Buyer’s hold the cards in Colorado housing markets

ENGLEWOOD, CO – After a long seller-dominated run in Colorado, the housing game shift is a welcome change for homebuyers who now find themselves holding the cards in what has become one of the most advantageous buyer environments in years. Today’s buyers are armed with far more options, relaxed timing, and more overall control in the process, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons working in markets across the state.

“Buyers, sellers, and real estate professionals are confronting a hard reality that has been months in the making, and September made it clear: it is not a great time to sell a home. Still, there is a bright side,” said Denver County-area REALTOR® Cooper Thayer. “When selling gets tougher, buying gets better, and today’s market gives buyers more leverage and choice, even with higher rates. By most metrics, this is the strongest buyer footing in years, and by some measures in decades, with more time to decide, more options to choose from, and more room to negotiate. The bottom line: this is a rebalancing, not a breakdown.”

Anticipating that interest rates will remain high and affordability challenges will continue, Colorado REALTORS® expect negotiating power and pricing strategy to remain central themes through year-end.

The September data showed a consistent result across most of the major categories including a decrease in the inventory of active listings, sold listings, as well as pending and under contract listings from August to September. However, all of those categories remain up from the same time last year. New listings were up 5.5% month over month in the seven-county Denver metro area, but statewide, new listings were down 2.6% month over month.

Despite the challenges, median pricing held its own with Denver-metro single-family pricing off just 1.1% from August to September at $618,342, up 1.7% from September 2024. Condo/townhome median pricing was up 2.6% in September to $400,000, down 2.4% from a year ago. Statewide, single-family homes ticked down 0.8% from August to September however, at $585,000 remains up 1.7% from a year prior. Condo/townhome pricing across the state rose 5.5% in September to $423,473, down just 0.4% from September 2024.

Colorado Housing Markets – September Snapshot

Based on analysis from REALTORS® working in markets across the state (for a more in-depth analysis by market, see full content in report):

Aurora – September brought renewed momentum to Aurora, Centennial, and Greenwood Village, where inventory declined year-over-year, prices edged up, and homes sold faster. Slightly lower interest rates appear to have boosted activity, with pending sales up about 11% from last year. Median prices remain attractive—$566,000 in Arapahoe County and $515,000 in Adams County.

Boulder and Broomfield counties – Shifting toward a buyer’s market, with inventory up over 10% and sellers more motivated. Despite a slight 2% rise in prices, concessions reveal real declines, especially for condos, down 11% in Broomfield. Homes are taking longer to sell, and smart sellers are pricing lower — giving buyers their best leverage in years.

Colorado Springs – Market appears stable on the surface, but beneath the numbers lies uncertainty. Prices are flat year-over-year, and while listings and sales are both up, transactions have become unpredictable. Sellers face tougher negotiations amid hesitant buyers and growing inventory, while buyers enjoy more leverage and options.

Crested Butte/Gunnison – September delivered a strong boost to the Crested Butte–Gunnison housing market, keeping 2025 slightly ahead of last year. Across the region, sales rose 10% and dollar volume climbed 6% year-to-date, with September alone seeing surges of 37% in sales and 73% in volume. Inventory remains moderate and prices steady, though days on market are inching up. Well-priced, move-in-ready homes are still moving quickly, while motivated sellers and reduced competition create ideal conditions for late-year buyers.

Denver Metro – September confirmed a clear market shift: it’s a tough time to sell but an excellent time to buy. Homes are staying on the market longer and selling for less relative to list price, giving buyers more leverage, options, and time to decide. Inventory continues to grow, especially for condos and townhomes, where prices dipped 2.4%. While the market isn’t breaking down, it’s rebalancing — favoring buyers with patience and negotiation power as affordability challenges persist.

Durango/LaPlata County –September continued the late-summer slowdown, leaning firmly toward buyers. Single-family listings and prices declined—median down 12.6% year-over-year—while days on market and inventory rose past six months. Condos and townhomes saw a temporary boost in sales but also faced falling prices and growing supply. Sellers are increasingly negotiating, with homes averaging about 96% of list price. Overall, the market is stabilizing with more options, longer timelines, and greater balance between buyers and sellers.

Evergreen – Market is settling into a balanced fall rhythm. Inventory remains elevated—up nearly 15% year-over-year—but new listings are slowing, signaling cautious optimism on both sides. Prices are largely steady, marketing times are longer, and buyers have more room to choose and negotiate. Overall, the market is stable but slower, marked by realistic pricing, selective buyers, and a return to pre-pandemic seasonality.

