New Listings Outpace Sales in Most Markets

Local markets experiencing varying degrees of increases in inventory paired with a slowed spring market; entry-level buyers unequivocally priced out due to compounding affordability challenges

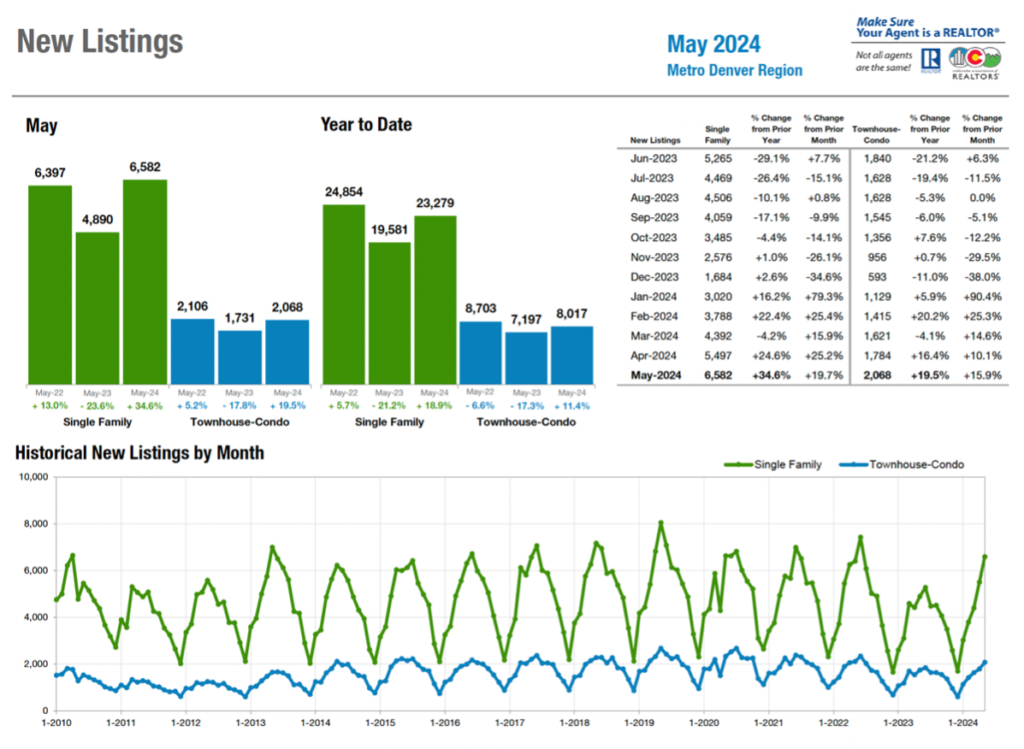

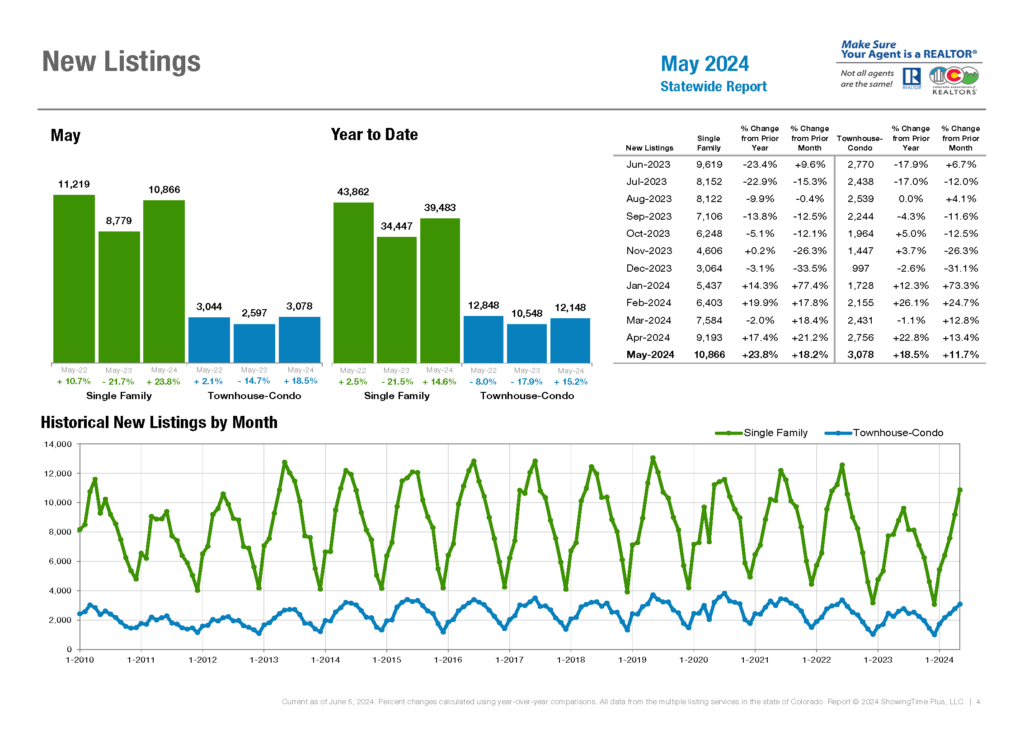

ENGLEWOOD, CO – The continued increase in new listings across all property types is creating a more balanced market across Colorado with May’s new listing gains in the seven-county Denver-metro area reaching 34.6% over May of last year, and statewide new listings rising 23.8% over the same period. This increase in listings has resulted in a 29.1% growth in the inventory of active listings in the metro area and a 24.3% increase statewide according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado.

