Inventory supply reaches highest levels in a decade, yet buyers choose to wait out election and possible future rate cuts

ENGLEWOOD, CO – Prospective homebuyers across the state anticipated temperatures would fall well before seeing any dip in housing prices. However, September temperatures stayed well above normal as market conditions, an upcoming election, a fast-approaching holiday season, and a more typical seasonal slowdown contributed to just a slight dip in the median pricing of single-family homes in markets statewide, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado. Townhome and condo pricing did increase from August to September but remains down from a year ago in the seven-county Denver metro area and statewide.

Thanks to the Federal Reserve’s September announcement, lower mortgage interest rates along with improving active inventory, price reductions, and slight decreases in median pricing are the key advantages to what remains a cautious, patient buyer pool – characteristics not seen since pre-pandemic markets.

“As the public holds its collective breath for the election to happen and the hope of more rate reductions, the market has become stagnant,” said Boulder/Broomfield-area REALTOR® Kelly Moye. “Smart buyers are taking advantage of motivated sellers, but others still choose to sit on the sidelines.”

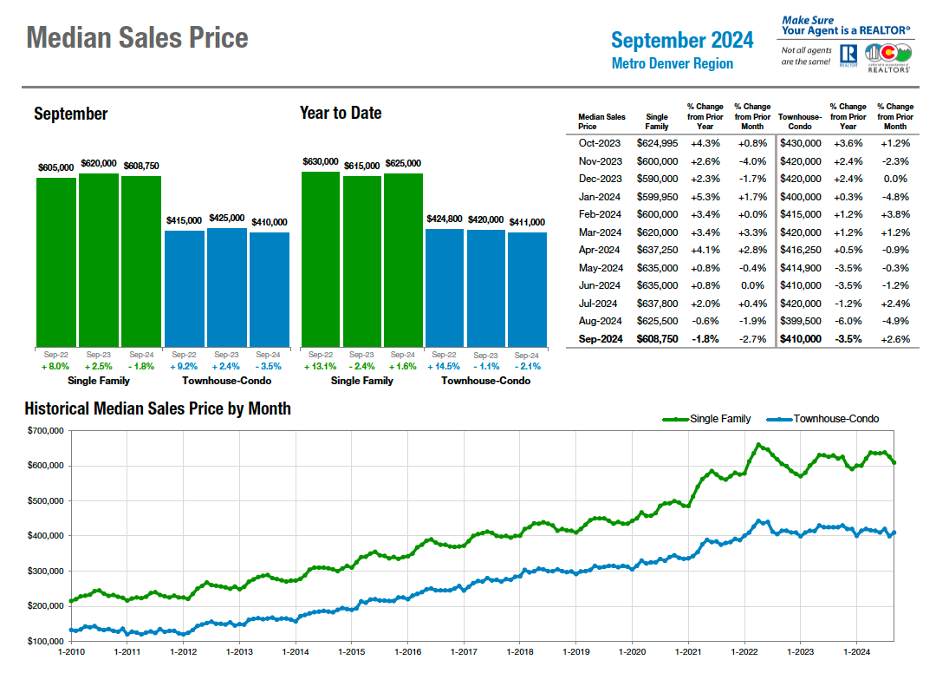

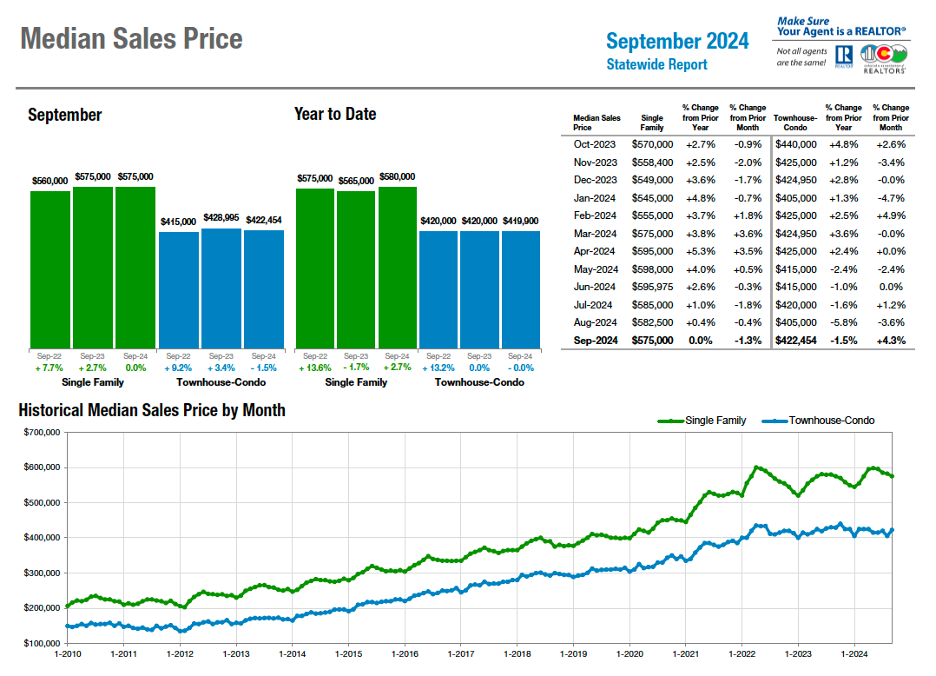

Median pricing for single-family homes in the Denver metro area slipped 2.7% from August to $608,750 and is down 1.7% from a year prior. Statewide, single-family home median pricing fell 1.3% from August and sits even with pricing from a year prior at $575,000. Condo/townhome pricing in the Denver-metro area rose 2.6% from the month prior to $410,000 but is down 3.5% from a year prior. Statewide, the $422,454 median price is off 1.5% from September 2023.

