Suddenly, it’s all about pricing

Percent of list price received on home purchases dips below 100% for the first time since 2020

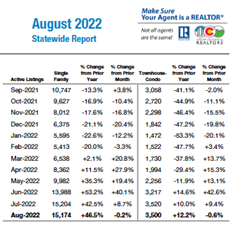

ENGLEWOOD, CO – Rising interest rates and traditional seasonal slowdown continued to pump the brakes on the metro area and statewide housing markets as potential buyers found a few more options to choose from and a few more days to think about their potential purchase of a home, according to the August 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

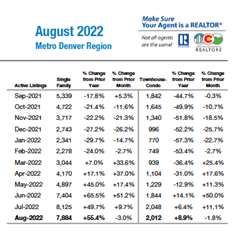

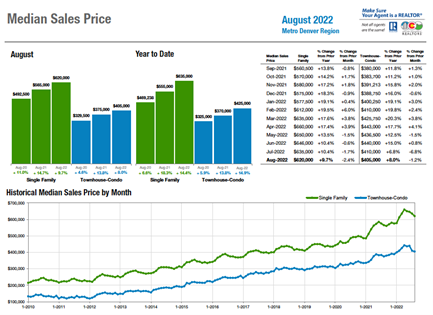

Adding in the decrease in purchasing power from those rising interest rates and inflation uncertainty, the median price of a single-family home in the seven-county Denver metro area dipped for the fourth straight month to $620,000 – up nearly 10% from a year prior but down $40,000 from its April 2022 record high. Although slightly more in demand due to its lower price point, the townhome/condo market also saw prices slip again from July to August with a median price of $405,000, up 8% from a year ago, but down $38,000 from its April high.

“Pricing strategy has proved to become one of the most important factors in the cooling market. Real estate agents typically rely on trailing six-month comparable sales figures to determine list prices, which are heavily skewed upwards due to the spring boom. The result is, eager sellers hoping to get top-dollar for their homes but resorting to price reductions after spending longer than anticipated on the market,” said Douglas County-area REALTOR® Cooper Thayer.

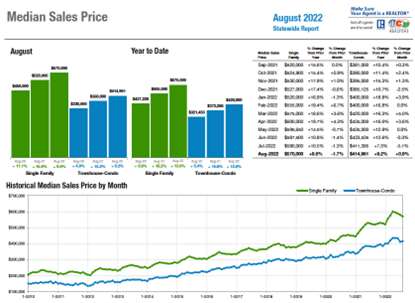

Looking statewide, median sales pricing for single-family homes also fell for the fourth straight month to $570,000, up 9.6% from a year prior however, it is down $30,000 from its record high four months earlier. The statewide townhome/condo market ticked up slightly from July to August – again, affordability playing a major factor – to $414,961 where it is down just more than $20,000 from its April high.

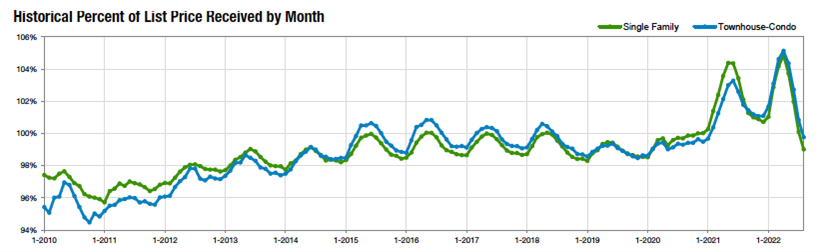

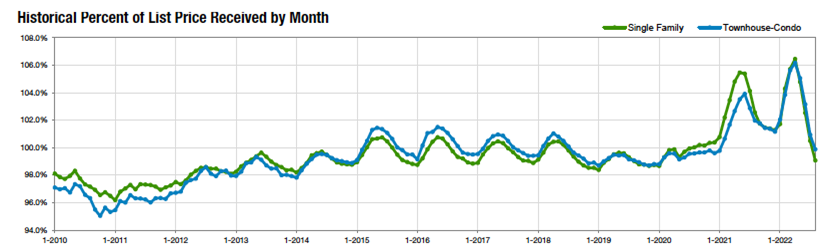

Perhaps more telling signs of the patience and caution being shown by buyers statewide is the combination of increased average days on market, as well as the percent of list price received. The latter dipped below 100% in the metro area and statewide for the first time since early 2020 for single-family homes and mid-to-late 2020 for the townhome/condo market. Statewide:

