Subdued home buyers and sellers push inventory higher across the state as the waiting game continues

ENGLEWOOD, CO – Parties on both sides of the housing transaction continued their waiting game going into the early November election, keeping a close eye on not just the results of the presidential election, but speculation about further interest rate reductions, the economy, and geo-political factors as well. These elements all contributed to a very cautious pool of homebuyers and helped push inventory higher in markets statewide, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado.

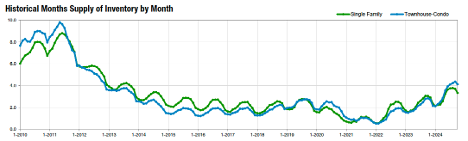

“While Denver has consistently been characterized as a seller’s market throughout recent years, current trends indicate a moderate shift toward a buyer’s market this winter season,” said Denver-area REALTOR® Cooper Thayer. “With 3 months of single-family inventory and over 5 months of townhouse/condo inventory on the market, we’re seeing a changing negotiation dynamic in our transactions. Average time on market rose to 42 days last month in the City and County of Denver, its highest level since February, and around 80% higher than the typical October figure over the past 3 years. This has provided buyers with more leverage and more time than usual, a great position to be in a negotiation.

Despite the potential buyer advantages, their behavior continues to be governed by caution.

“Buyer demand continues to be subdued, leading many sellers to reduce their prices in an effort to attract interest,” said Boulder/Broomfield-area REALTOR® Kelly Moye. “While there were initial hopes that market activity would pick up after the election, it’s still too early to draw any conclusions, as the anticipated surge in buyer engagement has yet to materialize. While some buyers are taking advantage of the situation, others continue to wait. Most REALTORS® anticipate a busy first quarter of 2025 when this pent-up demand will finally absorb the inventory and our market will be more robust.”