Fort Collins – September reflected a true balance—steady but slow-moving. Well-priced, move-in-ready homes sold quickly, while others lingered due to price or condition. Listings rose nearly 12% and sales climbed 13.5% year-over-year, yet homes are taking about 75 days to sell, keeping inventory above three months. With high mortgage rates and economic uncertainty, both buyers and sellers remain cautious, creating a market defined by patience and selective movement heading into winter.

Grand County –September market showed solid activity with signs of balance returning. Median prices held strong at about$1.6 million for single-family homes and $840,000 for condos and townhomes, while average days on market improved to 56, faster than both August and last year. Inventory remains elevated, giving buyers more choice and negotiation power.

Mesa County – Market remains uneven, with new listings and closed sales down but pending sales up. Despite a 10% drop in sales, higher-priced transactions kept the median home price steady at $413,750. Active inventory rose 19% to a 3.8-month supply, driven partly by canceled contracts. While conditions remain mixed, growing inventory and buyer activity suggest potential for improvement ahead.

Pagosa Springs – Market favored buyers, with median and average home prices down 12% and 16% year-over-year amid rising inventory and longer market times. High interest rates and elevated prices have slowed sales, particularly in the luxury segment, where listings far outpace contracts. With a nine-month supply and many second-home owners unmotivated to cut prices, homes are lingering while buyers gain leverage.

San Luis Valley – Market showed mixed trends in September, with activity varying sharply by county. Rio Grande led with strong growth—listings and sales both surging—while Alamosa, Costilla, and Mineral saw slower movement and longer market times. Prices fluctuated widely, from sharp declines in Costilla to solid gains in Conejos and Saguache. Overall, the Valley reflects a patchwork market driven by selective buyers, shifting prices, and uneven momentum across the six counties.

Summit and Park Counties – Closed September with a steady, active market marked by balance and resilience. Sales surged in Summit County – up 43% for single-family homes and 27% for condos, while inventory and buyer options expanded. Park County mirrored the trend with more sales, stable prices, and growing supply, creating clear buyer leverage. Across both counties, longer marketing times and strategic pricing reflect a cooling pace, not a slowdown.

Telluride – September showcased a split market in Telluride’s high-end luxury segment. Dollar volume rose 23% year-over-year to $131 million, even as total sales declined 15%, reflecting fewer but higher-value transactions. Overall market volume was down 19% from last year, yet Telluride remains a prime destination for affluent buyers seeking exclusivity, safety, and serenity. Despite broader economic caution and tight inventory, luxury demand continues to “fly above the storm.”

Vail – September capped the summer selling season in the Valley with mixed but generally positive momentum. Closed sales rose 17%, pending sales jumped 21%, and dollar volume increased 9%, though new listings fell sharply (-26%). Inventory grew nearly 24%, expanding supply by 32%. Market strength varied by price segment, but steady cash purchases and niche demand kept activity healthy despite broader economic pressures.

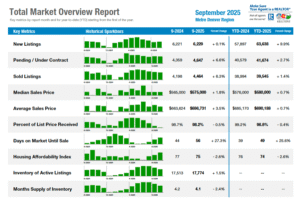

Total Market Overview – Seven-County Denver Metro

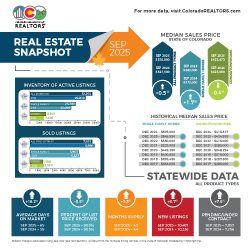

Total Market Overview – Statewide

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“September revealed an interesting change in several of the Aurora, Centennial, and Greenwood Village zip codes. While the numbers are not block busters, it’s interesting to note that inventory was actually down year over year in most zip codes, prices were up slightly, and average days on market was down. Maybe the slight reduction in the interest rates spurred activity.

“It’s interesting to note that the inventory numbers in most of Adams and Arapahoe County zip codes were down not only year over year, but month over month. Pricing is following the same trajectory and is up in many of the zip codes. It is a given that once interest rates come down, we will see more buyers come into the market. This is shown month over month with just the slight rate reduction we experienced. Under contract or pending listings were up approximately 11% over the same time last year.

“With pricing still considerably under what it was a year ago and interest rates lower, the opportunity for homebuyers is ideal. Overall, the median price in Arapahoe County is $566,000 and Adams County median price is $515,000 – well below the median price in several of the other Denver metro communities. Average days on market ranges between 30-60 days, giving buyers more time to think about their purchase. That said, the great homes, well priced, well maintained are still going under contract in just a couple of days. For those buyers waiting until spring, they may experience more competition and the possibility of bidding wars. For sellers, the nice, clean, and priced-right homes are still moving and, in many cases, moving quickly,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“The real estate tides have turned in Boulder and Broomfield counties, and buyers are loving it. With inventory up over 10% compared to this time last year and sellers growing more motivated by the day, it’s shaping up to be one of the most buyer-friendly markets these counties have seen in recent years.