Statewide:

Seven-County Denver Metro Area:

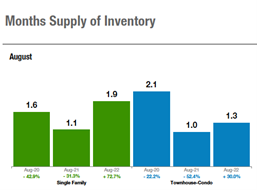

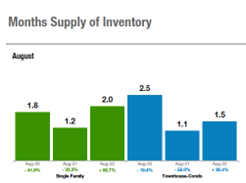

Yes, potential buyers are enjoying a few more options, opportunities and days to decide, but it remains a seller’s market as the months supply of inventory – ranging from 1.3 months for townhome/condos in the metro area, to 2 months for a single-family home statewide — remains well below the 4-6 month range considered to be a balanced market.

Despite changes in market conditions, housing affordability remains the most pressing issue facing potential homebuyers. The CAR Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers based on interest rates, median sales price and median income by county, continues to hover around its all-time lows for all property types statewide.

With diverse and local factors playing out across the state, REALTORS® across the metro area and state shared these highlights:

- Aurora – Up, up and… up some more. Looking at the August numbers for Aurora, Centennial, Adams County, and Arapahoe County, up is the word. And for buyers, that’s good news. Overall, inventory was up about 40% with many zip codes reflecting incredibly large increases. In the 80015 zip code, inventory was up 128%, giving more people the chance to purchase.

- Boulder/Broomfield counties – Suddenly, it’s all about pricing. Price reductions have increased dramatically in the last month as sellers try to find their way in this adjusted market.

- Colorado Springs – What a difference a few months make. The shift is here, and it is moving fast. We are down almost 30% on sold listings year over year. And that statistic continues to show how the buyers have dropped out of the market when you add in the 102.9% increase in inventory.

- Denver County – The sky isn’t falling, there isn’t some explosive market change as the market itself is always in motion, always in a state of flux. The only thing that is reliable is change and the fact that, year-over-year, market-over-market, values always increase with the wisdom of a historic perspective.

- Douglas County – Home sale prices in Douglas County declined for the fourth consecutive month as the market continued its natural slowdown into the winter season. Despite the negative connotations of ‘declining home prices,’ we are in a much healthier market than a year ago. The inventory of single-family homes for sale has increased nearly 70% from a year prior, providing homebuyers relief in a market where median sales prices remain over 10% higher than last year.

- Durango/La Plata County – Sellers are operating with a mindset of last year’s market, while buyers’ mindsets are in next year’s market. The result is an ever-widening gap between what buyers are willing to pay and what sellers are willing to accept. With more options for buyers, we are starting to see some seller concessions and price reductions for the first time in a long time.

- Fort Collins/Northern Larimer County – A buyer’s market has typically been defined as a market with more than 6 months of inventory. The northern Colorado market is nowhere near that number (1.7 months). However, sellers have grown accustomed to the idea that it only takes a matter of days to sell a home. Sellers will need to adjust expectations to ensure they can sell their homes quickly and price aggressively to drive interest and perhaps even create competitive offer situations.

- Glenwood Springs/Roaring Fort and Colorado River valleys – The Roaring Fork and Colorado River valleys housing market continues to hold steady with slight variations over last year. New listings are down 17% in the single-family sector and more than 50% in the townhome/condo market.

- Grand Junction – Mesa County is definitely feeling the effects of the current lull in the market. New listings are down 13.7% in August compared to the same period last year yet, because of slowing sales, active listings are up to 712, and months supply is now 2.2 months.

- Jefferson County/Golden – We are experiencing a normal seasonal slowdown with new single-family listings down 28%, sold listings down 22.9%. Median sales price rose again to $675,000. Average days on market increased substantially with the amount of inventory increasing 36.9%.

- Pueblo – The big change was in active listings, where we were up 50.3% over August 2021. We have 740 listings in Pueblo County as of Sept 8. A huge increase from four months ago. The inventory supply is up to 2.2 months, a 46.7% increase over last August.