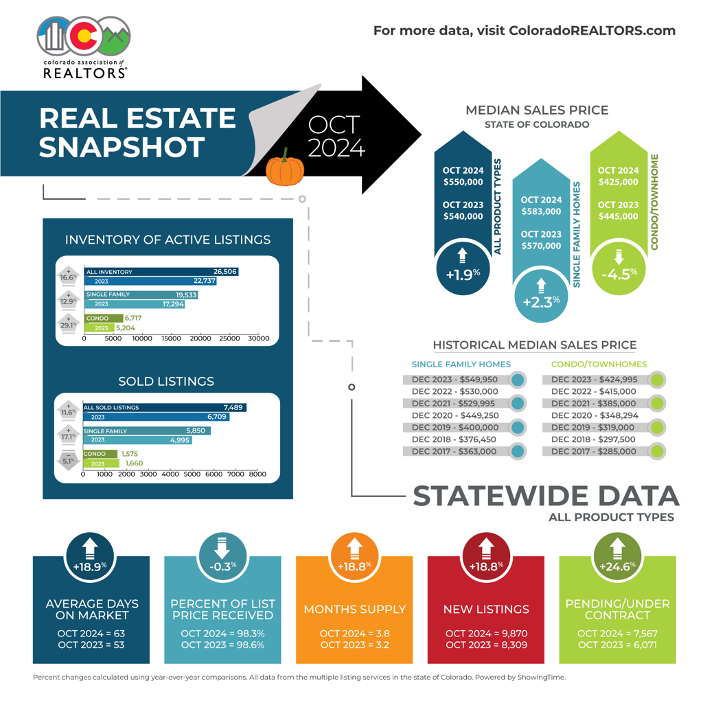

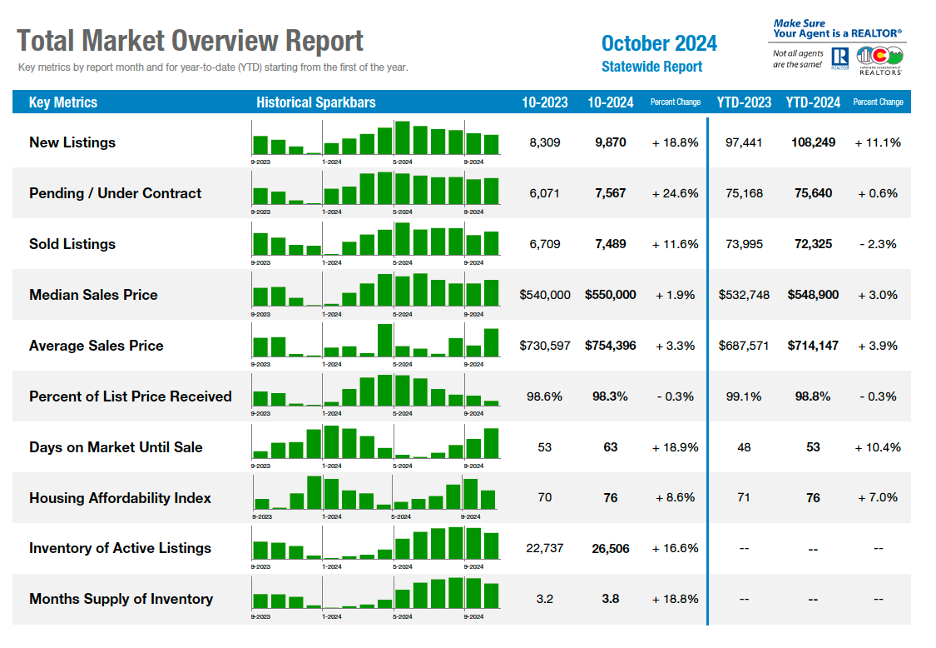

Inventory of active listings is up 14% year-over-year in the seven-county Denver metro area, and up 16.6% statewide. At 3.5 months’ supply of inventory in the Denver-metro area and 3.8 months statewide, the supply continues to hover at levels not seen in more than a decade.

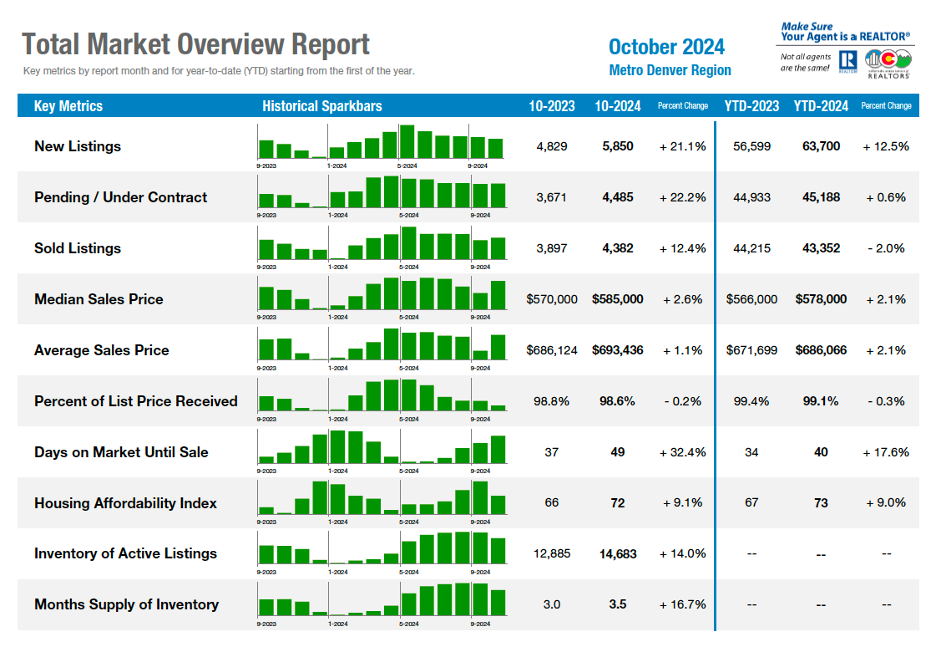

Seven-County Denver Metro

Statewide

“An enormous number of buyers (and sellers) are just waiting in the wings during this high-interest rate phase in our economy,” said Fort Collins-area REALTOR® Chris Hardy. “Pent-up housing demand is like holding your thumb over the end of a water hose,” Your thumb (high interest rates) is stopping the natural flow of the water (real estate sales), but the pressure builds up behind your thumb until the water starts to squirt out the sides. This is what we’re seeing in the real estate market right now.”

