Active listings increase but other market factors keep home buyers and sellers at a stalemate

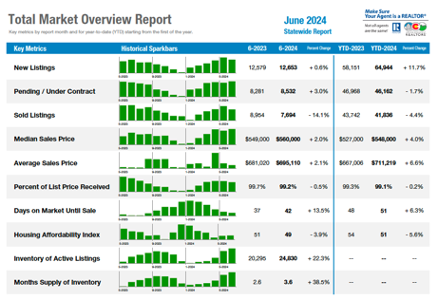

ENGLEWOOD, CO – The stalemate in Colorado’s housing market continues as both buyers and sellers choose to wait out the economic uncertainties being driven by stubbornly high interest rates, rising insurance rates and property tax hikes, inflation and more, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado. The combination of factors has helped push the inventory of active listings notably higher but has done very little to improve housing affordability as median pricing continues to tick up in most markets across the state.

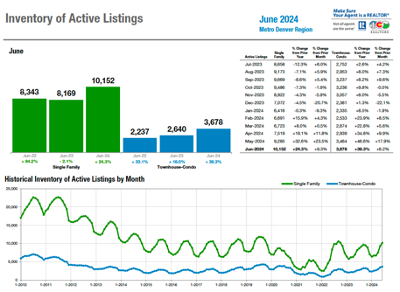

Active listings for single-family homes in the seven-county Denver metro area (10,152) were up 9.3% from May to June and are up 24.3% from a year ago. The 3,678 active townhome/condo listings represent a more than 6% increase from May and are up nearly 40% from a year ago. Statewide, the 18,373 active single-family listings are up 6.3% month-over-month and up 19% from a year prior. For townhome/condos, the 5,992 actives represent a nearly 5% bump from May to June and are up nearly 38% from June 2023.

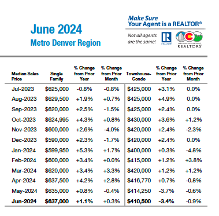

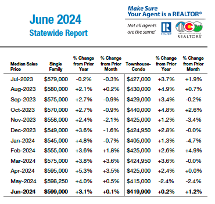

Median pricing for single-family homes in the Denver-metro area ($637,000) and statewide ($599,000) remains at or within striking distance of their all-time highs, up just over 1% and 3% year-over-year, respectively. The townhome/condo market has held strong as well with a 3.4% year-over-year dip to $410,500 in the seven-county Denver area, and a 0.2% bump statewide to $419,900.

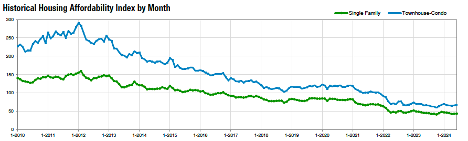

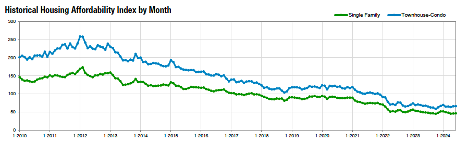

It comes as no surprise that the CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – remains at or near its all-time lows, down 4.4% in the metro area and -6.1% statewide, compared to the same time last year.

Seven County Denver area Total Market Overview (single family and condo/townhome):

Statewide Market Overview

Inventory of Active Listings – Metro Denver

Inventory of Active Listings – Statewide

Median Sales Price Denver Metro Region

Median Sales Price Statewide

Denver Metro Region

Housing Affordability Index Statewide

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“The real estate numbers in Adams and Arapahoe counties, including Aurora, Centennial and Greenwood Village, are reflecting the consistent message from around the state. Inventory is at a 12- year high for the total number of homes on the market. Aurora zip code 80015 is showing a 64% increase in inventory compared to June 2023. There were approximately 162 listings, 70 solds, a median price of $560,000, which is down 3.5% from June 2023. Englewood/Greenwood Village 80111 zip code had a 40% increase in inventory and the median price dropped 23% over June 2023, to $885,000.