Despite rising inventory resulting a more traditionally balanced market, REALTORS® are reporting a slow spring selling season in most markets, as most buyers seem more than willing to wait until interest rates improve. “A lackluster spring market leaves REALTORS® wondering if the 2024 market will continue to just limp along. With interest rates remaining high and the uncertainty of the upcoming election, many buyers seem to be waiting this one out,” said Boulder-area REALTOR® Kelly Moye.

Despite slower than expected sales, median prices for single-family properties continues their upward trajectory, showing an increase of 0.8% in the seven-county metro area, with a 4.1% increase statewide compared to one year ago. However, condos/townhomes are seeing a retraction, with median pricing falling 2.4% statewide and -3.5% in the Denver-metro area.

“A year ago, agents would argue that we need more inventory and buyers would come back to the market. We are not seeing that play out and once again, the truth is the cost of housing is too high – at least in the median price points,” said Colorado Springs-area REALTOR® Patrick Muldoon.

Compounding affordability challenges are keeping the entry-level segment out of the market entirely. The continued and seemingly unsustainable rising of median prices has resulted in affordability hitting near record lows, with the CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – down 4.4% in the metro area and -6.1% statewide.

“Since 2018, Colorado homeowners have endured a more than 57% increase in insurance premiums, compounding affordability challenges in the entry-level segment. The combination of recent property tax hikes, elevated prices, surging HOA dues, rising insurance costs, and inflation has curtailed activity in lower price ranges. Denver listings priced below $350,000 represented just 13.4% of overall closings in May and comprise around 15% of the current inventory for sale. If all goes well, inflation rates will continue to decelerate, and entry-level housing can become more attainable for new homebuyers,” said Denver-area REALTOR® Cooper Thayer.

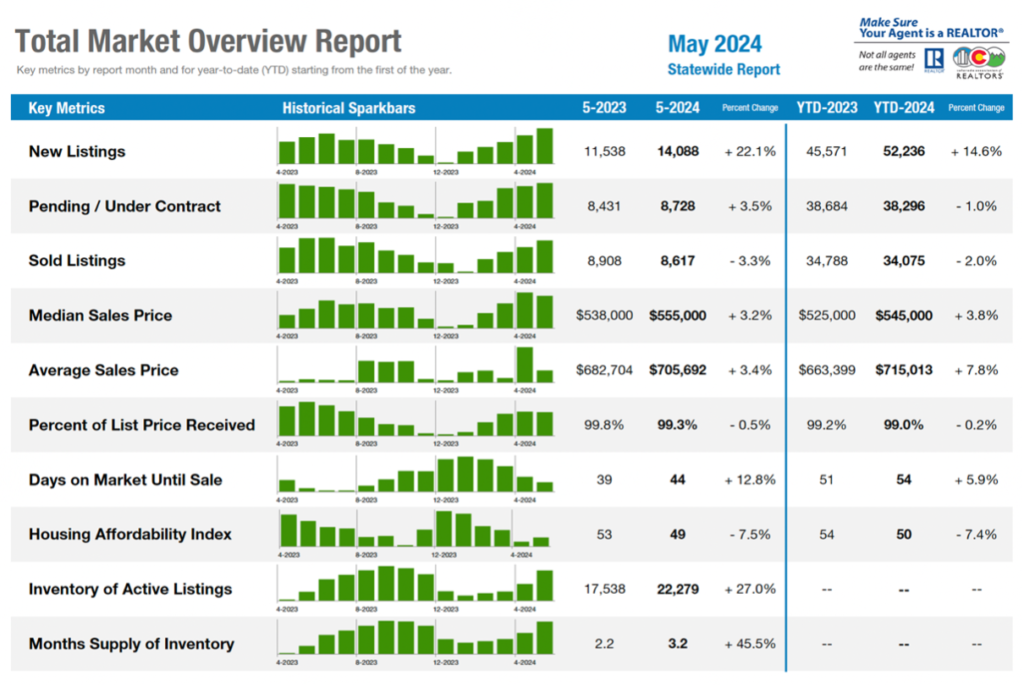

Seven County Denver area Total Market Overview (single family and condo/townhome):