- Steamboat Springs/Routt County – List prices in 2021 established the ‘floor’ with multiple offers setting the ‘ceiling’ and sellers receiving 98% – 102% of their ask. The market shift now has list prices likely at the ceiling with sellers receiving 97.4% – 99.1% of ask. As summer comes to an end and the balance of the year unfolds, there will likely be many tales of ‘could’ve, would’ve, should’ve’ with respect to interest rates, buying, and selling.

- Summit, Park & Lake counties – Buyers now have choices as inventory skyrockets, and they have been getting properties for under list price. Summit single-family home inventory is up an amazing 93%, condo inventory is up 30%. Inventory in Park is up 41%, and Lake is up 67%. Homes are getting about 97% of list.

- Telluride – The market continues to slow down from its peaks in 2020-21. In August 2022, we recorded $75.35 million in sales with 51 transactions, down 21% and 35%, respectively. That is still 50% higher than the dollar amount of sales in 2019. Sales prices are still about 90% of the peak prices in 2021 and 2022.

- Vail – Months supply of inventory has inched up to 2.9 months which is approximately 50% of a stable market level. Overall, our inventory of for sale product is in the mid $300,000s which is significantly up from earlier this year. However, the level remains at approximately 50% of a normal market inventory.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Up, up and… up some more. Looking at the August numbers for Aurora, Centennial, Adams County, and Arapahoe County, up is the word. And for buyers, that’s good news. Overall, inventory was up about 40% with many zip codes reflecting incredibly large increases. In the 80015 zip code, inventory was up 128%, giving more people the chance to purchase.

“Prices are also up over August 2021, with prices in the Aurora/Centennial area up 10% on average over this time last year. The median price in 80010 is $440,000, 80013 is $530,000 and the median price in 80111 is now up to nearly $1.1 million. That said, we are seeing some sellers lowering prices in certain situations.

“Average days on market is also up. In many areas we are seeing homes on the market longer than they were a year ago, and longer than they were in the first quarter of this year, allowing for more opportunity and time for buyers.

“The market is clearly reflecting change thanks to higher interest rates. Yet, homes are still selling, they may just take a little longer. The opportunity to find a home and close may be more in reach than many people thought,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Suddenly, it’s all about pricing. The market in Boulder and Broomfield counties continues to weather the latest shift as if nothing has changed. Homes prices are up about 11% since the beginning of the year and inventory continues to decline. The average list price to sale price ratio remains over asking at 104% and average days on market hovers around 12 in Broomfield and 30 in Boulder. It would appear we are still in that hot seller’s market we’ve become so accustomed to over the last two years. The condo/townhome market also apparently didn’t get the memo about the market shift as this category has appreciated in both areas 19% since the beginning of the year. This could be attributed to first time homebuyers desperate to get in before more interest rate hikes.

“However, the statistics only tell the story of what happens once a home is listed properly. The number of price reductions has increased dramatically in the last month as sellers try to find their way in this adjusted market. Sure, houses sell in a few weeks but only the ones that have adjusted their list price to meet current market conditions. REALTORS® are counseling their clients to price their homes closer to the end of 2021’s sales, not to those that sold six months ago. The demand is still there, and the local economy is still strong. The real estate market is still moving, as long as it’s priced right,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“What a difference a few months make. The shift is here, and it is moving fast. We are down almost 30% on sold listings year over year. And that statistic continues to show how the buyers have dropped out of the market when you add in the 102.9% increase in inventory. Just like last month, we are seeing a continuation of lower sold properties and higher inventory. At the beginning of the year, we were all told that we had a shortage of inventory and too much demand. Fast forward to now, and we have inventory, but demand is gone. Buyers have most of the power now, but are either patient, or not interested. Afterall, why would they be? Every day is a news cycle of bad economic news ranging from stocks, inflation, layoffs, and housing data. In fact, Moody’s recently published the top 183 housing markets that will see a 20% drop in values.

“The meat and potatoes of the economy is simple, make everything unaffordable and the consumer will stop buying. Terrible decisions by the Fed to create trillions of dollars inflated everything from food, stocks, and housing. Now the Fed continues quantitative tightening and it’s putting a lot of pressure on many asset classes, which include housing. Colorado continues to be one of the states making news on being unaffordable and in a housing bubble, and we are beginning to feel that as sellers either remove their homes from the market, or price drop. As this occurs, we are now seeing rents begin to soften.