“Overall, Aurora has seen a 45% increase in available properties and a median price of $540,000, down 1.8% from 2023, and an average of 33 days on market. Centennial had a 34% increase in properties on the market, a median price of $689.000, 5% lower than June 2023, and 20 days on market. This is all great news for buyers. The price drops are helping to ease the increased costs to buyers due to insurance prices, tax increases and HOA fee increases.

“I believe that even a slight reduction in the interest rate will spark another buying frenzy. Demand is there however, there is a long list of these buyers sitting on the fence waiting for the interest rates to drop so that they can be a part of another rush to purchase the perfect property. Now is a fantastic time to get off the fence, make an offer and not have to be part of the multiple offer craziness if the interest rates do enjoy a small rate drop,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The tables are starting to turn for buyers and sellers in Boulder and Broomfield counties. New listings continue to hit the market and buyers remain watchful and waiting. Boulder had 18% more listings this month and days on the market jumped just a little bit to an average of 54 days. Prices are down just 1.2% so they are keeping even with our market from earlier this year. Price reductions are the norm as sellers try to navigate what it will take to sell. Once priced properly, homes are selling pretty close to their list price, but bidding wars seem to be a thing of the past.

“In Broomfield, listings are up 11% and the number of sold properties is down causing prices to decline 4% since this time last year. Sellers who assume prices would be higher based on similar homes that sold last year are finding themselves sitting on the market. Buyers are enjoying more options with more inventory. Incentives and concessions to help reduce their interest rate is the name of game and it appears that we have finally reached more of a balanced market.

“The recent economic forecast of a rate change in the fall could bring out those buyers who are waiting to back into the market but until that happens, we enjoy finally having more inventory and a little slower pace,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“As summer begins, housing continues its slow down across the Pikes Peak Region. Once again, we see the median price rise slightly. But the other statistics are not great. Sold listings plummeted 15.2% year over year. We added 31% new listings to the market on top of May’s 40% increase. Housing inventory remains on the rise, and we witnessed a 42% increase in the average days on market for single-family residence. All indicators are now confirming that we are at a pivot point with housing locally.

“Nationally, inventory is up as buyers remain leery. Rates, combined with overall economic concerns, have buyers in a holding pattern. Buying conditions have collapsed to levels seen only twice since 1960. Those years were 1974 and 1980, per Game of Trades reporting. We have also seen multifamily default numbers not seen in a decade. Full-time employment fell by 28,000 jobs. Part time employment rose in June by 50,000 jobs. However, in May, full-time employment dropped 625,000 workers and added 286,000 part time workers. A trend you don’t want to continue. Unemployment has risen from 3.4% to 4.1%. It is taking Americans multiple jobs to survive. This is a transition that now has the Federal Reserve considering rate drops by September. This may occur faster though depending on how bad things get in the employment side of the house. To add insult to injury, 47% of newly-constructed apartments in Q4 2023 were not rented within three months of completion. And home inventory is now at its highest levels since 2009.

“Are we entering a corrective phase? It appears many indicators are pointing in that direction. Manufacturing fell to 48.5% in June, which was 3 months of contraction, and 19 of the last 20 months we have seen U.S. manufacturing shrink – the longest streak since 2008. Freight companies also remain slow, and we haven’t even touched on the commercial real estate market. A possible ticking time bomb that may put dozens of banks at risk. Toss in credit debt, student loan debt, and automobile debt, whip that all up with higher for longer and the consumer is at the breaking point. Don’t let the small rise in home values fool you, housing is at risk if this continues. And, if history repeats itself, when the Fed pivots into lower rates, that is when the economy tends to break down,” said Colorado Springs-area REALTOR® Patrick Muldoon.

CRESTED BUTTE/GUNNISON

“This month’s report is similar to the last few months where the Gunnison-Crested Butte market is not the same in both ends of the valley. Overall, the number of sales and the dollar volume of sales are basically the same as this time last year (number of sales down 5% and dollar volume up 5%). Throughout the area, the number of properties for sale is also relatively flat (up 6.7%). However, this trend does not hold up when you look at specific areas.

