February delivers increased housing inventory, but interest rates, affordability, and uncertainty continue to fuel buyer caution

ENGLEWOOD, CO – February brought another influx of housing inventory to markets across the Denver-metro area and state however, new and growing inventory outpaced the pending and closed sales driving active listings higher, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado. A growing pool of active buyers are seeing not just more inventory to choose from but some long-awaited negotiating power as sellers offer concessions on a large number of contracts. Yes, good news for buyers however, Interest rates in the mid 6% range, as well as overall affordability factors continue to keep sales in check.

“While the conditions might suggest an uptick in activity, the cautious approach of buyers has tempered expectations, leaving sellers to adjust their strategies and pricing in an effort to attract interest and complete sales. As the market continues to evolve, it remains to be seen when buyer confidence will fully return,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

A total of 4,284 new, single-family listings hit the seven-county Denver metro area in February, up 12% from January and 13.2% from a year prior. Condo/townhome new listings also rose more than 10% in the past month. The 1,654 new listings are up 17.5% from February 2024.

“Alongside this increase in new listings, we are also observing a rise in properties going under contract. However, the pace at which homes are going pending has not kept up with the influx of new listings, leading to an overall increase in inventory,” said Evergreen-area REALTOR® Julia Purrington Paluck. “Buyer activity is on the rise, with local lenders reporting climbing loan inquiries and applications. Nevertheless, buyers are approaching the market with caution, often hesitant making offers and during negotiations.”

Statewide, the 6,937 single-family new listings were up 3.6% from January to February and 8.3% from a year ago. The 2,489 condo/townhome new listings in February represent a 3.8% increase in the prior 30 days and are up nearly 13% compared to a year ago.

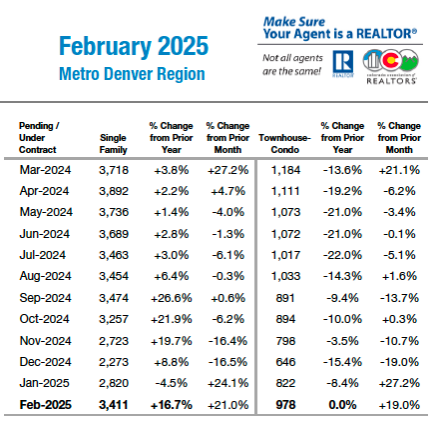

PENDING/UNDER CONTRACT – DENVER METRO AREA

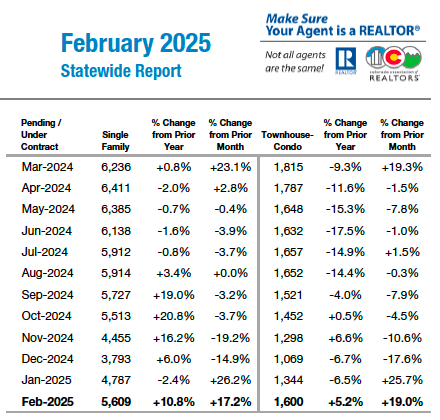

PENDING/UNDER CONTRACT – STATEWIDE

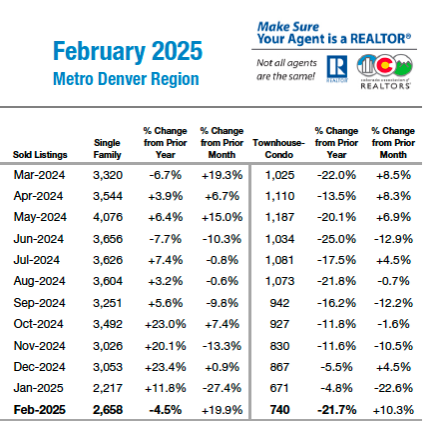

SOLD LISTINGS – DENVER METRO AREA

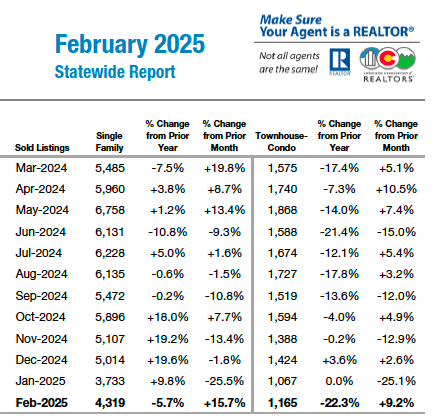

SOLD LISTINGS – STATEWIDE

Single family active listings in the Denver-metro area are up nearly 15% from a year prior at 8,019 properties with the condo/townhome active listings up just shy of 33% at 3,562. Statewide, active listings dipped slightly over the past 30 days but remain up nearly 17% from a year ago at 15,140 single family homes. The 6,048 condo/townhomes listed in the active category represent a 4% increase from January to February and are up more than 34% from a year ago.

