Active inventory grows in August but buyers wait out anticipated rate cut

ENGLEWOOD, CO – Despite a growing list of active inventory and motivated sellers across the seven-county Denver-metro area and statewide, buyers continue to stay away citing interest rates and pricing that has ignored the inventory increase and maintained its higher levels, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado.

While interest rates have softened over the past year, anticipation of a September Federal Reserve rate cut and the size of that potential cut may also be keeping many potential buyers on the sidelines.

“Buyers continue to have a tough time accepting today’s higher mortgage payments which, coupled with higher interest rates, higher insurance, and higher taxes, are taking a large bite out of the budget of our would-be homeowners,” said Aurora-area REALTOR® Sunny Banka.

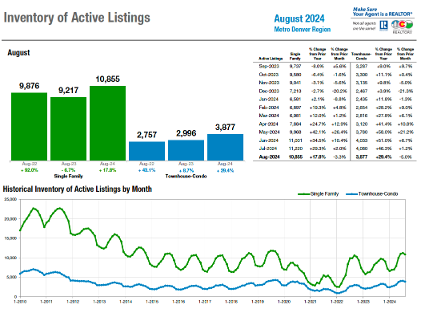

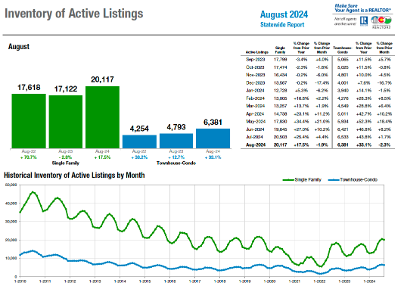

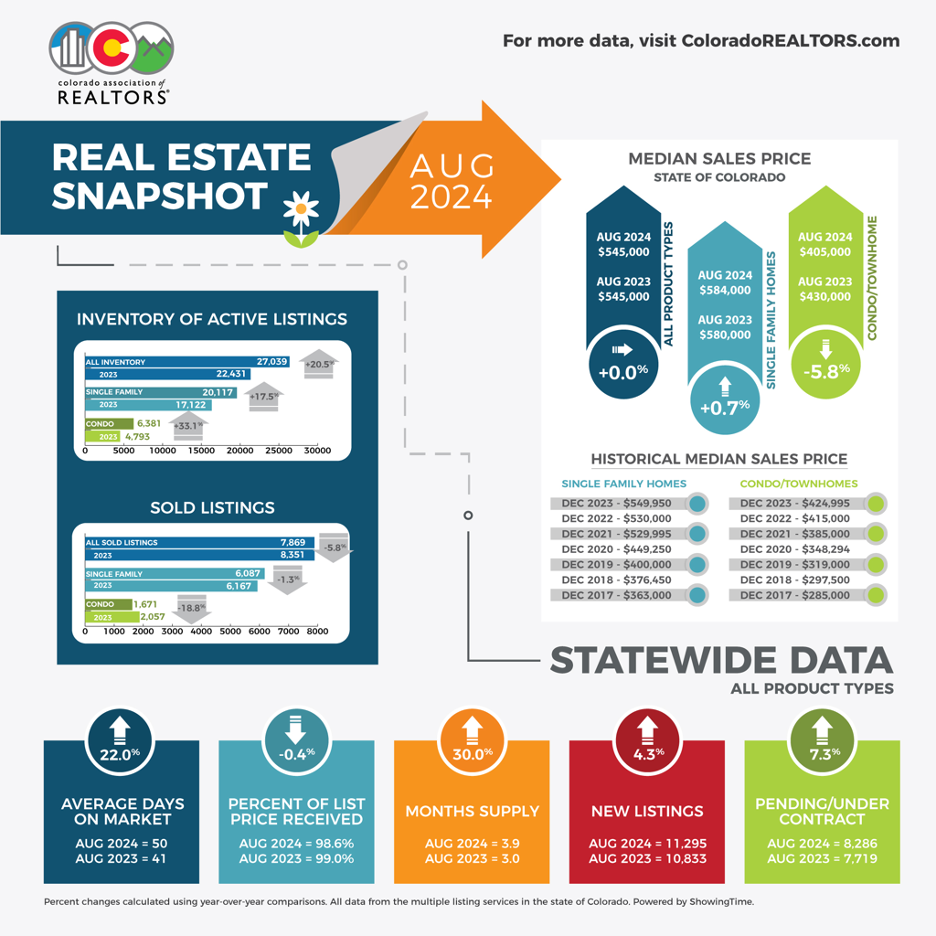

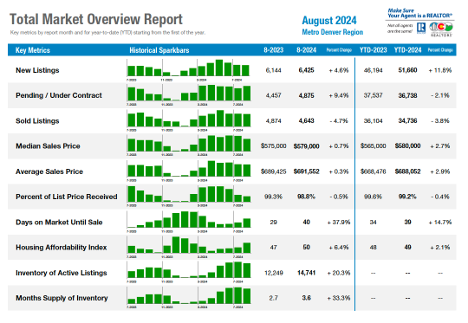

With more than 27,000 active listings across the state, more than half of which sit in the seven-county Denver-metro region (14,741), potential buyers have more than 20% more inventory to choose from than a year ago. Those numbers have pushed the months’ supply of inventory to 3.6 months in the Denver-metro area, and 3.9 months statewide, both up more than 30% from a year prior.

“Our market waits for the rate drops and most believe that if and when they occur, buyers who have been waiting on the sidelines will influence the supply and demand and jumpstart our lackluster market. Until then, sellers who price accurately and offer incentives will keep the market moving at a steady pace,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

The wait is nearly over but the opportunities may be immediate.