“While home prices appear to have ticked up a modest 2% year-over-year, seller concessions are softening those numbers and once those incentives are factored in, the real story is price decline.

Homes in Boulder are lingering on the market for an average of 60 days, while Broomfield is moving a bit quicker at around 38. With the condo and townhome market, patience is the name of the game, as average time to sell stretches to nearly 70 days. Condos and townhomes are feeling the pricing pinch even more, especially in Broomfield, where prices have dropped a notable 11%.

“With values declining most of the year, today’s listings should come on the market at about 3% under comparable sales from last spring. Smart sellers are taking the advice of their agent when pricing, while savvy buyers are jumping on the opportunity to negotiate in a market that’s finally leaning in their favor,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“The status quo continues. There was an extended time when every month we wrote about the never-ending sellers’ market where every buyer either gave it all up to the seller or they did not get to buy. Higher prices month over month, year over year. Escalation clauses, appraisal gaps, and prayers got buyers into homes and buyer opportunities were simply a struggle. Now we get to update on how we are stagnant. Year-over-year prices are about the same. Active listings were up, but properties sold were also up. An overview of the housing market appears to be stable, but the underlying story is different.

“At ground level, there is a lot to consider when you are a buyer and seller. Sellers have to have a great home at a great price and negotiate softly with what may be the only buyer they may get. With so many homes on the market and buyers only half committed to buying, even the simplest of inspection items can make a buyer move on. Agents and lenders are emotionally on edge. Listing agents try to explain a very unpredictable situation to sellers. Do you give it all away? Should you negotiate harder only to watch a buyer walk? How often do we price reduce? This is the gauntlet we all are traversing while trying to move homes. Buyers have it much easier. Plenty of homes to choose from, and if anything doesn’t go in favor of the buyer they can actually go find another home.

“Despite the numbers looking stable, the housing market is anything but stable when you get into the transaction. Nationally, we continue to see signs of much larger issues. Gold and silver continue to hit new highs. Although good for precious metal holders’, gold tends to be a barometer on the economy, and it appears there are concerns. Actual equity in housing dropped nationwide showing many areas are pulling back on values from their once absurd peaks. Yet, there are still more sellers than buyers and a sign of more softening in the housing market ahead. Case Freight Index was at the lowest level since the great financial crisis showing more indicators of a slowing national economy. The government shutdown is going on longer than most thought. We need a change in direction or what lies ahead appears to be higher unemployment and a worsening economy which does not help our already questionable housing market. And to top it off, we now have the local NED list growing meaning distressed sales are beginning to work through the system as moratoriums are lifted. We will have to stay on top of all the data locally and nationally to continue to see where we are headed,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“Last month, the inventory of single-family and patio homes in Colorado Springs reached 4,010, the highest level for September since 2014. This figure represents a healthy supply of 3.9 months. During this period, a total of 1,026 single-family and patio homes were sold. These inventory and sales numbers are quite comparable to those from September 2013, which had 4,070 active listings, and September 2014 recorded the same number of sales.

“For buyers, the current abundance of available homes offers a great opportunity to find properties that suit their preferences and negotiate better deals with motivated sellers. With declining interest rates, it has become more affordable for buyers to enter the market. This is an excellent time to purchase a home before the holiday season, especially while the weather is still pleasant.

“In today’s housing market, which has a high inventory of homes, properties that are realistically and competitively priced, updated, and ready for immediate move-in tend to sell quickly and closer to their asking price. In contrast, homes that are overpriced and in poor condition often remain on the market for an extended period,” said Colorado Springs-area REALTOR® Jay Gupta.

Key September Highlights from the Colorado Springs Market:

- Active Listings – Supply: In September 2025, there were 4,010 single-family and patio homes available for sale in the Colorado Springs area, according to the Pikes Peak MLS. It marked an impressive year-over-year increase of 18.2% and a colossal 302.6% rise compared to September 2020. The inventory level was the highest for September since September 2014, with a desirable supply level of just 3.9 months.

The overall months’ supply of active listings was at a very healthy supply level. For homes priced under $400,000, the supply was exceptional at 6.6 months. For homes in the price range of $400,000 to $600,000, the supply was good at 3.6 months. The supply for homes priced between $600,000 and $1 million was healthy at 4.4 months. Meanwhile, for homes priced over $1 million, the supply was more abundant at 6.6 months.