The median sales price for single-family homes in the seven-county Denver metro area rose just shy of 2% from January to February and the $620,000 median is 3.3% higher than a year ago. Condo/townhomes in the Denver metro area remained flat over the past 30 days and are off 3.6% from February 2024.

Statewide, the $575,000 median price of a single-family home increased just shy of 1% from January to February and is up 3.6% from a year ago. The $409,000 median condo/townhome price across the state reflects a 1.9% dip in the past 30 days and is -4.2% from February 2024.

“Now, the inventory of homes is abundant. However, buyers are paralyzed by fear stemming from unprecedented economic and job uncertainties, an incredibly turbulent political climate, and horrendous inflationary and affordability challenges. Regrettably, these factors are severely undermining consumer confidence in making housing purchases,” said Colorado Springs-area REALTOR® Jay Gupta. “However, the current abundance of available homes presents a fantastic opportunity for buyers to find properties that suit their preferences. It also allows them to negotiate more favorable offers with motivated sellers. In this market, sellers must price their homes competitively and stage them attractively to entice buyers.”

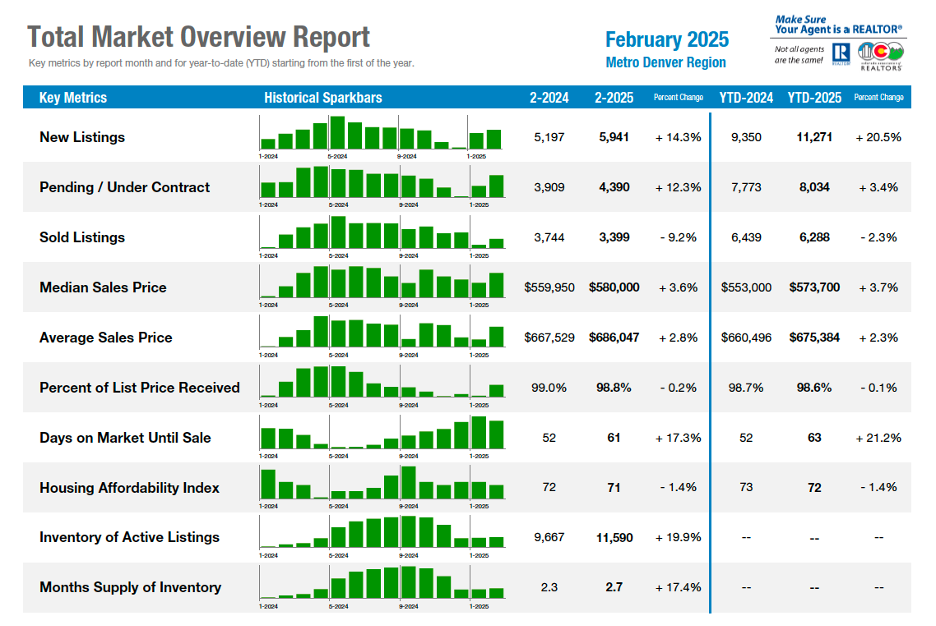

Total Market Overview – Seven-County Denver Metro

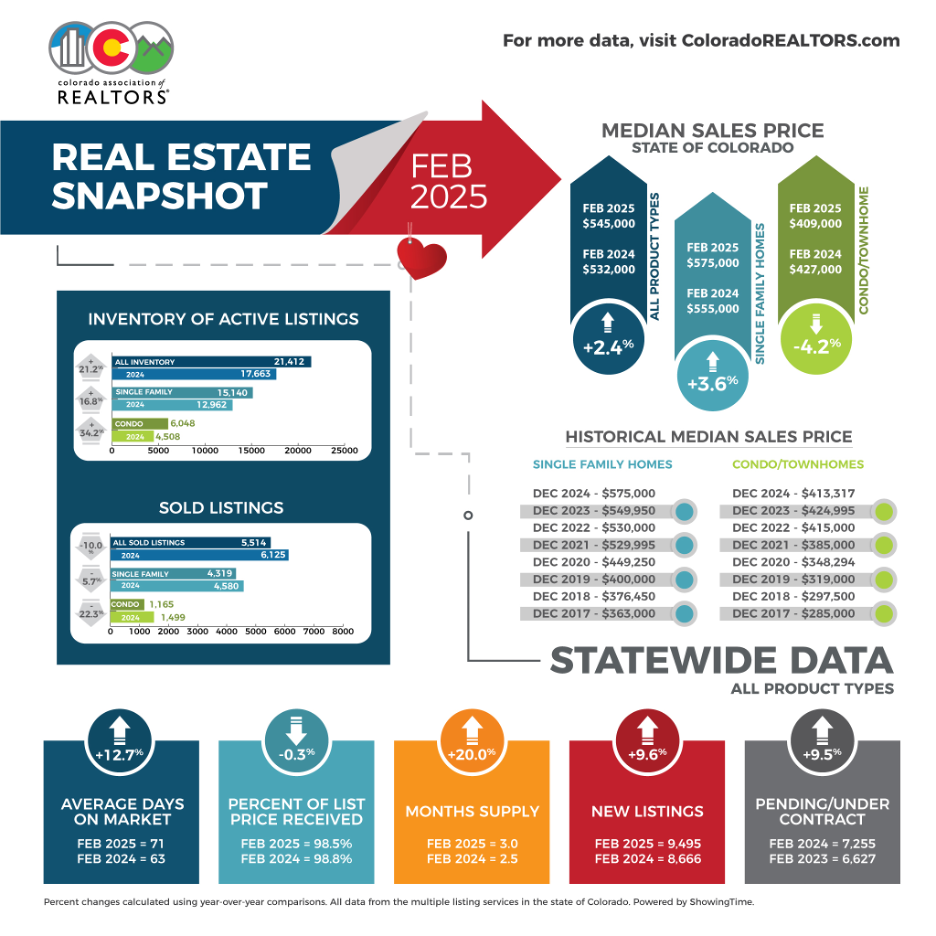

Total Market Overview – Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Spring is just around the corner. The flowers are starting to pop and new listings are popping up everywhere as well as we hit just over 900 single-family and close to 1,000 multi-family listings in Aurora in February.

“By zip code, the opportunities break down like this: 80010 and 80011, in the original Aurora area, there are 107 active listings with a median price of $445,000. Prices in this area are up 7% over February 2024. In the 80013 zip code, we have 150 active listings with a median price of $518,000. South Aurora zip code 80015 has 104 active listings and a median price of $572,000. In 80016, we have 139 active listings with a median price of $802,500. Zip code 80111 has 20 active listings and a median price of $1,113,750.

“Sold properties are up just slightly over this time last year and prices are up just slightly as well. Our market continues to show growth in inventory and very small increases in pricing. Average days on market is up slightly, giving buyers a little more time to think over their offer. We’re seeing many sellers willing to help with concessions to buy down the interest rate or pay some closing costs for the buyer.