The pent-up demand and inventory increase are having little to no effect on median pricing.

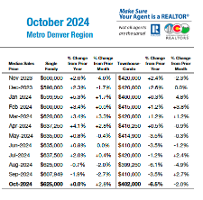

Median Sales Price Denver Metro Region

Median Sales Price Statewide

Looking at the statewide market, sold and pending/under contract homes were up significantly from a year prior and despite the volume of active inventory, it was not enough to keep year-over-year median pricing from ticking up in the single-family home category.

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“There’s some good news for Aurora-area buyers as they welcome more housing inventory and choices not seen in perhaps more than a decade. Inventory in most Aurora, Adams County, Arapahoe County and Centennial zip codes is up. Sold inventory is also up, which indicates that buyers are absorbing much of the additional inventory. Sold prices are relatively flat with most Aurora Zip Codes seeing only a 2-3% increase over this time in 2023. Adams County is at a median price of $530,000 with approximately 1,300 homes on the market. Arapahoe County has a median price of $599,000 with almost 1,300 single-family residential homes on the market. Aurora has a median price of $529,000 and 1,053 homes currently on the market. While the number of sold properties are up, the number of days on the market are also up. This is good news for buyers who may have a little more time to make a decision, and more inventory to choose from with prices remaining very close to pricing from this time last year.

“It seems that the townhome/condo market is offering buyers great choices and seemingly significant price reductions over this time last year. A home for the holidays is a great opportunity for buyers right now with the option to possibly sleep on the choices. This is an option that buyers simply have not had for several years,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“In Boulder and Broomfield counties, the current real estate market is characterized by a 14% increase in active listings with homes sitting on the market for an average of 55 days. Despite more inventory, home prices remain relatively flat compared to this time last year, with the average sales-price-to-list- price ratio holding steady at 98%. Buyer demand continues to be subdued, leading many sellers to reduce their prices in an effort to attract interest. While there were initial hopes that market activity would pick up after the election, it’s still too early to draw any conclusions, as the anticipated surge in buyer engagement has yet to materialize.

“The expected interest rate reduction never came, and the election caused ‘buyer anxiety’ which slowed the market and created a sluggish real estate environment. Areas of opportunity seem to be in the attached dwelling market where there are 20% more new listings in Boulder County, and a whopping 33% more listings in Broomfield. Buyers hoping to purchase a townhome or condo have options and motivated sellers are offering their listings at affordable prices. While some buyers are taking advantage of the situation, others continue to wait. Most REALTORS® anticipate a busy first quarter of 2025 when this pent-up demand will finally absorb the inventory and our market will be more robust,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Have we seen the first break in trend that may bring some reprieve to buyers? Maybe, maybe not. The good news is we sold 21.4% more listings year-over-year, but we were also up 30% on active listings across the Pikes Peak Region. The median price fell year over year for all properties. Although it is just one month, and it only fell 2.4%, could this be the start of the reprieve some buyers are waiting for? With days on market continuing to stack up, and price drops hitting the market daily, it will be a trend to watch as we work through the next few months. Nationwide though, median price rose 3% from a year ago.

“Many thought that the election was holding buyers and sellers up. Although I don’t personally believe this was true. The economy is hard, prices are high, and buyers are very cautious. The data coming out in October showed why there is apprehension in the economy. Only 15% of small firms planned on hiring over the next 3 months. The share of small business owners saying it was hard to fill jobs also fell to 34% – the lowest since 2021. Mortgage rates stayed elevated, and after the election results were made final, rose further. U.S. consumers saw a 14% chance of missing a debt payment in the next 3 months, the highest since 2020. Americans earning less than $50,000 a year saw a 20% chance of delinquency. And for those making over $100,000, they saw an 8.4% chance, which was the highest since 2014. Debt is breaking the backs of the consumer, businesses, and the country. We could drop a long list of retail and restaurant chains that are either closing stores or admitting they have seen major consumer weakness.

