Sluggish sales, flat prices, and lackluster buyer demand define housing markets statewide as buyers and sellers continue to wait it out

With no immediate return to low interest rates or home prices of prior years, buyers, sellers and REALTORS® look for a fresh start and opportunities in first half of 2025

ENGLEWOOD, CO – The uninspired, wait-and-see attitude that dominated the state’s housing markets for most of the year continued through November, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado.

The overall scenario is most evident in “…lackluster sales, flat prices, and sluggish buyer demand. The hopeful expectation that something better is around the corner, whether it be lower interest rates or more homes on the market, has lulled buyers and sellers into inactivity,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

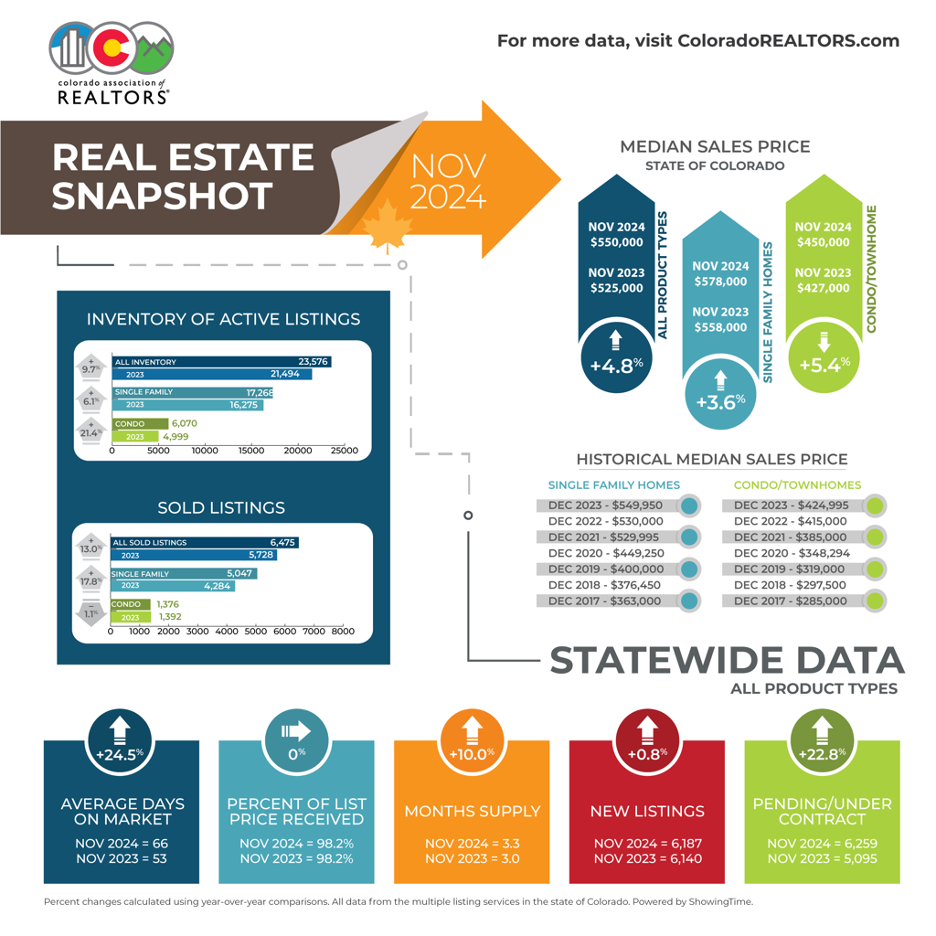

Although active inventory and the overall supply rose throughout the summer and into the fall season, it was not enough to bring buyers back to the market with any conviction as higher interest rates and higher prices created gridlock.