“Buyers in the market right now are clearly taking advantage of end-of-summer deals from sellers who have lowered their list prices and likely increased concessions to move buyers off the pause button to write offers and bet on lower interest rates in the coming year,” said Fort Collins-area REALTOR® Chris Hardy.

“Despite new dovish policy action by the Federal Reserve, the mortgage market hasn’t quite adjusted to recent positive inflation trends,” said Denver County-area REALTOR® Cooper Thayer. “With more inventory on the market and less motivated buyers than we’ve seen in years, there is certainly an argument to be made we are entering a true buyer’s market this winter season.”

Median Sales Price Denver Metro Region

Median Sales Price Statewide

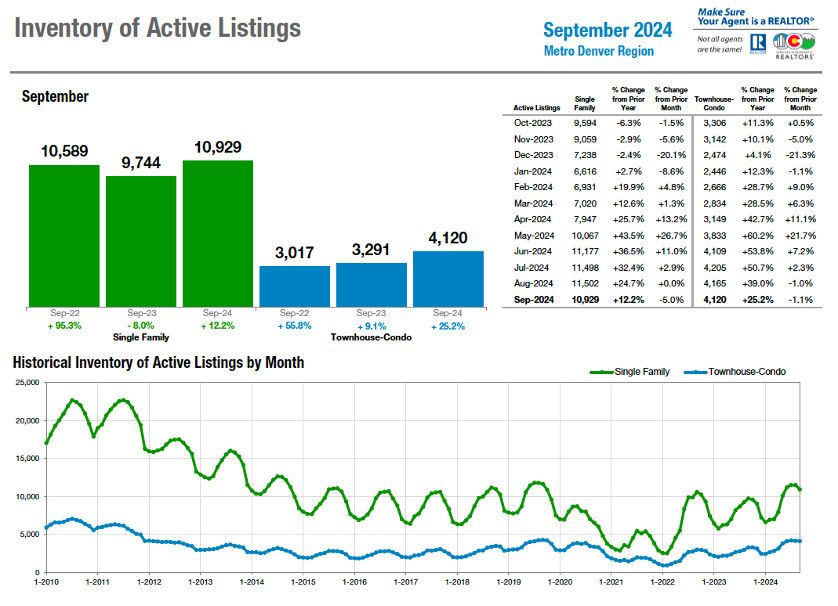

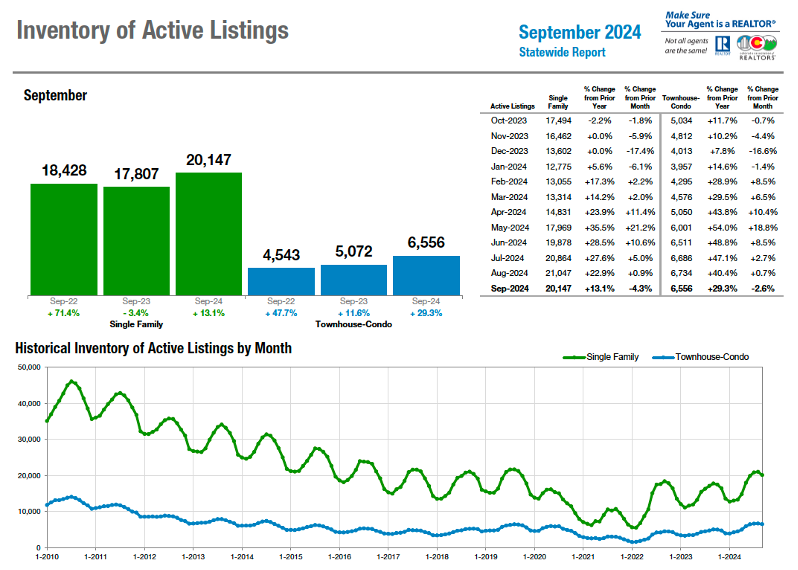

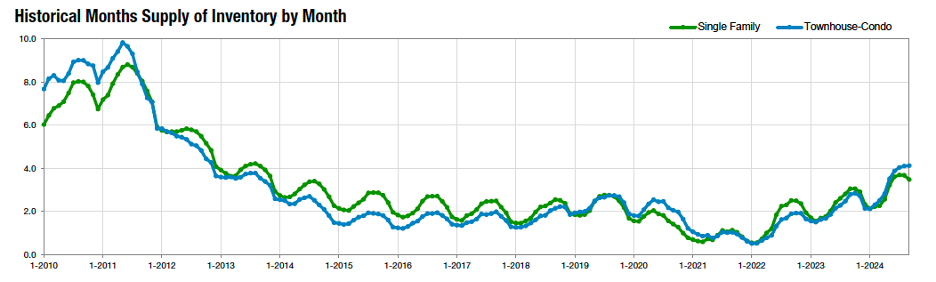

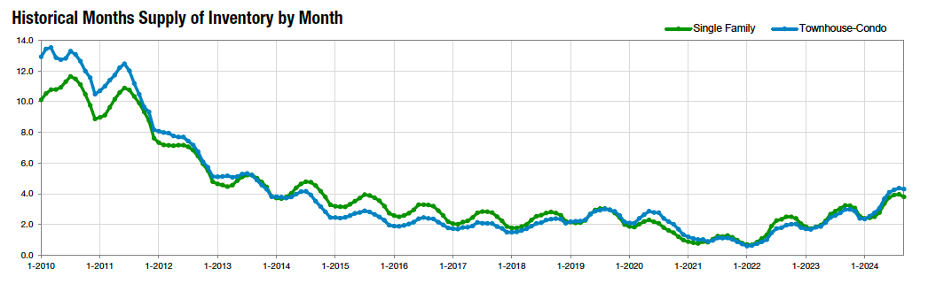

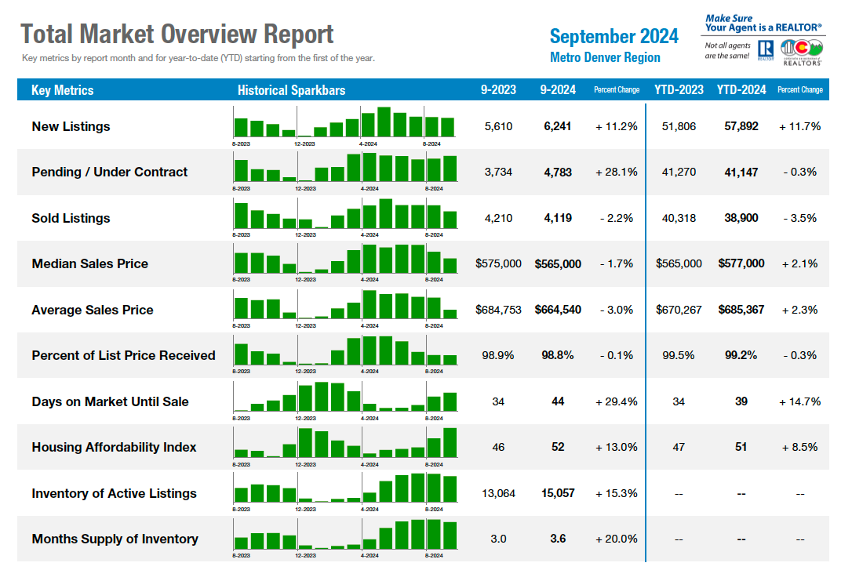

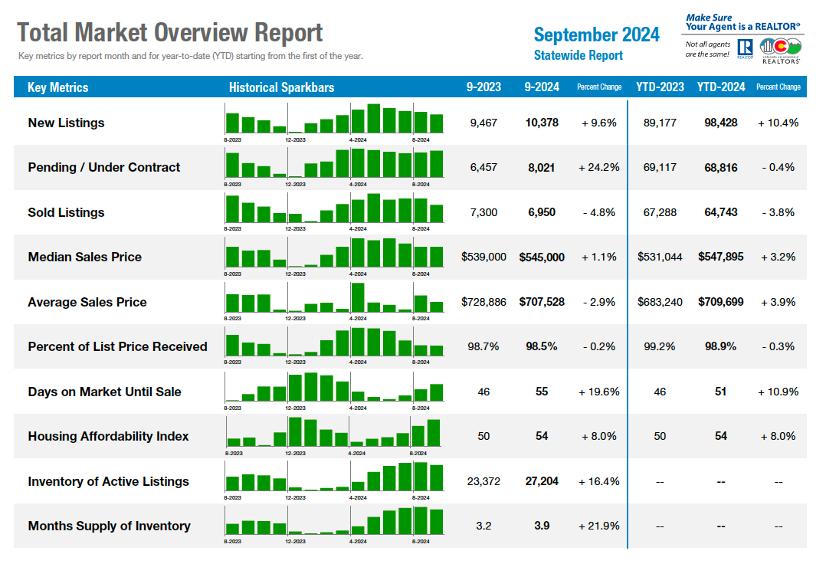

Active inventory for all property types fell from August but remains well ahead of where things were in September 2023. At 3.6 months’ supply of inventory in the Denver-metro area and 3.9 months statewide, the supply continues to hover at levels not seen in nearly a decade.