- Sales – Demand: Last month, the total number of single-family and patio homes sold was 1,026. It represents a nice 10.0% increase from the previous year. However, a more significant decrease of 43.1% compared to September 2020, five years ago.

The monthly sales volume experienced a 16.2% increase compared to the same month last year, but a substantial drop of 25.4% compared to September 2020. Nonetheless, it had a massive increase of 82.0% compared to September 2015.

The year-to-date sales volume showed a healthy increase of 12.6% from the previous month and 8.0% compared to September of last year. And, compared to September 2015, the year-to-date sales volume has escalated dramatically, with an increase of 87.7%.

- Days on the Market: The average number of days on the market in September 2025 rose to 54, increasing from 43 days last month and 44 in September of last year.

- Sales by Price Range: Last month, 26.9% of homes sold were priced below $400,000, while 43.0% were sold for between $400,000 and $600,000. Homes priced between $600,000 and $1 million accounted for 23.8% of the sales, and those priced over $1 million represented 6.3% of the total sales.

In September 2025, there was a nice 11.5% increase in the sale of single-family homes priced under $400,000 compared to the previous year. Homes priced between $400,000 and $600,000 also saw a modest 1.6% increase in sales. There was a bigger 16.7% increase in the sale of homes priced between $600,000 and $1 million. However, the homes sold for over $1 million experienced an incredible 51.2% increase in sales.

- Average & Median Sales Prices: Since 2011, the average price of single-family and patio homes has risen every September, except for last year, when it decreased by $5,859. This year, the average price reached a historic high of $565,356, with a 5.7% increase over last year. Additionally, it marks a remarkable 31.1% rise since September 2020, an impressive 111.3% increase since September 2015, and a staggering 127.0% jump since 2005.

The median sales price experienced a slight year-over-year decline of 1.1%. However, it showed a significant increase of 24.5% compared to September 2020, an astounding 99.8% rise since September 2015, and an extraordinary escalation of 130.0% compared to September 2005.

Price Reductions: Last month, 49.1% of active listings in El Paso County and 40.7% in Teller County saw price reductions. With the current record high volume of active listings, sellers must price competitively from the start to avoid repeated price reductions and ensure their properties are in good repair and attractively presented to draw buyers.

CRESTED BUTTE/GUNNISON

“Typically, September and October are the months with the most closings in the Crested Butte – Gunnison area and this year has proven to be on trend. Overall, 2025 has been very similar to 2024, but September sales moved this year ahead of last year and October seems to be on track to help that continue.

“Sales for the entire Gunnison Crested Butte Association of REALTORS® area are up 6% from 2024 in terms of dollar volume and up 10% in total sales. For September, dollar volume was up 73% and the number of sales was up 37% – not a surprise given the slow start to the summer and the activity we saw in late July and August.

“Sales in the Crested Butte area are also close to 2024 levels with dollar volume up 10% and the number of sales up just 2.5%. Again, September boosted the numbers for 2025 with the number of sales up 48% and dollar volume up a whopping 76%. Gunnison has seen 28% more sales this year and dollar volume is up 20%. This has been the trend all year and it continued with the sales in September. In Gunnison, the September increases were in line with the rest of the area – number of sales were up 53% and dollar volume up 75% from the same time last year.

“Inventory remains up from last year, but not dramatically. A lot of sellers will take their properties off the market until ski season and so inventory is falling. Typically, those will come back on the market in December so we will see if that happens this year, or if sellers decide to hang on to see what happens at the start of 2026. Prices remain steady and the number of days on the market is increasing slightly.

“As is true throughout the state, properties that are priced well and are move-in ready are selling quickly and sometimes with multiple offers. Buyers do have more to choose from and are not feeling pressure to make a move if they aren’t finding something that fits all the criteria. Sellers need to discuss recent sales with their REALTOR® and be realistic about what else is on the market. The remainder of 2025 should see strong sales numbers, but the number of contracts will decline until we get past the holiday season. Buyers should consider looking more seriously now as there is less competition and sellers may be motivated not to own their property through another winter,” said Crested Butte-area REALTOR® Molly Eldridge.

DENVER METRO (11-County)

“Buyers, sellers, and real estate professionals are confronting a hard reality that has been months in the making, and September made it clear: it is not a great time to sell a home. Still, there is a bright side. When selling gets tougher, buying gets better, and today’s market gives buyers more leverage and choice, even with higher rates. By most metrics, this is the strongest buyer footing in years, and by some measures in decades, with more time to decide, more options to choose from, and more room to negotiate. After a long seller-dominated run in Colorado, the shift is healthy and a welcome change for homebuyers.