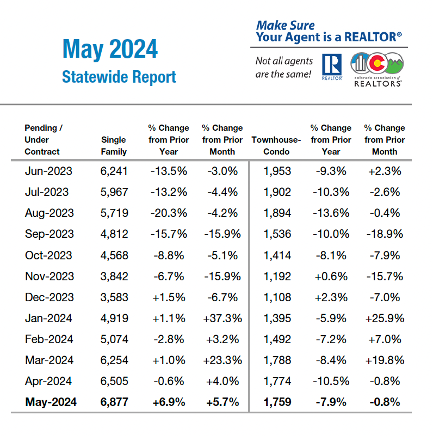

Statewide Market Overview

New Listings – Metro Denver

New Listings – Statewide

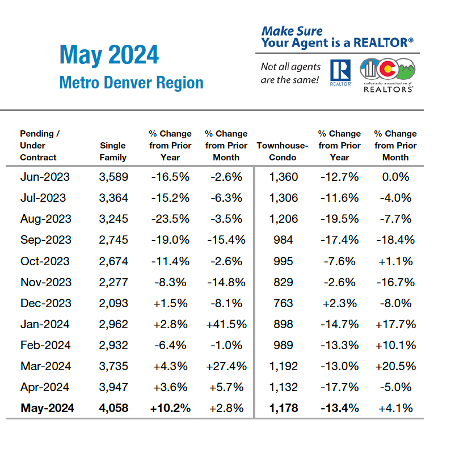

Pending/Under Contract – Metro Denver

Pending/Under Contract – Statewide

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA/CENTENNIAL

“Good news is on the horizon for buyers. Sadly, we cannot report interest rate reductions however, we can report an increase in the housing inventory for sale.

“Prices are fairly flat compared to over one year ago with little to no price increase in the Aurora, Centennial, Adams, and Arapahoe County areas. The other good news for buyers is the increase in days on the market. This gives buyers a chance to breathe before scrambling to make an offer on most homes. The spring market has been somewhat lackluster due to the higher interest rates. The reports and indications are that there will not be an interest drop until maybe fall, if then. I cannot recommend buyers hold off for a later day. It is absolutely possible to find a single-family home in the $450,000 price range in Aurora. If a home is in good shape, it is very probable that there will be multiple offers. The overall median price in Aurora is $540,000, and location determines how far off that median price buyers are paying. Centennial is boasting a median price of $710,000, which is about 3% lower than last year.

“There are opportunities for buyers. It is a possibility that the seller may help buy down the interest rate if the lender will allow,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“A lackluster spring market leaves REALTORS® wondering if the 2024 market will continue to just limp along. With interest rates remaining high and the uncertainty of the upcoming election, many buyers seem to be waiting this one out. The more sophisticated buyer recognizes the opportunity here with highly motivated sellers and loan programs available to get lower rates with seller-paid concessions. Some are jumping on the opportunity, but many are not, causing a fairly slow and atypical spring market.

“In Boulder County, new listings continue to come to market and while the number of sold listings is up by 31%, prices continue to stay under last year’s number by about 2%. Sellers whose homes are priced right are seeing about 98% sales price to list price and average days on the market remains and fairly reasonable 56 days. Townhomes and condos also continue to hit market with 24% more listings than this time last year but unlike single family homes, buyers are not grabbing those as quickly. Prices have held about even from last year, but they are taking closer to 72 days to sell.

“Broomfield County is also experiencing a somewhat dreary market with prices down 3% and sales not keeping up with new listings coming on the market. However, the homes that do sell are selling at a better clip with average days on market around 36 days. The bright light for buyers in this area is with new townhomes and condos. There are 68% more listings of this type of property on the market now due to several new construction projects. Buyers have plentiful options in this area of the market,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“We exit another month with numbers that do not tell the entire story. But I am going to fill in the gap, and I think it is going to lay out a different story – one that is not being told. We should be discussing it because I believe it’s beginning to show signs of a rollover on housing. First, we will discuss the statistics in the Pikes Peak region that will begin our story of change. Once again, we were down year over year on sold properties by 7.6%. The shocker for May was seeing an increase of almost 40% in active listings year over year, but then also seeing a 3.3% increase in prices. You may ask yourself; how do prices remain higher when inventory and sold properties continue to drop? I may have the answer. And for buyers in the sidelines, we may be seeing a roll over in housing.

“A year ago, agents would argue that we need more inventory and buyers would come back to the market. We are not seeing that play out and once again, the truth is the cost of housing is too high – at least in the median price points. My good friend and fellow REALTOR® ran some statistics for me to share with you that will show why home prices do not appear to be falling. In May of 2023 in the $500k and under category, we had 56 homes withdrawn/cancelled (pulled from market). In May of 2024, that number rocketed up to 105. From $501k-900k the May 2023 numbers showed 23 withdrawn, and then 82 for 2024. The surprising statistic is from $901,000-plus; we had 21 in May of 2023 but in May of 2024 that dropped to 15. We are witnessing an increase of properties below $500,000 that cannot sell, and yet the higher end is selling with a drop in withdrawn/cancelled properties year over year. This shows we are grading housing values on a bell curve. It should be noted that we are witnessing this firsthand with our property management department. Many homes we are signing up to become rentals had previously attempted to sell but were not successful due to being upside down on values. The Gazette Telegraph, our local paper, reported that apartment rents were on the decline. Between an increase in rentals coming on the market because they could not sell, and apartment rents dropping, we are seeing a softening in the rental market that we have not seen in the last 10 years.