“Looking into the future, the Federal Reserve dropped rates .25% again in November. I don’t think this will change much, but it should be noted for our report. We must continue to keep an eye on the commercial mortgage-backed securities market. The delinquencies there are continuing to rise. Unless we can figure out our debt issue, the rest seems futile. And let’s not forget, foreclosure moratoriums are on track to end at the end of the year. Can a new sitting president curtail all of this? I know many are hopeful. But the economy is a massive machine that is not easy to turn. Does housing avoid the rise in delinquencies that other parts of the economy are already seeing? Usually not. It will be an epic year ahead to watch and cover the housing market and economy,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“In the Colorado Springs housing market, the incremental increase in supply has raised the supply level to 3.4 months; in October 2021 and 2022, it was 0.6 and 0.5 months, respectively. This elevated level of supply is highly desirable because, in a normally balanced market, the supply level is between 4 and 6 months. Buyers currently have excellent opportunities due to high inventory levels, motivated sellers, and dropping interest rates.

“On the other hand, the election made it abundantly clear that the economy and affordability remain a hugely significant challenge for the American people. The highly unpredictable election introduced a significant level of caution among buyers and sellers, with many stepping aside, waiting for the outcome. The president-elect, during his campaign, made weighty comments about the need to improve housing affordability and supply. However, significant concerns among economists, home buyers, and sellers remain about potential impacts on housing affordability due to the president-elect’s anticipated proposal for higher tariffs on imports, which usually lead to increased consumer prices and inflation. Regrettably, this can radically fuel the wait-and-see posture among home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

Active Listings – Supply: In October 2024, the number of single-family/patio homes for sale in the Colorado Springs area was 3,394, representing a tiny 0.1% increase month-over-month and a whopping 35.5% increase year-over-year, and the highest level of inventory in September since October 2015. Overall months’ supply of active listings was at a healthy level of 3.4 months. For homes priced under $400,000, supply was 2.9 months; homes between $400,000 and $600,000 at 3.0 months, homes priced between $600,000 and $1 million at 4.1 months, and 6.5 months for homes priced over $1 million.

Sales – Demand: There were 998 sales of single-family/patio homes in October 2024, compared to 933 in the previous month and 851 in October last year, representing an increase of 7.0% month-over-month and a healthy 17.3% year-over-year. The monthly sales volume was up 11.5% month-over-month and 17.4% year-over-year. The year-to-date sales volume was down 3.1% compared to last year. However, looking back 10 years to October 2014, the monthly and year-to-date sales volumes are up 123.1% and 122.8%, respectively.

Days on the Market: The average number of days on the market in October 2024 was 44, the same as last month and 45 days in October last year.

Price Reductions: In October, 44.2% of active listings in El Paso County and 30.7% in Teller County had price reductions.

Sales by Price Range: Last month, 26.3% of the homes sold were priced under $400,000, 45.9% between $400,000 and $600,000, 22.2% between $600,000 and $1 million, and 5.6% over $1 million. Year-over-year in October 2024, there was an 18.5.0% increase in the sale of single-family homes priced under $400,000, a 14.2% increase in homes priced between $400,000 and $600,000, a 23.3% increase in homes priced between $600,000 and $1 million, and a 9.8% increase in homes priced over $1 million.

Average & Median Sales Prices: Last month, the average sales price of single-family/patio homes was $557,741 compared to $535,023 in the previous month and $556,964 in October last year, representing a 4.2% increase month-over-month and only 0.1% year-over-year. The median sales price dropped to $475,000 from $485,000 in the previous month and last October, indicating a decline of 2.1% both month-over-month and year-over-year. In October 2024, the average prices reached a record high level compared to any October previously.

CRESTED BUTTE/GUNNISON

“The real estate market in the Gunnison – Crested Butte area has been kind of a rollercoaster. We started the year a bit busier than 2023 and then things really slowed down as we headed into the summer. This is typically our busiest time of year, so it was concerning when July brought lots of visitors to town, but not much real estate activity. Things started to pick up again in late August and the showing and contract activity has continued into our off-season. Overall, the year is on track to have the same number of sales as 2023, but there is more under contract so we may end up slightly ahead.