“There are tremendous opportunities in the condo and townhome markets where active listings are up 51% over 2024 and median price, $365,000, is down 3.7% from a year prior. Condos and townhomes are a great way for buyers to get their foot in the door of homeownership. As typical for this time of year, we will see more inventory as we move through spring however, we will see more buyers entering the market as well,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“As the spring season approaches, the housing market in Boulder and Broomfield shows some encouraging signs, with listings up 6% providing buyers with more options. However, while inventory is growing, buyers are showing hesitation in pulling the trigger on new purchases. Single-family home prices in Boulder have dropped 2% as sellers are increasingly willing to negotiate in order to close deals. Despite the increase in available homes and pent-up buyer demand from 2024, homes are staying on the market longer, with average days to sell rising to 79 days in Boulder and 55 days in Broomfield.

“The warmer weather and increased inventory give the impression that a robust spring market is on the horizon, yet the lack of buyer confidence and urgency remains a significant factor holding back what is traditionally a highly active real estate season. While the conditions might suggest an uptick in activity, the cautious approach of buyers has tempered expectations, leaving sellers to adjust their strategies and pricing in an effort to attract interest and complete sales. As the market continues to evolve, it remains to be seen when buyer confidence will fully return,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Strange times in the housing market right now. Both locally and nationally, we continue to see a major dichotomy in homes that sell, and homes that sit. Higher-end homes continue to move, as seen in our local numbers. While median price rose 3% year over year on all property types, we sold 9% fewer homes, and we added 26% more homes on the market. The math does not add up. And we’re also starting to see some economic shifts that could spell a disaster if they are not corrected, and quickly.

“Looking at some data to see where we may be headed, we found out that 90-day lates on automobile loans hit a 14-year high. The Atlanta Federal Reserve said they believe the first quarter of 2025 will show a negative 1.5% GDP. Top that off, we found out FHA has been paying loan servicers not to foreclose. The delinquency rate is over 11%. It should also be noted that unemployment appears to be going up, corporate bankruptcies are up, and debt is up. I wonder how many other lenders were not foreclosing and how bad the loan situation is if we had all the real numbers. It’s speculation on my part, but we are also seeing short sales in the MLS increasing as we progress through the year. None of this screams strong economy and if unemployment spikes, it could cascade into housing quickly.