“The Kobeissi Letter on X reported that 6.4% of home sellers cut their asking price in the last 4 weeks. This is the most in 18 months and the second highest since 2021. In June 2023, it was 4.4% and in 2022 only 3.9%. U.S. pending home sales have declined to their lowest level since 2020. Are home prices really increasing, or are we just selling the higher end homes while the median-priced homes are not selling and not being counted? Locally, it appears the latter is the case. It should be noted we are at the two-year mark for interest rate hikes. After two years of higher rates is when the economy usually begins to show signs of struggle. We are beginning to hear about this as retailers like Target and Kohls continue to warn that consumers are struggling. FDIC has openly admitted they are tracking over 60 banks with liquidity issues. And the government continues to revise past data that was once positive, to data that is now negative – anything from job numbers to GDP. Cities that start to see a heavy increase in inventory begin to see values pushing down. Everyone is still waiting for the Federal Reserve to pivot. Remember, a Federal Reserve pivot is actually a sign of bad times coming. Strong economies don’t need low rates, weak ones do,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The number of single-family/patio homes for sale in the Colorado Springs area in May 2024 was 2,645, representing a 23.7% increase month-over-month and a whopping 51.1% year-over-year. It was the highest inventory level in May since 2016. Overall, months supply of active listings was 2.3 months. For homes priced under $400,000, it was 1.8 months, and homes between 400,000 and $600,000, it was 2 months. Homes priced between $600,000 and $1 million came in at 2.7 months, and for homes priced over $1 million, 5.6 months supply.

“There were 1,142 sales of single-family/patio homes in May compared to 959 in the previous month and 1,243 in May 2023, representing an increase of 19.1% month-over-month and 8.1% increase year-over-year. Monthly and year-to-date sales volume was down 4.6% and 6.2%, respectively compared to last year. However, looking back 10 years to May 2014, the monthly and year-to-date sales volumes are up 132.6% and 151.7%, respectively. The 36 average days on market compared to 40 days last month and 31 days in May last year. Last month, 43% of the El Paso County active listings in the Pikes Peak MLS had price reductions.

“Last month, the average sales price was $557,050 compared to $564,715 in the previous month and $536,478 in May 2023, representing a 1.4% decrease month-over-month and a 3.8% increase year-over-year. The $499,000 median sales price compared to $490,000 in the previous month and 475,000 in May last year, representing a 1.8% increase month-over-month and 5.1% increase year-over-year. The average and median prices reached record high levels in May 2024 compared to any previous May pricing.

“From an analysis of the single-family/patio homes sold by price range in May, 22.9% of the homes sold were priced under $400,000, 45.4% between $400,000 and $600,000, 26.4% between $600,000 and $1 million, and 5.3% over $1 million. Year-over-year in May 2024, there was a 15.9% drop in the sale of single-family homes priced under $400,000, a 13.2% decline in homes priced between $400,000 and $600,000, an 8.2% increase in homes priced between $600,000 and $1 million, and a 10.9% increase in homes priced over $1 million.

“Devastating affordability challenges resulting from a staggering combination of high-interest rates, record-high home prices, and inflated cost of living remain the most daunting barriers for Colorado Springs-area homebuyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“The Gunnison Valley is preparing for our busy summer season. After a relatively cold and snowy May, June has come in like a lion with hot temperatures resulting in rising rivers and melting snow. The real estate market continues along the same path that is has each month of 2024. For the Gunnison-Crested Butte Association of REALTORS’® area overall, the number of transactions is up slightly (9%) and the dollar volume is up 30%. In the Crested Butte end of the valley, the number of transactions is up 28% and the dollar volume is up a whopping 71% from 2023 – 2024. Gunnison continues to lag behind 2023 with the number of transactions down 24% and dollar volume down just 7%.

“The number of transactions remain historically low as you look at the last 15 years, but it is good to see the numbers continue to grow. Increasing inventory is helping buyers have more to choose from and the number of properties for sale is up 13-18% depending on the area. Keep an eye on sales in Gunnison – the number of single-family homes for sale jumped 42% just from May to June.

“Currently the number of pending sales is down as compared to this time last year, but we are just entering the biggest sales months of the year and, with inventory up, I anticipate more sales than we had last year by the time we get to October,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Over $762.9 million of real estate transactions closed last month in Denver, barely exceeding last May’s sales volume by just 0.9%. The market exhibited encouraging resilience amidst a substantial jump in the inventory of homes for sale. Over the past decade, Denver has averaged around 1.5 to 2 months of inventory, a moderate seller’s market. At the beginning of 2022, we experienced an extreme seller’s market, with inventory plummeting to just 2 weeks. Last month, for the first time since November 2012, there was 3.3 months of inventory in Denver, as over 1,700 new listings hit the market and only 1,013 sales closed.