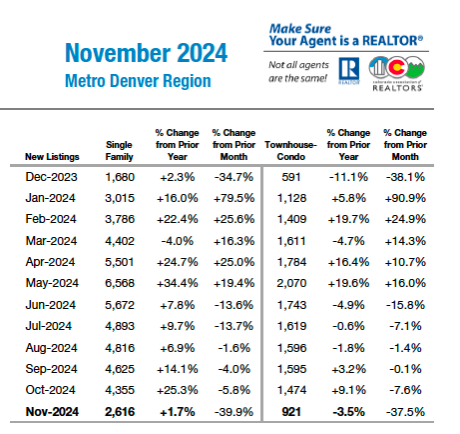

New listings of single-family homes fell nearly 40% from October to November in the seven-county Denver-metro area, while condo/townhome new listings were off more than 37%. Pending sales for single-family homes also fell more than 10% while condo/townhome were off more than 6% from October to November. The number of homes that closed in November also fell 14% month-over-month, while condo/townhome sales were off nearly 11%.

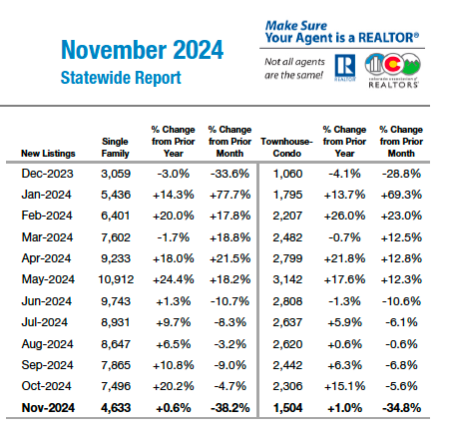

Looking at markets across the state, new single-family home listings fell more than 38% while the condo/townhome market saw a nearly 35% decrease in those new listings. Pending sales fell 13.6% for single-family homes and 6.4% for condo/townhomes. Closed sales were off 14.2% and 13.4%, respectively for single-family and condo/townhomes.

In numerous markets across the state, including Denver, approximately half of the homes are being sold below asking price and a smaller pool of buyers and sellers are working through buyer-favored concessions that sellers buying down interest rates and covering closing costs.

News Listings Seven County Denver Metro

New Listings Statewide

“Pricing remains resilient, although we’ve seen a growing number of homes pulled off the market, likely due to the lack of interest and contract offers,” said Colorado Springs-area REALTOR® Patrick Muldoon. “That seems to be the market dichotomy. Homes that sell continue to push the median price up, and on the reverse side, many sellers simply cannot get their homes sold.”

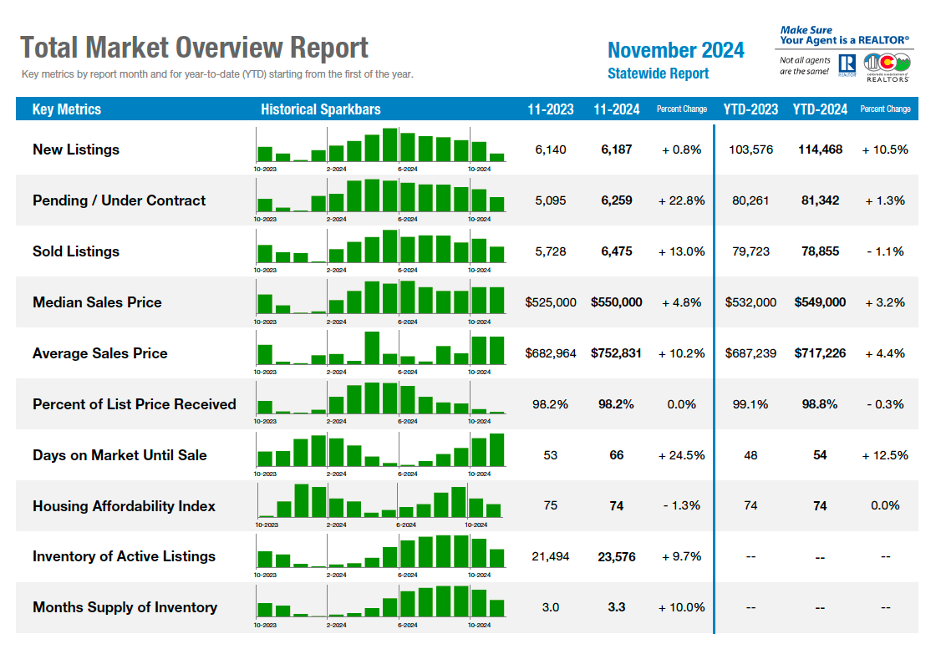

Median pricing in the Denver-metro area remained relatively flat for single-family homes at $620,000, while the $421,500 median price on a condo/townhome represented a 5.4% increase from October to November. Statewide, the results were similar with single-family homes down less than a half a percent from October to November at $578,000 and condo/townhomes up just shy of 6% to $450,000.