“What to expect moving forward? The national economy is getting worse. I believe we are at the beginning of what will be more months of declining home sales and price drops both in Colorado and nationwide. Even if inventory stays where we are, lack of demand will put more pressure on sellers to adjust prices. What was once a hot sellers’ market for years has now shifted. Buyers may have a little more control but are not showing their hand. After years of double-digit appreciation, the time has come to see those prices pull back. My father, a veteran REALTOR® of 45 years, once told me that Colorado is a boom-and-bust state for real estate. My guess is, the bust is coming,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“The sky is not falling – I repeat, the sky is not falling. Before we dig into the numbers this month, it’s vital that we look at historic perspectives and shift our thinking to pre-pandemic, pre-multiple offers and yes, pre-extreme price increase madness. While the median price for a freestanding home in Denver County dropped from $723,750 to $655,000 this month, that number represents just a 9.5% decrease which is, frankly, rather routine. In 2021, the same July to August median saw a 7.5% decrease and in 2020, a modest 0.4% increase occurred. During 2019, ‘18, ‘17 and ‘16, the decreases ranged from 2.5 to 6.7%. While it’s true that 2022’s July to August was the largest in percentage and amount, the rate at which the median price is increasing on a year-over-year basis is slowing considerably while the rate of acceleration may thankfully be more approachable to most buyers.

“Considering a year-over-year approach, occurring from August 2021 to August 2022, the median price changed upwards only 4.6%. The year before, 2020 to 2021 was higher at 15.9%. 2020 to 2021 was nearly identical to gunning your engine after a red light only to see that there’s another signal ahead. You obviously don’t slam on the brakes when you see the next light, but you do let off that gas and begin to slow as you grit your teeth and realize it was perhaps a little silly to expect that next one would be green, especially if this hypothetical road was Colorado Boulevard. Afterall, it’s rarer than a blue moon not to catch every other light. You’d simply take a big, deep breath and realize that ‘it is what it is’ and you’re at the mercy of a market, ahem, traffic flow that is slowing down to a more manageable and controlled pace and that’s simply the price you pay for living in a growing city.

“In 2017, the rate at which the prices in Denver were increasing was 12.5% year-over-year. In 2018, 7.8% and in 2019, 3.3%. This past month’s 4.6% shows that we have returned to growing at a healthier and more sustainable pace and while it may take some time for those who are a little tattered and bruised from playing the market over the last couple of years, the truth is that we have simply returned to more of a 2019-type of pace that’s simply less head spinning.

“The sky isn’t falling, there isn’t some explosive market change as the market itself is always in motion, always in a state of flux and is about as reliable as a 1973 Ford Pinto. The only thing that is reliable is change and the fact that, year-over-year, market-over-market, values always increase with the wisdom of a historic perspective. As Mark Twain said, ‘Buy land, they’re not making it anymore.’” And that is equally true today as it was a year ago,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“In August, home sale prices in Douglas County declined for the fourth consecutive month as the market continued its natural slowdown into the winter season. Despite the negative connotations of ‘declining home prices,’ we are in a much healthier market than a year ago. The inventory of single-family homes for sale has increased nearly 70% from a year prior, providing homebuyers relief in a market where median sales prices remain over 10% higher than last year. The natural result of a more balanced supply and demand is homes spending more time on the market, which increased to over three weeks on average last month. The townhouse/condo market remains firmly advantageous to sellers, with median sale prices continuing to increase month-over-month despite a sizeable increase in inventory.

“Pricing strategy has proved to become one of the most important factors in the cooling market. Real estate agents typically rely on trailing six-month comparable sales figures to determine list prices, which are heavily skewed upwards due to the spring boom. The result is eager sellers hoping to get top dollar for their homes but resorting to price reductions after spending longer than anticipated on the market. While it’s difficult to fight the FOMO mentality, it’s important to recognize that August listings have crossed below the 100% list-to-close price ratio for the first time this year, indicating a trend of overpricing. My recommendation to potential sellers is to be patient and modest, as you still hold the upper hand in the market, but greed will likely be detrimental to the sale of your home at this point in the year.