“Many pundits are predicting a surge in buyer traffic in the fourth quarter of this year. If that’s truly the case, buyers contemplating a purchase should act now while there’s many homes available for sale and sellers are open to negotiations like price reductions, temporary interest rate buy-down concessions, and various repairs and improvements discovered during inspections,” said Fort Collins-area REALTOR® Chris Hardy.

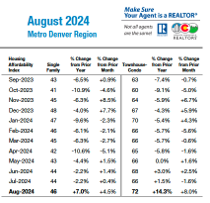

Seven-County Metro Denver

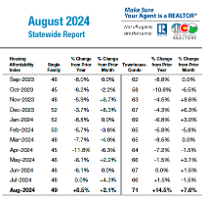

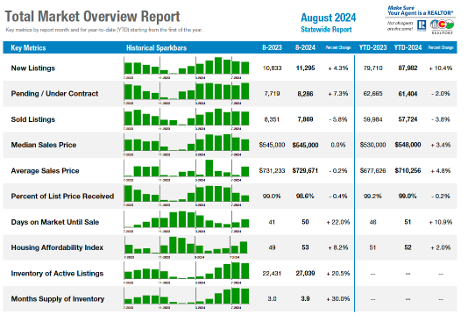

Statewide

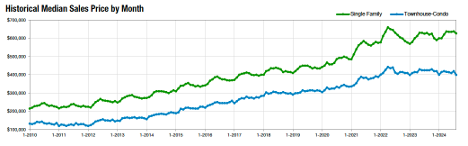

The influx has had little to no impact on pricing with the median single-family homes in the Denver-metro area at $626,779 in August, down less than a half a percent from August 2023. Condo/townhome median pricing in the Denver-metro area dipped below $400,000 for the first time in more than two years and is down 6% from August 2023 at $399,700.

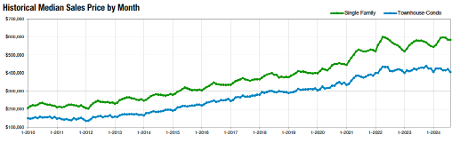

Statewide, the $584,000 median price tag for a single-family home is up 0.7% from a year ago. Condo/townhome pricing has also fallen off nearly 6% from a year prior and sits at $405,000.

Median Sales Price Denver Metro Region

Median Sales Price Statewide

With prices holding relatively steady, the CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – remains a troubling measure for both first-time homebuyers and those looking to move up due to life events and changes. The affordability index number – 46 in the Denver-metro area and 49 statewide – has improved approximately 7% for those considering a single-family home. In the townhome/condo market, the index has improved more than 14% to 71 in Denver-metro and 72 statewide. A score of 46 means that the median household income was only 46 percent of what’s necessary to qualify for a median-priced home under prevailing interest rates and median income.