“Affordability…is the single biggest factor governing the current real estate market right now,” said Fort Collins-area REALTOR® Chris Hardy. “When there’s a substantial section of potential home buyers and home sellers sitting on the sidelines (as much as 30% or more), what remains are the homebuyers and sellers that have motivation to buy and/or sell that are not directly related to affordability. In many regards, homebuyers and sellers, post-election, continue to hold their breath as the next administration fills its roster and prescribes policy that will undoubtedly affect perceptions of affordability in the coming year.”

“The current market continues to reflect a new normal, with no immediate return to the low interest rates or home prices of prior years. As the new year approaches, the market has the potential for a fresh start, offering an opportunity for the first and second quarters of 2025 to recover from the sluggish performance of 2024,” added Moye.

Seven-County Denver Metro

Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“We’re closing out 2024 with some very interesting market dynamics in Aurora. Although listing inventory is up compared to a year ago, there are just 1462 current active listings, including townhomes and condos. Pending sales sit at 539 and sold listings in the past 30 days were 414 including all product types. We continue to have a strong market with listings, pendings, and solds all up compared to 2023. That would stand to reason given that we have more homes for sell right now compared to a year ago. In addition, our average days on market is also up as are price reductions on listed homes.

“Over the past 30 days in Aurora, we have seen a total of seven solds over $1 million; 21 over $800,000; 16 over $700,000; 54 over $600,000; 84 over $500,000 and 111 in the past 30 days over $400,000.

“The median price in Arapahoe County is $569,900 and Adams County came in at $535,000. Clearly, the more moderate homes priced in the $400,000 range are the most appealing to our buyers. Payments and affordability are major concerns for buyers. Buyers are finding that there are sellers willing to pay some closing costs or help buy down the interest rate. Sellers are realizing that they need to put their best foot forward with a home that needs few, if any, repairs, shows well and is priced appropriately if they want to get the sale done. The good news is that we are seeing a more balanced market in Aurora,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“The real estate market in Boulder and Broomfield counties has lacked vitality for most of the year and as we close out 2024, this scenario is most evident in lackluster sales, flat prices, and sluggish buyer demand. The hopeful expectation that something better is around the corner, whether it be lower interest rates or more homes on the market, has lulled buyers and sellers into inactivity.

“While listings are up 12% in both counties, the lack of choices remains a point of contention for buyers. Those buyers who recognized an opportunity to negotiate on price or receive concessions from sellers have taken advantage of this market. However, home prices in both counties remain flat, with no appreciation since the beginning of the year. More than half of homes sold below asking price, with concessions increasingly common, often benefiting buyers through reduced interest rates or covered closing costs.

“Homes took longer to sell, giving buyers more time to make decisions, although Broomfield properties are selling at a relatively brisk 35 average days on the market while Boulder’s homes are taking longer at 56 days on average. Many of those properties sold in those time frames only after one or more price reduction.

“The current market continues to reflect a new normal, with no immediate return to the low interest rates or home prices of prior years. Buyers, sellers and REALTORS® need to practice acceptance by acknowledging current conditions and not holding out for something to change. As the new year approaches, the market has the potential for a fresh start, offering an opportunity for the first and second quarters of 2025 to recover from the sluggish performance of 2024,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“The housing market continues its march up on values as witnessed with a 3.3% increase in the median price across all properties in the month of November. This continues to keep buyers sidelined, waiting for any signs of affordability. We added inventory year over year with a 26.2% increase of properties on the market. We had hoped additional inventory would bring buyers back to the market. We were told buyers were on the sidelines due to a shortage of homes to choose from, but that does not appear to be the case since the average days on the market was also up. Buyers are gridlocked with high rates and high prices.