“A note on declining prices: As we enter times of economic uncertainty, stories about the housing market will often include ‘declining prices’ as a negative indicator. However, there are two important reasons why this may be misleading. First, home prices naturally fluctuate on a seasonal basis, and are expected to decrease from month-to-month after the summer season. A true price decline in the housing market will occur over an annual or multi-year time period, so do not fear when prices ‘decline’ from month to month. Second, in a market as desirable as the Denver-metro area, even annual price decreases may be healthy, as the market has experienced a trend of above-average appreciation rates for years, resulting in low affordability for consumers. Overall, I believe the market in Douglas County remains strong, and it is still an opportunistic time to be a buyer or a seller,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“I was listening to a podcast earlier this week, and Larry Kendall with the Group Real Estate hit the nail on the head describing the current state of the market. Larry said that sellers are operating with a mindset of last year’s market, while buyers’ mindsets are in next year’s market. The result is an ever-widening gap between what buyers are willing to pay and what sellers are willing to accept.

“In La Plata County, we are beginning to see a flattening in appreciation as sellers feel the pressure of increased inventory, fewer multiple offers, and decreased buyer traffic. We have seen single-family inventory grow from 126 units in January, to 207 units in August. The month’s supply of inventory has grown to 3.1 months in August compared to one month in January. Keep in mind that while this increase seems substantial, there were 545 units available in August 2019, our last ‘normal year’ before Covid.

“The percentage-of-list-price received is decreasing, from over 100% earlier this year to 98% in August, which coincidentally was the same as August 2019. With more options for buyers, we are starting to see some seller concessions and price reductions for the first time in a long time. The next few months will be interesting to watch, with interest rates continuing to fluctuate and inflation being front and center. Throw in the uncertainty of an election year, and it is anyone’s guess how our local market will react in the coming months,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“To say that the market has shifted since April and May is an understatement. To say that the market is now a buyer’s market is a bit of an overstatement. Yes, median prices have fallen across the region. Yes, the supply of homes available for sale has increased to nearly 2 months. Yes, it is taking a bit longer for homes to go under contract once listed for sale. However, the threat of having to engage in competing offers for those homes is still very real. Here’s why:

“Interest rates are still double what they were at the beginning of the year. Buyers no longer have as much discretionary cash to use in writing over-asking offers since they must use that cash as down payment to keep their monthly mortgage payments lower. This increase in out-of-pocket costs has forced many buyers to the sidelines of the market (especially in the below median price points) You can see this in the average list-price-to-sale-price numbers which have finally fallen below 100% for the first time in over a year – but just below 100% at 99.6%.

Homes that come on the market that don’t require a lot of fixing up are still premium purchases that garner lots of attention from the buyers that are still actively engaged in searching for a home. If we were in a true buyer’s market, that list-price-to-sale price number would be substantially lower. A leading indicator that is more difficult to suss out is the original list price to final sale price number which takes any price drops the property has seen over the course of its days on market. We’ve seen more price adjustments this past August as Sellers adapt their expectations to match demand.

“Sellers have been impacted by the run-up in mortgage rates, too. A seller that has been enjoying a mortgage payment based on a sub-4% (or even sub 3%) 30-year mortgage rate is likely a bit hesitant to jump into purchasing their next home and facing over 5% mortgage rates – even with a big chunk of equity as down payment. It is a difficult pill to swallow which has resulted in fewer homes coming on the market that otherwise may have been candidates for sale. So, the total number of homes available is even less than there may have been if interest rates had remained at the comparatively low rates of early 2022.

“Active inventory is still up slightly year-to-date which has been trending that way since June. You’ll see big numbers between August of last year and August of this year – but I believe that can be attributed to lingering effects of the covid buying spree that characterized last summer’s market since folks still hadn’t really been comfortable to travel en masse and most activity was still centered at home. This August was much like pre-covid Augusts where families focus on late summer travel and back-to-school activities taking place outside the home.

“Traditionally, a buyer’s market has been defined by a housing market with more than 6 months of inventory. The northern Colorado market is nowhere near that number (1.7 months). However, sellers have grown accustomed to the idea that it only takes a matter of days to sell a home. This expediency factor has shifted seller’s views and expectations of the market. Perhaps a new definition of buyer’s market needs to be formulated based on seller’s urgency.