“If you are a buyer, rates are dropping and that is opening opportunities that we did not have. Renting will still be less expensive, but owning a home is also nice. Sellers, you may be on borrowed time. If we see inventory continue to come to the market this spring, you could see this flip to being a buyers’ market. You want to be priced right, expect to pay 1-2% in buyers lending costs, and understand buyers are very finicky. They know the market is softer, and they are not typically rushing into a home. They are taking their time and making sure they are making the right decision. A major shift from a few years ago,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“An astonishing shift has occurred in the real estate market. Previously, sellers were fearful to sell their homes due to high interest rates, clinging to their low-interest mortgages. This situation made it challenging for eager buyers to find suitable homes. Now, the inventory of homes is abundant. However, buyers are paralyzed by fear stemming from unprecedented economic and job uncertainties, an incredibly turbulent political climate, and horrendous inflationary and affordability challenges. Regrettably, these factors are severely undermining consumer confidence in making housing purchases.

“However, the current abundance of available homes presents a fantastic opportunity for buyers to find properties that suit their preferences. It also allows them to negotiate more favorable offers with motivated sellers. In this market, sellers must price their homes competitively and stage them attractively to entice buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

Gupta shared these key highlights from the Colorado Springs Market:

- Active Listings – Supply: In February 2025, there were 2,425 single-family and patio homes listed for sale in the Colorado Springs area. It represented a significant year-over-year increase of 32.5%, although there was a 3.5% drop compared to the previous month. The inventory level was the highest for February since 2014. The overall months’ supply of active listings stood at a healthy 3.3 months. For homes priced under $400,000, the supply was quite low at 2.5 months. Homes priced between $400,000 and $600,000 also experienced low supply at 2.9 months. In the price range of $600,000 to $1 million, the supply was healthy at 4.3 months. However, for homes over $1 million, the supply was abundant at 7.8 months.

- Sales – Demand: Last month, 730 single-family and patio homes were sold in the Colorado Springs area, representing a moderate increase of 4.9% compared to the previous month but a 7.8% decline compared to February last year.

The monthly sales volume increased by 4.0% from the previous month, but there was a small year-over-year decline of 1.9%. Year-to-date sales volume is up 6% compared to last year. However, compared to February 2015, 10 years ago, the monthly and year-to-date sales volumes massively increased 123.2% and 132.1%, respectively.

- Days on the Market: The average number of days on the market in February 2025 was 62, compared to 68 days last month and 53 days in February last year.

- Price Reductions: Last month, 37.3% of active listings in El Paso County and 17.8% in Teller County had price reductions.

- Sales by Price Range: Last month, 27.7% of homes sold were priced under $400,000, while 46.4% sold for between $400,000 and $600,000. Homes priced between $600,000 and $1 million accounted for 21.5%, and those over $1 million represented 4.4% of the sales.

Comparing February 2025 to the previous year, there was a 15.9% decline in the sale of single-family homes priced under $400,000 and a 12.2% drop in homes priced between $400,000 and $600,000. In contrast, a 4.5% increase in homes priced between $600,000 and $1 million and a notable 14.3% increase in homes sold for over $1 million.

- Average & Median Sales Prices: Last month, the average and median sales prices of single-family and patio homes reached historically high levels for February, at $544,170 and $473,500, respectively. The average sales price rose 6.4% year-over-year and a massive 40.7% since February 2020, 5 years ago. Similarly, the median sales price climbed 3.8% year-over-year and 38.9% since February 2020.

DENVER METRO (11-County)

“Slowly but surely, the Denver-metro real estate market is picking up pace as we enter the spring selling season. Median home prices increased sharply last month as more homes were listed for sale, climbing 4.3% compared to January. Buyer demand, however, has remained slightly sluggish due to elevated interest rates but the market continues to show signs of resilience. The median time on market for listings reached 30 days in February, a welcome reduction from the year’s January high of 45 days. The combination of lower-than-typical buyer demand and an uptick in new listings hitting the market has resulted in higher relative inventory, with currently about 2.5 months’ supply of homes for sale on the market.

“With over 9,500 homes now actively listed for sale, homebuyers are beginning to feel more confident as their negotiating leverage improves. While interest rates pose a challenge, the prevalence of sellers offering rate buydowns in the form of concessions is quite common. Sellers are still generally seeking top dollar for their homes, while also understanding that extra marketing efforts and value propositions are required to differentiate themselves from the competition when buyers have more options available.