“The Crested Butte area has 19% more sales so far in 2024 and the dollar volume is up 28%. The number of sales continue to track with 2011 and to be lower than every year since then, except 2023. We were lower at this time of year in 2020, but the last half of 2020 was the start of the boom, so we will certainly end up below that year. The number of properties for sale is in line with this time last year and the number of current contracts is down slightly. Summer is when properties come on the market and when buyers are in town to look at them, so I would anticipate more contracts and listings in the coming weeks.

“The Gunnison area has had 32% less sales in 2024 and the dollar volume is down 25% through June. However, the number of homes for sale has doubled since April and the number of homes under contract has tripled in that time. Typically, the Gunnison market is more in line with primary residence markets – homes for sale and selling in spring/early summer, but this peak was reached later this year and should help to boost the sales numbers closer to where they were last year,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Market activity showed a sharp decline in June, indicating we’ve reached this year’s seasonal peak. A total of 826 homes closed in Denver last month, a 19% decline from May’s 11-month high. Prices overall held relatively steady, posting a median sales price of $620k, less than 1% lower than May, but still 3.2% higher than June of last year. Months supply of inventory continued to climb to 3.6 months, its highest level since October 2012. With more homes on the market and less incentives for buyers to move quickly, we can expect prices to cool quickly entering the fall.

“The townhouse/condo market has struggled to gain traction this year, as buyers face affordability challenges with elevated mortgage rates, spiking insurance costs, and overall inflation pressuring monthly budgets. Just 299 closed transactions in June were multifamily homes, a number we typically see in the quiet winter months when activity decreases. Prices have remained relatively stable, experiencing a slight depreciation since 2022’s market peak. We’ve measured over a 5% differential in appreciation rates over the last two years between the single-family market and condo/townhouse market, with median close prices of attached homes declining 2.3%,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“Median sale prices in Douglas County remained near all-time highs last month at $725,000, coming in 2.6% higher than this time last year. Single-family homes carried the market in the county, comprising 88.4% of all closed transactions and averaging 99.3% of list price received. Single-family homes did take slightly longer to sell than this time last year, averaging 31 days on market for closed listings. With 1,300-plus homes on the market, buyers had more time to make decisions and weigh their options without the fear of over-abundant bidding wars and competition.

“In-line with the rest of the Denver-metro area, the condo/townhouse market saw a moderate price decline in June, as more than 15% fewer closings have occurred this year to date compared to last year. The inventory of attached homes for sale remains relatively low in Douglas County, as our housing stock is primarily detached single-family homes. However, supply constraints are no match for affordability challenges, and sale prices have fallen over 9% from this year’s high in February. The median sale price for townhouse/condo listings in June was $461,000,” said Douglas County-area REALTOR® Cooper Thayer.

FORT COLLINS

“The June housing statistics for northern Colorado reflect a great prairie landscape like you might see in eastern Colorado or western Kansas. Aside from an occasional rolling hill or geological anomaly like the Pawnee Buttes, it is a vast plain of flatness. We are just over 12 months into the run-up in mortgage interest rates that began in earnest in June of 2023 when the average 30-year mortgage interest rate steadily remained at or above 6.5%. The Federal Reserve had already begun its mission to cool the economy, especially the housing sector that makes up between 15-18% of U.S. GDP (NAHB). The market had been red-hot since 2013. This is partially due to historic low mortgage interest rates and historic high demand for housing following the Great Recession of 2008-2009.

“Year-over-year market stats show the sum effect of those efforts by the Fed to stem the alarmingly stubborn post-pandemic inflation numbers. The graphs look like a cross section of the U.S. Great Plains on the right side (2023-2024) butting up against the Rocky Mountains on the left side (2021-2022). Year-over-year total sales for June in Fort Collins are off by just eight homes from last June (-3.6%). Year-to-date totals compared to same time frame in 2023 are even closer to flat, down just 2.3% median price, which has steadily climbed for the first two quarters of 2024, is now flat compared to June 2023 at $620,000. The median price did not exceed $600,000 in Fort Collins until early 2022.