Housing Affordability Index

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Looking to the year-over-year comparisons, Aurora listings are up, sales are down slightly and ironically, the price is up slightly across most zip codes. The monthly changes reflect price reductions in many areas. Buyers continue to have a tough time accepting the payments with the higher interest rates, higher insurance, and higher taxes. These numbers are taking a large bite out of the budget of our would-be homeowners. This scenario is consistent across all of Adams and Arapahoe counties.

“Buyers have more choices, and more time to make decisions in most cases however, the payment continues to be a stopping point when all the pieces are factored in. The current rates may change slightly, but waiting for that 3% interest rate is probably something that buyers will not see again. It is best to get into the housing market at whatever ownership level buyers can. We are continuing to see small appreciation, but there also seems to be a pent-up demand which will have a positive impact on current homeowners’ equity. Currently, Aurora is seeing a median price of $569,450. A much more affordable level than most of the metro Denver area,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“Boulder and Broomfield counties have experienced a less than remarkable market in the last month. New listings continue to enter the market and are sold within about 54 days in Boulder and a quicker 34 days in Broomfield. Prices are the same as this time last year, which actually illustrates a slight uptick from the month before. This small rebound can be attributed to the talk of a potential interest rate cut in September and more aggressive and realistic pricing by sellers. Yet, many buyers are still awaiting on the proposed cut not realizing that mortgage companies have already reduced rates in anticipation of that happening.

“Broomfield County has several new townhome products that have hit the market flooding it with 36% new listings which is holding prices to the same level as they were last year as the buyer demand has not increased as much as the inventory. Boulder’s condo and townhome market has experienced the same with 21% more listings lengthening the average days on the market to an average of 66 days.

“Our market waits for the rate drops and most believe that if and when they occur, buyers who have been waiting on the sidelines will influence the supply and demand and jumpstart our lackluster market. Until then, sellers who price accurately and offer incentives will keep the market moving at a steady pace,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“With a 33.1% increase in listings and a lack of buyers, our August median price pushed up 3.7% but overall, sold properties were down 2.1%. The market is very unpredictable right now. If you are selling a home, it better be very nice, maintained, and priced right. Anything other than that becomes hard to sell. Buyers have plenty of inventory to choose from and will likely be able to negotiate concessions, and maybe even a fridge along with a small price reduction. You would think we have become ‘balanced’ in the market, but it feels slower.

“Nationwide, even as rates drop, homebuyer sentiment continues to decline. The consumer index on housing dropped 4.1 points in August, the lowest in 11 years, according to The Kobeissi Letter. In August, U.S. monthly mortgage payments declined for the first time in 4 years. But house payments remained high. Each month I ask myself, is this the month housing pivots? But we know, not yet. In fact, the best is yet to come if history rhymes.

“The Federal Reserve is likely to drop rates in September. The only question is .25% or .5%. This about face from just a few months ago shows the Fed is now seeing what we all can see; the economy is not doing well. The Fed doesn’t drop rates if economies are fine. They drop rates when they realize they overstayed their welcome with keeping rates too high for too long. This typically ends up in a chase to the bottom with speculation now showing 150 basis points on drops for the remainder of the year. The ‘higher for longer’ will now turn to the ‘quicker the better.’ Now we can watch if unemployment begins to rise after the drops as it normally does. The next 6-18 months after the Fed pivot tend to not be great. Will we finally get to witness a soft landing, or will this one go down in flames? Time will tell,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Once again, the Colorado Springs real estate market followed the typical seasonal pattern, with a slight tapering in the sales after the peak activity months in May, June, and July. There is a heightened anticipation of increased buying activity following the expected lowering of mortgage interest rates by the Federal Reserve soon. There are incredible opportunities currently for buyers due to the elevated inventory level, softening interest rates, and highly motivated sellers. In August, 50% of active listings in El Paso County had price reductions.

“In August 2024, the number of single-family/patio homes for sale in the Colorado Springs area was 3,320, representing a 1.4% month-over-month increase and a whopping 37.2% increase year-over-year, and the highest level of inventory in August since 2016. Overall months’ supply of active listings was 3.1 months. For homes priced under $400,000, supply was 2.5 months; homes between 400,000 and $600,000 at 2.8 months, homes priced between $600,000 and $1 million at 3.8 months, and 5.6 months for homes priced over $1 million.