“Looking ahead, the Denver metro real estate market is expected to continue to gain momentum as we move into the spring season. Although inventory levels are expected to increase with the warmer weather, demand from buyers, even if somewhat tempered by interest rates, will likely continue to improve, keeping the market dynamic and fast-paced. Potential buyers and sellers should prepare for continued competition and prioritize staying informed about market trends to make strategic decisions,” said Denver County-area REALTOR® Cooper Thayer.

CRESTED BUTTE/GUNNISON

“On average, January and February are the slowest months for closings in the Crested Butte/Gunnison real estate market so it can be difficult to predict the future based on what happens at the start of any given year. This year, sales are up slightly in the first two months and up slightly from 2023 to 2024 as well. The overall Gunnison-Crested Butte Association of REALTORS® had four more sales (up 6%) for just $3 million more in volume (up 4%). Specifically, the Gunnison area had four more sales (up 20%), but dollar volume was actually down a bit (-18%). The Crested Butte area had several high dollar sales which resulted in an increase of 19% in the number of sales, but dollar volume almost doubled (up 89%).

“Overall inventory is statistically even with last year, but the number of properties for sale in the north end of the valley is down from this time last year. The Gunnison market is seeing increased inventory with 25% more properties for sale than in March 2024.

“The statistics indicate that properties are sitting on the market longer, but that number doesn’t necessarily indicate that everyone should expect that to be the case. Properties priced well and move in ready are still selling quickly. With uncertainty in the economy and little to no change in the interest rates, 2025 is still a blank canvas when it comes to real estate sales in the area. Prices continue to go up, albeit more slowly, so it is a good time to consider selling your property. For buyers, it is more important than ever to pay attention to the market, have an expert on your side and be prepared when the right property comes on the market,” said Crested Butte-area REALTOR® Molly Eldridge.

DURANGO/LA PLATA COUNTY

“February numbers show another strong month in the real estate markets making up La Plata County, continuing what we saw in January. Overall, single-family new listings rose 55% in volume and sales jumped 22% over YTD 2024, with the condo/townhome market at an equal pace compared to 2024 in both new listings and sales.

“Breaking down the regions of the county, in-town Durango single-family homes might have the most pronounced change with the months’ supply of inventory down 50% while sales numbers rose 220%.

“Rural Durango numbers don’t track; a light winter meant 113% more single-family listings coming on the market YTD, but sales plummeted 21%. Are sellers reaching too high with their list price, or is insurance cost to blame? Possibly both? We see an exactly tracking trend in rural Bayfield.

“February, and this altogether light winter, have not been kind to the resort market. There have been zero sales of single-family homes in 2025 thus far. Ten condos/townhomes have sold which is equivalent to 2024 sales at this time.

“While we have more inventory this February than we’ve had in several recent Februarys, we are still nowhere near the inventory levels we saw pre-Covid. In fact, we have around 50% of the inventory that we had in February 2020.

“La Plata County local governments have done an incredible job of bringing affordable housing to market and much more is on its way. The tariffs that are likely to hit lumber, gypsum, and appliances could not be at a worse time for the local markets. It seems just as the work affordable housing advocates manifested was coming to fruition, the costs of building may make housing still out of reach for many,” says La Plata County-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“March Madness has arrived in the foothills. While Punxsutawney Phil saw his shadow and predicted six more weeks of winter, the real estate market in the foothills is not waiting for the proverbial ‘spring’ to leap into action. This surge in activity is typical for mid-to-late March however, we are witnessing an earlier trend for the second consecutive year, with a notable 22% increase in active listings compared to a year ago and a 25% increase in new listings year-to-date as of the end of February.

“Alongside this increase in new listings, we are also observing a rise in properties going under contract. However, the pace at which homes are going pending has not kept up with the influx of new listings, leading to an overall increase in inventory. Buyer activity is on the rise, with local lenders reporting climbing loan inquiries and applications. Nevertheless, buyers are approaching the market with caution, often hesitant making offers and during negotiations.

“Focusing on Evergreen and Conifer, the heart of our foothills market, the average sales price remains steady, just above $1 million. However, properties in these areas are taking longer to go pending and close, with an average of more than 70 days from listing to closing. While there’s vibrant interest in the market, challenges arise during the inspection process, securing insurance, and navigating higher interest rates, resulting in increased concessions and contracts falling through. Currently, inventory in the foothills stands at 2.2 months of supply, compared to 1.8 months a year ago.