Seven-County Metro Denver

Statewide

Months Supply of Inventory – Denver Metro Area

Months Supply of Inventory – Statewide

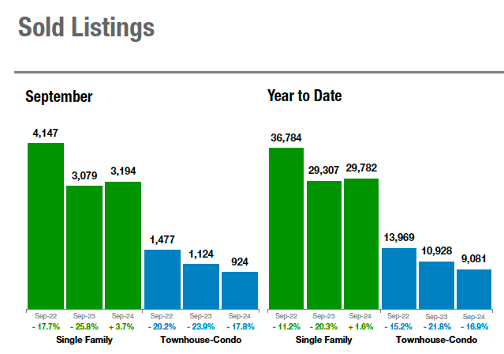

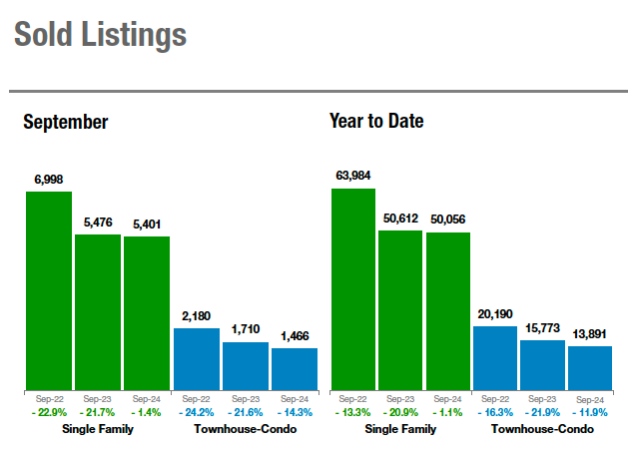

Sold listings for all property types continued to decline and are well off of the volume seen in the previous few years.

Denver Metro

Statewide

The CAR Housing Affordability Index – a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price, and median income by county – continues to improve over the past few months however, the overall affordability equation remains a troubling calculation for a majority of homebuyers. The affordability index number – 49 in the Denver-metro area and 52 statewide –improved 6% from August and 14% year-over-year for those considering a single-family home. A score of 49 means that the median household income was only 49% of what’s necessary to qualify for a median-priced home under prevailing interest rates and median income.

In the townhome/condo market, the index has improved more than 14% to 72 in the Denver-metro area compared to a year ago and is up nearly 13% statewide to a score of 70.

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“September delivered increased inventory of both single family homes and condos/townhomes and a reduced number of solds across the market. Ironically, pricing was relatively stable when looking year over year. We currently sit with an inventory level in the metro area near 2011 levels which is exciting news for buyers. With solds lower than a year ago, it is helping add choices for prospective buyers. Although our average days on market is extended, we are not seeing a huge reduction in list price, something we tend to see in the fall season, so we’ll have to see what next month brings.

A quick look around the city shows:

- Zip code 80011 with an inventory reduction and median price of $450,000.

- Zip code 80013 with an inventory increase of 29% and a median price of $516,000.

- Zip code 80015 Inventory is up 27% and a median price of $566,000.

- Zip code 80016 saw a 17% jump in inventory and an 8% decrease in price with a median price of $784,000.

- Zip code 80111 in Greenwood Village is up 57% in inventory with prices up 16%. The median price is $1,012,000.

“The housing shortage seems to be ebbing. There is a large increase in the townhome/condo inventory and prices have taken a dip. The number of homes on the market has grown substantially over the past 3-4 months and buyers may have the upper hand in some situations. These next few months may provide some very sound opportunities,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“The expected boost in buyer demand by the drop in interest rates never materialized in Boulder and Broomfield counties as buyers still seem to be waiting for the election to be completed and perhaps more rate drops to come. Boulder County is performing better than many neighboring counties with the number of new listings (+12%) matching the number of sales (also +12%). Prices are holding steady and are about even with what they were at the beginning of the year. Sellers are waiting an average of two months to sell, assuming they have priced appropriately and not counted on appreciation so far for this year. Sales-price-to-list-price ratio dipped to 98% as more sellers are willing to negotiate and provide concessions for buyers.

“Broomfield’s listings were also up 12% but buyers aren’t gobbling them up as quickly with sales up only 4% since January. Prices are down 3% since January and the influx of many new townhome and condo properties have created an imbalance of supply and demand. New listings in this category are up 36% but sales are trickling in at 6% more than what we saw at the beginning of the year.

“As the public holds its collective breath for the election to happen and the hope of more rate reductions, the market has become stagnant. Smart buyers are taking advantage of motivated sellers, but others still choose to sit on the sidelines,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“It looks like it’s groundhog month once again in Colorado Springs as we wake up at the beginning of each month to find statistics that make the numbers appear better than the market really is. Median pricing is up, again. Inventory is up, again. Units sold are down, again. This is all year-over-year data and what we have been watching occur for many months. And yet, median price is up, again. We could stop there, but I think it is important to touch on data that may paint a different picture.

“We have not seen this much inventory since 2014-2015. Price reductions are up. It is common to check our MLS and see that we have 450-plus price improvements in the last seven days. When jumping into specific neighborhoods, we will likely find 50% or more of the homes have seen price improvements. Withdrawn/cancelled homes are up. These are the homes that could not sell and then were pulled from the market. Which means our onboarding of rentals is also up. Would-be sellers are now forced to be landlords. A common theme in our market. Multi-family apartment vacancies are up along with units that are finishing. Rental applications are down. Many property managers state that rents are now dropping and days-to-rent are increasing. Mortgage rates are up. Adding to the real estate madness as everyone in the industry seemed to think the Federal Reserve rate cuts would lead to a buyer frenzy that fizzled as the 10-year rocketed up with a better-than-expected job report. It is impossible to read through this information and feel positive, despite what appears to be positive statistics.