“Across the Denver Metro Area, September unfolded at a measured pace. Single-family listings lingered for an average of 54 days on the market, about 29% longer than last year, and the typical sale closed at 98.2% of list, a historically low level, signaling pricing overshoot and buyer leverage. Yet momentum returned where it counted: pending single-family contracts rose 7.1% year-over-year, led by homes priced with discipline or sweetened by strategic concessions.

“Supply has continued to build compared to recent years. Last month, there were more than 12,800 active single-family listings, equal to 3.8 months of supply. Condos and townhomes posted a 5.3-month supply, which sits firmly in buyers’ market territory. This segment also contends with affordability friction from HOA dues and rising insurance costs. The median sale price for condos and townhomes slipped down 2.4% year-over-year to $400,000, while the single-family median sale price climbed 1.7% to $618,342. Across both segments, longer marketing times and wider negotiations confirm softer seller leverage.

“The bottom line: this is a rebalancing, not a breakdown. New listings were essentially flat year-over-year in September, and closed sales increased by more than 6%, showing that well-positioned homes are still finding buyers in this more price-sensitive market. At a high level, this is one of the most advantageous environments for homebuyers in years, defined less by falling prices and more by patience, optionality, and control. If rates stay high and affordability stays tight, expect negotiation power and pricing strategy to remain the central themes through year-end,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“September brought a continuation of the trends we saw in August’s residential real estate market in La Plata County. Fewer new single-family listings came on the market than in September 2024, the median price was down 12.6%, average days on market was up, and the amount of inventory on the market is over 6 months, leaning strongly towards a buyer’s market.

“Condos and townhomes bucked August’s trends with slightly fewer new listings coming up on the market, a greater number of sales, bringing days on market and months’ supply down from August. This September fared worse compared to September 2024, with a higher months’ supply of homes and the median price down 9.3%. There are currently 24.5% more homes for sale in this segment than in September 2024.

“One trend that has made itself very clear in our markets, no matter where a home is located or what type of home is for sale, the percent of list price received is declining. In September, it was 96.2% of list price for single-family homes and 96.7% for condos and townhomes as sellers get more comfortable working with buyers who are offering less than full price. In post-COVID years past this number was easily 99% or higher.

“Year to date, single-family homes still have a higher median than in 2024 overall (3.8%), but this will continue to change before year’s end. The condo and townhome median is down 5.5%.

Breaking down the areas, Durango in-town single-family homes are still taking much longer to sell than in 2024, with September at 93 days, a full month more than in September 2024. The median is still down (-18.9% in September), most likely due to buyers either choosing lower-priced homes, or less expensive homes are coming on the market for sale this year.

“Sales of condos and townhomes jumped again in September over last September’s sales by 50%, but the median is down 6.3%, just like in August.

“Another continuing trend is in rural Durango, where there are 18.8% more single-family homes on the market than in September 2024 (and 50% more condos and townhomes). There is a 7.1-month supply of single-family homes for sale currently. The In-town Bayfield market is doing well. There is newly constructed affordable inventory in the market, with only a 2.8 current months’ supply of homes for sale.

“Rural Bayfield had a few more sales than in September 2024, but the median price of the homes selling is down nearly 31% compared to September 2024. Again, this is most likely a case of buyers choosing less expensive homes or less expensive homes coming on the market. It does take homes significantly longer to sell, 15 more days than in September 2024.

“The Purgatory Resort area had a strong month in August, but it reversed in September, with only one single-family home selling and 50% fewer condos and townhomes closing than in September 2024. There is a lot of new inventory on the market this summer and it’s a great time to be looking to purchase in the resort area.

“Our Vallecito Lake market had fewer sales in September 2025 than in September 2024, but we had significantly higher sales in August this year. San Juan County had a slow month with only two single-family sales, both in Silverton. Year to date, 73 homes have come on the market in this segment, up 49% year to date over 2024, with only 11 sales (27% down from YTD 2024).

REALTORS® in the county report the difficult time sellers are having with longer days on market. Gone is the time you could expect an offer in the first few days. We’re advising clients that it just necessitates more patience and more communication than it did to sell a home in recent years and gently guiding sellers to be more agreeable with the buyer making an offer, whether accepting a bit less than was hoped, or working with the buyer on inspection items more than they have in the past to ensure a transaction gets to the closing table. With this, we are gently easing into our slower selling season; we hope to finish the year strongly with great inventory still for sale,” said Durango-area REALTOR® Heather Erb.