“There is now more than three months of inventory on the market in the greater Fort Collins area compared with the less than two weeks of inventory at the beginning of 2022. Buyers have a bit of leverage where they had not had any in 2021 and 2022. Sellers have had to make quick adjustments to their sale expectations as many homes have lingered on the market for weeks and even months, which is far beyond the days or hours it took to sell an average home just a year and a half ago.

“But remember those geological anomalies, like the Pawnee Buttes that stick out against the treeless, sage-strewn landscape of eastern Colorado? The market stats have a couple of those as well. If you look at the number of sales over $2 million in sale price, those numbers have increased dramatically. For example, there were just six properties in the first half of 2023 that sold over $2 million. In the first six months of 2024, there have been 19. Likewise, sales of homes listed over $1 million have gone up nearly 28% year over year. Those charts look just like the Pawnee Buttes standing resolutely against the flat prairie,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“Summer has arrived in western Colorado and while the sun is shining, and although the rivers have been rising the market has not seen the same effect. New listings of single-family homes remained stable or somewhat flat depending on your attitude. June saw 106 single family homes come on the market which is the same number as June 2023. Year to date, we are experiencing a 15.9% decrease in listings compared to last year in the single-family sector. Pending sales were up just slightly for an increase of 14.8% (70 vs 61 in 2023). June also saw a slight decrease in sold homes (65 vs 69 in 2023). Even the median sales price is holding tight at a 0.4 % increase ($675,000 vs $672,000 in 2023). The one increase is in the days on market, up 42.9%, indicating buyers are not enthusiastic about jumping in quickly and are taking their time to decide on a commitment. June ended with a 27.1% decrease in active listings.

“While the single-family market has been stable, the multi-family market has seen a decline in all numbers except for median sale price and days on market. June saw new listings down 37.8% (23 listings vs. 37 in 2023). Pending sales were down by half (15 vs 32 in 2023), and active listings were down 31.3% (33 vs 48 in 2023). On the bright side for sellers, the median sales price was up a dramatic 81.9% ($652,000 vs $359,000 in 2023). Buyers in this sector were also more patient with days on market increasing 228.6% (46 days vs 14 days in 2023).

“These trends highlight a classic supply and demand scenario. Despite the low inventory and buyers’ cautious approach, prices are holding steady or even increasing, especially in the multi-family sector. This indicates that those who need to buy are still proceeding with their purchases, regardless of interest rates, economic conditions, and political uncertainties,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County is seeing some positive signs in inventory, but there is a long way to go in closed transactions. Solds were down 26.6% from this time last year, standing at 254 units. Pending sales for June were better and active inventory was up 10.1%. Prices continue to edge up, with the median price now at $425,000 and the average price at $495,000. Sellers are receiving approximately 99% of asking price, and selling quickly, averaging 76 days on market. Between the rising prices and the current interest rates, a big concern is affordability. That index is now at 49, down almost 6%. A reduction in interest rates would be helpful,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“The Pueblo market never experienced a spring selling season, and we continued our downward trend over the first half of the year with new listings down 15.6% compared to June 2023. However, year-to-date we are only down 3.5%. Pending sales are still down 12.6% from June 2023 and are -13.7% year-to-date. Solds were down 22.6% from a year prior and are down 14% year-to-date. None of this is good news for sellers as buyers continue to wait for interest rates to come down with additional concerns ranging from economic uncertainty, the upcoming election, and employment keeping many on the sidelines.

“The median sales price held steady at $315,000 with the percent-of-list-price received steady at 98.4%. Sellers are holding strong on their prices. The average days on market moved up to 93 days as our active listings rose 1.3% in June to 695. With just 18 new housing permits, June was the second worst month this year as builders continue to be careful with their money,” said Pueblo-area REALTOR® David Anderson.