“Last year, the metro area experienced a peak in activity earlier than usual. And while the foothills real estate activity typically lags a month or two behind the seasonal trends established in the metro market, we saw new listings arriving sooner matching the metro’s market trend. The silver lining is that, as a specialized market, our selling season often doesn’t reach its peak until later in the year and thus our busy selling season did not taper as early as the larger metro area. I remain optimistic that this trend will continue, supporting strong buyer activity throughout the spring and summer months,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“Blame it on the naturally lengthening days of the coming spring or perhaps one of the several ‘false spring’ episodes of late February when temps pushed into the upper 60s for several days; one might even blame the effects of gravity on mortgage interest rates which are showing glimmers of the long-awaited descent to a more ‘natural’ 30-year fixed interest rate. Regardless of the source, the early spring housing market in northern Colorado seems primed for an awakening.

“Overall sales for single-family homes are up both year-over-year and prolonging a trend over the last 90 days with sales outpacing the previous year and the previous months. Interestingly, median prices remain relatively flat – a likely lagging indicator as sellers haven’t had enough time to adjust their list prices based on the uptick in activity. Given the increase in the sheer number of listings available across nearly all price points, more inventory is giving newly active buyers lots to choose from with listings up nearly 20% from the previous year.

“Unfortunately, much of the economic uncertainty that is helping push interest rates lower may not bode well for potential buyers who are struggling with stubbornly higher prices for consumer goods like eggs, gas, and coffee. Add on the expected run-up in prices following the recent tariffs imposed on Canada and new home prices may see substantial increases as well when the cost of lumber is adjusted. Many would-be buyers are still on the fence but not because of interest rates, but job security. The cascading effects of the changes in the federal work force may have far reaching impacts on unemployment, job availability and most certainly stagnating wages should a recession rear its head later in Q2 2025.

“Nonetheless, the harbinger of spring is here – no, not the jolly Robin Redbreast but the start of Daylight Saving time. The hour of sleep lost is a small price to pay for the added sunlight into the evening hour which raises our spirits, compels us to clean and declutter, and hold out hope for a prosperous change of seasons – and perhaps a change of address to a new home,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND COUNTY

“The Grand County real estate market is exhibiting a mix of rising home values, but with declining sales activity,” said Grand County REALTOR® Monica Graves who shared these market highlights:

Home Values:

- The average home value in Grand County reached $746,522, marking a 1.5% increase over the past year (excludes timeshare, land and commercial).

- The median sale price hit $873,000 for townhomes and $587,000 for condos, reflecting a 0.9% year-over-year increase.

- In the last 30 days, the median sale price for a single-family home stood at $1.17 million, up 41% compared to the same period last year.

Sales Activity:

- The number of homes sold in Grand County over the last 30 days fell 28.6% with properties now sitting on market for an average of 183 days for single-family homes, 68 days for condos and 162 days for townhomes.

- In the last 30 days, only 33 properties were sold, down from 38 in the same period last year.

Market Inventory:

- The total number of active listings for sale is 413 units, up 36.6% compared to last year.

- In the last 30 days, 58 new homes were listed for sale, up 5.5% year-over-year.

“In summary, while home values in Grand County have experienced growth, the market is characterized by a slowdown in sales activity and an increase in available inventory. These trends suggest a potential shift toward a more balanced or buyer-friendly market in the region,” added Graves.

GRAND JUNCTION/MESA COUNTY

“Finally, some encouraging signs in Mesa County as both the year-over-year and year-to-date statistics are on the positive side. Sellers were still getting 98.7% of asking price in February in what remains a seller’s market and the downward trend in interest rates, though slight, encouraged more buyers to make a decision. The addition of 262 new listings in February raised the number of active listings to 608, a 9.9% increase over February 2024.

“So far for the year, units are up 13.4% with median price at $394,000 and average price at $451,344. Days on market has increased to 100, giving buyers more time to consider which property to make an offer on. With the slight downward trend in interest rates, the market has a good opportunity to improve,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Buyers and sellers are migrating toward a new real estate life cycle. People decide to buy and sell real estate for various life reasons such as a growing or shrinking family, retirement, change in jobs, or to simply maximize gains in their real estate investment. Life circumstances prevail, regardless of the prevalence of interest rate, home inventory, home price or mortgage payment.

“The housing market continues to struggle with high prices and lower inventory producing fewer buyers and sellers. From the struggle, serious sellers and strategic cash buyers have emerged. Cash buyers tend to be older (owning their home free and clear or have high real estate wealth gains) or moving from a more expensive area have the means for an all-cash offer, keeping home prices elevated. February 2025 numbers surpassed February 2024 real estate market numbers including median and average sales prices. Sold listings were up 56.3 % at 25 homes compared to February 2024. New Listings were up 23.7% at 47 units.