“The current level of inventory is a strong indication that we are experiencing a balanced market for the first time in over a decade. On average, buyers and sellers aren’t significantly mismatched in negotiating power. More than ever, sellers are providing concessions in transactions to assist with interest rate buydowns for buyers. Buyers, however, have generally compensated for this with higher offers. Denver’s median close price reached $625,000 last month, a $95,000 (+17.9%) gain from the end of last year, a faster rate of change than we typically expect from seasonal fluctuations. Historically, inventory levels have reached their annual peak anywhere between July and November depending on market conditions. Predicting how inventory will change throughout the rest of the year is challenging, but the number new listings is still outpacing the number of sales by about 2.4X as of the first week of June.

“Focusing in on the condo/townhouse segment tells a slightly different story, as transactions have declined by more than -11% YTD compared to last year. Since 2018, Colorado homeowners have endured a more than 57% increase in insurance premiums, compounding affordability challenges in the entry-level segment. The combination of recent property tax hikes, elevated prices, surging HOA dues, rising insurance costs, and inflation has curtailed activity in lower price ranges. Denver listings priced below $350,000 represented just 13.4% of overall closings in May and comprise around 15% of the current inventory for sale. If all goes well, inflation rates will continue to decelerate, and entry-level housing can become more attainable for new homebuyers,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“While the age-old saying in real estate is ‘Location, Location, Location,’ recently buyers have been prioritizing interior condition and finishes over most other factors. Even homes in the most desirable locations may find attracting an offer difficult if updates and condition aren’t up to par. The inventory of homes for sale in Douglas County has increased 53% since January, with nearly 1,000 new listings hitting the market in May alone. The result is a more competitive environment for sellers, as buyers navigate the market with more options to choose from. As negotiating power slowly tips in the direction of homebuyers, sellers should be focusing on making their listing stand out by completing renovation work most buyers aren’t eager to do.

“Despite early indicators of the market shifting in favor of buyers, single-family close prices reached near all-time highs in May with a median price $768,000. This is just shy of the record set in April 2022 of $772,000. The condo/townhouse segment, however, has struggled to gain traction this year amongst rising HOA dues stemming from skyrocketing insurance premiums and inflationary pressures on maintenance costs. Just 392 condo/townhouse listings closed this year through May, a 14% decline over the same period last year. The prices of those listings have remained relatively stable this year, hovering around $500,000, but dropped around 5.6% in May to $472,000.

“While some of the population holds their breath awaiting interest rate changes, election results, or other economic changes, sellers focused on maximizing the quality of finishes in their homes are uniquely positioned to cash in on near-record prices in Douglas County. The sticker shock of last year’s interest rate hikes is steadily fading, and buyers are becoming acclimated to 6-7% mortgage rates as the new norm. With more confident buyers, sellers can certainly find great opportunities, though a little more elbow grease may be required. Be sure to seek advice from an experienced REALTOR® on which upgrades in your home may earn you the greatest return on investment.,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO AND LA PLATA COUNTY

“A recent real estate market analysis shows distinct trends between single-family homes and townhouse-condo properties. New listings for single-family homes experienced a notable 17.9% decrease, while townhouse-condo properties saw a modest increase of 2.8%.

“The median sales price also exhibited divergent movements. Single-family homes witnessed an 8.6% decrease, settling at $699,000, while townhouse-condo properties surged by 8% to $497,000. Meanwhile, the average days on the market increased by 3.8% for single-family homes and 17.7% for townhouse-condo properties.

“Delving deeper into regional insights, notable shifts were observed in specific locations. In the town of Durango, sold listings experienced a 27% decline in May, and the average sales price increased by 15%. Conversely, rural properties outside of Durango faced a 20% drop in sold listings, with a marginal decrease in median price to $832,000.

“Further analysis revealed intriguing statistics across various price ranges. Properties priced from $750,000 and under showcased an approximate 55-day market duration, with a current absorption rate of 1.7 months. As the price range escalates, the metrics vary, indicating a shift in market dynamics. For instance, the $1 million to $1.5 million range reported 96 days on the market and a 6 to 7-month supply of inventory.

“Notably, the market dynamics demonstrate a clear distinction based on price points. While the sub-$750,000 range remains a seller’s market, the $1 million and above segments are gravitating towards a stronger seller’s market. The price point of over $2 million indicates a shift towards a more robust buyer’s market.

“In conclusion, the real estate market paints a nuanced picture of contrasting trends between single-family homes and townhouse-condo properties, emphasizing the need for a tailored approach based on market segments and locations.,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“I’m not quite sure how to explain the ups and downs of the last couple years. One moment we are selling like hotcakes, and the next, we’re seeing price reduction after price reduction. I have had properties go under contract with multiple offers within hours seemingly like we are in COVID frenzy again, while others sit, stale and empty.