“Any way you slice the data, though – inventory (homes available for sale) remains constrained compared to the number of people needing homes (both for sale and for rent). The basic economic laws of supply and demand will continue to drive pricing but with far greater immediacy than in the past. The market shift we’ve seen in the last 60-90 days would take twice that long in the before-times (pre-internet). Sellers will need to adjust expectations to ensure they can sell their homes quickly and price aggressively to drive interest and perhaps even create competitive offer situations,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/ROARING FORK AND COLORADO RIVER VALLEYS

“The real estate market in the Roaring Fork and Colorado River valleys continues to hold steady with slight variations over last year. New listings are down 17% in the single-family sector and more than 50% in the townhome/condo market. The median sales price was up again, albeit not as dramatic as we have seen in the last year, 2.9% for single-family homes to come in at $715,000. August showed a spike of 30% in the median price of the multi-family market coming in at $515,000. While these numbers remain positive, brokers are seeing the subtle hints of change in the pending sales and days on market numbers. In pending sales, single-family homes experienced a decrease of 13% and an increase of 48% for days on market before a contract. In the townhome/condo sector, the decrease in pending sales was greater at 38% however, days on market was down 45%.

“What does the future hold for the local real estate market? Will the Roaring Fork and Colorado River valleys be the anomaly in the changing market throughout the state? Will the continued lack of inventory be enough to withstand the nation’s economy and the rise in interest rates? Time will tell,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“Mesa County is feeling the effects of the current market lull with new listings down 13.7% in August compared to a year earlier. Yet, because of slowing sales, active listings are up to 712, and months supply is now 2.2 months. Pending sales for August 2022 compared to August 2021 were down 19.9% and solds were down 18.0%.

“Our year-to-date reflects similar numbers, with listings down 3.3%, pendings down 15.4% and solds down 14.3%. Price wise, it is the opposite. Median price is up 18.2% in August compared to a year prior at $389,900, and average is up 16.6% to $443,420. YTD, median is up 18.5% to $385,000 and average is up 16.9% at $426,549.

“Percent-of-list-price received in August was 98.4%, and days on market up to 65. Affordability is down to 61. Sellers are offering some price reductions, or offering buyer incentives, such as interest rate buydowns and more,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY/GOLDEN

“With the school year in full swing, we are experiencing a normal seasonal slowdown. New listings for single-family homes have decreased 28%, and sold listings were down 22.9%. The median sales price once again jumped up and is now at $675,000. Average days on market increased substantially with the amount of inventory increasing 36.9%. For condo/townhomes, new listings decreased 20.8% along with sold listings down 14.3%. The median sales price did tick up to $389,900 with days on market increasing 62.5% and Inventory up 15.6% year-over-year.

“Sellers should be watching to see if more homes will be coming to the market. If not, we may see another strong seller’s market in January. For buyers, there is a lot more inventory to choose from currently – however, that may not be the case for long,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“The housing market in Pueblo County is still drifting away from a seller’s market toward a more balanced market. New listings in August were down 13.5% compared to 2021, but up 10.6% year to date. Pending sales, a gage for what will be sold, were down 23.2% in August compared to August 2021 and our title companies have seen fewer orders coming in.

“The median price was up 3.6% from July to August at $320,000 and is up 12.5% compared to last August. The percent-of-list-price received fell 2.8% to 98.4% and is down 1.4% year-to-date. The big change was in active listings, where we were up 50.3% over August 2021. We have 740 listings in Pueblo County as of Sept 8. A huge increase from four months ago. The inventory supply is up to 2.2 months, a 46.7% increase over last August.

“We have seen a lot of price reductions from sellers and yet, contracts still fall through. A couple of things have changed in the past month. More agents are having open houses for the public and agents are doing many broker opens for lunch. The broker opens are getting agents out with other agents, something many agents have said they missed during the pandemic, and it’s helping adjust prices appropriately,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“It can be a hard concept to wrap one’s head around – slower appreciation does not mean depreciation. Understandably, with price reductions happening daily – it can ‘feel like’ depreciation. Was a switch flipped in mid-June? As interest rates jumped to 5.78%, buyers seemed to pull back as they flashbacked to January’s rate of 3.22%. Interest rates, high inflation, and talks of recession each took their effect and cooled the summer sales market. List prices in 2021 established the ‘floor’ with multiple offers setting the ‘ceiling’ and sellers receiving 98% – 102% of their ask. The market shift now has list prices likely at the ceiling with sellers receiving 97.4% – 99.1% of ask. The biggest culprit to housing affordability remains the lack of inventory with 46.3% less homes coming on the market this year than last and 47.9% fewer multi-family. Months’ supply has increased ever so slightly to 3.1 months for single-family with days on market essentially the same as the same period last year. Multi-family barely increased to a 1.6 months’ supply with almost a 45% decrease in days on market. Fewer new listings with approximately 8% less total active listings and demand still strong resulted in average price increases of almost 21% for homes and 14.6% for condos and townhomes.