“The meat and potatoes of the national market is this: 47% of U.S. consumers think rates need to be between 5-5.49% for them to buy. Fifty-seven percent of Americans would consider getting a mortgage if rates fall below 5%, as reported by The Kobeissi Letter. The market is pricing in a 75-basis point Fed rate drop between now and the end of the year. This shows weakness in the economy and that weakness does not imply a better housing market in front of us. Despite the industry trying to stay optimistic, the average REALTOR® is now coming to the realization that the housing market is tough and is not likely going to get easier. The light at the end of the tunnel seems too distant to see currently and the industry is beginning to realize that. Will this mean that at some point we see a report where the median price drops in our region year over year? I can’t predict the future, but I feel that may be the case,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“In the Colorado Springs housing market, the continuing increase in inventory has elevated the level to 3.6 months’ supply. This is highly desirable because, in a normally balanced market, the supply level is between 4 and 6 months. Likely challenging affordability, the upcoming election, economic uncertainty, seasonal trends as the real estate market approaches the holiday season, and the expectation of further reduction in mortgage rates are pushing buyers to sit on the fence for now. However, there are fantastic opportunities for buyers due to those increased inventory levels, lower interest rates, and highly motivated sellers.

“Active Listings – Supply: In September 2024, the number of single-family/patio homes for sale in the Colorado Springs area was 3,392, representing a 2.2% increase month-over-month and a whopping 36.6% increase year-over-year, and the highest level of inventory in September since 2015. Overall months’ supply of active listings was at a healthy level of 3.6 months. For homes priced under $400,000, supply was 2.8 months; homes between 400,000 and $600,000 at 3.2 months, homes priced between $600,000 and $1 million at 4.6 months, and 8.6 months for homes priced over $1 million.

“Sales – Demand: There were 933 sales of single-family/patio homes in September 2024, compared to 1,064 in the previous month and 1,008 in September last year, representing a drop of 12.3% month-over-month and 7.4% year-over-year. The monthly sales volume was down 16% month-over-month and -8.4% year-over-year. The year-to-date sales volume was down 5% compared to last year. However, looking back 10 years to September 2014, the monthly and year-to-date sales volumes are up 92.1% and 122.7%, respectively.

Days on the Market: The 44 average days on the market In September 2024 compared to 38 days last month and also in September of last year.

Price Reductions: In September, 48.3% of active listings in El Paso County and 40.5% in Teller County had price reductions.

“Sales by Price Range: Last month, 26.5% of the homes sold were priced under $400,000, 46.5% between $400,000 and $600,000, 22.4% between $600,000 and $1 million, and 4.6% over $1 million. Year-over-year in September 2024, there was a 17.9.0% drop in the sale of single-family homes priced under $400,000, a 6.1% drop in homes priced between $400,000 and $600,000, a 3.8% decline in homes priced between $600,000 and $1 million, and a 3.2% decline in homes priced over $1 million.

“Average & Median Sales Prices: Last month, the average sales price of single-family/patio homes was $535,023 compared to $558,409 in the previous month and $540,882 in September last year, representing a 4.2% decrease month-over-month and -1.1% year-over-year. The median sales price was $485,000 compared to $490,000 in the previous month and 475,000 in September last year, representing a 1% decline month-over-month and 2.1% increase year-over-year. in September 2024, the median prices reached a record high level compared to any previous September,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“The real estate market in the Crested Butte and Gunnison area for 2024 is down overall from 2023. We had been tracking pretty closely, but our late summer contracts were down so now we are seeing those effects. Anecdotally, there does seem to be more activity in the last month and the number of pending contracts is up about 12% from this time last year. For the overall area covered by the Gunnison Crested Butte Association of Realtors, sales are down 12% and dollar volume is down 7%.

“The number of sales and dollar volume is basically the same year over year for the area around Crested Butte. The number of single-family homes sold is down 14% and average prices are statistically the same. The number of condos and townhomes sold is up 20% and prices are up 3%.

“In the Gunnison area, the number of sales overall is down 29% and dollar volume is down 21%. The number of single-family homes sold is down 23%, but the average price is up 13%. The condo and townhome market tells a slightly more dramatic story with sales down 45% and the average price up 22%.

“Our inventory is about the same as it was last year, but as we head into the ‘stick season’ we are seeing price reductions and properties being withdrawn from the market with plans to come back on once the skiing starts. There are also properties coming up for sale now because they are available to be shown due to less vacation renters for the coming months. When priced correctly, these are going under contract quickly and sometimes above asking or with multiple offers,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“The typical seasonal slowdown is in full effect in Denver, as supply remains elevated, and homes spend a little more time on market than usual. In September, the average listing spent 42 days on the market before going under contract, a 7% jump from the previous month. There are nearly 3,000 current active listings on the market in the county, with the supply of inventory persisting just below this summer’s 11-year high of 3.9 months.