“There were 1,064 sales of single-family/patio homes in August 2024, compared to 1,127 in the previous month and 1,067 in August last year, representing a decrease of 5.6% month-over-month and 0.3% year-over-year. The monthly sales volume was up 0.5% and year-to-date sales volume down 4.6% compared to last year. However, looking back 10 years to August 2014, the monthly and year-to-date sales volumes are up 107.0% and 126.9%, respectively. The 38 average days on the market compared to 34 days last month and 29 days in August last year.

“From an analysis of the single-family/patio homes sold by price range, last month, 25.3% of the homes sold were priced under $400,000, 44.4% between $400,000 and $600,000, 24.2% between $600,000 and $1 million, and 6.1% over $1 million. Year-over-year in August 2024, there was a 3.6% drop in the sale of single-family homes priced under $400,000, a 0.2% increase in homes priced between $400,000 and $600,000, a 6.2% increase in homes priced between $600,000 and $1 million, and a 16.1% increase in homes priced over $1 million.

“Last month, the average sales price was $558,409 compared to $571,152 in the previous month and $553,959 in August last year, representing a 2.2% decrease month-over-month and a 0.8% increase year-over-year. The median sales price was $490,000 compared to $499,000 in the previous month and 480,000 in August last year, representing a 1.8% month-over-month decrease and 2.1% increase year-over-year. in August 2024, the average and median prices reached record high levels compared to any August previously,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“The 2024 Crested Butte and Gunnison area market remains very similar to 2023 through August. Our inventory is up around 10% overall, sales are down about 5%, and the dollar volume is basically flat. However, the story remains the same as it has most of the year where different parts of the area are having very different years.

“The Gunnison area has slowed considerably with the number of sales down 28% (117 in 2024 vs. 163 in 2023) and 20% less dollar volume. This area has always been more affordable than the north end of the valley, but prices increased as they did everywhere following the pandemic. Even though the market is slower, prices continue to rise with the average price sold in the Gunnison area up 16% from last year.

“Crested Butte is slightly busier than it was in 2023 with 13% more sales (173 in 2024 vs. 153 in 2023) and dollar volume is also up 16% year over year. Our pending contracts are currently down from this time last year, so it remains to be seen where we end up.

“The number of sales is still relatively low and continues to be in line with the number of transactions we saw in 2011. For historical perspective and learning, 2011 was the first year after the great recession where the number of sales improved dramatically. It was the start of an 8-year run of slow and steady increases for the Crested Butte real estate market in terms of the number of transactions. There was a slight dip in 2019 and then 2020 and 2021 were crazy before it dipped back down below pre-pandemic levels for 2022 and 2023.

“These are big picture market statistics, so they do not hold true for all property types or areas. For example, there are fewer single-family homes for sale right now than there were last year and there is more vacant land for sale. Depending on what you are selling or buying, the information you need should apply to your needs and not just the market in general,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“With 3.7 total months of inventory on the market and mortgage rates trending down, it’s becoming an advantageous time to be a buyer in the Denver market. Last month, inventory levels persisted at a relatively stable level, with around 2,824 active listings for sale. Interestingly, nominal active inventory was almost exactly 50% single-family and 50% condo/townhouse, though months’ supply of inventory, which accounts for the pace at which buyers are purchasing homes, had a large differential between the two asset classes. Single-family listings came in at 3.1 months of inventory, while the townhouse/condo market displayed a whopping 4.7 months of inventory.

“Buyer reluctance in the townhouse/condo market is likely being driven by increasing HOA and insurance costs, which is resulting in massive price decreases by sellers to keep up with fierce competition. Last month, the median close price in Denver County for townhouse/condo homes was just $377,000, a 10.7% decline since July and -11.5% year over year. We’re seeing price adjustments happen in real time to compensate for increasing secondary homeownership costs, allowing buyers to pick up condos and townhomes at much lower prices than recent years. However, with the increase in ongoing costs of ownership, even with lower prices and interest rates, buyers can still expect similar monthly payments when considering all costs.