“Our inventory is up slightly overall, but not substantially. On average, prices continue to remain steady. In some specific areas and property types, average sales prices are down as much as 2-4% and some are up as much as 10%. Remember that average prices are just that and because we don’t have huge numbers of sales, it will be important to look at sales in the last year when determining the value of your property and to be as targeted as possible when making calculations.

“Many sellers have taken their properties off the market for a couple of months to get a fresh start when ski season starts. As we prepare for 2025 and the coming winter, it is likely that more properties will come up for sale and that buyers will continue to look to the area as a special Colorado ski town where they want to spend time. A “wait and see” strategy could likely mean paying more and having more competition when you make an offer – especially for properties that are priced correctly. Real estate in the area continues to be a good investment, but more importantly, this area continues to be a place where life is good and people want to be,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“While Denver has consistently been characterized as a seller’s market throughout recent years, current trends indicate a moderate shift toward a buyer’s market this winter season. With 3 months of single-family inventory and over 5 months of townhouse/condo inventory on the market, we’re seeing a changing negotiation dynamic in our transactions. Average time on market rose to 42 days last month in the City and County of Denver, its highest level since February, and around 80% higher than the typical October figure over the past 3 years. This has provided buyers with more leverage and more time than usual, a great position to be in a negotiation.

“While pricing has remained steady in the single-family market, the townhouse/condo market has been particularly impacted by high levels of inventory. Median sales prices came in at just $400,500 for the month of October, a 12% decline from last year. For comparison, single-family median sales prices are up from last year by about 2.3%, at $675,000 for the month. But prices alone don’t tell the whole story. Over 55% of closed transactions in Denver in October logged seller concessions, with an average concession amount of $8,760. This means, on average, net pricing has actually decreased by around $4,000 per transaction on average beyond the posted decrease in sales price.

“We’ve seen buyers taking advantage of this more favorable environment, utilizing the competition between sellers to seek out better deals. The average list-to-close price ratio in Denver last month was just 98.2%, meaning on average, buyers were able to close on their homes for 1.8% below asking price. With election uncertainty now behind us, it looks like we may be setting the stage for a busy spring. However, interest rates, insurance premiums, and HOA costs are still challenges for buyers to overcome, and spring activity will likely be contingent upon some relief in those areas,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“Even in this challenging market, Douglas County continues to prove its exceptional desirability, posting near-record sales prices last month. Median close prices in October rose 5.1% month-over-month to $725,000 – just shy of the all-time monthly record of $731,000 experienced in April 2022. Despite the number of sales remaining at relatively normal levels, overall transaction volume exceeded $400 million last month, the first time October sales reached that level since 2021.

“Patience has proven to be the key in this market, with over 3 months of inventory for sale and affordability challenges creating hurdles for new homeowners. Listings in Douglas County spent an average of 50 days on the market in October, marking a roughly 100% slowdown from the summer season. Slow isn’t bad, though, and we have found certain adjustments in strategy to keep clients successful in this environment. One piece of advice to sellers is to emphasize differentiating your listing from the abundance of supply on the market.

“Today’s homebuyers have much more time to make decisions and negotiate and are spending a higher percentage of their income on housing costs, driving them to be much more cost-conscious. The most successful listings today are those that are more unique and/or put in more preparation work than comparable properties on the market. Sellers should focus not only on addressing potential areas of concern before listing, but also consider going ‘above and beyond’ to make their listing stand out more,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“October started out with a flurry of closings, but by the end of the month, winter weather had arrived and with it, we saw quite a few active listings withdraw for the season. This was especially pronounced in our rural areas. Even with homes withdrawing from the market, looking at our numbers, La Plata County has quite a bit more home inventory than last year at this time. Purgatory and Vallecito resort areas are firmly in the buyer’s market category with at least 7 months of inventory. In-town, Durango clearly remains a seller’s market hovering around a 3-month supply, and it is also the only area with any significant median increase in 2024.