Average Sales Price $864,268 (up+27.7%, over the 2024 price of $676,950)

Median Sales Price $627,500 (up+23.1%, over the 2024 price of $505,050)

“Even with rising inventory, there is some good news for sellers as average days on market declined from 185 days in 2024 to 130 in February of this year. Increased inventory and sales are attributed to late and light winter snow. Spring inventory promises to arrive early if Mother Nature continues with lighter snow in the area. The reality of home pricing in Pagosa Springs is that over half of the inventory is well over the $627,500 median home price. Buyers have chosen to evolve into their purchase and understand the value and beauty of rural southwest Colorado lifestyle living. Savvy sellers are adjusting to the fact that their homes may be on the market longer than years past. Sellers are now back to the days of their homes priced well, show-ready, repairs completed, no clutter, well staged, and maybe even concessions to make their home competitive in the sales arena to entice the fewer available buyers.

“Buyers considering retiring and building within 5-7 years are aware purchasing land is an investment alternative to achieve their goal to live in Pagosa Springs and South Fork. With rising land prices, sellers owning land property who have no intent on building are in a strategic 2025 platform to sell. This produces the perfect bloom. Home prices are stabilizing at higher numbers than buyer’s desire. Buyers are faced with higher prices by not purchasing in 2024. Just like the spring bulb flowers popping up to bloom every year, so are buyers and sellers embarking on their real estate life cycle,” said Pagosa Springs REALTOR® Wen Saunders.

PUEBLO

“There is positive activity across the Pueblo real estate market in this early spring season and we’re seeing an increase in showing and a growing number of buyers out looking at homes. Our inventory is up 14.5% from February 2024 and new listings are up 10.3% for the year. Our sold listings fell 21.2% in February 2025 compared to 2024 and are down 16.3% year to date. The median price stayed flat in February compared a year prior at $318,500 as the percent-of-list-price received in February ticked down a touch to 97.7%.

“Looking to the average 100 days on market, we haven’t seen much change over the past year, and we currently have 4.5 months supply of homes to choose from. Our local agents are hosting a lot of open houses and seeing a few more buyers thanks to some warmer days.

“Builders pulled a few more building permits in February than in previous months with the majority continuing to happen in Pueblo West,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“The southern Colorado market continues to show a mix of trends with some counties experiencing growth and others seeing a noticeable slowdown. Conejos County faced a challenging month, recording no home sales in February, while new listings dropped 33%. Days on market increased 38.5%, signaling slower activity. In contrast, Costilla County saw an uptick in new listings, up 33%, though both median and average sales prices fell 24.9% and 41.8%, respectively — suggesting a shift toward more affordable properties.

“Mineral County emerged as a bright spot in the region, with a 400% surge in new listings and a 200% increase in sold listings compared to February 2024. Home prices also climbed steadily, with median sales prices rising 13% to $390,000 and average prices jumping 35.3%. Saguache County, however, painted a more complex picture — despite a 40% rise in sold listings, the median sales price dropped 13.4%, and the average sales price fell sharply, -67.4%, reflecting a trend of lower-value transactions.

“For single-family homes across the region, the year-over-year data reveals interesting shifts. February 2025 saw a 33% rise in new listings but a 66.7% drop in sold listings. Yet, prices moved upward — median sales prices increased 31.3%, while average prices climbed 61.3%. Year-to-date figures showed a 22% increase in new listings and a striking 121% jump in median sales prices, indicating growing demand for higher-priced homes.

“As we move into spring, buyers and sellers should stay informed and adaptable, keeping an eye on pricing trends and shifting inventory levels across these diverse markets,” said San Luis Valley, REALTOR® Megan Bello.

STEAMBOAT SPRINGS/ROUTT COUNTY

“The first quarter of the year for Routt County does not usher a significant sales impact to the market. Ski condos are often guest occupied, hindering showings and sales and the bulk of homes sell when the snow is gone, and buyers can see the land around the house.

“In February, new single-family listings were minuscule (14 compared to 11 last year), with two transactions that closed – equivalent to February 2024. A total of 49 total homes in both the city and county limits of Steamboat came on the market: the lowest price at $1.1 million, a median price of $4.75 million, average price $5.68 million and highest list price at $15 million. The higher price points and additional factors likely impacted the months’ supply of inventory, increasing a full month to 3.9.

“Multi-family homes in Steamboat realized 22 more new listings than February 2024 with total units for sale at 122 – this was a considerable increase from 37 the year prior. The offerings include new construction properties at the base area; with the completion of these developments months or a year down the road, the months’ supply of inventory at 4.5 months compared to the prior year of 1.4 factor into that lag since these projects were not started until last spring/summer. There were 10 fewer units that traded compared to last year; however, sellers received 98.4% of their list price and days on market were 13 days less. It is not uncommon for properties in great locations, and/or cream puff conditions to go pending in less than a week if priced appropriately.