“Pricing remains resilient although we’ve seen a growing number of homes pulled off the market, likely due to the lack of interest and contract offers. That seems to be the market dichotomy. Homes that sell continue to push the median price up, and on the reverse side, many sellers simply cannot get their homes sold.

“With U.S. household debt jumping another $147 billion in Q3, to another new all-time high of $17.94 trillion, it is hard to imagine this continuing. Twenty percent of small businesses saw their sales drop over the last three months, the highest since 2020. According to National Federation of Independent Business (NFIB) data, these conditions are worse than both 1991 and 2008. And yet, here we are with housing pushing up.

“The Federal Reserve may drop rates again shortly. This shows they may have some concern for the economy, but that does not seem to be bringing home prices down any time soon. Until we see home prices drop, or rates drop, it is going to leave a lot of buyers on the sidelines and permanent renters. A sad time for would-be homeowners,” said Colorado Springs-area REALTOR® Patrick Muldoon.

CRESTED BUTTE/GUNNISON

“As we near the end of 2024, I think most people are excited to say goodbye to this year and move into 2025. This year has been tough in real estate, but in the Gunnison Valley, it will end up being pretty similar to 2023. The area covered by the Gunnison Country Association of REALTORS® will likely end up with fewer overall sales, but it will be close. For Crested Butte, 2024 will end up with more sales than 2023 since we have already surpassed that number, but it will likely be up less than 10% from last year.

“Today, two different pundits expressed that buyers in resort areas are getting older and richer and continue to likely pay cash for their real estate purchases. This helps explain why our average and median prices continue to go up, even in the face of longer days on market and slowing sales in general. Our inventory continues to be quite low and there are certain segments of the market where it is very challenging to find something to buy. The increase of average prices is helped by the number of large, luxury homes at prices exceeding $5 million, a relatively new segment in this area. The area’s highest-priced, single-family home ever just came on the market at $16.6 million.

“Affordable housing will continue to be a challenge, but there are several projects in the works that should help some people find housing in the coming years. The desire to be in the Gunnison Valley does not seem to be waning, and I anticipate 2025 will bring more properties and buyers to the market,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“A ‘wait and see’ attitude characterized the fall market this year, and it seems to be continuing into the winter. Buyers and sellers who took the waiting approach with the election have now found new reasons to ‘wait and see,’ as the election (unsurprisingly) didn’t really impact the real estate market. The result of over-waiting is a slight exaggeration in the normal seasonal slowdown we typically expect. Average time on the market reached 50 days in Denver County last month, nearly exceeding this year’s typical January peak of 52 days and surpassing last year’s January peak of 45 days. Nearly reaching a three-year high average time on the market this early in the winter season may be indicative of an even slower market to come in December and January.

“While delaying a move to next year in hopes that rates will cool off isn’t necessarily a bad idea (especially for buyers with tighter monthly budgets), there can be some downsides to entering the market once spring comes around. Last month, the supply of inventory on the market began to retreat quickly off the 12-year-high supply of homes we’ve had on the market since May, signaling a likely departure from the rare buyer’s market we’ve experienced in recent months. If you’re a seller, this is great news, as you now have less relative competition with just 3.1 months’ supply of inventory on the market rather than close to 4 months. But for the buyers who have been waiting, now may be your last chance to take advantage of a market slightly more favorable to you than we’ve seen in years.

“Despite strange inventory dynamics this year compared to what we’re used to, home prices have held steady in the Denver market, with November posting a median close price of $587.500, a 5% increase from 12 months ago. However, we are seeing a significant number of seller concessions, which means our median close price figure may be slightly inflated, though not significantly. Over 57% of Denver closings last month reported a seller concession at an average amount of over $9,600. This means that buyers are negotiating in different ways than just the sales price, often opting for rate buydowns and closing costs to be covered instead of a slightly lower sale price on the home,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“In November, 432 listings closed and just 351 new listings came on the market, easing the supply of inventory down to 2.6 months. This is the first month since June that inventory has fallen below the three-plus months of supply level in Douglas County. However, even with some relief from higher inventory, the market is still experiencing its effect, compounded by the natural seasonal slowdown. This year’s high inventory levels have increased the median time on the market to 34 days last month, elevated by about seven days when compared to the past two-year November average of 26.5 days.