“The market seems to be less consistent than what I have encountered in the past. Days on the market are indicative of this up and down roller coaster for both single-family homes and townhouse/condos. For May 2024, days on the market increased 10% from 50 to 55. For townhouse/condos, the increase is even larger, a flip flop from years past, up to 71 days from 55, an increase of 29.1% compared to May 2023.

“New listings are still popping up at an increase over last year, a 11.1% year-to-date increase for single- family homes. Townhomes/condos have also been popping up at a 31.7% higher rate than May 2023. But will they sell? Sold listings are down 13% for townhomes/condos compared to May of last year, but only down 1.2% year-to-date. Single-family homes are also on the trend of selling less – 5.1% fewer than May of last year and 3.9% less year-to-date.

“Have prices escalated so quickly, it turned off buyers in this area? Prices are still climbing, even with price reductions happening left and right. The average sales price for single-family homes continued to climb, 7.5% over May 2023. Townhomes/condos are seeing a correction and have not increased in price. The average sales price is now sitting at $437,630, a 5.8% dip from 2023, down 1.9% year-to-date. We’re definitely feeling a slower start to this summer than in the past few years,”said Estes Park-area REALTOR® Abby Pontius.

FORT COLLINS

“In the frontier days when a mountaineer came home from a day of ‘shooting at some food’ the contents of that sack of game was likely a variety of whatever the hunter could successfully target; maybe a pheasant, maybe quail, maybe a squirrel, or even a possum; hence the term ‘mixed bag.’ This month’s housing market is definitely that. How can median price go up by 9% year over year when many price points are seeing consistent price reductions of listings that haven’t yet sold? How can days on market trend downward (down 7% year-over-year) when there are currently nearly 200 homes for sale that have been on the market a month or longer without an offer? With the inventory of active listings nearing 450 units – why are there still reports of competitive offers on some listings?

“In short, the current turbulence in the market is driven by, you guessed it – high interest rates. Let’s take median price, for example. Homes in the luxury market (top 10% of the price bracket) are generally less interest rate sensitive than the first-time homebuyer price point. Luxury home sales over $1 million have risen just over 26% in the last year while most other price brackets have seen declines in overall sales numbers. This is how median price rises while sales in the lower price points have declined. Days on market is a lagging indicator. Many of the homes that sold in May went under contract in April when interest rates hovered ever so briefly below 7%. Buyers came out of the winter torpor and took advantage of favorable loan terms and snapped up the available inventory. Then in May, interest rates buoyed by the Fed and another mixed bag of economic data tipped up over 7% and many buyers went back into the holding pattern of months passed.

“Suffice to say that the mixed bag trend is likely to continue through the summer. Savvy sellers will price aggressively to lure buyers into the market. Savvy buyers will take advantage of homes that are lingering on the market and negotiate concessions to buy-down the interest rate on the loans they plan to use to buy a house. This isn’t a bad market, it’s just one that many sellers, buyers, and brokers have not seen for nearly 20 years. Three months of inventory in most markets may as well be labeled a balanced market (between supply and demand) with many sellers urgent to sell in less than 60 days. A mixed bag is like a box of chocolates. You’re never quite sure what you’ll end up with,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“The Fremont County real estate market for May 2024 compared to May 2023 shows new listings on the market up by 27.1% while new sales are down by 25%. This gives current buyers a higher number of listings to choose from. The median price range May 2023 vs. May 2024 is up by 5.3% but still at an affordable price of $347,000. The year over year median price weighs in at $327,500. Our 22.7% inventory increase over last year leaves us with a total of close to 6 months’ supply of inventory. Our average days-on-market is 91 days.

“Year over year, new listings are down by 6% while sales are down by 19.3%. Sellers are receiving an average of only 2.8% less than what they listed the property for in final sales contracts.

“Fremont County’s affordably low $327,500 median price range brings retirees from the Colorado metro areas and other surrounding states. In the higher-end local market, a buyer can purchase a newer 3,000 to 3,500-square-foot home in a newer neighborhood with one-half acre or larger lots for an affordable average price around $612,000.

“Local listings and sales typically increase from May through August each year. May’s new listing inventory increase of 22.7% is historically accurate. Buyers are now able to view a better selection of inventory, and sales should increase in the next few months,” said Fremont County-area REALTOR® David Madone.

PAGOSA SPRINGS

“The May 2024 market overview showed gains in all categories including more inventory, higher prices, and a longer time to sell.

Median Sales Price $660,500 (up 9.7% year-to-date)

Average Sales Price $733,865 (up 17.9% year-to-date).