“As we see in every presidential election cycle, some buyers with discretionary income will hold off on home purchases until the election has been decided. We expect these buyers to return to purchase soon.

“The only thing you can count on about the La Plata County real estate market is the quiet time between Thanksgiving until after the first of the year, and we are now headed into that season for home sales outside of our resort market. That resort market exception is where we look forward to a busy winter season with Purgatory opening weeks before we usually have significant snowfall. Our visitors will soon be on their way for holiday shopping of homes, hopefully boosting our sales up north which had a less than stellar summer season.

“Of note this past month is the affordable inventory coming on market, with new deed restricted subdivisions and dozens of move-in ready homes in Bayfield and Ignacio that are easing a fraction of the housing strain of our working community,” said Durango-area REALTOR® Heather Erb.

FORT COLLINS

“’Simba! You are more than what you have become!’ These words of warning came from the late great James Earl Jones voicing the character of Simba’s father, Mufasa, in Disney’s Lion King. This warning applies to our current housing market as we stand on a precipice overlooking a host of frothy economic data following the conclusion of the long-awaited presidential election.

“Let’s start with the economy since that’s the primary driver of what determines mortgage interest rates. Broadly speaking, the U.S. economy is on solid footing with inflation hovering near the Federal Reserve’s target rate of 2%. The unemployment rate for October is just over 4% – a level that indicates a bit of balance between jobs available and job seekers (the Fed doesn’t like an overly hot job market). Consumer spending remains robust. All of these indicators led the Fed to reduce their rate by .25% at their most recent meeting. One might think that with all this rosiness, mortgage interest rates would also participate in this economic-feel-good-vibe. Sadly, no.

“Wall Street investors had already priced in the quarter point reduction weeks ahead of the recent Fed meeting, so those who closed on homes in early October and had locked down their rate in late September received the lion’s share of lower mortgage rates. At the time of this writing, the stock market has rallied based on the election being over but major investors have flocked to the bond market in anticipation of the next presidential administration’s proposed economic policy which is perceived to be inflationary, causing the government to likely need more money to pay its bills. This is pushing the yield of 10-year treasury notes higher, which in turn, drives up the cost of 30-year mortgage interest rates.

“What does this have to do with our market being more than what it has become? If you consider that a humongous number of buyers (and sellers) are just waiting in the wings during this high interest rate phase in our economy, pent-up housing demand is like holding your thumb over the end of a trickling water hose. Your thumb (high interest rates) is stopping the natural flow of the water (real estate sales), but the pressure builds up behind your thumb until the water starts to squirt out the sides. This is what we’re seeing in the real estate market right now. Some buyers are willing to accept a higher interest rate now because they know they might have a more competitive opportunity to get a house they want without having to compete as aggressively as they would when the thumb comes off the end of the hose and all the buyers are in the market looking for homes at the same time.

“This is why we are seeing such paradoxical numbers in the sales data right now. Sales in Fort Collins were up 29% year-over-year – but that is to be expected since it was this time last year that we saw the severest drop off in sales due to the previous year’s spike in interest rates. In September 2024, when interest rates started to drop into the mid to low 6% range, buyers jumped in quickly. Sellers saw this as an opportunity and decided to put their houses on the market so they could take advantage of the lower rates for their replacement property purchase (listings are up nearly 9% year over year). That’s also apparently why the median sale price has crept up to $628,850 year over year. Year-to-date, the median price is up just 2.2%.

“Combine those numbers with a clear economic demographic shift and you’ll see the bulk of houses being sold right now are to home buyers less sensitive to interest rate fluctuation. The vast majority of homes being sold in our area right now are in the $500,00 to $1 million range and the year-over-year sales numbers in that price band are all in positive territory. This tells us that the majority of buyers in the market right now are those buyers who have the wherewithal to withstand higher interest rates from money they have in other investments, money they have cashed in on the increase in value of their existing homes, or the money they have enjoyed since the post-pandemic bump up in wages.