“Despite a high inventory year, elevated mortgage rates, and a slowing market velocity, home prices in Douglas County have yet to show any signs of weakness. Year to date, the median close price of single-family homes is nearly $740,000, posting a 2.8% increase over the same figure last year. The median close price for the month of November alone has cooled moderately as expected, down from this year’s May peak of $765,000 to $745,000 (-2.6%) for single-family homes.

“The real surprise in November, however, is the condo/townhouse market displaying significant signs of strength. Last month’s median close price for the segment came in just below $500,000, spiking up +13.6% month-over-month, nearing the county’s all-time high of $523,000. Only 53 condo/townhouse listings closed last month, which could partially explain the spike in close prices. Inventory decreased slightly to a healthy 2.5 months of supply in the segment, with 178 active listings on the market,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Newly listed November homes in La Plata County took a dip compared to October – a normal ebb and flow of our seasonal market as winter approaches and fewer people list their homes. Just 35 new single-family homes came on the market, a reduction of 47%. The number of newly listed condos and townhomes dipped 32% to 17, which is still an 8% increase from November 2023 for residential combined.

“Some homes have come off-market for the season, leaving us with fewer homes for sale; this amounted to 18% fewer single-family homes and some condos and townhomes compared to October.

Our median price for single-family homes has been flat over the past 12 months, and condo/townhome pricing jumped 7.7%. This jump reflects the new projects ready for occupancy that weren’t available the previous year and don’t reference a particular home’s value jumping. For example, in November 2024 compared to November 2023, the median price of townhomes more than doubled from $489,000 to $1 million. Taken out of context, it can look like prices are rising rapidly when indeed they are flat like the rest of our inventory’s sales.

“On a side note, November is the first time in memory that the average price for condo/townhome sales in the resort area exceeded single-family home sales. Seven of the 12 November condo/townhome sales were above $1 million, including an extraordinary sale of a Purgatory Lodge penthouse for $2.1 million.

“La Plata County home sales have been flat in number year to date compared to last year (797 sales in 2024 vs 793 in 2023), and our overall inventory is climbing. REALTORS® expect to see a bump in sales in 2025 with buyers returning to the market. Some of the potential 2024 buyers were election-hesitant, and some were waiting on rates to come down. Whether or not anything changes in the market, we believe buyers will be more bullish about making a decision and diving in,” says La Plata County-area REALTOR® Heather Erb.

FORT COLLINS

“Affordability, whether it is simply a gut feeling or a conclusion drawn from detailed data analysis, is the single biggest factor governing the current real estate market right now. Yes, year-over-year median price continues to rise (up 1.9% from last year) but median price across the market as a whole has become a less reliable marker of actual appreciation over time due to the dynamics of affordability.

“When there’s a substantial section of potential home buyers and home sellers sitting on the sidelines (as much as 30% or more), what remains are the home buyers and sellers that have motivation to buy and/or sell that are not directly related to affordability. These are transactions of necessity; a job change, a family change, displacement due to flood, storm surge, wildfire, etc. There’s also a significant portion of the active buyer pool accepting a higher interest rate and making a bet on that interest rate moving lower over the short term. The luxury market, generally comprised of the top 5% of a given market’s price points, on the other hand, has remained fairly robust with substantial year-over-year gains in the number of sales over $1 million and $2 million increasing 26% and 140%, respectively. Affordability for this market segment is certainly less sensitive to prevailing interest rates.

We see hints of the affordability issue within the sales data in terms of an increase in days on market (up 19% year over year), percent-of-list-price received (98.6%), and the under-reported number of transactions subject to seller concessions where sellers are providing substantial incentives to buyers in the market to help partially alleviate the affordability anxiety. We’ve also seen an uptick in price reductions for homes listed that have languished due to an initial list price that was betting on lower interest rates that have remained stubbornly volatile, unpredictable and higher than what the zeitgeist of affordability.

“In many regards, home buyers and sellers, post-election, continue to hold their breath as the next administration fills its roster and prescribes policy that will undoubtedly affect perceptions of affordability in the coming year,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“Looking at our market year-to-date compared to 2023, Mesa County is positive in all categories. However, when looking at the actual number of sold transactions, we are up just 1.2% over 2023.