“Nationwide, over 67% of homeowners have either paid off their mortgage or have at least 50% home equity. Pagosa sellers placing homes on the market seem to be among those national homeowners. Many sellers are investors or second homeowners understanding that now is the time to cash out. Gains in inventory reflect the new norm average range $500,000-699,000 (up 62.5% at 39 homes) and median range $700,000-$999,999 (up 35.5% at 42 homes) price points. Additional inventory climbs between $1-2 million are at 51 homes. With a total inventory of 181 homes, months supply of inventory is 6.7 months. At first glance, the month’s home supply reflects a more normal, healthier market inventory. However, dissecting the supply inventory showcases a bias toward higher priced homes, with over 60% of inventory priced over $700,000 for the 6.7 months of inventory. Those buyers in the remaining 40% of inventory have a buying reality evaluation with buyers migrating to the new norm of average sales price – not by choice, but necessity. Buyers looking for homes under $550,000 do not have the luxury to stall their purchase, as homes go under contract swiftly. The overall sale is only about 3% less than the list price received, even with a hefty price-per-square-foot scenario in most price points. Those buyers who had the strategy of waiting for interest rates to lower are seeing even higher prices this year and depleting any buying leverage.

“Sellers realize they must price well, have more patience, and allow more time to sell, as average days on market have climbed to almost five months. Homes needing updates tend to stay on the market longer, as buyers paying higher mortgages simply do not have the extra income to renovate, nor the time to perform renovations. Out-of-state buyers (typically cash buyers) of second or short-term rental homes do not have desires for a remote renovation project and purchase homes that are move-in ready. Sellers who do not desire renovations are adjusting their prices, giving closing cost concessions, or point buy down incentives to achieve a home sale. Higher interest rates have driven first-time homebuyers off the sidelines and into the spectator seats. Unfortunately, today’s interest rates, high home prices, and living expenses are overpowering those buyers in today’s market. Historically, Pagosa Springs has been a resort, second home community. Perhaps that is the wheel turning and driving today’s sales back to Pagosa’s historical character. Showing records and inquiries indicate less buyers and sellers are in the game these days. Sales show those choosing to participate in real estate are serious motivated players with the intent to succeed in buying and selling represented by year-to-date pending sales – up over 15% – even with higher home prices. Like day and night temperatures, the 2024 summer buying and selling season is heating up early,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The Pueblo real estate market isn’t showing any big gains and has been staying in line with what has been happening the past year. The big key that isn’t opening any doors are the buyers, who are still sitting on the sidelines waiting for better interest rates and a better feeling about the economy.

“New listings in May were down 4.5% from last May, but total active listings were up 6.1% for the same period. Pending sales moved up 9.5% compared to last May but are down 11.4% year-to-date. The median sales price did improve to $319,900, up 6.6%. The percent of list price received is staying around 98.4%. Average days on market is creeping up to 3.7 months. Sellers are still reducing list prices to help buyers look at their home. Agents are still doing a lot of open houses but not getting many buyers to look.

“There were just 25 new building permits in May. This is still down 3.5% year-to-date and just 139 permits have been pulled in the first five months of the year. With no spring buying season this year, agents are ready for a strong summer season,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“Alamosa County’s new listings are up 12.5% from last year and 20% year-to-date from 2023 to 2024. Sold listings experienced a slight dip in May (down 11.1%), but remain strong for the year-to-date, totaling a 34.4% increase.

“Conejos County presents abundant opportunities for your buyers; our new listings decreased 28% in May, with sold listings down 22% year-to-date. The average sales price still hovers slightly below $300,000.

“Costilla County saw a remarkable 700% increase in sold listings and a 27% rise in new listings. The average price ranges from the low to high $200,000s, offering another excellent opportunity for buyers to enter the market and start building equity.

“Mineral County experienced a 200% increase in activity from last May to this May, with the average price soaring from the high $200,000s to the high $500,000s. New listings surged 133%, with sold listings increasing 200%.

“Rio Grande County witnessed a 38% increase in new listings, with the average price reaching the low $600,000s in May; overall, the year-to-date average price stands in the high $300,000s.

“Saguache County also presents significant opportunities for buyers, with the average price still around the low $300,000s. We’ve seen a 17% increase in new listings compared to last year and a 35% year-to-date increase from 2023 to 2024. Saguache County remains an excellent choice for buyers,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“May 2024 didn’t look a whole lot different than May 2023 in Steamboat Springs. New listings for single-family were comparable at 30 and multi-family was the same as last year at 43. Thirteen homes closed just like 12 months ago with the days on market relative at 82 days. Townhomes/condos closed 22 properties vs. 27. What did change was the median/average sales prices and percent of list price received. Year-to-date prices are up double digits with home sellers receiving 97.4% and townhome/condo sellers receiving 98.4%. Months supply in Steamboat continues to simmer around three months with single-family inventory equivalent to last year at 43 properties and increased multi-family sitting at 78 units.

“The Town of Hayden realized 12 new single-family listings vs. two last year and two multi-family units whereas there had been none in May 2023. Hayden looks to be the most affordable in Routt County where you can still buy a house for under $550,000. Days on market is less than a month for homes and seven days for multi-family. With 13 homes currently for sale, the supply of inventory is four months leaning itself to a more balanced market for buyers and sellers. This is not the case for townhomes in Hayden where there is one unit for sale equating to less than one months supply.