EVERGREEN/MOUNTAIN METRO

“With fall settling in, the real estate market is showing its seasonal slowdown—but with a twist. Inventory remains higher than in recent years, yet the pace of new listings is tapering off, suggesting that both buyers and sellers are finding a more cautious rhythm. September’s data points to a market that’s finding equilibrium: steady prices, longer marketing times, fewer bidding wars, but continued demand for well-priced, move-in-ready homes.

“At the end of September, active listings across the foothills were up almost 15% year over year, marking one of the highest inventory levels in over a decade. However, compared to August, inventory dipped slightly, hinting that the peak summer supply has passed and happily pairs with pending listings up from last month and last year. With fewer new homes coming on the market, the increase in available homes is more about slower absorption than a surge of new sellers entering the market or decreasing sales.

“Conditions varied across the region. Evergreen and Conifer rebounded after several soft months, with the median price rising 12% and sellers receiving 96.6% of list price on average, although with median home price slipping, there is an indication that the higher-end luxury market is not as active as it has been. Jefferson County’s foothills saw a 5.8% increase in median price to $696,500, though homes took 45 days to sell on average—41% longer than last year. Park County activity accelerated again, with closed sales up 78% and prices holding steady, making it one of the most affordable and active foothills markets. On the other end of the spectrum, Clear Creek County softened, with the median price down 7% to $550,000 and days on market climbing to 87, more than triple last year’s pace.

“Nationally, housing inventory dipped for the first time this year, but foothills numbers bucked that trend. The Colorado Front Range continues to attract out-of-state buyers, even as affordability remains a challenge. The region’s housing affordability index fell 6.5% year over year to 72, highlighting growing barriers for first-time buyers.

“Insurance and utility costs also continue to impact transaction timelines. Homes in wildfire-prone areas or with aging roofs are facing heightened insurer scrutiny and rising premiums. Meanwhile, new construction of both single-family and attached homes along the I-70 corridor is adding competitively priced, energy-efficient inventory, which is influencing buyer preferences and placing mild pressure on resale homes needing updates. Overall, the foothills market remains stable but slower, characterized by realistic pricing, selective buyers, and a gradual return to pre-pandemic seasonality,” said Evergreen-area REALTOR® Julia Purrington Paluck.

FORT COLLINS

“The September housing market in Fort Collins sputtered along as balanced markets are wont to do. Some houses in great shape and well-priced go under contract in a matter of days and some with competing offers (over 2 dozen homes went under contract within a week of being listed). Other homes appear to be languishing on the market for any variety of reasons: price, competition with new construction, neighborhood desirability, and probably most importantly, condition. Many sellers, unhappy with the lack of interest at the list price, have opted to not sell rather than lower their price and have removed their homes from the market. Other sellers have made repeat adjustments to price in hopes of luring a buyer to make an offer.

“That being said, overall sales are up which seems proportional to the increase in the number of listings. New listings are up nearly 12% and sales are up 13.5% year over year. Yet average days on market rose to two-and-a-half months from list date to sale date. This has contributed to the months supply of inventory holding steady at over three months. Buyers have a lot to look at and plenty of time to see what’s available.

“Economic and political uncertainty combined with higher than desirable mortgage interest rates are still keeping many would-be buyers on the sidelines. Sellers who have built up equity over the last 5 years aren’t willing to let that go and give up ultra-low mortgage interest rates. It’s an ongoing tug-of-war that leaves the housing market inching forward as we head toward the colder winter months ahead,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND COUNTY

Grand County’s September market showed solid activity with signs of balance returning. Median prices held strong at about$1.6 million for single-family homes and $840,000 for condos and townhomes, while average days on market improved to 56, faster than both August and last year. Inventory remains elevated, giving buyers more choice and negotiation power,” said Grand County REALTOR® Monica Graves.

- Median sale price (Grand County) — about $840,000 for Townhomes and Condos and $1.6M for single family home.

- Days on market — ~56 days, better than August and the year over year.

- Local seller strength / prices in resort sub-markets — Winter Park single-family average sale price jumped (from ~$1.621M → ~$1.859 million) and Winter Park area sales volume rose strongly (Winter Park area SFH volume +37% per the local brokerage market update). Granby volumes are up but average price in Granby held roughly flat near $1M; Hot Sulphur Springs and Grand Lake show mixed movement (HSS up, Grand Lake dollar volume slightly down but average price up ~7%).