“Comparing November 2024 to November 2023, the statistics are a roller coaster of up and down. New listings for the month were down more than 16%, solds were flat, but pending sales spiked 32.5%. It will be interesting to see what the closed transactions look like in December.

“The average price in November hit a new high for Mesa County, going over $500,000 for the first time at $511,333. Median price was also up at $410,000. The percent-of-list-price received was down slightly to 97.5% with average days on market up to 88. Our months’ supply of inventory is gradually creeping up, now at 2.9 months, it is slowly, slowly moving a little closer towards a balanced market,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“It’s been a challenging year for the Pueblo real estate market with the only real plus being new listings, up 2.1% for the year. However, overall listings were down 25.2% in November compared to November 2023. Pending sales were up in November 2024, but down 9.2% year to date. Sold listings were down 1.4% in November 2024 and down 9.8% year to date.

“Buyer activity remains an issue as would-be owners sit on the sidelines waiting for rates to come down. We expect to see rates in the 5.5% to 6.5% in 2025.

“The median price rose 11.6% in November and is up 3.7% year to date at $319,000. Sellers are offering a lot more price reductions which has helped some but not a lot. The percent-of-price received is holding at 98% in November 2024 and 98.4% year to date. Average days on market came in at 97 for November, up 25%, and sits at 90 days year to date. These numbers bring the market closer to a buyer’s market with a five-month supply of homes.

“It hasn’t been a great year for builders either and November delivered just 25 new permits,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

Looking at markets across the San Luis Valley, REALTOR® Megan Bello shared the following summaries:

Alamosa County:

New listings were down 30% compared to last November, but sales increased 12.5%. The median sales price grew slightly, rising 3.8% from $289,000 to $300,000. However, the average sales price decreased slightly (-1.8%), from $303,375 to $297,978.

Conejos County:

New listings doubled, but sales decreased for November. This could be attributed to the sharp increases in both the median and average sale prices, which rose from $201,025 to $585,000. Year-to-date numbers provide a more balanced view: the median price dropped from $252,000 to $195,000, while the average sale price increased from $310,751 to $332,019.

Costilla County:

New listings were down 14.3%, but sales surged 250%. The median sale price fell from $235,000 to $192,000, while the average sale price increased slightly, from $235,000 to $242,671. Year-to-date numbers indicate a steady rise in the median sale price, which grew from $217,500 to $260,000.

Rio Grande County:

This county experienced the largest change in sold listings, with a 57% increase. Both the median sale price and average sale price have seen significant growth with the median price increasing 58.6%, from $290,000 to $460,000, and the average sale price jumped 85.7%, from $258,200 to $479,449.

Saguache County:

Both new and sold listings were down compared to last year. However, the median sale price increased 19.3%, rising from $335,000 to $399,500, while the average sale price climbed 32.9%, from $310,338 to $411,020.

STEAMBOAT SPRINGS/ROUTT COUNTY

“The Steamboat Springs real estate market continues to reflect its status as a world-class ski destination, with demand driving notable growth across various property segments. Year-to-date, new listings for single-family homes with a Steamboat address have risen 19.6%, and the median sales price climbed to more than $2.1 million, a 22.2% increase from the previous year. The townhome and condo market has also experienced 34.8% more listings, with a 26.4% increase in the median sales price to $850,000.

“Inventory variety remains a challenge. The months’ supply for homes stayed constant at four – multi-family saw only a modest increase, keeping the market competitive for buyers. Steamboat’s mountain lifestyle and seasonal appeal continue to draw high-value transactions, affirming its reputation as a premier resort community.

“The surrounding communities present a diverse set of market dynamics, offering alternatives to Steamboat’s premium pricing. Hayden’s inventory has realized 20 more listings than last year with stable price growth and average sales price year to date at $574,493, up 4.1%. Meanwhile, Oak Creek’s market reflects a mixed landscape with 22% fewer single-family listings. There was a slight 1.8% increase in median sales price for November but a year-to-date decline of 11%. Months’ supply for Hayden and Oak Creek hover around three months. These neighboring communities offer more attainable price points for buyers outside Steamboat’s core and underscore the varied opportunities available across the region for primary residences, vacation homes, and investment properties,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“The allure of mountain living continues to draw buyers, but sales activity across Summit, and Lake counties remains flat so far this year. However, the story doesn’t end there. Prices are climbing and seller concessions are becoming a key strategy to close deals.