“The Denver single-family market, in contrast, displayed resilience to economic uncertainty in August. Median home prices increased 1.5% month-over-month to $699,000. However, buyers are undoubtedly in a more advantageous position than we’ve seen in a while, with sellers receiving just 98.5% of their asking price on average. As a whole, this summer has been relatively slow, and we can expect the slowdown to continue through the winter until ongoing ownership costs experience reprieve,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“Homes in Douglas County continued a gradual declining trend in median close price, marking a third consecutive month with moderate decreases. The median single-family home in August sold for $733,950 – right near the 2023 average for that metric. Single-family inventory levels appear to have reached their annual peak in July, declining last month to 3.2 months of inventory on the market. Time on market, however, spiked last month to an average of 41 days, 36.7% higher than last August.

The townhouse/condo segment in Douglas County continues to be in high demand, as entry-level buyers are priced out of larger single-family homes. ‘Just’ 2.9 months of inventory remained on the market in August, signaling a fairly balanced market. From my personal experience, townhouse/condo buyers today seem much more cautious and cost-conscience in their searches, and even though inventory is relatively lower than other markets, buyers are still picking up negotiation power as sellers are pressured by time and competition,” said Douglas County-area REALTOR® Cooper Thayer.

FORT COLLINS

“We’ve all been through the summer road trip season and likely encountered the dreaded ‘Road Work Ahead’ signs. We either re-route to avoid the whole situation or endure a seemingly endless creep along the shoulder of the road until we pass the construction zone and return to hurtling down the highway at full speed. A similar situation continues to plague the housing market. The ‘cone zone’ of the housing market is decade’s high mortgage interest rates reaching heights of 7.39% last fall (road closed) but recently have been flirting below 6.5% (one-lane traffic). Although this seems like the road has reopened, buyers are still quite ponderous in the pursuit of purchasing a home.

“One of the side effects of this slowdown has been a buildup of inventory pushing to almost 4 months’ worth of available housing on the market. This is also showing up in the days on market metric that is hovering at about 2 months from the time a house goes on the market until it closes. Even the uphill slog of the median price of homes has slowed to less than 1% in August ($600,000 in Fort Collins). Sellers have had to settle for less than what they expected when they initially decided to sell their home earlier this spring. This is the same story we’ve been telling all summer long.

“However, it appears the Federal Reserve has sufficient inflation and wage data to support altering policy at the next meeting to begin lowering the U.S. Federal Prime rate by at least a quarter point. While the Fed’s rate doesn’t directly affect mortgage interest rates, banks are already pricing in the Fed’s anticipated move and 30-year fixed rates have been tiptoeing as low as 6.3%.

“So, with the mortgage rate barricade removed, why haven’t buyers stepped on the gas and bought up everything in sight? One explanation may be that buyers are waiting for interest rates to drop below 6% before they’ll be willing to fly down the on-ramp to home ownership. Many pundits are predicting a surge in buyer traffic in the fourth quarter of this year. If that’s truly the case, buyers contemplating a purchase should act now while there’s many homes available for sale and sellers are open to negotiations like price reductions, temporary interest rate buy-down concessions, and various repairs and improvements discovered during inspections. If buyers re-enter the highway to home ownership like they do after passing the last flagger in the cone zone, available homes will become scarce, prices will rise, and buyer leverage in the home purchase transaction will fade quickly in the rearview mirror,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“It was a hot month in Mesa County, temperature wise, but not real estate wise. With just 288 closed sales across single family and condo/townhome, we were down 1.4% year over year. New listings are also down, but one bright spot, the number of properties under contract, is up 12.6%. Both the median and average prices are up a bit, $399,950 and $449,036, respectively. Sellers are doing well, still getting 98.4% of list price. Inventory is still creeping up due to the low number of sales, and at the end of August we had 698 active listings available for sale.

“At this point in 2021 we had seen 3,310 listings come on market and this year, so far, 2,755. Many would be sellers are still waiting to see if interest rates improve, as even if they want to sell or move up, they don’t want to give up their low interest mortgages,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Summer ends with chilled evenings and shorter days for both sellers and buyers as they head into the fall sales season. Expectations for both buyers and sellers are somewhat unsettled. Unlike the change of season, today’s market is not much of a change from last year with continued higher home prices, high interest rates creating escalating mortgages, and low home affordability. What has changed are average days on market (127 days), an 8-month (or more in higher price points) inventory of homes and year inventory of land.