Inventory & demand (what’s driving Sept)

- Inventory is elevated vs last year and more new listings are hitting the market in Grand County — giving buyers more choices and slightly more negotiation leverage vs the height of the seller’s market. Local broker commentary and county-area market posts both point to rising inventory.

- Winter Park area (Fraser/Tabernash/Winter Park proper): big gains in average sale price and sales volume in the September local update — strong demand for higher-end single-family product tied to resort activity.

- Granby / Granby area: sales volume up (local reports) while average sales price has been relatively stable near the ~$1 million range.

- Grand Lake: mixed signals — some months show declining #sold, but average sale price has increased.

Market Takeaways & Outlook

- Sellers: Need to Price smartly and market aggressively early. Homes in desirable locations (views, ski access, lake frontage) will command stronger premiums.

- Buyers: More opportunity vs prior years—leverage inventory and timing. In Winter Park especially, it’s still competitive for well-priced properties.

- Watch interest rates: Slight easing is encouraging buyer activity, but affordability remains tight.

- Seasonal & resort effect: Towns like Winter Park and Grand Lake see amplified swings; when pricing, the comps to use should be recent and location sensitive.

MESA COUNTY/GRAND JUNCTION

“Mesa County continues to have a bumpy ride when it comes to the housing market. Compared to September 2024, we’re down on new listings, up on pending sales and down on sales. Sales were off 10%. Surprisingly 59% of sales were over $500,000. That helped the median and average pricing stay fairly even, with the median at $413,750, and the average $472,871. Because of a high number of pending sales canceling, active inventory continues to grow, and there is now a 3.8-month supply of homes, up 19%. Looking ahead, we have a lot of possibilities for an improved market,” said Mesa County-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Relative to September 2024, sellers placing homes on the market in September 2025 have experienced price decreases in median sold (-12.2%) and average sales (-16.1%) price, even with a 13.9% increase in pending sales at 41 homes. September Inventory increased 42% to 61 homes, 293 active listings (+21.1%), and longer days on market (125 days) have created happy days for buyers deciding to purchase today.

“High mortgage payments due to higher interest rates and higher pricing still have many buyers pausing toward a purchase. Currently there are over 100 homes priced $900,000 and higher and only eight under contract, creating a trickle sale scenario for the sellers. With the onset of winter, price adjustments are common. Buyers working with their real estate agent should be savvy to the price reduction history when writing their offer, as some sellers are now at their bottom reduction to sell.

“Increasing assessed home values in 2025 are also a factor when a buyer offers less than list price. Buyers who offer below assessed value in today’s market does not create a good price negotiation advantage and often backfires, with sellers simply rejecting the offer. Longer days on market will continue to climb, due to stagnant sales in higher priced home inventory. This scenario creates the perfect storm for some sellers to go back into hibernation (taking homes off the market). Unlike many Colorado areas, Pagosa Springs has a large second-home market whose sellers are not as motivated to sell at a significantly reduced price.

Year-to-Date Median Sales Price: $575,000

Year- to Date Average Sales Price: $718,207

Inventory of Homes: 293

Months Inventory Supply: 9

Days On Market to Sell: 147

“High interest rates, higher home prices, together creating high monthly mortgages, and a nine-month supply of home inventory are keeping homes on the market longer. Some buyers are migrating toward land purchases (especially those with acreage). Summer land sales were sluggish with September bringing an uptick in land sales. Higher home prices and low inventory in lower home price points are enticing buyers to consider purchasing with the intent to build later, securing their piece of Pagosa Springs and the rural mountain town atmosphere, now. Historically, Autumn has produced notable sales in both land and homes, as both buyers and sellers put on their aggressive buyer and selling hats before winter,” said Pagosa Springs-area REALTOR® Wen Saunders.

SAN LUIS VALLEY

“The San Luis Valley housing market in September 2025 reflects shifting dynamics across all six counties compared to last year.

- In Alamosa County, new listings rose from 11 to 14 (+27.3%), though sales fell from 10 to 8 (-20%), with the median price up 7.3% to $350,500 and days on market lengthening to 92.

- Costilla County saw more listings this September (15 vs. 11, +36.4%) and slightly higher closings (7 vs. 6), but median prices plunged 45.3% to $190,000 and days on market more than doubled to 134.

- Conejos County posted a sharp increase in listings (9 vs. 3) with sales flat at 2, while the median price nearly doubled to $317,000 and market times shortened from 149 to 107 days.

- In Mineral County, new listings doubled (4 vs. 2) and sales improved to 7 from 5, though the median price slipped 4.3% to $465,000 and days on market rose to 62.