“The relatively high supply of inventory is especially prevalent in the townhouse/condo market segment, where there is over 5.1 months’ supply on the market, and homes are spending nearly two months on the market on average before a sale. Sold listings in the townhouse/condo segment have declined over 27% from this time last year, amidst budgetary pressures on buyers sparked by rising HOA, insurance, and general maintenance costs.

“Despite new dovish policy action by the Federal Reserve, the mortgage market hasn’t quite adjusted to recent positive inflation trends. With more inventory on the market and less motivated buyers than we’ve seen in years, there is certainly an argument to be made we are entering a true buyer’s market this winter season. My best advice to sellers to make your home stand out in this competitive environment is to do the work buyer’s may not be willing to do,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“While Douglas County has similar inventory supply levels to the rest of the Denver-metro market, homes last month took slightly longer on average to sell as home prices remain nearly equal to this time last year. Average time on market reached 46 days in September, a 10.8% increase month-over-month. For comparison, Denver County reached 42 days last month, and the Denver-metro area as a whole posted 41 days.

“The relatively slower market velocity is likely attributable to significantly higher prices in Douglas County. The median close price for homes sold last month was $690,000, over $100,000 higher than that metric for the entire Denver Metro Area. With the population of the county approaching 400,000 residents, entry-level workforce housing and affordability remain a key concern for local economic stability. Homes priced below $500,000 account for just 7.7% of the active inventory in the county.

“The luxury market (homes priced $1.5 million or above) in Douglas County struggled to pick up traction entering the fall season, with over 6.4 months’ supply of inventory on the market. Many high-end buyers are taking the ‘wait-and-see’ approach with the upcoming election and potential shift in economic policy entering the new year,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“In September, La Plata County single-family homes tracked in line with 2023 numbers regarding new inventory coming on market, which has been the case all year. The news is the jump in closings-sales are up 26% over last September, even with 2024 as a whole still trailing 2023 numbers by 5%. The median price has held steady in the previous twelve months, and we have 15% more inventory.

“Contrary to the single-family home market, condos and townhomes have experienced a jump – we have seen 28% more homes come on the market this year. Sales did not track at just 2% up, leaving us with a lot more inventory than at this period of 2023 – over 50% more for a 5.3-month supply. This makes for a huge change in the area markets.

“Our resort market ended its summer season with a total of 28% fewer sales and an inventory jump of 75% in condos and townhomes.

“With the rates having dipped, our affordability index stands 17% higher than a year ago which has been great news for buyers who had been struggling with purchasing at the higher rates. Additionally, we are seeing affordable housing inventory county-wide hit the market, which will put a small dent in our workforce housing crisis. Durango, Bayfield, and Ignacio are making affordable housing a much-needed priority after many years of neglect and rules for developers which were difficult to follow.

“Overall, it’s a robust autumn season, with contracts coming in and price reductions as the cold nights settle in, sort of a ‘last hurrah’ of sales as we start to approach slower holiday times for our market,” said Durango-area REALTOR® Heather Erb.

FORT COLLINS

“Remember when we all used to watch movies on VHS players? We used the ‘pause’ button at our own peril since it literally paused the tape moving from one side of the cassette to the other. You risked breaking the tape because of the tension created by hitting pause. That’s our current housing market.

“The ongoing tension created by the collective ‘pause button’ in the housing market persists. But what about the lower interest rates? Well, that was a short-lived benefit that a number of lucky buyers and mortgage re-financers took advantage of in late summer. With the most recent economic data showing a healthier than expected job market, the Federal Reserve is likely to remain steadfast in assuring inflation remains low while also guarding against recession. That tends to make the bookmakers in the mortgage markets disinclined to lower mortgage interest rates – so we are stuck at an average of 6.5% for a 30-year fixed mortgage rate – an interest rate threshold that all but guarantees the pause button for buyers will remain in place.

“The results of this tension are evident in the sales numbers for September. Days on market sits well above the two-month mark, list-price to sale-price ratio has dropped to 98.3%, and median sales price has fallen to a year-to-date low just under $587,000. Active inventory is up over 17% (continuing the trend throughout the summer months). Buyers in the market right now are clearly taking advantage of end-of-summer deals from sellers who have lowered their list prices and likely increased concessions to move buyers off the pause button to write offers and bet on lower interest rates in the coming year.

“The other elephant in the room creating palpable uncertainty is the impending election. It’s as if the entire country is holding its breath to see what the outcome will be, increasing the pressure on that metaphorical pause button,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/GARFIELD COUNTY

“Garfield County and several of its communities have been in the spotlight lately. In May, NBC News reporter Jasmine Cui penned an article focusing on the network’s “home-buying index,” a new model that sets out to rank the difficulty of buying in home markets by county across the nation. Despite what buyers and agents in the trenches have experienced for some time, it still came as a surprise to discover that Garfield County came in as the #1 hardest county in the nation in which to buy a home. Routt County and Mesa County came in 2nd and 3rd, respectively. To quote Cui: ‘All three Colorado counties have high cost and competition scores, indicating that homes are both expensive and going quickly when they hit the market.’”