“In the outlying communities of Hayden, Oak Creek and Clark, there were a total of 10 new listings compared to six in February 2024 for both single and multi-family. Two sales consummated in Hayden at an average price of $680,000 and one home sale in Clark for $929,000. Lack of inventory is certainly a culprit here with Hayden only having 14 homes/three townhomes for sale, Oak Creek, eight homes/0 multi-family homes and Clark with just three homes for sale last month. Several applications are going through the county planning process for the Oak Creek and Hayden areas which would create more housing opportunities. Each major subdivision will have an Essential Housing requirement – a housing category restricted for use by a Routt County resident to support affordable housing,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“Envision the real estate market in Summit, Park, and Lake counties as a grand chessboard where each move represents a calculated play in a high-stakes game of strategy and foresight. Let’s examine the positions and ponder the next moves in this intricate contest.

“For new players entering the game with hopes of quick gains through rental income, the opening gambit often falls short—particularly when a loan weights the board. Revenue from renting seldom offsets the full array of costs, akin to expecting a single pawn to secure a checkmate. Most owners here aren’t chasing short-term victories; they acquire properties as a dual-purpose move—personal use paired with a shield against expenses like insurance and HOA fees, through renting. Summit County, in particular, has proven a formidable stronghold for long-term strategy, rewarding those who endure the midgame slumps. The numbers bear this out: average residential property values advanced from $562,407 in 2015 to $1,567,829—a commanding 180% escalation over a decade, dwarfing the 47% rise of the prior 10 years.

“Summit and Park counties are following the trend of fewer sales, down 20%, and greater than 40% additional listings. Median prices were up almost 15%.

Average Single-Family Home Sale Prices (February 2025):

Summit County $2,762,229 (28 sales, up 2 from Feb ‘24)

Park County $ 691,500 (8 sales, down 6 from Feb ‘24)

Lake County $ 782,500 (2 sales, up 2 from Feb ‘24)

Average Multi-Family Home Sale Prices (February 2025):

Summit County $ 983 ,279 (53 sales, down 22 from Feb ‘24)

“Among the 552 active residential listings—168 more than last month—the most affordable property is a mobile home in Park County priced at $125,000. On the other end of the spectrum, a high-end single-family home in Breckenridge is listed just under $19 million. Notably, there are currently eight properties on the market priced above $10 million.

“February saw 82 residential sales spanning a broad price range:

- Lowest Sale: A mobile home in Breckenridge for $110,000.

- Highest Sale: A Breckenridge single-family estate fetching $14,850,000.

“High-end buyers remain undeterred, with 56% of sales exceeding $1 million and nearly 41% of all transactions closing in cash.

“What emerges from this chessboard analysis? A narrative of endurance, escalating valuations, and a pronounced tilt toward luxury, with Summit, Park, and Lake counties offering terrain for every strategist—from modest tacticians to grandmasters. The game is far from over; each move merits careful consideration as the board evolves,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The Telluride regional market sales came in at $66.5 million through 45 sales. This is a significant decrease in the February sales 2024 of $92.3 million and 36 total number of sales. The biggest change in what is selling comes from the ultra-high-end sales slowing down and the mid-range priced homes and condominiums selling briskly.

“My personal opinion is that the wealthy are starting to worry about a recession coming while they watch significant gyrations in the stock market and rising inflation. The next couple of months should be watched very closely to see if caution sets in,” said Telluride-area REALTOR® George Harvey.

VAIL

“The market is starting off with a 15.6% increase in inventory, the highest supply since the pre-Covid period. January started the year with a similar trend to the past market trends we had been experiencing however, February has taken a bit of change in market dynamics. Both single-family/duplex and townhouse/condo saw a significant decline in February transactions. This decline was 48.4% in units versus February 2024 and dropped our year-to-date closings just shy of 30%. It appears the catalyst for this movement is the uncertainty of macro-economic factors. One other factor is that last year, we had a couple of new projects hitting the market which have since been sold out. Due to a change in mix of pricing niches, the February dollar decline of 35% was less severe than the unit decline for February. The year-to-date performance was similar as dollars were only negative 19.4%

“As we look forward to the spring/summer season, our pending sales and increased inventory look positive for market activity. The macro-economy will be the component to keep our eyes upon and I believe our client base will be doing the same. The current inventory of homes fits into our sales trends year to date which is a positive as demand begins to increase. More options for our buyers are a positive scenario and increased activity should hopefully continue bringing more product to the market. As we track through March, which is the end of the winter season, keeping our eyes open for trends will be critical to stay on top of demand. March is the snowiest month in Colorado thus our visitor traffic remains high and could give us a bump for the month,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The February 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 25,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.