“Oak Creek (Stagecoach) and Clark are located approximately 30 minutes from Steamboat. Each is home to State Parks with lakes and marinas. Oak Creek realized five home sales with an average sales price of $757,272. With inventory currently at seven, the months supply sits at 1.7. There were two townhome/condos that came on the market with one available resulting in only a months’ worth of supply. Clark (Steamboat Lake) incurred five new listings with one sale for $1.225 million. These areas are considered a recreational paradise in Routt County and together with Hayden, buyers will find their dollar goes further than in the hub of Steamboat Springs,” said Steamboat Springs-area REALTOR® Marci Valicenti.

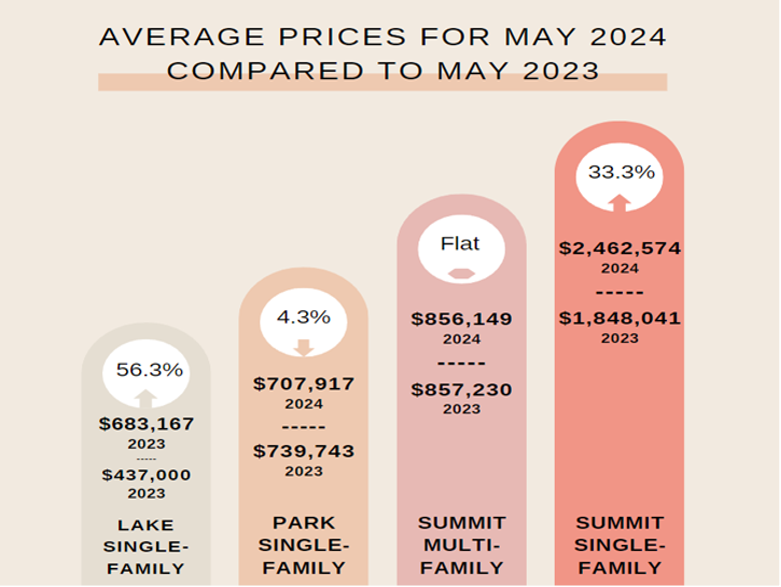

SUMMIT, PARK, AND LAKE COUNTIES

“For the month of May, statistics show that there were 7.5% fewer sales compared to last year and half as many single-family homes sold as compared to last month, yet multi-family home sales soared. Once again, we are seeing that there are more listings (31%), it is taking longer to sell a property, interest rates are still higher, and sales are going down, yet prices have been pretty much higher than the same time last year. 40% of the sales were cash.

“The fundamental principles of supply and demand continue to drive price trends. A balanced market typically features 4 to 6 months of inventory and our market currently sitting at 5 months of inventory reflects a 36% increase from last year. This summer will be a crucial period for the market, as the balance between supply and demand will be put to the test.

“Among the 700 active residential listings in Summit, Park, and Lake Counties – an increase of 34% from last month – the spectrum of property prices is wide. The most affordable listing is a mobile home in Park County priced at $125,000, while the most expensive is a luxurious single-family home in Breckenridge, listed at nearly $20 million.

“Out of the 113 sales in May, the lowest was a mobile home in Leadville for $138,000 and the highest was a single-family home in Breckenridge for $6.7 million. Fifty-one percent had a sales price over $1 million and 45% of sales were cash. These numbers exclude deed restricted, affordable housing, land and commercial.” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The vitality of the Telluride regional real estate market continues with May dollar amount of sales coming in at $109.7 million with the number of sales at 38. However, there continues to be a downward trend in the number of sales reflecting a decrease of 25% in the number of sales as compared to the five-year average number of sales through May. May saw the highest sales price for a home ever at $20 million. That home was in the Mountain Village and was just passed another Mountain Village May home sale at $18.1 million, which was the third highest home sale ever in our region. Mountain Village total sales real estate sales for the first five months of 2024 comprised 45.7 percent of all sales in San Miguel County. The main reason for this market domination is due to the severe lack of inventory in the town of Telluride and all other regional markets segments in our county,” said Telluride-area REALTOR® George Harvey.

VAIL

“The real estate market has continued its trend toward stabilization as we enter the summer sales season. New listings were off 2.8% from May 2023, however, the year-to-date status maintains a positive 11% versus 2023. Pending sales were plus 20.3% for the month; slightly better than the 18.2% year-to-date pace. The closed sales were solid at plus 20% in units and 25% in dollars for the month. May is usually a slower month as we transition for the summer season however, this performance was significant. On a year-to-date basis units are positive 29.7% and dollars are positive 37%.

“The strength of the market is highlighted by the days on market data which was 24.3% lower than 2023 for the month. The year-to-date data for days on market is running at a plus 8.6% rate which highlights the positive activity for May. Months supply of inventory tweaked up to 4 months which is the highest level we have seen for the past few years. We are still below the 6-month mark, which is considered a stable market, but progress is being made. The catalyst for the improvement in the aforementioned values is the inventory which is 8.1% better than a year ago.

“Stepping back and looking at the data allows us a continued positive perspective for the market!

Assuming no macro factors out of our local control, the summer looks positive and a continuation of the current trends.,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The May 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.