“In September, Forbes magazine published an article that highlights the town of Carbondale which sits mid-way between Glenwood Springs and Aspen in a story about the cities where home values have grown the most in the last 20 years. According to data obtained from Zillow, the article states the median home value in Carbondale in August 2004 was $256,998. In the last 20 years that median has increased five-and-a-half times to over $1.44 million in August 2024. The article also stated that while Carbondale is wealthier than most cities in its size, its median household income is lower than expected at $92,083, while the household income for owner occupied homes is $133,333. It is clear not only low inventory and high interest rates have made home-buying difficult in Garfield County but also the fact that wages have not kept pace with the increase in prices. The City of Rifle came in 13th in the nation with a 339% increase from $109,019 in 2004 to $479,433 in 2024.

“The single-family market statistics for September show new listings in Garfield County down 4.8% (3 properties). Sold listings remained steady over last year, and there was an increase of 5.2% percent in the median sale price, coming in at $710,000 vs $675,000 last September. In contrast, the average sale price this year was $1,004,201, which was also a 23.5% increase over last September. Days on market tightened 18% from 94 days last year to 77 this September. Inventory remained steady at 195 active listings, which equates to a 3.7-month supply.

“The multi-family market was sluggish in September with 20 new listings coming on, a decrease of 13% (3 properties). Sold listings were down 31% (6 properties) and along with this decline, the median sales price came in at $525,000, a 12% decrease from $601,900. The average sale price for multi-family properties fell as well to $706,462, a 14% decrease from $822,543 last year. Average days on market was up 60% to 109. Currently, there were 50 active listings resulting in a 3.2-month supply which is up from 2.7 in September of 2023.

“It remains to be seen if and how the news spotlight regarding home values in our valley will affect sales. Will buyers think twice before making a move to the area? Will sellers hold tight to their perceived home values, even if the market softens? Will appraisers be able to quantify the news and use the market data when they value a home, even if the comparable sales are not comparable to the contract price?” asked Glenwood Springs-area REALTOR® Erin Bassett.

PUEBLO

“The Pueblo real estate market improved a bit in September with new listings up 12% compared to September 2023 and up 1.7% year to date. Our median price rose 5% from a year ago and sits at $315,000. There are clearly a lot more homes for potential buyers to look at with active listings jumping 17% to 869 compared to September 2023. Our average days on market sits at 91 days.

“The other side of the equation in our September market revealed pending sales that are down 11.3% year to date but up 21.7% compared to September 2023. Solds listings were also down 16.1% in September and are off 13.8% year to date. New building permits reached 24 in September, the same number we saw in August. Despite the increase in inventory and mortgage rates that have dipped a bit, buyers remain reluctant to jump in,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“New listings in Alamosa took a slight dip from last year, with year-to-date new listings down 4%. However, sold listings are up 6.5%, and the average sales price is still sitting in the mid-$300,000s.

Conejos County has not seen much change from last year to now, with the same number of new listings this September as last September. Prices remain affordable, with the median sales price coming in at $182,500.

“Costilla County has seen new listings increase 14%, with year-to-date new listings up 14.3%. The average sales price has risen 12.9%, now at $278,532.

“Mineral County experienced a significant decrease, with new listings down 66.7% from September 2023 to now, and sold listings down 16.7%. However, year-to-date we had a 35% increase in new listings and a 3.3% increase in sold listings. The median sale price is also down 13.2%, now at $486,000.

“Rio Grande County is down 28.6% in new listings compared to last September, with no change in sold listings. Year-to-date, we are seeing a 2.1% increase in new listings and a 1.4% dip in sold listings. The median sales price has risen 7.8% to $310,000.

“Finally, Saguache County remains steady with no change in new listings from September to September but has experienced a remarkable 400% increase in sold listings. They have also seen a significant 39% increase in new listings and an 11.5% increase in sold listings. The median sale price ticked up 0.7% to $337,500,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS/ROUTT COUNTY

“In Routt County, we’re still seeing increases in sales prices overall between 2023 and 2024 for the month of September and year-to-date. There are few areas where this trend is starting to reverse though. For example, townhomes and condos actually saw a decrease in 2024 in both the month of September and year-to-date. With buyers expecting the Federal Reserve to lower rates in September, many could have been waiting on the sidelines prior to that time, which would have influenced this data.

“During the month of September, both single family units and townhouses/condos had less of a disparity between median and average sales price. That tells us there were less blockbuster sales and more of the sales were hovering around the middle of the price range.

“Single-family homes have seen an increase in days on market both for the month and the year-to-date, whereas townhomes and condos are seeing a decrease. There could be a plethora of reasons why this is happening, but the gap between these categories is decreasing.

“Percent of list price has increased and now hovers between 97% and 98%. This is interesting because, while pricing is starting to level, homes are now selling closer to asking price. Sellers may have a better understanding of the market, or it could imply that competition among buyers is still strong. Inventory and sold listings are lower in 2024, so it’s likely a combination of both factors,” said Steamboat Springs-area REALTOR® Travis Crooke.