“Buyers and sellers in today’s market are faced with both reality and affordability. Cash sales continue to keep home sales prices strong as interest rate hikes have little effect on cash buyers. Buyers are either adjusting their expectations or are likely priced out of the market (as indicated by the pending sales (down11.7%) and sold listings (down 16.9%) from last year. Although compared to home pricing in other Colorado resort towns, Pagosa Springs still consistently has the value of lower pricing, especially in higher end luxury home price points. Local sellers are finding it difficult to find a replacement or move-up home. Some sellers are cashing out of their second homes and upgrading their current first home or paying off first home mortgages from their second home real estate wealth proceeds. This is adding inventory to the Pagosa Springs real estate market. Leading into winter, those sellers not obtaining their desired home sale proceeds and time-to-sell windows, evolve the selling strategy into enticing seller concessions, accepting home sale contingent offers, or maybe a price reduction to sell before the serious snow occurs.

- Median Sales Price: $573,500 (+6.2%) (year-to-date)

- Average Sales Price $719,687 (+9.5%) (year-to-date)

- Inventory of Homes at 259 Units (+28.2%) Months’ Supply 8 (+27%)

Relative to higher monthly mortgage and not enough buyers; some home prices will continue to decelerate for sellers desiring to sell within the average days on market with the onset of winter home showing demands, and land a sale before the new year. Price adjustments are not of abundance in the “comfort price point”, as the main inventory exists in the higher price points,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“August delivered some positive news for the Pueblo market with new listings up 8.5% from a year ago and +8% year to date. Pending sales were also up 8% from August 2023 but remain down 13.4% year to date. Our median price was up 8% from August 2023 and up 3.2% year to date to $319,900. Percent of list price received was up 0.3% from a year ago and has seen no change year to date (98.5%). The one significant negative was sold listings were down 17.5% compared to August 2023 and down 13.8% year to date. Our average days on market moved up to 91 days, up 7.1% year to date.

“Looking to our 844 active listings, we were up 14.7% compared to the same time last year, good news for buyers as we now sit with a 5-month supply of homes. Only 25 building permits were pulled in August 2024, down 9% year to date. Everyone is anticipating the upcoming Fed meeting and hoping that lower interest rates will get buyers off the sidelines and into contracts,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“In Alamosa we had a slight decrease in new and sold listings from last August, but year to date we are still up 12.5%. Average sales price is still very affordable in the low to mid 300s.

“Conejos County is down sold listings both in the month and the year to date. New listings are up 17% from last year, and the median sales price is up 29% from last August, from $387,000 to $500,000.

“Costilla County has had a slower August than they had last year, however the new listings are up 13.5% and sold are up 33.3%. This county is also very affordable, with the median sales price jumping up from $230,555 to $266,256.

“Mineral County has had a slight rise in their year-to-date numbers with new listings up 42% and sold listings up 8.3%. The Median price jumped 10.4% from $412,000 to $455,000.

“Rio Grande County’s new listings are only up less than 1% year to date, and their sold listings have increased 20% compared to last August. Rio Grande County’s Median price has jumped 20% from $282,000 to $340,000.

“Saguache County is up 45% in new listings year to date, and up 57% of sold listings compared to last August. The Median Sales Price has grown less than 1% from 335,000 to 337,500,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS

“Overall, August in Routt County experienced the same old, same old as the number of new single-family listings for Steamboat, Hayden, Oak Creek & Clark were essentially the same as August 2023, as was the case in July. However, year-to-date new listings in Steamboat are up over 29%, with Hayden up 59% and the Clark (Steamboat Lake) area up 12.5%. The Oak Creek/Stagecoach area has 34.1% fewer new listings than last year. The number of sold listings for Steamboat, Hayden and Clark pretty much mirrored the same as the period last year, yet Oak Creek (Stagecoach) experienced a 29% decline in homes sold. Looking at 2024, the sold transactions are slightly higher for Steamboat at 3.2%, down 13.6% for Hayden and up 18.2% for Clark. Both median and average sales prices have realized an average 27% gain over the previous year, so pricing remains strong.