SUMMIT, PARK, AND LAKE COUNTIES

“In June 2024, the real estate market in Summit, Park, and Lake Counties showed some intriguing trends and statistics,” said Summit-area REALTOR® Dana Cottrell.

Sales Overview:

- There were fewer sales overall compared to the previous year, with a 7% decrease.

- In Summit County, 21 single-family homes sold with an average price of $2,538,855. There were also 55 multi-family homes sold at an average price of $830,339.

- Across the three counties (Summit, Park, and Lake), there were 90 total sales, ranging from $160,000 for a single-family home in Park County to $4.27 million for a single-family home in Breckenridge.

- 45% of these sales were for homes priced over $1 million, indicating a significant presence of high-end transactions.

Market Conditions:

- Despite a 34% increase in listings compared to the previous year, indicating a growing inventory, there is an over a 7.5-month supply of inventory. This surplus generally favors buyers, but prices have remained high.

- Median sales prices in Summit and Park Counties have increased by 25% compared to last year, despite the higher inventory.

Buyer Behavior:

- Over 50% of single-family homes in Summit County were purchased with cash, suggesting strong buyer liquidity in the high-end segment.

- Multi-family home prices have remained flat, contrasting with the rising prices of single-family homes.

Property Range:

- The spectrum of properties available is broad, ranging from a mobile home in Park County priced at $125,000 to a luxurious single-family home in Breckenridge listed at nearly $20 million.

- This diversity in pricing reflects the wide range of buyers and investor interests in the region.

Market Dynamics:

- Interest rates are noted to be high, which typically suppresses demand, yet prices have not seen a corresponding decline, indicating resilience in the market.

- Despite the economic indicators that might suggest a cooling market, such as fewer sales and higher interest rates, prices have generally remained stable or increased.

“Overall, while the market shows signs of potential correction with fewer sales and higher inventory, the high demand for single-family homes, especially in the luxury segment, coupled with significant cash purchases, has contributed to sustained high prices across the mountain towns,” added Cottrell.

TELLURIDE

“The Telluride regional market, including all of San Miguel County, closed out June and the first six months of 2024 with a robust $507.87 million in sales, a 16% increase over the same period in 2023. The Mountain Village’s share of that volume was $231 million from 106 transactions, while Telluride recorded $135.15 million from 42 sales. The average sales price in San Miguel County increased 19%, rising from $1.98 million to $2.36 million. However, the town of Telluride’s average price rose 28% from $2.52 million to $3.22 million, indicative of high demand and limited inventory.

“In the first six months of 2024, there have been 34 sales surpassing $5 million each, amounting to a total of $314.35 million. This substantial figure represents approximately 62% of the total sales volume so far this year. The average sales price per square foot for a Mountain Village home was $1,511.65 and in the town of Telluride that number is $2,095.65 per square foot for a home for the first six months of 2024,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Vail market had a challenging June with closed transactions down 16.5% versus 2023. However, the first half of the year delivered a 21.2% positive transaction performance. The dollar value of the month’s transactions was down 19.6% however, the first half dollar volume ended up 27%. June is usually the kickoff to the summer season however, we didn’t see the traditional trend in sales and contracts.

“We have made progress in listings and months of supply; however, a deeper dive shows inventory is skewed to condos/townhomes. The increase in this inventory is due to the numerous projects that have generated significant sales and inventory and is now catching up to demand. The decline in June transactions was across all-pricing niches however, the upper levels had greater slippage compared to the lower pricing niches. When we look at the year-to-date performance, we see the upper niches as the drivers in unit and dollar market share. The year-to-date upper niches represent 68% of the transactions and an even greater proportion of the dollar volume.

“Showing activity dramatically increased in the later part of June and the July 4 hoiday weekend was extremely busy. It looks like our summer season will be a bit more consolidated from the usual time frame. We are in a better inventory position to address the market and optimism is the focus in the current state of the market,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The June 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.