“In Summit County, the numbers paint a complex picture. Active listings surged 28%, and median prices rose 6%. Meanwhile, the pace of sales tells a different story. Single-family homes are taking over 20% longer to sell, and multi-family properties are on the market 86% longer than before.

“For single-family homes in Summit and Park counties, November’s median sale price reached $1.185 million, with an average of $1.788. This range indicates strong activity in the lower-priced segment of the market during the month. While these numbers reflect a decline compared to November 2023, the year-to-date average price has risen an impressive 11.7%, signaling continued long-term growth despite recent fluctuations.”

Breaking it down further:

- Summit County single-family homes averaged $2,767,247, with 35 homes sold.

- Park County saw an average of $605,902 across 24 sales.

- Lake County recorded one single-family home sale at $830,000.

For multi-family homes, Summit County’s average price came in at $846,322 with 85 units sold.

Market Extremes: Affordable to Ultra-Luxury

Among the 591 active residential listings, prices range from a $139,000 mobile home in Breckenridge to a breathtaking $19 million luxury estate, also in Breckenridge. Sales for November reflected this spectrum, with the lowest transaction at $220,000 for a Park County home and the highest at $6.9 million for a single-family property in Breckenridge.

Notably, 23% of November’s transactions exceeded $1 million, and 36% were cash sales—which is a bit down compared to previous months.

“This year’s market dynamics are unique, with prices climbing despite flat sales and extended listing times. These figures exclude deed-restricted affordable housing, land, and commercial properties.

As 2024 progresses, the interplay of higher prices, increased inventory, and economic conditions will shape the market’s trajectory, offering opportunities and challenges for both buyers and sellers in the picturesque mountain regions,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“So far this year, the Telluride regional market has proven to be very consistent from month to month with the town of Telluride leading in average sales prices up 40% compared to 2023 prices and the town of Mountain Village down 12% in average sales price. The rest of San Miguel County average sale price increased 28% through the end of November. Yes, inventory has increased but only by about 10% over an 11-month period.

“Almost all national real estate prognosticators are predicting a good real estate market in 2025 with a little more inventory and continued strong buyer interest. We see the same for Telluride with sellers still in the driver’s seat at the upper end market price points, but some downward price pressure in the bottom one third of the market. The United States currently has the largest concentration of wealth in the top 5% of our population than at any other time in the last 100 years. That being said, we’ve also had the lowest percentage of first-time home buyers in the real estate market ever. I do not see that situation changing for several years. High end resort markets will continue to do well next year with the challenges of local affordable housing increasing even more,” said Telluride-area REALTOR® George Harvey.

VAIL

“The November performance for the Vail Market was similar to October in showing a positive trend from last year and this year to date, which improved our year-to-date sales to a positive 8.9%.

The month of November was positive 56% in units and 53% in dollars compared to November 2023. The strong performance compared to last year has been driven by new development product hitting the market along with a consistent trend on existing units.

“The under $1 million and $1-$2 million niches represented 75% of units and 30% of dollars for the month. Compared to 2023, these niches represented 58% of units and 23% of dollars. The top niche at $5 million-plus was 15% of units and 55% of dollars for 2024 and 13% of units and 45% of dollars in 2023. If the three niches are combined for 2024, they represent 90% of the transactions and 85% of the dollars.

“Pending sales are not as strong as the October numbers but still show a 59.5% increase over 2023. Pending sales remain strong from November and bode well for the impending months. Overall, inventory is basically flat compared to a year ago which has lowered the months’ supply of inventory to 4.5 which is lower than a year ago due to the current market activity. Average days on market is up 65.5% from last year which is a factor of new construction and mix of inventory versus availability in key price points.

“Looking forward to 2025 we feel good as our market trends are positive, albeit somewhat different than historical. The key will be the macro-economic factors and their impact on our buyer profile,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The November 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 26,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.