“Eight more new multi-family listings came on the market this August compared to last – yet when you look at year-to-date there is a 40.2% increase with 10% fewer sold listings. Even with the fewer number of sales, the median and average sales prices are up over 30% from the previous year. Months’ supply is now about 5 months for both single and multifamily indicating a more balanced market – for single-family this is similar to last year and last month; for multi-family this is slightly more than double August 2023. A more balanced market is good news for buyers as there can be more negotiation for price as well as inspections. Even with 5 months’ supply of inventory buyers need to know that the average days on market until a sale was 37 days, so acting sooner than later can still be a factor. As we close out the third quarter of the year, which represents the highest sales volume for our area, perhaps there are some opportunities for buyers. Sellers wanting to sell before the snow flies is not an uncommon phenomenon in the mountain areas,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“Over recent months, the real estate market has demonstrated a pattern of subtle fluctuations. This August, single-family median home prices experienced a slight decline, while median prices for multi-family homes saw a modest increase. Consistent with ongoing trends, the market has also witnessed a decrease in sales and an uptick in active listings.

“In Summit and Park counties, the average sale price for homes increased 9% compared to August 2023. Single-family homes in these areas sold for an average of $1.97 million, while multi-family homes averaged $951,199. Notably, the number of active listings surged 37% from the previous year, resulting in approximately 7 months of inventory and a shift towards a buyer’s market.

The average prices for single-family and multi-family homes are as follows:

Single-Family Homes:

- Summit County: $2,257,735

- Park County: $651,050

- Lake County: $622,375

Multi-Family Homes:

- Summit County: $936,003

“Among the 848 active residential listings across Summit, Park, and Lake Counties, the most affordable property is a mobile home in Breckenridge listed at $169,000, whereas the priciest listing is a luxurious single-family home in Breckenridge with an asking price of nearly $20 million.

“August’s 156 transactions in these counties showcased a broad price spectrum, from a condo in Lake County which sold for $142,000 to a single-family home in Breckenridge which sold for $8.99 million. Approximately 48% of transactions exceeded $1 million, and 45% were cash purchases. These figures exclude deed-restricted, affordable housing, land, and commercial properties,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The Telluride greater market area of San Miguel County achieved its second-highest August total dollar volume on record, reaching $120.7 million via 46 sales. This performance was only surpassed by August 2020, which recorded $125.2 million. It also marks the largest monthly sales volume since September 2022. Compared to the same period last year, total sales volume has risen 18%, while the number of sales county-wide has remained relatively stable.

“As of August 2024, Telluride has emerged as hotter, characterized by a rapid increase in sales prices (32% increase from 2023) and strong buyer demand for homes and condominiums in the town of Telluride where most everything is walkable. Total sales volume in the town of Telluride is also up 24% over 2023 for the same period of time. The Mountain Village sales activity, despite maintaining robust sales activity this year, is down 7% from last year for the same period of time. Mountain Village continues to appeal to those buyers who want more square footage and big distance mountain views. Also, the proximity to skiing and golf are a big reason some buyers prefer the Mountain Village location,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Valley Market followed the national trends with a softening sales performance for the month of August. Overall, sales for the month were down 12.4 % in units and flat in dollar volume. Significant data points for the total market show new listings for the month up 4.5% and year to date +1.2%. Pending sales for the month were down compared to August 2023. Inventory for the month was up 5.7% and months’ supply rose to 5.7 months but remains significantly below historic levels. Plus, the months’ supply would indicate a position near the standard of 6 months for a stable market.

“The overall market could be viewed as a mixed but relatively stable market. However, when we dive into the segments of the market significant variances jump out. Single-family/duplex unit sales were down 27.9% for the month versus August 2023. Year-to-date sales are down 6.8%, with new listings down 11.1% for the month and -6.8% year to date. Inventory is flat versus 2023, and months’ supply is up 9.2% at 7.1. The townhouse/condo market has a very different performance picture. Closed sales were up 7.8% for the month and are up 32.1% year to date. New listings are up 23.3% for the month and are up 18.3% year to date. Active inventory is up 37.6% and months’ supply rose 9.8% at 4.8 months.

“One final data point to understand the market variables is the opening price niche represents 33% of transactions and 10% of dollar sales with the top price niche at 10% of transactions and 35% of dollars. We are also entering our shoulder season prior to the ski season,” said Vail-area REALTOR® Mike Budd.

Seven County Denver area Total Market Overview (single family and condo/townhome):

Statewide Market Overview (single family and condo/townhome):

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The August 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.