“Time can only tell how long the high interest rate thumb will remain over the housing sales hose. But when interest rates come down into the low 6% range, as some economists are predicting for 2025, prepare for our market to be more than what is has become,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/GARFIELD COUNTY

“Fall In the Roaring Fork and Colorado River valleys did not bring a substantial change in new listings over last October. In the single-family sector, new listings were down 10%, with 58 new homes entering the market compared with 65 in 2023. Pending sales remain steady with 59 homes under contract versus 55 last October. Days on market did see a substantial adjustment from 92 days last October to 69 days this October. The most significant change in the market came to our buyers in the trenches and median home price. The median home price in October 2023 was $590,000. This October, we saw an increase of 23.5% for a median sales price of $728,400. The month of October ended with 181 active single-family homes on the market which equates to a 3.4-month supply.

“The multifamily sector saw similar lack of excitement with 20 new listings coming on in October compared to 16 in 2023. There were 20 multifamily units under contract at the end of October, compared to 13 at the end of last October. Days on market did increase from 51 to 70, there were 47 active listings at the end of the month versus the 43 the market saw in October of 2023. This keeps our month’s supply steady in multifamily with 2.9 months’ supply this year versus 2.6 last October. The big change in the multifamily sector was a softening of the median sales price which fell 17.6%. October 2024 saw the median sales price of the condo townhouse market settling in at $515,000, a $115,000 reduction from 2023.

“With the long-awaited election past us, REALTORS® on the street are looking towards the future and the hope of interest rate changes helping to bring new product to buyers anxiously waiting,” asked Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Compared to this time last year, we are making a little headway, but not by much. Active listings have increased giving buyers more choice, but affordability remains the challenge. The greatest number of available listings are in the $400,000-$600,000 range however, with no improvement in the interest rates, buyers are still forced to sit on the sidelines.

“Our median price in October was just under $400,000 and the more affordable condo/townhomes are in short supply. Although active listings grew slowing, October was the lowest month since last February,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Month-over month increases for the Pagosa Springs market included inventory (+21% at 222 homes),

median sales price (+4.6 % at $527,500), average sales price (+23% at $850,543), and the number of days homes were on the market before being sold (+51.9% at 120 days). Year-over-year increases included new listings (+6.3% at 578 homes), median sales price (+9.2% at $599,000), average sales price (+15.4% at $771,356), and the number of days homes were on the market before being sold (+28.2% at 123 days).

Year-to-Date Average Home Price $771,356

Year-to-Date Median Sales Price $599,000

Actives Homes & Condos on Market 222

“Relative to 2024, brave sellers placing homes on the market have received a gain from October 2023. Unseasonally high temperatures and a large increase in pricing (compared to 2023 pricing) likely increased October listings. High interest rates, higher home prices, together creating high monthly mortgages, and a 7-month supply of home inventory are keeping homes on the market longer. Sellers are adapting to the consequence with patience in selling and listing earlier than anticipated to meet their goals. Currently there are 222 homes and condos on the market for sale. About half of the inventory (109 homes) is priced at $600,000 and up.

“Land inventory is decreasing as properties are placed under contract and winter inventory diminishes. Prices for 2025 land prices are positioned to be higher than 2024 prices as recent land assessments have escalated. November and December sales will likely reveal the true 2024 real estate picture for Pagosa Springs, especially with early winter snowstorms bringing more snow than normal for fall,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“Pueblo’s real estate market showed some positive numbers in October with new listings up 30.2% compared to 2023 and up 4.3% for the year and active listings jumped 24.9% to 892. That activity has pushed the months’ supply of homes up 39.5% to 5.3 months and sits on the cusp of a balanced market.

Pending sales were up 10% compared to October 2023 and sold listings rose 9.45% compared to October 2023, although we remain down 11% year to date. Our median price is up 3.2% year to date at $319,900.

“The percentage of list price received ticked up 0.7% and sits at 98.4% while the average days on market fell in October to 77 days, down 12.5%.