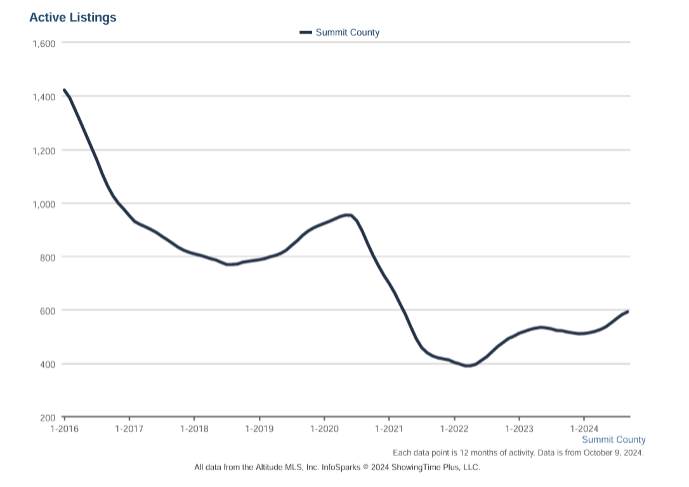

SUMMIT, PARK, AND LAKE COUNTIES

“The real estate market in Summit, Park, and Lake counties saw some interesting trends in September 2024. Inventory was up 29%, sales dropped 8%, yet average pricing increased 21%. How does that add up? Well, context matters.

“Despite the increase in available listings, inventory levels are still low compared to pre-COVID times. The rise in listings follows a record low in 2022, so even though more properties are hitting the market, supply remains below historical norms. The region continues adjusting to a ‘new normal’ post-pandemic. Also, a high-end sale over $10 million can easily skew the average price upwards.

“In Summit and Park counties, the median sale price in September 2024 was 3.6% higher than the same time last year. Single-family homes averaged $2.26 million, while multi-family homes sold for an average of $1.04 million. The 27% increase in new listings from last year has created about 7.5 months of inventory, shifting the market closer to favoring buyers. About one-third of sales had a monetary concession,” said Summit-area REALTOR® Dana Cottrell.

Average single-family home sale prices by region:

- Summit County: $2,845,598 (42 sold)

- Park County: $650,133 (15 sold)

- Lake County: $611,000 (1 sold)

Multi-Family Homes:

- Summit County: $1,070,511 (79 sold)

Among the 763 active residential listings, prices vary widely. The most affordable listing is a single-family home in Park County at $178,000, while the priciest is a nearly $19 million luxury home in Breckenridge. Sales (139) for the month spanned from a $135,000 mobile home in Park County to a $10.9 million single-family home in Breckenridge. Notably, 44% of transactions topped $1 million, and 40% of all sales were cash purchases. These numbers exclude deed restricted, affordable housing, land and commercial.

TELLURIDE

“In September, San Miguel County’s real estate market demonstrated resilience, with a total dollar volume of approximately $106 million via 52 transactions. For the third quarter of 2024, the year-to-date volume was about $791 million with the average price per square foot up 13% from 2023. At the end of September, the average price per square foot for a home sale in the town of Telluride was up 39% compared to the same time in 2023. Recently, a condominium at Riverwatch sold for $4,778 per square foot, the highest price per square foot for a home or condominium ever in the town of Telluride or the Mountain Village. This sale was a private ‘off’ the MLS transaction.

“Despite the above notable sales, the overall market is slowing in the number of transactions and inventory is building up as compared to the same time last year. For the first time in about four years, were seeing asking prices drop mostly in the bottom one third of the market and a few with comments ‘bring any and all’ offers. Buicks are moving off the lot slower and Bentleys are selling briskly,” said Telluride-area REALTOR® George Harvey.

VAIL

“September delivered several factors that impacted and created variables in different segments of the market. The macro-economic factors of the economy, volatility of mortgage rates, and variability of local market conditions were the key factors.

“Unit sales for the month were down 17% compared to the same time last year. Single-family/duplex sales were down 28% compared to last year while condo/townhome were down 7.3%. This is the trend we have been seeing year to date driven by the new product availability in condo/townhome development. Pending sales are strong with particular emphasis on single family/duplex properties, up 96.9% versus September 2023. Inventory is becoming balanced with 52% single family and 47% condo townhome – which is still low by historic standards. However, the months’ supply of inventory hit 6.5 and 4.4 in their respective categories which is indicative of the current level of demand.

“The trend in market niches is remaining consistent with 31% in units under $1 million and 9% of dollars. The top niche of $5 million-plus representing 12% of units and 42% of dollars. This leaves 57% of the units and 49% of the dollars between the low and high niches.

“The fourth quarter of the year is what we refer to as the shoulder season and then transitions into the ski season real estate market. Due to less traffic in the early part of the season buying opportunities can become enhanced and it’s often a good time to consider being a buyer in the market,” said Vail-area REALTOR® Mike Budd.

Seven County Denver area Total Market Overview (single family and condo/townhome):

Statewide Market Overview (single family and condo/townhome):

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The September 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.