- Rio Grande County had a very strong September, with listings jumping to 18 from 11 (+63.6%) and sales more than doubling (18 vs. 8, +125%), while median prices held steady at $312,500 (+0.8%).

- Meanwhile, Saguache County cooled, as listings fell from 14 to 9 (-35.7%) and sales dropped nearly half (6 vs. 11), though the median price climbed 14.6% to $340,450 despite longer selling times at 188 days.

“Overall, the Valley shows a clear split: Rio Grande led with robust growth, Conejos and Saguache experienced volatile pricing shifts, while Alamosa, Costilla, and Mineral revealed slower or more selective buyer activity,” said San Luis Valley-area REALTOR® Megan Bello.

SUMMIT AND PARK COUNTIES

“As the mountain slopes turn to shades of gold and the air grows crisp, the real estate market in Summit and Park counties remains steady, bright, and full of movement. Like the aspen leaves fluttering toward winter, the local market is shifting—but not fading.

“In Summit County, both single-family homes and condos saw strong sales and rising activity this September:

- Single-family sales jumped 42.9% year over year, with 60 homes sold compared to 42 last September.

- The median price rose 2.1% to $2,087,500, while the average price dipped slightly (-3.1%) to $2.76 million, showing continued strength in the luxury segment but more balanced pricing overall.

- Townhome and condo sales climbed 26.6%, with 100 sold, and the median price rose 2.9% to $807,500.

- Inventory increased—260 single-family and 532 multi-family homes are now on the market—giving buyers more to choose from as the months’ supply remains near 7–8 months, signaling a market balancing toward the buyer’s side.

- September brought more sales, higher inventory, and mostly steady pricing.

“There is healthy activity as both buyers and sellers adjust to new price realities. It’s not a frenzy—but it’s far from frozen.

“Park County mirrored the broader mountain trend with a steady market and measured gains:

- Sold listings rose 26.7%, though new listings dipped 28.6%, tightening available options.

- The median sales price increased 2.7% to $608,600, showing continued demand for homes in more accessible price ranges.

- The average sales price landed at $627,658 (-3.5%), while days on market rose modestly to 98, reflecting a slower but stable pace of sales.

- Inventory grew 18.4%, with 11 months of supply, marking Park County as a buyer’s market with plenty of choices and room for negotiation.

“Across these counties, inventory remains higher than last year but continues to move. Median prices held strong while days on market ticked upward—a classic sign of seasonal cooling, not a market stall. Buyers have more leverage, sellers are pricing strategically, and deals are still getting done close to list price—about 96–97% received on average.

“With ski season around the corner, Summit and Park County real estate continues to attract buyers seeking both investment potential and lifestyle value. The market remains resilient, balanced, and glowing with autumn energy,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“September sales were really the tale of two markets, the high-end luxury market and everything else. The HELM made a meaningful rebound in dollar volume year over year: from $106.31 million in September 2024 to $131.11 million in September 2025, a 23% increase. However, the number of sales from 52 to 44 is a 15% decrease for the same period. On a year-over-year basis, the market is off from September 2024 at $791.5 million compared to $641.6 million (19% decrease) in September 2025.

“I’ve often said that the super wealthy are ‘flying above the storm’ and the rest of us are worried about the economy being too frothy, tightening budgets, and still historically high mortgage rates. Overall, inventory is constrained but Telluride’s appeal for the wealthy has never been greater. Remote, safe, peaceful resort locations that are a little hard to get to have never been more desirable for the affluent,” said Telluride-area REALTOR® George Harvey.

VAIL

“September is the closing month for the summer selling season in the Valley with unique activity and, 2025 maintained the trend. Closed unit sales were up 17.2% for the month which brought the unit sales year-to-date down 10%. The month’s dollar volume was positive 8.8% which is one of the few months where the dollar increase was lower than the unit increase. This anomaly is created by sales in the varying pricing niches. New listings were down 25.7% compared to the 13.6% year to date increase. Pending sales were up 21.3% for the month versus 4.7% year to date. Closed sales were up 17.2% for the month compared to the 10% year-to-date dip. Overall, inventory is up nearly 24% along with the 32% increase in months’ supply of inventory.

“A lot of variable numbers to breaking down the market’s performance. The best way to evaluate is the market has been reasonably strong in certain price niches and the inventory that currently exists does fit into the key market niches. There are certainly excellent opportunities to buy and sell as the macro economy does not necessarily drive our market. We still sell most properties with cash purchases, so mortgage rates have less impact on the market activity,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The September 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 23,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com