdivision for $12.83 million and Lot 5 in Elk Creek Meadows Ranch for $10.4 million. The total amount of sales outside of the towns of Telluride and Mountain Village, were up 174% as compared to the first quarter of 2023. After 40-plus years as a real estate broker in the Telluride region I am amazed. Lastly, there are currently two homes in the Mountain Village under contract, both over $20 million,” said Telluride-area REALTOR® George Harvey.

VAIL

“March arrived like the proverbial lion from the standpoint of snow and real estate activity. Closed sales for the month were positive 43.1% in units and plus 29% in dollars. The dollar amount not keeping pace with the units was due to smaller percentage of sales in the top price niches than in 2023. The trend on market shares for the first quarter year to date is similar in unit sales, positive 53.9% and dollars plus 34%. Overall, it has been a good start to the year and activity seems to be holding its own as we enter the spring season.

“Pending sales for the month are 21.6% ahead of 2023 and year to date the pending performance is plus 23.1%. The strength of the market is interesting as inventory is one unit higher than at this time in 2023. Thus, product has been coming on the market however, demand has not allowed the inventory to increase as we were expecting. We are still under inventoried in certain price points as we enter the shoulder season for the market. Our current 3.9 months of supply is 8% better than 2023, but still below the target of six months for a stable market. Hopefully, we will see product coming on the market over the next couple of months to increase inventory in anticipation of the summer selling season,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA – Median Sales Price

STATEWIDE – Median Sales Price

SEVEN-COUNTY DENVER METRO AREA – Inventory of Active Listings

STATEWIDE – Inventory of Active Listings

SEVEN-COUNTY DENVER METRO AREA – Days on Market Until Sale

STATEWIDE – Days on Market Until Sale

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The March 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.