“The change of seasons reminds us that nothing stays the same. As summer comes to an end and the balance of the year unfolds, there will likely be many tales of ‘could’ve, would’ve, should’ve’ with respect to interest rates, buying and selling,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

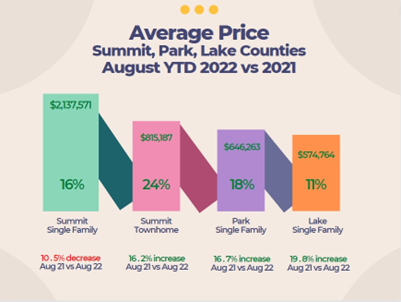

“Opportunities abound in Summit, Park, and Lake counties for amazing real estate deals. Buyers now have choices as inventory skyrockets, and they have been getting properties for under list price. Summit single-family home inventory is up an amazing 93%, condo inventory is up 30%. Inventory in Park is up 41%, and Lake is up 67%. Homes are getting about 97% of list.

“With all these listings you would think sales would be going up, but sales have decreased 32%. In the last week, 42 properties have dropped their prices. While prices have not fallen to 2021 levels, sale prices are down 20% on average from the peak of the market this past January. This could indicate that lower-priced properties are selling most often, or overall prices are coming down. August saw about 32% of closings paid for with cash. There is about 4.5 months of inventory. A balanced market is about six months of inventory.

“There are 593 residential active listings in the Summit MLS that range from a low-price, single-family home in Park County for $149,900 and a high price single-family home in Breckenridge for $18.99 million, which has been on the market for over 2 years. Out of the 181 sales in August, the lowest was a studio in Leadville for $110,000 and the highest was a single-family home in Breckenridge for $5.5 million. These numbers exclude deed restricted affordable housing. In Summit County, an average priced home is now $2,137,571, down about $55,000 from last month,” said Summit-area REALTOR® Dana Cottrell

TELLURIDE

“The Telluride market continues to slow down from its peaks in 2020-21. In August 2022, we recorded $75.35 million in sales with 51 transactions, down 21% and 35%, respectively. That is still 50% higher than the dollar amount of sales in 2019. Sales prices are still about 90% of the peak prices in 2021 and 2022. Telluride was responsible for 30% of the total dollar volume, Mountain Village 40%, and the remaining 30% spread across the rest of the county in the month of August. New listings are still coming on the market with contracts happening every day,” said Telluride-area REALTOR® George Harvey.

VAIL

“The August Market Trends direction seems to be firming up. Macro-economic factors are having a more significant impact then the supply and demand issues of the past two years. The month of August saw a 32% decline in units sold versus 2021 which brought the YTD transactions, to a negative 25% from 2021. Similar to July, the negative dollar performance was trending closer to units with a negative 28%. Thus, the pricing niches are holding similar and the appreciation of the past couple of years is relatively stable. The dollar performance for August had a 28% decrease similar to the earlier summer performance. The YTD dollar decline is now at minus 9% which would project a total for the year in the $2.5 billion area, which would settle the market to a more typical yearly performance than the past two years.

“Other indicators of this trend are pending sales which were down 25% for August versus previous year and the YTD pendings are now at negative 24.5%. Days on market continue to run in the mid-30 days range which speaks to the supply/demand levels for product. Months supply of inventory has inched up to 2.9 months which is approximately 50% of a stable market level. Overall, our inventory of for sale product is in the mid $300,000s which is significantly up from earlier this year. However, the level remains at approximately 50% of a normal market inventory,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

Inventory of Active Listings

STATEWIDE

Inventory of Active Listings

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The August 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.