“With the election behind us, the market should get a little boost and NAR economists are predicting interest rates will stay in the 5.5% to 6.5% range in 2025,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“The Steamboat Springs real estate market demonstrated growth in the single-family home segment for listings. Year-to-date, new listings have increased 25.7%, while the median sales price rose 28.1% to $2,249,000. The townhome and condo market has seen similar upward trends with median sales price reaching $846,00 – a 22.3% year-over-year increase. Even with increased listings, inventory remains limited, which has contributed to rising prices across property types, despite the slight increase in days on market for single-family homes.

“In the outlying areas, market conditions vary. In Clark, where inventory remains low, sale prices have been higher while sustaining a longer time on market. The Hayden market has seen a few more new listings with stable price growth. Hayden appeals to buyers looking for a rural lifestyle and more accessible price points compared to Steamboat. Oak Creek, however, has experienced a decline in both median and average sales prices, as well as a 33.3% reduction in sold listings, largely due to 26.5% fewer listings. Days on market for this south Routt area sits at 91 compared to 61 last year. These communities offer diverse housing options for those drawn to the Steamboat area but seeking alternatives outside the main resort hub,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“Inventory is up 30%, median prices are down 13%, and the numbers of sales are up 18%. With the various factors keeping prices high over the last few months, it is the sellers who are negotiating and dropping their prices to get their places sold before the snow flies.

“Single-family homes in Summit and Park counties had a median sale price of $1,025,000 and the average was $1,756,498. While the median price was down the average price was up showing that higher end homes are also moving.

Average price of a Single-Family Home sold this October:

Summit County $2,425,969 37 sold

Park County $ 716,546 37 sold

Lake County $ 765,000 1 sold

Average price of a Multi-Family Home sold this October:

Summit County $ 897,023 71 sold

“Among the 651 active residential listings in Summit, Park and Lake counties, the most affordable listing is a single-family home in Park County priced at $178,000, while the most expensive is a luxurious single-family home in Breckenridge, listed at nearly $19 million.

“October’s 174 sales in Summit, Park and Lake counties saw a wide price range as well, with the lowest a home in Park County for $120,000 and the highest was a single-family home in Breckenridge for $8.8 million. Forty-one percent of the transactions had a sales price exceeding $1 million and 34% of sales were cash. These numbers exclude deed restricted, affordable housing, land and commercial,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“Telluride and the greater San Miguel County year-to-date transactions sit at 394, down 28% compared to the same period in 2023. However, total dollar volume through October is $871.2 million, up 17% compared to 2023 for the same period of time. The town of Mountain Village continues to drive the dollar volume of sales with $220.8 million with price per square foot falling 8%. The town of Telluride had a dollar volume of $131.3 million, with prices per square foot increasing 43% so far this year.

“An interesting observation is the amount of marketing by long time successful real estate brokers as listings sit at an all-time low and the number of agents in our market slightly increasing. I don’t see this situation changing in the near future or even for several more years. New inventory takes two to three years to build in this market and percentage of motivated sellers is still low,” said Telluride-area REALTOR® George Harvey.

VAIL

“October is the shoulder season between summer and ski season which traditionally is stable on activity. However, this year, between the election and macro-economic issues, there have been some significant swings in the market. New listings are stable at plus 2% and total inventory is positive 3.7%. Months’ supply of inventory is down 2% to 4.8 months, which is still below the 6 months considered a stable market. Closed unit sales are down 14.6% however, pending sales are contributory as they are positive 39.5%, a big jump from a typical month.

“October had some interesting activity when we go into a bit more depth in analysis. As previously mentioned, transactions were down 14.6% compared to October 2023. However, dollar sales were up 43% versus last year. The variance is the most significant swing for any month this year, or in recent memory. The opening price niche represented 31% of units and 10% of dollar volume in 2023 versus 37% of units and 8% of dollars on 2024. The top price niche is the catalyst for the swing with 6% of transactions and 19% of dollars in 2023 compared to 18% of transactions and 56% of dollars in 2024. This swing was driven by a handful of transactions at the very top end of the market. We have never experienced a swing this significant in the past.

“If the post-election stock market is an indicator of the potential impact on our ski season market, the next few months could be interesting. At this point everything is speculative, and inventory will be the key to the future market,” said Vail-area REALTOR® Mike Budd.

Metro Denver Region

Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.